UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF A

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2021

Commission File Number: 1-16269

AMÉRICA MÓVIL, S.A.B. DE C.V.

(Exact Name of the Registrant as Specified in the Charter)

America Mobile

(Translation of Registrant’s Name into English)

Lago Zurich

245

Plaza Carso / Edificio Telcel, Piso 16

Colonia Ampliación Granada, Miguel Hidalgo

11529 Mexico City, Mexico

(Address of Principal Executive Office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

NOT FOR DISTRIBUTION IN OR INTO THE UNITED STATES OR FOR THE ACCOUNT OR BENEFIT OF U.S. PERSONS (AS DEFINED IN

REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933) OR IN OR INTO AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH DISTRIBUTION WOULD BE PROHIBITED BY APPLICABLE LAW.

América Móvil using its Dutch subsidiary América Móvil B.V. completed the placement of approximately

€2.1 billion bonds exchangeable into ordinary shares of Koninklijke KPN N.V.

Mexico City, Mexico, February 23, 2021.

América Móvil, S.A.B. de C.V. (“AMX”) [BMV: AMX] [NYSE: AMX | AMOV], announces that its wholly-owned Dutch subsidiary América Móvil B.V. (the “Issuer”) has completed the placement of approximately

EUR 2.1 billion principal amount of senior unsecured bonds (the “Bonds”) exchangeable into ordinary shares of Koninklijke KPN N.V. (the “Exchangeable Bond Offering”). The Bonds will have a maturity of 3 years, they will not

bear interest (zero-coupon) and will be issued at an issue price of 104.75% of their principal amount, resulting in an annual

yield-to-maturity of (1.53)%. The aggregate proceeds from the Bonds will be approximately EUR 2.2 billion. The Bonds will be exchangeable into Koninklijke KPN N.V.

(“KPN”) ordinary shares and the initial exchange price has been set at EUR 3.1185, a premium of 15 per cent. above the Reference Price of EUR 2.7117 (the volume weighted average price of the KPN ordinary shares on Euronext Amsterdam

on 23 February 2021). The Exchangeable Bond Offering is expected to close on 2 March 2021.

Underlying the Bonds are approximately

672.4 million KPN shares, corresponding to approximately 16.0% of the currently outstanding share capital of KPN. In line with market practice for equity-linked transactions in Europe, the Bonds were placed with institutional investors outside

the US, in accordance with Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”).

The Issuer will have

the option to redeem all, but not some only, of the Bonds in certain circumstances, including from approximately 1.5 years after the issue date at their principal amount provided that the value of the pro rata share of the Exchange Property in

respect of a Bond shall have exceeded 125 per cent. of the principal amount of a Bond over a specified period.

If not previously exchanged or

redeemed, the Bonds will be redeemed at their principal amount on the maturity date, expected to be 2 March 2024. Upon redemption at maturity, the Issuer will have the flexibility to settle all or part of the redemption value in shares. Upon

exchange, the Issuer will have the flexibility to settle in cash, deliver the underlying KPN shares or a combination thereof.

AMX has agreed not to

place any further KPN shares (the “Shares”) in the market for a period beginning today and ending 90 days following the closing of the Exchangeable Bond Offering, subject to customary exceptions. The Issuer will use the proceeds of the

Exchangeable Bond Offering for general corporate purposes.

An application will be made to admit the Bonds to trading on an internationally

recognised, regularly operating, regulated or non-regulated stock exchange as determined by the Issuer.

Citigroup Global Markets Europe AG is acting as Sole Global Coordinator. Citigroup Global Markets Europe AG, BofA Securities Europe SA and Barclays Bank

PLC are acting as Joint Bookrunners.

Disclaimer

NEITHER THIS PRESS RELEASE NOR ANY COPY OF IT MAY BE TAKEN OR TRANSMITTED INTO THE UNITED STATES, AUSTRALIA, JAPAN OR SOUTH AFRICA. THE DISTRIBUTION OF

THIS PRESS RELEASE IN OTHER JURISDICTIONS MAY BE RESTRICTED BY LAW AND PERSONS INTO WHOSE POSSESSION THIS PRESS RELEASE COMES SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH RESTRICTIONS. BY ACCEPTING THIS PRESS RELEASE POTENTIAL INVESTORS AGREE

TO BE BOUND BY THE FOREGOING INSTRUCTIONS.

