UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D/A

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO § 240.13d-2(a)

(Amendment No. 5)

AMPCO-PITTSBURGH CORPORATION

(Name of Issuer)

Common Stock, par value $1.00 per share

(Title of Class of Securities)

032037103

(CUSIP Number)

Edward F. Crawford, Trustee

L. W. Van Loan Trust dated September 8, 2006

c/o The Crawford Group

6065 Parkland Boulevard

Cleveland, OH 44124

(440) 947-2222

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

February 16, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 032037103

|

13D/A

|

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

L. W. Van Loan Trust dated September 8, 2006

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

(b)

|

☐

☐

|

|

3.

|

SEC USE ONLY

|

|

|

|

4.

|

SOURCE OF FUNDS*

OO

|

|

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

☐ |

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Ohio

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

0

|

|

|

| 8. |

SHARED VOTING POWER

986,580 (Note 5)

|

|

|

| 9. |

SOLE DISPOSITIVE POWER

0

|

|

|

| 10. |

SHARED DISPOSITIVE POWER

986,580 (Note 5)

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

986,580 (Note 5)

|

|

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES*

|

|

☐ |

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.9%

|

|

|

| 14. |

TYPE OF REPORTING PERSON*

OO

|

|

|

|

CUSIP No. 032037103

|

13D/A

|

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

Edward F. Crawford

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

(b)

|

☐

☐

|

|

3.

|

SEC USE ONLY

|

|

|

|

4.

|

SOURCE OF FUNDS*

OO

|

|

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

☐ |

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

0

|

|

|

| 8. |

SHARED VOTING POWER

986,580 (Note 5)

|

|

|

| 9. |

SOLE DISPOSITIVE POWER

0

|

|

|

| 10. |

SHARED DISPOSITIVE POWER

986,580 (Note 5)

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

986,580 (Note 5)

|

|

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES*

|

|

☐ |

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.9%

|

|

|

| 14. |

TYPE OF REPORTING PERSON*

IN

|

|

|

|

CUSIP No. 032037103

|

13D/A

|

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

Crawford United Corporation

|

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

(b)

|

☐

☐

|

|

3.

|

SEC USE ONLY

|

|

|

|

4.

|

SOURCE OF FUNDS*

OO

|

|

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

☐ |

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Ohio

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

0

|

|

|

| 8. |

SHARED VOTING POWER

986,580 (Note 5)

|

|

|

| 8. |

SOLE DISPOSITIVE POWER

0

|

|

|

| 10. |

SHARED DISPOSITIVE POWER

986,580 (Note 5)

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

986,580 (Note 5)

|

|

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES*

|

|

☐ |

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.9%

|

|

|

| 14. |

TYPE OF REPORTING PERSON*

CO

|

|

|

AMENDMENT NO. 5 TO

SCHEDULE 13D

The following information amends and supplements the information contained in the Schedule 13D previously filed with the Securities and Exchange Commission (“SEC”) on August 13, 2020 and thereafter amended by Amendment No. 1 filed with the SEC on October 1, 2020, Amendment No. 2 filed with the SEC on February 1, 2021, Amendment No. 3 filed with the SEC on April 9, 2021 and Amendment No. 4 filed with the SEC on July 1, 2021 (collectively, the “Statement”) relating to the beneficial ownership of Common Stock, par value $1.00 per share, of AMPCO-Pittsburgh Corporation (the “Issuer”) by (i) L. W. Van Loan Trust dated September 8, 2006, a trust formed under the laws of the state of Ohio (the “Trust”), (ii) Edward F. Crawford, an individual and trustee of the Trust (“Mr. Edward Crawford”) and (iii) Crawford United Corporation, an Ohio corporation (“Crawford United”). The Trust, Mr. Edward Crawford and Crawford United are hereinafter referred to as the “Reporting Persons” and each, individually, as a “Reporting Person.” Except as specifically amended by this Amendment No. 5, the Statement remains in full force and effect. Capitalized terms used and not otherwise defined in this Amendment No. 5 shall have the meanings given to them in the Statement.

The purpose of this final Amendment No. 5 is to update the Reporting Persons’ beneficial ownership information to reflect that, as a result of cumulative dispositions of shares of the Issuer since the filing date of the last amendment to the Statement, the amount of shares of the Issuer beneficially owned by the Reporting Persons has decreased below the 5% threshold for further reporting on Schedule 13D.

|

Item 5.

|

Interest in Securities of the Issuer.

|

Item 5 is hereby amended and restated, in its entirety, as follows:

The information contained on the cover pages to this Schedule 13D and the information set forth or incorporated in Items 2, 3 and 4 is incorporated herein by reference.

As the Reporting Persons may be deemed to be acting in concert with respect to the securities of the Issuer beneficially owned by the Reporting Persons, the Reporting Persons may be deemed to have beneficial ownership of all securities of the Issuer collectively beneficially owned by the Reporting Persons.

