UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-38077

Bright Scholar Education Holdings Limited

No. 1, Country Garden Road

Beijiao Town, Shunde District, Foshan, Guangdong

528300

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Bright Scholar Education Holdings Limited |

| |

|

|

| Date: August 2, 2024 |

By: |

/s/ Hui Zhang |

| |

Name: |

Hui Zhang |

| |

Title: |

Chief Financial Officer |

EXHIBIT INDEX

2

Exhibit 99.1

Bright Scholar Announces Unaudited Financial

Results for the Third Quarter of Fiscal 2024

Gross Profit Increased 5.0% YoY and Revenue

Increased 6.2% QoQ

Management to hold a conference call today at

8:00 a.m. Eastern Time

FOSHAN, China, August 2, 2024 /PRNewswire/—Bright

Scholar Education Holdings Limited (“Bright Scholar,” the “Company,” “we” or “our”) (NYSE:

BEDU), a global premier education service company, today announced its unaudited financial results for its fiscal 2024 third quarter ended

May 31, 2024.

THIRD QUARTER OF FISCAL 2024 FINANCIAL HIGHLIGHTS

| • | Revenue

was RMB554.0 million, compared to RMB586.4 million for the same quarter last fiscal year, representing a quarter-over-quarter increase

of 6.2%. |

| • | Revenue

from Overseas Schools was RMB264.9 million, representing an increase of 19.4% from the same quarter last fiscal year. |

| • | Gross

profit was RMB202.7 million, representing an increase of 5.0% from the same quarter last fiscal year. Gross margin increased to 36.6%

from 32.9% for the same quarter last fiscal year. |

| • | Net

loss was RMB90.3 million, compared to RMB37.7 million for the same quarter last fiscal year, mainly attributable to an impairment loss

on goodwill of RMB133 million. Adjusted net income1 was RMB48.5 million, compared to

an adjusted net loss of RMB34.8 million for the same quarter last fiscal year. |

Revenue by Segment

| | |

For the third quarter ended May 31, | | |

YoY | | |

% of total

revenue in | |

| (RMB in millions except for percentage) | |

2024 | | |

2023 | | |

% Change | | |

F3Q2024 | |

| Overseas Schools | |

| 264.9 | | |

| 221.8 | | |

| 19.4 | % | |

| 47.8 | % |

| Complementary Education Services2 | |

| 169.5 | | |

| 207.5 | | |

| -18.3 | % | |

| 30.6 | % |

| Domestic Kindergartens & K-12 Operation Services3 | |

| 119.6 | | |

| 157.1 | | |

| -23.9 | % | |

| 21.6 | % |

| Total | |

| 554.0 | | |

| 586.4 | | |

| -5.5 | % | |

| 100.0 | % |

| 1.

|

Adjusted

net income/(loss) is defined as net income/(loss) excluding share-based compensation expenses, amortization of intangible assets,

tax effect of amortization of intangible assets and impairment loss on goodwill. |

| 2.

|

The

Complementary Education Services business comprises language training, overseas study counselling, career counselling, study tours

and camps, as well as international contest training and others. |

| 3.

|

The

Domestic Kindergartens & K-12 Operation Services business comprises for-profit kindergartens and operation services for students

of domestic K-12 schools, including catering and procurement services. |

For

more information on these adjusted financial measures, please see the section captioned “Non-GAAP Financial Measures” and

the tables captioned “Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this release.

MANAGEMENT COMMENTARY

Mr. Robert Niu, Chief Executive Officer of Bright

Scholar, commented, “Our resilient business continues to recover and thrive. We delivered solid quarterly results amid an uncertain

and evolving external environment through solid strategic execution and dedicated initiatives to fuel our global business. During the

quarter, our core Overseas Schools business maintained its double-digit year-over-year revenue growth trajectory, and student enrollment

grew by 8% compared to the same quarter last fiscal year. Year to date, over 900 students have accepted offers for our September intake.

