0000006176false0000006176us-gaap:CommonStockMember2023-08-232023-08-230000006176us-gaap:WarrantMember2023-08-232023-08-2300000061762023-08-232023-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 23, 2023 |

AMPCO-PITTSBURGH CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

1-898 |

25-1117717 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

726 Bell Avenue Suite 301 |

|

Carnegie, Pennsylvania |

|

15106 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 412 456-4400 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $1 par value |

|

AP |

|

New York Stock Exchange |

Series A Warrants to purchase shares of Common Stock |

|

AP WS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On August 23, 2023, Ampco-Pittsburgh Corporation (the “Corporation”) posted an investor presentation to its investor relations website (www.ampcopgh.com/investors). This presentation, or excerpts from this presentation, may be provided to existing and/or prospective investors during future meetings. The investor presentation is furnished herewith as Exhibit 99.1.

The information in this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information on the Corporation’s website is not part of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

August 23, 2023 |

By: |

/s/ Michael G. McAuley |

|

|

|

Michael G. McAuley

Senior Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

Ampco-Pittsburgh Moving forward(Logo) Union Electric Steel(Logo) Aerofin Heat Transfer Products(Logo) BUFFALO AIR HANDLING(Logo) Buffalopumps(Logo) Producing Quality Products Since 1929 —Always Moving Forward! Three Part Advisors’ Midwest IDEAS Conference August 24, 2023

Disclaimer Forward-Looking Statements -The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a safe harbor for forward-looking statements made by us or on behalf of the Corporation. This presentation may include, but is not limited to, statements about operating performance, trends and events that the Corporation expects or anticipates will occur in the future, statements about sales and production levels, statements about future demand for steel products, restructurings, statements regarding the effects of capital expenditure initiatives on the Corporation’s profits and losses, the impact from global pandemics, profitability and anticipated expenses, inflation, the global supply chain, future proceeds from the exercise of outstanding warrants, and cash outflows. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward-looking statements” within the meaning of the Act and words such as “may,” “will,” “intend,” “believe,” “expect,” “anticipate,” “estimate,” “project,” “forecast” and other terms of similar meaning that indicate future events and trends are also generally intended to identify forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made, are not guarantees of future performance or expectations, and involve risks and uncertainties. For the Corporation, these risks and uncertainties include, but are not limited to: economic downturns, cyclical demand for our productsand insufficient demand for our products; excess global capacity in the steel industry; statements regarding expected margins; fluctuations in the value of the U.S. dollar relative to other currencies; increases in commodity prices or insufficient hedging against increases in commodity prices, reductions in electricity and natural gas supply or shortages of key production materials for us or our customers; limitations in availability of capital to fund our strategic plan; inability to maintain adequate liquidity in order to meet our operating cash flow requirements, repay maturing debt and meet other financial obligations; inability to obtain necessary capital or financing on satisfactory terms in order to acquire capital expenditures that may be necessary to support our growth strategy;inoperability of certain equipment on which we rely and/or our inability to execute our capital expenditure plan; liability of our subsidiaries for claims alleging personal injury from exposure to asbestos-containing components historically used in certain products of our subsidiaries; changes in the existing regulatory environment; inability to successfully restructure our operations and/or invest in operations that will yield the best long term value to our shareholders; consequences of global pandemics and international conflicts; work stoppage or another industrial action on the part of any of our unions; inabilitytosatisfy the continued listing requirements of the New York Stock Exchange or the NYSE American Exchange; potential attacks on information technology infrastructure and other cyber-based business disruptions; failure to maintain an effective system of internal control; and those discussed more fully elsewhere in this report, particularly in Item 1A, Risk Factors, in Part I of the Corporation’s latest Annual Report on Form 10-K, and Part II of subsequent Quarterly Reports on Form 10-Q.. The Corporation cannot guarantee any future results, levels of activity, performance or achievements. In addition, there may be events in the future that we are not able to predict accurately or control which may cause actual results to differ materially from expectations expressed or implied by forward-looking statements. Except as required by applicable law, we assume no obligation, and disclaim any obligation, to update forward-looking statements whether as a result of new information, events or otherwise. Industry Information-Unless otherwise indicated, information contained in this presentation concerning the Corporation’s industry, competitive position and the markets in which it operates is based on information from independent and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from the Corporation’s internal research, and are based on assumptions made by the Corporation upon reviewing such data,and the Corporation’s experience in, and knowledge of, such industry and markets, which the Corporation believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Corporation operatesand the Corporation’s future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by the Corporation.August 2023 Ampco-Pittsburgh Investor Presentation 2

Disclaimer, cont’d Non-GAAP Financial Measures –The Corporation presents herein, non-GAAP operating income -Air & Liquid Processing Segment, as adjusted, and operating margin, Air & Liquid Processing Segment, as adjusted, defined as operating income –Air & Liquid Processing Segment, as adjusted, expressed as a percentage of reported segment net sales, as supplemental financial measures to GAAP financial measures regarding the Air &Liquid Segment’s operational performance. These non-GAAP financial measures exclude certain items affecting comparability, as described more fully in the footnotes to the attached “Non-GAAP Financial Measures Reconciliation Schedule.” These non-GAAP financial measures are not based on any standardized methodology prescribed by accounting principles generally accepted in the United States of America and may not be comparable to similarly-titled measures presented by other companies. These non-GAAP financial measures exclude significant charges or credits, that are one-time charges or credits, unrelated to theCorporation’s ongoing results of operations or beyond its control. The Corporation believes these non-GAAP financial measures help identify underlyingtrends in its business and the business of the Air & Liquid Processing Segment that could otherwise be masked by the effect of the items excluded from operating income (loss) –Air & Liquid Processing Segment. In particular, the Corporation believes that the exclusion of the Asbestos-Related Charge (Recoveries) can provide a useful measure for period-to-period comparisons of the Corporation’s core business performance. The Corporation also believes this non-GAAP financial measure provides useful information to management, shareholders and investors, and others in understanding and evaluating its operating results, enhancing the overall understanding of its past performance and future prospectsand allowing for greater transparency with respect to key financial metrics used by the Corporation’s management in its financial and operational decision-making. The adjustments reflected in adjusted operating income, Air & Liquid Processing Segment and adjusted Operating Margin, Air & Liquid Processing Segment are pre-tax. Operating income -Air & Liquid Processing Segment, as adjusted and Operating Margin -Air & Liquid Processing Segment, as adjusted, are not prepared in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance withGAAP. There are limitations related to the use such Non-GAAP measures relative to the nearest GAAP equivalent measure. Among other things, therecan be no assurance that additional expenses similar tothose items listed in the accompanying Non-GAAP reconciliation schedule will not occur in future periods. August 2023 Ampco-Pittsburgh Investor Presentation 3

Snapshot Ampco-Pittsburgh(NYSE:AP) (NYSE: AP-WS) 77% Forged and Cast Engineered Products 23% Air and Liquid Processing 2022 Revenue Mix #1 North America & #1 Europe market share for forged and cast rolls [1] #1 North American producer of heat exchangers for Nuclear Power Generation [1] Leading producer of pumps for U.S. Navy Combat Ships [1]Year Founded 1929 Number of Employees [2022] 1,565 2022 Revenue $390M Market Cap (as of 8/16/2023)* * Common shares outstanding 19,865,749; Share price $3.21 $64M

Forged and Cast Engineered Products Segment Ampco-Pittsburgh Investor Presentation 5 August 2023 Ampco-Pittsburgh Moving forward(Logo) Union Electric Steel(Logo)

Market Share Leader in Forged & Cast Rolls $299M 2022 Net segment sales Forged engineered products (FEP) used in automotive tooling, plastic injection molding, infrastructure, general industrial, and oil & gas. 14% of segment sales 86% of segment sales Key roll customers: #1 Market Share in both North America & Europe[1] Forged and Cast Engineered Products 77% of 2022 Revenue [1] Corporation EstimatesAmpco-Pittsburgh Investor Presentation 6 August 2023 Company(Logo)