THE BONDS MENTIONED IN THIS PRESS RELEASE HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S.

SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) AND MAY NOT BE OFFERED, SOLD OR DELIVERED WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS SUCH TERMS ARE DEFINED IN REGULATION S

UNDER THE SECURITIES ACT) ABSENT REGISTRATION OR AN EXEMPTION FROM THE APPLICABLE REGISTRATION REQUIREMENTS UNDER THE SECURITIES ACT. THERE WILL BE NO PUBLIC OFFER OF THE BONDS IN THE UNITED STATES OR IN ANY OTHER JURISDICTION.

THIS DOCUMENT IS AN ADVERTISEMENT AND DOES NOT COMPRISE A PROSPECTUS FOR THE PURPOSES OF THE PROSPECTUS REGULATION (AS DEFINED BELOW) AND/OR PART VI OF

THE FINANCIAL SERVICES AND MARKETS ACT 2000 OF THE UNITED KINGDOM OR OTHERWISE.

THIS PRESS RELEASE IS DIRECTED EXCLUSIVELY AT MARKET PROFESSIONALS

AND INSTITUTIONAL INVESTORS, BEING “QUALIFIED INVESTORS” WITHIN THE MEANING OF THE PROSPECTUS REGULATION. IT IS FOR INFORMATION PURPOSES ONLY AND IS NOT TO BE RELIED UPON IN SUBSTITUTION FOR THE EXERCISE OF INDEPENDENT JUDGEMENT. IT IS NOT

INTENDED AS INVESTMENT ADVICE AND UNDER NO CIRCUMSTANCES IS IT TO BE USED OR CONSIDERED AS AN OFFER TO SELL TO, OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY SECURITY.

THIS PRESS RELEASE AND THE OFFERING WHEN MADE ARE ONLY ADDRESSED TO, AND DIRECTED IN, MEMBER STATES OF THE EUROPEAN ECONOMIC AREA (THE

“EEA”) AND THE UNITED KINGDOM, AT PERSONS WHO ARE “QUALIFIED INVESTORS” WITHIN THE MEANING OF THE PROSPECTUS REGULATION (“QUALIFIED INVESTORS”). FOR THESE PURPOSES, THE EXPRESSION “PROSPECTUS

REGULATION” MEANS, RESPECTIVELY, REGULATION 2017/1129 AND REGULATION 2017/1129 AS IT FORMS PART OF THE UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 AS AMENDED (THE “EUWA”).

IN ADDITION, IN THE UNITED KINGDOM THIS PRESS RELEASE IS BEING DISTRIBUTED ONLY TO, AND IS DIRECTED ONLY AT, QUALIFIED INVESTORS (I) WHO HAVE

PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS FALLING WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER”) AND QUALIFIED INVESTORS FALLING WITHIN

ARTICLE 49(2)(A) TO (D) OF THE ORDER, AND (II) TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT PERSONS”).

THIS PRESS RELEASE MUST NOT BE ACTED ON OR RELIED ON (I) IN THE UNITED KINGDOM, BY PERSONS WHO ARE NOT RELEVANT PERSONS, AND (II) IN ANY

MEMBER STATE OF THE EEA, BY PERSONS WHO ARE NOT QUALIFIED INVESTORS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PRESS RELEASE RELATES IS AVAILABLE ONLY TO (A) RELEVANT PERSONS IN THE UNITED KINGDOM AND WILL BE ENGAGED IN ONLY WITH

RELEVANT PERSONS IN THE UNITED KINGDOM AND (B) QUALIFIED INVESTORS IN MEMBER STATES OF THE EEA.

