NVIDIA (NASDAQ: NVDA) today reported revenue for the third quarter

ended October 30, 2022, of $5.93 billion, down 17% from a year ago

and down 12% from the previous quarter.

GAAP earnings per diluted share for the quarter were $0.27, down

72% from a year ago and up 4% from the previous quarter. Non-GAAP

earnings per diluted share were $0.58, down 50% from a year ago and

up 14% from the previous quarter.

“We are quickly adapting to the macro environment, correcting

inventory levels and paving the way for new products,” said Jensen

Huang, founder and CEO of NVIDIA.

“The ramp of our new platforms ― Ada Lovelace RTX graphics,

Hopper AI computing, BlueField and Quantum networking, Orin for

autonomous vehicles and robotics, and Omniverse ― is off to a great

start and forms the foundation of our next phase of growth.

“NVIDIA’s pioneering work in accelerated computing is more vital

than ever. Limited by physics, general purpose computing has slowed

to a crawl, just as AI demands more computing. Accelerated

computing lets companies achieve orders-of-magnitude increases in

productivity while saving money and the environment,” he said.

During the third quarter of fiscal 2023, NVIDIA returned to

shareholders $3.75 billion in share repurchases and cash dividends,

bringing the return in the first three quarters to $9.29 billion.

As of October 30, 2022, the company had $8.28 billion remaining

under its share repurchase authorization through December 2023.

NVIDIA will pay its next quarterly cash dividend of $0.04 per

share on December 22, 2022, to all shareholders of record on

December 1, 2022.

Q3 Fiscal 2023 Summary

|

GAAP |

|

($ in millions, except earnings per share) |

Q3 FY23 |

Q2 FY23 |

Q3 FY22 |

Q/Q |

Y/Y |

|

Revenue |

$5,931 |

|

$6,704 |

|

$7,103 |

|

Down 12% |

Down 17% |

|

Gross margin |

53.6 |

% |

|

43.5 |

% |

|

65.2 |

% |

Up 10.1 pts |

Down 11.6 pts |

|

Operating expenses |

$2,576 |

|

$2,416 |

|

$1,960 |

|

Up 7% |

Up 31% |

|

Operating income |

$601 |

|

$499 |

|

$2,671 |

|

Up 20% |

Down 77% |

|

Net income |

$680 |

|

$656 |

|

$2,464 |

|

Up 4% |

Down 72% |

|

Diluted earnings per share |

$0.27 |

|

$0.26 |

|

$0.97 |

|

Up 4% |

Down 72% |

|

Non-GAAP |

|

($ in millions, except earnings per share) |

Q3 FY23 |

Q2 FY23 |

Q3 FY22 |

Q/Q |

Y/Y |

|

Revenue |

$5,931 |

|

$6,704 |

|

$7,103 |

|

Down 12% |

Down 17% |

|

Gross margin |

56.1 |

% |

|

45.9 |

% |

|

67.0 |

% |

Up 10.2 pts |

Down 10.9 pts |

|

Operating expenses |

$1,793 |

|

$1,749 |

|

$1,375 |

|

Up 3% |

Up 30% |

|

Operating income |

$1,536 |

|

$1,325 |

|

$3,386 |

|

Up 16% |

Down 55% |

|

Net income |

$1,456 |

|

$1,292 |

|

$2,973 |

|

Up 13% |

Down 51% |

|

Diluted earnings per share |

$0.58 |

|

$0.51 |

|

$1.17 |

|

Up 14% |

Down 50% |

OutlookNVIDIA’s outlook for the

fourth quarter of fiscal 2023 is as follows:

- Revenue is expected to be $6.00 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins are expected to be 63.2% and

66.0%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be

approximately $2.56 billion and $1.78 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be

an income of approximately $40 million, excluding gains and losses

from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 9.0%, plus or

minus 1%, excluding any discrete items.

Highlights

NVIDIA achieved progress since its previous earnings

announcement in these areas:

Data Center

- Third-quarter revenue was $3.83 billion, up 31% from a year ago

and up 1% from the previous quarter.

- Began shipping the NVIDIA® H100 Tensor Core GPU based on

the new NVIDIA Hopper™ architecture, with first systems available

now.

- Announced at the SC22 supercomputing conference that NVIDIA

H100 and Quantum-2 systems are being broadly adopted; that NVIDIA

Omniverse™ connects to leading scientific computing visualization

software; and that NVIDIA powers 90% of the new systems in the

latest TOP500 list of the world’s fastest supercomputers, including

the H100-powered system deployed at the Flatiron Institute, in the

U.S, which topped the Green500 list of the most-efficient

systems.

