BCB Bancorp, Inc. (the “Company”), (NASDAQ: BCBP), the holding

company for BCB Community Bank (the “Bank”), today reported net

income of $6.1 million for the fourth quarter of 2023, compared to

$6.7 million in the third quarter of 2023, and $12.1 million for

the fourth quarter of 2022. Earnings per diluted share for the

fourth quarter of 2023 were $0.35, compared to $0.39 in the

preceding quarter and $0.69 in the fourth quarter of 2022.

The Company announced that its Board of

Directors declared a regular quarterly cash dividend of $0.16 per

share. The dividend will be payable on February 16, 2024 to common

shareholders of record on February 5, 2024.

As previously announced, the Company named

Michael A. Shriner as the President and Chief Executive Officer of

BCB Bancorp, Inc. and BCB Bank, effective January 1, 2024. Mr.

Shriner, a 36-year veteran of banking, was formerly President and

Chief Executive Officer of Millington, New Jersey-based MSB

Financial Corp. and Millington Bank prior to being acquired by

Kearny Bank. Mr. Shriner joined Millington Bank in 1987 and held

various leadership positions including that of Chief Operating

Officer and Board member prior to his promotion to President and

Chief Executive Officer in 2012. Most recently, he held the role of

Market President for Kearny Bank where he transitioned legacy

Millington Bank customers to Kearny Bank following the merger.

“BCB Bank is committed to its community and

focused on providing best-in-class service to its customers.

Historically, the Bank has posted strong growth while prudently

managing its profitability, liquidity, capital, and asset quality

profile. I am thrilled to be a part of the BCB Bank team and I am

excited at the prospect of leading this organization and to achieve

our future financial goals and initiatives,” stated Mr.

Shriner.

Executive Summary

- Total deposits were $2.979 billion

at December 31, 2023 compared to $2.820 billion at September 30,

2023.

- Net interest margin was 2.57

percent for the fourth quarter of 2023, compared to 2.78 percent

for the third quarter of 2023, and 3.76 percent for the fourth

quarter of 2022.

- Total yield on interest-earning

assets increased 2 basis points to 5.33 percent for the fourth

quarter of 2023, compared to 5.31 percent for the third quarter of

2023, and increased 48 basis points from 4.85 percent for the

fourth quarter of 2022.

- Total cost of interest-bearing

liabilities increased 28 basis points to 3.45 percent for the

fourth quarter of 2023, compared to 3.17 percent for the third

quarter of 2023, and increased 199 basis points from 1.46 percent

for the fourth quarter of 2022.

- The efficiency ratio for the fourth

quarter was 61.0 percent compared to 57.1 percent in the prior

quarter, and 51.3 percent in the fourth quarter of 2022.

- The annualized return on average

assets ratio for the fourth quarter was 0.63 percent, compared to

0.70 percent in the prior quarter, and 1.46 percent in the fourth

quarter of 2022.

- The annualized return on average

equity ratio for the fourth quarter was 7.9 percent, compared to

8.9 percent in the prior quarter, and 17.0 percent in the fourth

quarter of 2022.

- The provision for credit losses was

$1.9 million in the fourth quarter of 2023 compared to $2.2 million

for the third quarter of 2023. In the fourth quarter of 2022 the

Bank recorded a credit to the provision of $500 thousand.

- The allowance for credit losses

(“ACL”) as a percentage of non-accrual loans was 178.9 percent at

December 31, 2023, compared to 402.4 percent for the prior

quarter-end and 633.6 percent at December 31, 2022. The total

non-accrual loans were $18.8 million at December 31, 2023, $7.9

million at September 30, 2023 and $5.1 million at December 31,

2022.

- Total loans receivable, net of the

allowance for credit losses, increased 7.7 percent to $3.280

billion at December 31, 2023, up from $3.045 billion at December

31, 2022, but down 0.2 percent from $3.286 billion at September 30,

2023.

Balance Sheet Review

Total assets increased by $286.2 million, or 8.1

percent, to $3.832 billion at December 31, 2023, from $3.546

billion at December 31, 2022. The increase in total assets was

mainly related to increases in total loans and in cash and cash

equivalents.

