false

0001494582

0001494582

2024-02-14

2024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2024 (February 14, 2024)

|

BOSTON OMAHA CORPORATION

|

|

(Exact name of registrant as specified in its Charter)

|

|

|

|

Delaware

|

001-38113

|

27-0788438

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

|

|

|

|

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(Address and telephone number of principal executive offices, including zip code)

|

|

(857) 256-0079

(Registrant's telephone number, including area code)

|

|

Not Applicable

(Former name or address, if changed since last report)

|

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Class

|

Trading Symbol

|

Name of Exchange on Which Registered

|

|

Class A common stock,

$0.001 par value per share

|

BOC

|

The New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01

|

ENTRY INTO A DEFINITIVE MATERIAL AGREEMENT

|

On February 14, 2024, Link Media Holdings, Inc. (“Link”), a wholly-owned subsidiary of Boston Omaha Corporation (“BOC”), which owns and operates BOC’s billboard businesses, entered into an Eighth Amendment to Credit Agreement (the “Eighth Amendment”) with First National Bank of Omaha (the “Lender”). On August 12, 2019, Link entered into a Credit Agreement, as amended (the “Credit Agreement”) with the Lender under which Link could borrow up to $30,000,000 in the aggregate under two term loans and $5,000,000 under a revolving line of credit, each guaranteed by Link’s subsidiaries. The Eighth Amendment modifies the Credit Agreement to provide additional flexibility for Link to issue dividends to BOC by modifying the definition of "Consolidated Fixed Charge Coverage Ratio" in calculating the ratio to exclude a $5,000,000 dividend previously paid by Link to BOC in August 2023. All other terms regarding the Credit Agreement are unchanged.

BOC does not provide any guaranty under the Credit Agreement. Each of Link's subsidiaries have guaranteed all obligations of Link under the Credit Agreement.

The foregoing summary of the Eighth Amendment and the transactions contemplated thereby contained in this Item 1.01 does not purport to be a complete description and is qualified in its entirety by reference to the terms and conditions of the Eighth Amendment, a copy of which is attached as Exhibit 10.1 and incorporated herein by reference. Capitalized terms used in this Item 1.01 have the meaning given to such terms in the Eighth Amendment and Credit Agreement, as applicable.

|

ITEM 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The description contained in Item 1.01 is hereby incorporated by reference herein.

On On February 16, 2024, BOC announced that its Annual Meeting of Stockholders will be a virtual meeting which will be held on Wednesday, May 1, 2024 at 10:00 a.m. Central Time. Additional information regarding the Annual Meeting will be posted on the BOC website.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

|

(d)

|

Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

|

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BOSTON OMAHA CORPORATION

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Joshua P. Weisenburger

|

|

|

|

|

Joshua P. Weisenburger,

|

|

|

|

|

Chief Financial Officer |

|

Date: February 16, 2024

EXHIBIT 10.1

EIGHTH AMENDMENT TO CREDIT AGREEMENT

THIS EIGHTH AMENDMENT TO CREDIT AGREEMENT (this “Amendment”) is dated as of February 15th, 2024, by and between LINK MEDIA HOLDINGS, LLC, a Delaware limited liability company (“Borrower”), and FIRST NATIONAL BANK OF OMAHA, a national banking association (“Lender”).

W I T N E S S E T H :

WHEREAS, Borrower and Lender previously entered into that certain Credit Agreement, dated as of August 12, 2019, as amended by that certain First Amendment to Credit Agreement, dated as of October 25, 2019, as further amended by that certain Second Amendment to Credit Agreement, dated as of June 25, 2020, as further amended by that certain Third Amendment to Credit Agreement, dated as of August 18, 2021, but effective as of August 12, 2021, as further amended by that certain Fourth Amendment to Credit Agreement, dated as of December 6, 2021, as further amended by that certain Fifth Amendment to Credit Agreement, dated as of May 31, 2022, as further amended by that certain Sixth Amendment to Credit Agreement, dated as of April 6, 2023, as further amended by that certain Seventh Amendment to Credit Agreement, dated as of September 22, 2023, pursuant to which Lender agreed to make loans and otherwise extend credit to Borrower (as amended and further amended, restated or modified from time to time, the “Credit Agreement”); and

WHEREAS, the parties desire to amend the Credit Agreement as set forth in this Amendment.

