Posts double-digit room night growth

Drove 3 points of sequential acceleration in

gross bookings growth to 6%

Expedia Group, Inc. (NASDAQ: EXPE) announced financial results

today for the second quarter ended June 30, 2024.

“Our second quarter results came in at the high end of our

expectations, with gross bookings and revenue growing 6%. We're

pleased with our momentum and the sequential improvement in our

consumer brands. However, in July, we have seen a more challenging

macro environment and a softening in travel demand. We are

therefore adjusting our expectations for the rest of the year,”

said Ariane Gorin, CEO of Expedia Group.

Second Quarter Highlights

- Total gross bookings were $28.8 billion, an increase of 6%

compared to 2023.

- Lodging gross bookings were $20.7 billion, an increase of 8%

compared to 2023. Hotel bookings were up 11% compared to 2023.

- Room nights growth accelerated to +10% with Brand Expedia at

nearly 20% growth. Total room nights grew at the fastest rate since

the first quarter of 2023.

- Revenue at $3.6 billion grew 6% compared to 2023. B2B revenue

was $1.0 billion, an increase of 22% compared to 2023.

- Net income was $386 million and adjusted net income was $469

million. Adjusted EBITDA was $786 million, an increase of 5% with

15 basis points of margin contraction compared to 2023. Adjusted

EBIT was $475 million, an increase of 8% with 21 bps of margin

expansion compared to 2023.

- Repurchased approximately 9.2 million shares for $1.2 billion

year-to-date.

Financial Summary & Operating Metrics

(In millions except per share amounts)

Expedia Group, Inc.

Metric

Q2 2024

Q2 2023

Δ Y/Y

Booked room nights

98.9

89.7

10%

Gross bookings

$28,837

$27,321

6%

Revenue

$3,558

$3,358

6%

Operating income

$451

$443

2%

Net income attributable to Expedia Group,

Inc.

$386

$385

—%

Diluted earnings per share

$2.80

$2.54

10%

Adjusted EBITDA*

$786

$747

5%

Adjusted EBIT*

$475

$442

8%

Adjusted net income (loss)*

$469

$428

10%

Adjusted EPS*

$3.51

$2.89

21%

Net cash provided by operating

activities

$1,501

$1,146

31%

Free cash flow*

$1,307

$923

42%

* A reconciliation of non-GAAP financial

measures to the most comparable GAAP measures is provided at the

end of this release.

Conference Call

Expedia Group, Inc. will webcast a conference call to discuss

second quarter 2024 financial results and certain forward-looking

information on Thursday, August 8, 2024 at 1:30 p.m. Pacific Time

(PT). The webcast will be open to the public and available via

ir.expediagroup.com. Expedia Group expects to maintain access to

the webcast on the IR website for approximately twelve months

subsequent to the initial broadcast.

About Expedia Group

Expedia Group, Inc. brands power travel for everyone, everywhere

through our global platform. Driven by the core belief that travel

is a force for good, we help people experience the world in new

ways and build lasting connections. We provide industry-leading

technology solutions to fuel partner growth and success, while

facilitating memorable experiences for travelers.

Expedia Group’s three flagship consumer brands includes:

Expedia®, Hotels.com®, and Vrbo®. One Key™ is our comprehensive

loyalty program that unifies Expedia, Hotels.com and Vrbo into one

simple, flexible travel rewards experience. To enroll in One Key,

download Expedia, Hotels.com and Vrbo mobile apps for free on iOS

and Android devices. One Key is currently available in the U.S.

© 2024 Expedia, Inc., an Expedia Group company. All rights

reserved. Trademarks and logos are the property of their respective

owners. CST: 2029030-50

Expedia Group, Inc. Trended

Metrics (All figures in millions)

The metrics below are intended to supplement the financial

statements in this release and in our filings with the SEC, and do

not include adjustments for one-time items, acquisitions, foreign

exchange or other adjustments. The definition or methodology of any

of our supplemental metrics are subject to change, and such changes

could be material. We may also discontinue certain supplemental

metrics as our business evolves over time. In the event of any

discrepancy between any supplemental metric and our historical

financial statements, you should rely on the information included

in the financial statements filed with or furnished to the SEC.

2022

2023

2024

Full Year

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2022

2023

Units sold

Booked room nights

77.0

82.5

81.6

70.8

94.5

89.7

89.3

77.4

101.2

98.9

312.0

350.9

Booked air tickets

13.1

13.5

12.2

11.1

14.0

13.6

12.8

11.4

14.2

14.5

49.9

51.9

Gross bookings by business model

Agency

$11,346

$12,773

$10,904

$9,469

$13,425

$12,370

$10,927

$9,439

$13,301

$12,578

$44,492

$46,161

Merchant

13,066

13,366

13,083

11,042

15,976

14,951

14,758

12,233

16,863

16,259

50,557

57,918

Total

$24,412

$26,139

$23,987

$20,511

$29,401

$27,321

$25,685

$21,672

$30,164

$28,837

$95,049

$104,079

Lodging gross bookings

$17,756

$17,867

$17,099

$14,117

$21,055

$19,167

$18,513

$15,253

$21,903

$20,749

$66,839

$73,987

Revenue by segment

B2C

$1,740

$2,420

$2,707

$1,874

$1,921

$2,415

$2,819

$1,958

$1,986

$2,432

$8,741

$9,113

B2B

432

650

788

676

668

861

995

864

833

1,049

2,546

3,388

trivago (third-party revenue)

