New Aptiv to be a High Growth, High Margin

Provider of Full Sensor-to-Cloud Tech Solutions, Including Highly

Engineered Interconnects and Components Serving Diverse End

Markets

New EDS to be a Leading Global Supplier of Low

Voltage and High Voltage Signal, Power, and Data Distribution

Solutions for Automotive and Commercial Vehicle Markets with

Multiple Levers for Revenue, Earnings and Cash Flow Growth

Separation Expected to be Effected Through

Tax-Free Spin-Off of EDS to Aptiv Shareholders

Company to Host Conference Call and Webcast to

Discuss Separation Transaction Today at 8:00 a.m. (ET)

Company Affirms Full Year 2024 Outlook

Aptiv PLC (NYSE: APTV) (the “Company”), a global technology

company enabling a more safe, green and connected future, today

announced that its Board of Directors has unanimously approved a

plan to separate its Electrical Distribution Systems business

(“EDS” or the “EDS business”) from Aptiv, creating two independent

companies, each optimally positioned to serve their customers and

create value for their shareholders.

“We have a long track record of transforming Aptiv through

operational changes and organic and inorganic portfolio shifts to

best position our businesses in a dynamic environment. Today’s

separation announcement represents the next step in our

transformation journey. By enhancing strategic and operating focus,

we are positioning both Aptiv and EDS to more effectively address

the evolving needs of our customers and to further capitalize on

market opportunities, which we believe will drive even greater

success and value creation for both companies,” said Kevin Clark,

chairman and chief executive officer. “Following completion of the

transaction, Aptiv will have a portfolio of advanced software and

hardware technologies and highly engineered, mission-critical

products that are aligned with global mega trends fueling growth in

diverse end markets. The result will be a high growth, high margin

business with strong cash flow generation to support continued

organic and inorganic investment in differentiated products and

solutions and further penetration of adjacent markets, including

aerospace and defense, telecommunications, commercial vehicle, and

industrial, and return of excess capital to shareholders.”

Mr. Clark continued, “The benefits of the separation are equally

compelling for EDS, which is expected to build on its 100-year

legacy as a leader in designing and delivering fully optimized,

next-generation electrical architecture solutions for leading OEMs

in the global automotive and commercial vehicle markets. EDS’s more

focused strategy will enable the business to fully capitalize on

its global scale, localized regional capabilities, and broad

portfolio of low voltage and high voltage vehicle architecture.

Together with its industry-leading cost structure, global

footprint, and disciplined capital allocation, standalone EDS will

be poised to further strengthen its competitive position, while

continuing to deliver strong earnings and cash flow growth that

enable investment in bolt-on acquisitions and further manufacturing

process automation, as well as the return of capital to

shareholders.”

“We are excited about the separation transaction for both Aptiv

and EDS and believe it will deliver benefits for our customers,

provide opportunities for our employees, and create significant

value for our shareholders."

Benefits of the Separation Transaction

As separate companies, Aptiv and EDS are each expected to

benefit from:

- Strategies and operating initiatives that are focused on each

company’s unique product portfolio, customer challenges, market

opportunities, and financial objectives;

- Resources and investments concentrated on the distinct

opportunities and growth drivers of each business;

- Capital structures and capital allocation strategies that are

tailored to each company’s most value creating prospects;

- Investor bases best suited for their unique value propositions,

operating model, and financial characteristics; and

- A global employee base committed to developing and delivering

world-class products and solutions with career opportunities and

compensation programs more closely aligned with the operating and

financial outcomes of their individual business.

Two Leading Companies with Global Scale and Reach

Aptiv: A global industrial technology leader enabling a more

safe, green and connected future.

Following the separation, Aptiv – comprising Advanced Safety

& User Experience and the Engineered Components Group – will

offer a full sensor-to-cloud technology stack, including

industry-leading open-architected ADAS and in-cabin user experience

software platforms, and a broad range of interconnects and

components that optimize the distribution of signal, power, and

data for next-generation applications across diverse end markets,

including aerospace and defense, telecommunications, automotive and

commercial vehicle, and industrial. Aptiv’s portfolio of advanced

software, hardware, compute, and interconnect solutions is in the

sweet spot of long-term secular trends that include advanced

safety, electrification, digitalization, artificial intelligence,

and automation.

The pro forma Aptiv is expected to be a high growth, high margin

company with robust cash flows to support organic and inorganic

investments in advanced products and technologies across diverse

end markets, as well as return excess capital to shareholders. In

the medium term, Aptiv is targeting mid-to-high single digit

revenue growth, low-to-mid teens U.S. GAAP operating income

margins, high-teens-to-low-twenties Adjusted EBITDA margins, and

significant free cash flow for the company. The Company estimates

that Aptiv had $12.1 billion in revenues, including intercompany

sales to EDS that are currently eliminated in consolidation, $1.4

billion in U.S. GAAP operating income, and $2.3 billion in Adjusted

EBITDA for 2024, excluding the EDS business to be separated.