NOW, THEREFORE, in consideration of the mutual covenants herein contained and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1. Definitions. All capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Credit Agreement.

2. Amendments to Credit Agreement. The definition of “Consolidated Fixed Charge Coverage Ratio” in Section 11 of the Credit Agreement is hereby amended and restated in its entirety as follows:

“Consolidated Fixed Charge Coverage Ratio” shall mean the ratio of (a) (i) Consolidated EBITDA for a period minus (ii) unfinanced Maintenance Capital Expenditures for such period (other than Maintenance Capital Expenditures funded by means of a capital contribution by Parent to Borrower or to any Subsidiary) minus (iii) federal, state and local income tax expenses paid in cash for such period minus (iv) Dividends for such period (excluding (1) any Dividends paid from the proceeds of Term Loan on or prior to June 31, 2022 in an amount not to exceed $8,125,000.00 in the aggregate and (2) solely for the purposes of calculating the Consolidated Fixed Charge Coverage Ratio for the Test Period ending on June 30, 2024, the Dividend paid to Parent during the month of August 2023 in an amount equal to $5,000,000.00) to (b) the sum of (i) Consolidated Interest Expense paid in cash for such period plus (ii) scheduled principal amortization payments or redemptions (as initially scheduled on the incurrence of such debt and excluding optional prepayments thereof) on Consolidated Total Funded Debt required to be paid in cash for such period plus (iii) Capitalized Lease Obligations payments for such period (but excluding from clauses (ii) and (iii) any component of Consolidated Interest Expense to the extent the same is included in clause (i)).

3. No Further Amendments. Except as expressly provided herein, nothing contained herein is intended to reduce, restrict or otherwise affect any warranties, representations, covenants or other agreements made by Borrower. Except as expressly provided herein, this Amendment is not intended to supersede or amend the Credit Agreement or any documents executed in connection therewith. All of the covenants and obligations of Borrower under the Credit Documents are hereby acknowledged, ratified and affirmed by Borrower, and Borrower specifically acknowledges and agrees that all Collateral pledged to Lender secures the Obligations.

4. Representations and Warranties. Borrower hereby represents and warrants to Lender as follows:

(a) The representations and warranties contained in the Credit Agreement and the other Credit Documents are true and correct on and as of the date hereof as though made on and as of this date, except to the extent that such representations and warranties relate solely to an earlier date;

(b) There exists no Event of Default or Default;

(c) The execution, delivery and performance by Borrower of this Amendment and all other agreements and documents required hereunder have been duly authorized by all necessary action and do not and will not: (i) result in any breach of or constitute a default under any indenture, loan or credit agreement or any other agreement, lease or instrument to which Borrower or Parent is a party or by which it or its properties may be bound or affected; or (ii) result in, or require, for the benefit of any person or entity other than Lender, the creation or imposition of any mortgage, deed of trust, pledge, lien, security interest or other charge or encumbrance of any nature upon or with respect to any of the properties now owned or hereafter acquired by Borrower or Parent; and

(d) No authorization, approval or other action by and notice to or filing with any governmental authority or regulatory body or any person or entity is required for the execution, delivery and performance by Borrower of this Amendment.

5. Conditions Precedent. As conditions precedent to the enforceability of this Amendment, Lender shall have received from Borrower all of the following, each dated (unless otherwise indicated) such day, in form and substance satisfactory to Lender:

(a) This Amendment executed by Borrower.

(b) Without limitation, attorneys’ fees and expenses, incurred by Lender in connection with this Amendment and the Credit Documents and all related documentation, recording or filing fees.

6. Limited Effect. Except as expressly provided herein or contemplated by this Amendment, the Credit Agreement and the other Credit Documents shall remain unmodified and in full force and effect. This Amendment shall not be deemed (a) to be a waiver of, or consent to, or a modification or amendment of, any other term or condition of the Credit Agreement or any other Credit Document or a waiver of any Default or Event of Default, (b) to prejudice any right or rights which Lender may now have or may have in the future under or in connection with the Credit Agreement or the other Credit Documents or any of the instruments or agreements referred to therein, as the same may be amended, restated, supplemented or modified from time to time, or (c) to be a commitment or any other undertaking or expression of any willingness to engage in any further discussion with Borrower, any Guarantor or any other Person with respect to any waiver, amendment, modification or any other change to the Credit Agreement or the other Credit Documents or any rights or remedies arising in favor of Lender under or with respect to any such documents.

