0001490281False00014902812024-05-012024-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2024

Commission File Number: 1-35335 | | | | | | | | | | | | | | |

| Groupon, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 27-0903295 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 35 W. Wacker | | 60601 |

| Floor 25 | | (Zip Code) |

| Chicago | | |

| Illinois | | (773) | 945-6801 |

| (Address of principal executive offices) | | (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | GRPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 406 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

CEO Appointment

On May 7, 2024, the Company announced that its Board of Directors (the “Board”) appointed Dusan Senkypl as permanent Chief Executive Officer (“CEO") of the Company. In connection with such appointment, Mr. Senkypl entered into an employment agreement with the Company’s wholly owned subsidiary, Groupon Management LLC (the “Employment Agreement”), which was effective on May 1, 2024.

Mr. Senkypl, who is based in the Czech Republic, has served as the Company’s Interim CEO since March 30, 2023, and has served as a member of the Company’s Board since June 2022. In addition, since January 2017, he has been a Partner of Pale Fire Capital SE (“PFC”), the Company’s largest stockholder and a private equity investment group that invests in e-commerce companies both in Europe and worldwide. He also served as a director of PFC from November 2019 to April 2021, and has served as Chairman of the PFC Board since April 2021. He also holds director roles or non-managing partner roles for PFC investment entities. Mr. Senkypl stepped down from day-to-day responsibilities at PFC upon his appointment to Interim CEO.

In connection with his appointment as CEO, Mr. Senkypl will receive (i) an annual base salary of $150,000 USD (which will be converted to his local currency of CZK at time of payment); (ii) a target bonus opportunity of up to a maximum of 150% of his base salary; and (iii) on May 1, 2024 (the “Award Date”), an award of 1,393,948 performance share units (“PSUs”) under that certain PSU Award Agreement (the “CEO PSU Award Agreement”) dated May 7, 2024, by and between Mr. Senkypl and the Company (the “CEO PSU Award”) and pursuant to the Groupon, Inc. 2011 Incentive Plan, as amended (the “Plan”).

The CEO PSU Award is subject to stockholder approval of an amendment to the Plan to increase the available share pool (the “Plan Amendment”) at the Company's annual meeting of stockholders on June 12, 2024. If stockholders do not approve the Plan Amendment, the CEO PSU Award is null and void and the PSUs thereunder will be forfeited and canceled for no consideration. The description of the Plan Amendment is not complete and is qualified by reference in its entirety to the form of the Plan Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

A summary of the terms of the CEO PSU Award is as follows:

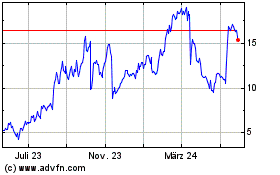

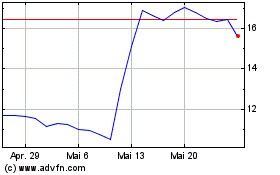

•The PSUs can only be earned if certain stock price hurdles ($14.86, $20.14, $31.01, and $68.82) are met during a performance period and Mr. Senkypl satisfies certain service conditions.

•Achievement of each stock price hurdle would entitle Mr. Senkypl to 25% of the target number of PSUs, subject to the service condition being met.

•The performance period begins on the Award Date and ends on the third anniversary of the Award Date. The stock price hurdles must be achieved during the measurement period. The measurement period for determination of any stock price hurdle achievement begins nine months from the Award Date.

•To determine whether a stock price hurdle is met during the measurement period, stock prices will be calculated based on a 90 consecutive calendar day volume-weighted average stock price, and all determinations will be certified by the Compensation Committee of the Board (the “Committee”).

•If, on the last day of the three-year performance period, the 90 consecutive day volume weighted stock price is between hurdles, a portion of the PSUs in that vesting tranche will be considered earned based on linear interpolation between stock price hurdles; however, no shares will be earned if the first stock price hurdle is not achieved.

•Once the stock price hurdle is achieved, a service condition must also be met before the shares will vest. The service condition must be met on each anniversary of the Award Date throughout the performance period in the following manner: for 33% of the award, on the first anniversary of the Award Date; for 33% of the remaining award, on the second anniversary of the Award Date; and for the final 34% of the award, on the third anniversary of the Award Date.

•In addition, Mr. Senkypl must be (a) actively employed in his current position or in an equivalent position throughout the date on which the stock price hurdle is achieved, subject to Board approval, or (b) serving as a director in an Executive Chairman role, subject to approval by the Company’s independent directors.

•PSUs otherwise eligible to vest on a particular date following the achievement of both the service and stock price hurdle conditions are subject to a 20% downward adjustment by the Committee in the event that the Company’s current material weakness remains unremediated on such vesting date. If so reduced, the shares comprising the reduction shall be forfeited.

Additionally, the PSUs are subject to the terms and conditions set forth in the Plan and in the CEO PSU Award Agreement.

In connection with his agreement to serve as permanent CEO, Mr. Senkypl and the Company also expect to enter into a Severance Benefit Agreement on the following terms. Mr. Senkypl will receive a severance benefit amount upon an involuntary termination of employment without Cause or a resignation for Good Reason (each as defined in the severance benefit agreement) equal to 3 months of salary; the accelerated vesting of outstanding time-based equity awards that are scheduled to vest over the 12 month period following termination; and vesting of a pro-rata portion of his outstanding performance based equity awards for the applicable performance period (subject to the Committee’s certification of the performance objectives following the end of the performance period). In the event that Mr. Senkypl’s employment is terminated in connection with a Change in Control of the Company (as defined in the severance benefit agreement), he will receive an amount equal to 3 months of salary, a pro rata amount of his target bonus opportunity, and the accelerated vesting of the service condition and prorated vesting of the stock price hurdle condition of his PSUs, provided that a Change in Control shall be deemed not to include a transaction resulting in PFC, together with its affiliated entities and individuals, becoming the direct or indirect beneficial owner of more than fifty percent (50%) of the total combined voting power of the Company’s then‑outstanding securities entitled to vote generally in the election of Board members, unless the Change in Control occurs as a result of a transaction approved by the Board, including by a majority of members of the Board unaffiliated with PFC.

The Company expects to provide a full description and furnish the Severance Benefit Agreement on an amended Form 8-K with its Quarterly Report for the quarter ended on March 31, 2024, assuming Mr. Senkypl and the Company finalize and execute the Severance Benefit Agreement.

The description of Mr. Senkypl’s compensation terms are not complete and are qualified by reference to the Employment Agreement and the CEO PSU Award Agreement, which are filed as Exhibits 10.2 and 10.3, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

There are no family relationships between Mr. Senkypl and any of the directors or executive officers of the Company. As previously disclosed, Mr. Senkypl is party to the Standstill Agreement, among Pale Fire Capital SE, Pale Fire Capital SICAV a.s., Jan Barta (these parties, including Mr. Senkypl, are collectively the “Pale Fire Parties”), and the Company. The Standstill Agreement provides that the Pale Fire Parties are subject to certain standstill restrictions, including limitations on their beneficial ownership of the Company and a prohibition against proxy solicitation and making any proposal for consideration by stockholders at any annual or special meeting of stockholders of the Company, each of the foregoing subject to certain exceptions. Other than the Standstill Agreement, there is no arrangement or understanding between Mr. Senkypl and any other person pursuant to which Mr. Senkypl was appointed as an officer of the Company.

The following is a transaction in which Mr. Senkypl has an interest requiring disclosure under Item 404(a) of Regulation S-K. In 2022, the Company entered into an agreement with Internet Ventures s.r.o (“IV”) to provide certain technology consulting services to the Company. Mr. Senkypl’s spouse Katerina Hanusova is an owner of IV. Pursuant to the agreement, IV received payments of approximately $122,000 for its services under the agreement for the year ended December 31, 2023.