In addition, we are utilizing our facilities and teaching resources more effectively, increasing the utilization rate of our overseas

schools to 62% during the quarter. As a global premier education service company, we are committed to enhancing teaching quality and fostering

an enriched learning experience for our students. Aligned with our strategy to focus our resources on our high-growth core business while

optimizing organizational structure to improve our operational and management efficiency, we divested our non-core international contest

training business and career counseling business from our Complementary Education Services segment in May and June. Building on our well-established

brand and abundant educational resources, we are well-positioned to expand our high-return businesses and are gearing up to seize the

tremendous growth opportunities ahead.”

Ms. Cindy Zhang, Chief Financial Officer of Bright

Scholar, added, “We achieved healthy financial results in the third fiscal quarter. Led by our Overseas Schools business, our total

revenues grew by 6% quarter over quarter on an expanding gross margin of 36.6%, up 370 basis points year-over-year and 560 basis points

quarter over quarter. Driven by increases in both the number of students enrolled and the average tuition fees of overseas schools, our

Overseas Schools revenue grew by 19.4% year-over-year. We also strengthened our cash position, closing the quarter with a total of RMB537.2

million in cash, cash equivalents and restricted cash. Our healthy balance sheet supports our organic growth initiatives as we work to

create sustainable value for our customers and shareholders over the long term.”

UNAUDITED

FINANCIAL RESULTS for THE THIRD FISCAL QUARTER ENDED MAY 31, 2024

Revenue

Revenue was RMB554.0 million, compared to RMB586.4

million for the same quarter last fiscal year.

Overseas Schools: Revenue contribution

was RMB264.9 million, representing a 19.4% increase from RMB221.8 million for the same quarter last fiscal year. The increase was mainly

attributable to increases in both the number of students enrolled and the average tuition fees of overseas schools.

Complementary Education Services: Revenue

contribution was RMB169.5 million, compared to RMB207.5 million for the same quarter last fiscal year. The decrease was mainly attributable

to a reduction in extracurricular programs, study tours and the camp business.

Domestic Kindergartens & K-12 Operation

Services: Revenue contribution was RMB119.6 million, compared with RMB157.1 million for the same quarter last fiscal year.

Cost of Revenue

Cost of revenue was RMB351.2 million, or 63.4%

of revenue, compared to RMB393.4 million, or 67.1%, for the same quarter last fiscal year. The improvement was mainly attributable to

cost-saving measures and efficiency enhancements in our headquarters.

Gross Profit, Gross Margin and Adjusted Gross Profit

Gross profit was RMB202.7 million, representing

a 5.0% increase from RMB193.0 million for the same quarter last fiscal year. The increase was mainly attributable to the revenue growth

in Overseas Schools. Gross margin increased to 36.6% from 32.9% for the same quarter last fiscal year.

Adjusted gross profit4

was RMB205.9 million, representing a 4.7% increase from RMB196.7 million for the same quarter last fiscal year.

Selling, General and Administrative Expenses

Total SG&A expenses were RMB147.0 million,

representing a 3.5% increase from RMB142.0 million for the same quarter last fiscal year.

Operating Loss/Income, Operating Margin and

Adjusted Operating Income

Operating loss was RMB84.3 million, compared to

an operating income of RMB73.9 million for the same quarter last fiscal year. Operating loss margin was 15.2%, compared to an operating

income margin of 12.6% for the same quarter last fiscal year.

Adjusted operating income5

was RMB55.1 million, compared to RMB77.6 million for the same quarter last fiscal year.

Net Loss and Adjusted Net Income/Loss

Net loss was RMB90.3 million, compared to RMB37.7

million for the same quarter last fiscal year.

Adjusted net income was RMB48.5 million, compared

to an adjusted net loss of RMB34.8 million for the same quarter last fiscal year.

Adjusted EBITDA6

Adjusted EBITDA was RMB76.6 million, compared

to RMB96.0 million for the same quarter last fiscal year.

Net Loss per Ordinary Share/ADS and Adjusted

Net Earnings/Loss per Ordinary Share/ADS

Basic and diluted net loss per ordinary share

attributable to ordinary shareholders were RMB0.56 each, compared to RMB0.32 each for the same quarter last fiscal year.