7. GOVERNING LAW; SUBMISSION TO JURISDICTION; VENUE; WAIVER OF JURY TRIAL.

(a) THIS AMENDMENT, THE CREDIT AGREEMENT AND THE OTHER CREDIT DOCUMENTS AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER AND THEREUNDER AND ANY CLAIMS, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT, THE CREDIT AGREEMENT OR ANY OTHER CREDIT DOCUMENT SHALL, EXCEPT AS TO ANY OTHER CREDIT DOCUMENT AS EXPRESSLY SET FORTH THEREIN, BE CONSTRUED IN ACCORDANCE WITH AND BE GOVERNED BY THE LAW OF THE STATE OF NEBRASKA. ANY LEGAL ACTION OR PROCEEDING WITH RESPECT TO THIS AMENDMENT, THE CREDIT AGREEMENT OR ANY OTHER CREDIT DOCUMENT SHALL BE BROUGHT IN THE COURTS OF THE STATE OF NEBRASKA OR OF THE UNITED STATES FOR THE DISTRICT OF NEBRASKA, IN EACH CASE WHICH ARE LOCATED IN THE COUNTY OF DOUGLAS. EACH PARTY HERETO HEREBY IRREVOCABLY ACCEPTS FOR ITSELF AND IN RESPECT OF ITS PROPERTY, GENERALLY AND UNCONDITIONALLY, THE EXCLUSIVE JURISDICTION OF THE AFORESAID COURTS. EACH PARTY HERETO HEREBY FURTHER IRREVOCABLY WAIVES ANY CLAIM THAT ANY SUCH COURTS LACK PERSONAL JURISDICTION OVER SUCH PARTY, AND AGREES NOT TO PLEAD OR CLAIM, IN ANY LEGAL ACTION PROCEEDING WITH RESPECT TO THIS AMENDMENT, THE CREDIT AGREEMENT OR ANY OTHER CREDIT DOCUMENTS BROUGHT IN ANY OF THE AFOREMENTIONED COURTS, THAT SUCH COURTS LACK PERSONAL JURISDICTION OVER SUCH PARTY. EACH OF THE PARTIES HERETO AGREES THAT A FINAL NON-APPEALABLE JUDGMENT IN ANY SUCH ACTION OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON THE JUDGMENT OR IN ANY OTHER MANNER PROVIDED BY LAW. EACH PARTY HERETO FURTHER IRREVOCABLY CONSENTS TO THE SERVICE OF PROCESS OUT OF ANY OF THE AFOREMENTIONED COURTS IN ANY SUCH ACTION OR PROCEEDING BY THE MAILING OF COPIES THEREOF BY REGISTERED OR CERTIFIED MAIL, POSTAGE PREPAID, TO SUCH PARTY AT ITS ADDRESS SPECIFIED IN SECTION 12.03 OF THE CREDIT AGREEMENT, SUCH SERVICE TO BECOME EFFECTIVE 30 DAYS AFTER SUCH MAILING. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES ANY OBJECTION TO SUCH SERVICE OF PROCESS AND FURTHER IRREVOCABLY WAIVES AND AGREES NOT TO PLEAD OR CLAIM IN ANY ACTION OR PROCEEDING COMMENCED HEREUNDER OR UNDER ANY OTHER CREDIT DOCUMENT THAT SERVICE OF PROCESS WAS IN ANY WAY INVALID OR INEFFECTIVE. NOTHING HEREIN SHALL AFFECT THE RIGHT OF ANY PARTY HERETO TO SERVE PROCESS IN ANY OTHER MANNER PERMITTED BY LAW.