A press release announcing the matters described above Is attached hereto as Exhibit 99.1 and incorporated herein by reference.

CFO Amended Compensatory Arrangement

The Company reached an agreement with our Chief Financial Officer (“CFO”), Jiri Ponrt, regarding his 2024 compensation, and Mr. Ponrt executed a Merit Letter (the “Merit Letter”) on May 6, 2024, which sets forth his

compensation arrangement. Mr. Ponrt will receive (i) an annual base salary of approximately $450,000; (ii) a target bonus opportunity of $150,000, capped at 150% of target; and (iii) on May 1, 2024, he received an award of 522,731 PSUs under a PSU Award Agreement dated May 6, 2024, by and between the Company and Mr. Ponrt (the “CFO PSU Award Agreement”) and pursuant to the Plan, subject to stockholder approval of the Plan Amendment. If stockholders do not approve the Plan Amendment, the CFO PSU Award is null and void and the PSUs thereunder will be forfeited and canceled for no consideration. Mr. Ponrt’s PSU award is generally subject to the same vesting conditions as applicable to the CEO PSU Award described above, except that in regard to the service conditions, Mr. Ponrt must be actively employed in his current position or in an equivalent position through the date on which the stock price hurdle is achieved, subject to Board approval.

The Company also expects Mr. Ponrt to enter into an updated Severance Benefit Agreement under which he will receive the same benefits as described above for Mr. Senkypl, and the Company expects to provide a full description of and furnish the Severance Benefit Agreement on an amended 8-K with its Quarterly Report for the quarter ended on March 31, 2024, assuming Mr. Ponrt and the Company finalize and execute the Severance Benefit Agreement on or before the filing date.

The description of Mr. Ponrt’s compensation terms are not complete and are qualified by reference to the Merit Letter and CFO PSU Award Agreement which are filed as Exhibits 10.4 and 10.5, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

There are no family relationships between Mr. Ponrt and any of the directors or executive officers of the Company. There is no arrangement or understanding between Mr. Ponrt and any other person pursuant to which Mr. Ponrt was appointed as an officer of the Company.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| (d) | Exhibits: |

| | Exhibit No. | | Description |

| 10.1 | | |

| 10.2 | | |

| 10.3 | ` | |

| 10.4 | | |

| 10.5 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*The information in Exhibit 99.1 is being furnished and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

** Management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | GROUPON, INC. |

| Date: May 7, 2024 | |

| | By: /s/ Jiri Ponrt Name: Jiri Ponrt Title: Chief Financial Officer |

Proposal 5

Approval of the Share Increase Amendment

Key Terms

In April 2024, our Compensation Committee approved a performance-based equity program (the “2024 PSU Program”) for our executive team, which is earned based on the performance of our stock price during a three-year performance period and a service condition. This program was designed with the input of the Compensation Committee's compensation consultant.

The philosophy underlying this performance-based program is to incentivize our executive team to create sustained value for stockholders and to promote our executive team’s long-term service to the Company. Simply put, we believe our executives earn equity in our business when they create value for our stockholders.

The 2024 PSU Program drives close alignment between our management team and our stockholders. We expect this program will play an important tool to motivate, retain and recruit high quality executive team members who are highly focused on building a world class experience marketplace while delivering market-beating returns for our stockholders.

A summary of the terms of the 2024 PSU Program is as follows:

•Each eligible participant will receive a three-year PSU award that measures achievement of stock price hurdles over a three-year performance period. On the third anniversary of the grant date, all shares not vested will be forfeited.

•The measurement period for the three-year performance period starts nine months after the award date of May 1, 2024.

•The vesting of the awards is tied to stock price hurdles which can be achieved at any point during the measurement period if the 90 calendar day volume-weighted average closing stock price of one share of the Company’s common stock equals or exceeds the hurdle. The hurdle will be deemed achieved following certification by the Compensation Committee.

•The program has four stock price hurdles as detailed below, and shares awarded under the PSU award are divided equally between the 4 tranches:

◦Stock Price Hurdle 1 = $14.86

◦Stock Price Hurdle 2 = $20.14

◦Stock Price Hurdle 3 = $31.01

◦Stock Price Hurdle 4 = $68.82

•The Compensation Committee determined that these hurdles are sufficiently challenging to produce market beating returns and reflect ambitious growth rates for the underlying fundamental drivers of our business.

•Once the stock price hurdle is achieved, a service condition must also be met before the shares will vest. Specifically, the service condition for: (i) 33% of the award will be met after the first anniversary of the award date; (ii) an additional 33% of the award will be met after the second anniversary of the grant; and (ii) the final 33% of the award will be met after the third anniversary of the grant.

•The participant must be actively employed in their current position or, subject to Board approval, in an equivalent position through the date on which the stock price hurdle is achieved; provided, however, for the CEO, if he continues to serve as a director in an Executive Chairman role, his PSUs will continue to vest during such service (subject to approval by the Company’s independent directors).

•If, on the last day of the performance period, the 90 calendar day trailing volume-weighted stock price is between hurdles, a portion of the PSUs subject to the vesting tranche are considered earned based on linear interpolation between price hurdles; however, no shares shall be earned if the first stock price hurdle is not achieved.

•At the discretion of the Compensation Committee, the CEO and CFO shares are also subject to downward modifiers, specifically if the present material weakness is not remediated, subject to other performance conditions prior to the shares vesting.

Prior to the grant date of 2024 PSU Awards, as of March 31, 2024, there were only approximately 1,116,850 shares of Common Stock remaining available for issuance under the Plan. The Committee therefore determined to make any shares awarded under the 2024 PSU Program contingent on stockholder approval of an amendment to the Plan that increases the Plan’s share reserve to cover the shares that may be delivered under the 2024 PSU Awards.

Accordingly, we are requesting that our stockholders approve an amendment to our 2011 Incentive Plan that would add 7,000,000 shares to the 2011 Incentive Plan (the “Share Increase Amendment”). If this increase is approved, then as of March 31, 2024 we would have had 8,116,850 shares available for issuance for future awards under the 2011 Incentive Plan.

If approved, we intend to utilize our share pool in the following manner:

•Approximately 4 million shares would be used to make awards to existing executive team members under 2024 PSU Program. We anticipate making PSU awards under the program prior to the Annual Meeting; provided, all such awards would be contingent upon receiving stockholder approval of the Share Increase Amendment.

•We plan to use the majority of the remaining shares to make additional awards using a similar performance philosophy to attract and motivate our management team.

•We then expect to utilize a minority of the remaining share pool to issue time-based service awards to other employees, such as for new hire grants, annual equity awards or promotion awards.

The Board believes that the shares requested for the 2024 Equity Program and for the other anticipated grants as specified above are necessary for our compensation program to be aligned with our stockholders and drive our transformation, including furthering our business strategy and culture, attracting and retaining talent, and rewarding employees for strong business results and individual performance. The closing trading price of a share of Groupon common stock on the Nasdaq global select market on April 26, 2024 was $11.67.

If we do not obtain requisite stockholder approval of the Share Increase Amendment to our 2011 Incentive Plan as described above, the current 2011 Incentive Plan will remain in effect and any awards made under the 2024 PSU Program prior to our Annual Meeting that were awarded contingent on receiving stockholder approval of the Share Increase Amendment shall forfeit and be void.

Equity Usage

In developing our share request for the 2011 Incentive Plan and analyzing the impact of utilizing equity on our stockholders, the Board considered our equity usage and “overhang.” As of March 31, 2024 we had 1,116,850 shares remaining available for issuance of future awards under the 2011 Incentive Plan.

