BCB Bancorp, Inc. (the “Company”), (NASDAQ: BCBP), the holding

company for BCB Community Bank (the “Bank”), today reported net

income of $8.1 million for the first quarter of 2023, compared to

$12.1 million in the fourth quarter of 2022, and $10.0 million for

the first quarter of 2022. Earnings per diluted share for the first

quarter of 2023 were $0.46, compared to $0.69 in the preceding

quarter and $0.56 in the first quarter of 2022. Net income and

earnings per diluted share for the first quarter of 2023, adjusted

for the unrealized losses on equity investments, were $10.4 million

and $0.60, respectively.

The Company announced that its Board of

Directors declared a regular quarterly cash dividend of $0.16 per

share. The dividend will be payable on May 19, 2023 to common

shareholders of record on May 5, 2023.

“We posted another quarter of strong loan growth

as we continued to onboard new relationships and customers that

have become available to us from recent market disruptions. We are

acutely aware of the liquidity challenges posed by the

macroenvironment and remain very focused on maintaining a strong

capital and liquidity position,” stated Thomas Coughlin, President

and Chief Executive Officer. “In a persistently high rate

environment, our customers have remained loyal to us and continue

to book business with us. Our core deposits grew at an annualized

rate of 7.1 percent during the quarter. Like many of our peers, the

increasing cost of liquidity has pressured our net interest margin.

While we believe that our net interest margin has stabilized, we

remain focused on protecting our net interest income, which will

benefit from higher-priced loan originations and from the upward

repricing of the existing loan book.”

“On January 1, 2023, the Company implemented the

Current Expected Credit Losses (“CECL”) methodology and the Day One

CECL adjustment resulted in a $4.2 million reduction to our

Allowance for Credit Losses (“ACL”) which further benefitted our

capital (net of taxes). Our asset quality remains strong and the

Bank’s loan portfolio continues to perform very well. Our

non-accrual to total loans ratio decreased to 0.16 percent at March

31, 2023 from 0.17 percent at December 31, 2022 and 0.38 percent a

year ago. Using the CECL methodology, we recorded a loan loss

provision of $622,000 during the first quarter of 2023 compared to

a credit to the loan loss provision of $500,000 during the fourth

quarter of 2022 under the incurred loss methodology,” said

Coughlin.

“We remain committed to building a strong

franchise despite the current challenges and headwinds facing the

banking industry. Our continued ability to hire talent, grow our

balance sheet organically, and digitize our products and services

will only further enhance the value of our Bank over time. We are

well-positioned to come out stronger and more profitable on the

other side of the current economic cycle,” said Coughlin.

Executive Summary

- Total deposits were $2.867 billion

at March 31, 2023, up from $2.631 billion at March 31, 2022.

- Net interest margin was 3.15

percent for the first quarter of 2023, compared to 3.76 percent for

the fourth quarter of 2022, and 3.46 percent for the first quarter

of 2022.

- Total yield on interest-earning

assets increased 1 basis point to 4.86 percent for the first

quarter of 2023, compared to 4.85 percent for the fourth quarter of

2022, and increased 104 basis points from 3.82 percent for the

first quarter of 2022.

- Total cost of interest-bearing

liabilities increased 78 basis points to 2.24 percent for the first

quarter of 2023, compared to 1.46 percent for the fourth quarter of

2022, and increased 174 basis points from 0.50 percent for the

first quarter of 2022.

- The efficiency ratio for the first

quarter was 53.7 percent compared to 51.3 percent in the prior

quarter, and 53.0 percent in the first quarter of 2022.

- The annualized return on average

assets ratio for the first quarter was 0.90 percent, compared to

1.46 percent in the prior quarter, and 1.33 percent in the first

quarter of 2022.

- The annualized return on average

equity ratio for the first quarter was 11.0 percent, compared to

17.0 percent in the prior quarter, and 14.7 percent in the first

quarter of 2022.

- The provision for loan losses was

$622,000 in the first quarter of 2023 compared to a credit for loan

losses of $500,000 for the fourth quarter of 2022 and a credit for

loan losses of $2.6 million for the first quarter of 2022.

- Allowance for credit losses as a

percentage of non-accrual loans was 571.0 percent at March 31,

2023, compared to 633.6 percent for the prior quarter-end and 368.1

percent at March 31, 2022, as total non-accrual loans decreased to

$5.06 million at March 31, 2023, from $5.11 million for the prior

quarter and $9.23 million at March 31, 2022.

- Total loans receivable, net of

allowance for credit losses, increased 34.9 percent to $3.232

billion at March 31, 2023, up from $2.396 billion at March 31,

2022.

Balance Sheet Review

Total assets increased by $216.9 million, or 6.1

percent, to $3.763 billion at March 31, 2023, from $3.546 billion

at December 31, 2022. The increase in total assets was mainly

related to increases in total loans and in cash and cash

equivalents.

Total cash and cash equivalents increased by

$31.7 million, or 13.8 percent, to $261.1 million at March 31,

2023, from $229.4 million at December 31, 2022. The increase was

primarily due to an increase in Federal Home Loan Bank (“FHLB”)

borrowings and in deposits.

Loans receivable, net, increased by $186.5

million, or 6.1 percent, to $3.232 billion at March 31, 2023, from

$3.045 billion at December 31, 2022. Total loan increases for the

first three months of 2023 included increases of $121.7 million in

commercial real estate and multi-family loans, $45.6 million

in commercial business loans, $17.6 million in construction loans,

and $2.1 million in home equity and consumer loans, partly offset

by a decrease of $3.4 million in residential one-to-four family

loans. The allowance for credit losses decreased $3.5 million to

$28.9 million, or 571.0 percent of non-accruing loans and 0.89

percent of gross loans, at March 31, 2023, as compared to an

allowance for credit losses of $32.4 million, or 633.6 percent of

non-accruing loans and 1.05 percent of gross loans, at December 31,

2022.