77

111

124

68

76

82

115

65

70

77

380

338

Total

$2,249

$3,181

$3,619

$2,618

$2,665

$3,358

$3,929

$2,887

$2,889

$3,558

$11,667

$12,839

Revenue by product

Lodging

$1,610

$2,400

$2,881

$2,014

$2,029

$2,698

$3,233

$2,304

$2,228

$2,862

$8,905

$10,264

Air

74

95

100

93

113

111

100

86

115

111

362

410

Advertising and media - EG(1)

89

102

98

108

99

119

125

140

145

152

397

483

Advertising and media - trivago(1)

77

111

124

68

76

82

115

65

70

77

380

338

Other(2)

399

473

416

335

348

348

356

292

331

356

1,623

1,344

Total

$2,249

$3,181

$3,619

$2,618

$2,665

$3,358

$3,929

$2,887

$2,889

$3,558

$11,667

$12,839

Revenue by geography

U.S. points of sale

$1,656

$2,208

$2,358

$1,717

$1,748

$2,172

$2,440

$1,787

$1,793

$2,246

$7,939

$8,147

Non-U.S. points of sale

593

973

1,261

901

917

1,186

1,489

1,100

1,096

1,312

3,728

4,692

Total

$2,249

$3,181

$3,619

$2,618

$2,665

$3,358

$3,929

$2,887

$2,889

$3,558

$11,667

$12,839

Adjusted EBITDA by segment(3)

B2C

$188

$582

$943

$411

$148

$653

$1,056

$468

$215

$654

$2,124

$2,325

B2B

80

156

221

142

133

206

266

193

172

263

599

798

Other(4)

(95)

(90)

(85)

(104)

(96)

(112)

(106)

(129)

(132)

(131)

(374)

(443)

Total

$173

$648

$1,079

$449

$185

$747

$1,216

$532

$255

$786

$2,349

$2,680

Net income (loss) attributable to Expedia

Group, Inc.(5)

$(122)

$(185)

$482

$177

$(145)

$385

$425

$132

$(135)

$386

$352

$797

(1) Our advertising and media business

consists of Expedia Group ("EG") Media Solutions, which is

responsible for generating advertising revenue on our global online

travel brands, and third-party revenue for trivago, a leading hotel

metasearch site.

(2) Other revenue primarily includes

insurance, car rental, destination services and cruise revenue.

(3) See the section below titled "Tabular

Reconciliations for Non-GAAP Measures — Adjusted EBITDA by segment"

for additional details.

(4) Other is comprised of trivago,

corporate and intercompany eliminations.

(5) Expedia Group does not calculate or

report net income (loss) by segment.

Notes:

- All trivago revenue is classified as Non-U.S. point of

sale.

- Some numbers may not add due to rounding. All percentages

throughout this release are calculated on precise, unrounded

numbers.

EXPEDIA GROUP, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except share and

per share data)

(Unaudited)

Three months ended

June 30,

Six months ended

June 30,

2024

2023

2024

2023

Revenue

$

3,558

$

3,358

$

6,447

$

6,023

Costs and expenses:

Cost of revenue (exclusive of depreciation

and amortization shown separately below) (1)

362

407

720

821

Selling and marketing - direct

1,793

1,579

3,443

3,066

Selling and marketing - indirect (1)

197

191

383

378

Technology and content (1)

331

344

672

661

General and administrative (1)

180

194

366

378

Depreciation and amortization

205

199

415

391

Legal reserves, occupancy tax and

other

21

1

41

6

Restructuring and related reorganization

charges (1)

18

—

66

—

Operating income

451

443

341

322

Other income (expense):

Interest income

67

63

118

106

Interest expense

(61

)

(61

)

(123

)

(122

)

Other, net

31

19

(3

)

97

Total other income (expense), net

37

21

(8

)

81

Income before income taxes

488

464

333

403

Provision for income taxes

(113

)

(77

)

(94

)

(156

)

Net income

375

387

239

247

Net (income) loss attributable to

non-controlling interests

11

(2

)

12

(7

)

Net income attributable to Expedia

Group, Inc.

$

386

$

385

$

251

$

240

Earnings per share attributable to

Expedia Group, Inc. available to common stockholders:

Basic

$

2.92

$

2.62

$

1.88

$

1.60

Diluted

2.80

2.54

1.79

1.55

Shares used in computing earnings per

share (000's):

Basic

131,948

147,168

133,724

149,808

Diluted

137,832

151,844

140,131

154,425

(1) Includes stock-based compensation as

follows:

Cost of revenue

$

4

$

4

$

6

$

7

Selling and marketing

23

20

42

40

Technology and content

40

36

80

70

General and administrative

39

46

82

92

Restructuring and related reorganization

charges

8

—

8

—

EXPEDIA GROUP, INC.