Total cash and cash equivalents increased by

$50.2 million, or 21.9 percent, to $279.5 million at December 31,

2023, from $229.4 million at December 31, 2022. The increase was

primarily due to an increase in Federal Home Loan Bank (“FHLB”)

borrowings and in deposits.

Loans receivable, net, increased by $234.4

million, or 7.7 percent, to $3.280 billion at December 31, 2023,

from $3.045 billion at December 31, 2022. Total loan increases

during 2023 included increases of $90.2 million in commercial

business loans, $88.9 million in commercial real estate and

multi-family loans, $47.9 million in construction loans and $9.8

million in home equity and consumer loans. 1-4 family residential

loans decreased $1.8 million. The allowance for credit losses

increased $1.2 million to $33.6 million, or 178.9 percent of

non-accruing loans and 1.01 percent of gross loans, at December 31,

2023, as compared to an allowance for credit losses of $32.4

million, or 633.6 percent of non-accruing loans and 1.05 percent of

gross loans, at December 31, 2022.

Total investment securities decreased by $12.5

million, or 11.5 percent, to $96.9 million at December 31, 2023,

from $109.4 million at December 31, 2022, representing unrealized

losses, calls and maturities, and repayments.

Deposit liabilities increased by $167.5 million,

or 6.0 percent, to $2.979 billion at December 31, 2023, from $2.812

billion at December 31, 2022. Certificates of deposits and money

market accounts increased $417.9 million and $65.4 million,

respectively, offset by interest bearing demand, non-interest

bearing and savings and club accounts which declined $315.8 million

during the twelve months of 2023.

Debt obligations increased by $90.7 million to

$510.4 million at December 31, 2023 from $419.7 million at December

31, 2022. The weighted average interest rate of FHLB advances was

4.21 percent at December 31, 2023 and 4.07 percent at December 31,

2022. The weighted average maturity of FHLB advances as of December

31, 2023 was 1.93 years. The interest rate of our subordinated debt

balances was 8.36 percent at December 31, 2023 and 5.62 percent at

December 31, 2022 due to the fixed-rate period on such debt ending

as of July 31, 2023.

Stockholders’ equity increased by $22.8 million,

or 7.8 percent, to $314.1 million at December 31, 2023, from $291.3

million at December 31, 2022. The increase was primarily

attributable to the increase in retained earnings of $20.8 million,

or 18.1 percent, to $135.9 million at December 31, 2023 from $115.1

million at December 31, 2023.

Fourth Quarter 2023 Income Statement

Review

Net income was $6.1 million for the fourth

quarter ended December 31, 2023 and $12.1 million for the

fourth quarter ended December 31, 2022. The decline was primarily

driven by lower net interest income, higher credit loss

provisioning and higher non-interest expenses, which were partially

offset by an increase in non-interest income for the fourth quarter

of 2023 as compared with the fourth quarter of 2022.

Net interest income decreased by $6.3 million,

or 20.7 percent, to $23.9 million for the fourth quarter of

2023, from $30.2 million for the fourth quarter of 2022. The

decrease in net interest income resulted from higher interest

expense which was partially offset by higher interest income.

Interest income increased by $10.8 million, or

27.9 percent, to $49.7 million for the fourth quarter of 2023 from

$38.9 million for the fourth quarter of 2022. The average

balance of interest-earning assets increased $521.4 million, or

16.3 percent, to $3.729 billion for the fourth quarter of 2023 from

$3.207 billion for the fourth quarter of 2022, while the average

yield increased 48 basis points to 5.33 percent for the fourth

quarter of 2023 from 4.85 percent for the fourth quarter of

2022.

Interest expense increased by $17.1 million to

$25.8 million for the fourth quarter of 2023 from

$8.7 million for the fourth quarter of 2022. The increase

resulted primarily from an increase in the average rate on

interest-bearing liabilities of 199 basis points to 3.45 percent

for the fourth quarter of 2023 from 1.46 percent for the fourth

quarter of 2022, while the average balance of interest-bearing

liabilities increased by $607.5 million to $2.990 billion for the

fourth quarter of 2023 from $2.382 billion for the fourth quarter

of 2022. The increase in the average cost of funds resulted

primarily from the persistently high interest rate environment.

