0001703644false00017036442023-10-122023-10-120001703644exch:XNYSus-gaap:CommonStockMember2023-10-122023-10-120001703644exch:XNYSus-gaap:SeriesAPreferredStockMember2023-10-122023-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 12, 2023

Granite Point Mortgage Trust Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-38124 | | 61-1843143 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 3 Bryant Park, Suite 2400A |

| New York, | NY | 10036 |

(Address of principal executive offices)

(Zip Code) |

Registrant’s telephone number, including area code: (212) 364-5500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Stock, par value $0.01 per share | | GPMT | | NYSE |

7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share | | GPMTPrA | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 12, 2023, GP Commercial JPM LLC, a wholly-owned subsidiary of Granite Point Mortgage Trust Inc. (the “Company”), entered into an amendment (the “MRA Amendment”) to that certain previously disclosed Master Repurchase and Securities Contract Agreement, dated as of December 3, 2015, with JPMorgan Chase Bank, National Association (“JPMorgan”). The MRA Amendment increases the maximum facility amount by up to $100 million (the “Additional Advance Amounts”) for a period of up to eighteen (18) months (inclusive of a Company-held 6-month extension option), subject to various terms, conditions and restrictions.

In connection with the MRA Amendment, on October 12, 2023, the Company entered into an amendment (the “Guaranty Amendment”) of that certain Amended and Restated Guarantee Agreement, dated as of June 28, 2017, with JPMorgan (as amended from time to time, the “Guaranty”). The Guaranty Amendment, among other things, (i) modifies the “Minimum Interest Expense Coverage Ratio” (as defined in the Guaranty) financial covenant; (ii) establishes the recourse level for the Additional Advance Amounts; and (iii) sets forth conditions and restrictions related to the Company’s ability to incur additional indebtedness and materially modify existing indebtedness and certain loan investments while the Additional Advance Amounts remain outstanding.

The foregoing descriptions of the MRA Amendment and the Guaranty Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of the MRA Amendment and the Guaranty Amendment, which are filed herewith as Exhibits 10.1 and 10.2, respectively, and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1* | | |

| 10.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Certain schedules and similar attachments have been omitted in reliance on Instruction 4 of Item 1.01 of Form 8-K and Item 601(a)(5) of Regulation S-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GRANITE POINT MORTGAGE TRUST INC. |

| | | |

| | | |

| | By: | /s/ MICHAEL J. KARBER |

| | | Michael J. Karber |

| | | General Counsel and Secretary |

| | | |

| Date: October 17, 2023 | | |

AMENDMENT NO. 11 TO MASTER REPURCHASE AGREEMENT

AMENDMENT NO. 11 TO MASTER REPURCHASE AGREEMENT, dated as of October 12, 2023 (this “Amendment”), between GP COMMERCIAL JPM LLC (f/k/a TH COMMERCIAL JPM LLC) (“Seller”), a Delaware limited liability company, and JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association (the “Buyer”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Repurchase Agreement (as defined below).

RECITALS

WHEREAS, Seller and Buyer are parties to that certain Uncommitted Master Repurchase Agreement, dated as of December 3, 2015 (as amended by that certain Amendment No. 1 to Master Repurchase Agreement, dated as of June 28, 2017, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated as of June 28, 2019, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement, dated as of August 23, 2019, as further amended by that certain Amendment No. 4 to Master Repurchase Agreement, dated as of December 13, 2019, as further amended by that certain Amendment No. 5 to Master Repurchase Agreement and Amendment No. 2 to Amended and Restated Guarantee Agreement, dated as of July 2, 2020, as further amended by that certain Amendment No. 6 to Master Repurchase Agreement and Amendment No. 3 to Amended and Restated Guarantee Agreement, dated as of September 25, 2020, as further amended by that certain Amendment No. 7 to Master Repurchase Agreement, dated as of September 27, 2021, as further amended by that certain Term SOFR Conforming Changes Amendment, dated as of December 31, 2021, as further amended by that certain Amendment No. 8 to Master Repurchase Agreement and Amendment No. 4 to Fee and Pricing Letter, dated as of June 28, 2022, as further amended by that certain Amendment No. 9 to Master Repurchase Agreement and Amendment No. 5 to Fee and Pricing Letter, dated as of March 16, 2023, as further amended by that certain Amendment No. 10 to Master Repurchase Agreement and Amendment No. 6 to Fee and Pricing Letter, dated as of July 28, 2023, as amended hereby and as further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Repurchase Agreement”).