CONSOLIDATED BALANCE

SHEETS

(In millions, except number of

shares which are reflected in thousands and par value)

June 30, 2024

December 31, 2023

June 30, 2023

(Unaudited)

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

6,242

$

4,225

$

6,274

Restricted cash and cash equivalents

2,120

1,436

2,484

Short-term investments

31

28

27

Accounts receivable, net of allowance of

$57, $46 and $51

4,127

2,786

2,903

Income taxes receivable

71

47

70

Prepaid expenses and other current

assets

924

708

1,055

Total current assets

13,515

9,230

12,813

Property and equipment, net

2,381

2,359

2,318

Operating lease right-of-use assets

332

357

348

Long-term investments and other assets

1,283

1,238

1,202

Deferred income taxes

544

586

665

Intangible assets, net

991

1,023

1,180

Goodwill

6,847

6,849

7,150

TOTAL ASSETS

$

25,893

$

21,642

$

25,676

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable, merchant

$

2,206

$

2,041

$

1,775

Accounts payable, other

1,361

1,077

1,066

Deferred merchant bookings

12,083

7,723

11,523

Deferred revenue

176

164

185

Income taxes payable

32

26

61

Accrued expenses and other current

liabilities

857

752

819

Current maturities of long-term debt

1,041

—

—

Total current liabilities

17,756

11,783

15,429

Long-term debt, excluding current

maturities

5,218

6,253

6,247

Deferred income taxes

31

33

35

Operating lease liabilities

292

314

302

Other long-term liabilities

470

473

447

Commitments and contingencies

Stockholders’ equity:

Common stock: $.0001 par value; Authorized

shares: 1,600,000

—

—

—

Shares issued: 284,861, 282,149 and

280,006; Shares outstanding: 125,281, 131,522 and 138,885

Class B common stock: $.0001 par value;

Authorized shares: 400,000

—

—

—

Shares issued: 12,800; Shares outstanding:

5,523

Additional paid-in capital

15,697

15,398

15,072

Treasury stock - Common stock and Class B,

at cost; Shares 166,857, 157,903 and 148,398

(14,204

)

(13,023

)

(11,937

)

Retained earnings (deficit)

(381

)

(632

)

(1,169

)

Accumulated other comprehensive income

(loss)

(223

)

(209

)

(207

)

Total Expedia Group, Inc. stockholders’

equity

889

1,534

1,759

Non-redeemable non-controlling

interests

1,237

1,252

1,457

Total stockholders’ equity

2,126

2,786

3,216

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

25,893

$

21,642

$

25,676

EXPEDIA GROUP, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In millions)

(Unaudited)

Six months ended

June 30,

2024

2023

Operating activities:

Net income

$

239

$

247

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation of property and equipment,

including internal-use software and website development

385

361

Amortization of intangible assets

30

30

Amortization of stock-based

compensation

218

209

Deferred income taxes

39

(17

)

Foreign exchange (gain) loss on cash,

restricted cash and short-term investments, net

44

(3

)

Realized (gain) loss on foreign currency

forwards, net

55

(26

)

Gain on minority equity investments,

net

(47

)

(54

)

Other, net

38

28

Changes in operating assets and

liabilities:

Accounts receivable

(1,361

)

(846

)

Prepaid expenses and other assets

(180

)

(147

)

Accounts payable, merchant

165

66

Accounts payable, other, accrued expenses

and other liabilities

403

175

Tax payable/receivable, net

(8

)

(91

)

Deferred merchant bookings

4,360

4,371

Net cash provided by operating

activities

4,380

4,303

Investing activities:

Capital expenditures, including

internal-use software and website development

(371

)

(456

)

Purchases of investments

(69

)

—

Sales and maturities of investments

43

22

Other, net

(52

)

46

Net cash used in investing

activities

(449

)

(388

)

Financing activities:

Purchases of treasury stock

(1,172

)

(1,062

)

Proceeds from exercise of equity awards

and employee stock purchase plan

48

40

Other, net

(25

)

4

Net cash used in financing

activities

(1,149

)

(1,018

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash and cash equivalents

(81

)

10

Net increase in cash, cash equivalents

and restricted cash and cash equivalents

2,701

2,907

Cash, cash equivalents and restricted cash

and cash equivalents at beginning of period

5,661

5,851

Cash, cash equivalents and restricted

cash and cash equivalents at end of period

$

8,362

$

8,758

Supplemental cash flow

information

Cash paid for interest

$

116

$

115

Income tax payments, net

57

193

Notes & Definitions:

Booked Room Nights: Represents

booked hotel room nights and property nights for our B2C reportable

segment and booked hotel room nights for our B2B reportable

segment. Booked hotel room nights include both merchant and agency

hotel room nights. Property nights are related to our alternative

accommodation business.

Booked Air Tickets: Includes both

merchant and agency air bookings.