The net interest margin was 2.57 percent for the

fourth quarter of 2023 compared to 3.76 percent for the fourth

quarter of 2022. The decrease in the net interest margin compared

to the fourth quarter of 2022 was the result of the increase in the

cost of interest-bearing liabilities partially offset by the

increase in the yield on interest-earning assets.

During the fourth quarter of 2023, the Company

recognized $233,000 in net charge-offs compared to $322,000 in net

charge-offs in the fourth quarter of 2022. The Bank had non-accrual

loans totaling $18.8 million, or 0.57 percent of gross loans,

at December 31, 2023 as compared to $5.1 million, or 0.17

percent of gross loans, at December 31, 2022. The allowance for

credit losses on loans was $33.6 million, or 1.01 percent of

gross loans at December 31, 2023, and $32.4 million, or 1.05

percent of gross loans at December 31, 2022. The provision for

credit losses was $1.9 million for the fourth quarter of 2023

compared to a $500,000 credit for the fourth quarter of 2022.

Management believes that the allowance for credit losses on loans

was adequate at December 31, 2023 and December 31, 2022.

Non-interest income increased by $2.2 million to

$3.2 million for the fourth quarter of 2023 from $1.1 million

for the fourth quarter of 2022. The increase in total non-interest

income was mainly related to gains on equity securities of $1.8

million and an increase in fees and service charges of

$307,000.

Non-interest expense increased by $531,000, or

3.3 percent, to $16.6 million for the fourth quarter of 2023

from $16.0 million for the fourth quarter of 2022. The

increase in such expenses for the fourth quarter of 2023 was

primarily driven by higher regulatory assessment charges, higher

salaries and employee benefits, and increased data processing

expenses compared to the fourth quarter of 2022. The fourth quarter

of 2023 salaries and benefits expense included a previously

disclosed one-time payment of $1.17 million to Thomas Coughlin, the

Company’s former President and Chief Executive Officer.

The income tax provision decreased by $1.0

million, or 28.6 percent, to $2.6 million for the fourth

quarter of 2023 from $3.6 million for the fourth quarter of

2022. The consolidated effective tax rate was 29.9 percent for the

fourth quarter of 2023 compared to 23.1 percent for the fourth

quarter of 2022. The income tax provision for the fourth quarter of

2022 benefited from the reversal of a portion of tax accrual that

was no longer required to cover the tax liability.

Year-to-Date Income Statement

Review

Net income decreased by $16.1 million, or

35.3 percent, to $29.5 million for the year ended December 31,

2023 from $45.6 million for the year ended December 31, 2022.

The decrease in net income was driven by less net interest income

and an increased provision for credit losses on loans being

recorded.

Net interest income decreased by

$9.9 million, or 8.7 percent, to $104.1 million for the year

of 2023 from $113.9 million for the year of 2022. The decrease in

net interest income resulted from a $66.8 million increase in

interest expense, offset by an increase of $56.9 million in

interest income.

The $56.9 million increase in interest income to

$188.4 million for the twelve months of 2023, was a 43.3 percent

increase from $131.4 million for the twelve months of 2022. The

average balance of interest-earning assets increased $641.0

million, or 21.3 percent, to $3.652 billion for the twelve months

of 2023, from $3.011 billion for the twelve months of 2022, while

the average yield increased 79 basis points to 5.16 percent from

4.37 percent for the same comparable period. The increase in the

average balance of interest-earning assets and in interest income

mainly related to an increase in the average balance of loans

receivable of $654.6 million to $3.281 billion for the twelve

months of 2023, from $2.627 billion for the twelve months of

2022.

The $66.8 million increase in interest expense

to $84.3 million for the twelve months of 2023, was a 381.8 percent

increase from $17.5 million for the 2022 comparable period. This

increase resulted primarily from an increase in the average rate on

interest-bearing liabilities of 214 basis points to 2.93 percent

for the twelve months of 2023, from 0.79 percent for the twelve

months of 2022, and an increase in the average balance of

interest-bearing liabilities of $667.5 million, or 30.3 percent, to

$2.873 billion from $2.206 billion over the same comparable

periods. The increase in the average cost of funds primarily

resulted from the high interest rate environment and an increase in

the level of borrowed funds in the twelve months of 2023 compared

to the same period in 2022.