Adjusted basic and diluted net earnings per ordinary

share7 attributable to ordinary shareholders were RMB0.42 each, compared to adjusted

basic and diluted net loss per ordinary share of RMB0.30 each for the same quarter last fiscal year.

| 4. |

Adjusted

gross profit is defined as gross profit excluding amortization of intangible assets. |

| 5. |

Adjusted

operating income/(loss) is defined as operating income/(loss) excluding share-based compensation expenses, amortization of intangible

assets and impairment loss on goodwill. |

| 6. |

Adjusted

EBITDA is defined as net income/(loss) excluding interest income/(expense), net, income tax expense/benefit, depreciation and amortization,

share-based compensation expenses and impairment loss on goodwill. |

| 7 |

Adjusted

basic and diluted earnings/(loss) per share is defined as adjusted net income/(loss) attributable to ordinary shareholders (net income/(loss)

attributable to ordinary shareholders excluding share-based compensation expenses, amortization of intangible assets, tax effect

of amortization of intangible assets and impairment loss on goodwill) divided by the weighted average number of basic and diluted

ordinary shares. |

Basic and diluted net loss per ADS attributable

to ADS holders were RMB2.24 each, compared to RMB1.28 each for the same quarter last fiscal year.

Adjusted basic and diluted net earnings per ADS8

attributable to ADS holders were RMB1.68 each, compared to adjusted basic and diluted net loss per ADS of RMB1.20 each for the same quarter

last fiscal year.

Cash and Working Capital

As of May 31, 2024, the Company had cash and cash

equivalents and restricted cash of RMB537.2 million (US$74.2 million), compared to RMB496.9 million as of February 29, 2024.

Conference

Call

The Company’s management will host an earnings

conference call at 8:00 a.m. U.S. Eastern Time (8:00 p.m. Beijing/Hong Kong Time) on August 2, 2024.

Dial-in details for the earnings conference call

are as follows:

| Mainland China: | 4001-201203 |

|

| Hong Kong: | 800-905945 |

|

| United States: | 1-888-346-8982 |

|

| International: | 1-412-902-4272 |

|

Participants should dial in at least 5 minutes

before the scheduled start time and ask to be connected to the call for “Bright Scholar Education Holdings Limited.”

Additionally, a live and archived webcast of the

conference call will be available on the Company’s investor relations website at http://ir.brightscholar.com/.

A replay of the conference call will be accessible after the conclusion

of the live call until August 9, 2024, by dialing the following telephone numbers:

| United States Toll Free: | 1-877-344-7529 |

|

| International: | 1-412-317-0088 |

|

| Replay Passcode: | 8092477 |

|

CONVENIENCE TRANSLATION

The Company’s reporting currency is Renminbi (“RMB”).

However, periodic reports made to shareholders will include current period amounts translated into U.S. dollars using the prevailing exchange

rates at the balance sheet date for the convenience of readers. Translations of balances in the condensed consolidated balance sheets,

and the related condensed consolidated statements of operations, and cash flows from RMB into U.S. dollars as of and for the quarter ended

May 31, 2024 are solely for the convenience of the readers and were calculated at the rate of US$1.00=RMB7.2410, representing the noon

buying rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board on May 31, 2024. No representation is made that

the RMB amounts could have been, or could be, converted, realized or settled into US$ at that rate on May 31, 2024, or at any other rate.

| 8. |

Adjusted

basic and diluted earnings per American depositary share (“ADS”) is defined as adjusted net income attributable to ADS

shareholders (net income attributable to ADS shareholders excluding share-based compensation expenses, amortization of intangible

assets, tax effect of amortization of intangible assets and impairment loss on goodwill) divided by the weighted average number of

basic and diluted ADSs. |

NON-GAAP FINANCIAL MEASURES

In

evaluating our business, we consider and use certain non-GAAP measures, including primarily adjusted EBITDA, adjusted net income/(loss),

adjusted gross profit/(loss), adjusted operating income/(loss), adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS

holders basic and diluted as supplemental measures to review and assess our operating performance. The presentation of these non-GAAP

financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented

in accordance with U.S. GAAP. We define adjusted gross profit/(loss) as gross profit/(loss) excluding amortization of intangible assets.