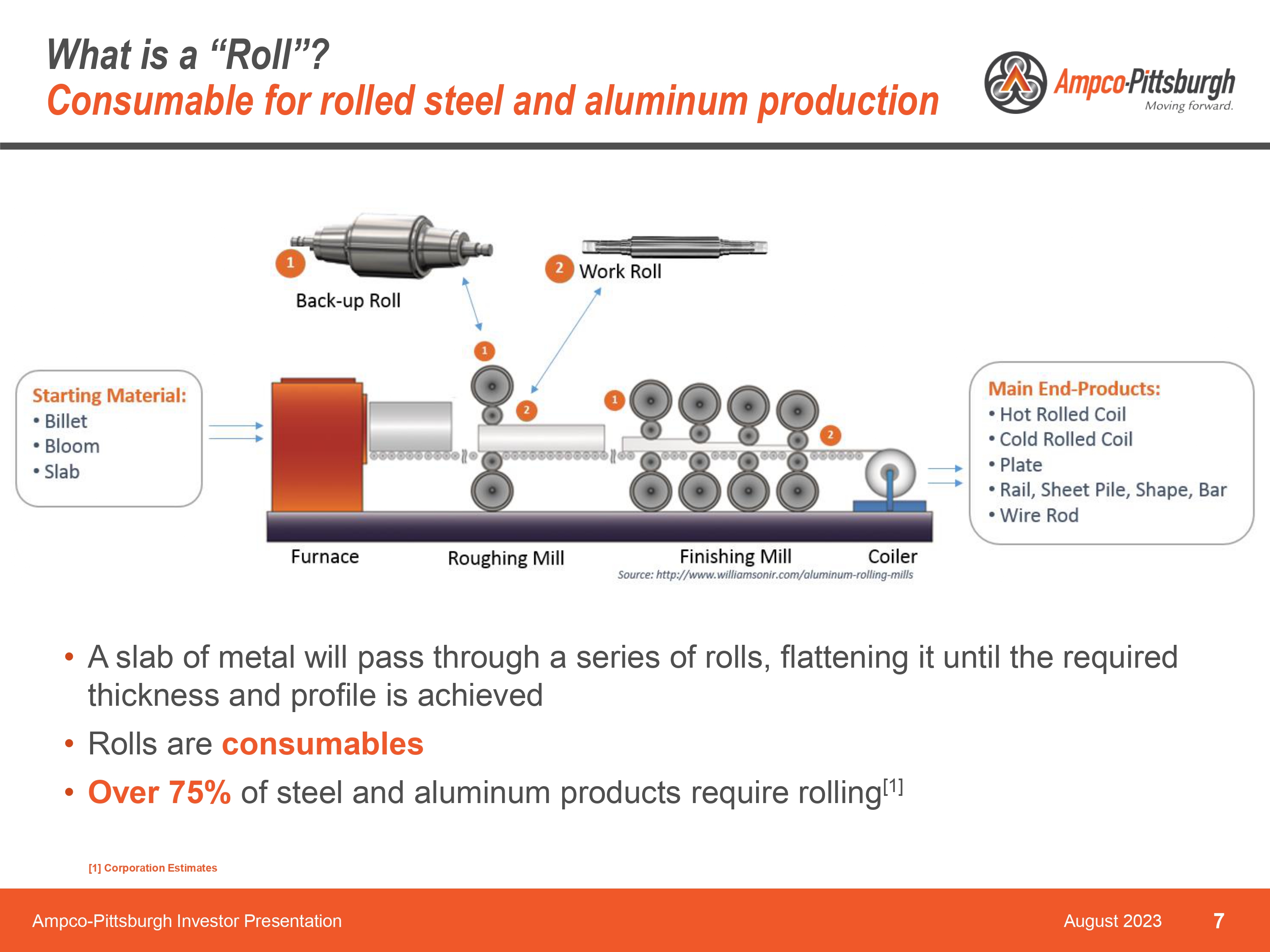

What is a “Roll”? Consumable for rolled steel and aluminum production A slab of metal will pass through a series of rolls, flattening it until the required thickness and profile is achieved Rolls are consumables Over 75% of steel and aluminum products require rolling[1] [1] Corporation EstimatesAmpco-Pittsburgh Investor Presentation 7 August 2023 Starting Billet Bloom Slab Back-up Roll Work Roll Main End-Products: Hot Rolled Coil Cold Rolled Coil Plate Rail, Sheet Pile, Shape, Bar Wire Rod Furnace Roughing Mill Finishing Mill Coiler Source: http://www.williamsonir.com/aluminum-rolling-mills

Steel Demand Outlook World Steel Association (Worldsteel) Short Range Outlook, April 2023:2023:Worldsteelrevised up its bi-annual demand outlook, saying globaldemand is expectedto increase 2.3% this year (2023) 2024:United States: steel demand is expected to grow by 2.5% US light vehicle sales are expected to recover by 8.0% in 2023 and anadditional7.0% in 2024 Infrastructure program expected to increase U.S. steel production 6-8% European Union (27) and the United Kingdom:demand is expectedtorebound 5.6% Demand is expected to see a visible rebound as the impact of the Ukrainewar andsupply chain disruptions are expected to dissipate August 2023 Ampco-Pittsburgh Investor Presentation 8

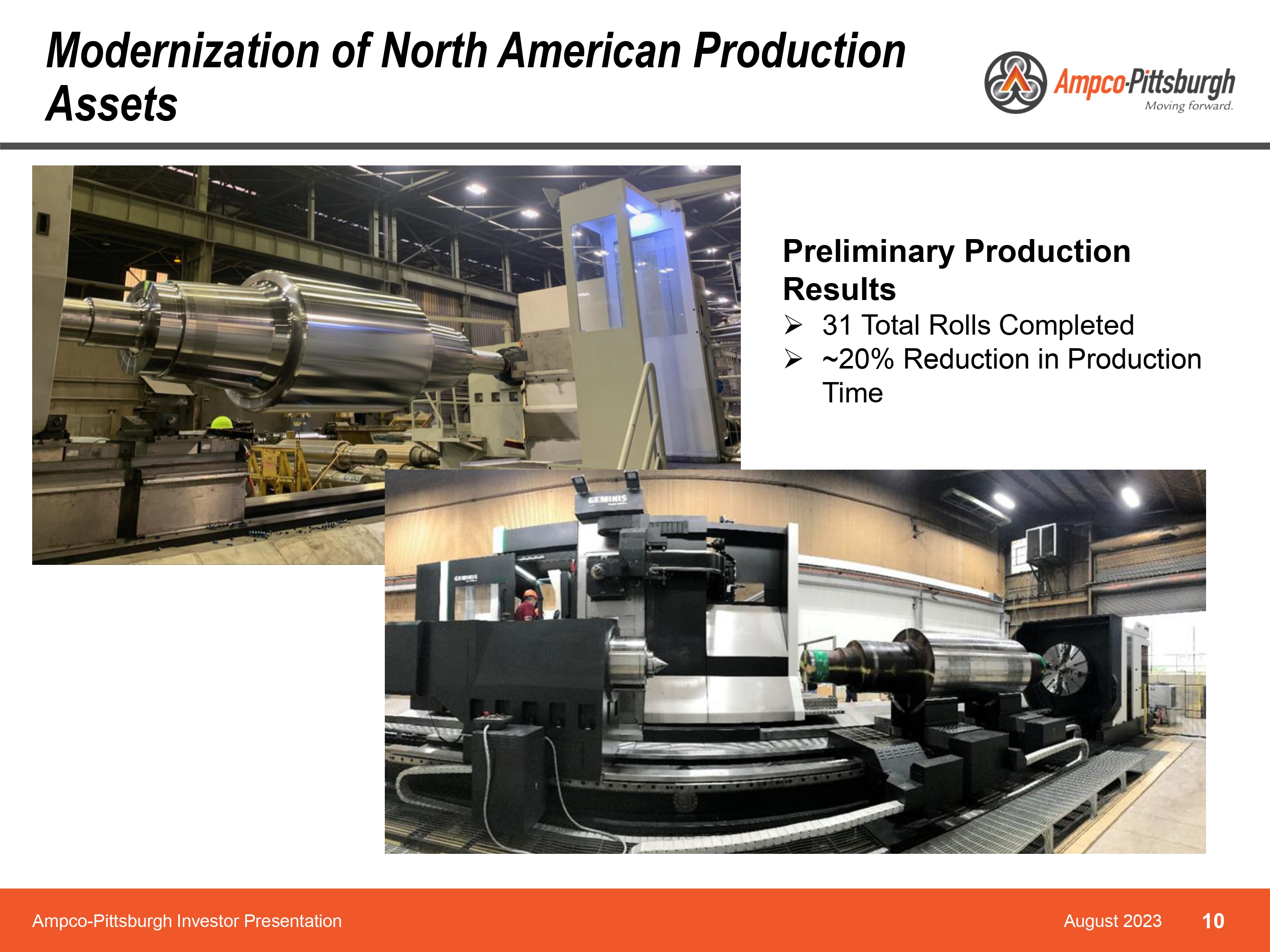

Expected Completion late 2023 Capital Investment of $26M Replace single-purpose machines with multi-purpose machines Expand forged and heat treatment capacity P&L Benefit of ~ $8M Modernization of North American Production Assets Efficiency Improvements Repair & Maintenance Savings Working Capital Reduction Improved Reliability Labor Savings Capacity Expansion August 2023 Ampco-Pittsburgh Investor Presentation 9

Modernization of North American Production Assets Preliminary Production Results 31 Total Rolls Completed ~20% Reduction in Production Time Ampco-Pittsburgh Investor Presentation 10 August 2023

Expanding the Addressable Market Forged Engineered Products Company LOGO Forged Bar Distribution Tool Steel, Carbon and Alloy supplier to steel service centers Recovery beginning now as inventory diminishes Strong relationships and positive history with major players Carpenter Latrobe (Tool and Alloy) PSK Steel (Tool Steel) Ryerson divisions (Alloy and Carbon) Voestalpine (Tool Steel) Alloys Unlimited (Captured Division) Segment sales from this market grew from $2.2M in 2017to $16.2M in 2022 –More growth available once the market inventory correction takes place Frac Market Oil Production expected to remain at record highs in 2023 and 2024 [U.S. EIA] Corporation anticipates Frac spreads to remain stable or increase as production remains high Inventory correction for fracking fluid end manufacturers to be complete in H1 2024 Increase asset utilization, diversify and grow Ampco-Pittsburgh Investor Presentation 11 August 2023