Net interest margin was 2.85 percent for the

twelve months of 2023, compared to 3.78 percent for the twelve

months of 2022. The decrease in the net interest margin compared to

the prior period was the result of an increase in the average

volume of interest-bearing liabilities as well as an increase in

the cost of interest-bearing liabilities.

During the twelve months of 2023, the Company

recognized $704,000 in net-charge offs compared to $1.7 million in

net-charge offs for the same period in 2022.

Non-interest income increased by $2.5 million to

$4.1 million for the twelve months of 2023 from $1.6 million for

the twelve months of 2022. The improvement in total non-interest

income was mainly related to a $2.9 million decrease in the

realized and unrealized losses on equity securities. The realized

and unrealized losses on equity securities are based on market

conditions.

Non-interest expense increased by $5.1 million,

or 9.2 percent, to $60.6 million for the twelve months of 2023

from $55.5 million for the same period in 2022. The increase in

operating expenses for 2023 was driven primarily by an increase in

salaries and employee benefits, an increase in regulatory

assessments, and higher data processing expenses. The 2023 salaries

and benefits expense included the payment to Mr. Coughlin described

above.

The income tax provision decreased by $5.5

million or 31.7 percent, to $12.0 million for the twelve months of

2023 from $17.5 million for the same period in 2022. The decrease

in the income tax provision was a result of the lower taxable

income for the twelve months ended December 31, 2023 compared to

the same period in 2022. The consolidated effective tax rate was

28.9 percent for the twelve months of 2023 compared to 27.8 percent

for the twelve months of 2022.

Asset Quality

The Bank had non-accrual loans totaling

$18.8 million, or 0.57 percent, of gross loans at December 31,

2023, as compared to $5.1 million, or 0.17 percent, of gross

loans at December 31, 2022. The allowance for credit losses was

$33.6 million, or 1.01 percent of gross loans at December 31,

2023, and $32.4 million, or 1.05 percent of gross loans at December

31, 2022. The allowance for credit losses was 178.9 percent of

non-accrual loans at December 31, 2023, and 633.6 percent of

non-accrual loans at December 31, 2022.

About BCB Bancorp, Inc.

Established in 2000 and headquartered in

Bayonne, N.J., BCB Community Bank is the wholly-owned subsidiary of

BCB Bancorp, Inc. (NASDAQ: BCBP). The Bank has twenty-four branch

offices in Bayonne, Edison, Hoboken, Fairfield, Holmdel, Jersey

City, Lyndhurst, Maplewood, Monroe Township, Newark, Parsippany,

Plainsboro, River Edge, Rutherford, South Orange, Union, and

Woodbridge, New Jersey, and four branches in Hicksville and Staten

Island, New York. The Bank provides businesses and individuals a

wide range of loans, deposit products, and retail and commercial

banking services. For more information, please go to

www.bcb.bank.

Forward-Looking Statements

This release, like many written and oral

communications presented by BCB Bancorp, Inc., and our authorized

officers, may contain certain forward-looking statements regarding

our prospective performance and strategies within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. We intend

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this

statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions

and describe future plans, strategies, and expectations of the

Company, are generally identified by use of words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,”

“seek,” “strive,” “try,” or future or conditional verbs such as

“could,” “may,” “should,” “will,” “would,” or similar expressions.

Our ability to predict results or the actual effects of our plans

or strategies is inherently uncertain. Accordingly, actual results

may differ materially from anticipated results.

