Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

24 Januar 2025 - 10:49PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

97.8%

Australia

:

2.4%

30,173

BHP

Group

Ltd.

-

Class

DI

$

795,641

0.5

15,432

Fortescue

Metals

Group

Ltd.

191,317

0.1

14,908

Rio

Tinto

Ltd.

1,153,982

0.6

95,415

South32

Ltd.

-

Class

DI

231,562

0.1

442,978

Telstra

Group

Ltd.

1,140,766

0.6

109,998

Transurban

Group

920,932

0.5

4,434,200

2.4

Brazil

:

0.5%

162,800

Cia

Siderurgica

Nacional

SA

298,986

0.2

27,187

Telefonica

Brasil

SA

222,672

0.1

172,637

TIM

SA/Brazil

444,734

0.2

966,392

0.5

Canada

:

4.8%

8,493

Agnico

Eagle

Mines

Ltd.

716,177

0.4

32,775

AltaGas

Ltd.

801,554

0.4

42,051

Barrick

Gold

Corp.

736,467

0.4

7,269

Canadian

National

Railway

Co.

811,711

0.5

2,323

Canadian

Pacific

Kansas

City

Ltd.

177,720

0.1

7,234

Canadian

Utilities

Ltd.

-

Class

A

185,701

0.1

16,248

CCL

Industries,

Inc.

-

Class

B

900,687

0.5

10,887

Enbridge,

Inc.

471,001

0.3

1,583

Franco-Nevada

Corp.

193,843

0.1

29,044

Keyera

Corp.

957,795

0.5

23,581

Kinross

Gold

Corp.

230,917

0.1

10,983

Pembina

Pipeline

Corp.

452,483

0.3

17,109

Rogers

Communications,

Inc.

-

Class

B

611,014

0.3

4,680

TC

Energy

Corp.

228,175

0.1

7,134

West

Fraser

Timber

Co.

Ltd.

700,738

0.4

3,333

WSP

Global,

Inc.

592,705

0.3

8,768,688

4.8

Chile

:

0.3%

60,455

Lundin

Mining

Corp.

593,301

0.3

China

:

2.1%

514,500

BOE

Technology

Group

Co.

Ltd.

-

Class

A

307,079

0.2

1,070,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

563,900

0.3

206,000

China

Oilfield

Services

Ltd.

-

Class

H

178,381

0.1

1,744,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

229,484

0.1

47,100

China

Yangtze

Power

Co.

Ltd.

-

Class

A

177,902

0.1

240,000

CMOC

Group

Ltd.

-

Class

H

179,839

0.1

347,500

Fosun

International

Ltd.

188,977

0.1

175,500

Goldwind

Science

&

Technology

Co.

Ltd.

-

Class

A

272,020

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

290,700

Inner

Mongolia

Yuan

Xing

Energy

Co.

Ltd.

-

Class

A

$

235,500

0.1

568,000

(2)

MMG

Ltd.

194,962

0.1

18,100

Sieyuan

Electric

Co.

Ltd.

-

Class

A

194,912

0.1

178,500

Sinoma

International

Engineering

Co.

-

Class

A

258,486

0.1

180,000

Weichai

Power

Co.

Ltd.

-

Class

H

249,599

0.1

110,300

Western

Mining

Co.

Ltd.

-

Class

A

258,900

0.2

55,800

Yutong

Bus

Co.

Ltd.

-

Class

A

169,136

0.1

60,200

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

213,759

0.1

3,872,836

2.1

Denmark

:

0.1%

115

AP

Moller

-

Maersk

A/S

-

Class

B

195,715

0.1

France

:

5.7%

6,556

Aeroports

de

Paris

759,315

0.4

7,007

Air

Liquide

SA

1,165,509

0.6

2,703

Airbus

SE

422,493

0.2

3,473

Arkema

SA

275,569

0.2

14,715

Cie

de

Saint-Gobain

1,343,615

0.7

10,005

Eiffage

SA

903,356

0.5

40,374

Engie

SA

643,599

0.4

63,830

Getlink

SE

1,043,758

0.6

9,202

Legrand

SA

923,323

0.5

71,808

Orange

SA

765,330

0.4

23,801

Rexel

SA

615,214

0.3

1,796

Safran

SA

419,085

0.2

4,882

Schneider

Electric

SE

1,257,703

0.7

10,537,869

5.7

Germany

:

3.0%

5,499

Deutsche

Post

AG,

Reg

202,334

0.1

61,406

Deutsche

Telekom

AG,

Reg

1,964,431

1.1

4,982

Heidelberg

Materials

AG

629,989

0.4

10,592

Siemens

AG,

Reg

2,057,575

1.1

5,543

Symrise

AG

613,173

0.3

5,467,502

3.0

Greece

:

0.3%

44,563

Public

Power

Corp.