We define adjusted EBITDA as net income/(loss) excluding interest income/(expense), net, income tax expense/benefit, depreciation and

amortization, share-based compensation expenses and impairment loss on goodwill. We define adjusted net income/(loss) as net income/(loss)

excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets and impairment

loss on goodwill. We define adjusted operating income/(loss) as operating income/(loss) excluding share-based compensation expenses,

amortization of intangible assets and impairment loss on goodwill. Additionally,

we define adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders, basic and diluted, as adjusted net

income/(loss) attributable to ordinary shareholders/ADS holders (net income/(loss) to ordinary shareholders/ADS holders excluding share-based

compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets and impairment loss on goodwill)

divided by the weighted average number of basic and diluted ordinary shares or ADSs.

We incur amortization expense of intangible assets

related to various acquisitions that have been made in recent years. These intangible assets are valued at the time of acquisition and

are then amortized over a period of several years after the acquisition. We believe that exclusion of these expenses allows greater comparability

of operating results that are consistent over time for the Company’s newly-acquired and long-held business as the related intangibles

do not have significant connection to the growth of the business. Therefore, we provide exclusion of amortization of intangible assets

to define adjusted gross profit, adjusted operating income/(loss), adjusted net income/(loss), and adjusted net earnings/(loss) per share

attributable to ordinary shareholders/ADS holders, basic and diluted.

We present the non-GAAP financial measures because

they are used by our management to evaluate our operating performance and formulate business plans. Such non-GAAP measures include adjusted

EBITDA, adjusted net income/(loss), adjusted gross profit/(loss), adjusted operating income/(loss), adjusted net earnings/(loss) per share

attributable to ordinary shareholders/ADS holders basic and diluted. Non-GAAP financial measures enable our management to assess our operating

results without considering the impact of non-cash charges, including depreciation and amortization and share-based compensation expenses,

and without considering the impact of non-operating items such as interest income/(expense), net; income tax expense/benefit; share-based

compensation expenses; amortization of intangible assets, tax effect of amortization of intangible assets and impairment loss on goodwill.

We also believe that the use of these non-GAAP measures facilitates investors’ assessment of our operating performance.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools.

One of the key limitations of using these non-GAAP financial measures is that they do not reflect all items of income and expense that

affect our operations. Interest income/(expense), net; income tax expense/benefit; depreciation and amortization; share-based compensation

expense; tax effect of amortization of intangible assets, and impairment loss on goodwill have been and may continue to be incurred in

our business and are not reflected in the presentation of these non-GAAP measures, including adjusted EBITDA or adjusted net income/(loss).

Further, these non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore

their comparability may be limited.

About Bright Scholar Education Holdings Limited

Bright Scholar is a premier global education service

Group. The Company primarily provides quality international education to global students and equips them with the critical academic foundation

and skillsets necessary to succeed in the pursuit of higher education.

For more information, please visit: https://ir.brightscholar.com/.

Safe Harbor Statement

This announcement contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s business plans and development,

which can be identified by terminology such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to” or other similar expressions. Such statements are based upon management’s current expectations and

current market and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all

of which are difficult to predict and many of which are beyond the Company’s control, which may cause the Company’s actual

results, performance or achievements to differ materially from those in the forward-looking statements. Further information regarding

these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission.

The Company does not undertake any obligation to update any forward-looking statement as a result of new information, future events or

otherwise, except as required under law.

IR Contact:

Email: BEDU@thepiacentegroup.com

Phone: +86 (10) 6508-0677/ +1-212-481-2050

Media Contact:

