Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

25 Juli 2024 - 10:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

Voya Infrastructure, Industrials & Materials Fund

(Name of Issuer)

Common Shares, $0.01 par value

(Title of Class of Securities)

92912X101

(CUSIP Number)

Saba Capital Management, L.P.

405 Lexington Avenue

58th Floor

New York, NY 10174

Attention: Michael D'Angelo

(212) 542-4635

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 23, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1 of 7 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSON

Saba Capital Management, L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

939,236 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

939,236 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

939,236 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.20% |

| 14 |

TYPE OF REPORTING PERSON

PN; IA |

| |

|

|

|

The percentages used herein are calculated based upon 15,156,320 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/9/24

| 1 |

NAME OF REPORTING PERSON

Boaz R. Weinstein |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

939,236 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

939,236 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

939,236 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.20% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

The percentages used herein are calculated based upon 15,156,320 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/9/24

| 1 |

NAME OF REPORTING PERSON

Saba Capital Management GP, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

939,236 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

939,236 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

939,236 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.20% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

The percentages used herein are calculated based upon 15,156,320 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/9/24

| Item 1. |

SECURITY AND ISSUER |

| |

|

| |

This Amendment No. 3 amends and supplements the statement on Schedule 13D filed with the SEC on 5/8/23, as amended by Amendment No.1 filed 7/24/23, and Amendment No. 2 filed 10/12/23; with respect to the common shares of Voya Infrastructure, Industrials & Materials Fund. This Amendment No. 3 amends Items 3, and 5, as set forth below. |

| |

|

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| |

|

| |

Funds for the purchase of the Common Shares were derived from the subscription proceeds from investors and the capital appreciation thereon and margin account borrowings made in the ordinary course of business. In such instances, the positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the account, which may exist from time to time. Since other securities are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Common Shares reported herein. A total of approximately $9,043,919 was paid to acquire the Common Shares reported herein. |

| |

|

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| |

|

| (a) |

See rows (11) and (13) of the cover pages to this Schedule 13D/A for the aggregate number of Common Shares and percentages of the Common Shares beneficially owned by each of the Reporting Persons. The percentages used herein are calculated based upon 15,156,320 shares of common stock outstanding as of 2/29/24, as disclosed in the company's N-CSR filed 5/9/24 |

| |

|

| (b) |

See rows (7) through (10) of the cover pages to this Schedule 13D/A for the number of Common Shares as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

|

| (c) |

The transactions in the Common Shares effected within the past sixty days by the Reporting Persons, which were all in the open market, are set forth in Schedule A, and are incorporated herein by reference. |

| |

|

| (d) |

The funds and accounts advised by Saba Capital have the right to receive the dividends from and proceeds of sales from the Common Shares. |

| |

|

| (e) |

Not applicable. |

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: July 25, 2024

| |

SABA CAPITAL MANAGEMENT, L.P.

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo

Title: Chief Compliance Officer |

| |

|

| |

|

| |

SABA CAPITAL MANAGEMENT GP, LLC

By: /s/ Michael D'Angelo

Name: Michael D'Angelo

Title: Authorized Signatory |

| |

|

| |

|

| |

BOAZ R. WEINSTEIN

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo |

| |

Title: Attorney-in-fact* |

* Pursuant to a power of attorney dated as of November 16, 2015, which is incorporated herein by reference to Exhibit 2 to the Schedule 13G filed by the Reporting Persons on December 28, 2015, accession number: 0001062993-15-006823 |

|

Schedule A

This Schedule sets forth information with respect to each purchase and sale of Common Shares which were effectuated by Saba Capital during the past sixty days. All transactions were effectuated in the open market through a broker.

| Trade Date |

Buy/Sell |

Shares |

Price |

| 5/28/2024 |

Sell |

3,611 |

10.48 |

| 5/29/2024 |

Sell |

41,961 |

10.38 |

| 5/30/2024 |

Sell |

13,166 |

10.39 |

| 5/31/2024 |

Sell |

11,971 |

10.48 |

| 6/3/2024 |

Sell |

10,467 |

10.44 |

| 6/4/2024 |

Sell |

3,787 |

10.37 |

| 6/5/2024 |

Sell |

100 |

10.36 |

| 6/7/2024 |

Sell |

17,241 |

10.29 |

| 6/12/2024 |

Sell |

5,612 |

10.38 |

| 6/13/2024 |

Sell |

4,922 |

10.32 |

| 6/14/2024 |

Sell |

400 |

10.28 |

| 6/17/2024 |

Sell |

4,368 |

10.24 |

| 6/18/2024 |

Sell |

10 |

10.23 |

| 6/24/2024 |

Sell |

1,000 |

10.42 |

| 7/2/2024 |

Sell |

200 |

10.26 |

| 7/5/2024 |

Sell |

2,000 |

10.34 |

| 7/8/2024 |

Sell |

11,827 |

10.35 |

| 7/12/2024 |

Sell |

594 |

10.58 |

| 7/15/2024 |

Sell |

12,449 |

10.57 |

| 7/16/2024 |

Sell |

13,342 |

10.56 |

| 7/17/2024 |

Sell |

17,326 |

10.63 |

| 7/18/2024 |

Sell |

3,574 |

10.57 |

| 7/19/2024 |

Sell |

4,999 |

10.52 |

| 7/22/2024 |

Sell |

6,851 |

10.53 |

| 7/23/2024 |

Sell |

17,805 |

10.54 |

| 7/24/2024 |

Sell |

12,500 |

10.47 |

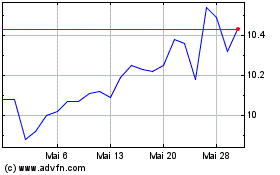

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

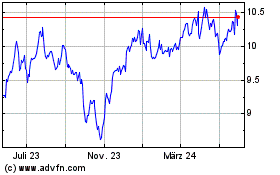

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

Von Feb 2024 bis Feb 2025