SA

539,994

0.3

Hong

Kong

:

0.7%

65,500

CK

Hutchison

Holdings

Ltd.

342,532

0.2

78,500

Power

Assets

Holdings

Ltd.

516,009

0.3

52,500

Swire

Pacific

Ltd.

-

Class

A

432,280

0.2

1,290,821

0.7

India

:

2.9%

2,126

ABB

India

Ltd.

187,184

0.1

209,417

Bharat

Electronics

Ltd.

766,125

0.4

20,155

Havells

India

Ltd.

410,492

0.2

46,079

Hindalco

Industries

Ltd.

358,906

0.2

5,262

Hindustan

Aeronautics

Ltd.

279,784

0.1

25,058

Larsen

&

Toubro

Ltd.

1,107,087

0.6

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

India

(continued)

106,046

NMDC

Ltd.

$

290,006

0.2

135,817

Power

Grid

Corp.

of

India

Ltd.

530,260

0.3

426,621

Tata

Steel

Ltd.

732,085

0.4

126,052

Vedanta

Ltd.

678,305

0.4

5,340,234

2.9

Indonesia

:

0.1%

528,600

Indah

Kiat

Pulp

&

Paper

Tbk

PT

242,139

0.1

Ireland

:

1.6%

5,647

AerCap

Holdings

NV

561,086

0.3

4,833

Allegion

PLC

680,680

0.4

4,073

CRH

PLC

IE

417,874

0.2

12,630

DCC

PLC

921,061

0.5

5,474

(2)

James

Hardie

Industries

PLC

203,943

0.1

512

Trane

Technologies

PLC

213,105

0.1

2,997,749

1.6

Italy

:

0.3%

9,462

Leonardo

SpA

254,817

0.1

36,738

Terna

-

Rete

Elettrica

Nazionale

310,935

0.2

565,752

0.3

Japan

:

7.5%

57,700

Central

Japan

Railway

Co.

1,188,312

0.7

74,400

Chubu

Electric

Power

Co.,

Inc.

787,683

0.4

7,200

FANUC

Corp.

187,065

0.1

39,400

Hitachi

Ltd.

992,914

0.5

11,500

Japan

Airlines

Co.

Ltd.

191,456

0.1

53,900

JFE

Holdings,

Inc.

616,756

0.3

11,300

Kansai

Electric

Power

Co.,

Inc.

145,593

0.1

13,300

Kawasaki

Kisen

Kaisha

Ltd.

177,218

0.1

4,100

Keyence

Corp.

1,778,961

1.0

17,500

Makita

Corp.

549,530

0.3

35,800

Marubeni

Corp.

540,345

0.3

109,600

Mitsubishi

Chemical

Group

Corp.

576,617

0.3

10,900

Mitsubishi

Corp.

184,582

0.1

25,900

Mitsubishi

Electric

Corp.

439,765

0.2

11,900

Mitsubishi

Heavy

Industries

Ltd.

175,202

0.1

40,700

Murata

Manufacturing

Co.

Ltd.

681,024

0.4

57,500

Nitto

Denko

Corp.

919,298

0.5

37,000

Osaka

Gas

Co.

Ltd.

812,489

0.5

31,200

Shin-Etsu

Chemical

Co.

Ltd.

1,157,782

0.6

3,000

SoftBank

Group

Corp.

179,841

0.1

49,800

Sumitomo

Corp.

1,068,914

0.6

50,200

(2)

Tokyo

Electric

Power

Co.

Holdings,

Inc.

180,633

0.1

12,700

Toyota

Tsusho

Corp.

217,293

0.1

13,749,273

7.5

Luxembourg

:

0.5%

33,205

ArcelorMittal

SA

834,834

0.5

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Malaysia

:

0.2%

67,000

Tenaga

Nasional

Bhd

$

205,931

0.1

247,000

YTL

Power

International

Bhd

189,413

0.1

395,344

0.2

Netherlands

:

0.1%

59,864

Koninklijke

KPN

NV

232,232

0.1

Norway

:

0.1%

2,049

Kongsberg

Gruppen

ASA

241,458

0.1

Qatar

:

0.2%

126,649

Ooredoo

QPSC

411,844

0.2

Russia

:

—%

267,141

(3)

Alrosa

PJSC

—

—

4,101,092

(3)

Inter

RAO

UES

PJSC

—

—

124,960

(3)

Mobile

TeleSystems

PJSC

—

—

—

—

Saudi

Arabia

:

0.4%

25,774

Sahara

International

Petrochemical

Co.

