UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2024

Commission

File Number: 001-38278

Jianpu Technology Inc.

5F Times Cyber Building, 19 South Haidian Road

Haidian District, Beijing

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit Index

Exhibit 99.1 – Jianpu Technology Inc. Reports First Half Year 2024 Unaudited Financial Results

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Jianpu Technology Inc. |

| |

|

|

|

| |

By |

: |

/s/ Yilü (Oscar) Chen |

| |

Name |

: |

Yilü (Oscar) Chen |

| |

Title |

: |

Chief Financial Officer |

Date: August 23,

2024

Exhibit 99.1

Jianpu Technology Inc. Reports First Half Year

2024 Unaudited Financial Results

Beijing,

August 23, 2024 -- Jianpu Technology Inc. (“Jianpu,” or the “Company”)

(OTCQB: AIJTY), a leading open financial technology platform in China, today announced its unaudited

financial results for the first half year ended June 30, 2024.

First Half Year 2024 Operational and Financial

Highlights:

| · | Total revenues were RMB429.2 million (US$59.1 million) in the first half of 2024, decreasing by 25.3% from RMB574.9 million in the

same period of 2023. |

| · | Income from operations was RMB8.5 million (US$1.2 million) in the first half of 2024, compared with loss from operations of RMB34.2

million in the same period of 2023. The turnaround from an operation loss to an operation income can be attributed to the Company’s

continuous focus on businesses optimization and commitment to efficiency improvements. |

| · | Net income was RMB28.9 million (US$4.0 million) in the first half of 2024, turning from net loss of RMB21.7 million into profit on

a year-over-year basis. Net income margin was 6.7% in the first half year of 2024, compared with net loss margin of 3.8% in the same period

of 2023. |

First Half Year 2024 Financial Results

Total revenues

decreased by 25.3% to RMB429.2 million (US$59.1 million) in the first half of 2024 from RMB574.9 million in the same period of 2023.

Revenues

from recommendation services decreased by 22.8% to RMB289.7 million (US$39.9 million) in the first half of 2024 from RMB375.2

million in the same period of 2023. The decrease was primarily due to the decrease in revenues from recommendation services for credit

cards as a result of the lower marketing budget of credit card issuers, partially offset by the increase in revenues from recommendation

services for loans caused by the increase in the number of loan applications.

Revenues

from digital intelligence as a service1 decreased by 26.4% to RMB37.3 million (US$5.1 million) in the first half

of 2024 from RMB50.7 million in the same period of 2023, primarily due to a gradual shift of the Company’s business model towards

cooperation with licensed credit reporting agencies starting from the second half of 2023. Through the cooperation, which is mandated

by the relevant PRC regulation, the Company, together with the licensed credit reporting agencies, provides digital intelligence as a

service1 to the financial institutions and share the economic interests accordingly. The decline was also partially due to

the deconsolidation of Newsky Wisdom Treasure (Beijing) Co., Ltd, or Newsky Wisdom, in the second quarter of 2023.

1

Starting from the first half of 2024, the Company updated the description of its revenue stream “big data and system-based

risk management services” to “digital intelligence as a service” to provide more relevant and clear information. It

also updated the revenue description in comparative periods to conform to the current classification.

Revenues

from marketing and other services decreased by 31.4% to RMB102.2 million (US$14.1 million) in the first half of 2024 from RMB149.0

million in the same period of 2023, primarily due to the decreases of the insurance brokerage services and marketing solutions and services

provided to telecommunication services providers.

Cost of

promotion and acquisition decreased by 38.5% to RMB247.0 million (US$34.0 million) in the first half of 2024 from RMB401.5

million in the same period of 2023. The decrease was primarily due to the decreases in revenues from recommendation services for credit

cards and those from marketing and other services, and to a lesser extent, the improvement in operational efficiency resulting from the

strategic optimization of business structure.

Cost of

operation decreased by 26.8% to RMB28.1 million (US$3.9 million) in the first half of 2024 from RMB38.4 million in the same

period of 2023. The decrease was primarily attributable to the decrease in data acquisition costs related to the Company’s digital

intelligence as a service1 during its shift of business model, as well as the decrease in software development and maintenance

costs due to the deconsolidation of Newsky Wisdom2, partially offset by the increase in call center outsourcing costs.