- Announced a multi-year collaboration with Microsoft to help

enterprises train, deploy and scale AI, including state-of-the-art

models, through Microsoft Azure, which is deploying tens of

thousands of A100 and H100 GPUs.

- Announced a multi-year partnership with Oracle to bring

NVIDIA’s full accelerated computing stack to Oracle Cloud

Infrastructure, which is deploying tens of thousands more NVIDIA

GPUs, including A100 and H100 accelerators.

- Announced a partnership with Nuance Communications to bring

AI-based diagnostic tools to clinical radiologists.

- Announced that Rescale is integrating NVIDIA AI Enterprise

software into its HPC-as-a-service offering.

- Announced two new large language model cloud AI services —

NVIDIA NeMo™ LLM and NVIDIA BioNeMo™ LLM — enabling developers to

easily adapt LLMs and deploy customized AI applications for content

generation, text summarization, protein structure and biomolecular

property predictions, and more.

- Announced that NVIDIA H100 Tensor Core GPUs set records in both

AI inference and AI training on all workloads in their first

appearances on the MLPerf AI benchmarks.

- Unveiled the second generation of NVIDIA OVX™, powered by the

Ada Lovelace GPU architecture and enhanced networking technology,

enabling the creation of 3D worlds with groundbreaking

real-time graphics, AI and digital-twin simulation

capabilities.

- Announced a new data center solution delivering zero-trust

security optimized for VMware vSphere 8 combining Dell PowerEdge

servers with NVIDIA BlueField® DPUs, NVIDIA GPUs and NVIDIA AI

Enterprise software.

Gaming

- Third-quarter revenue was $1.57 billion, down 51% from a year

ago and down 23% from the previous quarter.

- Launched GeForce RTX™ 4090, the first Ada Lovelace architecture

GPU for gamers and creators, which quickly sold out in many

locations. Sales began today of the RTX 4080.

- Introduced NVIDIA DLSS 3, an AI-powered performance multiplier

for a new era of NVIDIA RTX™ neural rendering. More than 240 DLSS

games and applications are now available, and 35 have announced

support for DLSS 3, including Marvel’s Spider-Man Remastered,

Cyberpunk 2077 and Microsoft Flight Simulator.

- Shipped 37 new RTX games and apps, pushing up the total

available to more than 360.

- Expanded the GeForce NOW™ library with 85+ games, bringing the

total available games to 1,400+.

Professional Visualization

- Third-quarter revenue was $200 million, down 65% from a year

ago and down 60% from the previous quarter.

- Introduced NVIDIA Omniverse™ Cloud, the company’s first

software- and infrastructure-as-a-service offering, with a

comprehensive suite of cloud services for artists, developers and

enterprise teams to access metaverse applications.

Automotive and Embedded

- Third-quarter revenue was $251 million, up 86% from a year ago

and up 14% from the previous quarter.

- Introduced NVIDIA DRIVE Thor™, the company’s 2,000 TFLOPS

next-generation centralized computer for safe and secure autonomous

vehicles, with Geely-owned ZEEKR integrating it into electric

vehicles in 2025.

- Marked the launch of the all-electric Volvo EX90, powered by

NVIDIA DRIVE Orin and Xavier™, and Polestar 3, the brand’s first

SUV, which runs on the NVIDIA DRIVE™ platform.

- Announced that Hozon Auto’s Neta brand will build future

electric vehicles on the NVIDIA DRIVE Orin™ platform, enabling

automated driving and intelligent features.

- Announced new DRIVE IX ecosystem partners that are building on

the company’s open AI cockpit software stack to deliver interactive

features for vehicles.

- Launched Jetson Orin Nano™ system-on-modules that deliver up to

80x the performance over the prior generation for entry-level edge

AI and robotics.

CFO CommentaryCommentary on the quarter by

Colette Kress, NVIDIA’s executive vice president and chief

financial officer, is available at

https://investor.nvidia.com/.

Conference Call and Webcast InformationNVIDIA

will conduct a conference call with analysts and investors to

discuss its third quarter fiscal 2023 financial results and current

financial prospects today at 2 p.m. Pacific time (5 p.m. Eastern

time). A live webcast (listen-only mode) of the conference call

will be accessible at NVIDIA’s investor relations website,

https://investor.nvidia.com. The webcast will be recorded and

available for replay until NVIDIA’s conference call to discuss its

financial results for its fourth quarter and fiscal 2023.

