UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38278

Jianpu Technology Inc.

5F Times Cyber Building, 19 South Haidian Road

Haidian District, Beijing

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

By |

: |

/s/ Yilü (Oscar) Chen |

| |

Name |

: |

Yilü (Oscar) Chen |

| |

Title |

: |

Chief Financial Officer |

Date: November 24, 2023

Exhibit Index

Exhibit 99.1 – Jianpu Technology Inc. Reports Third Quarter 2023 Unaudited Financial Results

Exhibit 99.1

Jianpu Technology Inc. Reports Third Quarter

2023 Unaudited Financial Results

Beijing, November 24, 2023

-- Jianpu Technology Inc. (“Jianpu,” or the “Company”) (NYSE: JT), a leading independent open platform

for the discovery and recommendation of financial products in China, today announced its unaudited financial results for the third quarter

ended September 30, 2023.

Third Quarter 2023 Operational and Financial

Highlights:

| · | Revenues

from recommendation services for the third quarter of 2023 decreased by 9.6% to RMB191.2

million (US$26.2 million) from RMB211.6 million in the same period of 2022. Revenues from

recommendation services for loans increased by 25.3% to RMB102.9 million (US$14.1 million)

in the third quarter of 2023 from RMB82.1 million in the same period of 2022, primarily due

to the increase in the number of loan applications. Revenues from recommendation services

for credit cards decreased by 31.8% to RMB88.3 million (US$12.1 million) in the third quarter

of 2023 from RMB129.5 million in the same period of 2022, primarily due to the decrease in

the credit card volume. |

| · | Revenues

from big data and system-based risk management services decreased by 24.4% to RMB18.9 million

(US$2.6 million) in the third quarter of 2023 from RMB25.0 million in the same period of

2022, primarily due to the deconsolidation of Newsky Wisdom Treasure (Beijing) Co., Ltd (“Newsky

Wisdom”) in the second quarter of 2023. The decline was also caused by a gradual shift

of our business model of data-based risk management services towards the cooperation with

the licensed credit reporting agencies. |

| · | Revenues

from marketing and other services1

increased by 41.3% to RMB45.5 million (US$6.2 million) in the third quarter

of 2023 from RMB32.2 million in the same period of 2022. The increase was mainly attributable

to the growth of insurance brokerage services and other new businesses. |

| · | Loss

from operations was RMB8.7 million (US$1.2 million) in the third quarter of 2023, compared

with RMB31.9 million in the same period of 2022. Operating loss margin was 3.4% in the third

quarter of 2023, compared with 11.9% in the same period of 2022. The improvement of loss

from operations was mainly attributable to the decrease in costs and expenses resulting from

efficiency improvement and cost optimization. |

| · | Net

loss was RMB6.4 million (US$0.9 million) in the third quarter of 2023, compared with RMB25.1

million in the same period of 2022. Net loss margin was 2.5% in the third quarter of 2023,

compared with 9.3% in the same period of 2022. |

| · | Non-GAAP

adjusted net loss2

was RMB5.6 million (US$0.8 million) in the third quarter of 2023, compared with RMB9.4 million

in the same period of 2022. Non-GAAP adjusted net loss margin2 was 2.2% in the

third quarter of 2023, compared with 3.5% in the same period of 2022. |

1

Starting from the fourth quarter of 2022, the Company updated the description of its revenue stream “advertising,

marketing and other services” to “marketing and other services” to provide more relevant and clear information. It

also updated the revenue description in comparative periods to conform to the current classification.

2 Non-GAAP adjusted net loss represents net loss before

share-based compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation

of subsidiaries and tax effects of above Non-GAAP adjustments. See “Unaudited Reconciliations of GAAP and Non-GAAP Results”

at the end of this press release for more details about Non-GAAP adjusted net loss. Non-GAAP adjusted net loss margin equals Non-GAAP

adjusted net loss divided by total revenues.

First Nine Months 2023 Operational and Financial

Highlights:

| · | Revenues

from recommendation services was RMB566.4 million (US$77.6 million) in the first nine months

of 2023, compared with RMB560.4 million in the same period of 2022. Revenues from recommendation

services for loans increased by 27.3% to RMB248.4 million (US$34.0 million) in the first

nine months of 2023 from RMB195.2 million in the same period of 2022, primarily due to the

increase in the number of loan applications. Revenues from recommendation services for credit

cards decreased by 12.9% to RMB318.0 million (US$43.6 million) in the first nine months of

2023 from RMB365.2 million in the same period of 2022, primarily due to the decrease in the

credit card volume. |

| · | Revenues

from big data and system-based risk management services was RMB69.6 million (US$9.5 million)

in the first nine months of 2023, compared with RMB68.0 million in the same period of 2022. |

| · | Revenues

from marketing and other services1 increased by 72.1% to RMB194.5 million (US$26.7

million) in the first nine months of 2023 from RMB113.0 million in the same period of 2022.