Sales and

marketing expenses were RMB64.4 million (US$8.9 million) in the first half of 2024, remaining relatively stable compared to

those of RMB64.7 million in the same period of 2023.

Research

and development expenses decreased by 25.6% to RMB37.0 million (US$5.1 million) in the first half of 2024 from RMB49.7 million

in the same period of 2023, primarily due to the decrease in payroll expenses resulting from the Company’s continued efforts in

cost optimization.

General

and administrative expenses decreased by 19.5% to RMB44.2 million (US$6.1 million) in the first half of 2024, compared with

RMB54.9 million in the same period of 2023. The decrease was primarily due to the decreases in professional fees and allowance for credit

losses.

Income

from operations was RMB8.5 million (US$1.2 million) in the first half of 2024, compared with a loss from operations of RMB34.2 million

in the same period of 2023. Operating income margin was 2.0% in the first half of 2024, compared with a operating loss margin of 5.9%

in the same period of 2023. The turnaround from an operation loss to an operation income can be attributed to the Company’s continuous

focus on businesses optimization and commitment to efficiency improvements.

Others,

net increased by 42.7% to RMB14.7 million (US$2.0 million) in the first half of 2024 from RMB10.3 million in the same period

of 2023. The Company recognized a net investment gain of RMB7.8 million from the investment in Conflux Global and other crypto assets,

as well as an investment gain of RMB5.9 million resulting from the termination of a non-controlling investment2 in the first

half of 2024; while the Company recognized an investment gain of RMB7.1 million resulting from the deconsolidation of Newsky Wisdom2

in the same period of 2023.

1

Starting from the first half of 2024, the Company updated the description of its revenue stream “big data and system-based

risk management services” to “digital intelligence as a service”, to provide more relevant and clear information. It

also updated the revenue description in comparative periods to conform to the current classification.

2

In May 2023, the Group (Jianpu, its subsidiaries, and VIEs together are referred to as the “Group”) entered into a

share transfer agreement with the founder and minority shareholder of Newsky Wisdom, which is one of the subsidiaries of the Group

before the completion of the share transfer. During the second quarter of 2023, according to the share transfer agreement, the Group

transferred 35.5% shares to the founder of Newsky Wisdom and consequently became a minority shareholder of Newsky Wisdom, and the Group

no longer has control over Newsky Wisdom. The investment gain of RMB7.1 million was recognized in the second quarter of 2023 accordingly.

In August 2023, the Group entered into a share transfer agreement with a third-party buyer to sell its remaining 15% equity interests

in Newsky Wisdom. During the fourth quarter of 2023, the transaction was completed. The investment gain of RMB5.5 million was recognized

accordingly.

In January 2024, the Company, together with other shareholders of an

investee company, entered into an investment termination agreement with the investee company, according to which the company’s investment

into the investee company was terminated and the investee company would pay the Company US$0.8 million as compensation for such termination.

The compensation was fully paid to the Company in January 2024. The investment had been fully impaired by the Company in the year 2022,

and therefore, the termination led to an investment gain of US$0.8 million in January 2024.

Net income

was RMB28.9 million (US$4.0 million) in the first half of 2024 compared with a net loss of RMB21.7 million in the same period

of 2023. Net income margin was 6.7% in the first half of 2024, compared with a net loss margin of 3.8% in the same period of 2023.

Non-GAAP

adjusted net income3, which excluded share-based compensation expenses and investment gain of disposal of subsidiaries

and equity investment, was RMB24.3 million (US$3.3 million) in the first half of 2024, compared with a Non-GAAP adjusted net loss3

of RMB26.7 million in the same period of 2023. Non-GAAP adjusted net income margin3 was 5.7% in the first half of 2024 compared

with a Non-GAAP adjusted net loss margin3 of 4.6% in the same period of 2023.

Non-GAAP

adjusted EBITDA4, which excluded share-based compensation expenses, investment gain of disposal of subsidiaries

and equity investment, depreciation and amortization, interest income and expenses, and income tax benefits/(expenses) from net income/(loss),

for the first half of 2024 was an income of RMB20.6 million (US$2.8 million), compared with a loss of RMB26.7 million in the same period

of 2023.

As of June 30,

2024, the Company had cash and cash equivalents, time deposits and restricted cash and time deposits of RMB660.1 million (US$90.8 million)

and working capital of approximately RMB362.8 million (US$49.9 million). Compared to those as of December 31, 2023, cash and cash

equivalents, time deposits and restricted cash and time deposits decreased by RMB29.6 million.