Total investment securities decreased by $8.0

million, or 7.3 percent, to $101.4 million at March 31, 2023, from

$109.4 million at December 31, 2022, representing unrealized

losses, calls and maturities, and repayments.

Deposit liabilities increased by $55.6 million,

or 2.0 percent, to $2.867 billion at March 31, 2023, from $2.812

billion at December 31, 2022. The increase in deposits was

primarily driven by an increase of $43.3 million in non-brokered

deposits during the first quarter of 2023.

Debt obligations increased by $150.2 million to

$570.0 million at March 31, 2023 from $419.8 million at December

31, 2022. The weighted average interest rate of FHLB advances was

4.52 percent at March 31, 2023 and 4.07 percent at December 31,

2022. The weighted average maturity of FHLB advances as of March

31, 2023 was 0.78 years. The fixed interest rate of our

subordinated debt balances was 5.62 percent at March 31, 2023 and

December 31, 2022.

Stockholders’ equity increased by $6.4 million,

or 2.2 percent, to $297.6 million at March 31, 2023, from $291.3

million at December 31, 2022. The increase was primarily

attributable to the increase in retained earnings of $8.0 million,

or 7.0 percent, to $123.1 million at March 31, 2023 from $115.1

million at December 31, 2022.

First Quarter 2023 Income Statement

Review

Net income was $8.1 million for the first

quarter ended March 31, 2023 and $10.0 million for the first

quarter ended March 31, 2022. The decline was primarily driven by

higher loan loss provisioning and unrealized losses on equity

investments for the first quarter of 2023 as compared with the

first quarter of 2022.

Net interest income increased by $2.4 million,

or 9.6 percent, to $27.5 million for the first quarter of

2023, from $25.1 million for the first quarter of 2022. The

increase in net interest income resulted from higher interest

income which was partially offset by higher interest expense.

Interest income increased by $14.6 million, or

52.8 percent, to $42.4 million for the first quarter of 2023 from

$27.7 million for the first quarter of 2022. The average

balance of interest-earning assets increased $583.5 million, or

20.1 percent, to $3.483 billion for the first quarter of 2023 from

$2.900 billion for the first quarter of 2022, while the average

yield increased 104 basis points to 4.86 percent for the first

quarter of 2023 from 3.82 percent for the first quarter of 2022.

Compared to the first quarter of 2023, the interest income on loans

for the first quarter of 2022 also included $147,000 of

amortization of purchase credit fair value adjustments related to a

prior acquisition, which added approximately three basis points to

the average yield on interest-earning assets.

Interest expense increased by $12.2 million to

$14.9 million for the first quarter of 2023 from

$2.7 million for the first quarter of 2022. The increase

resulted primarily from an increase in the average rate on

interest-bearing liabilities of 174 basis points to 2.24 percent

for the first quarter of 2023 from 0.50 percent for the first

quarter of 2022, while the average balance of interest-bearing

liabilities increased by $551.7 million to $2.661 billion for the

first quarter of 2023 from $2.109 billion for the first quarter of

2022. The increase in the average cost of funds resulted primarily

from the persistently high interest rate environment.

The net interest margin was 3.15 percent for the

first quarter of 2023 compared to 3.46 percent for the first

quarter of 2022. The decrease in the net interest margin compared

to the first quarter of 2022 was the result of the increase in the

cost of interest-bearing liabilities partially offset by the

increase in the yield on interest-earning assets. In a persistently

high interest rate environment, management has been proactive in

managing both the yield on earning assets and the cost of funds to

protect net interest margin and continue to support the growth of

net interest income.

During the first quarter of 2023, the Company

experienced $48,000 in net recoveries compared to $564,000 in the

first quarter of 2022. The Bank had non-accrual loans totaling

$5.06 million, or 0.16 percent of gross loans, at March 31,

2023 as compared to $9.2 million, or 0.38 percent of gross

loans, at March 31, 2022. The allowance for credit losses on loans

was $28.9 million, or 0.89 percent of gross loans at March 31,

2023, and $34.0 million, or 1.40 percent of gross loans at

March 31, 2022. The provision for loan losses was $622,000 for the

first quarter of 2023 compared to a credit for loan losses of $2.6

million for the first quarter of 2022. Management believes that the

allowance for credit losses on loans was adequate at March 31, 2023

and March 31, 2022.

Non-interest income decreased by $1.1 million to

a loss of $1.7 million for the first quarter of 2023 from a

loss of $600,000 for first quarter of 2022. The decrease in total

non-interest income was mainly related to an increase in the

realized and unrealized losses on equity securities from $2.7

million to $3.2 million and a decrease in BOLI income of $334,000.

The realized and unrealized losses on equity securities are based

on market conditions.

Non-interest expense increased by $895,000, or

6.9 percent, to $13.9 million for the first quarter of 2023

from $13.0 million for the first quarter of 2022. The increase

in operating expenses for the first quarter of 2023 was primarily

driven by the higher salaries and employee benefits and increased

spending for advertising and promotions compared to the first

quarter of 2022. The increase in salaries related to normal

compensation increases, higher commission expenses from strong loan

production, and staff hiring. The higher advertising and

promotional spending is intended to continue the strong growth in

our business. The number of full-time equivalent employees for the

first quarter of 2023 was 298, as compared to 303 for the same

period in 2022.