Equity usage provides a measure of the potential dilutive impact of our annual equity award program. Set forth below is a table that reflects our equity usage for 2021, 2022 and 2023, as well as the average over those years.

| | | | | | | | | | | |

Fiscal Year | Award Shares Granted | Basic Weighted Average Number of Common Shares Outstanding | Gross Equity Usage (1) |

2021 | 2,150,963 | 29,365,880 | 7.3% |

| 2022 | 2,720,990 | 30,166,100 | 9.0% |

| 2023 | 4,447,590 | 31,243,179 | 14.2% |

Three Year Average | 3,106,514 | 30,258,386 | 10.2% |

(1) “Gross Equity Usage” is defined as the number of equity awards granted in the year divided by the basic weighted average number of common shares outstanding.

Overhang is a measure of potential dilution and is defined as (i) the sum of (a) the total number of shares underlying all equity awards outstanding and (b) the total number of shares available for future award grants, divided by (ii) the sum of (a) the total number of shares underlying all equity awards outstanding, (b) the total number of shares available for future award grants and (c) the basic weighted average common shares outstanding for the most recently completed fiscal year. Our overhang at March 31, 2024 was 16.66% (excluding the impact of the new share request). If the 7,000,000 shares proposed to be authorized for grant under the 2011 Incentive Plan are included in the calculation, our overhang would have been 38.63% at March 31, 2024, which assumes no repurchases under our stock existing repurchase program.

Equity Compensation Plan

The following is a summary of the key provisions of the 2011 Incentive Plan, as proposed to be amended by the Share Increase Amendment. This summary, however, does not purport to be a complete description of all the provisions of the 2011 Incentive Plan and is qualified in its entirety by reference to the 2011 Incentive Plan, as proposed to be amended by the Share Increase Amendment, a copy of which is attached hereto as Appendix B and conformed to reflect this amendment.

Purpose of the 2011 Incentive Plan. The 2011 Incentive Plan provides a variety of equity-based and cash incentives designed to motivate, retain and attract employees, directors, consultants, independent contractors, agents and other service providers to Groupon through the acquisition of a larger personal financial interest in Groupon.

Eligible Award Recipients. Officers and other employees of Groupon or its subsidiaries, as well as non-employee directors and consultants, independent contractors and agents of Groupon or its subsidiaries are eligible to participate in the 2011 Incentive Plan. Although they are eligible for awards, it is the Company’s current practice to grant awards to consultants and independent contractors only occasionally. There are currently two executive officers, approximately 174

other employees, five non-employee directors, and eight consultants or independent contractors that are eligible to participate. In 2023, we granted awards under the 2011 Incentive Plan to two executive officers, 96 other employees and three non-employee directors, and six consultants or independent contractors. Subject to the terms and conditions of the 2011 Incentive Plan, the Compensation Committee will determine and designate, in its discretion, from time to time, from among these categories those persons who will be granted one or more awards under the 2011 Incentive Plan.

Administration. The 2011 Incentive Plan is administered by the Compensation Committee of the Board. The Compensation Committee has the discretion to grant awards under the 2011 Incentive Plan, to determine the terms thereof, to interpret the provisions of the 2011 Incentive Plan and to take action as it deems necessary or advisable for the administration of the 2011 Incentive Plan. The Compensation Committee may provide a limited delegation of authority to Groupon’s management to approve certain awards under the 2011 Incentive Plan.

Number of Authorized Shares. The 2011 Incentive Plan provides for awards during the term of the 2011 Incentive Plan with respect to a maximum of 13,775,000 shares of common stock, which amount will be increased to 20,775,000 shares if the Share Increase Amendment is approved, subject to adjustment as described below (the “Share Pool”). Under the terms of the 2011 Incentive Plan, up to 1,500,000 shares may be granted as incentive stock options (“ISOs”) (discussed below). The maximum number of shares that may be covered by awards granted to any one participant during any calendar year shall not exceed $25,000,000 in value (calculating the value of any such Awards determined either as of the grant date or, if specified in the documentation creating the award, determined as based on the average Fair Market Value over a specified period) (and the maximum number of shares covered by awards granted to any non-employee director (based on grant date value) may not exceed $750,000 in value in any calendar year, when taken together with any cash fees paid to such director in that year with respect to such director’s service as a director of the Company). The maximum amount payable pursuant to a cash incentive award to any participant during any calendar year is $5,000,000. The number and class of shares available under the 2011 Incentive Plan and/or subject to outstanding awards will be equitably adjusted by the Compensation Committee (as determined by the Compensation Committee in its sole discretion) in the event of various changes in the capitalization of Groupon to preserve the benefits or potential benefits of the awards. To the extent that an award under the 2011 Incentive Plan expires, is canceled, forfeited, or otherwise terminated without delivery of shares, the shares retained by or returned to Groupon generally will be available for future grants under the 2011 Incentive Plan. In addition, in the case of any award granted in assumption of or in substitution for an award of a company or business acquired by Groupon or a subsidiary or affiliate or with which Groupon or a subsidiary or affiliate combines, shares issued or issuable in connection with such substitution award will not be counted against the Share Pool or the limit on the number of shares that may be covered by awards granted to any one participant during any calendar year; further, if the acquired business has shares available under a pre-existing plan approved by stockholders and not adopted in contemplation of such acquisition or combination, the shares available for grant pursuant to the terms of such pre-existing plan may be used for future grants under the 2011 Incentive Plan and shall not reduce the Share Pool; provided, that awards using such available shares from the pre-existing plan shall not be made after the date awards or grants could have been made under the terms of the pre-existing plan, absent the acquisition or combination, and shall only be made to individuals who were not employed by or providing services to Groupon and its subsidiaries and

affiliates immediately prior to such acquisition or combination. Shares subject to an award under the 2011 Incentive Plan may again be made available for issuance under the Plan if such shares are: (i) shares that were subject to a stock-settled SAR (as defined below) and were not issued or delivered upon the net settlement of such SAR; and (ii) shares delivered to or withheld by Groupon to pay the exercise price or the withholding taxes related to an outstanding award.

Type of Awards. The following forms of awards may be granted to eligible award recipients, subject to such terms, conditions and provisions as the Compensation Committee may determine to be necessary or desirable: (i) ISOs; (ii) nonstatutory stock options (“NSOs”); (iii) share-settled or cash-settled stock appreciation rights (“SARs”); (iv) full value awards, including restricted stock, restricted stock units, deferred stock, deferred stock units, performance shares and performance share units; and (v) cash incentive awards.

Options and Stock Appreciation Rights. The Compensation Committee is authorized to grant ISOs, NSOs and SARs. Except with respect to options/SARs that are assumed, substituted or converted in connection with certain corporate transactions (“substitute awards”), the exercise price per share of an option will in no event be less than 100% (or less than 110% for certain ISO grants) of the fair market value per share of Groupon common stock underlying the award on the date of grant and may be exercised on a “net exercise” basis. The Compensation Committee has the discretion to determine the exercise price and other terms of SARs, except that the exercise price of a freestanding SAR will be fixed as of the date of grant and will not be less than the fair market value of a share of common stock on the grant date. Without the approval of stockholders, Groupon will not amend or replace previously granted options or SARs in a transaction that constitutes a “repricing” within the meaning of the rules of the Nasdaq.

The Compensation Committee will set the terms and conditions of vesting and exercise for options and SARs, and the Compensation Committee will determine the methods by which an option or SAR may be exercised. Upon the exercise of a SAR, the participant is entitled to receive shares having an aggregate fair market value equal to (A) the excess of (i) the fair market value of one share of common stock as of the date of exercise over (ii) the exercise price of the shares covered by the SAR, or the portion thereof being exercised. As a general matter, options and SARs (other than substitute awards and Mr. Senkypl’s March 30, 2023 grant of 3,500,000 stock options, as applicable) granted under the 2011 Incentive Plan will have a minimum vesting period of one year, except that (a) the exercisability and vesting of options and SARs (i) will be fully accelerated upon the death of the participant and (ii) may be accelerated (in whole or in part) as determined by the Compensation Committee in the event of a participant’s disability, retirement or involuntary termination in connection with a change in control.