The increase was mainly attributable to the growth of insurance brokerage services and other

new businesses. |

| · | Loss

from operations was RMB42.9 million (US$5.9 million) in the first nine months of 2023, compared

with RMB122.4 million in the same period of 2022. Operating loss margin was 5.2% in the first

nine months of 2023, compared with 16.5% in the same period of 2022. The improvement of loss

from operations was mainly attributable to the increase in revenues and the decrease in operating

expenses resulting from efficiency improvement and cost optimization. |

| · | Net

loss was RMB28.1 million (US$3.9 million) in the first nine months of 2023, compared with

RMB114.1 million in the same period of 2022. Net loss margin was 3.4% in the first nine months

of 2023, compared with 15.4% in the same period of 2022. |

| · | Non-GAAP

adjusted net loss2 was RMB32.3 million (US$4.4 million) in the first nine months

of 2023, compared with RMB92.2 million in the same period of 2022. Non-GAAP adjusted net

loss margin2 was 3.9% in the first nine months of 2023, compared with 12.4% in

the same period of 2022. |

1 Starting from the fourth quarter of 2022, the Company

updated the description of its revenue stream “advertising, marketing and other services” to “marketing and other services”

to provide more relevant and clear information. It also updated the revenue description in comparative periods to conform to the current

classification.

2 Non-GAAP adjusted net loss represents net loss before

share-based compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation

of subsidiaries and tax effects of above Non-GAAP adjustments. See “Unaudited Reconciliations of GAAP and Non-GAAP Results”

at the end of this press release for more details about Non-GAAP adjusted net loss. Non-GAAP adjusted net loss margin equals Non-GAAP

adjusted net loss divided by total revenues.

Mr. David Ye, Co-founder, Chairman and Chief Executive Officer

of Jianpu, commented, “We have made progress in navigating the challenging environment and executing our diversification strategy

since earlier this year, resulting in an increase of 12.0% year-over-year of our total revenue to RMB830.5 million (US$113.8 million)

during the first nine months. Through our continued efforts to enhance operational efficiency and to optimize cost structure, our ROI3

experienced a remarkable 5.9 percentage points increase year-over-year, reaching 141.2%, and our net loss was RMB6.4 million (US$0.9

million) in the third quarter of 2023.”

“Moreover, we are cognizant of the immense opportunities coming

with the advancement of AI, and will target to develop flexible and low-coupling AI solutions with coverage in AI product architecture,

and will continue to empower our ecosystem partners in their digital transformation with digital technology and artificial intelligence,”

concluded Mr. Ye.

“During the third quarter of 2023, we persistently focused on

achieving a diversified revenue structure, improving operating efficiency and executing cost optimization initiatives. In this quarter,

our loan recommendation services and marketing and other services continued to grow, leading to a more balanced revenue structure. Driven

by our improved productivity and continued efficiency improvement, we trimmed our Non-GAAP adjusted net loss2 significantly

by 40.4% year-over-year to RMB5.6 million (US$0.8 million) in the third quarter of 2023,” said Oscar Chen, Chief Financial

Officer of Jianpu.

Third Quarter 2023 Financial Results

Total revenues for the third quarter of 2023 decreased by 4.9%

to RMB255.6 million (US$35.0 million) from RMB268.8 million in the same period of 2022. The decrease was mainly attributable to the decrease

in revenues from recommendation services, partially offset by the increase of revenues from marketing and other services1.

Revenues from recommendation services decreased by 9.6% to

RMB191.2 million (US$26.2 million) in the third quarter of 2023 from RMB211.6 million in the same period of 2022.

Revenues from recommendation services for credit cards

decreased by 31.8% to RMB88.3 million (US$12.1 million) in the third quarter of 2023 from RMB129.5 million in the same period of

2022. As certain credit card issuers lowered their marketing budget from the second quarter of 2023, credit card volume decreased by

27.3% to approximately 0.8 million in the third quarter of 2023 from 1.1 million in the same period of 2022. The average fee per credit

card was RMB115.2 (US$15.8) and RMB116.4 in the third quarters of 2023 and 2022, respectively.

3 ROI represents revenue of recommendation services, marketing

and other services divided by cost of promotion and acquisition.

2 Non-GAAP adjusted net loss represents net loss before

share-based compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation

of subsidiaries and tax effects of above Non-GAAP adjustments. See “Unaudited Reconciliations of GAAP and Non-GAAP Results”

at the end of this press release for more details about Non-GAAP adjusted net loss. Non-GAAP adjusted net loss margin equals Non-GAAP

adjusted net loss divided by total revenues.

1 Starting from the fourth quarter of 2022, the Company

updated the description of its revenue stream “advertising, marketing and other services” to “marketing and other services”

to provide more relevant and clear information. It also updated the revenue description in comparative periods to conform to the current

classification.

Revenues from recommendation services for loans increased

by 25.3% to RMB102.9 million (US$14.1 million) in the third quarter of 2023 from RMB82.1 million in the same period of 2022, primarily

due to an increase in the number of loan applications. The number of loan applications was approximately 7.4 million in the third quarter

of 2023, representing a 48.0% increase from that in the same period of 2022. The average fee per loan application was RMB14.0 (US$1.9)

and RMB16.5 in the third quarters of 2023 and 2022, respectively.

Revenues from big data and system-based risk management services

decreased by 24.4% to RMB18.9 million (US$2.6 million) in the third quarter of 2023 from RMB25.0 million in the same period of 2022,

primarily due to the deconsolidation of Newsky Wisdom in the second quarter of 2023.

The decline was also caused by a gradual shift of our business model of data-based risk management services towards the cooperation

with the licensed credit reporting agencies. Through the cooperation, which is mandated by the relevant PRC regulation, we, together

with the licensed credit reporting agencies, provide data-based risk management services to the financial institutions and share the

economic interests accordingly.

Revenues from marketing and other services1 increased

by 41.3% to RMB45.5 million (US$6.2 million) in the third quarter of 2023 from RMB32.2 million in the same period of 2022, primarily

due to the growth of the Company’s insurance brokerage services and other new businesses.