Non-GAAP MeasuresTo supplement NVIDIA’s

condensed consolidated financial statements presented in accordance

with GAAP, the company uses non-GAAP measures of certain components

of financial performance. These non-GAAP measures include non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP income from operations, non-GAAP other income (expense),

net, non-GAAP net income, non-GAAP net income, or earnings, per

diluted share, and free cash flow. For NVIDIA’s investors to be

better able to compare its current results with those of previous

periods, the company has shown a reconciliation of GAAP to non-GAAP

financial measures. These reconciliations adjust the related GAAP

financial measures to exclude acquisition termination costs,

stock-based compensation expense, acquisition-related and other

costs, contributions, IP-related costs, legal settlement costs,

restructuring costs, gains and losses from non-affiliated

investments, interest expense related to amortization of debt

discount, the associated tax impact of these items where applicable

and domestication tax benefit. Free cash flow is calculated as GAAP

net cash provided by operating activities less both purchases of

property and equipment and intangible assets and principal payments

on property and equipment and intangible assets. NVIDIA believes

the presentation of its non-GAAP financial measures enhances the

user’s overall understanding of the company’s historical financial

performance. The presentation of the company’s non-GAAP financial

measures is not meant to be considered in isolation or as a

substitute for the company’s financial results prepared in

accordance with GAAP, and the company’s non-GAAP measures may be

different from non-GAAP measures used by other companies.

About NVIDIASince its founding in 1993, NVIDIA

(NASDAQ: NVDA) has been a pioneer in accelerated computing. The

company’s invention of the GPU in 1999 sparked the growth of the PC

gaming market, redefined computer graphics, ignited the era of

modern AI and is fueling the creation of the metaverse. NVIDIA is

now a full-stack computing company with data-center-scale offerings

that are reshaping industry. More information at

https://nvidianews.nvidia.com/.

For further information, contact:

|

Simona Jankowski |

Robert Sherbin |

|

Investor Relations |

Corporate Communications |

|

NVIDIA Corporation |

NVIDIA Corporation |

|

sjankowski@nvidia.com |

rsherbin@nvidia.com |

|

|

|

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0b2b7b7d-12bb-4da3-a570-cce517e9f884

Certain statements in this press release including, but not

limited to, statements as to: NVIDIA quickly adapting to the macro

environment, correcting inventory levels and paving the way for new

products; the ramp of NVIDIA’s new platforms forming the foundation

of NVIDIA’s next phase of growth; NVIDIA’s pioneering work in

accelerated computing being more vital than ever; AI demanding more

computing; accelerated computing letting companies achieve

orders-of-magnitude increases in productivity while saving money

and the environment; NVIDIA’s next quarterly cash dividend;

NVIDIA’s financial outlook for the fourth quarter of fiscal 2023;

NVIDIA’s expected tax rates for the fourth quarter of fiscal 2023;