Email: media@brightscholar.com

Phone: +86-757-2991-6814

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

| | |

As of | |

| | |

August 31, |

|

|

|

May 31, | |

| | |

2023 |

|

|

|

2024 | |

| | |

RMB | | |

RMB | | |

USD | |

| ASSETS | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 537,325 | | |

| 515,200 | | |

| 71,150 | |

| Restricted cash | |

| 28,261 | | |

| 21,789 | | |

| 3,009 | |

| Accounts receivable | |

| 19,209 | | |

| 27,549 | | |

| 3,805 | |

| Amounts due from related parties, net | |

| 188,445 | | |

| 128,607 | | |

| 17,761 | |

| Other receivables, deposits and other assets, net | |

| 148,679 | | |

| 129,597 | | |

| 17,898 | |

| Inventories | |

| 5,480 | | |

| 3,872 | | |

| 535 | |

| | |

| | | |

| | | |

| | |

| Total current assets | |

| 927,399 | | |

| 826,614 | | |

| 114,158 | |

| | |

| | | |

| | | |

| | |

| Restricted cash - non-current | |

| 1,650 | | |

| 250 | | |

| 35 | |

| Property and equipment, net | |

| 414,225 | | |

| 363,267 | | |

| 50,168 | |

| Intangible assets, net | |

| 343,077 | | |

| 325,128 | | |

| 44,901 | |

| Goodwill, net | |

| 1,328,872 | | |

| 1,182,035 | | |

| 163,242 | |

| Long-term investments, net | |

| 36,070 | | |

| 35,716 | | |

| 4,932 | |

| Prepayments for construction contracts | |

| 1,711 | | |

| 1,540 | | |

| 213 | |

| Deferred tax assets, net | |

| 1,810 | | |

| 1,498 | | |

| 207 | |

| Other non-current assets, net | |

| 15,249 | | |

| 12,885 | | |

| 1,779 | |

| Operating lease right-of-use assets - non current | |

| 1,549,447 | | |

| 1,456,486 | | |

| 201,144 | |

| | |

| | | |

| | | |

| | |

| Total non-current assets | |

| 3,692,111 | | |

| 3,378,805 | | |

| 466,621 | |

| | |

| | | |

| | | |

| | |

| TOTAL ASSETS | |

| 4,619,510 | | |

| 4,205,419 | | |

| 580,779 | |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS-CONTINUED

(Amounts in thousands)