3

Non-GAAP adjusted net income/(loss) represents net income/(loss) before share-based compensation expenses and investment gain of

disposal of subsidiaries and equity investment. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” at the

end of this document for more details about Non-GAAP adjusted net income/(loss). Non-GAAP adjusted net income/(loss) margin equals Non-GAAP

adjusted net income/(loss) divided by total revenues.

4

Non-GAAP adjusted EBITDA represents EBITDA before share-based compensation expenses, investment gain of disposal of subsidiaries

and equity investment. EBITDA represents net income/(loss) before interest income and expenses, income tax benefits/(expenses) from net

income/(loss), and depreciation and amortization. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” for more details.

Share Repurchase Program

As previously

disclosed, the Company had been authorized to establish a share repurchase program in January 2024, under which the Company may repurchase

up to US$3 million of its American depositary shares (“ADSs”) or Class A ordinary shares over the next 12 months.

As of August 21, 2024, the Company had repurchased an aggregate of 448,192 of its ADSs and 40,631,775 of its Class A ordinary

shares for a total cost of approximately US$1.5 million, including 284,147 ADSs (representing 5,682,940 Class A ordinary shares)

and 40,537,205 Class A ordinary shares repurchased from Lightspeed China Partners I, L.P. and Lightspeed China Partners I-A, L.P.

Subsequent Event

In July 2024,

the Group entered into a share transfer agreement with a third party. According to the share transfer agreement, the Group will transfer

100% of the shares of Shanghai Anguo Insurance Brokerage Co., Ltd., or Anguo, which is an insurance brokage company that the Group

acquired in December 2019, to the third party. Anguo held less than 10% of the Group’s total assets as of December 31,

2023 and June 30, 2024, and contributed less than 10% of the Group’s revenue for both the year ended December 31, 2023

and the six months ended June 30, 2024. The transaction is expected to be completed in fiscal year 2024.

About Jianpu Technology Inc.

Jianpu Technology

Inc. operates a leading open financial technology platform, under Rong360 brand, connecting users with an extensive spectrum of financial

products and other products and services. By leveraging cutting-edge digital technology, the Company offers intelligent and comprehensive

search and recommendation results in a seamless, efficient, and secure manner to meet the needs of its diverse audience. The Company

also enables financial and non-financial partners to enhance their efficiency and competitiveness by offering digital intelligence as

a service, including data- and analytical-based risk management, intelligent marketing, and other integrated solutions and services.

As the Company expands into FinTech+ ecosystem and broadens its global footprint, it will continue to underscore its dedication to innovation

and solidify its influence in the space of financial technology and digital transformation. For more information, please visit http://ir.jianpu.ai.

Use of Non-GAAP Financial Measures

The Company uses adjusted EBITDA and adjusted net income/(loss), each

a Non-GAAP financial measure, in evaluating its operating results and for financial and operational decision-making purposes.

The Company believes that adjusted EBITDA and adjusted net income/(loss)

help identify underlying trends in its business that could otherwise be distorted by the effect of the expenses and gains that the Company

include in income/(loss) from operations and net income/(loss). The Company believes that adjusted EBITDA and adjusted net income/(loss)

provide useful information about its operating results, enhance the overall understanding of its past performance and future prospects

and allow for greater visibility with respect to key metrics used by its management in its financial and operational decision-making.

Adjusted EBITDA and adjusted net income/(loss) should not be considered

in isolation or construed as alternatives to net income/(loss) or any other measure of performance or as indicators of the Company’s

operating performance. Investors are encouraged to review the historical Non-GAAP financial measures to the most directly comparable GAAP

measures. Adjusted EBITDA and adjusted net income/(loss) presented here may not be comparable to similarly titled measures presented by

other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures

to the Company’s data. The Company encourages investors and others to review its financial information in its entirety and not rely

on a single financial measure.

Adjusted EBITDA represents EBITDA before share-based compensation expenses

and investment gain of disposal of subsidiaries and equity investment. EBITDA represents net income/(loss) before interest income and

expenses, income tax benefits/(expenses) from net income/(loss), and depreciation and amortization.

Adjusted net income/(loss) represents net income/(loss) before share-based

compensation expenses and investment gain of disposal of subsidiaries and equity investment.

