Final Agreements Signed Between PSA Peugeot Citroën, Dongfeng Motor Group, the French State & the Family-Owned Etablissement...

26 März 2014 - 7:20PM

Business Wire

- Strengthening and deepening the

existing manufacturing and sales partnership with Dongfeng Motor

Group (DFG)

- Manufacturing synergies estimated at

around €400 million a year for PSA Peugeot Citroën in 2020

- Share and rights issues totalling €3

billion, of which €800 million taken up by DFG and €800 million by

the French State

- Share warrants granted without

consideration to existing shareholders

- A balanced shareholder structure for

Peugeot SA, with the French State, the family-owned Etablissements

Peugeot Frères and FFP and DFG each owning 14%.

Regulatory News:

In Paris today, Pierre Moscovici, France’s Minister of Economy

and Finance, Philippe Varin, Chairman of the PSA Peugeot Citroën

(Paris:UG) Managing Board, Xu Ping, Chairman of the Board of

Directors of DFG, Robert Peugeot, Chairman and Chief Executive

Officer of FFP and Jean-Philippe Peugeot, Chairman and Chief

Executive Officer of Etablissements Peugeot Frères, signed the

final agreements concerning the share and rights issues announced

last 19 February.

The ceremony was attended by Xi Jinping, President of the

People’s Republic of Chine and François Hollande, President of

France.

Capitalising on the success of their cooperation initiated more

than 20 years ago, PSA Peugeot Citroën and DFG today opened a new

phase with the signature of the final agreement concerning their

strategic manufacturing and sales partnership.

This strategic partnership covers three aspects:

- Increasing output at DPCA, the

Wuhan-based joint venture created in China by DFG and PSA Peugeot

Citroën, with the objective of producing and selling 1.5 million

vehicles per year in 2020.

- Creating a joint R&D centre in

China, dedicated to the development of products and technologies

for fast-growing markets, including China,

- Creating a new joint venture to drive

the sales of Peugeot, Citroën and Feng Shen (DPCA own

brand)-branded vehicles in South-east Asia and possibly in other

emerging markets.

Thanks to this partnership, PSA Peugeot Citroën and DFG estimate

that they will each be able to generate around €400 million in

manufacturing synergies a year in 2020.

About PSA Peugeot Citroën

With its two world-renowned brands, Peugeot and Citroën, PSA

Peugeot Citroën sold 2.8 million vehicles worldwide in

2013, of which 42% outside Europe. The second largest carmaker in

Europe, PSA Peugeot Citroën recorded sales and revenue of €54

billion in 2013. The Group is the European leader in terms of CO2

emissions, with an average of 115.9 grams of CO2/km in 2013. PSA

Peugeot Citroën has sales operations in 160 countries. It is also

involved in financing activities (Banque PSA Finance) and

automotive equipment (Faurecia). For more information, please visit

www.psa-peugeot-citroen.com

About the PSA Peugeot Citroën capital increase

As announced last 19 February, the agreements provide for the

issue of new shares and rights to new shares in a total amount of

€3 billion and the grant of share warrants without consideration to

existing Peugeot SA shareholders, under the following terms and

conditions:

- A restricted share issue, in an amount

of €1,048 million, would be taken up equally by DFG and the French

State on the basis of €7.50 per share.

- A rights issue, in an amount of around

€1,950 million and open to all Peugeot SA shareholders, including

DFG and the French State, would be underwritten by a broad banking

syndicate for the portion not taken up by DFG, the French State and

FFP/EPF.

- Prior to these issues, warrants would

be granted without consideration to existing Peugeot SA

shareholders (i.e. excluding DFG and the French State) on the basis

of one warrant for every share held, with ten warrants giving the

right to purchase three new shares. These warrants would expire in

three years, with the possibility of exercise from the second year

at the same price as the shares issued under the offer restricted

to DFG and the French State, e.g. €7.50 per share.

Through these issues, DFG and the French State are expected to

invest €800 million each in Peugeot SA, giving them a 14% stake in

the Company, the same as the Peugeot family group.

