Credicorp Ltd. Announces that One of Its Subsidiaries Offers to Purchase 100% of Credicorp Capital Client’s Investments in the 'Credicorp Capital Factoring Dólares ' and 'Credicorp Capital Factoring Soles' Funds

30 Dezember 2024 - 11:05PM

LIMA, PERU, December 30, 2024 – Credicorp Ltd.

(“Credicorp”) (NYSE: BAP | BVL: BAP), the leading financial

services holding company in Peru with a presence in Chile,

Colombia, Bolivia, and Panama, announced today that its subsidiary

Credicorp Capital S.A. Sociedad Administradora de Fondos

(“Credicorp Capital”), has notified its clients that it has offered

to purchase 100% of the value of investments in the Credicorp

Capital Factoring Dólares FMIV and Credicorp Capital Factoring

Soles FMIV funds. These funds, which had exposure to assets managed

by Sartor Administradora General de Fondos S.A. (“Sartor”) in

Chile, a third-party fund manager, were impacted by recent

regulatory actions and alleged misconduct at Sartor.

To facilitate the purchase process, Credicorp

Capital will execute participation transfer agreements through its

affiliate Atlantic Security Holding Corporation (ASHC), covering up

to US$125.3 million in investment value. As a result, Credicorp

Capital (directly or through its affiliate) would assume creditor

status with respect to Sartor, pursuing legal actions to recover

funds and holding those responsible accountable. Credicorp expects

to partially recover these funds and will be providing updates as

they become available.

As publicly disclosed, the Chilean Financial

Market Commission (CMF) recently ordered the suspension of

contributions, as well as redemptions and payments, of all funds

managed by Sartor, which included the Credicorp Capital Factoring

Soles FMIV and Credicorp Capital Factoring Dólares FMIV funds.

Following a complaint filed by Credicorp Capital, the CMF issued a

resolution on December 20, 2024, by which it (i) revoked Sartor’s

authorization to operate, and (ii) ordered the liquidation of all

funds under Sartor’s management.

In response to this situation, Credicorp Capital

has committed to acquiring through ASHC the value of the investment

units from its clients within 45 days. This move seeks to ensure

that clients will not bear the uncertainty of the liquidation

process of Sartor-managed funds, which was mandated by the CMF.

About Credicorp Ltd.

Credicorp Ltd. (NYSE: BAP) is the leading

financial services holding company in Peru, with a diversified

business portfolio organized into four primary lines of business:

Universal Banking, through Banco de Crédito del Perú (BCP) and

Banco de Crédito de Bolivia; Microfinance, through Mibanco in Peru

and Colombia; Insurance and Pension Funds, through Grupo Pacifico

and Prima AFP; and Investment Management and Advisory, through

Credicorp Capital and ASB Bank Corp. Credicorp has a presence in

Peru, Chile, Colombia, Bolivia, and Panama.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements, which include words such as “will”,

“would”, “expects” and “seeks”, are based on the current beliefs

and expectations of Credicorp's management and are subject to risks

and uncertainties. Actual results may differ materially from those

projected. Credicorp Ltd. assumes no obligation to update these

statements.

For more information, please refer to our

filings with the U.S. Securities and Exchange Commission.

IR Contact:

investorrelations@credicorpperu.com

Investor RelationsCredicorp Ltd.

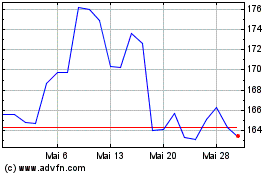

Credicorp (NYSE:BAP)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

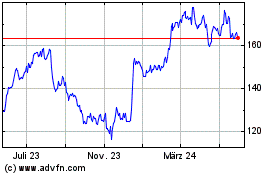

Credicorp (NYSE:BAP)

Historical Stock Chart

Von Jan 2024 bis Jan 2025