166,742

0.1

26,172

Saudi

Basic

Industries

Corp.

479,984

0.3

646,726

0.4

Singapore

:

0.8%

71,400

(1)

BOC

Aviation

Ltd.

552,019

0.3

55,906

(2)

Grab

Holdings

Ltd.

-

Class

A

279,530

0.2

156,000

Sembcorp

Industries

Ltd.

608,504

0.3

1,440,053

0.8

South

Africa

:

0.2%

12,330

Gold

Fields

Ltd.

176,746

0.1

33,059

Sasol

Ltd.

162,317

0.1

339,063

0.2

South

Korea

:

1.6%

10,813

GS

Holdings

Corp.

325,463

0.2

643

HD

Hyundai

Electric

Co.

Ltd.

163,377

0.1

3,514

(2)

HD

Korea

Shipbuilding

&

Offshore

Engineering

Co.

Ltd.

517,577

0.3

29,042

Hyundai

Steel

Co.

437,711

0.2

1,012

LG

Chem

Ltd.

207,049

0.1

41,020

LG

Uplus

Corp.

341,363

0.2

2,231

Samsung

Electro-

Mechanics

Co.

Ltd.

174,182

0.1

9,233

SK

Telecom

Co.

Ltd.

406,467

0.2

3,588

SK,

Inc.

352,479

0.2

2,925,668

1.6

Spain

:

1.4%

19,629

ACS

Actividades

de

Construccion

y

Servicios

SA

912,300

0.5

2,550

(1)

Aena

SME

SA

552,257

0.3

32,870

Red

Electrica

Corp.

SA

587,121

0.3

95,220

Telefonica

SA

431,365

0.3

2,483,043

1.4

Sweden

:

2.8%

14,628

Atlas

Copco

AB

-

Class

A

233,845

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Sweden

(continued)

90,872

Husqvarna

AB

-

Class

B

$

525,825

0.3

11,473

Indutrade

AB

293,086

0.2

9,920

Saab

AB

-

Class

B

217,507

0.1

21,636

Sandvik

AB

400,443

0.2

24,162

Skanska

AB

-

Class

B

504,467

0.3

46,732

SKF

AB

-

Class

B

898,475

0.5

34,405

Telefonaktiebolaget

LM

Ericsson

-

Class

B

279,531

0.2

114,437

Telia

Co.

AB

335,514

0.2

5,104

Trelleborg

AB

-

Class

B

168,828

0.1

47,998

Volvo

AB

-

Class

B

1,195,508

0.6

5,053,029

2.8

Switzerland

:

1.9%

30,617

ABB

Ltd.,

Reg

1,747,900

0.9

126

Givaudan

SA,

Reg

555,883

0.3

5,259

Holcim

AG

535,994

0.3

10,494

SIG

Group

AG

208,043

0.1

1,971

Sika

AG,

Reg

511,499

0.3

3,559,319

1.9

Taiwan

:

1.8%

1,162,000

AUO

Corp.

560,187

0.3

46,000

Delta

Electronics,

Inc.

545,372

0.3

46,000

Evergreen

Marine

Corp.

Taiwan

Ltd.

309,046

0.2

9,000

Fortune

Electric

Co.

Ltd.

153,496

0.1

189,000

Hon

Hai

Precision

Industry

Co.

Ltd.

1,150,951

0.6

154,000

Yang

Ming

Marine

Transport

Corp.

349,008

0.2

62,000

Zhen

Ding

Technology

Holding

Ltd.

220,572

0.1

3,288,632

1.8

Turkey

:

0.1%

34,987

KOC

Holding

AS

202,183

0.1

United

Kingdom

:

3.9%

9,551

Anglo

American

PLC

306,702

0.2

7,035

Anglogold

Ashanti

PLC

176,606

0.1

104,283

BAE

Systems

PLC

1,629,921

0.9

406,136

Centrica

PLC

658,681

0.4

55,164

Melrose

Industries

PLC

403,649

0.2

14,003

Pentair

PLC

1,526,187

0.8

87,553

(2)

Rolls-Royce

Holdings

PLC

622,800

0.3

44,441

Smiths

Group

PLC

1,001,659

0.6

896,600

Vodafone

Group

PLC

808,946

0.4

7,135,151

3.9

United

States

:

49.4%

8,020

A.O.