The aggregate number of Shares to which this Schedule 13D relates is 986,580 shares of Common Stock, representing 4.9% of the 20,170,193 shares of the Issuer’s common stock currently outstanding (calculated by adding the number of outstanding shares reported in the Issuer’s most recently filed Form 10-Q for the period ended September 30, 2023 (19,865,749) to the number of shares (304,444) issuable to the Trust upon exercise of the Series A warrants issued to the Trust in the rights offering). If unexercised Series A warrants held by the Trust are excluded from the foregoing calculation, the aggregate number of Shares owned by the Reporting Persons is 682,136, representing 3.4% of the outstanding shares of common stock.

The Reporting Persons beneficially own securities as follows:

(A) The Trust

(a)-(b) See cover pages.

| |

(c)

|

The Trust made a series of open market purchases using personal funds between June 1, 2020 and August 6, 2020, aggregating a total of 682,000 shares of Common Stock for an aggregate purchase price of $2,153,157.41. On September 14, 2020, the Trust exercised its right to purchase 681,999 Units in the Issuer’s rights offering at a price per unit of $1.5624, using personal funds on hand. Upon completion of the rights offering, the Trust was issued an aggregate of 304,444 shares of common stock and Series A warrants to purchase an aggregate of 304,444 shares of common stock at an exercise price of $5.75 per share.

|

During February and March, 2021, the Trust sold 128,700 shares of the Issuer’s Common Stock in ordinary broker transactions at an average price of $7.60 per share.

During June 2021, the Trust sold 185,000 shares of the Issuer’s Common Stock in ordinary broker transactions at an average price of $6.49 per share.

During January and February 2024, the Trust sold 187,448 shares of the Issuer’s Common Stock in ordinary broker transactions at an average price of $2.53 per share.

| |

(d)

|

Mr. Edward Crawford is the trustee of the Trust and has the power to direct the affairs of the Trust, including the voting and disposition of Issuer Common Stock held in the name of the Trust.

|

| |

(e)

|

The Trust ceased to be the beneficial owner of more than 5% of the Issuer’s Common Stock on February 16, 2024.

|

(B) Mr. Edward Crawford

(a)-(b) See cover pages.

| |

(c)

|

Mr. Edward Crawford has made no purchases or sales of Issuer Common Stock directly.

|

| |

(d)

|

Mr. Edward Crawford is the trustee of the Trust and has the power to direct the affairs of the Trust, including the voting and disposition of Issuer Common Stock held in the name of the Trust.

|

| |

(e)

|

Mr. Edward Crawford ceased to be the beneficial owner of more than 5% of the Issuer’s Common Stock on February 16, 2024.

|

(C) Crawford United

(a)-(b) See cover pages.

| |

(c)

|

Crawford United Corporation made a series of open market purchases utilizing working capital between September 22, 2020 and September 30, 2020, ultimately acquiring an aggregate total of 280,000 common shares at an average price of $3.3903 for an aggregate purchase price of $945,293.

|

During March, 2021, Crawford United Corporation sold 36,300 shares of the Issuer’s Common Stock in ordinary broker transactions at an average price of $7.64 per share.

During January and February, 2024, Crawford United Corporation sold 46,860 shares of the Issuer’s Common Stock in ordinary broker transactions at an average price of $2.53 per share.

| |

(e)

|

Crawford United Corporation ceased to be the beneficial owner of more than 5% of the Issuer’s Common Stock on February 16, 2024.

|

Signatures

After reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: February 20, 2024

| |

|

/s/ Edward F. Crawford |

|

| |

Edward F. Crawford |

|

| |

|

|

| |

2006 IRREVOCABLE TRUST OF LAURA W. VAN |

|

| |

LOAN FOR THE BENEFIT OF MARY M. CRAWFORD |

|

| |

|

|

| |

By: |

Edward F. Crawford, its trustee |

|

| |

|

|

| |

By: |

/s/ Edward F. Crawford |

|

| |

|

Name: Edward F. Crawford |

|

| |

|

Title: Trustee |

|

| |

|

|

| |

CRAWFORD UNITED CORPORATION |

|

| |

|

|

| |

By: |

/s/ Brian E. Powers |

|

| |

|

Name: Brian E. Powers |

|

| |

|

Title: President and Chief Executive Officer |

|

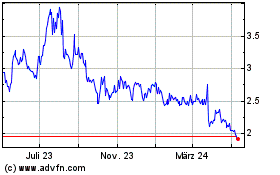

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

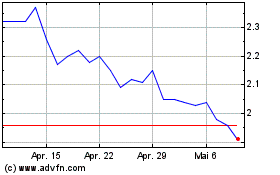

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024