Cost of promotion and acquisition decreased by 7.0% to RMB167.6

million (US$23.0 million) in the third quarter of 2023 from RMB180.2 million in the same period of 2022. The decrease was primarily due

to the efficiency improvements and, to a lesser extent, the decrease in revenues from recommendation services.

Cost of operation decreased by 30.5% to RMB14.6 million (US$2.0

million) in the third quarter of 2023 from RMB21.0 million in the same period of 2022. The decrease was primarily attributable to the

decrease in data acquisition costs, as well as the decrease in software development and maintenance costs related to the big data and

system-based risk management services, which partially resulted from the deconsolidation of Newsky Wisdom.

Sales and marketing expenses was RMB33.2 million (US$4.6 million)

in the third quarter of 2023, compared with RMB34.5 million in the same period of 2022. The decrease was primarily due to the decreases

in payroll expenses, rental expenses, and travel and entertainment expenses, partially offset by an increase in client service-related

expenses.

Research and development expenses decreased by 8.4% to RMB26.2

million (US$3.6 million) in the third quarter of 2023 from RMB28.6 million in the same period of 2022, primarily due to the decreases

in payroll expenses and rental expenses resulting from the Company’s continued efforts in cost optimization.

1 Starting from the fourth quarter of 2022, the Company

updated the description of its revenue stream “advertising, marketing and other services” to “marketing and other services”

to provide more relevant and clear information. It also updated the revenue description in comparative periods to conform to the current

classification.

General and administrative expenses was RMB22.6 million (US$3.1

million) in the third quarter of 2023, compared with RMB23.0 million in the same period of 2022. The change was primarily due to the

decreases in rental expenses and travel and entertainment expenses, partially offset by the increases in allowance for credit losses

and payroll expenses.

Impairment of goodwill and intangible assets was RMB13.3 million

in the third quarter of 2022 related to the impairment of the goodwill and intangible assets of Newsky Wisdom, which experienced a decline

in revenue due to the impact of COVID-19 prevention and control measures. There was no such impairment loss in the same period of 2023.

Loss from operations was RMB8.7 million (US$1.2 million) in

the third quarter of 2023, compared with RMB31.9 million in the same period of 2022. Operating loss margin was 3.4% in the third quarter

of 2023, compared with 11.9% in the same period of 2022. The decrease in operating loss was mainly attributable to the decrease in costs

and expenses resulting from efficiency improvement and cost optimization.

Others, net decreased by 97.3% to RMB0.2 million (US$0.0 million)

in the third quarter of 2023 from RMB7.5 million in the same period of 2022. The decrease was mainly attributable to the decrease in tax

benefits for value-added tax.

Net loss was RMB6.4 million (US$0.9 million) in the third quarter

of 2023 compared with RMB25.1 million in the same period of 2022. Net loss margin was 2.5% in the third quarter of 2023, compared with

9.3% in the same period of 2022.

Non-GAAP adjusted net loss2, which excluded share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation of

subsidiaries and tax effects of above Non-GAAP adjustments, was RMB5.6 million (US$0.8 million) in the third quarter of 2023, compared

with RMB9.4 million in the same period of 2022. Non-GAAP adjusted net loss margin2 was 2.2% in the third quarter of 2023 compared

with 3.5% in the same period of 2022.

Non-GAAP adjusted EBITDA5, which excluded share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation of

subsidiaries, depreciation and amortization, interest income and expenses, and income tax benefits from net loss, for the third quarter

of 2023 was a loss of RMB6.6 million (US$0.9 million), compared with a loss of RMB7.2 million in the same period of 2022.

2 Non-GAAP adjusted net loss represents net loss before

share-based compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation

of subsidiaries and tax effects of above Non-GAAP adjustments. See “Unaudited Reconciliations of GAAP and Non-GAAP Results”

at the end of this press release for more details about Non-GAAP adjusted net loss. Non-GAAP adjusted net loss margin equals Non-GAAP

adjusted net loss divided by total revenues.

5 Non-GAAP adjusted EBITDA represents EBITDA before share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets and investment gain of deconsolidation

of subsidiaries. EBITDA represents net (loss)/income before interest income and expenses, income tax benefits from net loss, and depreciation

and amortization. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” for more details.

As of September 30, 2023, the Company had cash and cash equivalents,

time deposits and restricted cash and time deposits of RMB687.3 million (US$94.2 million) and working capital of approximately RMB350.0

million (US$48.0 million). Compared to those as of December 31, 2022, cash and cash equivalents, time deposits and restricted cash

and time deposits increased by RMB3.1 million.

First Nine Months 2023 Financial Results

Total revenues for the first nine months of 2023 increased

by 12.0% to RMB830.5 million (US$113.8 million) from RMB741.4 million in the same period of 2022. The increase was mainly attributable

to the increase in revenues from marketing and other services1.

Revenues from recommendation services was RMB566.4 million

(US$77.6 million) in the first nine months of 2023, compared with RMB560.4 million in the same period of 2022.

Revenues from recommendation services for credit cards

decreased by 12.9% to RMB318.0 million (US$43.6 million) in the first nine months of 2023 from RMB365.2 million in the same period

of 2022. As certain credit card issuers lowered their marketing budget from the second quarter of 2023, credit card volume in the first

nine months of 2023 decreased by 12.5% to approximately 2.8 million from 3.2 million in the same period of 2022. The average fee per

credit card were RMB114.3 (US$15.7) and RMB113.4 in the first nine months of 2023 and 2022, respectively.