The restricted share issues and the grant of warrants without

consideration will be described in a prospectus filed with French

securities regulator AMF before the Annual Meeting of Peugeot SA

shareholders called for 24 April 2014. The rights issue will be

described in a prospectus filed after the Annual Meeting.

A share issue restricted to employees will also be carried out

in 2014, in order to give them a greater stake in their Group’s

recovery.

These transactions are subject to obtaining the related

regulatory authorisations in France and China, as well as to the

approval of Peugeot SA shareholders at the Annual Meeting.

Important information

No communication and no information in respect of this

transaction may be distributed to the public in any jurisdiction

where a registration or approval is required. No steps have been or

will be taken in any jurisdiction (other than France) where such

steps would be required. The issue, the subscription for or the

purchase of Peugeot S.A.’s shares and/or warrants may be subject to

specific legal or regulatory restrictions in certain jurisdictions.

Peugeot S.A. assumes no responsibility for any violation of any

such restrictions by any person.

This announcement is not a prospectus within the meaning of

Directive 2003/71/EC of the European Parliament and the Council of

November 4th, 2003, as amended, in particular by Directive

2010/73/EU to the extent such Directive has been transposed in the

relevant member State of the European Economic Area (together, the

“Prospectus Directive”).

No securities offering will be opened to the public in France

before the delivery of the visa on a prospectus prepared in

compliance with the Prospectus Directive, as approved by the French

Autorité des marchés financiers.

With respect to the member States of the European Economic Area

which have implemented the Prospectus Directive (each, a “relevant

member State”), other than France, no action has been undertaken or

will be undertaken to make an offer to the public of the securities

requiring publication of a prospectus in any relevant member State.

As a result, the new shares and/or warrants of Peugeot S.A. may

only be offered in relevant member States (i) to qualified

investors, as defined by the Prospectus Directive; or (ii) in any

other circumstances, not requiring Peugeot S.A. to publish a

prospectus as provided under Article 3(2) of the Prospectus

Directive.

The distribution of this press release is not made, and has not

been approved, by an “authorised person” within the meaning of

Article 21(1) of the Financial Services and Markets Act 2000. As a

consequence, this press release is directed only at persons who (i)

are located outside the United Kingdom, (ii) have professional

experience in matters relating to investments within the meaning of

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotions) Order 2005 (as amended), (iii) are persons

falling within Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Financial Services and

Markets Act 2000 (Financial Promotions) Order 2005 (as amended) or

(iv) are persons to whom this press release may otherwise lawfully

be communicated (all such persons mentioned in paragraphs (i),

(ii), (iii) et (iv) collectively being referred to as “Relevant

Persons”). The securities are directed only at Relevant Persons and

no invitation, offer or agreements to subscribe, purchase or

acquire the securities may be proposed or made other than with

Relevant Persons. Any person other than a Relevant Person may not

act or rely on this document or any provision thereof. This press

release is not a prospectus which has been approved by the

Financial Conduct Authority or any other United Kingdom regulatory

authority within the meaning of Section 85 of the Financial

Services and Markets Act 2000.

This press release does not constitute or form a part of any

offer or solicitation to purchase or subscribe for securities in

the United States. Securities may not be offered, subscribed or

sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the “U.S. Securities Act”),

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements thereof. The warrants and

the shares of Peugeot S.A. and rights in respect thereof have not

been and will not be registered under the U.S. Securities Act and

Peugeot S.A. does not intend to make a public offer of its

securities in the United States.

The distribution of this document in certain countries may

constitute a breach of applicable law. The information contained in

this document does not constitute an offer of securities for sale

in the United States, Canada, Australia or Japan.

This press release may not be published, forwarded or

distributed, directly or indirectly, in the United States

(including its territories and dependencies and any state of the

United States), Canada, Australia or Japan.

Media contacts:PSA Peugeot Citroën+33(0)1 40 66 42 00

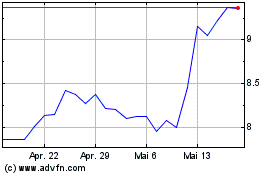

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

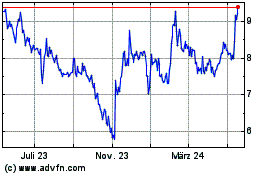

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024