Smith

Corp.

597,410

0.3

11,887

AECOM

1,390,422

0.8

12,220

AMERCO

763,017

0.4

8,824

AMETEK,

Inc.

1,715,209

0.9

3,346

(2)

Arista

Networks,

Inc.

1,357,874

0.7

88,865

AT&T,

Inc.

2,058,113

1.1

7,324

Atmos

Energy

Corp.

1,108,268

0.6

582

(2)

Axon

Enterprise,

Inc.

376,531

0.2

35,553

Baker

Hughes

Co.

1,562,554

0.9

3,855

(2)

Boeing

Co.

599,221

0.3

978

Carlisle

Cos.,

Inc.

446,653

0.2

3,042

Carrier

Global

Corp.

235,359

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

3,129

Caterpillar,

Inc.

$

1,270,718

0.7

17,969

CenterPoint

Energy,

Inc.

586,149

0.3

2,061

Cheniere

Energy,

Inc.

461,685

0.3

59,038

Cisco

Systems,

Inc.

3,495,640

1.9

1,489

Constellation

Energy

Corp.

382,018

0.2

37,275

CSX

Corp.

1,362,401

0.7

445

Deere

&

Co.

207,325

0.1

19,169

Delta

Air

Lines,

Inc.

1,223,366

0.7

5,263

Dominion

Energy,

Inc.

309,201

0.2

1,107

Dover

Corp.

227,931

0.1

8,840

DTE

Energy

Co.

1,111,895

0.6

10,149

DuPont

de

Nemours,

Inc.

848,355

0.5

6,647

Eastman

Chemical

Co.

696,074

0.4

4,362

Eaton

Corp.

PLC

1,637,582

0.9

18,086

Edison

International

1,587,046

0.9

739

EMCOR

Group,

Inc.

376,979

0.2

5,095

Emerson

Electric

Co.

675,597

0.4

11,204

Entergy

Corp.

1,749,729

1.0

15,274

Evergy,

Inc.

987,159

0.5

11,651

Eversource

Energy

751,373

0.4

5,505

(2)

F5,

Inc.

1,378,177

0.8

3,475

FedEx

Corp.

1,051,778

0.6

2,677

Ferguson

Enterprises,

Inc.

578,045

0.3

18,184

Fortive

Corp.

1,442,537

0.8

31,151

Freeport-McMoRan,

Inc.

1,376,874

0.7

2,172

(2)

GE

Vernova,

Inc.

725,709

0.4

11,826

General

Electric

Co.

2,154,224

1.2

10,374

Graco,

Inc.

944,864

0.5

31,721

Halliburton

Co.

1,010,631

0.6

2,749

Honeywell

International,

Inc.

640,325

0.3

6,048

Howmet

Aerospace,

Inc.

715,962

0.4

733

Hubbell,

Inc.

337,246

0.2

14,506

Ingersoll

Rand,

Inc.

1,511,090

0.8

3,212

Jabil,

Inc.

436,286

0.2

14,429

Johnson

Controls

International

PLC

1,210,016

0.7

5,656

(2)

Keysight

Technologies,

Inc.

966,271

0.5

30,429

Kinder

Morgan,

Inc.

860,228

0.5

3,322

Linde

PLC

US

1,531,409

0.8

922

Lockheed

Martin

Corp.

488,116

0.3

2,226

Masco

Corp.

179,326

0.1

10,833

NextEra

Energy,

Inc.

852,232

0.5

40,310

NiSource,

Inc.

1,535,408

0.8

3,805

Nordson

Corp.

993,067

0.5

3,059

Nucor

Corp.

473,197

0.3

4,850

Old

Dominion

Freight

Line,

Inc.

1,091,929

0.6

3,687

ONEOK,

Inc.

418,843

0.2

6,688

Owens

Corning

1,375,187

0.7

2,605

Parker-Hannifin

Corp.

1,831,054

1.0

82,094

PG&E

Corp.

1,775,693

1.0

11,080

PPG

Industries,

Inc.

1,378,020

0.8

11,157

Raytheon

Technologies

Corp.