For more information on this Non-GAAP financial measure, please see

the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP results” set forth at the end of this document.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “confident” and similar statements.

Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s goals

and strategies; the Company’s future business development, financial condition and results of operations; the Company’s expectations

regarding demand for, and market acceptance of, its solutions and services; the Company’s expectations regarding keeping and strengthening

its relationships with users, financial service providers and other parties it collaborates with; trends, competition and regulatory policies

relating to the industries the Company operates in; general economic and business conditions globally and in China; and assumptions underlying

or related to any of the foregoing. Further information regarding these and other risks is included in the Company’s filings with

the SEC. All information provided in this document and in the attachments is as of the date of this document, and the Company undertakes

no obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

Jianpu Technology Inc.

(IR) Liting

Lu, E-mail: IR@rong360.com

(PR) Amanda

Hu, E-mail: Media@rong360.com

Tel: +86 (10) 6242 7068

Jianpu Technology Inc.

Unaudited Condensed Consolidated Balance Sheets

| | |

As of December 31, | | |

As of June 30, | |

| (In thousands) | |

2023 | | |

2024 | |

| | |

RMB | | |

| RMB | | |

| US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 344,569 | | |

| 312,946 | | |

| 43,063 | |

| Time deposits | |

| 31,949 | | |

| 32,148 | | |

| 4,424 | |

| Restricted time deposits | |

| 278,359 | | |

| 280,092 | | |

| 38,542 | |

| Accounts receivable, net (including amounts billed through related party of nil and RMB951 as of December 31, 2023 and June 30, 2024, respectively) | |

| 161,821 | | |

| 141,699 | | |

| 19,498 | |

| Amount due from related parties | |

| 155 | | |

| 2,651 | | |

| 365 | |

| Prepayments and other current assets | |

| 40,209 | | |

| 56,054 | | |

| 7,713 | |

| Total current assets | |

| 857,062 | | |

| 825,590 | | |

| 113,605 | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 11,747 | | |

| 10,432 | | |

| 1,435 | |

| Intangible assets, net | |

| 17,162 | | |

| 30,959 | | |

| 4,260 | |

| Restricted cash and time deposits | |

| 34,846 | | |

| 34,924 | | |

| 4,806 | |

| Other non-current assets | |

| 10,984 | | |

| 24,731 | | |

| 3,403 | |

| Total non-current assets | |

| 74,739 | | |

| 101,046 | | |

| 13,904 | |

| Total assets | |

| 931,801 | | |

| 926,636 | | |

| 127,509 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 236,212 | | |

| 227,193 | | |

| 31,263 | |

| Accounts payable (including amounts billed through related party of RMB3,253 and RMB801 as of December 31, 2023 and June 30, 2024, respectively) | |

| 106,461 | | |

| 100,915 | | |

| 13,886 | |

| Advances from customers | |

| 46,142 | | |

| 49,420 | | |

| 6,800 | |

| Tax payable | |

| 10,304 | | |

| 11,030 | | |

| 1,518 | |

| Amount due to related parties | |

| 10,623 | | |

| 5,039 | | |

| 693 | |

| Accrued expenses and other current liabilities | |

| 89,541 | | |

| 69,144 | | |

| 9,515 | |

| Total current liabilities | |

| 499,283 | | |

| 462,741 | | |

| 63,675 | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| 3,405 | | |

| 3,205 | | |

| 441 | |

| Other non-current liabilities | |

| 11,683 | | |

| 11,173 | | |

| 1,537 | |

| Total non-current liabilities | |

| 15,088 | | |

| 14,378 | | |

| 1,978 | |

| Total liabilities | |

| 514,371 | | |

| 477,119 | | |

| 65,653 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 286 | | |

| 286 | | |

| 39 | |

| Treasury stock, at cost | |

| (72,939 | ) | |

| (71,906 | ) | |

| (9,895 | ) |

| Additional paid-in capital | |

| 1,891,045 | | |

| 1,890,328 | | |

| 260,118 | |

| Accumulated losses | |

| (1,450,925 | ) | |

| (1,421,821 | ) | |

| (195,649 | ) |

| Statutory reserves | |

| 2,027 | | |

| 2,027 | | |

| 279 | |

| Accumulated other comprehensive income | |

| 47,407 | | |

| 50,162 | | |

| 6,903 | |

| Total Jianpu’s shareholders’ equity | |

| 416,901 | | |

| 449,076 | | |

| 61,795 | |

| Noncontrolling interests | |

| 529 | | |

| 441 | | |

| 61 | |

| Total shareholders’ equity | |

| 417,430 | | |

| 449,517 | | |

| 61,856 | |

| Total liabilities and shareholders’ equity | |

| 931,801 | | |

| 926,636 | | |

| 127,509 | |

Jianpu Technology Inc.