Revenues from recommendation services for loans increased

by 27.3% to RMB248.4 million (US$34.0 million) in the first nine months of 2023 from RMB195.2 million in the same period of 2022, primarily

due to the increase in the number of loan applications. The number of loan applications was approximately 17.1 million in the first nine

months of 2023, representing a 29.5% increase from that in the same period of 2022. The average fee per loan application was RMB14.6

(US$2.0) and RMB14.8 in the first nine months of 2023 and 2022, respectively.

Revenues from big data and system-based risk management services

was RMB69.6 million (US$9.5 million) in the first nine months of 2023, compared with RMB68.0 million in the same period of 2022.

Revenues from marketing and other services1 increased

by 72.1% to RMB194.5 million (US$26.7 million) in the first nine months of 2023 from RMB113.0 million in the same period of 2022, primarily

due to the growth of the Company’s insurance brokerage services and other new businesses.

1 Starting from the fourth quarter of 2022, the Company

updated the description of its revenue stream “advertising, marketing and other services” to “marketing and other services”

to provide more relevant and clear information. It also updated the revenue description in comparative periods to conform to the current

classification.

Cost of promotion and acquisition increased by 9.1% to RMB569.1

million (US$78.0 million) in the first nine months of 2023 from RMB521.5 million in the same period of 2022, primarily due to the growth

of the Company’s revenues from marketing and other services1.

Cost of operation decreased by 11.5% to RMB53.0 million (US$7.3

million) in the first nine months of 2023 from RMB59.9 million in the same period of 2022. The decrease was primarily attributable to

the decreases in data acquisition costs, as well as the decrease in software development and maintenance costs related to the big data

and system-based risk management services, which partially resulted from the deconsolidation of Newsky Wisdom.

Sales and marketing expenses was RMB97.9 million (US$13.4 million)

in the first nine months of 2023, compared with RMB101.6 million in the same period of 2022. The decrease was primarily due to the decreases

in payroll expenses, rental expenses and marketing and advertising expenses, partially offset by an increase in client service-related

expenses.

Research and development expenses decreased by 13.5% to RMB75.9

million (US$10.4 million) in the first nine months of 2023 from RMB87.7 million in the same period of 2022, primarily due to the decreases

in payroll expenses, rental expenses and share-based compensation expenses resulting from our continued efforts in cost optimization.

General and administrative expenses was RMB77.5 million (US$10.6

million) in the first nine months of 2023 from RMB79.9 million in the same period of 2022, the change was primarily due to the decreases

in rental expenses, share-based compensation expenses and travel and entertainment expenses, partially offset by an increase in professional

fees.

Impairment of goodwill and intangible assets was RMB13.3 million

in the first nine months of 2022 related to the impairment of the goodwill and intangible assets of Newsky Wisdom. There was no such

impairment loss in the same period of 2023.

Loss from operations was RMB42.9 million (US$5.9 million) in

the first nine months of 2023, compared with RMB122.4 million in the same period of 2022. Operating loss margin was 5.2% in the first

nine months of 2023, compared with 16.5% in the same period of 2022. The decrease in operating loss was mainly attributable to the increase

in revenues and the decrease in operating expenses resulting from efficiency improvement and cost optimization.

Others, net decreased by 9.5% to RMB10.5 million (US$1.4 million)

in the first nine months of 2023 from RMB11.6 million in the same period of 2022. The decrease was mainly attributable to the decrease

in tax benefits of value-added tax, partially offset by the investment gain from the deconsolidation of Newsky Wisdom4 in

the first nine months of 2023.

Net loss was RMB28.1 million (US$3.9 million) in the first

nine months of 2023 compared with RMB114.1 million in the same period of 2022. Net loss margin was 3.4% in the first nine months of 2023

compared with 15.4% in the same period of 2022.

Non-GAAP adjusted net loss2, which excluded share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation of

subsidiaries and tax effects of above Non-GAAP adjustments, was RMB32.3 million (US$4.4 million) in the first nine months of 2023, compared

with RMB92.2 million in the same period of 2022. Non-GAAP adjusted net loss margin2 was 3.9% in the first nine months of 2023

compared with 12.4% in the same period of 2022.

Non-GAAP adjusted EBITDA5, which excluded share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation of

subsidiaries, depreciation and amortization, interest income and expenses, and income tax benefits from net loss, for the first nine

months of 2023 was a loss of RMB33.3 million (US$4.6 million), compared with a loss of RMB84.7 million in the same period of 2022.

4

In May 2023, the Group (Jianpu, its subsidiaries, and VIEs together are referred to as the “Group”.) entered

into a share transfer agreement with the founder and minority shareholder of Newsky Wisdom, which is one of the subsidiaries of the Group

before the completion of the share transfer. During the second quarter of 2023, according to the share transfer agreement, the Group transferred

35.5% shares to the founder of Newsky Wisdom and consequently became a minority shareholder of Newsky Wisdom, and the Group no longer

has control over Newsky Wisdom. The investment gain of RMB7.1 million was recognized in the second quarter of 2023 accordingly.

In June 2022, Databook Tech Ltd (“Databook”), one of the

Company’s subsidiaries, made a cash distribution to its shareholders, through which the Company received a portion of the cash distribution.

Databook also issued additional shares to one minority shareholder and changed the Company’s board seat in Databook to one director.

The Company consequently became a minority shareholder of Databook and no longer has control over Databook. The investment gain of RMB6.1

million was realized in the second quarter of 2022, and RMB17.0 million was realized in the fourth quarter of 2022.