the benefits, impact, performance, and availabilities of our

products and technologies; NVIDIA H100 and Quantum-2 systems being

broadly adopted; the multi-year collaboration with Microsoft to

help enterprises train, deploy and scale AI, including

state-of-the-art models; the multi-year partnership with Oracle to

bring NVIDIA’s full accelerated computing stack to Oracle Cloud

Infrastructure; the partnership with Nuance Communications to bring

AI-based diagnostic tools to clinical radiologists; Rescale

integrating NVIDIA AI Enterprise into its HPC-as-a-service

offering; NVIDIA NeMo LLM and NVIDIA BioNeMo LLM enabling

developers to easily adapt LLMs and deploy customized AI

applications for content generation, text summarization, protein

structure, biomolecular property predictions, and more; the second

generation of NVIDIA OVX enabling the creation of 3D worlds with

groundbreaking real-time graphics, AI and digital-twin simulation

capabilities; the new data center solution delivering zero-trust

security optimized for VMware vSphere 8 combining Dell PowerEdge

servers with NVIDIA BlueField DPUs, NVIDIA GPUs and NVIDIA AI

Enterprise software; NVIDIA Omniverse Cloud providing a

comprehensive suite of cloud services for artists, developers and

enterprise teams to access metaverse applications; ZEEKR

integrating NVIDIA DRIVE Thor into electric vehicles in 2025; Hozon

Auto’s Neta brand building future electric vehicles on the NVIDIA

DRIVE Orin platform, enabling automated driving and intelligent

features; new DRIVE IX ecosystem partners building on the company’s

open AI cockpit software stack to deliver interactive features for

vehicles; and the Jetson Orin Nano system-on-modules delivering up

to 80x the performance over the prior generation for entry-level

edge AI and robotics are forward-looking statements that are

subject to risks and uncertainties that could cause results to be

materially different than expectations. Important factors that

could cause actual results to differ materially include: global

economic conditions; our reliance on third parties to manufacture,

assemble, package and test our products; the impact of

technological development and competition; development of new

products and technologies or enhancements to our existing product

and technologies; market acceptance of our products or our

partners’ products; design, manufacturing or software defects;

changes in consumer preferences or demands; changes in industry

standards and interfaces; unexpected loss of performance of our

products or technologies when integrated into systems; as well as

other factors detailed from time to time in the most recent reports

NVIDIA files with the Securities and Exchange Commission, or SEC,

including, but not limited to, its annual report on Form 10-K and

quarterly reports on Form 10-Q. Copies of reports filed with the

SEC are posted on the company’s website and are available from

NVIDIA without charge. These forward-looking statements are not

guarantees of future performance and speak only as of the date

hereof, and, except as required by law, NVIDIA disclaims any

obligation to update these forward-looking statements to reflect

future events or circumstances.

© 2022 NVIDIA Corporation. All rights reserved. NVIDIA, the

NVIDIA logo, GeForce, GeForce NOW, GeForce RTX, Jetson Orin Nano,

NVIDIA BioNeMo, NVIDIA BlueField, NVIDIA DRIVE, NVIDIA DRIVE Orin,

NVIDIA DRIVE Thor, NVIDIA Hopper, NVIDIA NeMo, NVIDIA RTX, NVIDIA

OVX and NVIDIA Omniverse are trademarks and/or registered

trademarks of NVIDIA Corporation in the U.S. and/or other

countries. Other company and product names may be trademarks of the

respective companies with which they are associated. Features,

pricing, availability, and specifications are subject to change

without notice.

| |

| NVIDIA

CORPORATION |

| CONDENSED

CONSOLIDATED STATEMENTS OF INCOME |

| (In millions, except

per share data) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

October

30, |

|

October

31, |

|

October

30, |

|

October

31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

5,931 |

|

|

$ |

7,103 |

|

|

$ |

20,923 |

|

|

$ |

19,271 |

|

|

Cost of revenue |

|

2,754 |

|

|

|

2,472 |

|

|

|

9,400 |

|

|

|

6,795 |

|

|

Gross profit |

|

3,177 |

|

|

|

4,631 |

|

|

|

11,523 |

|

|

|

12,476 |

|

|

Operating expenses |

|

|

|

|

|

|

|

| |

Research and development |

|

1,945 |

|

|

|

1,403 |

|

|

|

5,387 |

|

|

|

3,802 |

|

| |

Sales, general and administrative |

|

631 |

|

|

|

557 |

|

|

|

1,815 |

|

|

|

1,603 |

|

| |

Acquisition termination cost |

|

- |

|

|

|

- |

|

|

|

1,353 |

|

|

|

- |

|

| |

|

Total

operating expenses |

|

2,576 |

|

|

|

1,960 |

|

|

|

8,555 |

|

|

|

5,405 |

|

|

Income from operations |

|

601 |

|

|

|

2,671 |

|

|

|

2,968 |

|

|

|

7,071 |

|

| |

Interest income |

|

88 |

|

|

|

7 |

|

|

|

152 |

|

|

|

20 |

|

| |

Interest expense |

|

(65 |

) |

|

|

(62 |

) |

|

|

(198 |

) |

|

|

(175 |

) |

| |

Other, net |

|

(11 |

) |

|

|

22 |

|

|

|

(29 |

) |

|

|

160 |

|

| |

|

Other income

(expense), net |

|

12 |

|

|

|

(33 |

) |

|

|

(75 |

) |

|

|

5 |

|

|

Income before income tax |

|

613 |

|

|

|

2,638 |

|

|

|

2,893 |

|

|

|

7,076 |

|

|

Income tax expense (benefit) |

|

(67 |

) |

|

|

174 |

|

|

|

(61 |

) |

|

|

327 |

|

|

Net income |

$ |

680 |

|

|

$ |

2,464 |

|

|

$ |

2,954 |

|

|

$ |

6,749 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

| |

Basic |

$ |

0.27 |

|

|

$ |

0.99 |

|

|

$ |

1.18 |

|

|

$ |

2.71 |

|

| |

Diluted |

$ |

0.27 |

|

|

$ |

0.97 |

|

|

$ |

1.17 |

|

|

$ |

2.67 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in per share computation: |