Gross Bookings: Generally represent

the total retail value of transactions booked, recorded at the time

of booking reflecting the total price due for travel by travelers,

including taxes, fees and other charges, adjusted for cancellations

and refunds.

Lodging Metrics: Reported on a

booked basis except for revenue, which is on a stayed basis.

Lodging consists of both merchant and agency model hotel and

alternative accommodations.

B2C: The B2C segment provides a

full range of travel and advertising services to our worldwide

customers through a variety of consumer brands including: Expedia,

Hotels.com, Vrbo, Orbitz, Travelocity, Wotif Group, ebookers,

Hotwire.com, and CarRentals.com.

B2B: The B2B segment fuels a wide

range of travel and non-travel companies including airlines,

offline travel agents, online retailers, corporate travel

management and financial institutions, who leverage our leading

travel technology and tap into our diverse supply to augment their

offerings and market Expedia Group rates and availabilities to

their travelers.

trivago: The trivago segment

generates advertising revenue primarily from sending referrals to

online travel companies and travel service providers from its

localized hotel metasearch websites.

Corporate: Includes unallocated

corporate expenses.

Non-GAAP Measures

Expedia Group reports Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted EBIT, Adjusted EBIT Margin, Leverage Ratio, Adjusted Net

Income (Loss), Adjusted EPS, Free Cash Flow and Adjusted Expenses

(non-GAAP cost of revenue, non-GAAP selling and marketing, non-GAAP

technology and content and non-GAAP general and administrative),

all of which are supplemental measures to GAAP and are defined by

the SEC as non-GAAP financial measures. These measures are among

the primary metrics by which management evaluates the performance

of the business and on which internal budgets are based. Management

believes that investors should have access to the same set of tools

that management uses to analyze our results. These non-GAAP

measures should be considered in addition to results prepared in

accordance with GAAP, but should not be considered a substitute for

or superior to GAAP. Adjusted EBITDA, Adjusted Net Income (Loss)

and Adjusted EPS have certain limitations in that they do not take

into account the impact of certain expenses to our consolidated

statements of operations. We endeavor to compensate for the

limitation of the non-GAAP measures presented by also providing the

most directly comparable GAAP measures and descriptions of the

reconciling items and adjustments to derive the non-GAAP measures.

Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income (Loss) and

Adjusted EPS also exclude certain items related to transactional

tax matters, which may ultimately be settled in cash. We urge

investors to review the detailed disclosure regarding these matters

in the Management Discussion and Analysis and Legal Proceedings

sections, as well as the notes to the financial statements,

included in the Company's annual and quarterly reports filed with

the Securities and Exchange Commission. The non-GAAP financial

measures used by the Company may be calculated differently from,

and therefore may not be comparable to, similarly titled measures

used by other companies.

Adjusted EBITDA is defined as net

income (loss) attributable to Expedia Group adjusted for:

(1) net income (loss) attributable to non-controlling interests;

(2) provision for income taxes; (3) total other expenses, net; (4)

stock-based compensation expense, including compensation expense

related to certain subsidiary equity plans; (5) acquisition-related

impacts, including

(i) amortization of intangible assets and

goodwill and intangible asset impairment, (ii) gains (losses)

recognized on changes in the value of contingent consideration

arrangements; and (iii) upfront consideration paid to settle

employee compensation plans of the acquiree;

(6) certain other items, including restructuring; (7) items

included in legal reserves, occupancy tax and other, which includes

reserves for potential settlement of issues related to

transactional taxes (e.g. hotel and excise taxes), related to court

decisions and final settlements, and charges incurred, if any, for

monies that may be required to be paid in advance of litigation in

certain transactional tax proceedings; (8) that portion of gains

(losses) on revenue hedging activities that are included in other,

net that relate to revenue recognized in the period; and (9)

depreciation.

The above items are excluded from our Adjusted EBITDA measure

because these items are non-cash in nature, or because the amount

and timing of these items is unpredictable, not driven by core

operating results and renders comparisons with prior periods and

competitors less meaningful. We believe Adjusted EBITDA is a useful

measure for analysts and investors to evaluate our future on-going

performance as this measure allows a more meaningful comparison of

our performance and projected cash earnings with our historical

results from prior periods and to the results of our competitors.

Moreover, our management uses this measure internally to evaluate

the performance of our business as a whole and our individual

business segments. In addition, we believe that by excluding

certain items, such as stock-based compensation and

acquisition-related impacts, Adjusted EBITDA corresponds more

closely to the cash operating income generated from our business

and allows investors to gain an understanding of the factors and

trends affecting the ongoing cash earnings capabilities of our

business, from which capital investments are made and debt is

serviced.

