Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today announced it has updated

its pipeline of build-to-suit development commitments.

Additionally, the Company announced that BNL’s CEO, John Moragne,

CFO, Kevin Fennell, and Director of Corporate Finance and Investor

Relations, Brent Maedl, will be participating in the Nariet

REITworld 2024 Annual Conference in Las Vegas, NV, on November 19

and November 20, 2024.

DEVELOPMENT FUNDING COMMITMENTS

As of the date of this release, we have a total of $246.5

million in estimated build-to-suit development commitments to be

funded through the second quarter of 2026. Since our October 30,

2024, release, in which we previously announced a total of $418.8

million remaining estimated build-to-suit development commitments,

we were notified that a prospective tenant for a large

build-to-suit transaction in our pipeline shifted its strategy in

connection with an unanticipated change in its executive

leadership, and determined not to proceed with certain initiatives,

including our transaction.

“We are steadfast in our commitment to scaling a robust and

resilient pipeline of build-to-suit developments as part of our

core building blocks of growth,” said John Moragne, BNL’s Chief

Executive Officer. “We are focused on laddering additional

build-to-suit opportunities that provide visibility to embedded

growth in future years while maintaining a strong appetite for

accretive regular-way acquisitions to optimize near-term results

and generate sustainable, long-term growth.”

As of today, the $246.5 million in total estimated build-to-suit

commitments includes $125.4 million of commitments for developments

that are actively under construction and $121.1 million in

additional development commitments. The following table summarizes

developments that are actively under construction:

(unaudited, in thousands)

Property

Property Type

Projected Rentable Square

Feet

Start Date

Target Completion Date

Estimated Total Project

Investment

Cumulative Investment at

11/18/2024

Estimated Remaining Funding

Commitment

Estimated Cash Capitalization

Rate

Estimated Straight-line

Yield1

Sierra Nevada (Dayton - OH)

Industrial

122

10/2024

12/2025

$

58,563

$

1,619

$

56,944

7.6

%

9.5

%

Sierra Nevada (Dayton - OH)

Industrial

122

10/2024

5/2026

55,525

1,644

53,881

7.7

%

9.7

%

UNFI (Sarasota - FL)

Industrial

1,016

05/2023

Substantially Completed

204,833

190,239

14,594

7.2

%

8.6

%

Total

1,260

$

318,921

$

193,502

$

125,419

1 Represents the estimated first year

yield to be generated on a real estate investment, which was

computed at the time of investment based on the estimated annual

straight-line rental income computed in accordance with GAAP,

divided by the estimated total project investment.

As of the date of this release, we have an aggregate of $264.4

million in total investment commitments, which is comprised of the

aforementioned $246.5 million in total remaining estimated

build-to-suit developments, $9.9 million of acquisitions under

control, and $8.0 million of commitments to fund revenue generating

capital expenditures with existing tenants.

About Broadstone Net Lease, Inc. BNL is an

industrial-focused, diversified net lease REIT that invests in

primarily single-tenant commercial real estate properties that are

net leased on a long-term basis to a diversified group of tenants.

Utilizing an investment strategy underpinned by strong fundamental

credit analysis and prudent real estate underwriting, as of

September 30, 2024, BNL’s diversified portfolio consisted of 773

individual net leased commercial properties with 766 properties

located in 44 U.S. states and seven properties located in four

Canadian provinces across the industrial, restaurant, retail,

healthcare, and office property types.

Forward-Looking Statements This press release contains

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, regarding, among other

things, our plans, strategies, and prospects, both business and

financial. Such forward-looking statements can generally be

identified by our use of forward-looking terminology such as

“outlook,” “potential,” “may,” “will,” “should,” “could,” “seeks,”

“approximately,” “projects,” “predicts,” “expect,” “intends,”

“anticipates,” “estimates,” “plans,” “would be,” “believes,”

“continues,” or the negative version of these words or other

comparable words. Forward-looking statements, including our 2024

guidance and assumptions, involve known and unknown risks and

uncertainties, which may cause BNL’s actual future results to

differ materially from expected results, including, without

limitation, risks and uncertainties related to general economic

conditions, including but not limited to increases in the rate of

inflation and/or interest rates, local real estate conditions,

tenant financial health, property investments and acquisitions, and

the timing and uncertainty of completing these property investments

and acquisitions, and uncertainties regarding future distributions

to our stockholders. These and other risks, assumptions, and

uncertainties are described in Item 1A “Risk Factors” of the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the SEC on February 22,

2024, which you are encouraged to read, and will be available on

the SEC’s website at www.sec.gov. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

indicated or anticipated by such forward-looking statements.

Accordingly, you are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they

are made. The Company assumes no obligation to, and does not

currently intend to, update any forward-looking statements after

the date of this press release, whether as a result of new

information, future events, changes in assumptions, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118933459/en/

Company Contact:

Brent Maedl Director, Corporate Finance & Investor Relations

brent.maedl@broadstone.com 585.382.8507

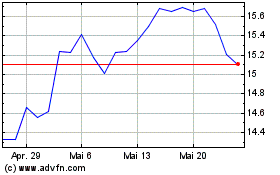

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

Von Apr 2024 bis Apr 2025