Options and SARs will expire at such time as the Compensation Committee determines; provided, however, that no option or SAR may be exercised more than ten years from the grant date; provided, however, that unless otherwise provided by the Compensation Committee each vested and exercisable Option and SAR outstanding on the expiration date with an exercise price that is less than the fair market value per share of Groupon common stock as of such date shall automatically be exercised on the expiration date, and provided further that that if the expiration date falls during a blackout period, the expiration date may be automatically be extended until 30 calendar days after the end of the blackout period.

Full Value Awards. The Compensation Committee may grant full value awards in the form of restricted stock, restricted stock units, deferred stock, deferred stock units, performance shares or performance share units to participants. The grant, issuance, retention, vesting and/or settlement of such full value awards will occur at such times and in such installments as determined by the Compensation Committee. The Compensation Committee will have the right to make the timing of the grant and/or the issuance, ability to retain, vesting and/or settlement of these full value awards subject to continued employment, passage of time and/or performance conditions (or, in the case of performance share units, a combination of the foregoing) as deemed appropriate by the Compensation Committee. However, any time-based service restrictions on full value awards will immediately lapse upon the death of the participant.

Holders of restricted stock have all the rights of a stockholder, such as the right to vote the shares or receive dividends and other distributions, except to the extent restricted by the terms of the 2011 Incentive Plan or any award document relating to the restricted stock and subject to any mandatory reinvestment or other requirement imposed by the Compensation Committee. Holders of restricted stock units and deferred stock units will not have any such stockholder rights until shares have been issued to them upon vesting, although the Compensation Committee may provide for dividend equivalent rights. No dividends or dividend equivalents will be paid on restricted stock units, deferred stock units or performance share unit awards prior to vesting, or if applicable, the satisfaction of the underlying performance conditions.

Cash Incentive Awards. The Compensation Committee may grant cash incentive awards that may be contingent on the achievement of a participant’s performance objectives over a specified period established by the Compensation Committee. The grant of cash incentive awards may also be subject to other conditions, restrictions and contingencies, as determined by the Compensation Committee. Cash incentive awards may include the right to receive payment of cash or shares having the value equivalent to the cash otherwise payable.

Certain Events of Forfeiture. The Compensation Committee has the discretion to add forfeiture provisions to any grant under the 2011 Incentive Plan, including forfeiture for violation of a restrictive covenant set forth in any applicable award agreement.

Change in Control. In the event of a change in control of Groupon, the Board has discretion to take such actions as it deems appropriate including, but not limited to requiring that outstanding options and SARs or other equity awards become fully vested and exercisable and, in certain cases, paid to participants and providing that the performance period applicable to performance-based awards will lapse and/or the performance goals for such awards will be deemed to be satisfied. If the company resulting from, surviving or succeeding Groupon following a change in control transaction does not assume or substitute an outstanding award in accordance with the terms of the 2011 Incentive Plan, then the outstanding award will become fully vested or exercisable immediately prior to the change in control (with performance conditions deemed satisfied at the level determined by the Compensation Committee in its sole discretion).

Clawback Policy. Any compensation earned or paid under the 2011 Incentive Plan is subject to forfeiture, recovery by Groupon, or other action pursuant to the Groupon Clawback Policy, adopted on October 14, 2021, and amended effective as of October 2, 2023.

Adjustments to Shares. In the event there is a change in the capital structure of Groupon as a result of any stock dividend or split, recapitalization, issuance of a new class of common stock, merger, consolidation, spin-off or other similar corporate change, or any distribution to stockholders holdings shares other than regular cash dividends, the Compensation Committee shall make an equitable adjustment (in the manner and form determined in the Compensation Committee’s sole discretion) in the number of shares and forms of the awards authorized to be granted under the 2011 Incentive Plan, including any limitation imposed on the number of shares with respect to which an award may be granted in the aggregate under the 2011 Incentive Plan or to any participant, and make appropriate adjustments (including exercise price) to any outstanding awards.

Tax Withholding and Tax Offset Payments. The Compensation Committee is authorized to withhold from awards and related payments amounts of withholding and other taxes due or potentially payable in connection with any transaction involving an award by withholding common stock or other property to satisfy such withholding requirements or by taking certain other actions. For participants who are subject to Section 16 of the Exchange Act, shares will be withheld from the applicable equity-based award to satisfy withholding obligations, unless otherwise determined by the Compensation Committee. In addition, shares withheld under the 2011 Incentive Plan may be used to satisfy the tax withholding required by applicable law (or other rates that will not have a negative accounting impact).

Term of 2011 Incentive Plan. Unless earlier terminated by the Board, the authority of the Compensation Committee to make grants under the 2011 Incentive Plan will terminate on the tenth anniversary of June 15, 2022.

Amendment and Termination. The Board may suspend, amend or terminate the 2011 Incentive Plan; provided, however, that Groupon’s stockholders will be required to approve any amendment (i) to the extent required by law or the Nasdaq rules; or (ii) that would alter the 2011 Incentive Plan’s provisions restricting Groupon’s ability to grant options and SARs with an exercise price that is not less than the fair market value of the underlying options or SARs with an exercise price that is not less than the fair market value of the underlying common stock.

Awards granted prior to a termination of the 2011 Incentive Plan will continue in accordance with their terms following such termination. No amendment, suspension or termination of the 2011 Incentive Plan will adversely affect the rights of a participant in awards previously granted without such participant’s consent.

Certain Federal Income Tax Consequences. The following is a general description of certain significant United States federal income tax consequences, under the Code, as in effect on the date of this summary, applicable to Groupon and participants in connection with awards under the 2011 Incentive Plan. This summary assumes that all awards will be exempt from, or comply with, the rules under Section 409A of the Code regarding nonqualified deferred compensation. If an award constitutes nonqualified deferred compensation and fails to comply with Section 409A of the Code, the award will be subject to immediate taxation and tax penalties in the year the award vests. This summary is not intended to be exhaustive, and, among other things, does not describe state, local or non-United States tax consequences, or the effect of gift, estate or inheritance taxes. Because individual circumstances may vary, we advise all participants to

consult their own tax advisor concerning the tax implications of awards granted under the 2011 Incentive Plan.

The grant of options under the 2011 Incentive Plan will not, in itself, result in the recipient of the option realizing taxable income or Groupon realizing an income tax deduction. However, the transfer of shares to an option holder upon exercise of the option may or may not give rise to taxable income to the option holder and a tax deduction for Groupon, depending upon whether such option is a NSO or an ISO.

The exercise of an NSO by an option holder generally results in immediate recognition of taxable ordinary income by the option holder and a corresponding tax deduction for Groupon, in the amount equal to the excess of fair market value of the shares received at the time of exercise over the exercise price. Any subsequent gain that the option holder recognizes when he or she later sells or disposes of the shares will be short-term or long-term capital gain, depending on how long the shares were held.

The exercise of an ISO generally does not result in the immediate recognition of taxable ordinary income by the option holder; however, for purposes of the alternative minimum tax under the United States tax laws, the excess of the fair market value of the shares acquired upon exercise of an ISO (determined at the time of exercise) over the exercise price of the ISO will be considered income. If the recipient was continuously employed from the date of grant until the date three months prior to the date of exercise and such recipient does not sell the shares received pursuant to the exercise of the ISO within the earlier of: (i) two years after the date of the grant of the ISO, or (ii) one year after the date of exercise, a subsequent sale of such shares will result in long-term capital gain or loss to the recipient and will not result in a tax deduction to Groupon.