Adjusted EBIT is defined as net

income (loss) attributable to Expedia Group adjusted for:

(1) net income (loss) attributable to non-controlling interests;

(2) provision for income taxes; (3) total other expenses, net; (4)

acquisition-related impacts, including

(i) gains (losses) recognized on changes in

the value of contingent consideration arrangements; and (ii)

upfront consideration paid to settle employee compensation plans of

the acquiree;

(5) certain other items, including restructuring; (6) items

included in legal reserves, occupancy tax and other, which includes

reserves for potential settlement of issues related to

transactional taxes (e.g. hotel and excise taxes), related to court

decisions and final settlements, and charges incurred, if any, for

monies that may be required to be paid in advance of litigation in

certain transactional tax proceedings; and (7) that portion of

gains (losses) on revenue hedging activities that are included in

other, net that relate to revenue recognized in the period.

The above items are excluded from our Adjusted EBIT measure

because the amount and timing of these items is unpredictable, not

driven by core operating results and renders comparisons with prior

periods and competitors less meaningful. We believe Adjusted EBIT

is a useful measure for analysts and investors to evaluate our

future on-going performance as this measure allows a more

comprehensive comparison of our performance with our historical

results from prior periods and to the results of our competitors.

Moreover, our management uses this measure internally to evaluate

the performance of our business as a whole and it allows investors

to gain an understanding of the factors and trends affecting

profitability, including the ongoing costs to operating our

business, which we believe are inclusive of non-cash items such as

stock-based compensation.

Trailing Twelve Month Financial

Information

Expedia Group includes certain unaudited financial information

for the trailing twelve months ("TTM") ended June 30, 2024, which

is calculated as the six months ended June 30, 2024 plus the year

ended December 31, 2023 less the six months ended June 30, 2023.

This presentation is not in accordance with GAAP. However, we

believe that this presentation provides useful information to

investors regarding its recent financial performance, and it views

this presentation of the four most recently completed fiscal

quarters as a key measurement period for investors to assess its

historical results.

Adjusted Net Income (Loss)

generally captures all items on the statements of operations that

occur in normal course operations and have been, or ultimately will

be, settled in cash and is defined as net income (loss)

attributable to Expedia Group plus the following items, net of

tax(a):

(1) stock-based compensation expense, including compensation

expense related to equity plans of certain subsidiaries and

equity-method investments; (2) acquisition-related impacts,

including;

(i) amortization of intangible assets,

including as part of equity-method investments, and goodwill and

intangible asset impairment; (ii) gains (losses) recognized on

changes in the value of contingent consideration arrangements;

(iii) upfront consideration paid to settle employee compensation

plans of the acquiree; and (iv) gains (losses) recognized on

non-controlling investment basis adjustments when we acquire or

lose controlling interests;

(3) currency gains or losses on U.S. dollar denominated cash;

(4) the changes in fair value of equity investments; (5) certain

other items, including restructuring charges; (6) items included in

legal reserves, occupancy tax and other, which includes reserves

for potential settlement of issues related to transactional taxes

(e.g., hotel occupancy and excise taxes), related court decisions

and final settlements, and charges incurred, if any, for monies

that may be required to be paid in advance of litigation in certain

transactional tax proceedings, including as part of equity method

investments; (7) discontinued operations; (8) the non-controlling

interest impact of the aforementioned adjustment items; and (9)

unrealized gains (losses) on revenue hedging activities that are

included in other, net.

Adjusted Net Income (Loss) includes preferred share dividends.

We believe Adjusted Net Income (Loss) is useful to investors

because it represents Expedia Group's combined results, taking into

account depreciation, which management believes is an ongoing cost

of doing business, but excluding the impact of certain expenses and

items not directly tied to the core operations of our

businesses.

(a) Effective January 1, 2023, we changed our methodology for

the computation of the effective tax rate used in the calculation

of adjusted net income to a long-term projected tax rate as we

believe this tax rate provides better consistency across reporting

periods and produces results that are reflective of Expedia Group’s

long-term effective tax rate. This projected effective tax rate is

a total tax rate, and eliminates the effects of non-recurring and

period- specific income tax items which can vary in size and

frequency. We apply this tax rate to pretax income, as adjusted

commensurate with our Adjusted Net Income definition. Based on our

long-term projections, in 2023 and 2024 we are applying a 21.5%

effective tax rate to compute Adjusted Net Income.

Adjusted EPS is defined as Adjusted

Net Income (Loss) divided by adjusted weighted average shares

outstanding, which, when applicable, include dilution from our

convertible debt instruments per the treasury stock method for

Adjusted EPS. The treasury stock method assumes we would elect to

settle the principal amount of the debt for cash and the conversion

premium for shares. If the conversion prices for such instruments

exceed our average stock price for the period, the instruments

generally would have no impact to adjusted weighted average shares

outstanding. This differs from the GAAP method for dilution from

our convertible debt instruments, which include them on an

if-converted method. We believe Adjusted EPS is useful to investors

because it represents, on a per share basis, Expedia Group's

consolidated results, taking into account depreciation, which we

believe is an ongoing cost of doing business, as well as other

items which are not allocated to the operating businesses such as

interest expense, taxes, foreign exchange gains or losses, and

minority interest, but excluding the effects of certain expenses

not directly tied to the core operations of our businesses.