|

|

|

|

|

|

| |

Basic |

|

2,483 |

|

|

|

2,499 |

|

|

|

2,495 |

|

|

|

2,493 |

|

| |

Diluted |

|

2,499 |

|

|

|

2,538 |

|

|

|

2,517 |

|

|

|

2,532 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| NVIDIA

CORPORATION |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| (In millions) |

| (Unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

October

30, |

|

January

30, |

|

|

|

|

|

|

2022 |

|

|

|

2022 |

|

|

ASSETS |

|

|

|

|

| |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

| |

Cash, cash equivalents and marketable securities |

|

$ |

13,143 |

|

|

$ |

21,208 |

|

| |

Accounts receivable, net |

|

|

4,908 |

|

|

|

4,650 |

|

| |

Inventories |

|

|

4,454 |

|

|

|

2,605 |

|

| |

Prepaid expenses and other current assets |

|

|

718 |

|

|

|

366 |

|

| |

|

Total

current assets |

|

|

23,223 |

|

|

|

28,829 |

|

| |

|

|

|

|

|

|

|

Property and equipment, net |

|

|

3,774 |

|

|

|

2,778 |

|

|

Operating lease assets |

|

|

927 |

|

|

|

829 |

|

|

Goodwill |

|

|

4,372 |

|

|

|

4,349 |

|

|

Intangible assets, net |

|

|

1,850 |

|

|

|

2,339 |

|

|

Deferred income tax assets |

|

|

2,762 |

|

|

|

1,222 |

|

|

Other assets |

|

|

3,580 |

|

|

|

3,841 |

|

| |

|

Total

assets |

|

$ |

40,488 |

|

|

$ |

44,187 |

|

| |

|

|

|

|

|

|

| LIABILITIES

AND SHAREHOLDERS' EQUITY |

| |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

| |

Accounts payable |

|

$ |

1,491 |

|

|

$ |

1,783 |

|

| |

Accrued and other current liabilities |

|

|

4,115 |

|

|

|

2,552 |

|

| |

Short-term debt |

|

|

1,249 |

|

|

|

- |

|

| |

|

Total

current liabilities |

|

|

6,855 |

|

|

|

4,335 |

|

| |

|

|

|

|

|

|

|

Long-term debt |

|

|

9,701 |

|

|

|

10,946 |

|

|

Long-term operating lease liabilities |

|

|

798 |

|

|

|

741 |

|

|

Other long-term liabilities |

|

|

1,785 |

|

|

|

1,553 |

|

| |

|

Total

liabilities |

|

|

19,139 |

|

|

|

17,575 |

|

| |

|

|

|

|

|

|

|

Shareholders' equity |

|

|

21,349 |

|

|

|

26,612 |

|

| |

|

Total

liabilities and shareholders' equity |

|

$ |

40,488 |

|

|

$ |

44,187 |

|

| |

|

|

|

|

|

|

| NVIDIA

CORPORATION |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In millions) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