The new EDS: A leading global provider of low voltage and

high voltage electrical architectures for automotive and commercial

vehicle markets.

EDS’s differentiated design and development capabilities enable

the optimization of vehicle architecture systems and thereby reduce

vehicle weight, mass, and costs for OEM customers. EDS’s full range

of low voltage and high voltage power, signal, and data

distribution solutions uniquely position the business to enable the

increasing demand for feature rich, higher contented vehicles that

require optimized vehicle architectures, including electric

vehicles (“EV”). As EV penetration continues to outpace the growth

in global vehicle production, EVs represent a key growth market for

EDS.

In the medium term, Aptiv is targeting pro forma EDS to generate

mid-single digit revenue growth, mid-to-high single digit GAAP

operating income margins, high-single to low-double digit Adjusted

EBITDA margins, and solid free cash flow. The Company estimates

that EDS had $8.3 billion in revenues, $0.4 billion in U.S. GAAP

operating income, and $0.8 billion in Adjusted EBITDA for 2024,

excluding the Aptiv business from which it will be separated.

Separation Transaction Details

The separation transaction is expected to be effected through a

spin-off of EDS, under which Aptiv shareholders will retain their

current shares of Aptiv stock and receive a pro-rata dividend of

shares of the new EDS company stock. The transaction is expected to

be tax-free to Aptiv and its shareholders for both Swiss and U.S.

federal income tax purposes. Aptiv is targeting completion of the

separation by March 31, 2026, subject to final approval by Aptiv’s

Board of Directors and other customary conditions, including the

receipt of opinions from tax advisors and the filing and

effectiveness of a Form 10 registration statement with the U.S.

Securities and Exchange Commission. There can be no assurance that

any separation transaction will ultimately occur or, if one does

occur, of its terms or timing.

Full-Year 2024 Outlook Affirmed

In connection with today’s announcement, Aptiv affirmed its

full-year 2024 outlook, as previously provided on October 31, 2024.

As previously announced, Aptiv will release its fourth quarter 2024

financial results on February 6, 2025, and will hold an investor

call the same day at 8:00 a.m. ET.

Conference Call and Webcast Today

The Company will host a conference call to discuss this

announcement at 8:00 a.m. ET today, which is accessible by dialing

+1 323-994-2093 (U.S.) or +1 888-394-8218 (international) or

through a webcast at ir.aptiv.com. The

conference ID number is 5856118. A slide presentation will

accompany the prepared remarks and be posted on the investor

relations section of the Company’s website. A replay will be

available following the conference call.

Advisors

Goldman Sachs & Co. LLC and Centerview Partners LLC are

serving as financial advisors to Aptiv, and Paul, Weiss, Rifkind,

Wharton & Garrison LLP is serving as legal counsel.

About Aptiv

Aptiv PLC (NYSE: APTV) is a global technology company enabling a

more safe, green and connected future. Visit aptiv.com.

Use of Non-GAAP Financial Information

This press release contains information about Aptiv’s and EDS’s

financial results which are not presented in accordance with U.S.

GAAP. Specifically, Adjusted EBITDA and Adjusted EBITDA margin are

non-GAAP financial measures. Adjusted EBITDA represents net income

before depreciation and amortization (including asset impairments),

interest expense, income tax (expense) benefit, other income

(expense), net, equity income (loss), net of tax, restructuring and

other special items. Adjusted EBITDA margin is Adjusted EBITDA as a

percent of revenue.

Management believes the non-GAAP financial measures used in this

press release are useful to both management and investors in their

analysis of the Company’s and EDS’s financial position, results of

operations and liquidity. In particular, management believes that

each of Adjusted EBITDA and Adjusted EBITDA margin is a useful

measure in assessing the Company’s and EDS’s ongoing financial

performance that, when reconciled to the corresponding GAAP

measure, provides improved comparability between periods through

the exclusion of certain items that management believes are not

indicative of the Company’s core operating performance and that may

obscure underlying business results and trends. Management also

uses these non-GAAP financial measures for internal planning and

forecasting purposes.

Such non-GAAP financial measures are reconciled to the most

directly comparable GAAP financial measures in the attached

supplemental schedules at the end of this press release. Non-GAAP

measures should not be considered in isolation or as a substitute

for our reported results prepared in accordance with GAAP and, as

calculated, may not be comparable to other similarly titled

measures of other companies.

Forward-Looking Statements

This press release, as well as other statements made by Aptiv

PLC, contain forward-looking statements that reflect, when made,

the Company’s current views with respect to current events, the

anticipated separation transaction and financial performance. We

also include estimated 2024 results, but have not yet completed our

financial close or audit, and therefore such estimates are subject

to change, which could be material.