2

Non-GAAP adjusted net loss represents net loss before share-based compensation expenses, investment impairment loss, impairment of goodwill

and intangible assets, investment gain of deconsolidation of subsidiaries and tax effects of above Non-GAAP adjustments. See “Unaudited

Reconciliations of GAAP and Non-GAAP Results” at the end of this press release for more details about Non-GAAP adjusted net loss.

Non-GAAP adjusted net loss margin equals Non-GAAP adjusted net loss divided by total revenues.

5 Non-GAAP adjusted EBITDA represents EBITDA before share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets and investment gain of deconsolidation

of subsidiaries. EBITDA represents net (loss)/income before interest income and expenses, income tax benefits from net loss, and depreciation

and amortization. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” for more details.

Subsequent Event

In August 2023, the Group entered into a share transfer agreement

with a third-party buyer to sell its remaining 15% equity interests in Newsky Wisdom. The transaction was completed in late October 2023.

The Group received all of the considerations and recognized the related investment gains in October 2023.

Conference Call

The Company’s management will host an earnings conference call

at 8:00 AM U.S. Eastern Time on November 24, 2023 (9:00 PM Beijing/Hong Kong Time on November 24, 2023).

Dial-in details for the earnings conference call are as follows:

| United States (toll free): |

1-888-346-8982 |

| International: |

1-412-902-4272 |

| Hong Kong, China (toll free): |

800-905-945 |

| Hong Kong, China: |

852-3018-4992 |

| Mainland China: |

400-120-1203 |

Participants should dial-in at least 5 minutes before the scheduled

start time and ask to be connected to the call for “Jianpu Technology Inc.”

Additionally, a live and archived webcast of the conference call will

be available on the Company's investor relations website at http://ir.jianpu.ai.

A replay of the conference call will be accessible approximately one

hour after the conclusion of the live call until December 1, 2023, by dialing the following telephone numbers:

| United States (toll free): |

1-877-344-7529 |

| International: |

1-412-317-0088 |

| Replay Access Code: |

9027544 |

About Jianpu Technology Inc.

Jianpu Technology Inc. is a leading independent open platform for

the discovery and recommendation of financial products in China. The Company connects users with financial service providers in a convenient,

efficient, and secure way. By leveraging its proprietary technology, Jianpu provides users with customized search results and recommendations

tailored to each user’s particular financial needs and profile. The Company also enables financial service providers with sales

and marketing solutions to reach and serve their target customers more effectively through integrated channels and enhance their competitiveness

by providing them with tailored data, risk management services and solutions. The Company is committed to maintaining an independent

open platform, which allows it to serve the needs of users and financial service providers impartially. For more information, please

visit http://ir.jianpu.ai.

Use of Non-GAAP Financial Measures

The Company uses adjusted EBITDA and adjusted net (loss)/income, each

a Non-GAAP financial measure, in evaluating its operating results and for financial and operational decision-making purposes.

The Company believes that adjusted EBITDA and adjusted net (loss)/income

help identify underlying trends in its business that could otherwise be distorted by the effect of the expenses and gains that the Company

include in (loss)/income from operations and net (loss)/income. The Company believes that adjusted EBITDA and adjusted net (loss)/income

provide useful information about its operating results, enhance the overall understanding of its past performance and future prospects

and allow for greater visibility with respect to key metrics used by its management in its financial and operational decision-making.

Adjusted EBITDA and adjusted net (loss)/income should not be considered

in isolation or construed as alternatives to net (loss)/income or any other measure of performance or as indicators of the Company’s

operating performance. Investors are encouraged to review the historical Non-GAAP financial measures to the most directly comparable

GAAP measures. Adjusted EBITDA and adjusted net (loss)/income presented here may not be comparable to similarly titled measures presented

by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures

to the Company’s data. The Company encourages investors and others to review its financial information in its entirety and not

rely on a single financial measure.

Adjusted EBITDA represents EBITDA before share-based compensation

expenses, investment impairment loss, impairment of goodwill and intangible assets and investment gain of deconsolidation of subsidiaries.

EBITDA represents net (loss)/income before interest, tax, depreciation and amortization.

Adjusted net (loss)/income represents net (loss)/income before share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation of

subsidiaries and tax effects of above Non-GAAP adjustments.

For more information on this Non-GAAP financial measure, please see

the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP results” set forth at the end of this press release.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “confident” and similar statements.

Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s goals

and strategies; the Company’s future business development, financial condition and results of operations; the Company’s expectations

regarding demand for, and market acceptance of, its solutions and services; the Company’s expectations regarding keeping and strengthening

its relationships with users, financial service providers and other parties it collaborates with; trends, competition and regulatory

policies relating to the industries the Company operates in; general economic and business conditions globally and in China; and assumptions

underlying or related to any of the foregoing. Further information regarding these and other risks is included in the Company’s

filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release,

and the Company undertakes no obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Jianpu Technology Inc.

(IR) Liting Lu, E-mail: IR@rong360.com

(PR) Amanda Hu, E-mail: Media@rong360.com

Tel: +86 (10) 6242 7068

Christensen

Suri Cheng, E-mail: suri.cheng@christensencomms.com

Tel: +86 185 0060 8364

Crystal Lai, E-mail: crystal.lai@christensencomms.com

Tel: +852 2232 3907

In US:

Christensen

Linda Bergkamp, E-mail: linda.bergkamp@christensencomms.com

Tel: +1 480 353 6648

Jianpu Technology Inc.