October

30, |

October

31, |

October

30, |

October

31, |

| |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net income |

$ |

680 |

|

|

$ |

2,464 |

|

|

$ |

2,954 |

|

|

$ |

6,749 |

|

|

Adjustments to reconcile net income to net cash |

|

|

|

|

|

|

|

|

provided by operating activities: |

|

|

|

|

|

|

|

| |

Stock-based compensation expense |

|

745 |

|

|

|

559 |

|

|

|

1,971 |

|

|

|

1,453 |

|

| |

Depreciation and amortization |

|

406 |

|

|

|

298 |

|

|

|

1,118 |

|

|

|

865 |

|

| |

Losses (gains) on investments in non affiliates, net |

|

11 |

|

|

|

(21 |

) |

|

|

35 |

|

|

|

(152 |

) |

| |

Deferred income taxes |

|

(532 |

) |

|

|

(20 |

) |

|

|

(1,517 |

) |

|

|

(182 |

) |

| |

Acquisition termination cost |

|

- |

|

|

|

- |

|

|

|

1,353 |

|

|

|

- |

|

| |

Other |

|

(45 |

) |

|

|

10 |

|

|

|

(27 |

) |

|

|

25 |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

|

|

|

| |

Accounts receivable |

|

410 |

|

|

|

(366 |

) |

|

|

(258 |

) |

|

|

(1,523 |

) |

| |

Inventories |

|

(563 |

) |

|

|

(118 |

) |

|

|

(1,848 |

) |

|

|

(400 |

) |

| |

Prepaid expenses and other assets |

|

247 |

|

|

|

(1,575 |

) |

|

|

(1,307 |

) |

|

|

(1,557 |

) |

| |

Accounts payable |

|

(917 |

) |

|

|

141 |

|

|

|

(358 |

) |

|

|

385 |

|

| |

Accrued and other current liabilities |

|

(92 |

) |

|

|

(8 |

) |

|

|

1,175 |

|

|

|

159 |

|

| |

Other long-term liabilities |

|

42 |

|

|

|

155 |

|

|

|

102 |

|

|

|

253 |

|

|

Net cash provided by operating activities |

|

392 |

|

|

|

1,519 |

|

|

|

3,393 |

|

|

|

6,075 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

| |

Proceeds from maturities of marketable securities |

|

5,809 |

|

|

|

2,545 |

|

|

|

16,792 |

|

|

|

7,780 |

|

| |

Proceeds from sales of marketable securities |

|

75 |

|

|

|

211 |

|

|

|

1,806 |

|

|

|

916 |

|

| |

Purchases of marketable securities |

|

(2,188 |

) |

|

|

(6,752 |

) |

|

|

(9,764 |

) |

|

|

(16,020 |

) |

| |

Purchases

related to property and equipment and intangible assets |

|

|

(530 |

) |

|

|

(221 |

) |

|

|

(1,324 |

) |

|

|

(703 |

) |

| |

Acquisitions, net of cash acquired |

|

- |

|

|

|

(203 |

) |

|

|

(49 |

) |

|

|

(203 |

) |

| |

Investments and other, net |

|

(18 |

) |

|

|

(18 |

) |

|

|

(83 |

) |

|

|

(14 |

) |

|

Net cash provided by (used in) investing activities |

|

3,148 |

|

|

|

(4,438 |

) |

|

|

7,378 |

|

|

|

(8,244 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

| |

Proceeds related to employee stock plans |

|

143 |

|

|

|

149 |

|

|

|

349 |

|

|

|

277 |

|

| |

Payments related to repurchases of common stock |

|

(3,485 |

) |

|

|

- |

|

|

|

(8,826 |

) |

|

|

- |

|

| |

Payments related to tax on restricted stock units |

|

(294 |

) |

|

|

(440 |

) |

|

|

(1,131 |

) |

|

|

(1,282 |

) |

| |

Dividends paid |

|

(100 |

) |

|

|

(100 |

) |

|

|

(300 |

) |

|

|

(298 |

) |

| |

Principal

payments on property and equipment and intangible assets |

|

|

(18 |

) |

|

|

(22 |

) |

|

|

(54 |

) |

|

|

(62 |

) |

| |

Issuance of debt, net of issuance costs |

|

- |

|

|

|

(8 |

) |

|

|

- |

|

|

|

4,977 |

|

| |

Repayment of debt |

|

- |

|

|

|

(1,000 |

) |

|

|

- |

|

|

|

(1,000 |

) |

| |

Other |

|

1 |

|

|

|

- |

|

|

|

1 |

|

|

|

(2 |

) |

|

Net cash provided by (used in) financing activities |

|

(3,753 |

) |

|

|

(1,421 |

) |

|

|

(9,961 |

) |

|

|

2,610 |

|

|

Change in cash and cash equivalents |

|

(213 |

) |

|

|

(4,340 |

) |

|

|

810 |

|

|

|

441 |

|

|

Cash and cash equivalents at beginning of period |

|

3,013 |

|

|

|

5,628 |

|

|

|

1,990 |

|

|