Adjusted Net Income (Loss) and Adjusted EPS have similar

limitations as Adjusted EBITDA. In addition, Adjusted Net Income

(Loss) does not include all items that affect our net income (loss)

and net income (loss) per share for the period. Therefore, we think

it is important to evaluate these measures along with our

consolidated statements of operations.

Free Cash Flow is defined as net

cash flow provided by operating activities less capital

expenditures. Management believes Free Cash Flow is useful to

investors because it represents the operating cash flow that our

operating businesses generate, less capital expenditures but before

taking into account other cash movements that are not directly tied

to the core operations of our businesses, such as financing

activities, foreign exchange or certain investing activities. Free

Cash Flow has certain limitations in that it does not represent the

total increase or decrease in the cash balance for the period, nor

does it represent the residual cash flow for discretionary

expenditures. Therefore, it is important to evaluate Free Cash Flow

along with the consolidated statements of cash flows.

Adjusted Expenses (cost of revenue, direct

and indirect selling and marketing, technology and content and

general and administrative expenses) exclude stock-based

compensation related to expenses for stock options, restricted

stock units and other equity compensation under applicable

stock-based compensation accounting standards. Expedia Group

excludes stock-based compensation from these measures primarily

because they are non-cash expenses that we do not believe are

necessarily reflective of our ongoing cash operating expenses and

cash operating income. Moreover, because of varying available

valuation methodologies, subjective assumptions and the variety of

award types that companies can use when adopting applicable

stock-based compensation accounting standards, management believes

that providing non-GAAP financial measures that exclude stock-based

compensation allows investors to make meaningful comparisons

between our recurring core business operating results and those of

other companies, as well as providing management with an important

tool for financial operational decision making and for evaluating

our own recurring core business operating results over different

periods of time. There are certain limitations in using financial

measures that do not take into account stock-based compensation,

including the fact that stock-based compensation is a recurring

expense and a valued part of employees' compensation. Therefore, it

is important to evaluate both our GAAP and non-GAAP measures. See

the Notes to the Consolidated Statements of Operations for

stock-based compensation by line item.

Expedia Group, Inc. (excluding

trivago) In order to provide increased transparency on the

transaction-based component of the business, Expedia Group is

reporting results both in total and excluding trivago.

Tabular Reconciliations for Non-GAAP

Measures

Adjusted EBITDA (Adjusted Earnings Before

Interest, Taxes, Depreciation & Amortization) by Segment(1)

Three months ended June 30,

2024

B2C

B2B

trivago

Corporate &

Eliminations

Total

(In millions)

Operating income (loss)

$

533

$

236

$

(6

)

$

(312

)

$

451

Realized gain (loss) on revenue hedges

(8

)

(7

)

—

—

(15

)

Restructuring and related reorganization

charges, excluding stock-based compensation

—

—

—

10

10

Legal reserves, occupancy tax and

other

—

—

—

21

21

Stock-based compensation

—

—

—

114

114

Amortization of intangible assets

—

—

—

15

15

Depreciation

129

34

1

26

190

Adjusted EBITDA(1)

$

654

$

263

$

(5

)

$

(126

)

$

786

Three months ended June 30,

2023

B2C

B2B

trivago

Corporate &

Eliminations

Total

(In millions)

Operating income

$

529

$

175

$

12

$

(273

)

$

443

Realized gain (loss) on revenue hedges

(6

)

4

—

—

(2

)

Legal reserves, occupancy tax and

other

—

—

—

1

1

Stock-based compensation

—

—

—

106

106

Amortization of intangible assets

—

—

—

15

15

Depreciation

130

27

1

26

184

Adjusted EBITDA(1)

$

653

$

206

$

13

$

(125

)

$

747

(1) Adjusted EBITDA for our B2C and B2B

segments includes allocations of certain expenses, primarily cost

of revenue and facilities, the total costs of our global travel

supply organizations, the majority of platform and marketplace

technology costs, and the realized foreign currency gains or losses

related to the forward contracts hedging a component of our net

merchant lodging revenue. We base the allocations primarily on

transaction volumes and other usage metrics. We do not allocate

certain shared expenses such as accounting, human resources,

certain information technology and legal to our reportable

segments. We include these expenses in Corporate and Eliminations.

Our allocation methodology is periodically evaluated and may

change.

Adjusted EBIT (Adjusted Earnings Before

Interest & Taxes) and Adjusted EBITDA (Adjusted Earnings Before

Interest, Taxes, Depreciation & Amortization)

Three months ended

June 30,

Six months ended

June 30,

Year Ended December

31,

TTM

June 30,

2024

2023

2024

2023

2023

2024

($ in millions)

Net income attributable to Expedia Group,

Inc.