WHEREAS, Seller and Buyer have agreed, subject to the terms and conditions hereof, that the Repurchase Agreement shall be amended as set forth in this Amendment.

NOW THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Buyer each agree as follows:

SECTION 1. Amendments to Repurchase Agreement.

(a) Article 2 of the Repurchase Agreement is hereby amended by adding the following defined terms in alphabetical order:

“Additional Advance” shall mean, with respect to any Additional Advance Purchased Asset, an advance of additional funds on such Additional Advance Purchased Asset by

Buyer to Seller in accordance with Article 3(dd). For the avoidance of doubt, an Additional Advance made with respect to a Purchased Asset shall be deemed to be part of the related Transaction.

“Additional Advance Amortization Amount” shall have the meaning specified in the Fee Letter.

“Additional Advance Amount” shall mean, with respect to any Additional Advance Purchased Asset, the amount of Additional Advances funded in respect of such Additional Advance Purchased Asset as of the Additional Advance Effective Date, as reflected in the Confirmation related to such Purchased Asset, minus any Additional Advance Amounts reduced by giving effect to a repurchase in whole or in part by Seller of the related Additional Advance Purchased Asset or application of any Additional Advance Amortization Amount pursuant to Article 3(dd), as applicable, plus any Additional Advance Amounts re-allocated by Buyer in respect of any Additional Advance Purchased Asset pursuant to Article 3(dd).

“Additional Advance Cash Sweep Period” shall mean any period of time (i) during the Additional Advance Extension Period in which the aggregate Purchase Price of all Purchased Assets (inclusive of all outstanding Additional Advance Amounts) divided by the aggregate Market Value of all Purchased Assets equals a fraction (expressed as a percentage) that is greater than 65%, or (ii) in which the Unrestricted Cash (as defined in the Guarantee Agreement) of Guarantor is less than $100,000,000.

“Additional Advance Effective Date” shall mean October 12, 2023.

“Additional Advance Extension Fee” shall mean have the meaning specified in the Fee Letter.

“Additional Advance Extension Period” shall the meaning assigned to such term in Article 3(dd).

“Additional Advance Make Whole Amount” shall have the meaning assigned to such term in the Fee Letter.

“Additional Advance Maximum Amount” shall have the meaning assigned to such term in the Fee Letter.

“Additional Advance Purchased Asset” shall mean each of the Purchased Assets set forth on Schedule II to the Fee Letter and any other Purchased Asset in respect of which Buyer funds any Additional Advance.

“Additional Advance Purchased Asset Spread” shall have the meaning assigned to such term in the Fee Letter.

“Additional Advance Termination Date” shall mean, initially, October 12, 2024 as may be extended pursuant to Article 3(dd).

“Pay-Down Amount” shall mean, with respect to each asset set forth on Schedule III to the Fee Letter, the corresponding "JPM Over-Advance Amount" set forth in the row corresponding to such asset.

(b) Article 2 of the Repurchase Agreement is hereby amended by amending and restating the following defined terms in their entirety to read as follows:

“Advance Rate” shall mean, with respect to each Transaction and any Pricing Rate Period, the initial Advance Rate selected by Buyer for such Transaction on a case by case basis in its sole discretion as shown in the related Confirmation, (A) as may be increased or decreased pursuant to Article 3(dd) and (B) as may be reduced pursuant to Article 11(ff), which in any case shall not exceed the Maximum Advance Rate for the related Purchased Asset as specified in Schedule I attached to the Fee Letter, unless otherwise agreed to by Buyer and Seller and specified in the related Confirmation or as otherwise specified by Buyer in relation to any Additional Advance Purchased Asset.

“Maximum Facility Amount” shall mean the sum of (x) $425,000,000 and (y) the then-current Additional Advance Maximum Amount.