Company Logos Air and Liquid Processing Segment Ampco-Pittsburgh Investor Presentation 12 August 2023

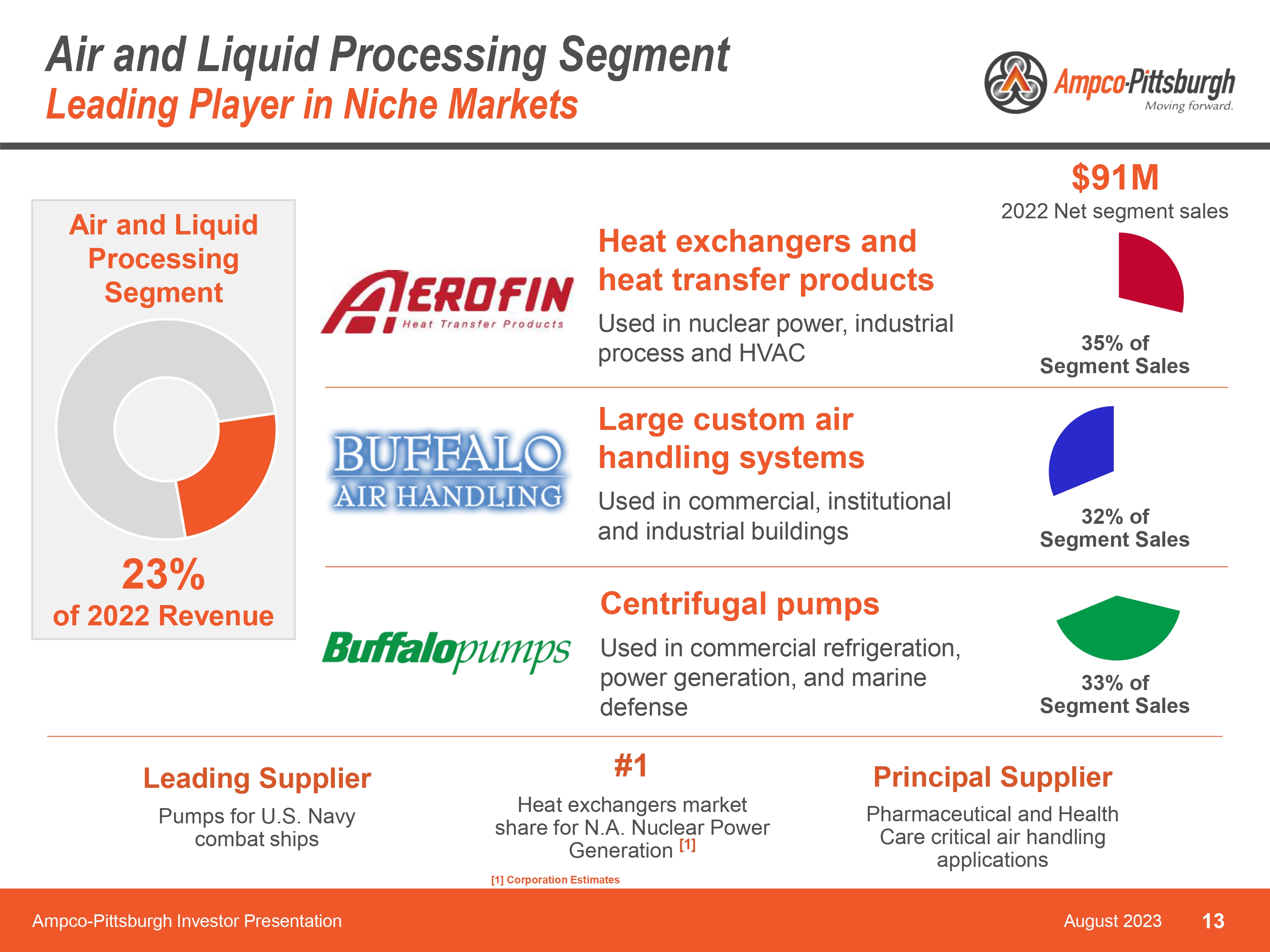

Air and Liquid Processing Segment leading Player in Niche Markets Company LOGO Heat exchangers and heat transfer products Used in nuclear power, industrial process and HVAC Company LOGO Large custom air handling systems Used in commercial, institutional and industrial buildings. Company LOGO 35% of Segment Sales Centrifugal pumps Used in commercial refrigeration, power generation, and marine defense. Company LOGO Principal Supplier Pharmaceutical and Health Care critical air handling applications Leading Supplier Pumps for U.S. Navy combat ships #1 Heat exchangers market share for N.A. Nuclear Power Generation [1] Air and Liquid Processing Segment 23% of 2022 Revenue $91M 2022 Net segment sales 32% of Segment Sales 33% of Segment Sales [1] Corporation Estimates Ampco-Pittsburgh Investor Presentation 13 August 2023

Air and Liquid Processing Segment Key Customers Company Logos Ampco-Pittsburgh Investor Presentation 14 August 2023

Mission-Critical Functions Across Demanding End Markets Company Logos Ampco-Pittsburgh Investor Presentation 15 August 2023

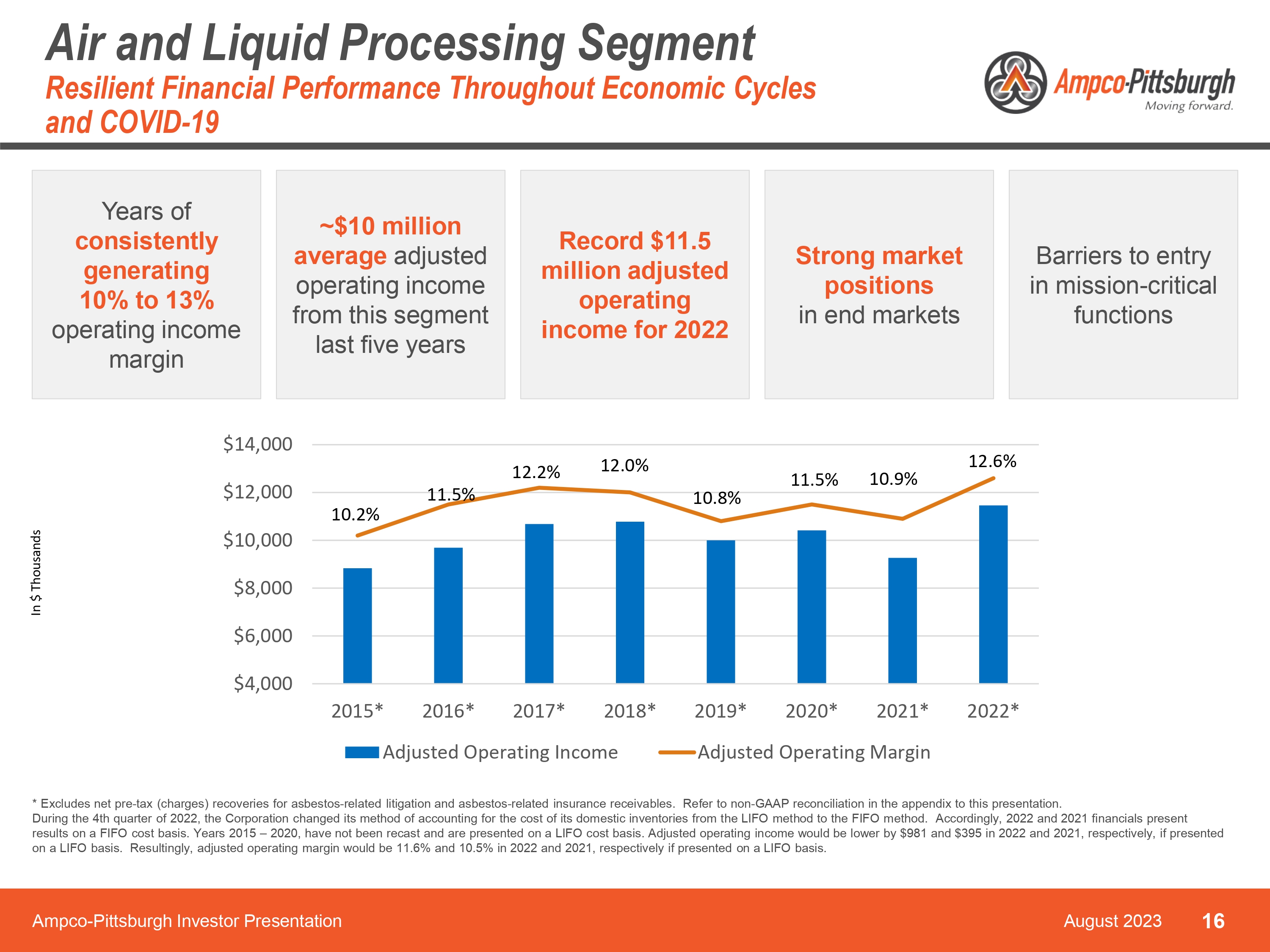

Air and Liquid Processing Segment Resilient Financial Performance Throughout Economic Cycles and COVID-19 Company LOGO Years of consistently generating 10% to 13% operating income margin ~$10 million average adjusted operating income from this segment last five years Record $11.5 million adjusted operating income for 2022 Strong market position in end markets Barriers to entry in mission-critical functions In $ Thousands $14,000 $4,000 $6,000 $8,000 $10,000 $12,000 10.2% 11.5% 12.2% 12.0% 10.8% 11.5% 10.9% 12.6% 2015* 2016* 2017* 2018* 2019* 2020* 2021* 2022* Adjusted Operating Income Adjusted Operating Margin * Excludes net pre-tax (charges) recoveries for asbestos-related litigation and asbestos-related insurance receivables. Refer to non-GAAP reconciliation in the appendix to this presentation. During the 4thquarter of 2022, the Corporation changed its method of accounting for the cost of its domestic inventories from the LIFO method to the FIFO method. Accordingly, 2022 and 2021 financials present results on a FIFO cost basis. Years 2015 –2020, have not been recast and are presented on a LIFO cost basis. Adjusted operating income would be lower by $981 and $395 in 2022 and 2021, respectively, if presented on a LIFO basis. Resultingly, adjusted operating margin would be 11.6% and 10.5% in 2022 and 2021, respectively if presented On a LIFO basis. Ampco-Pittsburgh Investor Presentation 16 August 2023