Such forward-looking statements are subject to many risks,

uncertainties and factors relating to the Company’s and EDS’s

operations and business environment, which may cause the actual

results of the Company and EDS to be materially different from any

future results. All statements that address future operating,

financial or business performance or the Company’s strategies or

expectations, including plans to complete the separation, are

forward-looking statements. Factors that could cause actual results

to differ materially from these forward-looking statements include,

but are not limited to, the following: the ability to effect the

separation transaction described herein and to meet the conditions

related thereto; potential uncertainty during the pendency of the

separation transaction that could affect the Company’s financial

performance; the possibility that the separation transaction will

not be completed within the anticipated time period or at all; the

possibility that the separation transaction will not achieve its

intended benefits; the possibility of disruption, including changes

to existing business relationships, disputes, litigation or

unanticipated costs in connection with the separation transaction;

uncertainty of the expected financial performance of the Company or

EDS following completion of the separation transaction; negative

effects of the announcement or pendency of the separation

transaction on the market price of the Company’s securities and/or

on the financial performance of the Company; global and regional

economic conditions, including conditions affecting the credit

market; global inflationary pressures; uncertainties created by the

conflict between Ukraine and Russia, and its impacts to the

European and global economies and our operations in each country;

uncertainties created by the conflicts in the Middle East and their

impacts on global economies; fluctuations in interest rates and

foreign currency exchange rates; the cyclical nature of global

automotive sales and production; the potential disruptions in the

supply of and changes in the competitive environment for raw

material and other components integral to the Company’s products,

including the ongoing semiconductor supply shortage; the Company’s

ability to maintain contracts that are critical to its operations;

potential changes to beneficial free trade laws and regulations,

such as the United States-Mexico-Canada Agreement; changes to tax

laws; future significant public health crises; the ability of the

Company to integrate and realize the expected benefits of recent

transactions; the ability of the Company to attract, motivate

and/or retain key executives; the ability of the Company to avoid

or continue to operate during a strike, or partial work stoppage or

slow down by any of its unionized employees or those of its

principal customers; and the ability of the Company to attract and

retain customers. Additional factors are discussed under the

captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in the Company’s

filings with the Securities and Exchange Commission. New risks and

uncertainties arise from time to time, and it is impossible for us

to predict these events or how they may affect the Company. It

should be remembered that the price of the ordinary shares and any

income from them can go down as well as up. The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

and/or otherwise, except as may be required by law.

Where required by law, no binding decision will be made with

respect to the contemplated transactions other than in compliance

with applicable employee information and consultation

requirements.

# # #

APTIV PLC RECONCILIATION OF NON-GAAP

MEASURES (Unaudited)

In this press release the Company has provided information

regarding certain non-GAAP financial measures, including “Adjusted

EBITDA” and “Adjusted EBITDA margin.” Such non-GAAP financial

measures are reconciled to their closest U.S. GAAP financial

measure in the following schedule.

EDS

New Aptiv

Eliminations

Total

($ in millions)

Estimated Full Year 2024 (1)

Net income attributable to Aptiv

—

—

—

$

1,790

Interest expense

—

—

—

335

Other income, net

—

—

—

(45

)

Gain on Motional transactions

—

—

—

(640

)

Income tax expense

—

—

—

230

Equity loss, net of tax

—

—

—

125

Net income attributable to noncontrolling

interest

—

—

—

20

U.S. GAAP Operating Income

$

405

$

1,410

$

—

$

1,815

Depreciation and amortization

225

730

—

955

Restructuring

133

77

—

210

Other acquisition and portfolio project

costs

30

40

—

70

Compensation expense related to

acquisitions

—

25

—

25

Adjusted EBITDA

$

793

$

2,282

$

—

$

3,075

Net Sales

$

8,307

$

12,123

$

(680

)

$

19,750

U.S. GAAP Operating Income Margin

4.9

%

11.6

%

—

%

9.2

%

Adjusted EBITDA Margin

9.5

%

18.8

%

—

%

15.6

%

(1)

Prepared at the estimated mid-point of the

Company’s financial guidance range.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122849365/en/

Investor Relations Contact: Jane Wu Vice President,

Investor Relations and Corporate Development jane.wu@aptiv.com

Media Relations Contact: Lisa Scalzo Senior Vice

President and Chief Communications Officer lisa.scalzo@aptiv.com

(818) 395-8443

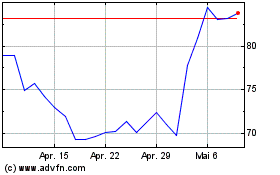

Aptiv (NYSE:APTV)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

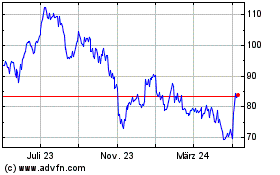

Aptiv (NYSE:APTV)

Historical Stock Chart

Von Jan 2024 bis Jan 2025