AustralianSuper, Australia’s largest pension fund, today

announced that it is investing €1.5 billion to acquire a

significant minority stake in Vantage Data Centers Europe, Middle

East and Africa (Vantage EMEA), a DigitalBridge-sponsored company.

DigitalBridge Group, Inc. (NYSE: DBRG) (“DigitalBridge”), is a

leading global alternative asset manager dedicated to investing in

digital infrastructure.

AustralianSuper will be a key shareholder in Vantage EMEA, one

of the fastest growing hyperscale data center platforms in the

region. Together, AustralianSuper and DigitalBridge-sponsored

vehicles will support Vantage’s expansion and development of

hyperscale data centers across EMEA, utilizing the company’s campus

model to drive accelerated time to market while building on its

longstanding customer relationships, track record of growth and

next-generation infrastructure capabilities.

The investment, which represents AustralianSuper’s first

significant exposure in hyperscale data centers, provides

AustralianSuper with access to an attractive market with strong

growth prospects.

Nik Kemp, Head of Infrastructure at AustralianSuper, said, “The

Vantage EMEA platform is at an exciting point in its history, with

a strong pipeline of developments in growing markets across the

region. We look forward to working with DigitalBridge and Vantage

EMEA to continue to support the rapid growth of its customers while

also delivering on our purpose to help more than 3.2 million

members achieve their best financial position in retirement. The

Vantage EMEA platform will complement our existing digital

infrastructure investments and this acquisition represents an

important step for the Fund as we build out our infrastructure

capability in Europe.”

Jon Mauck, Senior Managing Director at DigitalBridge who leads

DigitalBridge’s data center investment strategy, said, “We are

delighted to welcome AustralianSuper as an investor to EMEA’s

premier data center platform. Vantage, led by an experienced

management team, has a track record of success and is aligned with

the long-term growth of cloud demand and the need for AI

infrastructure. Digital infrastructure continues to demonstrate its

resilience as an asset class, and we look forward to building on

our track record as we become a partner of choice to Australian

investors seeking to increase their exposure to high-quality

digital infrastructure investments.”

Sureel Choksi, President and CEO of Vantage Data Centers, said,

“As data center demand continues to rapidly accelerate across EMEA,

this investment will fuel Vantage’s ability to accelerate the

growth of our environmentally friendly, large-scale data center

footprint across the region and further deepen our relationships

with customers as we enable them to grow and scale their businesses

with reliable, efficient and sustainable data centers. We look

forward to partnering with AustralianSuper and supporting our

customers’ continued growth."

Since entering the EMEA market in February 2020, Vantage EMEA

has expanded to six countries and established its presence in some

of the region’s most important financial and commercial hubs,

including Frankfurt and Berlin, Germany; Milan, Italy; Warsaw,

Poland; Johannesburg, South Africa; Zurich, Switzerland; and

Cardiff, United Kingdom. Most recently, Vantage EMEA announced its

entry into the London market with 75MW of IT capacity across two

campuses. Vantage EMEA has a strong focus on environmental

sustainability and is committed to reaching net zero carbon

emissions by 2030.

The transaction is expected to close in the fourth quarter of

2023, subject to customary closing conditions.

About AustralianSuper

AustralianSuper is Australia’s largest pension fund, managing

more than €180 billion in members’ retirement savings on behalf of

more than 3.2 million members from more than 448,000 businesses (as

at 30 June 2023). AustralianSuper has a more than €24 billion

infrastructure portfolio invested primarily in developed markets,

targeting large direct ownership stakes across the infrastructure

spectrum. AustralianSuper has a long history of astute investment

in high quality Australian and global infrastructure assets such as

Peel Ports (United Kingdom), Transurban Chesapeake (US), Indara

Digital Infrastructure, Transurban Queensland, NSW Ports,

WestConnex, and Sydney Airport (Australia).

About Vantage Data Centers

Vantage Data Centers powers, cools, protects and connects the

technology of the world’s well-known hyperscalers, cloud providers

and large enterprises. Developing and operating across five

continents in North America, EMEA and Asia Pacific, Vantage has

evolved data center design in innovative ways to deliver dramatic

gains in reliability, efficiency and sustainability in flexible

environments that can scale as quickly as the market demands.

About DigitalBridge

DigitalBridge (NYSE: DBRG) is a leading global alternative asset

manager dedicated to investing in digital infrastructure. With a

heritage of over 25 years investing in and operating businesses

across the digital ecosystem including cell towers, data centers,

fiber, small cells and edge infrastructure, the DigitalBridge team

manages over $70 billion portfolio of digital infrastructure assets

on behalf of its limited partners and shareholders. Headquartered

in Boca Raton, Florida, DigitalBridge has key offices in New York,

Los Angeles, London, Luxembourg and Singapore. For more

information, visit: www.digitalbridge.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as "may," "will," "should,"

"expects," "intends," "plans," "anticipates," "believes,"

"estimates," "predicts," or "potential" or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond our control, and may cause

actual results to differ significantly from those expressed in any

forward-looking statement. Factors that might cause such a

difference include whether the transaction will close on the

anticipated time frame, the ability of the Vantage EMEA platform to

continue to grow and scale, and other risks and uncertainties,

including those detailed in DigitalBridge’s Annual Report on Form

10-K for the year ended December 31, 2022, Quarterly Reports on

Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023,

and its other reports filed from time to time with the U.S.

Securities and Exchange Commission. All forward-looking statements

reflect DigitalBridge’s good faith beliefs, assumptions and

expectations, but they are not guarantees of future performance.

DigitalBridge cautions investors not to unduly rely on any

forward-looking statements. The forward-looking statements speak

only as of the date of this press release. DigitalBridge is under

no duty to update any of these forward-looking statements after the

date of this press release, nor to conform prior statements to

actual results or revised expectations, and DigitalBridge does not

intend to do so.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230911843629/en/

Media Contacts

AustralianSuper UK Montfort Olly Scott /

Georgia Colkin australiansuper@montfort.london +44 (0)78 1234

5205

Australia Stephen McMahon, Senior Manager Media Relations

smcmahon@australiansuper.com +61 407-507-415

Vantage Data Centers Mark Freeman +1-202-680-4243

DigitalBridge Joele Frank, Wilkinson Brimmer Katcher Jon

Keehner / Kara Brickman / Sarah Salky dbrg-jf@joelefrank.com

+1-212-355-4449

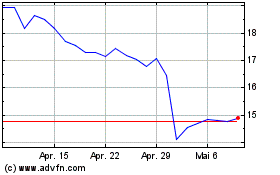

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024