| | |

As of | |

| | |

August 31, |

|

|

|

May 31, | |

| | |

2023 |

|

|

|

2024 | |

| | |

RMB | | |

RMB | | |

USD | |

| LIABILITIES AND EQUITY | |

| | |

| | |

| |

| Current liabilities | |

| | |

| | |

| |

| Accounts payable | |

| 105,193 | | |

| 105,927 | | |

| 14,629 | |

| Amounts due to related parties | |

| 311,451 | | |

| 214,836 | | |

| 29,669 | |

| Accrued expenses and other current liabilities | |

| 279,690 | | |

| 225,063 | | |

| 31,082 | |

| Income tax payable | |

| 99,367 | | |

| 93,440 | | |

| 12,904 | |

| Contract liabilities - current | |

| 541,683 | | |

| 416,084 | | |

| 57,462 | |

| Refund liabilities - current | |

| 17,572 | | |

| 15,929 | | |

| 2,200 | |

| Operating lease liabilities - current | |

| 125,447 | | |

| 121,235 | | |

| 16,743 | |

| | |

| | | |

| | | |

| | |

| Total current liabilities | |

| 1,480,403 | | |

| 1,192,514 | | |

| 164,689 | |

| | |

| | | |

| | | |

| | |

| Non-current contract liabilities | |

| 2,116 | | |

| 2,597 | | |

| 359 | |

| Deferred tax liabilities, net | |

| 42,093 | | |

| 34,652 | | |

| 4,786 | |

| Operating lease liabilities - non current | |

| 1,523,242 | | |

| 1,446,627 | | |

| 199,783 | |

| | |

| | | |

| | | |

| | |

| Total non-current liabilities | |

| 1,567,451 | | |

| 1,483,876 | | |

| 204,928 | |

| | |

| | | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 3,047,854 | | |

| 2,676,390 | | |

| 369,617 | |

| | |

| | | |

| | | |

| | |

| EQUITY | |

| | | |

| | | |

| | |

| Share capital | |

| 8 | | |

| 8 | | |

| 1 | |

| Additional paid-in capital | |

| 1,697,370 | | |

| 1,706,654 | | |

| 235,693 | |

| Statutory reserves | |

| 20,155 | | |

| 19,616 | | |

| 2,709 | |

| Accumulated other comprehensive income | |

| 172,230 | | |

| 178,803 | | |

| 24,693 | |

| Accumulated deficit | |

| (473,154 | ) | |

| (485,455 | ) | |

| (67,043 | ) |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity | |

| 1,416,609 | | |

| 1,419,626 | | |

| 196,053 | |

| Non-controlling interests | |

| 155,047 | | |

| 109,403 | | |

| 15,109 | |

| | |

| | | |

| | | |

| | |

| TOTAL EQUITY | |

| 1,571,656 | | |

| 1,529,029 | | |

| 211,162 | |

| | |

| | | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

| 4,619,510 | | |

| 4,205,419 | | |

| 580,779 | |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except for shares and per

share data)

| | |

Three Months Ended May 31 | | |

Nine Months Ended May 31 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| 586,446 | | |

| 553,976 | | |

| 76,505 | | |

| 1,563,977 | | |

| 1,648,158 | | |

| 227,615 | |

| Cost of revenue | |

| (393,418 | ) | |

| (351,227 | ) | |

| (48,505 | ) | |

| (1,075,767 | ) | |

| (1,080,294 | ) | |

| (149,191 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 193,028 | | |

| 202,749 | | |

| 28,000 | | |

| 488,210 | | |

| 567,864 | | |

| 78,424 | |

| Selling, general and administrative expenses | |

| (142,016 | ) | |

| (146,989 | ) | |

| (20,300 | ) | |

| (437,730 | ) | |

| (431,735 | ) | |

| (59,624 | ) |

| Impairment loss on goodwill | |

| - | | |

| (133,022 | ) | |

| (18,371 | ) | |

| - | | |

| (133,022 | ) | |

| (18,371 | ) |

| Other operating income/(loss) | |

| 22,937 | | |

| (7,033 | ) | |

| (971 | ) | |

| 49,119 | | |

| 4,369 | | |

| 603 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income/(loss) | |

| 73,949 | | |

| (84,295 | ) | |

| (11,642 | ) | |

| 99,599 | | |

| 7,476 | | |

| 1,032 | |

| Interest expense, net | |

| (2,859 | ) | |

| (22 | ) | |

| (3 | ) | |

| (8,587 | ) | |

| (2,457 | ) | |

| (339 | ) |

| Investment income /(loss) | |

| 614 | | |

| 5,127 | | |

| 708 | | |

| (849 | ) | |

| 5,605 | | |

| 774 | |

| Other expenses | |

| (23 | ) | |

| 3,496 | | |

| 483 | | |

| (2,776 | ) | |

| 106 | | |

| 14 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income/(loss) before income taxes and share of equity in (loss)/profit of unconsolidated affiliates | |

| 71,681 | | |

| (75,694 | ) | |

| (10,454 | ) | |

| 87,389 | | |

| 10,730 | | |

| 1,481 | |

| Income tax expense | |

| (109,327 | ) | |

| (14,543 | ) | |

| (2,008 | ) | |

| (133,493 | ) | |

| (38,988 | ) | |

| (5,384 | ) |

| Share of equity in (loss)/profit of unconsolidated affiliates | |

| (52 | ) | |

| (43 | ) | |

| (6 | ) | |

| (400 | ) | |

| 81 | | |

| 11 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (37,698 | ) | |

| (90,280 | ) | |

| (12,468 | ) | |

| (46,506 | ) | |

| (28,177 | ) | |

| (3,892 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income/(loss) attributable to non-controlling interests | |

| 397 | | |

| (24,210 | ) | |

| (3,343 | ) | |

| 4,020 | | |

| (19,761 | ) | |

| (2,729 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| (38,095 | ) | |

| (66,070 | ) | |

| (9,125 | ) | |

| (50,526 | ) | |

| (8,416 | ) | |

| (1,163 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to

ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| (0.32 | ) | |

| (0.56 | ) | |

| (0.08 | ) | |

| (0.43 | ) | |

| (0.07 | ) | |

| (0.01 | ) |

| —Diluted | |

| (0.32 | ) | |

| (0.56 | ) | |

| (0.08 | ) | |

| (0.43 | ) | |

| (0.07 | ) | |

| (0.01 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in calculating net loss per