If the recipient is not continuously employed from the date of grant until the date three months prior to the date of exercise of an ISO, then the special tax rule described in the preceding paragraph does not apply and the exercise is treated as though the option exercised as an NSO. Furthermore, if such recipient disposes of shares acquired upon the timely exercise of the ISO within either of the time periods described in the immediately preceding paragraph, the recipient will generally realize as ordinary income an amount equal to the lesser of (i) fair market value of such shares on the date of exercise over the exercise price and (ii) the amount realized upon disposition over the exercise price. In such event, Groupon generally will be entitled to an income tax deduction equal to the amount recognized as ordinary income. Any gain realized in such disposition in excess of such amount realized by the recipient as ordinary income would be taxed at the rates applicable to short-term or long-term capital gains (depending on the holding period).

The granting of SARs does not, in itself, result in taxable income to the recipient of a SAR or a tax deduction for Groupon. Upon exercise of a SAR, the amount of any cash and/or the fair market value of any of our shares received as of the exercise date are taxable to the participant as ordinary income and deductible by Groupon.

A participant will not recognize any taxable income upon the award of shares of restricted stock which are not transferable and are subject to a substantial risk of forfeiture. Dividends paid with respect to restricted stock, if any, prior to the lapse of restrictions applicable to that stock, or

dividend equivalents paid with respect to unvested restricted stock units, will be taxable as compensation income to the participant.

Generally, a participant will recognize taxable ordinary income in connection with restricted shares when the shares become transferable and are no longer subject to a substantial risk of forfeiture, in an amount equal to the fair market value of those shares at the time such restrictions lapse. However, a participant may elect to recognize taxable ordinary income upon the award date of restricted stock based on the fair market value of the shares subject to the award on the date of the award. If a participant makes such an election, any dividends paid with respect to that restricted stock will not be treated as compensation income, but rather as dividend income, and the participant will not recognize additional taxable income when the restrictions applicable to his or her restricted stock award lapse.

Assuming compliance with the applicable reporting requirements, Groupon will be entitled to a tax deduction equal to the amount of ordinary income recognized by a participant in connection with his or her restricted stock award in the same taxable year that the participant recognizes that ordinary income. The granting of restricted stock units does not result in taxable income to the recipient of a restricted stock unit or a tax deduction for Groupon. The amount of cash received or the then-current fair market value of shares received following vesting and delivery of the underlying shares with respect to the restricted stock unit is taxable to the recipient as ordinary income and deductible by Groupon.

The granting of full value awards (such as restricted stock units, deferred stock units and performance share units) or cash incentive awards subject to performance conditions generally should not result in the recognition of taxable income by the recipient or a tax deduction by Groupon. The payment or settlement of any such award should generally result in immediate recognition of taxable ordinary income by the recipient equal to the amount of any cash received or the then-current fair market value of the shares received, and a corresponding tax deduction by Groupon. If shares or any portion of the cash settlement covered by the award are not transferable and subject to a substantial risk of forfeiture, the tax consequences to the participant and Groupon will be similar to the tax consequences of restricted stock awards, previously described. If the award consists of unrestricted shares, the recipient of those shares will immediately recognize as taxable ordinary income the fair market value of those shares on the date of the award, and Groupon will be entitled to a corresponding tax deduction.

Under certain circumstances, accelerated vesting, exercise or payment of awards under the 2011 Incentive Plan in connection with a “change of control” may be deemed an “excess parachute payment” for purposes of the golden parachute payment provisions of Section 280G of the Code. To the extent it is so considered, the participant holding the award would be subject to an excise tax equal to 20% of the amount of the excess parachute payment, and Groupon would be denied a tax deduction for the excess parachute payment.

New Plan Benefits under the 2011 Incentive Plan

Other than the annual grant of restricted stock units and the award of deferred stock units to our non-employee directors under our Non-Employee Directors’ Compensation Plan (as set forth in the table below), equity-based or cash compensation awards to be granted in the future under the 2011 Incentive Plan, as amended, to eligible individuals, including current and future

employees, officers and directors, cannot be determined at this time, as actual awards will be made at the discretion of the Compensation Committee. We anticipate making PSU awards under the program prior to the Annual Meeting (not to exceed approximately 4 million shares) to existing executive team members; provided, all such awards would be contingent upon receiving stockholder approval of the Share Increase Amendment. For an understanding of the equity-based compensation awards made in the past to our executives, see the “Grants of Plan-Based Awards in 2023” table and the “Outstanding Equity Awards at 2023 Year-End” table.

| | | | | |

Name and Position | Dollar Value(1) |

Dusan Senkypl, Interim Chief Executive Officer | N/A |

Kedar Desphpande, former Chief Executive Officer | N/A |

Jiri Ponrt, Chief Financial Officer | N/A |

Damien Schmitz, former Chief Financial Officer | N/A |

Dane Drobny, former Chief Administrative Officer, General Counsel, and Corporate Secretary | N/A |

Executive Group Total | N/A |

Non-Executive Director Group | $608,333 |

Non-Executive Officer Employee Group | N/A |

(1) The amount disclosed is equal to the total dollar value of all annual stock grants to be issued to our non-employee directors following the Annual Meeting, including the total dollar value of any portion of the annual cash retainer that any non-employee director elected to defer into an award of deferred stock units. Share figures will be determined by dividing the dollar value by the closing share price on the date of the Annual Meeting (rounded to the nearest share).

Unfunded and Unqualified Plan. The 2011 Incentive Plan is intended to be an unfunded plan and is not qualified under Section 401 of the Code. In addition, the 2011 Incentive Plan is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Vote required. Approval of this proposal requires the affirmative vote of a majority of the votes represented by the shares of our common stock present at the Annual Meeting in person or by proxy and entitled to vote. Abstentions and broker non-votes shall have no effect on the outcome of the vote.

Our Board unanimously recommends a vote “FOR” the approval of the amendment to the 2011 Incentive Plan to increase the number of authorized shares thereunder.

Proxies solicited by the Board will be voted “FOR” Proposal 5 unless stockholders specify a contrary vote.

EMPLOYMENT CONTRACT

THIS EMPLOYMENT CONTRACT (the “Contract”) provides the terms for Dusan Senkypl’s services as Chief Executive Officer of Groupon, Inc (“Groupon”) and was concluded on 1 May 2024.

BETWEEN:

(1) GROUPON MANAGEMENT, LLC, 35 W. Wacker, Floor 2500, United States of America, Registration Number: ###-##-####, Groupon Management, LLC – Czech Branch, having its registered office at Vrchlickeho 479/51, Kosire, 150 00 Praha 5 ICO: 19491450, DIC: CZ19491450, Company entered in the Commercial Register administered by the Municipal Court in Prague, File No. A 80386 (the “Employer”); and

(2) DUŠAN ŠENKYPL, residing at Jestřábí 493, Osnice, 252 42 Jesenice, Czech Republic, born on 13 September 1975 (the “Employee”)

(hereinafter referred to jointly as the “Parties” and individually as the “Party”)

1 Basic terms of employment

1.1 The Employee shall carry out work in the position of Chief Executive Officer of Groupon (“CEO”) and will report directly to Groupon’s Board of Directors (the “Board”).

1.2 In the role of CEO, Employee will have a fiduciary duty to Employer, and Groupon (and its other subsidiaries and affiliates) consistent with those provided for under the laws of the State of Delaware for an officer of a Delaware Corporation, details of such fiduciary duty have been described to the Employee by Groupon and the Employee acknowledges that he understands Employee’s obligations.

1.3 The Board will determine the job specifications of the Employee’s position. The Employee acknowledges that the Board is entitled to unilaterally change the Employee’s job specifications at any time.