1,359,257

0.7

3,561

Rockwell

Automation,

Inc.

1,050,993

0.6

10,642

RPM

International,

Inc.

1,476,897

0.8

4,816

Schlumberger

NV

211,615

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

21,419

Sempra

Energy

$

2,006,318

1.1

5,880

Sherwin-Williams

Co.

2,336,712

1.3

22,701

Smurfit

WestRock

PLC

1,249,009

0.7

2,145

Snap-on,

Inc.

792,985

0.4

7,221

Stanley

Black

&

Decker,

Inc.

645,918

0.4

11,884

Textron,

Inc.

1,017,627

0.6

6,478

T-Mobile

US,

Inc.

1,599,677

0.9

211

TransDigm

Group,

Inc.

264,377

0.1

10,445

(2)

Trimble,

Inc.

762,172

0.4

25,984

(2)

Uber

Technologies,

Inc.

1,869,809

1.0

2,723

Union

Pacific

Corp.

666,209

0.4

3,024

United

Parcel

Service,

Inc.

-

Class

B

410,417

0.2

1,535

United

Rentals,

Inc.

1,329,310

0.7

56,590

Verizon

Communications,

Inc.

2,509,201

1.4

7,648

Vertiv

Holdings

Co.

-

Class

A

975,885

0.5

6,018

Vistra

Corp.

961,917

0.5

474

Watsco,

Inc.

261,458

0.1

8,268

Westinghouse

Air

Brake

Technologies

Corp.

1,658,726

0.9

556

WW

Grainger,

Inc.

670,169

0.4

10,699

Xcel

Energy,

Inc.

776,319

0.4

3,291

Xylem,

Inc.

417,134

0.2

90,702,709

49.4

Zambia

:

0.1%

14,394

(2)

First

Quantum

Minerals

Ltd.

196,677

0.1

Total

Common

Stock

(Cost

$142,643,221)

179,650,430

97.8

EXCHANGE-TRADED

FUNDS

:

2.3%

34,369

iShares

MSCI

ACWI

ETF

4,185,113

2.3

Total

Exchange-Traded

Funds

(Cost

$3,927,138)

4,185,113

2.3

PREFERRED

STOCK

:

0.3%

Brazil

:

0.3%

97,900

Centrais

Eletricas

Brasileiras

SA

628,390

0.3

Total

Preferred

Stock

(Cost

$755,921)

628,390

0.3

Total

Long-Term

Investments

(Cost

$147,326,280)

184,463,933

100.4

Shares

RA

Value

Percentage

of

Net

Assets

SHORT-TERM

INVESTMENTS

:

0.6%

Mutual

Funds

:

0.6%

1,021,000

(4)

BlackRock

Liquidity

Funds,

FedFund,

Institutional

Class,

4.530%

(Cost

$1,021,000)

$

1,021,000

0.6

Total

Short-Term

Investments

(Cost

$1,021,000)

$

1,021,000

0.6

Total

Investments

in

Securities

(Cost

$148,347,280)

$

185,484,933

101.0

Liabilities

in

Excess

of

Other

Assets

(1,789,536)

(1.0)

Net

Assets

$

183,695,397

100.0

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2024.