$

386

$

385

$

251

$

240

$

797

$

808

Net income (loss) attributable to

non-controlling interests

(11

)

2

(12

)

7

(109

)

(128

)

Provision for income taxes

113

77

94

156

330

268

Total other (income) expense, net

(37

)

(21

)

8

(81

)

15

104

Operating income

451

443

341

322

1,033

1,052

Gain (loss) on revenue hedges related to

revenue recognized

(15

)

(2

)

(32

)

4

(7

)

(43

)

Restructuring and related reorganization

charges, including stock-based compensation

18

—

66

—

—

66

Legal reserves, occupancy tax and

other

21

1

41

6

8

43

Impairment of goodwill

—

—

—

—

297

297

Impairment of intangible assets

—

—

—

—

129

129

Adjusted EBIT

475

442

416

332

1,460

1,544

Stock-based compensation, excluding

restructuring and related reorganization charges

106

106

210

209

413

414

Depreciation and amortization

205

199

415

391

807

831

Adjusted EBITDA

$

786

$

747

$

1,041

$

932

$

2,680

$

2,789

Net income margin(1)

10.8

%

11.5

%

3.9

%

4.0

%

6.2

%

6.1

%

Adjusted EBIT margin(1)

13.3

%

13.1

%

6.4

%

5.5

%

11.4

%

11.6

%

Adjusted EBITDA margin(1)

22.1

%

22.2

%

16.1

%

15.5

%

20.9

%

21.0

%

Long-term debt, including current

maturities

$

6,259

Long-term debt to net income ratio

7.7

Long-term debt, including current

maturities

$

6,259

Unamortized discounts and debt issuance

costs

35

Adjusted debt

$

6,294

Leverage ratio(2)

2.3

(1) Net income, Adjusted EBIT and Adjusted

EBITDA margins represent net income (loss) attributable to Expedia

Group, Inc., Adjusted EBIT or Adjusted EBITDA divided by

revenue.

(2) Leverage ratio represents adjusted

debt divided by TTM Adjusted EBITDA.

Adjusted Net Income (Loss) & Adjusted

EPS

Three months ended

June 30,

Six months ended

June 30,

2024

2023

2024

2023

(In millions, except share and

per share data)

Net income attributable to Expedia

Group, Inc.

$

386

$

385

$

251

$

240

Less: Net (income) loss attributable to

non-controlling interests

11

(2

)

12

(7

)

Less: Provision for income taxes

(113

)

(77

)

(94

)

(156

)

Income before income taxes

488

464

333

403

Amortization of intangible assets

15

15

30

30

Stock-based compensation

114

106

218

209

Legal reserves, occupancy tax and

other

21

1

41

6

Restructuring and related reorganization

charges, excluding stock-based compensation

10

—

58

—

Unrealized (gain) loss on revenue

hedges

(2

)

17

(3

)

15

Gain on minority equity investments,

net

(56

)

(53

)

(47

)

(54

)

TripAdvisor tax indemnification

adjustment

(6

)

2

(6

)

(67

)

Gain on sale of businesses

—

(4

)

(3

)

(24

)

Adjusted income before income taxes

584

548

621

518

GAAP Provision for income taxes

(113

)

(77

)

(94

)

(156

)

Provision for income taxes for

adjustments

(13

)

(40

)

(40

)

45

Total Adjusted provision for income

taxes

(126

)

(117

)

(134

)

(111

)

Total Adjusted income tax rate

21.5

%

21.5

%

21.5

%

21.5

%

Non-controlling interests

11

(3

)

11

(9

)

Adjusted net income attributable to

Expedia Group, Inc.

$

469

$

428

$

498

$

398

GAAP diluted earnings per share

$

2.80

$

2.54

$

1.79

$

1.55

Amortization of intangible assets

0.11

0.10

0.22

0.20

Stock-based compensation

0.85

0.72

1.60

1.39

Legal reserves, occupancy tax and

other

0.16

—

0.30

0.04

Restructuring and related reorganization

charges

0.08

—

0.43

—

Unrealized (gain) loss on revenue

hedges

(0.01

)

0.11

(0.02

)

0.11

Gain on minority equity investments,

net

(0.42

)

(0.36

)

(0.35

)

(0.36

)

TripAdvisor tax indemnification

adjustment

(0.05

)

0.02

(0.05

)

(0.44

)

Gain on sale of businesses

—

(0.03

)

(0.03

)

(0.16

)

Income tax effects and adjustments

(0.09

)

(0.27

)

(0.29

)

0.30

Non-controlling interest

(0.01

)

(0.01

)

(0.01

)

(0.01

)

Adjustment to GAAP dilutive securities

(1)

0.08

0.07

0.05

0.04

Adjusted earnings per share(2)

$

3.51

$

2.89

$

3.66

$

2.64

GAAP diluted weighted average shares

outstanding (000's)

137,832

151,844

140,131

154,425

Adjustment to dilutive securities

(000's)(1)

(3,921

)

(3,921

)

(3,921

)

(3,921

)

Adjusted weighted average shares

outstanding (000's) (2)

133,910

147,923

136,209

150,504

Ex-trivago Adjusted Net Income and

Adjusted EPS

Adjusted net income attributable to

Expedia Group, Inc.