The income tax provision decreased by $911,000

or 22.0 percent, to $3.2 million for the first quarter of 2023

from $4.1 million for the first quarter of 2022. The

consolidated effective tax rate was 28.5 percent for the first

quarter of 2023 compared to 29.4 percent for the first quarter of

2022.

Asset Quality

During the first quarter of 2023, the Company

recognized $48,000 in net recoveries, compared to $564,000 for the

first quarter of 2022.

On January 1, 2023, the Company adopted

Accounting Standards Update No. 2016-13, Financial

Instruments-Credit Losses (Topic 326): Measurement of Credit Losses

on Financial Instruments (“CECL”), which upon adoption resulted in

a Day One adjustment of $4.2 million (reduction to the 12/31/2022

Allowance for Credit Losses and benefit to capital, net of tax

effect). The provision for loan losses was $622,000 for the first

quarter of 2023 compared to a credit for loan losses of $2.6

million for the first quarter of 2022. The Bank had non-accrual

loans totaling $5.06 million, or 0.16 percent of gross loans,

at March 31, 2023, as compared to $9.2 million, or 0.38

percent of gross loans at March 31, 2022. The allowance for credit

losses on loans was $28.9 million, or 0.89 percent of gross

loans at March 31, 2023, and $34.0 million, or 1.40 percent of

gross loans at March 31, 2022. The allowance for credit losses was

571.0 percent of non-accrual loans at March 31, 2023, and

368.1 percent of non-accrual loans at March 31, 2022.

About BCB Bancorp, Inc.

Established in 2000 and headquartered in

Bayonne, N.J., BCB Community Bank is the wholly-owned subsidiary of

BCB Bancorp, Inc. (NASDAQ: BCBP). The Bank has 27 branch offices in

Bayonne, Edison, Hoboken, Fairfield, Holmdel, Jersey City,

Lyndhurst, Maplewood, Monroe Township, Newark, Parsippany,

Plainsboro, River Edge, Rutherford, South Orange, Union, and

Woodbridge, New Jersey, and three branches in Hicksville and Staten

Island, New York. The Bank provides businesses and individuals a

wide range of loans, deposit products, and retail and commercial

banking services. For more information, please go to

www.bcb.bank.

Forward-Looking Statements

This release, like many written and oral

communications presented by BCB Bancorp, Inc., and our authorized

officers, may contain certain forward-looking statements regarding

our prospective performance and strategies within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. We intend

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this

statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions

and describe future plans, strategies, and expectations of the

Company, are generally identified by use of words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,”

“seek,” “strive,” “try,” or future or conditional verbs such as

“could,” “may,” “should,” “will,” “would,” or similar expressions.

Our ability to predict results or the actual effects of our plans

or strategies is inherently uncertain. Accordingly, actual results

may differ materially from anticipated results.

In addition to factors previously disclosed in

the Company’s reports filed with the U.S. Securities and Exchange

Commission (the "SEC") and those identified elsewhere in this

release, the following factors, among others, could cause actual

results to differ materially from forward-looking statements or

historical performance: the inability to close loans in our

pipeline; changes in asset quality and credit risk; the inability

to sustain revenue and earnings growth; changes in interest rates

and capital markets; inflation; supply chain disruptions; any

future pandemics and the related adverse local and national

economic consequences; civil unrest in the communities that the

company serves; customer acceptance of the Bank’s products and

services; customer borrowing, repayment, investment and deposit

practices; customer disintermediation; the introduction,

withdrawal, success and timing of business initiatives; competitive

conditions; economic conditions; and the impact, extent and timing

of technological changes, capital management activities, and

actions of governmental agencies and legislative and regulatory

actions and reforms.

Annualized, pro forma, projected and estimated

numbers are used for illustrative purpose only, are not forecasts

and may not reflect actual results.

Explanation of Non-GAAP Financial

Measures

Reported amounts are presented in accordance

with accounting principles generally accepted in the United States

of America ("GAAP"). This press release also contains certain

supplemental Non-GAAP information that the Company’s management

uses in its analysis of the Company’s financial results. The

Company’s management believes that providing this information to

analysts and investors allows them to better understand and

evaluate the Company’s financial results for the periods in

question.

The Company provides measurements and ratios

based on tangible stockholders' equity and efficiency ratios. These

measures are utilized by regulators and market analysts to evaluate

a company’s financial condition and, therefore, the Company’s

management believes that such information is useful to investors.

For a reconciliation of GAAP to Non-GAAP financial measures

included in this press release, see "Reconciliation of GAAP to

Non-GAAP Financial Measures" below.