“Purchase Price” shall mean, with respect to any Purchased Asset, the price at which such Purchased Asset is transferred by Seller to Buyer on the applicable Purchase Date, adjusted after the Purchase Date as set forth below. The Purchase Price as of the Purchase Date for any Purchased Asset shall be an amount (expressed in dollars) equal to the product obtained by multiplying (i) the Market Value of such Purchased Asset as of the Purchase Date (or the par amount of such Purchased Asset, if lower than Market Value) by (ii) the Advance Rate for such Purchased Asset, as determined by Buyer in its sole and absolute discretion and as set forth on the related Confirmation. The Purchase Price of any Purchased Asset shall be (x) increased by any Future Funding Amount or Additional Advance Amount actually funded by Buyer and any additional amounts disbursed by Buyer to Seller or to the related Mortgagor on behalf of Seller or otherwise with respect to such Purchased Asset and (y) decreased by (A) the portion of any Principal Proceeds on such Purchased Asset that are applied pursuant to Article 5 hereof to reduce such Purchase Price and (B) any other amounts paid to Buyer by Seller specifically to reduce such Purchase Price and that are applied pursuant to Article 3(dd) or Article 5 hereof.

(c) Article 2 of the Repurchase Agreement is hereby amended by amending the definition of “Applicable Spread” by deleting the word “and” at the end of clause (i), adding such word to the end of clause (ii) and adding a new clause (iii) to read in its entirety as follows:

(iii) with respect to any Additional Advance Purchased Asset, solely with respect to the portion of the Purchase Price equal to the related Additional Advance Amount, the Additional Advance Purchased Asset Spread.

(d) Article 3 of the Repurchase Agreement is hereby amended by adding a new Article 3(dd) therein as follows:

(dd) (i) On the Additional Advance Effective Date, Buyer shall make Additional Advances with respect to the Additional Advance Purchased Assets in such amounts as set forth with respect to each Additional Advance Purchased Asset in the respective amounts set forth in the column described as "Over-Advance Amount" on Schedule II to the Fee Letter, which amounts shall be added to the respective Purchase Prices of the specified Purchased Assets as set forth in the amended Confirmations with respect to such specified Purchased Assets. Upon Seller’s request, Buyer may in its sole discretion re-allocate existing Additional Advances to any other Additional Advance Purchased Asset, and, in connection therewith, Seller shall execute and deliver new Confirmations acceptable to Buyer reflecting the new Purchase Prices and Additional Advance Amounts of all affected Purchased Assets. In no event shall any Additional Advance be made if such Additional Advance would cause the aggregate amount of all Additional Advances to exceed the Additional Advance Maximum Amount.

(ii) Upon at least five (5) Business Days’ prior written notice, Seller may repurchase all or part of any Additional Advance then outstanding by (i) effecting a repurchase of any Additional Advance Purchased Asset in an amount up to the total Additional Advance Amount allocated to such Additional Advance Purchased Asset and (ii) paying to Buyer the related Additional Advance Make Whole Amount, if any; provided that, no Exit Fee shall be due upon the repurchase of all or any portion of any Additional Advances of any Additional Advance Purchased Asset pursuant to this Article 3(dd)(ii).

(iii) Seller shall repurchase in part the Additional Advance Purchased Assets in the amount of any outstanding Additional Advances on the Additional Advance Termination Date.

(iv) Seller shall pay to Buyer an Additional Advance Amortization Amount on or before each of the following dates: January 12, 2024, April 12, 2024 and July 12, 2024; provided that, Buyer may allocate any Additional Advance Amortization Amount actually received among the Additional Advance Purchased Assets in its sole discretion. Notwithstanding anything herein to the contrary, any Principal Proceeds paid to Buyer in respect of any Additional Advance Purchased Asset shall be applied first to reduce the Additional Advance Amount of such Additional Advance Purchased Asset.

(v) Upon at least thirty (30) days’ prior written notice to Buyer, Seller may request an extension of the Additional Advance Termination Date of six (6) months, which shall be granted by Buyer so long as (i) Seller has paid to Buyer the Additional Advance Extension Fee, (ii) the requirements of Article 3(n)(ii)(C) and Article 3(n)(ii)(D) are satisfied as of originally scheduled Additional Advance Termination Date (such period, the “Additional Advance Extension Period”).

(vi) To the extent Buyer, Guarantor and Seller cannot agree on a course of action with respect to any Loan Material Modification (as defined in the Guarantee Agreement) requiring Buyer's consent under the terms of the Guarantee Agreement, Seller and

Guarantor may elect, in lieu of obtaining Buyer's consent in respect of such Loan Material Modification, to make a repurchase in part with respect to the Additional Advance Purchased Assets in an amount equal to the applicable Pay-Down Amount corresponding to the asset that is the subject of the proposed Loan Material Modification, which Pay-Down Amount shall be applied to reduce the outstanding Additional Advance Amounts of all Additional Advance Purchased Assets (in such order and with such application as determined by Buyer in its sole discretion), and for the avoidance of doubt, Seller and Guarantor shall not permit the related Loan Material Modification to occur prior to Seller's making such repurchase in part in the amount of the related Pay-Down Amount.