|

847 |

|

|

Cash and cash equivalents at end of period |

$ |

2,800 |

|

|

$ |

1,288 |

|

|

$ |

2,800 |

|

|

$ |

1,288 |

|

| |

|

|

|

|

|

|

|

|

|

| |

NVIDIA

CORPORATION |

| |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

| |

(In millions, except

per share data) |

| |

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

October

30, |

|

July

31, |

|

October

31, |

|

October

30, |

|

October

31, |

| |

|

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP gross profit |

$ |

3,177 |

|

|

$ |

2,915 |

|

|

$ |

4,631 |

|

|

$ |

11,523 |

|

|

$ |

12,476 |

|

| |

GAAP gross margin |

|

53.6 |

% |

|

|

43.5 |

% |

|

|

65.2 |

% |

|

|

55.1 |

% |

|

|

64.7 |

% |

| |

|

Acquisition-related and other costs (A) |

|

120 |

|

|

|

121 |

|

|

|

86 |

|

|

|

335 |

|

|

|

258 |

|

| |

|

Stock-based compensation expense (B) |

|

32 |

|

|

|

38 |

|

|

|

44 |

|

|

|

108 |

|

|

|

102 |

|

| |

|

IP-related

costs |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

8 |

|

| |

Non-GAAP gross profit |

$ |

3,329 |

|

|

$ |

3,074 |

|

|

$ |

4,761 |

|

|

$ |

11,966 |

|

|

$ |

12,844 |

|

| |

|

Non-GAAP

gross margin |

|

|

56.1 |

% |

|

|

45.9 |

% |

|

|

67.0 |

% |

|

|

57.2 |

% |

|

|

66.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP operating expenses |

$ |

2,576 |

|

|

$ |

2,416 |

|

|

$ |

1,960 |

|

|

$ |

8,555 |

|

|

$ |

5,405 |

|

| |

|

Stock-based compensation expense (B) |

|

(713 |

) |

|

|

(611 |

) |

|

|

(515 |

) |

|

|

(1,863 |

) |

|

|

(1,351 |

) |

| |

|

Acquisition-related and other costs (A) |

|

(54 |

) |

|

|

(54 |

) |

|

|

(70 |

) |

|

|

(164 |

) |

|

|

(224 |

) |

| |

|

Restructuring costs (C) |

|

(16 |

) |

|

|

- |

|

|

|

- |

|

|

|

(16 |

) |

|

|

- |

|

| |

|

Contributions |

|

|

- |

|

|

|

(2 |

) |

|

|

- |

|

|

|

(2 |

) |

|

|

- |

|

| |

|

Acquisition termination cost |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,353 |

) |

|

|

- |

|

| |

|

Legal settlement costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7 |

) |

|

|

- |

|

| |

Non-GAAP operating expenses |

$ |

1,793 |

|

|

$ |

1,749 |

|

|

$ |

1,375 |

|

|

$ |

5,150 |

|

|

$ |

3,830 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP income from operations |

$ |

601 |

|

|

$ |

499 |

|

|

$ |

2,671 |

|

|

$ |

2,968 |

|

|

$ |

7,071 |

|

| |

|

Total impact of non-GAAP adjustments to income from operations |

|

935 |

|

|

|

826 |

|

|

|

715 |

|

|

|

3,848 |

|

|

|

1,943 |

|

| |

Non-GAAP income from operations |

$ |

1,536 |

|

|

$ |

1,325 |

|

|

$ |

3,386 |

|

|

$ |

6,816 |

|

|

$ |

9,014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP other income (expense), net |

$ |

12 |

|

|

$ |

(24 |

) |

|

$ |

(33 |

) |

|

$ |

(75 |

) |

|

$ |

5 |

|

| |

|

(Gains) losses from non-affiliated investments |

|

11 |

|

|

|

7 |

|

|

|

(20 |

) |

|

|

36 |

|

|

|

(153 |

) |

| |

|

Interest expense related to amortization of debt discount |

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

3 |

|

| |

Non-GAAP other income (expense), net |

$ |

24 |

|

|

$ |

(16 |

) |

|

$ |

(52 |

) |

|

$ |

(36 |

) |

|

$ |

(145 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP net income |

|

$ |

680 |

|

|

$ |

656 |

|

|

$ |

2,464 |

|

|

$ |

2,954 |

|

|

$ |

6,749 |

|

| |

|

Total pre-tax impact of non-GAAP adjustments |

|

947 |

|

|

|

833 |

|

|

|

696 |

|

|

|

3,887 |

|

|

|

1,793 |

|

| |

|

Income tax impact of non-GAAP adjustments (D) |

|

(171 |

) |

|

|

(197 |

) |

|

|

(187 |

) |

|

|

(649 |

) |

|

|

(381 |

) |

| |

|

Domestication tax adjustments |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(252 |