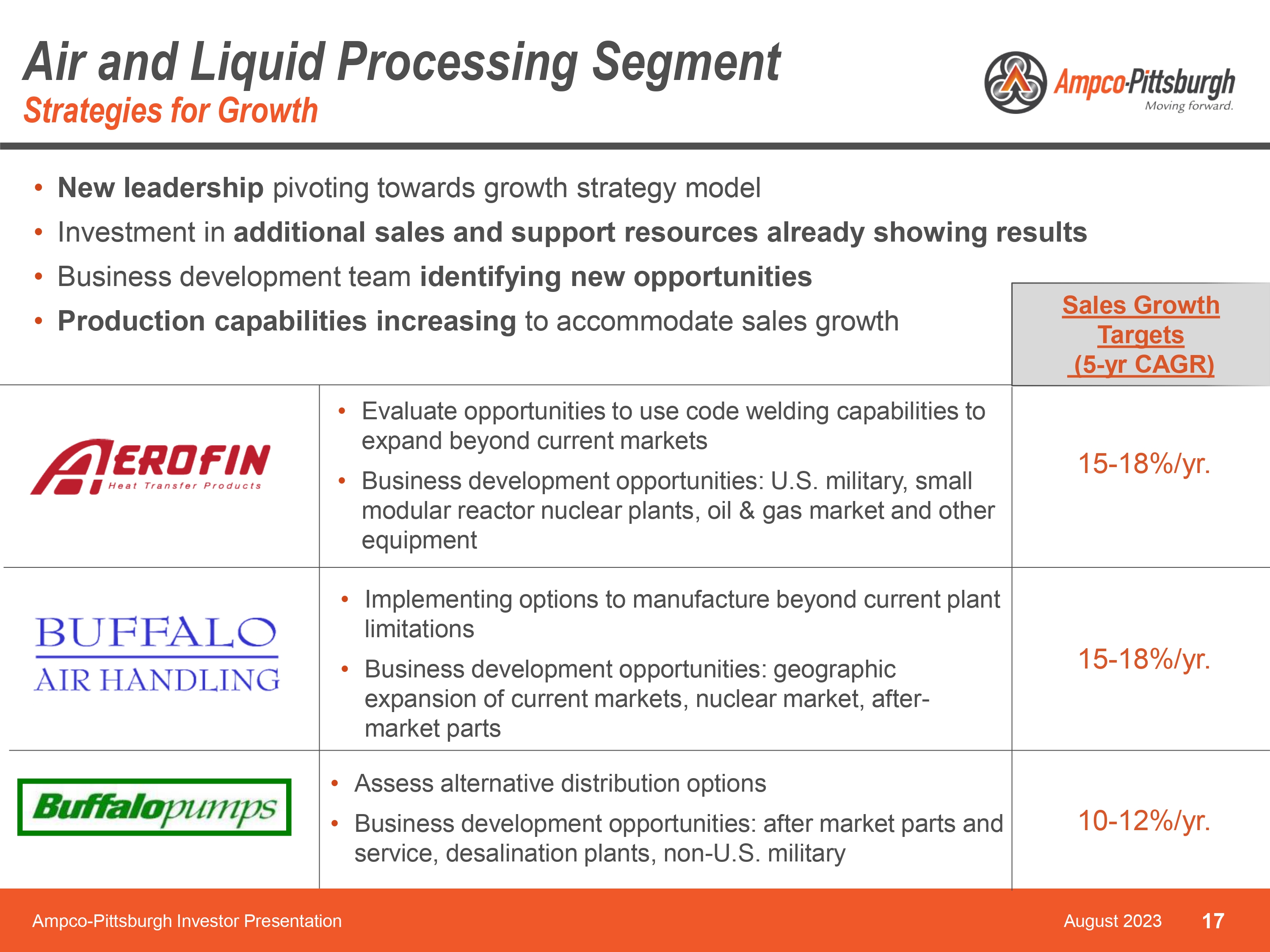

Air and Liquid Processing Segment Strategies for Growth Company LOGO New leadership pivoting towards growth strategy model Investment in additional sales and support resources already showing results Business development team identifying new opportunities Production capabilities increasing to accommodate sales growth Company LOGO Evaluate opportunities to use code welding capabilities to expand beyond current markets Business development opportunities: U.S. military, small modular reactor nuclear plants, oil & gas market and other equipment Company LOGO Implementing options to manufacture beyond current plant limitations Business development opportunities: geographic expansion of current markets, nuclear market, after-market parts Company LOGO Assess alternative distribution options Business development opportunities: after market parts and service, desalination plants, non-U.S. military Sales Growth Targets(5-yr CAGR) 15-18%/yr. 15-18%/yr. 10-12%/yr. Ampco-Pittsburgh Investor Presentation August 2023 17

Air and Liquid Processing Segment Strengthening Sales Capabilities Company LOGO New teaming relationships in key markets for improved market access: Curtiss Wright has a significant presence in nuclear markets worldwide. The relationship with Curtiss Wright allows Aerofin to expand in markets in Europe, Asia, and South America where we have traditionally not had sales representation. Company LOGO Fairbanks Morse Defense now provides repair services for Buffalo Pumps products. With repair locations at all the major U.S. shipyards, this relationship allows us to capture service work for U.S. Navy pumps that previously went to independent service shops. Company LOGO ECI Defense Group provides Buffalo Pumps with increased visibility into the demand for spare parts and replacement parts for the U.S. military. This relationship allows us to capture more aftermarket parts and replacement pumps for the U.S. Navy. Company LOGO Ampco-Pittsburgh Investor Presentation August 2023 18