|

|

Statements of Income - Three Months Ended, |

|

|

|

|

March 31,2023 |

December 31,2022 |

March 31, 2022 |

Mar. 31, 2023 vs. Dec. 31,2022 |

Mar. 31, 2023 vs. Mar. 31, 2022 |

|

Interest and dividend income: |

(In thousands, except per share amounts,

Unaudited) |

|

|

|

Loans, including fees |

$ |

38,889 |

|

$ |

36,173 |

|

$ |

26,321 |

|

7.5 |

% |

47.7 |

% |

|

Mortgage-backed securities |

|

186 |

|

|

185 |

|

|

159 |

|

0.5 |

% |

17.0 |

% |

|

Other investment securities |

|

1,120 |

|

|

1,177 |

|

|

948 |

|

-4.8 |

% |

18.1 |

% |

|

FHLB stock and other interest earning assets |

|

2,157 |

|

|

1,321 |

|

|

296 |

|

63.3 |

% |

628.7 |

% |

|

Total interest and dividend income |

|

42,352 |

|

|

38,856 |

|

|

27,724 |

|

9.0 |

% |

52.8 |

% |

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Demand and Money Market |

|

3,154 |

|

|

2,410 |

|

|

758 |

|

30.9 |

% |

316.1 |

% |

|

Savings and club |

|

118 |

|

|

118 |

|

|

108 |

|

0.0 |

% |

9.3 |

% |

|

Certificates of deposit |

|

6,453 |

|

|

3,973 |

|

|

980 |

|

62.4 |

% |

558.5 |

% |

|

|

|

9,725 |

|

|

6,501 |

|

|

1,846 |

|

49.6 |

% |

426.8 |

% |

|

Borrowings |

|

5,156 |

|

|

2,174 |

|

|

806 |

|

137.2 |

% |

539.7 |

% |

|

Total interest expense |

|

14,881 |

|

|

8,675 |

|

|

2,652 |

|

71.5 |

% |

461.1 |

% |

|

|

|

|

|

|

|

|

Net interest income |

|

27,471 |

|

|

30,181 |

|

|

25,072 |

|

-9.0 |

% |

9.6 |

% |

|

Provision (credit) for loan losses |

|

622 |

|

|

(500 |

) |

|

(2,575 |

) |

-224.4 |

% |

-124.2 |

% |

|

|

|

|

|

|

|

|

Net interest income after provision (credit) for loan

losses |

|

26,849 |

|

|

30,681 |

|

|

27,647 |

|

-12.5 |

% |

-2.9 |

% |

|

|

|

|

|

|

|

|

Non-interest income: |

|

|

|

|

|

|

Fees and service charges |

|

1,098 |

|

|

1,138 |

|

|

1,214 |

|

-3.5 |

% |

-9.6 |

% |

|

Gain on sales of loans |

|

6 |

|

|

3 |

|

|

65 |

|

100.0 |

% |

-90.8 |

% |

|

Realized and unrealized loss on equity investments |

|

(3,227 |

) |

|

(723 |

) |

|

(2,685 |

) |

346.3 |

% |

20.2 |

% |

|

BOLI income |

|

421 |

|

|

584 |

|

|

755 |

|

-27.9 |

% |

-44.2 |

% |

|

Other |

|

38 |

|

|

60 |

|

|

51 |

|

-36.7 |

% |

-25.5 |

% |

|

Total non-interest income |

|

(1,664 |

) |

|

1,062 |

|

|

(600 |

) |

-256.7 |

% |

177.3 |

% |

|

|

|

|

|

|

|

|

Non-interest expense: |

|

|

|

|

|

|

Salaries and employee benefits |

|

7,618 |

|

|

7,626 |

|

|

6,736 |

|

-0.1 |

% |

13.1 |

% |

|

Occupancy and equipment |

|

2,552 |

|

|

2,651 |

|

|

2,695 |

|

-3.7 |

% |

-5.3 |

% |

|

Data processing and communications |

|

1,665 |

|

|

1,579 |

|

|

1,465 |

|

5.4 |

% |

13.7 |

% |

|

Professional fees |

|

566 |

|

|

2,169 |

|

|

494 |

|

-73.9 |

% |

14.6 |

% |

|

Director fees |

|

265 |

|

|

261 |

|

|

321 |

|

1.5 |

% |

-17.4 |

% |

|

Regulatory assessment fees |

|

536 |

|

|

431 |

|

|

304 |

|

24.4 |

% |

76.3 |

% |

|

Advertising and promotions |

|

278 |

|

|

260 |

|

|

141 |

|

6.9 |

% |

97.2 |

% |

|

Other real estate owned, net |

|

1 |

|

|

4 |

|

|

1 |

|

-75.0 |

% |

0.0 |

% |

|

Other |

|

373 |

|

|

1,056 |

|

|

802 |

|

-64.7 |

% |

-53.5 |

% |

|

Total non-interest expense |

|

13,854 |

|

|

16,037 |

|

|

12,959 |

|

-13.6 |

% |

6.9 |

% |

|

|

|

|

|

|

|

|

Income before income tax provision |

|

11,331 |

|

|

15,706 |

|

|

14,088 |

|

-27.9 |

% |

-19.6 |

% |

|

Income tax provision |

|

3,225 |

|

|

3,634 |

|

|

4,136 |

|

-11.3 |

% |

-22.0 |

% |

|

|

|

|

|

|

|

|

Net Income |

|

8,106 |

|

|

12,072 |

|

|

9,952 |

|

-32.9 |

% |

-18.5 |

% |

|

Preferred stock dividends |

|

173 |

|

|

172 |

|

|

276 |

|

0.5 |