THIS PRESS RELEASE AND ANY INFORMATION ISSUED BY THE ISSUER AND/OR AMX ON THE TERMS OF THE BONDS IS SOLELY

THE RESPONSIBILITY OF THE ISSUER AND AMX RESPECTIVELY AND HAS NOT BEEN REVIEWED OR AUTHORISED BY THE MEXICAN NATIONAL BANKING AND SECURITIES COMMISSION (COMISIÓN NACIONAL BANCARIA Y DE VALORES, OR “CNBV”). THE TERMS AND

CONDITIONS OF THE OFFERING OF THE BONDS WILL BE NOTIFIED TO THE CNBV FOR INFORMATION PURPOSES ONLY AND SUCH NOTICE DOES NOT CONSTITUTE A CERTIFICATION AS TO THE INVESTMENT VALUE OF THE BONDS OR THE SOLVENCY OF THE ISSUER, AMX OR KPN. THE BONDS MAY

NOT BE OFFERED OR SOLD IN MEXICO, ABSENT AN AVAILABLE EXEMPTION UNDER THE MEXICAN SECURITIES MARKET LAW (LEY DEL MERCADO DE VALORES). IN MAKING AN INVESTMENT DECISION, ALL INVESTORS, INCLUDING ANY MEXICAN CITIZEN WHO MAY ACQUIRE BONDS FROM TIME TO

TIME, MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER, AMX AND KPN.

THIS PRESS RELEASE CONTAINS CERTAIN FORWARD-LOOKING STATEMENTS THAT

REFLECT THE CURRENT VIEWS AND/OR EXPECTATIONS OF AMX AND ITS MANAGEMENT WITH RESPECT TO ITS PERFORMANCE, BUSINESS AND FUTURE EVENTS. WE USE WORDS SUCH AS “BELIEVE,” “ANTICIPATE,” “PLAN,” “EXPECT,”

“INTEND,” “TARGET,” “ESTIMATE,” “PROJECT,” “PREDICT,” “FORECAST,” “GUIDELINE,” “SHOULD” AND OTHER SIMILAR EXPRESSIONS TO IDENTIFY FORWARD-LOOKING STATEMENTS, BUT THEY

ARE NOT THE ONLY WAY WE IDENTIFY SUCH STATEMENTS. SUCH STATEMENTS ARE SUBJECT TO A NUMBER OF RISKS, UNCERTAINTIES AND ASSUMPTIONS. WE CAUTION YOU THAT A NUMBER OF IMPORTANT FACTORS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE PLANS,

OBJECTIVES, EXPECTATIONS, ESTIMATES AND INTENTIONS EXPRESSED IN THIS RELEASE. AMX IS UNDER NO OBLIGATION AND EXPRESSLY DISCLAIMS ANY INTENTION OR OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION,

FUTURE EVENTS OR OTHERWISE.

ANY DECISION TO PURCHASE ANY OF THE BONDS SHOULD ONLY BE MADE ON THE BASIS OF AN INDEPENDENT REVIEW BY A PROSPECTIVE

INVESTOR OF THE ISSUER’S, THE GUARANTOR’S AND KPN’S PUBLICLY AVAILABLE INFORMATION. NEITHER THE JOINT BOOKRUNNERS NOR ANY OF THEIR RESPECTIVE AFFILIATES ACCEPT ANY LIABILITY ARISING FROM THE USE OF, OR MAKE ANY REPRESENTATION AS TO

THE ACCURACY OR COMPLETENESS OF, THIS PRESS RELEASE OR THE ISSUER’S, THE GUARANTOR’S AND/OR KPN’S PUBLICLY AVAILABLE INFORMATION.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: February 23, 2021

|

|

|

|

AMÉRICA MÓVIL, S.A.B. DE C.V.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Carlos José García Moreno Elizondo

|

|

|

|

|

|

Name:

|

|

Carlos José García Moreno Elizondo

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

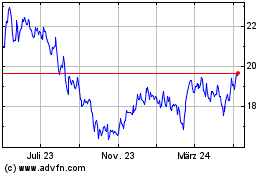

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

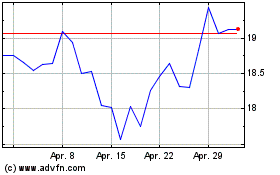

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025