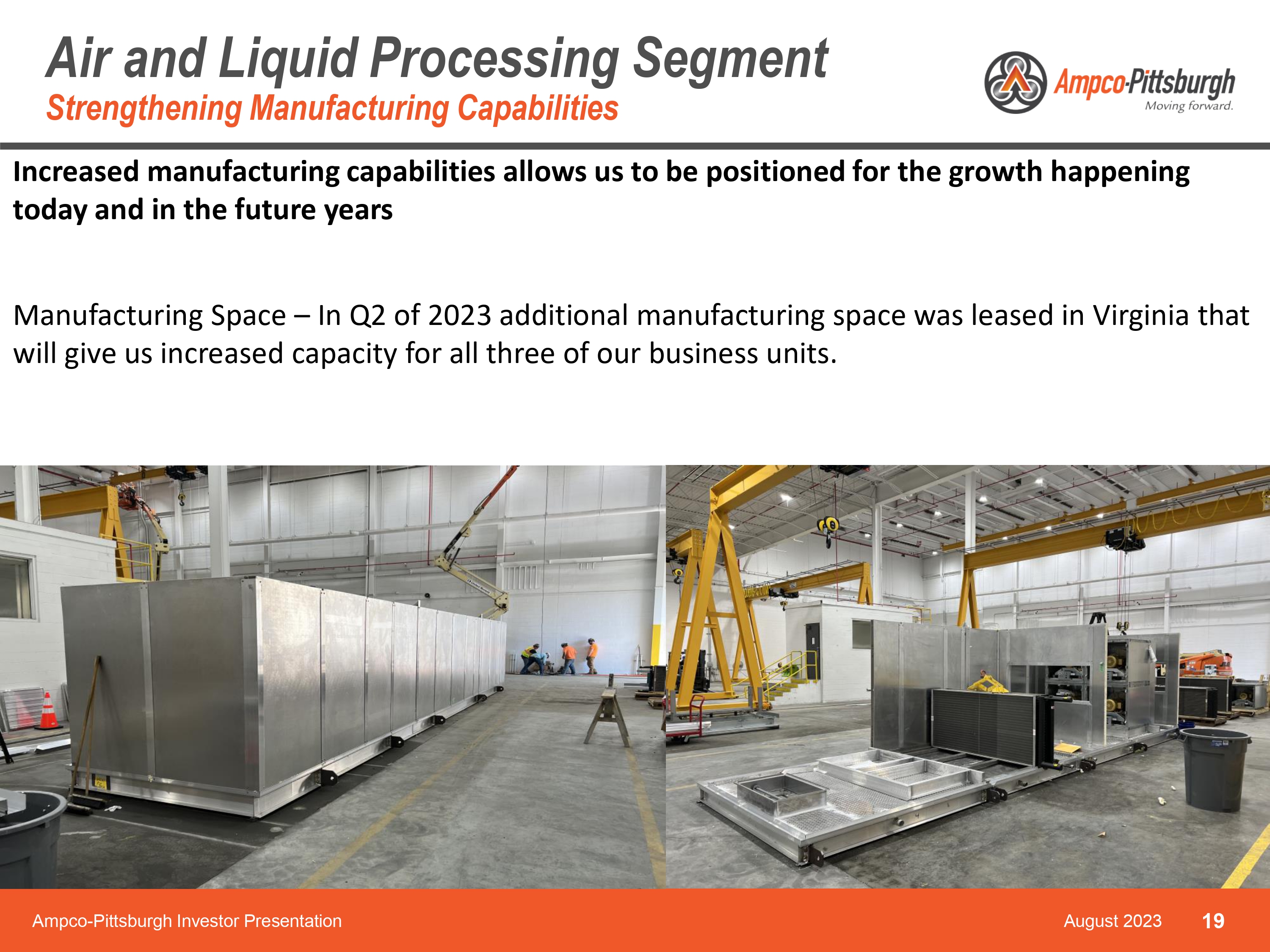

Air and Liquid Processing Segment Strengthening Manufacturing Capabilities Company LOGO Increased manufacturing capabilities allows us to be positioned for the growth happening today and in the future years Manufacturing Space –In Q2 of 2023 additional manufacturing space was leased in Virginia that will give us increased capacity for all three of our business units. Ampco-Pittsburgh Investor Presentation August 2023 19

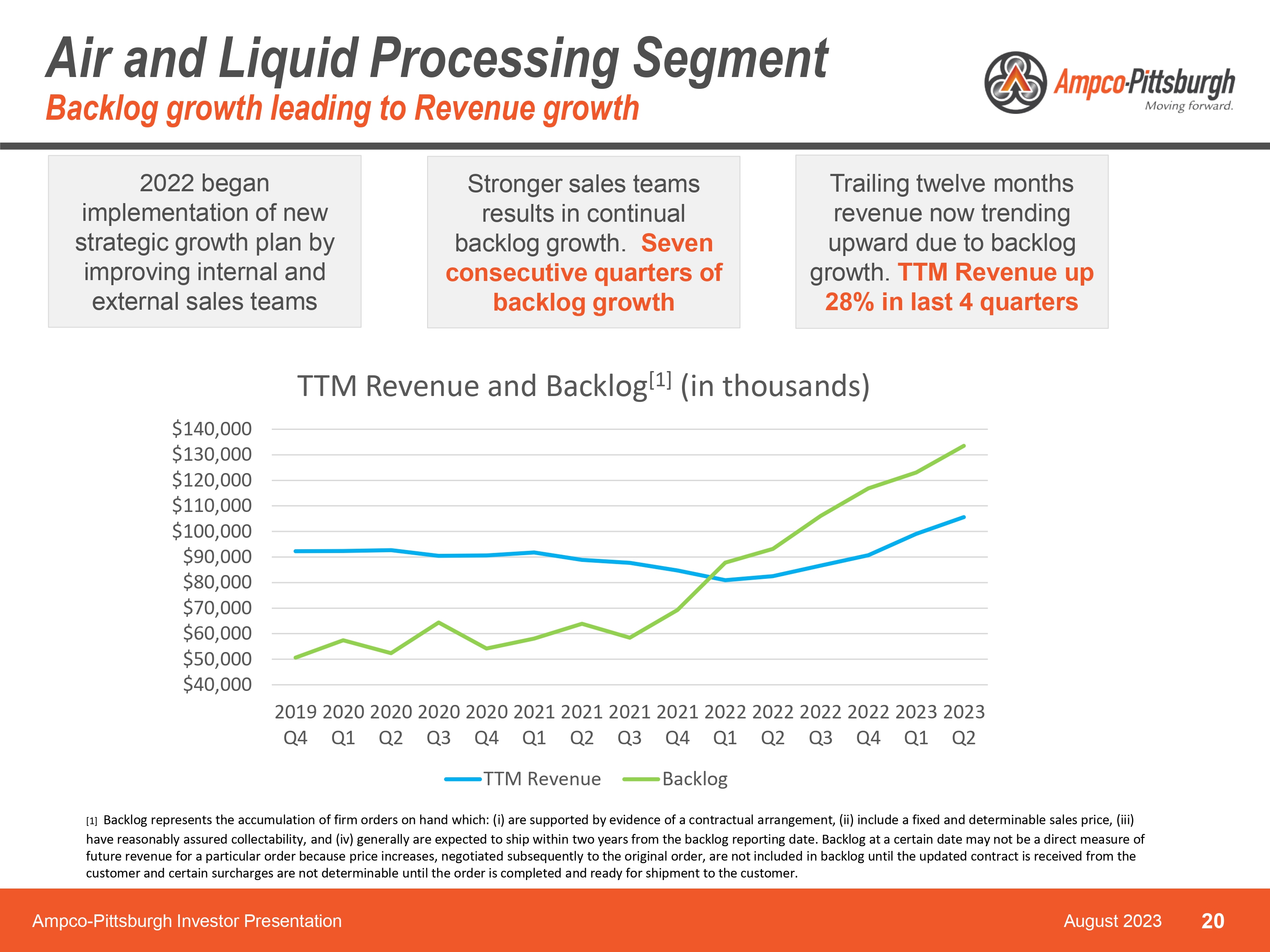

Air and Liquid Processing Segment Backlog growth leading to Revenue growth Company LOGO 2022 began implementation of new strategic growth plan by improving internal and external sales teams Stronger sales teams results in continual backlog growth. Seven consecutive quarters of backlog growth Trailing twelve months revenue now trending upward due to backlog growth. TTM Revenue up 28% in last 4 quarters TTM Revenue and Backlog[1] (in thousands) $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 TTM Revenue Backlog [1]Backlog represents the accumulation of firm orders on hand which: (i) are supported by evidence of a contractual arrangement, (ii) include a fixed and determinable sales price, (iii) have reasonably assured collectability, and (iv) generally are expected to ship within two years from the backlog reporting date. Backlog at a certain date may not be a direct measure of future revenue for a particular order because price increases, negotiated subsequently to the original order, are not included in backlog until the updated contract is received from the customer and certain surcharges are not determinable until the order is completed and ready for shipment to the customer. Ampco-Pittsburgh Investor Presentation August 2023 20