1.4 The place of work is either Prague or Employee’s home address as stated above in this Contract, or from any other address that has been communicated by the Employee to the Employer as his new home address in writing. The Employee hereby agrees that in connection with the fulfilment of Employee’s work tasks, the Employer will require Employee to undertake business trips abroad including to Groupon’s Headquarters in Chicago, Illinois (U.S.). The Parties have agreed that for the purposes of the calculation of travel expenses to be reimbursed under Act no. 262/2006 Coll., the Labour Code (the “Labour Code”), the regular workplace of the Employee will be Prague, Czech Republic.

1.5 At all times, Employee agrees to abide by Groupon’s policies, procedures, and practices, including those contained in Groupon’s Global Code of Conduct and Insider Trading Policy, a copy of which has been provided to Employee. Employee also agrees that during Employee’s employment, Employee will: (i) devote Employee’s full professional time and attention to Groupon, and will no longer be responsible for the day-to-day management of Pale Fire Capital; (ii) not engage in any employment, business or activity that may harm Groupon’s reputation or good name; (iii) not engage in any other employment or consult for any other business without prior written consent from Groupon’s Board of Directors or its designee; (iv) not serve on any other board of directors without prior written consent from Groupon’s General Counsel (or person acting in that role); and (iv) not assist any person or organization in competing with Groupon, in preparing to compete with Groupon, or in hiring any Groupon employees.

1.6 By signing this Contract, the Employee declares that Employee has been acquainted with all rights and duties arising from this Contract, with the legal and financial terms of his employment, with the Employer’s internal regulations and with the relevant health and safety regulations. The Employee also confirms that he has received the above information from the Employer in writing.

2 Term of employment

2.1 The employment hereunder is created on 1 May 2023, which date is stipulated as the date of the commencement of employment (the “Start Date”).

2.2 The employment is concluded for indefinite period of time.

3 Working hours and rest period

3.1 The Employee’s working hours shall be distributed unevenly based on the Employer’s needs. A more specific schedule of working hours shall be determined by the Employer in an internal regulation or otherwise in line with the Labour Code provided that the average weekly working time does not exceed the statutory weekly working time for a period of no more than 26 consecutive weeks.

3.2 The Employee confirms that at the instruction of the Employer he is prepared to carry out overtime work which shall not exceed eight hours per week and 150 hours per calendar year.

3.3 In line with Section 114 (3) of the Labour Code. the Parties have agreed that the Employee’s Salary set out in Section 4.1 below was agreed while taking into account any potential overtime work comprising 150 hours per calendar year.

3.4 The Employer shall schedule work so that the Employee has continuous daily rest in accordance with Section 90 of the Labour Code, i.e., at least 11 hours in 24 consecutive hours or shorter as provide for by Section 90 (2) of the Labour Code.

3.5 The Employer shall schedule work so that the Employee has continuous weekly rest in accordance with Section 92 of the Labour Code, i.e., at least 24 hours of rest per week immediately following the 11 hours of rest following the end of the last shift of the week. The Employer may shorten this period in the situations provided for by Section 90 (2) of the Labour Code, provided that the period of continuous rest in the next week shall be extended by the period of such shortening. Where permitted by the operational reasons of the Employee's position, the Employer shall schedule uninterrupted weekly rest under this section to include Sundays.

4 Salary, other payments and benefits

4.1 The Employee shall be entitled to an annualized base salary in the amount of $150,000 USD (One Hundred Fifty Thousand USD) less withholdings and deductions for the work carried out hereunder (the “Salary”). The Salary shall be payable in equal monthly instalments at the latest on the 30th day of each calendar month following the month in respect of which the Salary is paid to the Employee, and will be converted to the local currency (CZK) at time of payment based on the exchange rate announced by the Czech National Bank on the date the monthly salary is due.

4.2 Subject to shareholders’ approval to increase the number of authorized shares at Groupon’s annual meeting on June 12, 2024, Employee will be eligible to earn 1,393,948 Performance Share Units (“PSU Target”), which will be granted by Groupon pursuant to the Groupon, Inc. 2011 Incentive Plan (“Plan”). The award will be subject to the terms of the Plan and a form of award agreement that you will be required to sign as a condition of receiving the award. The actual number of PSUs earned, if any, will be determined by the achievement of specific objectives and satisfying other conditions as determined by the Compensation Committee. The earned PSUs will be paid in shares of Groupon Common Stock.

4.3 Employee will continue to be eligible for the Severance Benefit Agreement (“SBA”) which Employee executed on 30 March 2023.

4.4 Employee is eligible to for an annual bonus equal to 100% of Employee’s Salary (“Target Bonus”), capped at 150% of the Target Bonus. The actual amount of any bonus, if any, will be based on specific performance objectives which will be certified by the Compensation Committee of the Board (“Compensation Committee”). Final determination of any bonus pay out is at the discretion of the Compensation Committee. As such, the bonus pay out is not guaranteed. Employee will separately receive the terms and conditions of Employee’s 2024 annual bonus.

4.5 The Employer shall pay from the Salary and other considerations granted to the Employee all deductions required under the applicable Czech laws. Further, the Employer may also withhold from the Salary and any other form of remuneration, all taxes required by federal, state, local or other laws of countries where the Employee travels for work. During the term of Employee’s employment, the Employee shall immediately inform the Employer of any changes which had or could have an impact on the advance payment of income tax in respect of income from “dependent activity” (in Czech: závislá činnost), social and health insurance and other similar payments.

4.6 The Employee has agreed with the Employer that the Employee’s Salary, as well as any other remuneration paid on the basis of or in line with this Contract, net of any potential deductions and other payments, paid to the Employee on the basis of or under this Contract, will be remitted to the Employee’s bank account maintained by a Czech bank, of which the Employee shall inform the Employer in writing within five (5) working days of the date of the commencement of the Employee’s employment hereunder.

4.7 The Parties have agreed that any benefit or consideration of any kind provided by the Employer to the Employee (even if provided repeatedly) on top of this Contract and/or the Employer’s internal regulations (including any and all benefits and other considerations, right to which follows from stipulations of this Contract and/or the Employer’s internal regulations, in respect of which it is stipulated that their provision depends on the will of the Employer) shall not establish any right of the Employee to such benefits or other considerations being provided in the future. The Employer is in line with procedures stipulated by the Labour Code entitled to modify or cancel provision of such benefits or other considerations at any time.

5 Annual leave

5.1 The Employee shall be entitled to five (5) weeks (i.e. 25 working days) of annual leave per calendar year. The use of leave by the Employee that is longer than 10 business days must be determined or approved by the Board.

6 Sick days

6.1 The Employee shall be entitled to 5 (five) sick days (i.e. absence due to medical reasons without the necessity to present any confirmation obtained from a physician) per calendar year.

6.2 The Employee shall be entitled to full compensation of Employee’s Salary for the days on which Employee is absent from work due to his use of such sick days.

7 Business trips, reimbursement of costs

7.1 The Employee shall be entitled to the reimbursement of travel expenses which he incurred during a business trip and to the reimbursement of other legitimately incurred costs connected with the performance of the Employee’s job hereunder.

7.2 All costs shall be reimbursed to the Employee by the Employer against the presented relevant receipts and invoices and in line with the relevant legal regulations and the Employer’s internal regulations.

8 Personal data protection

8.1 In relation to the performance of this Contract, the Employer processes personal data of the Employee, which were provided to the Employer by the Employee or which are acquired by the Employer from other sources. Such personal data is processed for the purpose of performance of the Employer’s obligations under this Contract or relevant statutory obligations, and for the purpose of pursuing legitimate interests of the Employer.

8.2 The Employer will process the personal data in line with the Notice on Personal Data Processing which was provided to the Employee together with the signing of this Contract.