Unaudited

Condensed Consolidated Statements of Comprehensive Income/(Loss)

| | |

For the Six Months Ended June 30, | |

| (In thousands except for number of shares and per share data) | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Revenues: | |

| | |

| | |

| |

| Recommendation services [a] | |

| 375,172 | | |

| 289,741 | | |

| 39,870 | |

| Digital intelligence as a service1 [b] | |

| 50,740 | | |

| 37,300 | | |

| 5,133 | |

| Marketing and other services | |

| 149,009 | | |

| 102,156 | | |

| 14,057 | |

| Total revenues | |

| 574,921 | | |

| 429,197 | | |

| 59,060 | |

| Costs and expenses: | |

| | | |

| | | |

| | |

| Cost of promotion and acquisition [c] | |

| (401,498 | ) | |

| (247,044 | ) | |

| (33,994 | ) |

| Cost of operation [d] | |

| (38,353 | ) | |

| (28,122 | ) | |

| (3,870 | ) |

| Total cost of services | |

| (439,851 | ) | |

| (275,166 | ) | |

| (37,864 | ) |

| Sales and marketing expenses | |

| (64,690 | ) | |

| (64,366 | ) | |

| (8,857 | ) |

| Research and development expenses [e] | |

| (49,700 | ) | |

| (37,033 | ) | |

| (5,096 | ) |

| General and administrative expenses | |

| (54,879 | ) | |

| (44,166 | ) | |

| (6,077 | ) |

| Income/(Loss) from operations | |

| (34,199 | ) | |

| 8,466 | | |

| 1,166 | |

| Net interest income | |

| 2,034 | | |

| 6,275 | | |

| 863 | |

| Others, net | |

| 10,295 | | |

| 14,724 | | |

| 2,026 | |

| Income/(loss) before income tax | |

| (21,870 | ) | |

| 29,465 | | |

| 4,055 | |

| Income tax benefits/(expense) | |

| 162 | | |

| (524 | ) | |

| (72 | ) |

| Net income/(loss) | |

| (21,708 | ) | |

| 28,941 | | |

| 3,983 | |

| Less: net loss attributable to noncontrolling interests | |

| (512 | ) | |

| (163 | ) | |

| (22 | ) |

| Net income/(loss) attributable to Jianpu’s shareholders | |

| (21,196 | ) | |

| 29,104 | | |

| 4,005 | |

| | |

| | | |

| | | |

| | |

| Other comprehensive income | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| 20,018 | | |

| 2,829 | | |

| 389 | |

| Total other comprehensive income | |

| 20,018 | | |

| 2,829 | | |

| 389 | |

| Total comprehensive income/(loss) | |

| (1,690 | ) | |

| 31,770 | | |

| 4,372 | |

| Less: total comprehensive loss attributable to noncontrolling interests | |

| (538 | ) | |

| (87 | ) | |

| (12 | ) |

| Total comprehensive income/(loss) attributable to Jianpu’s shareholders | |

| (1,152 | ) | |

| 31,857 | | |

| 4,384 | |

| | |

| | | |

| | | |

| | |

| Net income/(loss) per share attributable to Jianpu’s shareholders | |

| | | |

| | | |

| | |

| Basic | |

| (0.05 | ) | |

| 0.07 | | |

| 0.01 | |

| Diluted | |

| (0.05 | ) | |

| 0.07 | | |

| 0.01 | |

| Net income/(loss) per ADS attributable to Jianpu’s shareholders | |

| | | |

| | | |

| | |

| Basic | |

| (1.00 | ) | |

| 1.38 | | |

| 0.19 | |

| Diluted | |

| (1.00 | ) | |

| 1.34 | | |

| 0.18 | |

| Weighted average number of shares | |

| | | |

| | | |

| | |

| Basic | |

| 424,521,907 | | |

| 422,748,795 | | |

| 422,748,795 | |

| Diluted | |

| 424,521,907 | | |

| 435,934,033 | | |

| 435,934,033 | |

[a] Including

revenues from related party of RMB709 and RMB186 for the six months ended June 30, 2023 and 2024, respectively.