(e) Article 5 (c)(iii) of the Repurchase Agreement is hereby amended and restated in its entirety to read as follows:

(iii) third, to Buyer, (a) an amount equal to any other amounts then due and payable to Buyer or its Affiliates under any Transaction Document (including any outstanding Margin Deficits) and (b) during any Additional Advance Cash Sweep Period, one hundred percent (100%) of all remaining Income to reduce the outstanding Additional Advance Amounts of all Purchased Assets (in such order and with such application as determined by Buyer in its sole discretion) until the aggregate Additional Advance Amounts for all Additional Advance Purchased Assets have been reduced to zero; and

(f) Article 5 (d)(ii) of the Repurchase Agreement is hereby amended and restated in its entirety to read as follows:

(ii) second, to Buyer, (a) an amount equal to any other amounts due and owing to Buyer or its Affiliates under any Transaction Document (including any outstanding Margin Deficits) and (b) during any Additional Advance Cash Sweep Period, one hundred percent (100%) of all remaining Principal Proceeds to reduce the outstanding Additional Advance Amounts of all Purchased Assets (in such order and with such application as determined by Buyer in its sole discretion) until the aggregate Additional Advance Amounts for all Additional Advance Purchased Assets have been reduced to zero; and

(g) Article 12(a)(i) of the Repurchase Agreement is hereby amended and restated in its entirety to read as follows:

(i) Seller or Guarantor shall fail to repurchase (A) Purchased Assets upon the applicable Repurchase Date (including, without limitation, any failure to make a repurchase in part as and when required under Article 3(dd)(iii), (iv) or (vi)) or (B) a Purchased Asset that is no longer an Eligible Asset in accordance with Article 12(c);

SECTION 2. Conditions Precedent; Effective Date. This Amendment shall become effective on the first date on which: (a) this Amendment, the Seventh Amendment to the Fee and Pricing Letter and the Fifth Amendment to Guarantee Agreement are each executed and delivered by a duly authorized officer of each of Seller, Guarantor and Buyer, as applicable, (b) those certain Pledge Agreements, identified in Schedule I attached hereto, in form and substance acceptable to Buyer in its sole discretion, shall have been executed and delivered to Buyer, (c)

payment by Seller to Buyer an amendment fee of $250,000, (d) Guarantor shall have funded the Liquidity Account in accordance with Guarantor’s obligations under Section 9(g) of the Guarantee Agreement (as amended on the date hereof) and (e) counsel for Seller has delivered opinions of counsel, including a bankruptcy safe harbor opinion, in form and substance acceptable to Buyer in its sole discretion.

SECTION 3. Seller’s Representations and Warranties. On and as of the date first above written, Seller hereby represents and warrants to Buyer that (a) Seller has taken all necessary action to authorize the execution, delivery and performance of this Amendment and (b) this Amendment has been duly executed and delivered by or on behalf of Seller and constitutes the legal, valid and binding obligation of Seller enforceable against Seller in accordance with its terms subject to applicable bankruptcy, insolvency, and other limitations on creditors’ rights generally and to equitable principles.

SECTION 4. Acknowledgments of Guarantor. Guarantor hereby acknowledges the execution and delivery of this Amendment by Seller and agrees that Guarantor continues to be bound by the Guarantee Agreement to the extent of the Obligations (as defined therein), notwithstanding the impact of the changes set forth herein.

SECTION 5. Limited Effect. Except as expressly amended and modified by this Amendment, the Repurchase Agreement and the Fee Letter shall continue to be, and shall remain, in full force and effect in accordance with its terms; provided, however, that upon the effective date hereof, all references in the Repurchase Agreement and the Fee Letter to the “Transaction Documents” shall be deemed to include, in any event, this Amendment. Each reference to Repurchase Agreement in any of the Transaction Documents shall be deemed to be a reference to the Repurchase Agreement, as amended hereby and each reference to the Fee Letter in any of the Transaction Documents shall be deemed to be a reference to the Fee Letter as amended hereby.