Unaudited Condensed Consolidated Balance Sheets

| | |

As of December 31, | | |

As of September 30, | |

| (In thousands) | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 346,539 | | |

| 271,708 | | |

| 37,241 | |

| Time deposits | |

| - | | |

| 89,826 | | |

| 12,312 | |

| Restricted time deposits | |

| 297,634 | | |

| 282,175 | | |

| 38,675 | |

| Accounts receivable, net | |

| 189,665 | | |

| 186,998 | | |

| 25,630 | |

| Amount due from related parties | |

| 153 | | |

| 157 | | |

| 22 | |

| Prepayments and other current assets | |

| 46,537 | | |

| 41,444 | | |

| 5,680 | |

| Total current assets | |

| 880,528 | | |

| 872,308 | | |

| 119,560 | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 12,578 | | |

| 12,348 | | |

| 1,692 | |

| Intangible assets, net | |

| 18,339 | | |

| 19,496 | | |

| 2,672 | |

| Restricted cash and time deposits | |

| 40,059 | | |

| 43,576 | | |

| 5,973 | |

| Other non-current assets | |

| 10,758 | | |

| 12,400 | | |

| 1,700 | |

| Total non-current assets | |

| 81,734 | | |

| 87,820 | | |

| 12,037 | |

| Total assets | |

| 962,262 | | |

| 960,128 | | |

| 131,597 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 253,481 | | |

| 254,465 | | |

| 34,877 | |

| Accounts payable (including amounts billed through related party of RMB5,652 and RMB2,682 as of December 31, 2022 and September 30, 2023, respectively) | |

| 96,729 | | |

| 111,154 | | |

| 15,235 | |

| Advances from customers | |

| 46,920 | | |

| 46,612 | | |

| 6,389 | |

| Tax payable | |

| 9,662 | | |

| 10,209 | | |

| 1,399 | |

| Amount due to related parties | |

| 13,534 | | |

| 12,115 | | |

| 1,660 | |

| Accrued expenses and other current liabilities | |

| 88,871 | | |

| 87,788 | | |

| 12,032 | |

| Total current liabilities | |

| 509,197 | | |

| 522,343 | | |

| 71,592 | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| 3,644 | | |

| 3,425 | | |

| 469 | |

| Other non-current liabilities | |

| 13,096 | | |

| 12,200 | | |

| 1,672 | |

| Total non-current liabilities | |

| 16,740 | | |

| 15,625 | | |

| 2,141 | |

| Total liabilities | |

| 525,937 | | |

| 537,968 | | |

| 73,733 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 286 | | |

| 286 | | |

| 39 | |

| Treasury stock, at cost | |

| (77,499 | ) | |

| (73,735 | ) | |

| (10,106 | ) |

| Additional paid-in capital | |

| 1,891,266 | | |

| 1,890,757 | | |

| 259,150 | |

| Accumulated losses | |

| (1,424,153 | ) | |

| (1,452,071 | ) | |

| (199,023 | ) |

| Statutory reserves | |

| 2,027 | | |

| 2,027 | | |

| 278 | |

| Accumulated other comprehensive income | |

| 37,941 | | |

| 54,304 | | |

| 7,445 | |

| Total Jianpu’s shareholders’ equity | |

| 429,868 | | |

| 421,568 | | |

| 57,783 | |

| Noncontrolling interests | |

| 6,457 | | |

| 592 | | |

| 81 | |

| Total shareholders’ equity | |

| 436,325 | | |

| 422,160 | | |

| 57,864 | |

| Total liabilities and shareholders’ equity | |

| 962,262 | | |

| 960,128 | | |

| 131,597 | |

Jianpu Technology Inc.

Unaudited Condensed Consolidated Statements

of Comprehensive Loss

| (In thousands | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended September 30, | |

| except for number of shares and per | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| share data) | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenues: | |

| | |

| | |

| | |

| | |

| | |

| |

| Recommendation services: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans [a] | |

| 82,114 | | |

| 102,915 | | |

| 14,106 | | |

| 195,186 | | |

| 248,394 | | |

| 34,045 | |

| Credit cards | |

| 129,454 | | |

| 88,300 | | |

| 12,103 | | |

| 365,229 | | |

| 317,993 | | |

| 43,585 | |

| Total recommendation services | |

| 211,568 | | |

| 191,215 | | |

| 26,209 | | |

| 560,415 | | |

| 566,387 | | |

| 77,630 | |

| Big data and system-based risk management services [b] | |

| 24,983 | | |

| 18,877 | | |

| 2,587 | | |

| 68,000 | | |

| 69,617 | | |

| 9,542 | |

| Marketing and other services [b]1 | |

| 32,244 | | |

| 45,499 | | |

| 6,236 | | |

| 113,002 | | |

| 194,508 | | |

| 26,660 | |

| Total revenues | |

| 268,795 | | |

| 255,591 | | |

| 35,032 | | |

| 741,417 | | |

| 830,512 | | |

| 113,832 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of promotion and acquisition [c] | |