Industry

Diversification

Percentage

of

Net

Assets

Electric

Utilities

7.2

%

Industrial

Machinery

&

Supplies

&

Components

7.2

Electrical

Components

&

Equipment

6.0

Specialty

Chemicals

5.8

Integrated

Telecommunication

Services

5.8

Aerospace

&

Defense

5.5

Industrial

Conglomerates

5.0

Multi-Utilities

4.3

Construction

&

Engineering

3.6

Trading

Companies

&

Distributors

3.6

Communications

Equipment

3.5

Building

Products

3.4

Construction

Machinery

&

Heavy

Transportation

Equipment

2.9

Rail

Transportation

2.3

Multi-Sector

Holdings

2.3

Wireless

Telecommunication

Services

2.2

Steel

2.1

Oil

&

Gas

Storage

&

Transportation

2.1

Diversified

Metals

&

Mining

2.1

Electronic

Equipment

&

Instruments

1.9

Oil

&

Gas

Equipment

&

Services

1.5

Gas

Utilities

1.5

Industrial

Gases

1.5

Electronic

Components

1.3

Gold

1.2

Copper

1.2

Passenger

Ground

Transportation

1.2

Highways

&

Railtracks

1.1

Cargo

Ground

Transportation

1.0

Heavy

Electrical

Equipment

1.0

Construction

Materials

1.0

Air

Freight

&

Logistics

0.9

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Electronic

Manufacturing

Services

0.9

%

Paper

&

Plastic

Packaging

Products

&

Materials

0.8

Passenger

Airlines

0.8

Airport

Services

0.7

Commodity

Chemicals

0.6

Marine

Transportation

0.5

Independent

Power

Producers

&

Energy

Traders

0.5

Metal,

Glass

&

Plastic

Containers

0.5

Diversified

Chemicals

0.4

Agricultural

&

Farm

Machinery

0.4

Forest

Products

0.4

Diversified

Real

Estate

Activities

0.2

Aluminum

0.2

Paper

Products

0.1

Oil

&

Gas

Drilling

0.1

Renewable

Electricity

0.1

Precious

Metals

&

Minerals

0.0

Liabilities

in

Excess

of

Other

Assets*

(0.4)

Net

Assets

100.0%

* Includes

short-term

investments.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2024

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2024

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

4,434,200

$

—

$

4,434,200

Brazil

966,392

—

—

966,392

Canada

8,768,688

—

—

8,768,688

Chile

593,301

—

—

593,301

China

372,814

3,500,022

—

3,872,836

Denmark

—

195,715

—

195,715

France

—

10,537,869

—

10,537,869

Germany

—

5,467,502

—

5,467,502

Greece

—

539,994

—

539,994

Hong

Kong

—

1,290,821

—

1,290,821

India

—

5,340,234

—

5,340,234

Indonesia

—

242,139

—

242,139

Ireland

1,454,871

1,542,878

—

2,997,749

Italy

—

565,752

—

565,752

Japan

—

13,749,273

—

13,749,273

Luxembourg

—

834,834

—

834,834

Malaysia

—

395,344

—

395,344

Netherlands

232,232

—

—

232,232

Norway

—

241,458

—

241,458

Qatar

411,844

—

—

411,844

Russia

—

—

—

—

Saudi

Arabia

479,984

166,742

—

646,726

Singapore

831,549

608,504

—

1,440,053

South

Africa

—

339,063

—

339,063

South

Korea

—

2,925,668

—

2,925,668

Spain

—

2,483,043

—

2,483,043

Sweden

—

5,053,029

—

5,053,029

Switzerland

—

3,559,319

—

3,559,319

Taiwan

—

3,288,632

—

3,288,632

Turkey

202,183

—

—

202,183

United

Kingdom

1,526,187

5,608,964

—

7,135,151

United

States

90,702,709

—

—

90,702,709

Zambia

196,677

—

—

196,677

Total

Common

Stock

106,739,431

72,910,999

—

179,650,430

Exchange-Traded

Funds

4,185,113

—

—

4,185,113

Preferred

Stock

628,390

—

—

628,390

Short-Term

Investments

1,021,000

—

—

1,021,000

Total

Investments,

at

fair

value

$

112,573,934

$

72,910,999

$

—

$

185,484,933

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(1,161,932)

$

—

$

(1,161,932)

Total

Liabilities

$

—

$

(1,161,932)

$

—

$

(1,161,932)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

At

November

30,

2024,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Infrastructure,

Industrials

and

Materials

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Industrial

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

01/02/25

USD

143.180

102,668

USD

14,783,165

$

235,202

$

(327,110)

iShares

MSCI

EAFE

ETF

UBS

AG

Call

12/19/24

USD

77.410

408,215

USD

32,236,739

428,503

(525,777)

iShares

MSCI

Emerging

Markets

ETF

Citibank

N.A.

Call

12/19/24

USD

42.950

62,864

USD

2,719,497

39,152

(28,998)

Materials

Select

Sector

SPDR

Fund

Wells

Fargo

Securities

LLC

Call

01/02/25

USD

94.300

151,644

USD

14,372,818

221,658

(280,047)

$

924,515

$

(1,161,932)

Currency

Abbreviations:

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

42,753,450

Gross

Unrealized

Depreciation

(5,615,796)

Net

Unrealized

Appreciation

$

37,137,654

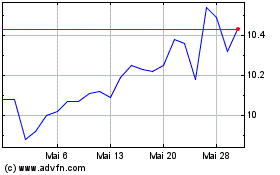

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

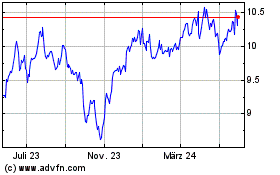

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025