SECTION 6. Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument, and the words “executed,” “signed,” “signature,” and words of like import as used above and elsewhere in this Amendment or in any other certificate, agreement or document related to this transaction shall include, in addition to manually executed signatures, images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, any electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code.

SECTION 7. No Novation, Effect of Agreement. Guarantor, Seller and Buyer have entered into this Amendment solely to amend the terms of the Repurchase Agreement and do not intend this Amendment or the transactions contemplated hereby to be, and this Amendment and the transactions contemplated hereby shall not be construed to be, a novation of any of the obligations owing by Seller or Guarantor (the “Repurchase Parties”) under or in connection with the Repurchase Agreement or any of the other document executed in connection therewith to which any Repurchase Party is a party (the “Transaction Documents”). It is the intention of each of the parties hereto that (i) the perfection and priority of all security interests securing the payment of the obligations of the Repurchase Parties under the Repurchase Agreement and the other Transaction Documents are preserved, (ii) the liens and security interests granted under the Repurchase Agreement continue in full force and effect, and (iii) any reference to the Repurchase Agreement in any such Transaction Document shall be deemed to also reference this Amendment.

SECTION 8. Consent to Jurisdiction; Waiver of Jury Trial.

(a) Each party irrevocably and unconditionally (i) submits to the non-exclusive jurisdiction of any United States Federal or New York State court sitting in Manhattan, and any appellate court from any such court, solely for the purpose of any suit, action or proceeding brought to enforce its obligations under this Amendment or relating in any way to this Amendment or any Transaction under the Repurchase Agreement and (ii) waives, to the fullest extent it may effectively do so, any defense of an inconvenient forum to the maintenance of such action or proceeding in any such court and any right of jurisdiction on account of its place of residence or domicile.

(b) To the extent that either party has or hereafter may acquire any immunity (sovereign or otherwise) from any legal action, suit or proceeding, from jurisdiction of any court or from set off or any legal process (whether service or notice, attachment prior to judgment, attachment in aid of execution of judgment, execution of judgment or otherwise) with respect to itself or any of its property, such party hereby irrevocably waives and agrees not to plead or claim such immunity in respect of any action brought to enforce its obligations under this Amendment or relating in any way to this Amendment or any Transaction under the Repurchase Agreement.

(c) The parties hereby irrevocably waive, to the fullest extent each may effectively do so, the defense of an inconvenient forum to the maintenance of such action or proceeding and irrevocably consent to the service of any summons and complaint and any other process by the mailing of copies of such process to them at their respective address specified in the Repurchase Agreement. The parties hereby agree that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Section 8 shall affect the right of Buyer to serve legal process in any other manner permitted by law or affect the right of Buyer to bring any action or proceeding against the Seller or its property in the courts of other jurisdictions.

(d) EACH OF THE PARTIES HEREBY IRREVOCABLY WAIVES ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AMENDMENT, ANY OTHER TRANSACTION DOCUMENT OR ANY INSTRUMENT OR DOCUMENT DELIVERED HEREUNDER OR THEREUNDER.

SECTION 9. GOVERNING LAW. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT, THE RELATIONSHIP OF THE PARTIES TO THIS AMENDMENT, AND/OR THE INTERPRETATION AND ENFORCEMENT OF THE RIGHTS AND DUTIES OF THE PARTIES TO THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS AND DECISIONS OF THE STATE OF NEW YORK, WITHOUT REGARD TO THE CHOICE OF LAW RULES THEREOF. THE PARTIES HERETO INTEND THAT THE PROVISIONS OF SECTION 5-1401 OF THE NEW YORK GENERAL OBLIGATIONS LAW SHALL APPLY TO THIS AMENDMENT.

[SIGNATURES FOLLOW]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered as of the day and year first above written.

BUYER:

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION,

a national banking association organized under the laws of the United States

By: /s/ THOMAS N. CASSINO

Name: Thomas N. Cassino

Title: Managing Director

SELLER:

GP COMMERCIAL JPM LLC, a Delaware limited liability company

By: /s/ MICHAEL KARBER

Name: Michael Karber

Title: Vice President, Secretary and

General Counsel

Acknowledged and Agreed:

GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation, in its capacity as Guarantor, and solely for purposes of acknowledging and agreeing to the terms of this Amendment:

By: /s/ MICHAEL KARBER

Name: Michael Karber

Title: Vice President, Secretary and

General Counsel

FIFTH AMENDMENT TO AMENDED AND RESTATED GUARANTEE AGREEMENT

THIS FIFTH AMENDMENT TO AMENDED AND RESTATED GUARANTEE AGREEMENT (this “Amendment”), dated as of October 12, 2023, is entered into by and between JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association, as Buyer (together with its successors and assigns “Buyer”) and GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation (“Guarantor”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Master Repurchase Agreement (as defined below).