% |

-37.1 |

% |

|

Net Income available to common stockholders |

$ |

7,933 |

|

$ |

11,900 |

|

$ |

9,676 |

|

-33.3 |

% |

-18.0 |

% |

| |

|

|

|

|

|

|

Net Income per common share-basic and diluted |

|

|

|

|

|

|

Basic |

$ |

0.47 |

|

$ |

0.70 |

|

$ |

0.57 |

|

-33.5 |

% |

-17.9 |

% |

|

Diluted |

$ |

0.46 |

|

$ |

0.69 |

|

$ |

0.56 |

|

-33.0 |

% |

-17.4 |

% |

| |

|

|

|

|

|

|

Weighted average number of common shares

outstanding |

|

|

|

|

|

|

Basic |

|

16,949 |

|

|

16,916 |

|

|

16,980 |

|

0.2 |

% |

-0.2 |

% |

|

Diluted |

|

17,208 |

|

|

17,289 |

|

|

17,343 |

|

-0.5 |

% |

-0.8 |

% |

|

Statements of Financial Condition |

March 31,2023 |

December 31,2022 |

March 31, 2022 |

March 31, 2023 vs. December 31, 2022 |

March 31, 2023 vs. March 31,2022 |

|

ASSETS |

(In thousands, Unaudited) |

|

|

|

Cash and amounts due from depository institutions |

$ |

13,213 |

|

$ |

11,520 |

|

$ |

8,448 |

|

14.7 |

% |

56.4 |

% |

|

Interest-earning deposits |

|

247,862 |

|

|

217,839 |

|

|

388,205 |

|

13.8 |

% |

-36.2 |

% |

|

Total cash and cash equivalents |

|

261,075 |

|

|

229,359 |

|

|

396,653 |

|

13.8 |

% |

-34.2 |

% |

|

|

|

|

|

|

|

|

Interest-earning time deposits |

|

735 |

|

|

735 |

|

|

735 |

|

- |

|

- |

|

|

Debt securities available for sale |

|

86,988 |

|

|

91,715 |

|

|

86,307 |

|

-5.2 |

% |

0.8 |

% |

|

Equity investments |

|

14,458 |

|

|

17,686 |

|

|

21,269 |

|

-18.3 |

% |

-32.0 |

% |

|

Loans held for sale |

|

- |

|

|

658 |

|

|

325 |

|

-100.0 |

% |

-100.0 |

% |

|

Loans receivable, net of allowance for credit losses |

|

|

|

|

|

|

of $28,882, $32,373 and $33,980, respectively |

|

3,231,864 |

|

|

3,045,331 |

|

|

2,395,930 |

|

6.13 |

% |

34.89 |

% |

|

Federal Home Loan Bank of New York stock, at cost |

|

26,875 |

|

|

20,113 |

|

|

6,128 |

|

33.6 |

% |

338.6 |

% |

|

Premises and equipment, net |

|

10,106 |

|

|

10,508 |

|

|

11,646 |

|

-3.8 |

% |

-13.2 |

% |

|

Accrued interest receivable |

|

14,717 |

|

|

13,455 |

|

|

9,593 |

|

9.4 |

% |

53.4 |

% |

|

Other real estate owned |

|

75 |

|

|

75 |

|

|

75 |

|

- |

|

- |

|

|

Deferred income taxes |

|

15,178 |

|

|

16,462 |

|

|

13,016 |

|

-7.8 |

% |

16.6 |

% |

|

Goodwill and other intangibles |

|

5,359 |

|

|

5,382 |

|

|

5,417 |

|

-0.4 |

% |

-1.1 |

% |

|

Operating lease right-of-use asset |

|

15,111 |

|

|

13,520 |

|

|

11,883 |

|

11.8 |

% |

27.2 |

% |

|

Bank-owned life insurance ("BOLI") |

|

72,077 |

|

|

71,656 |

|

|

73,240 |

|

0.6 |

% |

-1.6 |

% |

|

Other assets |

|

8,438 |

|

|

9,538 |

|

|

8,093 |

|

-11.5 |

% |

4.3 |

% |

|

Total Assets |

$ |

3,763,056 |

|

$ |

3,546,193 |

|

$ |

3,040,310 |

|

6.1 |

% |

23.8 |

% |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Non-interest bearing deposits |

$ |

604,935 |

|

$ |

613,910 |

|

$ |

621,402 |

|

-1.5 |

% |

-2.6 |

% |

|

Interest bearing deposits |

|

2,262,274 |

|

|

2,197,697 |

|

|

2,009,773 |

|

2.9 |

% |

12.6 |

% |

|

Total deposits |

|

2,867,209 |

|

|

2,811,607 |

|

|

2,631,175 |

|

2.0 |

% |

9.0 |

% |

|

FHLB advances |

|

532,399 |

|

|

382,261 |

|

|

71,848 |

|

39.3 |

% |

641.0 |

% |

|

Subordinated debentures |

|

37,566 |

|

|

37,508 |

|

|

37,333 |

|

0.2 |

% |

0.6 |

% |

|

Operating lease liability |

|

15,436 |

|

|

13,859 |

|

|

12,180 |

|

11.4 |

% |

26.7 |

% |

|

Other liabilities |

|

12,828 |

|

|

9,704 |

|

|

11,615 |

|

32.2 |

% |

10.4 |

% |

|

Total Liabilities |

|

3,465,438 |

|

|

3,254,939 |

|

|

2,764,151 |

|

6.5 |

% |

25.4 |

% |

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Preferred stock: $0.01 par value, 10,000 shares authorized |