The most significant factor that could cause

future results to differ materially from those anticipated by our

forward-looking statements include the ongoing impact of higher

inflation levels, higher interest rates and general economic and

recessionary concerns, all of which could impact economic growth

and could cause a reduction in financial transactions and business

activities, including decreased deposits and reduced loan

originations, our ability to manage liquidity and capital in a

rapidly changing and unpredictable market, supply chain

disruptions, labor shortages and additional interest rate increases

by the Federal Reserve. Other factors that could cause future

results to vary materially from current management expectations as

reflected in our forward-looking statements include, but are not

limited to: the global impact of the military conflicts in the

Ukraine and the Middle East; unfavorable economic conditions in the

United States generally and particularly in our primary market

area; the Company’s ability to effectively attract and deploy

deposits; changes in the Company’s corporate strategies, the

composition of its assets, or the way in which it funds those

assets; shifts in investor sentiment or behavior in the securities,

capital, or other financial markets, including changes in market

liquidity or volatility; the effects of declines in real estate

values that may adversely impact the collateral underlying our

loans; increase in unemployment levels and slowdowns in economic

growth; our level of non-performing assets and the costs associated

with resolving any problem loans including litigation and other

costs; the impact of changes in interest rates and the credit

quality and strength of underlying collateral and the effect of

such changes on the market value of our loan and investment

securities portfolios; the credit risk associated with our loan

portfolio; changes in the quality and composition of the Bank’s

loan and investment portfolios; changes in our ability to access

cost-effective funding; deposit flows; legislative and regulatory

changes, including increases in Federal Deposit Insurance

Corporation, or FDIC, insurance rates; monetary and fiscal policies

of the federal and state governments; changes in tax policies,

rates and regulations of federal, state and local tax authorities;

demands for our loan products; demand for financial services;

competition; changes in the securities or secondary mortgage

markets; changes in management’s business strategies; changes in

consumer spending; our ability to retain key employees; the effects

of any reputational, credit, interest rate, market, operational,

legal, liquidity, or regulatory risk; expanding regulatory

requirements which could adversely affect operating results; civil

unrest in the communities that we serve; and other factors

discussed elsewhere in this report, and in other reports we filed

with the SEC, including under “Risk Factors” in Part I, Item 1A of

our Annual Report on Form 10-K, in Part II, Item 1A of our

quarterly reports on Form 10-Q, and our other periodic reports that

we file with the SEC.

Annualized, pro forma, projected and estimated

numbers are used for illustrative purpose only, are not forecasts

and may not reflect actual results.

Explanation of Non-GAAP Financial

Measures

Reported amounts are presented in accordance

with accounting principles generally accepted in the United States

of America ("GAAP"). This press release also contains certain

supplemental Non-GAAP information that the Company’s management

uses in its analysis of the Company’s financial results. The

Company’s management believes that providing this information to

analysts and investors allows them to better understand and

evaluate the Company’s financial results for the periods in

question.

The Company provides measurements and ratios

based on tangible stockholders' equity and efficiency ratios. These

measures are utilized by regulators and market analysts to evaluate

a company’s financial condition and, therefore, the Company’s

management believes that such information is useful to investors.

For a reconciliation of GAAP to Non-GAAP financial measures

included in this press release, see "Reconciliation of GAAP to

Non-GAAP Financial Measures" below.