$

469

$

428

$

498

$

398

Less: Adjusted net income (loss)

attributable to trivago

7

7

(1

)

16

Adjusted net income excluding trivago

$

462

$

421

$

499

$

382

Adjusted earnings per share

$

3.51

$

2.89

$

3.66

$

2.64

Less: Adjusted earnings (loss) per share

attributable to trivago

0.05

0.05

(0.01

)

0.11

Adjusted earnings per share excluding

trivago(2)

$

3.46

$

2.84

$

3.67

$

2.53

(1) In periods for which we have Adjusted

net income, the GAAP diluted average shares and diluted earnings

(loss) per share is presented adjusted for our convertible debt

instruments per the treasury stock method.

(2) Share and per share numbers may not

add due to rounding.

Free Cash Flow

Three months ended

June 30,

Six months ended

June 30,

2024

2023

2024

2023

(In millions)

Net cash provided by operating

activities

$

1,501

$

1,146

$

4,380

$

4,303

Less: Total capital expenditures

(194

)

(223

)

(371

)

(456

)

Free cash flow

$

1,307

$

923

$

4,009

$

3,847

Adjusted Expenses (Cost of revenue, direct

and indirect selling and marketing, technology and content and

general and administrative expenses)

Three months ended

June 30,

Six months ended

June 30,

2024

2023

2024

2023

(In millions)

Cost of revenue

$

362

$

407

$

720

$

821

Less: stock-based compensation

4

4

6

7

Adjusted cost of revenue

$

358

$

403

$

714

$

814

Less: trivago cost of revenue(1)

4

4

8

9

Adjusted cost of revenue excluding

trivago

$

354

$

399

$

706

$

805

Selling and marketing - direct

$

1,793

$

1,579

$

3,443

$

3,066

Less: trivago selling and marketing -

direct(2)

54

42

107

70

Adjusted selling and marketing excluding

trivago - direct

$

1,739

$

1,537

$

3,336

$

2,996

Selling and marketing - indirect

$

197

$

191

383

378

Less: stock-based compensation

23

20

42

40

Adjusted selling and marketing -

indirect

$

174

$

171

$

341

$

338

Less: trivago selling and marketing -

indirect(1)

2

2

5

5

Adjusted selling and marketing excluding

trivago - indirect

$

172

$

169

$

336

$

333

Technology and content

$

331

$

344

$

672

$

661

Less: stock-based compensation

40

36

80

70

Adjusted technology and content

$

291

$

308

$

592

$

591

Less: trivago technology and

content(1)

12

12

24

23

Adjusted technology and content excluding

trivago

$

279

$

296

$

568

$

568

General and administrative

$

180

$

194

$

366

$

378

Less: stock-based compensation

39

46

82

92

Adjusted general and administrative

$

141

$

148

$

284

$

286

Less: trivago general and

administrative(1)

9

9

17

17

Adjusted general and administrative

excluding trivago

$

132

$

139

$

267

$

269

Total adjusted overhead expenses(3)

$

606

$

627

$

1,217

$

1,215

Note: Some numbers may not add due to

rounding.

(1) trivago amount presented without

stock-based compensation as those are included with the

consolidated totals above.

(2) Selling and marketing expense adjusted

to add back B2C direct marketing spend on trivago eliminated in

consolidation.

(3) Total adjusted overhead expenses is

the sum of adjusted expenses for Selling and marketing - indirect,

Technology and content, and General and administrative.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This release may contain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties. These forward-looking

statements are based on assumptions that are inherently subject to

uncertainties, risks and changes in circumstances that are

difficult to predict. The use of words such as “believe,”

“estimate,” “expect” and “will,” or the negative of these terms or

other similar expressions, among others, generally identify

forward-looking statements. However, these words are not the

exclusive means of identifying such statements. In addition, any

statements that refer to expectations, projections or other

characterizations of future events or circumstances are

forward-looking statements and may include statements relating to

future revenues, expenses, margins, profitability, net income

(loss), earnings per share and other measures of results of

operations and the prospects for future growth of Expedia Group,

Inc.’s business. Actual results may differ materially from the

results predicted and reported results should not be considered as

an indication of future performance. The potential risks and

uncertainties that could cause actual results to differ from the

results predicted include, among others, those described in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of our most

recently filed periodic reports on Form 10-K and Form 10-Q, which

are available on our investor relations website at

ir.expediagroup.com and on the SEC website at www.sec.gov. All

information provided in this release is as of August 8, 2024. Undue

reliance should not be placed on forward-looking statements in this

release, which are based on information available to us on the date

hereof. We undertake no duty to update this information unless

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808773380/en/

Investor Relations ir@expediagroup.com

Communications press@expediagroup.com

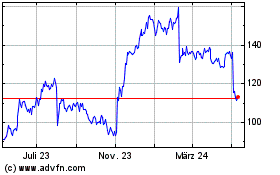

Expedia (NASDAQ:EXPE)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

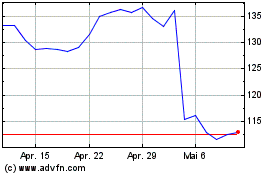

Expedia (NASDAQ:EXPE)

Historical Stock Chart

Von Nov 2023 bis Nov 2024