WITNESSETH:

WHEREAS, GP Commercial JPM LLC (“Seller”) and Buyer are parties to that certain Uncommitted Master Repurchase Agreement, dated as of December 3, 2015 (as amended by that certain Amendment No. 1 to Master Repurchase Agreement, dated as of June 28, 2017, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated as of June 28, 2019, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement, dated as of August 23, 2019, as further amended by that certain Amendment No. 4 to Master Repurchase Agreement, dated as of December 13, 2019, as further amended by that certain Amendment No. 5 to Master Repurchase Agreement and Amendment No. 2 to Amended and Restated Guarantee Agreement, dated as of July 2, 2020, as further amended by that certain Amendment No. 6 to Master Repurchase Agreement and Amendment No. 3 to Amended and Restated Guarantee Agreement, dated as of September 25, 2020, as further amended by that certain Amendment No. 7 to Master Repurchase Agreement, dated as of September 27, 2021, as further amended by that certain Term SOFR Conforming Changes Amendment, dated as of December 31, 2021, as amended further by that certain Amendment No. 8 to Master Repurchase Agreement and Amendment No. 4 to Fee and Pricing Letter, dated as of June 28, 2022, as further amended by that certain Amendment No. 9 to Master Repurchase Agreement and Amendment No, 5 to Fee and Pricing Letter, dated as of March 16, 2023, as amended further by that certain Amendment No. 10 to Master Repurchase Agreement and Amendment No. 6 to Fee and Pricing Letter, dated as of July 28, 2023, as amended further by that certain Amendment No. 11 to Master Repurchase Agreement and Amendment No. 7 to Fee and Pricing Letter, dated as of October 12, 2023 (“MRA Amendment”) (as further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Master Repurchase Agreement”); and

WHEREAS, Guarantor has executed and delivered that certain Amended and Restated Guarantee Agreement, dated as of June 28, 2017, as amended by that certain First Amendment to Amended and Restated Guarantee Agreement, dated as of December 17, 2019, and as further amended by Amendment No. 5 to Master Repurchase Agreement and Amendment No. 2 to Amended and Restated Guarantee Agreement, dated as of July 2, 2020, as further amended by Amendment No. 6 to Master Repurchase Agreement and Amendment No. 3 to Amended and Restated Guarantee Agreement, dated as of September 25, 2020, as further amended by that certain Fourth Amendment to Amended and Restated Guarantee Agreement, dated as of August 3, 2023 (as amended hereby and as further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Guarantee”); and

WHEREAS, Guarantor and Buyer wish to modify certain terms and provisions of the Guarantee, as set forth herein.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Amendment to Guarantee. The Guarantee is hereby amended as follows:

(a) Section 1 of the Guarantee is hereby amended by adding the following defined term in the correct alphabetical order therein:

“Loan Material Modification” means a modification of any loan term under any underlying purchased asset under any Third Party Facility which, (i) extends the maturity of a purchased asset by more than 12 months, (ii) defers principal or interest due under the related loan documents for more than 90 days from the date payable under such loan documents, (iii) releases collateral securing the related purchased asset that increases the loan-to-value ratio of the related purchased asset by more than 5%, (iv) releases any guarantor from any material obligation or replaces a guarantor of a purchased asset. (v) decreases the interest rate, (vi) amends the maturity date of a purchased asset to be earlier than the stated maturity date (which, for the avoidance of doubt, will not include an acceleration by Seller upon a default under such purchased asset), or (vii) changes in any material respect the definitions of “Default” or “Event of Default” thereunder.