ordinary share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| —Diluted | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss per ADS | |

| | |

| | |

| | |

| | |

| | |

| |

| —Basic | |

| (1.28 | ) | |

| (2.24 | ) | |

| (0.32 | ) | |

| (1.72 | ) | |

| (0.28 | ) | |

| (0.04 | ) |

| —Diluted | |

| (1.28 | ) | |

| (2.24 | ) | |

| (0.32 | ) | |

| (1.72 | ) | |

| (0.28 | ) | |

| (0.04 | ) |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in thousands)

| | |

Three Months Ended May 31 | | |

Nine Months Ended May 31 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net cash (used in)/generated from operating activities | |

| (8,198 | ) | |

| 96,249 | | |

| 13,292 | | |

| 15,338 | | |

| 22,353 | | |

| 3,087 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash (used in)/generated from investing activities | |

| (20,990 | ) | |

| 10,713 | | |

| 1,479 | | |

| (32,946 | ) | |

| 30,011 | | |

| 4,145 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash used in financing activities | |

| (41,255 | ) | |

| (71,323 | ) | |

| (9,850 | ) | |

| (90,397 | ) | |

| (84,258 | ) | |

| (11,636 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents, and restricted cash | |

| 7,873 | | |

| 4,740 | | |

| 655 | | |

| 15,615 | | |

| 1,897 | | |

| 261 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net change in cash and cash equivalents, and restricted cash | |

| (62,570 | ) | |

| 40,379 | | |

| 5,576 | | |

| (92,390 | ) | |

| (29,997 | ) | |

| (4,143 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash at beginning of the period | |

| 827,964 | | |

| 496,860 | | |

| 68,618 | | |

| 857,784 | | |

| 567,236 | | |

| 78,337 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash at end of the period | |

| 765,394 | | |

| 537,239 | | |

| 74,194 | | |

| 765,394 | | |

| 537,239 | | |

| 74,194 | |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

Reconciliations of GAAP and Non-GAAP Results

(Amounts in thousands, except for shares and per

share data)

| | |

Three Months Ended May 31 | | |

Nine Months Ended May 31 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Gross profit | |