| (180,200 | ) | |

| (167,634 | ) | |

| (22,976 | ) | |

| (521,488 | ) | |

| (569,132 | ) | |

| (78,006 | ) |

| Cost of operation [d] | |

| (20,985 | ) | |

| (14,598 | ) | |

| (2,001 | ) | |

| (59,893 | ) | |

| (52,951 | ) | |

| (7,258 | ) |

| Total cost of services | |

| (201,185 | ) | |

| (182,232 | ) | |

| (24,977 | ) | |

| (581,381 | ) | |

| (622,083 | ) | |

| (85,264 | ) |

| Sales and marketing expenses | |

| (34,539 | ) | |

| (33,227 | ) | |

| (4,554 | ) | |

| (101,561 | ) | |

| (97,917 | ) | |

| (13,421 | ) |

| Research and development expenses [e] | |

| (28,617 | ) | |

| (26,229 | ) | |

| (3,595 | ) | |

| (87,685 | ) | |

| (75,929 | ) | |

| (10,407 | ) |

| General and administrative expenses | |

| (23,044 | ) | |

| (22,645 | ) | |

| (3,104 | ) | |

| (79,875 | ) | |

| (77,524 | ) | |

| (10,626 | ) |

| Impairment of goodwill and intangible assets | |

| (13,327 | ) | |

| - | | |

| - | | |

| (13,327 | ) | |

| - | | |

| - | |

| Loss from operations | |

| (31,917 | ) | |

| (8,742 | ) | |

| (1,198 | ) | |

| (122,412 | ) | |

| (42,941 | ) | |

| (5,886 | ) |

| Net interest expenses | |

| (1,218 | ) | |

| 2,072 | | |

| 284 | | |

| (4,122 | ) | |

| 4,106 | | |

| 563 | |

| Others, net | |

| 7,472 | | |

| 193 | | |

| 26 | | |

| 11,643 | | |

| 10,488 | | |

| 1,438 | |

| Loss before income tax | |

| (25,663 | ) | |

| (6,477 | ) | |

| (888 | ) | |

| (114,891 | ) | |

| (28,347 | ) | |

| (3,885 | ) |

| Income tax benefits | |

| 588 | | |

| 81 | | |

| 11 | | |

| 837 | | |

| 243 | | |

| 33 | |

| Net loss | |

| (25,075 | ) | |

| (6,396 | ) | |

| (877 | ) | |

| (114,054 | ) | |

| (28,104 | ) | |

| (3,852 | ) |

| Less: net income/(loss) attributable to noncontrolling interests | |

| (7,562 | ) | |

| 326 | | |

| 45 | | |

| (9,968 | ) | |

| (186 | ) | |

| (25 | ) |

| Net loss attributable to Jianpu Technology Inc. | |

| (17,513 | ) | |

| (6,722 | ) | |

| (922 | ) | |

| (104,086 | ) | |

| (27,918 | ) | |

| (3,827 | ) |

| Accretion of mezzanine equity | |

| - | | |

| - | | |

| - | | |

| (8,740 | ) | |

| - | | |

| - | |

| Net loss attributable to Jianpu’s shareholders | |

| (17,513 | ) | |

| (6,722 | ) | |

| (922 | ) | |

| (112,826 | ) | |

| (27,918 | ) | |

| (3,827 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| 33,676 | | |

| (3,698 | ) | |

| (507 | ) | |

| 63,062 | | |

| 16,320 | | |

| 2,237 | |

| Total other comprehensive income/(loss) | |

| 33,676 | | |

| (3,698 | ) | |

| (507 | ) | |

| 63,062 | | |

| 16,320 | | |

| 2,237 | |

| Total comprehensive income/(loss) | |

| 8,601 | | |

| (10,094 | ) | |

| (1,384 | ) | |

| (50,992 | ) | |

| (11,784 | ) | |

| (1,615 | ) |

| Less: total comprehensive income/(loss) attributable to noncontrolling interests | |

| (7,581 | ) | |

| 309 | | |

| 42 | | |

| (9,818 | ) | |

| (229 | ) | |

| (31 | ) |

| Total comprehensive income/(loss) attributable to Jianpu Technology Inc. | |

| 16,182 | | |

| (10,403 | ) | |

| (1,426 | ) | |

| (41,174 | ) | |

| (11,555 | ) | |

| (1,584 | ) |

| Accretion of mezzanine equity | |

| - | | |

| - | | |

| - | | |

| (8,740 | ) | |

| - | | |

| - | |

| Total comprehensive income/(loss) attributable to Jianpu’s shareholders | |

| 16,182 | | |

| (10,403 | ) | |

| (1,426 | ) | |

| (49,914 | ) | |

| (11,555 | ) | |

| (1,584 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to Jianpu’s shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.04 | ) | |

| (0.02 | ) | |

| (0.00 | ) | |

| (0.27 | ) | |

| (0.07 | ) | |

| (0.01 | ) |

| Diluted | |

| (0.04 | ) | |

| (0.02 | ) | |

| (0.00 | ) | |

| (0.27 | ) | |

| (0.07 | ) | |

| (0.01 | ) |

| Net loss per ADS attributable to Jianpu’s shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.83 | ) | |

| (0.32 | ) | |

| (0.04 | ) | |

| (5.32 | ) | |

| (1.32 | ) | |

| (0.18 | ) |

| Diluted | |

| (0.83 | ) | |

| (0.32 | ) | |

| (0.04 | ) | |

| (5.32 | ) | |

| (1.32 | ) | |

| (0.18 | ) |

| Weighted average number of shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 424,297,809 | | |

| 424,665,581 | | |

| 424,665,581 | | |

| 423,896,586 | | |

| 424,570,325 | | |

| 424,570,325 | |

| Diluted | |

| 424,297,809 | | |

| 424,665,581 | | |

| 424,665,581 | | |

| 423,896,586 | | |

| 424,570,325 | | |

| 424,570,325 | |

1 Starting from the fourth quarter of 2022, the Company

updated the description of its revenue stream “advertising, marketing and other services” to “marketing and other services”

to provide more relevant and clear information. It also updated the revenue description in comparative periods to conform to the current

classification.