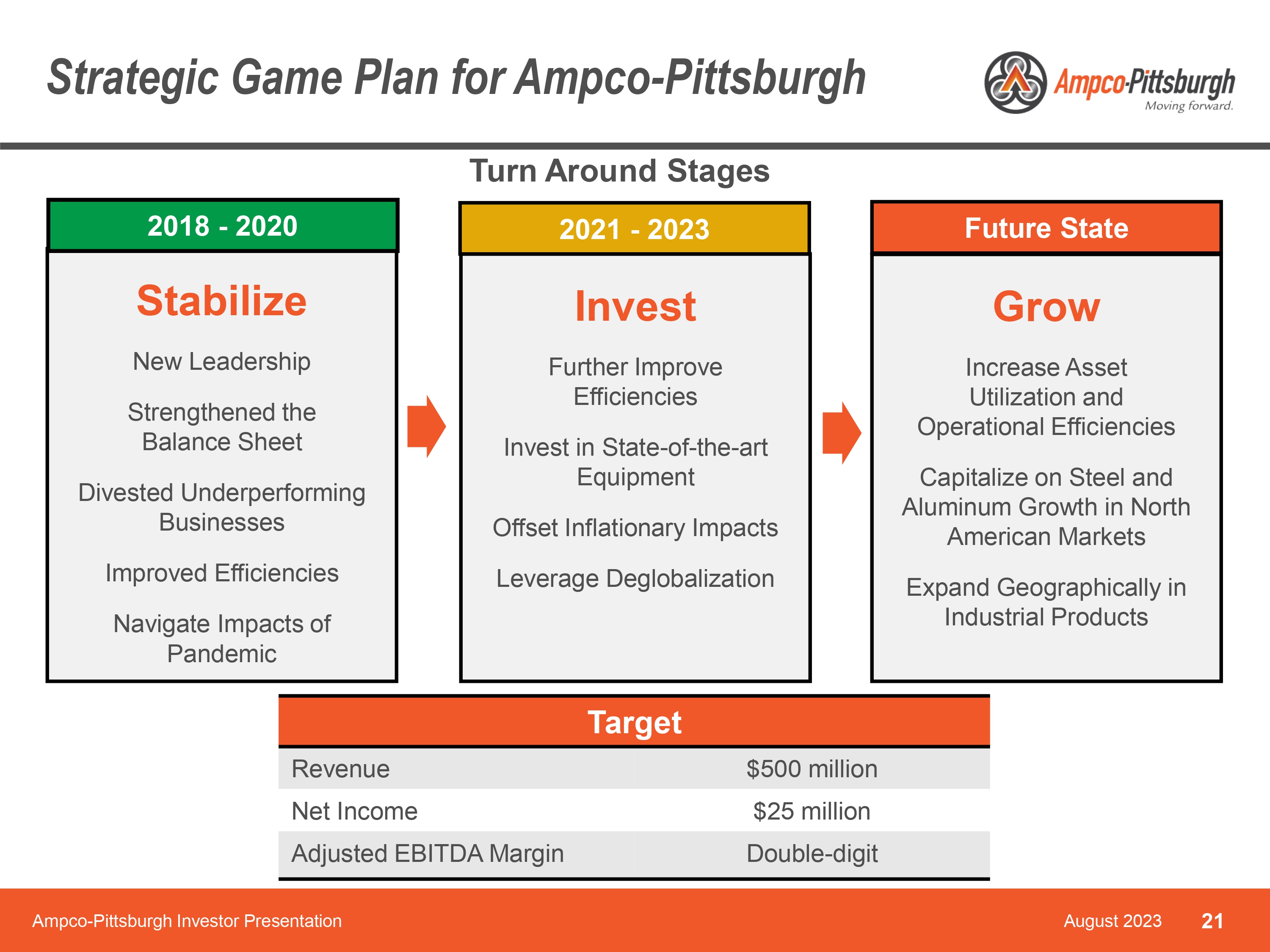

Strategic Game Plan for Ampco-Pittsburgh Ampco Pittsburgh Moving Forward Turn Around Stages 2018-2020 Stabilize New Leadership Strengthened the Balance Sheet Divested Underperforming Businesses Improved Efficiencies Navigate Impacts of Pandemic 2021-2023 Invest Further Improve Efficiencies Invest in State of the art Equipment Offset Inflationary Impacts Leverage Deglobalization Future State Grow Increase Asset Utilization and Operational Efficiencies Capitalize on Steel and Aluminum Growth in North American Markets Expand Geographically in Industrial Products Target Revenue $500 million Net Income $25 million Adjusted EBITDA Margin Double digit Ampco-Pittsburgh Investor Presentation August 2023 21

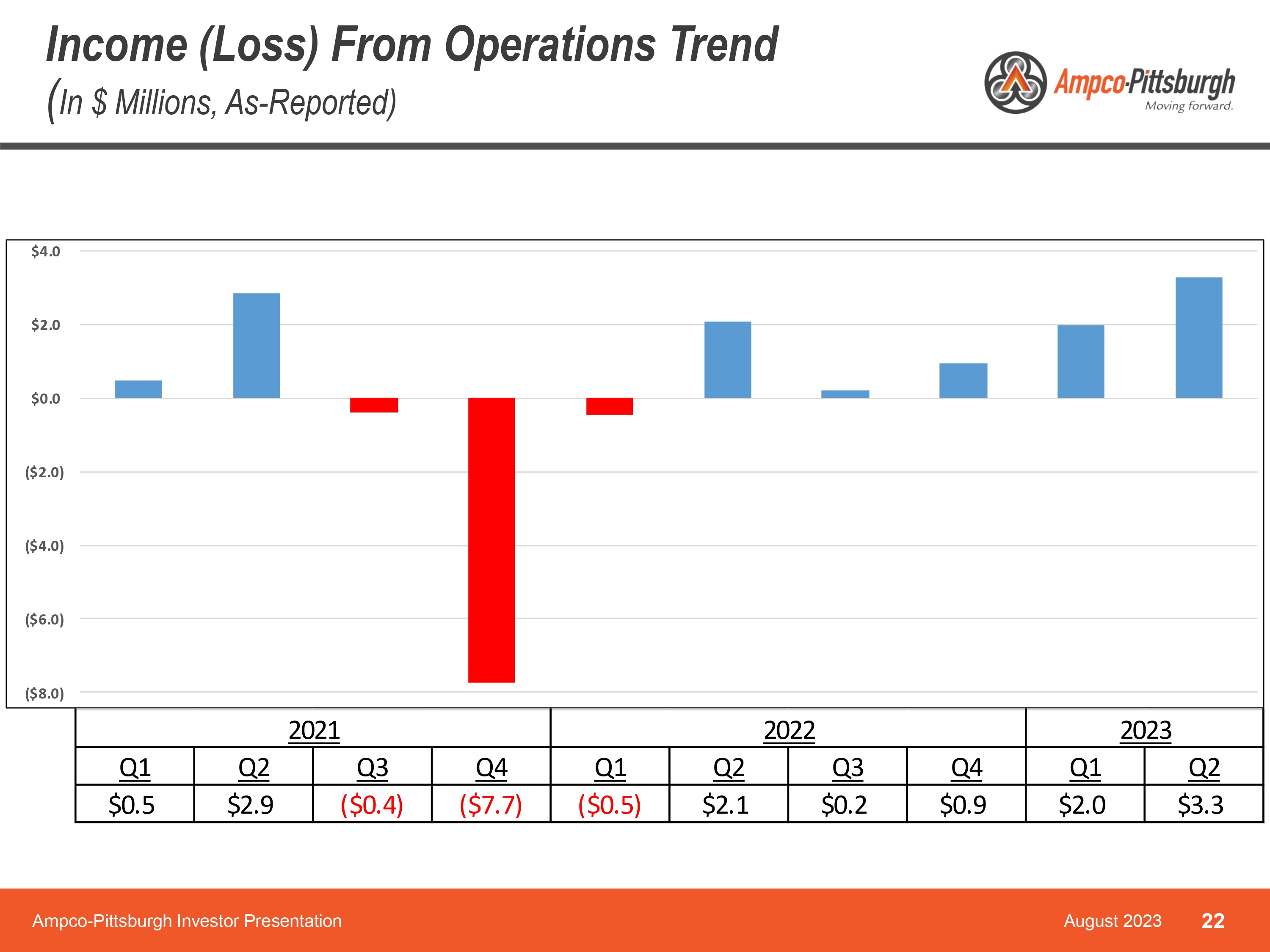

Income (Loss) From Operations Trend (In $ Millions, As-Reported) Ampco-Pittsburgh Moving Forward $4.0 $2.0 $0.0 ($2.0) ($4.0) ($6.0) ($8.0) 2021 2022 2023 Q1 $0.5 Q2 $2.9 Q3 ($0.4) Q4 ($7.7) Q1 ($0.5) Q2 $2.1 Q3 $0.2 Q4 $0.9 Q1 $2.0 Q2 Ampco-Pittsburgh Investor Presentation August 2023 22