[b] Including

revenues from related party of RMB1,628 and RMB22 for the six months ended June 30, 2023 and 2024, respectively.

[c] Including

cost of promotion and acquisition from related party of RMB8 and RMB819 for the six months ended June 30, 2023 and 2024 respectively.

[d] Including

cost of operation from related party of RMB471 and RMB493 for the six months ended June 30, 2023 and 2024, respectively.

[e] Including

expenses from related party of RMB256 and RMB38 for the six months ended June 30, 2023 and 2024, respectively.

1

Starting from the first half of 2024, the Company updated the description of its revenue stream “big data and system-based

risk management services” to “digital intelligence as a service”, to provide more relevant and clear information. It

also updated the revenue description in comparative periods to conform to the current classification.

Jianpu Technology Inc.

Unaudited Reconciliations of GAAP and Non-GAAP

Results

| | For the

Six Months Ended June 30, | |

| (In thousands) |

2023 | | |

2024 | |

| |

RMB | | |

RMB | | |

US$ | |

| Net income/(loss) |

| (21,708 | ) | |

| 28,941 | | |

| 3,983 | |

| Add: Share-based compensation expenses |

| 2,086 | | |

| 1,165 | | |

| 160 | |

| Investment gain of disposal of subsidiaries and equity investment2 |

| (7,057 | ) | |

| (5,850 | ) | |

| (805 | ) |

| Non-GAAP adjusted net income /(loss)3 |

| (26,679 | ) | |

| 24,256 | | |

| 3,338 | |

| Add: Depreciation and amortization |

| 2,216 | | |

| 2,050 | | |

| 282 | |

| Net interest income |

| (2,034 | ) | |

| (6,275 | ) | |

| (863 | ) |

| Income tax expenses/(benefits) |

| (162 | ) | |

| 524 | | |

| 72 | |

| Non-GAAP adjusted EBITDA4 |

| (26,659 | ) | |

| 20,555 | | |

| 2,829 | |

2

In May 2023, the Group (Jianpu, its subsidiaries, and VIEs together are referred to as the “Group”.) entered

into a share transfer agreement with the founder and minority shareholder of Newsky Wisdom, which is one of the subsidiaries of the Group

before the completion of the share transfer. During the second quarter of 2023, according to the share transfer agreement, the Group

transferred 35.5% shares to the founder of Newsky Wisdom and consequently became a minority shareholder of Newsky Wisdom, and the Group

no longer has control over Newsky Wisdom. The investment gain of RMB7.1 million was recognized in the second quarter of 2023 accordingly.

In August 2023, the Group entered into a share transfer agreement with a third-party buyer to sell its remaining 15% equity interests

in Newsky Wisdom. During the fourth quarter of 2023, the transaction was completed. The investment gain of RMB5.5 million was recognized

accordingly.

In January 2024, the Company, together with other shareholders of an

investee company, entered into an investment termination agreement with the investee company, according to which the company’s investment

into the investee company was terminated and the investee company would pay the Company US$0.8 million as compensation for such termination.

The compensation was fully paid to the Company in January 2024. The investment had been fully impaired by the Company in the year 2022,

and therefore, the termination will lead to an investment gain of US$0.8 million in January 2024.

3

Non-GAAP adjusted net income/(loss) represents net income/(loss) before share-based compensation expenses and investment

gain of disposal of subsidiaries and equity investment. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” at the

end of this document for more details about Non-GAAP adjusted net income/(loss). Non-GAAP adjusted net income/(loss) margin equals Non-GAAP

adjusted net income/(loss) divided by total revenues.

4

Non-GAAP adjusted EBITDA represents EBITDA before share-based compensation expenses, investment gain of disposal of subsidiaries

and equity investment. EBITDA represents net income/(loss) before interest income and expenses, income tax benefits/(expenses)

from net income/(loss), and depreciation and amortization. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” for

more details.

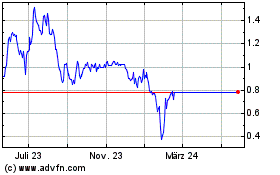

Jianpu Technology (NYSE:JT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Jianpu Technology (NYSE:JT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024