Herbalife Limited - Momentum

19 März 2012 - 1:00AM

Zacks

HLF 031612

Herbalife Limited (HLF)

It’s hard to deny

that we are becoming a much more informed society in general.

The internet alone has broadened the knowledge (and curiosity) of

millions of people around the world.

Fitness, medicine

and wellness in general are hot topics on the web. Many folks

visit sites like WebMD, Diagnosispro.com and others to diagnose

their ailments or perhaps just improve their way of life.

While it may not be

possible (or smart) to diagnose a major illness without the help of

a physician; some people find that adding a supplement or two can

help address minor conditions or deficiencies. Here in the

States, it’s becoming more and more common to complement your diet

with vitamins or other supplements.

In fact, 69 percent

of U.S. adults take dietary supplements according to a survey

commissioned by the Council for Responsible Nutrition (CRN), which

is the dietary supplement industry's leading trade association.

The survey also

shows an upward trend in dietary supplement consumption.

Consumer usage is up from 66 percent in 2010, 65 percent in 2009,

and 64 percent in 2008. Our fast moving society and demand

for quick, cheap, nutritional meals is also boosting the “meal

replacement market.” Shakes, protein bars and other high

calorie, vitamin balance snacks are growing fast as well.

Herbalife supplies these nutritional supplements, personal care

and meal replacement options to customers around the world.

According to Herbalife’s reports, volume and profits are on the

rise. Analysts are also putting HLF on their strong buy list

as the company is showing good earnings momentum in a sector that

is heating up.

Company Description &

Earnings Developments

Herbalife Limited is a network marketing company that sells weight

management, nutritional supplement, energy, sports and fitness, and

personal care products in over 75 different states.

In his notes on January 3rd, Todd Bunton noted that Herbalife

delivered record results for Q32011. Earnings per share came in at

87 cents, beating the Zacks Consensus Estimate of 76 cents; a 45%

increase over the same quarter in 2010. Net sales soared 30%

to $895 million and established markets saw volume growth of 20% in

the third quarter, while the emerging markets experienced 27%

volume growth.

In their Q4 on February 23rd, HLF again beat estimates, with

earnings coming in at $0.86 for the quarter. Revenue

increased to $884.6 for the quarter, which was 20% higher than the

same quarter one year prior.

HLF is a mid-cap

(8.23 billion) company that is trading at about 19.5 times forward

(expectations for next quarter) earnings. The health and

wellness company moved back up to a Zacks Rank 1 strong buy on

March 10th, 2011.

HLF earnings

increased from $2.34 in FY2010 to $3.30 in FY2011 (diluted) and

they expected to earn $3.64 in FY2012 according to the Zacks

Consensus Estimate.

Moving Forward

Herbalife has surprised analysts to the upside 4 quarters in a row

at an average of almost 16.50%.

Of the 11

analysts who cover HLF, the consensus is for the company to grow

earnings by 10% in the current year (FY2012) and roughly 13% in

FY2013.

In terms of the magnitude of analyst estimate trends, we are

seeing all of the consensus estimates higher than they were 90 days

ago for the current and next quarter as well as FY2012 and

FY2013.

Next quarter's average analyst estimate for revenue is $875.1

million, with a Zacks Consensus EPS estimate of $0.81.

Market Performance & Technicals

HLF is currently in a bullish trend making higher highs and higher

lows. Look for initial support to come at the $65

level. Below that the 50 and 200 day moving averages of

$61.16 and $56.95 will be key.

HLF has exceeded

the S&P 500’s performance in the past year by a whopping 67%

and outpaced it by over 23% in the past 3 months alone! The

stock remains in a bullish trend and has maintained its momentum in

the past month, leading the index by about 14%. Performance

tends to be correlated to the markets but with a higher volatility

factor.

Jared A Levy is the Momentum Stock Strategist for Zacks.com. He is

also the Editor in charge of the market-beating Zacks Whisper

Trader Service.

HERBALIFE LTD (HLF): Free Stock Analysis Report

To read this article on Zacks.com click here.

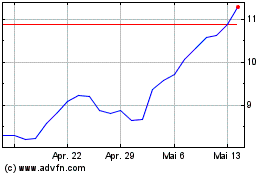

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024