Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

17 Juni 2024 - 12:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨

Definitive Proxy Statement

x

Definitive Additional Materials

¨

Soliciting Material under §240.14a-12

Cardiff Oncology, Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x

No fee required.

¨

Fee paid previously with preliminary materials.

¨

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

Cardiff Oncology, Inc.

Supplement to the

Proxy Statement

For the Annual Meeting

of Stockholders

To be Held on June 20,

2024

This proxy statement supplement, dated June 17, 2024 (the “Supplement”), supplements the definitive proxy statement (which

we refer to as the “Proxy Statement”) of the Board of Directors of Cardiff Oncology, Inc. (the “Company”) filed

with the U.S. Securities and Exchange Commission on April 25, 2024 relating to the annual meeting of stockholders of the Company to be

held on Thursday, June 20, 2024 at 9:00 a.m., local time, at the Company's offices located at 11055 Flintkote Ave., San Diego, CA 92121.

The purpose of this Supplement is to provide additional information with respect to Proposal 3 in the Proxy Statement. Except as described

in this Supplement, the information disclosed in the Proxy Statement continues to apply. To the extent that information in this Supplement

differs from information disclosed in the proxy statement, the information in this Supplement applies.

As

previously disclosed on June 3, 2024, the Board of Directors of the Company

adopted resolutions to rescind stock options exercisable for an aggregate 1,697,712 shares of common stock that were granted on

March 7, 2024 that were made in reliance on the 2022 amendment to the 2021 Equity Incentive Plan and approved replacement

grants with terms identical to the stock options rescinded. The replacement grants will be effective only upon stockholder

approval of Proposal 3.

We describe in the following table the replacement grants which have

been granted and will be effective only upon stockholder approval of Proposal 3.

| Name and Position |

Options |

| |

|

| Mark Erlander, CEO |

510,000 |

| James Levine, CFO |

205,008 |

| Fairooz Kabbinavar, CMO |

205,008 |

| Tod Smeal, CSO |

205,008 |

| Employees |

572,688 |

All of the options granted have a grant date of May 30, 2024,

an exercise price of $3.51 per share and expire on March 7, 2034. 25% of the options granted vest on March 7, 2025 and the remaining

shares vest in 36 equal monthly installment thereafter, subject to the continued service of the option holder.

Any proxies submitted

by stockholders before the date of this Supplement will be voted as instructed on those proxies, unless a stockholder changes his or her

vote by submitting a later dated proxy. Stockholders should follow the instructions described in the Proxy Statement regarding how to

submit proxies or vote at the Annual Meeting.

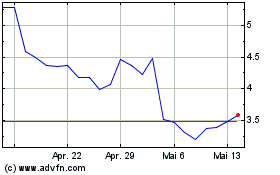

Cardiff Oncology (NASDAQ:CRDF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Cardiff Oncology (NASDAQ:CRDF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025