|

- |

|

|

- |

|

|

- |

|

|

|

|

Additional paid-in capital preferred stock |

|

21,003 |

|

|

21,003 |

|

|

26,213 |

|

- |

|

-19.9 |

% |

|

Common stock: no par value, 40,000 shares authorized |

|

- |

|

|

- |

|

|

- |

|

|

|

|

Additional paid-in capital common stock |

|

197,197 |

|

|

196,164 |

|

|

194,222 |

|

0.5 |

% |

1.5 |

% |

|

Retained earnings |

|

123,121 |

|

|

115,109 |

|

|

88,132 |

|

7.0 |

% |

39.7 |

% |

|

Accumulated other comprehensive loss |

|

(6,613 |

) |

|

(6,491 |

) |

|

(1,275 |

) |

1.9 |

% |

418.7 |

% |

|

Treasury stock, at cost |

|

(37,090 |

) |

|

(34,531 |

) |

|

(31,133 |

) |

7.4 |

% |

19.1 |

% |

|

Total Stockholders' Equity |

|

297,618 |

|

|

291,254 |

|

|

276,159 |

|

2.2 |

% |

7.8 |

% |

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity |

$ |

3,763,056 |

|

$ |

3,546,193 |

|

$ |

3,040,310 |

|

6.1 |

% |

23.8 |

% |

|

|

|

|

|

|

|

|

Outstanding common shares |

|

16,884 |

|

|

16,931 |

|

|

16,985 |

|

|

|

|

|

Average Balances and Rates -Three Months Ended March

31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

|

(Dollars in thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

Loans Receivable (4)(5) |

$ |

3,165,678 |

|

$ |

38,889 |

4.91 |

% |

|

$ |

2,343,845 |

|

$ |

26,321 |

4.49 |

% |

|

Investment Securities |

|

108,869 |

|

|

1,306 |

4.80 |

% |

|

|

108,960 |

|

|

1,107 |

4.06 |

% |

|

FHLB stock and other interest-earning assets |

|

208,842 |

|

|

2,157 |

4.13 |

% |

|

|

447,080 |

|

|

296 |

0.26 |

% |

|

Total Interest-earning assets |

|

3,483,390 |

|

|

42,352 |

4.86 |

% |

|

|

2,899,885 |

|

|

27,724 |

3.82 |

% |

|

Non-interest-earning assets |

|

116,769 |

|

|

|

|

|

102,118 |

|

|

|

|

Total assets |

$ |

3,600,159 |

|

|

|

|

$ |

3,002,003 |

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

Interest-bearing demand accounts |

$ |

713,788 |

|

$ |

1,789 |

1.00 |

% |

|

$ |

706,067 |

|

$ |

398 |

0.23 |

% |

|

Money market accounts |

|

314,427 |

|

|

1,365 |

1.74 |

% |

|

|

345,564 |

|

|

360 |

0.42 |

% |

|

Savings accounts |

|

322,760 |

|

|

118 |

0.15 |

% |

|

|

336,575 |

|

|

108 |

0.13 |

% |

|

Certificates of Deposit |

|

848,447 |

|

|

6,453 |

3.04 |

% |

|

|

611,813 |

|

|

980 |

0.64 |

% |

|

Total interest-bearing deposits |

|

2,199,422 |

|

|

9,725 |

1.77 |

% |

|

|

2,000,019 |

|

|

1,846 |

0.37 |

% |

|

Borrowed funds |

|

461,415 |

|

|

5,156 |

4.47 |

% |

|

|

109,105 |

|

|

806 |

2.95 |

% |

|

Total interest-bearing liabilities |

|

2,660,837 |

|

|

14,881 |

2.24 |

% |

|

|

2,109,124 |

|

|

2,652 |

0.50 |

% |

|

Non-interest-bearing liabilities |

|

645,883 |

|

|

|

|

|

621,575 |

|

|

|

|

Total liabilities |

|

3,306,720 |

|

|

|

|

|

2,730,699 |

|

|

|

|

Stockholders' equity |

|

293,439 |

|

|

|

|

|

271,305 |

|

|

|

|

Total liabilities and stockholders' equity |

$ |

3,600,159 |

|

|

|

|

$ |

3,002,003 |

|

|

|

|

Net interest income |

|

$ |

27,471 |

|

|

|

$ |

25,072 |

|

|

Net interest rate spread(1) |

|

|

2.63 |

% |

|

|

|

3.32 |

% |

|

Net interest margin(2) |

|

|

3.15 |

% |

|

|

|

3.46 |

% |

|

|

|

|

|

|

|

|

|

|

(1) Net interest rate spread represents the difference between the

average yield on average interest-earning assets and the average

cost of average interest-bearing liabilities. |

|

(2) Net interest margin represents net interest income divided by

average total interest-earning assets. |

|

(3) Annualized. |

|

(4) Excludes allowance for credit losses. |

|

(5) Includes non-accrual loans which are immaterial to the

yield. |

|

|

Financial Condition data by quarter |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

|

|

|

|

|

|

|

(In thousands, except book values) |

|

Total assets |

$ |

3,763,056 |

|

$ |

3,546,193 |

|

$ |

3,265,612 |

|

$ |

3,072,771 |

|

$ |

3,040,310 |

|

|

Cash and cash equivalents |

|

261,075 |

|

|

229,359 |

|

|

221,024 |

|

|

206,172 |

|

|

396,653 |

|

|

Securities |

|

101,446 |

|

|

109,401 |

|

|

111,159 |

|

|

105,717 |

|

|

107,576 |

|

|

Loans receivable, net |

|

3,231,864 |

|

|

3,045,331 |

|

|

2,787,015 |

|

|

2,620,630 |

|

|

2,395,930 |

|

|

Deposits |

|

2,867,209 |

|

|

2,811,607 |

|

|

2,712,946 |

|

|

2,655,030 |

|

|

2,631,175 |

|

|

Borrowings |

|

569,965 |

|

|

419,769 |

|

|

249,573 |

|

|

124,377 |

|

|

109,181 |

|

|

Stockholders’ equity |

|

297,618 |

|

|

291,254 |

|

|

282,682 |

|

|

271,637 |

|

|

276,159 |

|

|

Book value per common share1 |

$ |

16.38 |

|

$ |

15.96 |

|

$ |

15.42 |

|

$ |

15.04 |

|

$ |

14.72 |

|

|

Tangible book value per common share2 |

$ |

16.07 |

|

$ |

15.65 |

|

$ |

15.11 |

|

$ |

14.73 |

|

$ |

14.41 |

|

|

|

|

|

|

|

|

|

|

Operating data by quarter |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands, except for per share amounts) |