8.3 The Notice on Personal Data Processing provides the Employee with required information relating to the processing of his personal data by the Employer in relation to the Employee’s employment, including information about the Employee’s rights (in particular the right to access personal data and correction thereof and in certain situation the right to have his personal data deleted or transferred, request that the scope of processing be limited and the right to raise objection related to processing thereof), retention periods for relevant personal data and the Employer’s obligations related to personal data processing.

9 Termination of employment

9.1 This employment may be terminated by agreement between the Parties, by notice of termination or by immediate cancellation, provided that in all these instances the conditions set out in this Contract and the Labour Code have been fulfilled.

9.2 Either of the Parties may terminate the employment by serving two (2) months notice. Such notice must be given in writing and served on the other Party - otherwise it shall not be taken into account. If, at any time during the two (2) months notice period, the Employee is no longer providing material services to Groupon, the non-working notice period shall be deducted from any severance payments owed under the SBA. The determination of whether Employee is providing materials services to Groupon will be determined in Groupon's sole discretion. The Employee does not have to give any reason; however, the Employer may terminate the employment only in line with the provisions of Section 52 of the Labour Code and in all instances must state the reason in the notice of termination. The notice period shall start to run on the first day of the calendar month following the serving of notice of termination and end upon the expiry of the last day of the relevant calendar month.

9.3 Upon the termination of employment hereunder for any reason or at any earlier time upon the Employer’s request, the Employee shall return all materials and tools entrusted to him/her or otherwise belonging to the Employer without undue delay (at the latest on the day of the termination of employment) to the Employer in perfect condition (apart from the usual wear and tear). The same applies to all documents and/or electronic data concerning the Employer.

10 Final provisions

10.1 Any potential invalidity, ineffectiveness or unenforceability of any provision hereof shall have no effect on the validity, effectiveness or enforceability of other provisions hereof. The Parties undertake to replace an invalid, ineffective or unenforceable provision with a new provision whose wording should correspond to the intent of the original provision and this Contract as a whole.

10.2 Any overlooking or forgiveness by any Party of any failure to perform, breach, delay or failure to observe any duty arising hereunder shall not constitute a waiver of such a duty with regard to its continuing or any subsequent failure to perform, breach or failure to observe such duty and no such waiver shall be deemed effective if not expressed in writing in respect of each individual case.

10.3 Except as provided in Section 1.2 of his Contract, this Contract and relationships arising hereunder shall be governed by the Labour Code and other Czech laws.

10.4 Any changes hereto must be made in writing in the form of numbered amendments signed by both Parties. Amendments made via e-mail or other means of electronic communication shall not be deemed as having been made in writing.

10.5 The Employee acknowledges that all regulations and internal document noted in this Contract have been provided to him in writing as of execution of this Contract.

10.6 The Employee acknowledges that Employee continues to be bound by the Confidentiality, Intellectual Property, and Restrictive Covenants Agreement which Employee executed on 30 March 2023.

10.7 This Contract shall become valid and effective on the date of signature by both the Parties.

10.8 This Contract has been made in two (2) originals in English. Either Party shall obtain one (1) original of the Contract. The Employee hereby confirms that he has sufficient understanding of English language to fully understand the whole contents of this Contract.

10.9 The Parties declare that they have read this Contract and agree with its wording. In witness whereof, the Parties affix below their signatures as an expression of their true and free will.

10.10 Reference is made to the Indemnification Agreement between Employee and Groupon (the “Indemnification Agreement”). The Parties acknowledge and agree that all rights and benefits of the Employee under the Indemnification Agreement, including, without limitation, rights to indemnification, advancement of expenses, expense reimbursement and insurance, shall apply to any action of inaction of Employee in connection with his services under this Contract. The Employer agrees to pay or cause Groupon to pay on behalf of the Employee the reasonable legal and other outside advisors’ fees incurred by the Employee in connection with this Contract and any other agreements between Employee (or any affiliate of Employee) and the Employer or Groupon; provided, however, hat the aggregate amount payable by the Employer and Groupon hereunder and any other such agreement shall not exceed $40,000 without the Employer’s consent.

| | | | | | | | |

| In Chicago, Illinois (U.S.) | | In Prague (CZ) |

| | |

| GROUPON MANAGEMENT, LLC | | Employee |

| | |

| /s/ Meagan LeGear | | /s/ Dusan Senkypl |

| Name: Meagan LeGear | | Name: Dusan Senkypl |

| Position: VP, Deputy General Counsel | | |

PSU Award Terms

GROUPON, INC. 2011 INCENTIVE PLAN

NOTICE OF PERFORMANCE SHARE UNIT AWARD

The Participant (as defined below) has been granted a Full Value Award of performance share units (“PSUs”) in Groupon, Inc. (the “Company”), subject to the terms and conditions of the Performance Share Unit Award Agreement (the “Agreement”) and the Groupon, Inc. 2011 Incentive Plan, as amended (the “Plan”), as set forth below. Capitalized terms in this Notice of Performance Share Unit Award, including Exhibit A hereto (this “Notice”), unless otherwise defined herein, shall have the meanings assigned to them in the Plan.

1.Name: Dusan Senkypl (the “Participant”)

2.Award Date: May 1, 2024

3.Total Number of PSUs Granted: 1,393,948 PSUs (“Total PSUs”)

4.Performance Period: the period commencing on the first day of the Award Date and ending on the third anniversary of the Award Date (the “Performance Period”).

5.Measurement Period: the period commencing on the first day following the nine-month anniversary of the Award Date and ending on the third anniversary of the Award Date (the “Measurement Period”).

6.Vesting: Each PSU shall vest, if at all, on the date both of the following vesting requirements is deemed to be achieved:

a)the applicable continued service vesting requirement (the “Service Condition Requirement”); and

b)the applicable stock price hurdle requirement (the “Stock Price Hurdle Requirement”), each as set forth in Exhibit A.

The date on which both the Service Condition Requirement and the Stock Price Hurdle Requirement is met is the “Vesting Date”; provided that such Vesting Date occurs on or prior to the last day of the Performance Period. Except as otherwise provided herein, if either (or both) vesting requirement(s) is not achieved with respect to a PSU by the earlier of the last day of the Performance Period or Participant’s Service Termination Date (as defined in Exhibit A), the unvested PSU shall forfeit.

7.Settlement: Subject to the vesting requirements set forth in Section 5 and Exhibit A, the Participant shall be entitled to receive the number of Shares equal to the number of PSUs for which both the Service Condition Requirement and the Stock Price Hurdle Requirement have been achieved as of a particular Vesting Date, subject to any tax withholding obligation with respect to any Tax-Related Items (as defined in Section 3 of

the Agreement). Delivery of such Shares shall be made as soon as reasonably practicable following the Vesting Date, and in no event later than the first 2.5 months of the calendar year following the Vesting Date.

8.Termination of Continuous Service: If the Participant experiences a Service Termination Date prior to any Vesting Date, all rights of the Participant to any unvested PSUs shall be forfeited and all rights to such PSUs shall immediately terminate. If the Participant takes an extended non-medical leave of absence during the Performance Period, the Company may determine that such leave of absence constitutes a cessation of Continuous Service (as defined in Exhibit A) and the first date of such absence, the “Service Termination Date” for purposes of this Notice and the Agreement only. For the avoidance of doubt, if the Participant is party to a severance benefit agreement with the Company, the treatment of the PSUs in connection with any termination of employment shall be governed by the terms of such severance benefit agreement.