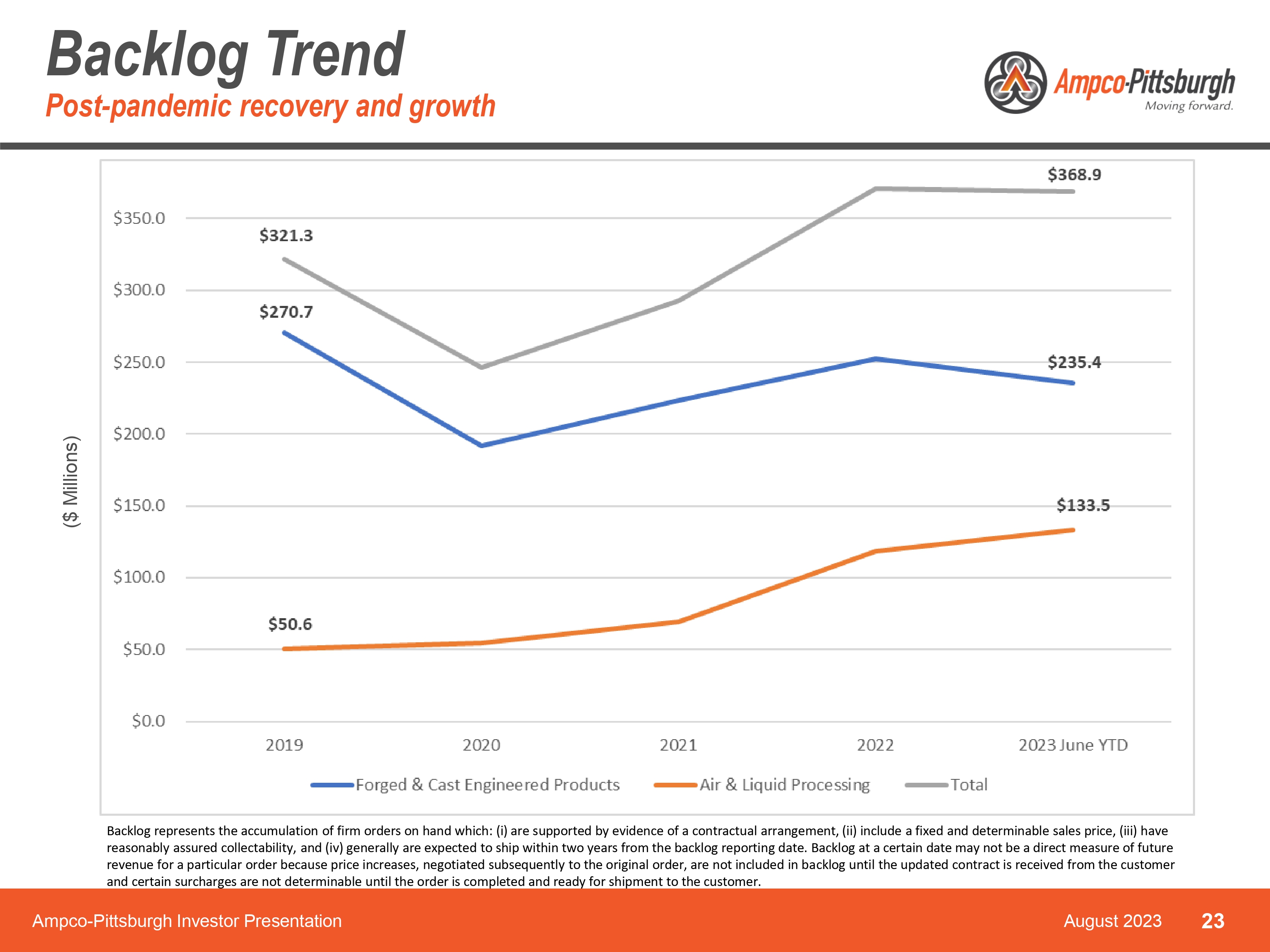

Backlog Trend Post pandemic recovery and growth Ampco Pittsburgh Movinf Forward $350.0 $321.3 $368.9 $300.0 $270.7 $250.0 $235.4 $200.0 $150.0 $133.5 $100.0 $50.0 $50.6 $0.0 2019 2020 2021 2022 2023 June YTD Backlog represents the accumulation of firm orders on hand which: ( i ) are supported by evidence of a contractual arrangement, (ii) include a fixed and determinable sales price, (iii) have reasonably assured collectability, and (iv) generally are expected to ship within two years from the backlog reporting date. Bac klog at a certain date may not be a direct measure of future revenue for a particular order because price increases, negotiated subsequently to the original order, are not included in ba ckl og until the updated contract is received from the customer and certain surcharges are not determinable until the order is completed and ready for shipment to the customer. Ampco-Pittsburgh Investor Presentation August 2023 23

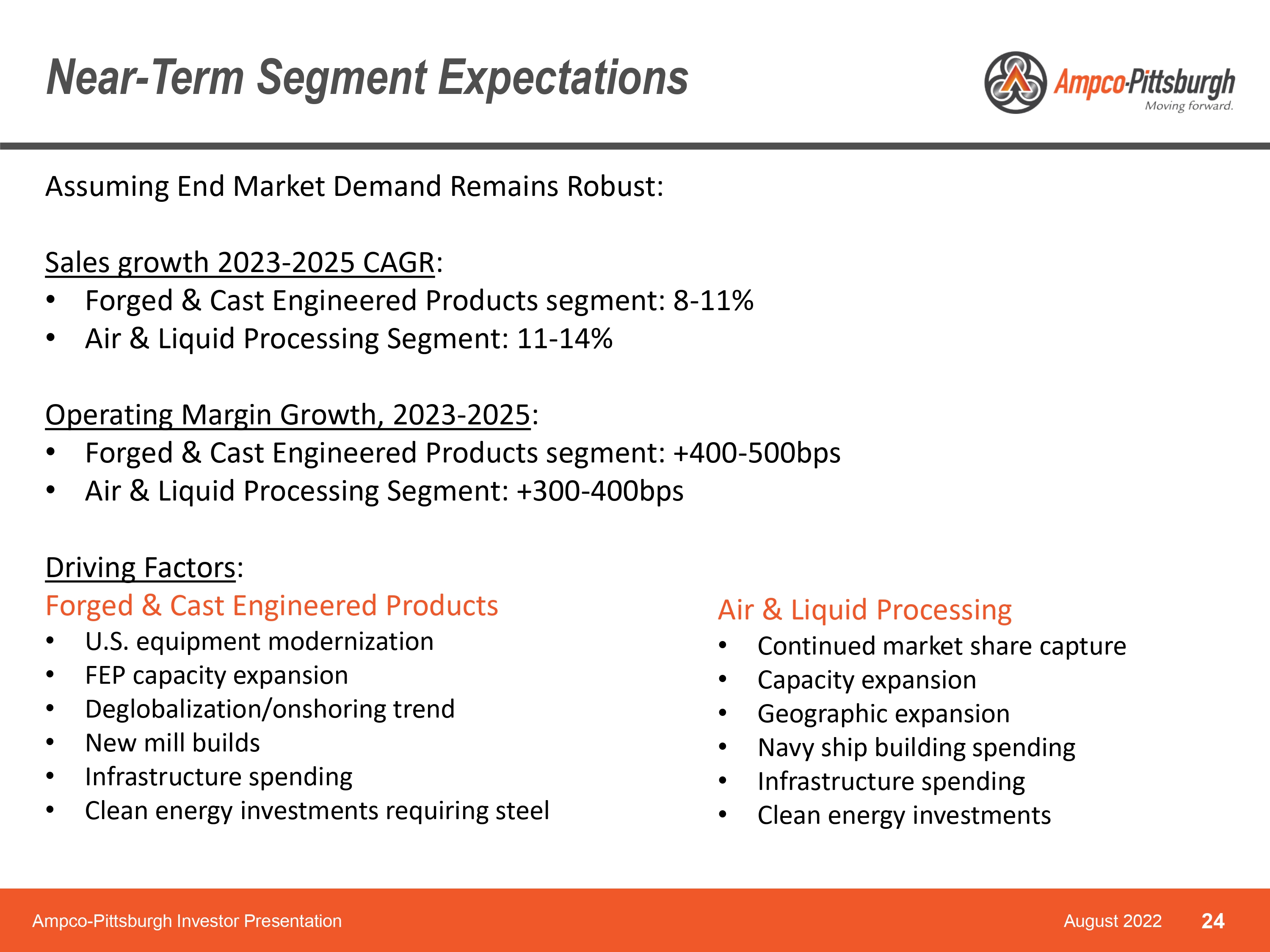

Near Term Segment Expectations Assuming End Market Demand Remains Robust: Sales growth 2023 2025 CAGR Forged & Cast Engineered Products segment: 8 11% Air & Liquid Processing Segment: 11 14% Operating Margin Growth, 2023 2025 Forged & Cast Engineered Products segment: +400 500bps Air & Liquid Processing Segment: +300 400bps Driving Factors Forged & Cast Engineered Products U.S. equipment modernization FEP capacity expansion Deglobalization/onshoring trend New mill builds Infrastructure spending Clean energy investments requiring steel Air & Liquid Processing Continued market share capture Capacity expansion Geographic expansion Navy ship building spending Infrastructure spending Clean energy investments Ampco-Pittsburgh Investor Presentation August 2022 24