[a] Including revenues from related party of RMB282 and RMB413 for

the three months ended September 30, 2022 and 2023, respectively, and RMB416 and RMB1,122 for the nine months ended September 30,

2022 and 2023, respectively.

[b] Including revenues from related party of RMB1,486 and RMB447 for

the three months ended September 30, 2022 and 2023, respectively, and RMB3,818 and RMB2,075 for the nine months ended September 30,

2022 and 2023, respectively.

[c] Including cost of promotion and acquisition from related party

of RMB41 and RMB58 for the three months ended September 30, 2022 and 2023, respectively, and RMB185 and RMB66 for the nine months

ended September 30, 2022 and 2023, respectively.

[d] Including cost of operation from related party of RMB79 and RMB322

for the three months ended September 30, 2022 and 2023, respectively, and RMB283 and RMB793 for the nine months ended September 30,

2022 and 2023, respectively.

[e] Including expenses from related party of RMB157 and RMB146 for

the three months ended September 30, 2022 and 2023, respectively, and RMB524 and RMB402 for the nine months ended September 30,

2022 and 2023, respectively.

Jianpu Technology Inc.

Unaudited Reconciliations of GAAP and Non-GAAP

Results

| | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended September 30, | |

| (In thousands) | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net

loss | |

| (25,075 | ) | |

| (6,396 | ) | |

| (877 | ) | |

| (114,054 | ) | |

| (28,104 | ) | |

| (3,852 | ) |

| Add: Share-based

compensation expenses | |

| 1,957 | | |

| 1,145 | | |

| 157 | | |

| 6,396 | | |

| 3,231 | | |

| 443 | |

| Investment impairment

loss | |

| 893 | | |

| - | | |

| - | | |

| 8,716 | | |

| - | | |

| - | |

| Impairment of

goodwill and intangible assets | |

| 13,327 | | |

| - | | |

| - | | |

| 13,327 | | |

| - | | |

| - | |

| Investment

gain of deconsolidation of subsidiaries4 | |

| - | | |

| (355 | ) | |

| (49 | ) | |

| (6,149 | ) | |

| (7,412 | ) | |

| (1,016 | ) |

| Tax

effects on Non-GAAP adjustments5 | |

| (464 | ) | |

| - | | |

| - | | |

| (464 | ) | |

| - | | |

| - | |

| Non-GAAP

adjusted net loss2 | |

| (9,362 | ) | |

| (5,606 | ) | |

| (769 | ) | |

| (92,228 | ) | |

| (32,285 | ) | |

| (4,425 | ) |

| Add: Depreciation

and amortization | |

| 1,082 | | |

| 1,145 | | |

| 157 | | |

| 3,806 | | |

| 3,361 | | |

| 461 | |

| Net interest

expenses | |

| 1,218 | | |

| (2,072 | ) | |

| (284 | ) | |

| 4,122 | | |

| (4,106 | ) | |

| (563 | ) |

| Income

tax benefits | |

| (124 | ) | |

| (81 | ) | |

| (11 | ) | |

| (373 | ) | |

| (243 | ) | |

| (33 | ) |

| Non-GAAP

adjusted EBITDA5 | |

| (7,186 | ) | |

| (6,614 | ) | |

| (907 | ) | |

| (84,673 | ) | |

| (33,273 | ) | |

| (4,560 | ) |

4 In May 2023, the Group (Jianpu, its subsidiaries, and

VIEs together are referred to as the “Group”.) entered into a share transfer agreement with the founder and minority shareholder

of Newsky Wisdom, which is one of the subsidiaries of the Group before the completion of the share transfer. During the second quarter

of 2023, according to the share transfer agreement, the Group transferred 35.5% shares to the founder of Newsky Wisdom and consequently

became a minority shareholder of Newsky Wisdom, and the Group no longer has control over Newsky Wisdom. The investment gain of RMB7.1

million was recognized in the second quarter of 2023 accordingly.

In June 2022, Databook Tech Ltd (“Databook”), one of the

Company’s subsidiaries, made a cash distribution to its shareholders, through which the Company received a portion of the cash

distribution. Databook also issued additional shares to one minority shareholder and changed the Company’s board seat in Databook

to one director. The Company consequently became a minority shareholder of Databook and no longer has control over Databook. The investment

gain of RMB6.1 million was realized in the second quarter of 2022, and RMB17.0 million was realized in the fourth quarter of 2022.

2 Non-GAAP adjusted net loss represents net loss before

share-based compensation expenses, investment impairment loss, impairment of goodwill and intangible assets, investment gain of deconsolidation

of subsidiaries and tax effects of above Non-GAAP adjustments. See “Unaudited Reconciliations of GAAP and Non-GAAP Results”

at the end of this press release for more details about Non-GAAP adjusted net loss. Non-GAAP adjusted net loss margin equals Non-GAAP

adjusted net loss divided by total revenues.

5 Non-GAAP adjusted EBITDA represents EBITDA before share-based

compensation expenses, investment impairment loss, impairment of goodwill and intangible assets and investment gain of deconsolidation

of subsidiaries. EBITDA represents net (loss)/income before interest income and expenses, income tax benefits from net loss, and depreciation

and amortization. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” for more details.

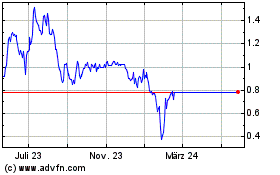

Jianpu Technology (NYSE:JT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Jianpu Technology (NYSE:JT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024