| 193,028 | | |

| 202,749 | | |

| 28,000 | | |

| 488,210 | | |

| 567,864 | | |

| 78,424 | |

| Add: Amortization of intangible assets | |

| 3,642 | | |

| 3,117 | | |

| 430 | | |

| 11,274 | | |

| 9,633 | | |

| 1,330 | |

| Adjusted gross profit | |

| 196,670 | | |

| 205,866 | | |

| 28,430 | | |

| 499,484 | | |

| 577,497 | | |

| 79,754 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income/(loss) | |

| 73,949 | | |

| (84,295 | ) | |

| (11,642 | ) | |

| 99,599 | | |

| 7,476 | | |

| 1,032 | |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 447 | | |

| - | | |

| 4,860 | | |

| 671 | |

| Add: Amortization of intangible assets | |

| 3,642 | | |

| 3,117 | | |

| 430 | | |

| 11,274 | | |

| 9,633 | | |

| 1,330 | |

| Add: Impairment loss on goodwill | |

| - | | |

| 133,022 | | |

| 18,371 | | |

| - | | |

| 133,022 | | |

| 18,371 | |

| Adjusted operating income | |

| 77,591 | | |

| 55,084 | | |

| 7,606 | | |

| 110,873 | | |

| 154,991 | | |

| 21,404 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (37,698 | ) | |

| (90,280 | ) | |

| (12,468 | ) | |

| (46,506 | ) | |

| (28,177 | ) | |

| (3,892 | ) |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 447 | | |

| - | | |

| 4,860 | | |

| 671 | |

| Add: Amortization of intangible assets | |

| 3,642 | | |

| 3,117 | | |

| 430 | | |

| 11,274 | | |

| 9,633 | | |

| 1,330 | |

| Add: Tax effect of amortization of intangible assets | |

| (738 | ) | |

| (631 | ) | |

| (87 | ) | |

| (2,302 | ) | |

| (1,951 | ) | |

| (269 | ) |

| Add: Impairment loss on goodwill | |

| - | | |

| 133,022 | | |

| 18,371 | | |

| - | | |

| 133,022 | | |

| 18,371 | |

| Adjusted net (loss)/income | |

| (34,794 | ) | |

| 48,468 | | |

| 6,693 | | |

| (37,534 | ) | |

| 117,387 | | |

| 16,211 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| (38,095 | ) | |

| (66,070 | ) | |

| (9,125 | ) | |

| (50,526 | ) | |

| (8,416 | ) | |

| (1,163 | ) |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 447 | | |

| - | | |

| 4,860 | | |

| 671 | |

| Add: Amortization of intangible assets | |

| 3,642 | | |

| 3,117 | | |

| 430 | | |

| 11,274 | | |

| 9,633 | | |

| 1,330 | |

| Add: Tax effect of amortization of intangible assets | |

| (738 | ) | |

| (631 | ) | |

| (87 | ) | |

| (2,302 | ) | |

| (1,951 | ) | |

| (269 | ) |

| Add: Impairment loss on goodwill | |

| - | | |

| 110,305 | | |

| 15,233 | | |

| - | | |

| 110,305 | | |

| 15,233 | |

| Adjusted net (loss)/income attributable to ordinary shareholders | |

| (35,191 | ) | |

| 49,961 | | |

| 6,898 | | |

| (41,554 | ) | |

| 114,431 | | |

| 15,802 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (37,698 | ) | |

| (90,280 | ) | |

| (12,468 | ) | |

| (46,506 | ) | |

| (28,177 | ) | |

| (3,892 | ) |

| Add: Interest expense, net | |

| 2,859 | | |

| 22 | | |

| 3 | | |

| 8,587 | | |

| 2,457 | | |

| 339 | |

| Add: Income tax expense | |

| 109,327 | | |

| 14,543 | | |

| 2,008 | | |

| 133,493 | | |

| 38,988 | | |

| 5,384 | |

| Add: Depreciation and amortization | |

| 21,553 | | |

| 16,064 | | |

| 2,218 | | |

| 63,929 | | |

| 49,981 | | |

| 6,902 | |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 447 | | |

| - | | |

| 4,860 | | |

| 671 | |

| Add: Impairment loss on goodwill | |

| - | | |

| 133,022 | | |

| 18,371 | | |

| - | | |

| 133,022 | | |

| 18,371 | |

| Adjusted EBITDA | |

| 96,041 | | |

| 76,611 | | |

| 10,579 | | |

| 159,503 | | |

| 201,131 | | |

| 27,775 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in calculating adjusted net (loss)/income per ordinary share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic and Diluted | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net (loss)/income per share attributable to ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| (0.30 | ) | |

| 0.42 | | |

| 0.06 | | |

| (0.35 | ) | |

| 0.96 | | |

| 0.13 | |

| —Diluted | |

| (0.30 | ) | |

| 0.42 | | |

| 0.06 | | |

| (0.35 | ) | |

| 0.96 | | |

| 0.13 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net (loss)/income per ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| (1.20 | ) | |

| 1.68 | | |

| 0.24 | | |

| (1.40 | ) | |

| 3.84 | | |

| 0.52 | |

| —Diluted | |

| (1.20 | ) | |

| 1.68 | | |

| 0.24 | | |

| (1.40 | ) | |

| 3.84 | | |

| 0.52 | |

11

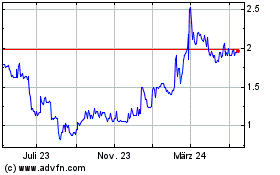

Bright Scholar Education (NYSE:BEDU)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

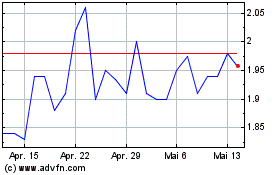

Bright Scholar Education (NYSE:BEDU)

Historical Stock Chart

Von Jan 2024 bis Jan 2025