) |

| |

Non-GAAP net income |

$ |

1,456 |

|

|

$ |

1,292 |

|

|

$ |

2,973 |

|

|

$ |

6,192 |

|

|

$ |

7,909 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted net income per share |

|

|

|

|

|

|

|

|

|

| |

|

GAAP |

|

$ |

0.27 |

|

|

$ |

0.26 |

|

|

$ |

0.97 |

|

|

$ |

1.17 |

|

|

$ |

2.67 |

|

| |

|

Non-GAAP |

|

$ |

0.58 |

|

|

$ |

0.51 |

|

|

$ |

1.17 |

|

|

$ |

2.46 |

|

|

$ |

3.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average shares used in diluted net income per share

computation |

|

2,499 |

|

|

|

2,516 |

|

|

|

2,538 |

|

|

|

2,517 |

|

|

|

2,532 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP net cash provided by operating activities |

$ |

392 |

|

|

$ |

1,271 |

|

|

$ |

1,519 |

|

|

$ |

3,393 |

|

|

$ |

6,075 |

|

| |

|

Purchases related to property and equipment and intangible

assets |

|

(530 |

) |

|

|

(432 |

) |

|

|

(221 |

) |

|

|

(1,324 |

) |

|

|

(703 |

) |

| |

|

Principal payments on property and equipment |

|

(18 |

) |

|

|

(15 |

) |

|

|

(22 |

) |

|

|

(54 |

) |

|

|

(62 |

) |

| |

Free cash flow |

|

$ |

(156 |

) |

|

$ |

824 |

|

|

$ |

1,276 |

|

|

$ |

2,015 |

|

|

$ |

5,310 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(A) Acquisition-related and other costs are comprised of

amortization of intangible assets, transaction costs, and certain

compensation charges and are included in the following line

items: |

| |

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

October

30, |

|

July

31, |

|

October

31, |

|

October

30, |

|

October 31, |

| |

|

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

Cost of revenue |

$ |

120 |

|

|

$ |

121 |

|

|

$ |

86 |

|

|

$ |

335 |

|

|

$ |

258 |

|

| |

|

Research and development |

$ |

10 |

|

|

$ |

10 |

|

|

$ |

7 |

|

|

$ |

29 |

|

|

$ |

10 |

|

| |

|

Sales, general and administrative |

$ |

44 |

|

|

$ |

44 |

|

|

$ |

63 |

|

|

$ |

135 |

|

|

$ |

214 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(B) Stock-based compensation consists of the following: |

|

|

|

| |

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

October

30, |

|

July

31, |

|

October

31, |

|

October

30, |

|

October 31, |

| |

|

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

Cost of revenue |

$ |

32 |

|

|

$ |

38 |

|

|

$ |

44 |

|

|

$ |

108 |

|

|

$ |

102 |

|

| |

|

Research and development |

$ |

530 |

|

|

$ |

452 |

|

|

$ |

363 |

|

|

$ |

1,365 |

|

|

$ |

935 |

|

| |

|

Sales, general and administrative |

$ |

183 |

|

|

$ |

159 |

|

|

$ |

152 |

|

|

$ |

498 |

|

|

$ |

416 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(C) Costs related to Russia branch office closure. |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(D) Income tax impact of non-GAAP adjustments, including the

recognition of excess tax benefits or deficiencies related to

stock-based compensation under GAAP accounting standard (ASU

2016-09). |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NVIDIA

CORPORATION |

|

RECONCILIATION OF GAAP TO NON-GAAP OUTLOOK |

|

|

|

|

| |

| |

|

Q4 FY2023 Outlook |

| |

|

($ in millions) |

| |

|

|

|

GAAP gross margin |

|

63.2 |

% |

|

|

Impact of stock-based compensation expense, acquisition-related

costs, and other costs |

|

2.8 |

% |

|

Non-GAAP gross margin |

|

66.0 |

% |

| |

|

|

|

GAAP operating expenses |

$ |

2,560 |

|

| |

Stock-based

compensation expense, acquisition-related costs, and other

costs |

|

(780 |

) |

|

Non-GAAP operating expenses |

$ |

1,780 |

|

| |

|

|

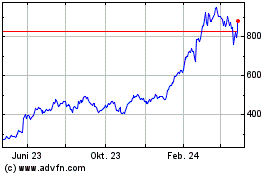

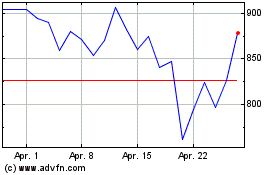

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024