|

Net interest income |

$ |

27,471 |

|

$ |

30,181 |

|

$ |

30,951 |

|

$ |

27,741 |

|

$ |

25,072 |

|

|

Provision (credit) for loan losses |

|

622 |

|

|

(500 |

) |

|

- |

|

|

- |

|

|

(2,575 |

) |

|

Non-interest income |

|

-1,664 |

|

|

1,062 |

|

|

1,446 |

|

|

(313 |

) |

|

(600 |

) |

|

Non-interest expense |

|

13,854 |

|

|

16,037 |

|

|

13,453 |

|

|

13,056 |

|

|

12,959 |

|

|

Income tax expense |

|

3,225 |

|

|

3,634 |

|

|

5,552 |

|

|

4,209 |

|

|

4,136 |

|

|

Net income |

$ |

8,106 |

|

$ |

12,072 |

|

$ |

13,392 |

|

$ |

10,163 |

|

$ |

9,952 |

|

|

Net income per diluted share |

$ |

0.46 |

|

$ |

0.69 |

|

$ |

0.76 |

|

$ |

0.58 |

|

$ |

0.56 |

|

|

Common Dividends declared per share |

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

Financial Ratios(3) |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

Return on average assets |

|

0.90 |

% |

|

1.46 |

% |

|

1.74 |

% |

|

1.32 |

% |

|

1.33 |

% |

|

Return on average stockholder’s equity |

|

11.05 |

% |

|

16.99 |

% |

|

19.42 |

% |

|

15.00 |

% |

|

14.67 |

% |

|

Net interest margin |

|

3.15 |

% |

|

3.76 |

% |

|

4.18 |

% |

|

3.74 |

% |

|

3.46 |

% |

|

Stockholder’s equity to total assets |

|

7.91 |

% |

|

8.21 |

% |

|

8.66 |

% |

|

8.84 |

% |

|

9.08 |

% |

|

Efficiency Ratio4 |

|

53.68 |

% |

|

51.33 |

% |

|

41.53 |

% |

|

47.60 |

% |

|

52.95 |

% |

| |

|

|

|

|

|

|

|

Asset Quality Ratios |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands, except for ratio %) |

|

Non-Accrual Loans |

$ |

5,058 |

|

$ |

5,109 |

|

$ |

8,505 |

|

$ |

9,201 |

|

$ |

9,232 |

|

|

Non-Accrual Loans as a % of Total Loans |

|

0.16 |

% |

|

0.17 |

% |

|

0.30 |

% |

|

0.35 |

% |

|

0.38 |

% |

|

ACL as % of Non-Accrual Loans |

|

571.0 |

% |

|

633.6 |

% |

|

390.3 |

% |

|

370.7 |

% |

|

368.1 |

% |

|

Individually Evaluated Loans |

|

17,585 |

|

|

28,272 |

|

|

40,524 |

|

|

42,411 |

|

|

40,955 |

|

|

Classified Loans |

|

17,585 |

|

|

17,816 |

|

|

30,180 |

|

|

31,426 |

|

|

29,850 |

|

| |

|

|

|

|

|

|

(1) Calculated by dividing stockholders' equity, less preferred

equity, by shares outstanding. |

|

(2) Calculated by dividing tangible stockholders’ common equity, a

non-GAAP measure, by shares outstanding. Tangible

stockholders’ |

|

common equity is stockholders’ equity less goodwill and preferred

stock. See “Reconciliation of GAAP to Non-GAAP Financial Measures

by quarter.” |

|

(3) Ratios are presented on an annualized basis, where

appropriate. |

|

(4) The Efficiency Ratio, a non-GAAP measure, was calculated by

dividing non-interest expense by the total of net interest

income |

|

and non-interest income. See “Reconciliation of GAAP to Non-GAAP

Financial Measures by quarter.” |

|

|

Recorded Investment in Loans Receivable by quarter |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands) |

|

Residential one-to-four family |

$ |

246,683 |

|

$ |

250,123 |

|

$ |

242,238 |

|

$ |

235,883 |

|

$ |

233,251 |

|

|

Commercial and multi-family |

|

2,466,932 |

|

|

2,345,229 |

|

|

2,164,320 |

|

|

2,030,597 |

|

|

1,804,815 |

|

|

Construction |

|

162,553 |

|

|

144,931 |

|

|

153,103 |

|

|

155,070 |

|

|

141,082 |

|

|

Commercial business |

|

327,598 |

|

|

282,007 |

|

|

205,661 |

|

|

181,868 |

|

|

198,216 |

|

|

Home equity |

|

58,822 |

|

|

56,888 |

|

|

56,064 |

|

|

51,808 |

|

|

52,279 |

|

|

Consumer |

|

3,383 |

|

|

3,240 |

|

|

2,545 |

|

|

2,656 |

|

|

2,726 |

|

|

|

$ |

3,265,971 |

|

$ |

3,082,418 |

|

$ |

2,823,931 |

|

$ |

2,657,882 |

|

$ |

2,432,369 |

|

|

Less: |

|

|

|

|

|

|

Deferred loan fees, net |

|

(5,225 |

) |

|

(4,714 |

) |

|

(3,721 |

) |

|

(3,139 |

) |

|

(2,459 |

) |

|

Allowance for credit loss |

|

(28,882 |

) |

|

(32,373 |

) |

|

(33,195 |

) |

|

(34,113 |

) |

|

(33,980 |

) |

|

|

|

|

|

|

|

|

Total loans, net |

$ |

3,231,864 |

|

$ |

3,045,331 |

|

$ |

2,787,015 |

|

$ |

2,620,630 |

|

$ |

2,395,930 |

|

| |

|

|

|

|

|

|

|

Non-Accruing Loans in Portfolio by quarter |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands) |