(b) Section 2(b) of the Guarantee is hereby amended and restated in its entirety to read as follows:

(b) Notwithstanding anything in Section 2(a) to the contrary, but subject in all cases to Sections 2(c), and (d) below, which shall control with respect to the circumstances described therein, the maximum liability of the Guarantor hereunder shall in no event exceed the sum of (i) with respect to the portion of the Purchase Price not constituting Additional Advance Amounts, twenty-five percent (25%) of the aggregate amount of the then-currently unpaid portion of such Purchase Price of all Purchased Assets that are Senior Mortgage Loans or Participation Interests in Senior Mortgage Loans, (ii) with respect to the portion of the Purchase Price consisting of Additional Advance Amounts, one hundred percent (100%) of the aggregate outstanding Additional Advance Amounts of all Additional Advance Purchased Assets, and (iii) one hundred percent (100%) of the then-currently unpaid aggregate Purchase Price of all Purchased Assets that do not consist of Senior Mortgage Loans or Participation Interests in Senior Mortgage Loans as of any date of determination.

(c) Section 9(d) of the Guarantee is hereby deleted in its entirety and replaced with the following:

(d) Minimum Interest Expense Coverage Ratio. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit the ratio of (i) all amounts set forth on an income statement of Guarantor and its consolidated Subsidiaries prepared in accordance with GAAP for interest income for the period of four (4) consecutive fiscal quarters ended on or most recently prior to such date of determination to (ii) the Interest Expense of Guarantor and its consolidated Subsidiaries for such period, to be (x) at all times until the date that is four quarters following the Additional Advance Termination Date (as may be extended in accordance with the Repurchase Agreement), less than 1.30 to 1.00, and (y) at all times thereafter, less than 1.40 to 1.00.

(d) Section 9 of the Guarantee is hereby amended by adding the following subsection (f) thereto:

(f) Notwithstanding anything to the contrary contained herein, at all times while any Additional Advances are outstanding, Guarantor shall not permit

any of the following actions to be taken without Buyer’s prior written consent (i) any additional funding or advances under any third party repurchase or credit facilities for which Guarantor is a guarantor (a “Third Party Facility”) (other than (x) future funding advances under a Third Party Facility in respect of scheduled advance amounts under existing purchased assets where the applicable borrower satisfies the requirements for such advance (e.g., capex advances); (y) pledging additional purchased assets under such Third Party Facility; and (z) entering into any repurchase or credit facility with a new lender (a “New Repo Lender”) for which a first priority perfected security interest in favor of Buyer is granted over 100% of the equity interests in the related Third Party Facility seller/borrower or its direct parent under the terms of a pledge agreement in form and substance acceptable to Buyer in its sole discretion), (ii) any change of the material terms of any facility documents in respect of any Third Party Facility and (iii)except with respect to any Loan Material Modifications, which in the aggregate, account for less than 10% of purchased assets (measured by the aggregate purchase price of all purchased assets under such Third Party Facility) under the related Third Party Facility and subject to Seller’s rights under Article 3(dd)(vi) of the Repurchase Agreement, any Loan Material Modification with respect to any loan document relating to any purchased asset relating to any Third Party Facility or any collateral relating thereto. To the extent the Buyer and Seller cannot agree on a course of action with respect to any Loan Material Modification, Seller shall have the option to pay to Buyer an amount equal to the Pay-Down Amount with respect to each purchased asset under the applicable Third Party Facility.

(e) Section 9 of the Guarantee is hereby amended by adding the following subsection (g) thereto:

(g) Guarantor shall fund an account (the “Liquidity Account”) established and maintained on the books and records of the JPMorgan Chase Bank, N.A. in the amount of $10,000,000 and cause at least $10,000,000 to be in such account at all times while any Additional Advance Amounts remain outstanding under the Repurchase Agreement. Following the occurrence of an Event of Default, Buyer shall be entitled to set off such amounts on deposit in the Liquidity Account against any and all amounts owing to Buyer under the Repurchase Agreement and the other Transaction Documents. Guarantor shall not at any time that any Additional Advance is outstanding incur any corporate level indebtedness or new recourse borrowing obligations (excluding any such indebtedness or borrowing under any Third Party Facility) exceeding $50,000,000 and/or which has a maturity on or prior to the final Additional Advance Termination Date (as may be extended in accordance with the Repurchase Agreement).

2. Conditions Precedent to Amendment. The effectiveness of this Amendment is subject to the following:

(a) This Amendment shall be duly executed and delivered, along with the MRA Amendment, by the Guarantor and Buyer and acknowledged by Seller;

(b) Payment by the Seller of the actual costs and expenses, including, without limitation, the reasonable fees and expenses of counsel to Buyer, incurred by Buyer in connection with this Amendment and the transactions contemplated hereby;

(c) Buyer shall have received such other documents as Buyer may reasonably request.