(b) EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES ANY OBJECTION WHICH IT MAY NOW OR HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY OF THE AFORESAID ACTIONS OR PROCEEDINGS ARISING OUT OF OR IN CONNECTION WITH THIS AMENDMENT, THE CREDIT AGREEMENT OR ANY OTHER CREDIT DOCUMENT BROUGHT IN THE COURTS REFERRED TO IN CLAUSE (A) ABOVE AND HEREBY FURTHER IRREVOCABLY WAIVES AND AGREES NOT TO PLEAD OR CLAIM IN ANY SUCH COURT THAT ANY SUCH ACTION OR PROCEEDING BROUGHT IN ANY SUCH COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM.

(c) EACH OF THE PARTIES TO THIS AMENDMENT HEREBY IRREVOCABLY WAIVES ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AMENDMENT, THE CREDIT AGREEMENT THE OTHER CREDIT DOCUMENTS OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY.

8. Counterparts. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. An electronic transmission or facsimile of this Amendment shall be deemed an original and shall be admissible as evidence of the document and the signer’s execution.

9. Entire Agreement. This Amendment is the entire agreement, and supersedes any prior agreements and contemporaneous oral agreements, of the parties concerning its subject matter.

10. Successors and Assigns. This Amendment shall be binding on and inure to the benefit of the parties and their respective heirs, beneficiaries, successors and permitted assigns.

[The Remainder of this Page Intentionally Left Blank, Signature Page to Follow]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the date and year first above written.

BORROWER:

LINK MEDIA HOLDINGS, LLC

By: /s/ Scott LaFoy

Name: Scott LaFoy

Title: President

LENDER:

FIRST NATIONAL BANK OF OMAHA

By: /s/ David S. Erker

Name: David S. Erker

Title: Vice President

REAFFIRMATION OF GUARANTY

Each of the undersigned (each, a “Guarantor”) hereby: (a) acknowledges that each Guarantor has reviewed and consents to this Amendment on the terms and conditions set forth herein; (b) acknowledges and agrees that all references to the “Credit Agreement” and “Credit Documents” contained in the Subsidiaries Guaranty shall constitute references to the Credit Agreement and Credit Documents as the same have been amended and may be amended, restated or otherwise modified from time to time hereafter; (c) acknowledges and agrees that the Subsidiaries Guaranty has not been discharged to any extent and that Lender has not waived any of its rights or remedies whatsoever against Borrower or the undersigned by entering into the Amendment or by any previous action taken by Lender; (d) ratifies and reaffirms in all respects the Subsidiaries Guaranty, agrees to be bound thereby, and agrees that the Subsidiaries Guaranty constitutes the legal, valid and binding obligation of the undersigned enforceable against each Guarantor in accordance with its terms, subject to applicable bankruptcy, insolvency reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law; and (e) acknowledges that no future obligation to obtain the undersigned’s consent or acknowledgment to Lender’s extending future loans or amending agreements with Borrower shall be imposed or otherwise implied as a result of the undersigned having giving this Reaffirmation of Guaranty.

GUARANTORS:

LINK MEDIA ALABAMA, LLC

LINK MEDIA FLORIDA, LLC

LINK MEDIA GEORGIA, LLC

LINK MEDIA MIDWEST, LLC

LINK MEDIA OMAHA, LLC

LINK MEDIA SERVICES, LLC

LINK MEDIA SOUTHEAST, LLC

LINK MEDIA WISCONSIN, LLC

LINK MEDIA PROPERTIES, LLC

LINK BILLBOARDS OKLAHOMA, LLC

By: /s/ Scott LaFoy

Name: Scott LaFoy

Title: President

v3.24.0.1

Document And Entity Information

|

Feb. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BOSTON OMAHA CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38113

|

| Entity, Tax Identification Number |

27-0788438

|

| Entity, Address, Address Line One |

1601 Dodge Street

|

| Entity, Address, Address Line Two |

Suite 3300

|

| Entity, Address, City or Town |

Omaha

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68102

|

| City Area Code |

857

|

| Local Phone Number |

256-0079

|

| Title of 12(b) Security |

Class A common stock

|

| Trading Symbol |

BOC

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001494582

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

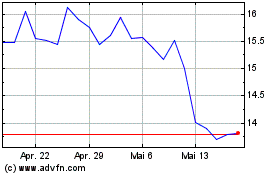

Boston Omaha (NYSE:BOC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Boston Omaha (NYSE:BOC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024