|

Residential one-to-four family |

$ |

237 |

|

$ |

243 |

|

$ |

263 |

|

$ |

267 |

|

$ |

278 |

|

|

Commercial and multi-family |

|

340 |

|

|

346 |

|

|

757 |

|

|

757 |

|

|

757 |

|

|

Construction |

|

3,217 |

|

|

3,180 |

|

|

3,180 |

|

|

3,043 |

|

|

2,954 |

|

|

Commercial business |

|

1,264 |

|

|

1,340 |

|

|

4,305 |

|

|

5,104 |

|

|

5,243 |

|

|

Home equity |

|

- |

|

|

- |

|

|

- |

|

|

30 |

|

|

- |

|

|

Total: |

$ |

5,058 |

|

$ |

5,109 |

|

$ |

8,505 |

|

$ |

9,201 |

|

$ |

9,232 |

|

| |

|

|

|

|

|

|

|

Distribution of Deposits by quarter |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands) |

|

Demand: |

|

|

|

|

|

|

Non-Interest Bearing |

$ |

604,934 |

|

$ |

613,909 |

|

$ |

610,425 |

|

$ |

595,167 |

|

$ |

621,403 |

|

|

Interest Bearing |

|

686,577 |

|

|

757,615 |

|

|

726,012 |

|

|

810,535 |

|

|

724,020 |

|

|

Money Market |

|

361,558 |

|

|

305,556 |

|

|

370,353 |

|

|

360,356 |

|

|

354,302 |

|

|

Sub-total: |

$ |

1,653,069 |

|

$ |

1,677,080 |

|

$ |

1,706,790 |

|

$ |

1,766,058 |

|

$ |

1,699,725 |

|

|

Savings and Club |

|

319,131 |

|

|

329,753 |

|

|

338,864 |

|

|

347,279 |

|

|

341,529 |

|

|

Certificates of Deposit |

|

895,009 |

|

|

804,774 |

|

|

667,291 |

|

|

541,693 |

|

|

589,921 |

|

|

Total Deposits: |

$ |

2,867,209 |

|

$ |

2,811,607 |

|

$ |

2,712,945 |

|

$ |

2,655,030 |

|

$ |

2,631,175 |

|

|

|

Reconciliation of GAAP to Non-GAAP Financial Measures by

quarter |

|

|

|

|

|

|

|

|

|

Tangible Book Value per Share |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands, except per share amounts) |

|

Total Stockholders' Equity |

$ |

297,618 |

|

$ |

291,254 |

|

$ |

282,682 |

|

$ |

271,637 |

|

$ |

276,159 |

|

|

Less: goodwill |

|

5,252 |

|

|

5,252 |

|

|

5,252 |

|

|

5,252 |

|

|

5,252 |

|

|

Less: preferred stock |

|

21,003 |

|

|

21,003 |

|

|

21,003 |

|

|

16,563 |

|

|

26,213 |

|

|

Total tangible common stockholders' equity |

|

271,363 |

|

|

264,999 |

|

|

256,427 |

|

|

249,822 |

|

|

244,694 |

|

|

Shares common shares outstanding |

|

16,884 |

|

|

16,931 |

|

|

16,974 |

|

|

16,960 |

|

|

16,984 |

|

|

Book value per common share |

$ |

16.38 |

|

$ |

15.96 |

|

$ |

15.42 |

|

$ |

15.04 |

|

$ |

14.72 |

|

|

Tangible book value per common share |

$ |

16.07 |

|

$ |

15.65 |

|

$ |

15.11 |

|

$ |

14.73 |

|

$ |

14.41 |

|

| |

|

|

|

|

|

|

|

Efficiency Ratios |

|

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

(In thousands, except for ratio %) |

|

Net interest income |

$ |

27,471 |

|

$ |

30,181 |

|

$ |

30,951 |

|

$ |

27,741 |

|

$ |

25,072 |

|

|

Non-interest income |

|

-1,664 |

|

|

1,062 |

|

|

1,446 |

|

|

-313 |

|

|

-600 |

|

|

Total income |

|

25,807 |

|

|

31,243 |

|

|

32,397 |

|

|

27,428 |

|

|

24,472 |

|

|

Non-interest expense |

|

13,854 |

|

|

16,037 |

|

|

13,453 |

|

|

13,056 |

|

|

12,959 |

|

|

Efficiency Ratio |

|

53.68 |

% |

|

51.33 |

% |

|

41.53 |

% |

|

47.60 |

% |

|

52.95 |

% |

| |

|

|

|

|

|

Contact:Thomas Coughlin, President & CEOJawad Chaudhry,

CFO(201) 823-0700

BCB Bancorp (NASDAQ:BCBP)

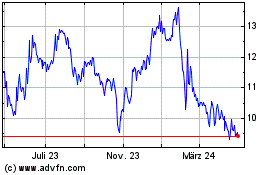

Historical Stock Chart

Von Mär 2024 bis Apr 2024

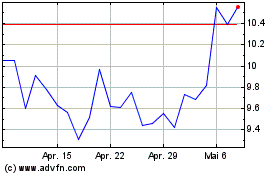

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024