3. Representations and Warranties of the Guarantor. On and as of the date hereof, after giving effect to this Amendment:

(a) the Guarantor hereby represents and warrants to Buyer that no Default, Event of Default or Margin Deficit exists, and no Default, Event of Default or Margin Deficit will occur as a result of the execution, delivery and performance by such party of this Amendment;

(b) all representations and warranties contained in the Guarantee are true, correct, complete and accurate in all respects (except such representations which by their terms speak as of a specified date); and

(c) Guarantor is duly authorized to execute and deliver this Amendment.

4. Continuing Effect; Reaffirmation of Guarantee. As amended by this Amendment, all terms, covenants and provisions of the Guarantee are ratified and confirmed and shall remain in full force and effect. In addition, any and all guaranties and indemnities for the benefit of Buyer and agreements subordinating rights and liens to the rights and liens of Buyer, are hereby ratified and confirmed and shall not be released, diminished, impaired, reduced or adversely affected by this Amendment, and each party indemnifying Buyer, and each party subordinating any right or lien to the rights and liens of Buyer, hereby consents, acknowledges and agrees to the modifications set forth in this Amendment and waives any common law, equitable, statutory or other rights which such party might otherwise have as a result of or in connection with this Amendment.

5. Binding Effect; No Partnership. The provisions of the Guarantee, as amended hereby, shall be binding upon and inure to the benefit of the respective parties thereto and their respective successors and permitted assigns. Nothing herein contained shall be deemed or construed to create a partnership or joint venture between any of the parties hereto.

6. Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument, and the words “executed,” “signed,” “signature,” and words of like import as used above and elsewhere in this Amendment or in any other certificate, agreement or document related to this transaction shall include, in addition to manually executed signatures, images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, any electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code.

7. Further Agreements. The Guarantor agrees to execute and deliver such additional documents, instruments or agreements as may be reasonably requested by Buyer and as may be necessary or appropriate from time to time to effectuate the purposes of this Amendment.

8. Governing Law; Submission to Jurisdiction, Etc. The provisions of Sections 15 and 17 of the

Guarantee are hereby incorporated herein by reference and shall apply to this Amendment, mutatis mutandis, as if more fully set forth herein.

9. Headings. The headings of the sections and subsections of this Amendment are for convenience of reference only and shall not be considered a part hereof nor shall they be deemed to limit or otherwise affect any of the terms or provisions hereof.

10. References to Transaction Documents. All references to the Guarantee in any Transaction Document or in any other document executed or delivered in connection therewith shall, from and after the execution and delivery of this Amendment, be deemed a reference to the Guarantee, as amended hereby, unless the context expressly requires otherwise.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the day first written above.

Buyer:

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association

By: /s/ THOMAS N. CASSINO

Name: Thomas N. Cassino

Title: Managing Director

GUARANTOR:

GRANITE POINT MORTGAGE TRUST INC.,

a Maryland corporation

By: /s/ MICHAEL KARBER

Name: Michael Karber

Title: Vice President, Secretary and

General Counsel

ACKNOWLEDGED AND AGREED TO BY:

SELLER:

GP COMMERCIAL JPM LLC, a Delaware limited liability company

By: /s/ MICHAEL KARBER

Name: Michael Karber

Title: Vice President, Secretary and

General Counsel

v3.23.3

Document and Entity Information Document

|

Oct. 12, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 12, 2023

|

| Entity Registrant Name |

Granite Point Mortgage Trust Inc.

|

| Entity Central Index Key |

0001703644

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-38124

|

| Entity Tax Identification Number |

61-1843143

|

| Entity Address, Address Line One |

3 Bryant Park, Suite 2400A

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

212

|

| Local Phone Number |

364-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Series A Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

GPMTPrA

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GPMT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

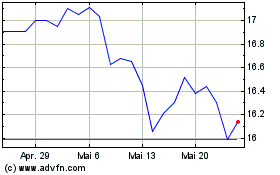

Granite Point Mortgage (NYSE:GPMT-A)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Granite Point Mortgage (NYSE:GPMT-A)

Historical Stock Chart

Von Dez 2023 bis Dez 2024