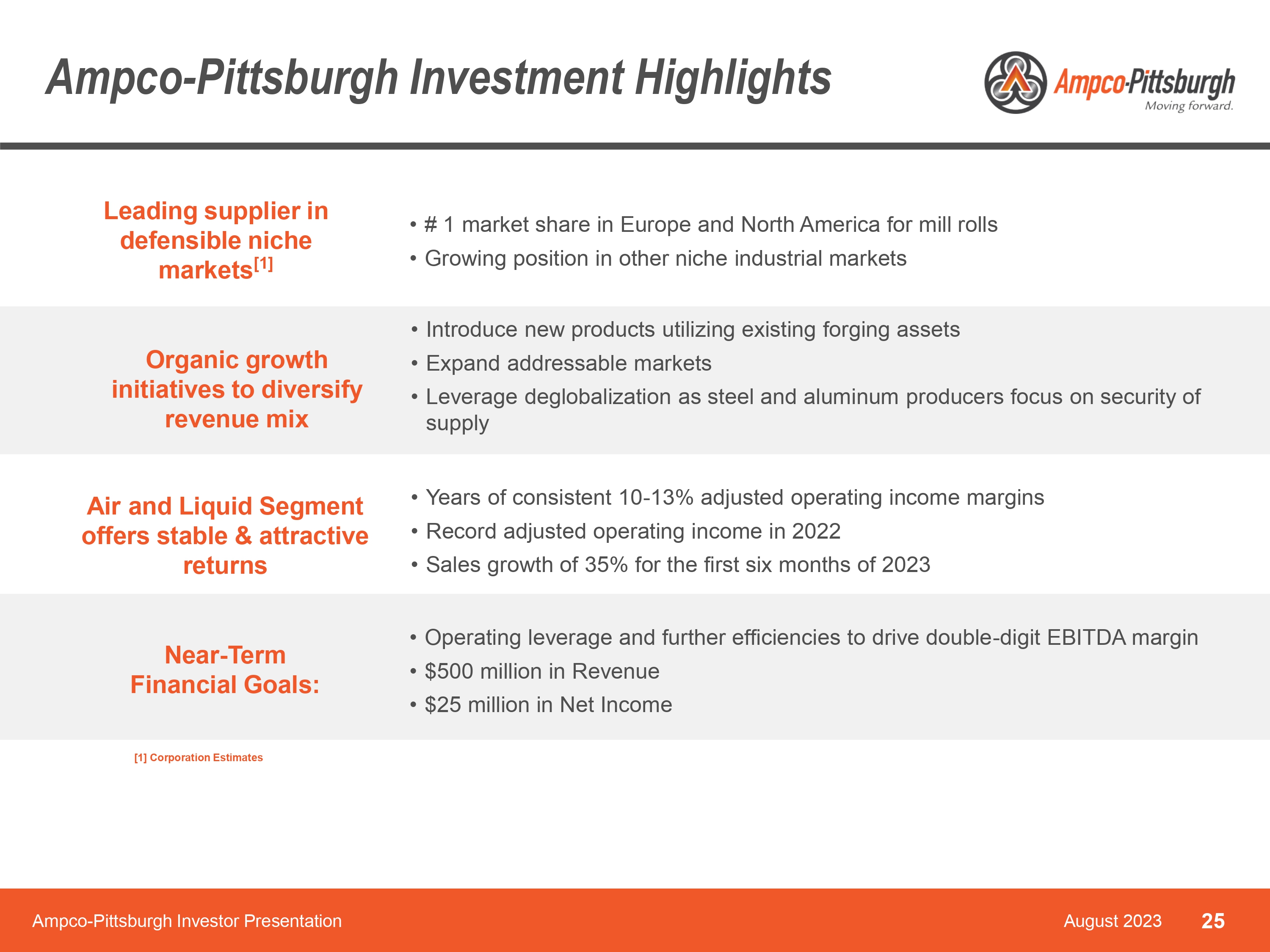

Ampco Pittsburgh Investment Highlights Ampco Pittsburgh Moving Forward Leading supplier in defensible niche markets [1] # 1 market share in Europe and North America for mill rolls Growing position in other niche industrial markets Organic growth initiatives to diversify revenue mix Introduce new products utilizing existing forging assets Expand addressable markets Leverage deglobalization as steel and aluminum producers focus on security of supply Air and Liquid Segment offers stable & attractive returns Years of consistent 10 13% adjusted operating income margins Record adjusted operating income in 2022 Sales growth of 35% for the first six months of 2023 Near Term Financial Goals: Operating leverage and further efficiencies to drive double digit EBITDA margin $500 million in Revenue $25 million in Net Income [1] Corporation Estimates Ampco-Pittsburgh Investor Presentation August 2023 25

Ampco Pittsburgh Moving forward Thank You ampcopgh.com Ampco-Pittsburgh Investor Presentation August 2023 26

Appendix Ampco Pittsburgh Moving forward Ampco-Pittsburgh Investor Presentation August 2023 27

Ampco-Pittsburgh Global Footprint Ampco Pittsburgh Moving Union Eletric Steel Forged and cast Engineered Products TM Valparaiso, IN Austintown, OH Erie, PA Carnegie, PA Burgettstown, PA Lynchburg, VA North Tonawanda, NY Amherst, VA and Lynchburg, VA Gateshead, England Åkers Styckebruk, Sweden Ravne na Koroškem, Slovenia Taiyuan, China Xinjian Town Yixing, China Maanshan, China Jointly Owned Manufacturing Facilities Locations Manufacturing Sales Buffalopumps Buffalo air handling Union Electric Steel Forged cast Engineered Products TM Ampco-Pittsburgh Investor Presentation August 2023 28

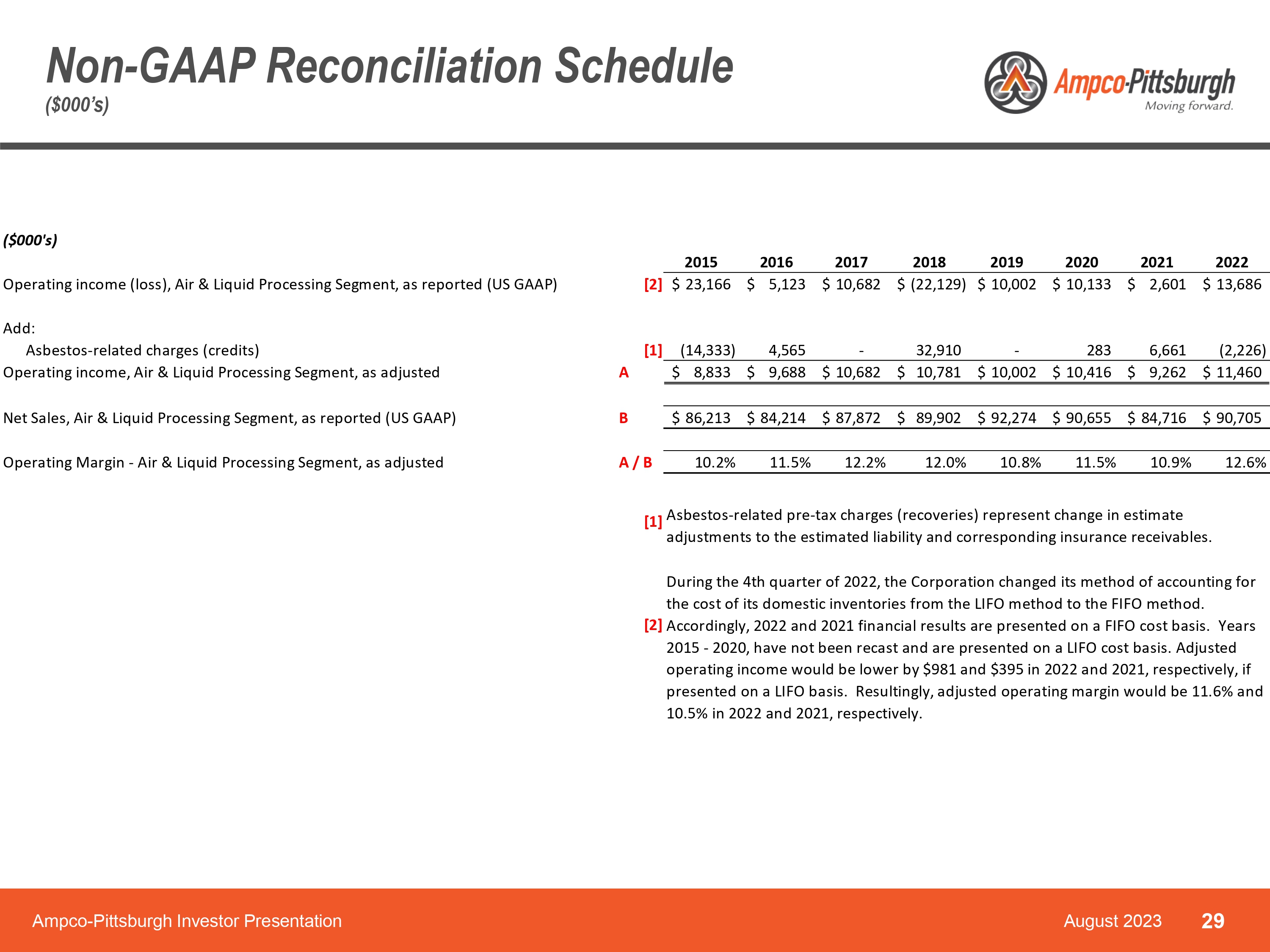

Non-GAAP Reconciliation Schedule ($000’s) Ampco-Pittsburgh Investor Presentation August 2023 29 ($000's) 2015 2016 2017 2018 2019 2020 2021 2022 Operating income (loss), Air & Liquid Processing Segment, as reported (US GAAP) [2] $ 23,166 $ 5,123 $ 10,682 $ (22,129) $ 10,002 $ 10,133 $ 2,601 $ 13,686 Add: Asbestos-related charges (credits) [1] (14,333) 4,565 - 32,910 - 283 6,661 (2,226) Operating income, Air & Liquid Processing Segment, as adjusted A $ 8,833 $ 9,688 $ 10,682 $ 10,781 $ 10,002 $ 10,416 $ 9,262 $ 11,460 Net Sales, Air & Liquid Processing Segment, as reported (US GAAP) B $ 86,213 $ 84,214 $ 87,872 $ 89,902 $ 92,274 $ 90,655 $ 84,716 $ 90,705 Operating Margin - Air & Liquid Processing Segment, as adjusted A / B 10.2% 11.5% 12.2% 12.0% 10.8% 11.5% 10.9% 12.6% [1] [2] Asbestos-related pre-tax charges (recoveries) represent change in estimate adjustments to the estimated liability and corresponding insurance receivables. During the 4th quarter of 2022, the Corporation changed its method of accounting for the cost of its domestic inventories from the LIFO method to the FIFO method. Accordingly, 2022 and 2021 financial results are presented on a FIFO cost basis. Years 2015 - 2020, have not been recast and are presented on a LIFO cost basis. Adjusted operating income would be lower by $981 and $395 in 2022 and 2021, respectively, if presented on a LIFO basis. Resultingly, adjusted operating margin would be 11.6% and 10.5% in 2022 and 2021, respectively. Ampco Pittsburgh Moving forward

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

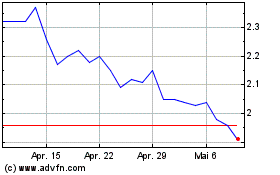

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024