9.General Terms; Stockholder Approval: The Participant understands that the Participant’s employment with or service to the Company, as applicable, is for an unspecified duration, can be terminated at any time in accordance with applicable law, and that nothing in this Notice, the Agreement, or the Plan changes the nature of that relationship. The Participant acknowledges that the vesting of the PSUs pursuant to this Notice and the Agreement is conditioned on the achievement of the Service Condition Requirement, the Stock Price Hurdle Requirement and the Participant’s Continuous Service through each applicable Vesting Date in the Performance Period, except as otherwise indicated above or Exhibit A. The Participant understands that this Notice is subject to (a) the terms and conditions of the Agreement and the Plan prospectus that contains the entire plan, both of which are incorporated herein by reference; and (b) the terms of the Company’s compensation recovery policy (the “Clawback Policy”). The Participant represents and warrants that the Participant has received and read this Notice, the Agreement, the Plan and the Clawback Policy. If there are any inconsistencies between this Notice or Agreement and the Plan, the terms of the Plan will govern. This grant of PSUs is contingent upon the stockholders of the Company approving an increase in the number of Shares available for issuance under the Plan at the Company’s 2024 annual meeting of stockholders, which approval the Company will use reasonable best efforts to seek and obtain. If the Company’s stockholders do not approve an increase in the number of Shares available for issuance under the Plan by the date of the Company’s 2024 annual meeting of stockholders, then this grant of PSUs shall become null and void on such date and the PSUs shall be canceled and forfeited for no consideration.

PARTICIPANT

Dusan Senkypl

5/7/2024

EXHIBIT A

TO

NOTICE OF PERFORMANCE SHARE UNIT AWARD

1.Vesting of PSUs. A PSU shall vest, if at all, on the date that both its Stock Price Hurdle Requirement and Service Condition Requirement are achieved, referred to herein as the Vesting Date; provided such Vesting Date occurs on or prior to the last day of the Performance Period.

2.Stock Price Hurdle Requirement.

a)During the Measurement Period, the Stock Price Hurdle Requirement may be achieved with respect to the PSUs in four tranches (each, a “Tranche”) as set forth in the table below, in each case, based on the satisfaction of the applicable Stock Price Hurdle Requirement.

| | | | | | | | |

| Stock Hurdle Tranche | Stock Price Hurdle Requirement | % of PSUs Achieving the Stock Price Hurdle Requirement |

| 1 | $14.86 | 25% |

| 2 | $20.14 | 25% |

| 3 | $31.01 | 25% |

| 4 | $68.82 | 25% |

b)The Stock Price Hurdle Requirement for a particular Tranche shall be achieved, if at all, if, as of any date during the Measurement Period, the Average Stock Price equals or exceeds the Share Price Hurdle Requirement set forth opposite such Tranche in the table above. The “Average Stock Price” is determined by calculating the 90 consecutive calendar day volume-weighted average stock price of one Share. The Stock Price Hurdle Requirement shall be deemed achieved on the date the Committee certifies its achievement, provided that Participant is in Continuous Service (as defined below) on such certification date.

c)If the Stock Price Hurdle Requirement set forth opposite a particular Tranche in the table above is not achieved on or prior to the last day of the Measurement

Period, the PSUs belonging to such Tranche shall be forfeited for no consideration.

d)Notwithstanding anything contained herein to the contrary, if, on the last day of the Measurement Period, the Average Stock Price is between two Stock Price Hurdle Requirements, the Stock Price Hurdle Requirement shall be deemed achieved for a portion of the PSUs in the Tranche opposite the higher Stock Price Hurdle Requirement. Linear interpolation shall be used to determine the number of PSUs achieving the Stock Price Hurdle Requirement, based on the Average Stock Price achieved as of the last day of the Performance Period; provided, that the Stock Price Hurdle Requirement shall not be considered achieved for any of the PSUs under this Notice unless the lowest Stock Price Hurdle Requirement is achieved and certified by the Committee.

3.Service Condition Requirement.

a)During the Performance Period, the Service Condition Requirement may be achieved with respect to each Tranche in three installments (each, an “Installment”) as set forth in the table below, in each case, subject to a Participant’s Continuous Service through the applicable Service Date.

| | | | | | | | |

| Service Condition Installment | “Service Date” upon which Service Condition Requirement is Achieved | % of each Tranche Achieving the Service Condition Requirement |

| A | May 1, 2025 | 33% |

| B | May 1, 2026 | 33% |

| C | May 1, 2027 | 34% |

b)In order to be deemed to be in “Continuous Service,” a Participant must be (i) providing continuous material services to the Company and/or its subsidiaries and affiliates; and (ii) must be providing such services in his or her current position or in an equivalent position (determined in the sole discretion of the Committee) through the Service Date. For purposes of the foregoing, while Participant is

serving as Chief Executive Officer, Participant shall be deemed to be in Continuous Service, even if he transitions to serve as a member of the Board in an Executive Chairman role subject to the approval of the Company’s independent directors. A Participant’s Continuous Service in each case, shall be subject to the Committee’s right, in its discretion, to allow for an approved leave of absence to count towards a Participant’s Continuous Service to the extent permitted under applicable law. The date upon which a Participant is deemed to cease to be in Continuous Service shall be referred to as the Participant’s “Service Termination Date” hereunder.

c)Except as otherwise provided herein, if the Service Condition Requirement set forth opposite a particular Installment in the table above is not achieved due to the cessation of the Participant’s Continuous Service prior to the applicable Service Date, the PSUs belonging to such Installment shall be forfeited for no consideration.

4.Vesting Modifier. If the Company’s material weakness in its internal control over financial reporting identified as of December 31, 2022 is not remediated as of a particular Vesting Date, then the Committee, in its sole discretion, has the right to reduce the number of PSUs vesting as of such Vesting Date by 20%, and the PSUs comprising that reduction that otherwise would have vested shall be forfeited for no consideration.

5.Example of Vesting Conditions. The following example is provided for illustrative purposes only.

Assume: (i) a participant receives an award of 100,000 PSUs on May 1, 2024, (ii) on May 1, 2025 the Committee certifies the achievement of the first Stock Price Hurdle Requirement and (iii) the participant provides Continuous Service through May 1, 2025. The participant’s PSUs would be impacted as follows:

| | | | | | | | | | | |

| May 1, 2025 | May 1, 2026 | May 1, 2027 |

| # of PSUs Achieving Stock Price Hurdle Requirement | 25,000 | - | |

| # of PSUs Achieving Service Condition Requirement | 8,333 | 8,333 | 8,334 |

| | | |

| # of PSUs Achieving Both Requirements & Vesting | 8,333 | 8,333 | 8,334 |

Note: Of the 25,000 PSUs that met the Stock Price Hurdle Requirement on May 1, 2025, only 8,333 PSUs met the Service Condition Requirement on May 1, 2025. Those 16,667 PSUs remain eligible to achieve the Service Condition Requirement at a later date within the Measurement Period as described in the above chart.

GROUPON, INC. 2011 INCENTIVE PLAN

PERFORMANCE SHARE UNIT AWARD AGREEMENT

Capitalized terms in this agreement (this “Agreement”), unless otherwise defined herein, shall have the meanings assigned to them in the Groupon, Inc. 2011 Incentive Plan, as amended (the “Plan”).

You, as the Participant, have been granted a Full Value Award of performance share units (“PSUs”) in Groupon, Inc. (the “Company”) subject to the terms, restrictions and conditions of the Plan, the Notice of Performance Share Unit Award, including Exhibit A thereto (the “Notice”) and this Agreement.

1.No Stockholder Rights. Unless and until such time as Shares are issued in settlement of vested PSUs, the Participant shall have no ownership of the Shares underlying the PSUs and shall have no right to receive dividends or dividend equivalents with respect to such Shares or to vote such Shares.

2.No Transfer. Awards under the Plan are not transferable except to the Participant’s Beneficiary upon the death of the Participant.

3.Tax Withholding Obligations.