Contact:Michael Shriner, President & CEOJawad Chaudhry, EVP

& CFO(201) 823-0700

| |

Statements

of Income - Three Months Ended, |

|

|

|

| |

December 31, 2023 |

September 30, 2023 |

December 31, 2022 |

Dec 31, 2023 vs. Sept 30, 2023 |

|

Dec 31, 2023 vs. Dec 31, 2022 |

|

Interest and dividend income: |

(In

thousands, except per share amounts, Unaudited) |

|

|

|

|

Loans, including fees |

$ |

43,893 |

$ |

44,133 |

|

$ |

36,173 |

|

-0.5 |

% |

|

21.3 |

% |

|

Mortgage-backed securities |

|

293 |

|

217 |

|

|

185 |

|

35.0 |

% |

|

58.4 |

% |

|

Other investment securities |

|

991 |

|

1,045 |

|

|

1,177 |

|

-5.2 |

% |

|

-15.8 |

% |

|

FHLB stock and other interest-earning assets |

|

4,527 |

|

3,672 |

|

|

1,321 |

|

23.3 |

% |

|

242.7 |

% |

|

Total interest and dividend

income |

|

49,704 |

|

49,067 |

|

|

38,856 |

|

1.3 |

% |

|

27.9 |

% |

| |

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

Demand |

|

5,015 |

|

4,556 |

|

|

2,410 |

|

10.1 |

% |

|

108.1 |

% |

|

Savings and club |

|

177 |

|

182 |

|

|

118 |

|

-2.7 |

% |

|

50.0 |

% |

|

Certificates of deposit |

|

13,308 |

|

10,922 |

|

|

3,973 |

|

21.8 |

% |

|

235.0 |

% |

| |

|

18,500 |

|

15,660 |

|

|

6,501 |

|

18.1 |

% |

|

184.6 |

% |

|

Borrowings |

|

7,282 |

|

7,727 |

|

|

2,174 |

|

-5.8 |

% |

|

235.0 |

% |

|

Total interest

expense |

|

25,782 |

|

23,387 |

|

|

8,675 |

|

10.2 |

% |

|

197.2 |

% |

| |

|

|

|

|

|

|

| Net

interest income |

|

23,922 |

|

25,680 |

|

|

30,181 |

|

-6.8 |

% |

|

-20.7 |

% |

|

Provision (benefit) for credit losses |

|

1,927 |

|

2,205 |

|

|

(500 |

) |

-12.6 |

% |

|

-485.4 |

% |

| |

|

|

|

|

|

|

| Net

interest income after provision (benefit) for credit

losses |

|

21,995 |

|

23,475 |

|

|

30,681 |

|

-6.3 |

% |

|

-28.3 |

% |

| |

|

|

|

|

|

|

|

Non-interest income (loss): |

|

|

|

|

|

|

|

Fees and service charges |

|

1,445 |

|

1,349 |

|

|

1,138 |

|

7.1 |

% |

|

27.0 |

% |

|

Gain on sales of loans |

|

11 |

|

19 |

|

|

3 |

|

-42.1 |

% |

|

266.7 |

% |

|

Gain on sale of other real estate owned |

|

77 |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

Realized and unrealized gain (loss) on equity

investments |

|

1,029 |

|

(494 |

) |

|

(723 |

) |

-308.3 |

% |

|

-242.3 |

% |

|

BOLI income |

|

597 |

|

466 |

|

|

584 |

|

28.1 |

% |

|

2.2 |

% |

|

Other |

|

69 |

|

66 |

|

|

60 |

|

4.5 |

% |

|

15.0 |

% |

|

Total non-interest

income |

|

3,228 |

|

1,406 |

|

|

1,062 |

|

129.6 |

% |

|

204.0 |

% |

| |

|

|

|

|

|

|

|

Non-interest expense: |

|

|

|

|

|

|

|

Salaries and employee benefits |

|

7,974 |

|

7,524 |

|

|

7,626 |

|

6.0 |

% |

|

4.6 |

% |

|

Occupancy and equipment |

|

2,606 |

|

2,622 |

|

|

2,651 |

|

-0.6 |

% |

|

-1.7 |

% |

|

Data processing and communications |

|

1,721 |

|

1,787 |

|

|

1,579 |

|

-3.7 |

% |

|

9.0 |

% |

|

Professional fees |

|

987 |

|

560 |

|

|

2,169 |

|

76.3 |

% |

|

-54.5 |

% |

|

Director fees |

|

274 |

|

274 |

|

|

261 |

|

0.0 |

% |

|

5.0 |

% |

|

Regulatory assessment fees |

|

1,142 |

|

1,111 |

|

|

431 |

|

2.8 |

% |

|

165.0 |

% |

|

Advertising and promotions |

|

403 |

|

317 |

|

|

260 |

|

27.1 |

% |

|

55.0 |

% |

|

Other real estate owned, net |

|

4 |

|

1 |

|

|

4 |

|

300.0 |

% |

|

0.0 |

% |

|

Other |

|

1,457 |

|

1,267 |

|

|

1,056 |

|

15.0 |

% |

|

38.0 |

% |

|

Total non-interest

expense |

|

16,568 |

|

15,463 |

|

|

16,037 |

|

7.1 |

% |

|

3.3 |

% |

| |

|

|

|

|

|

|

|

Income before income tax provision |

|

8,655 |

|

9,418 |

|

|

15,706 |

|

-8.1 |

% |

|

-44.9 |

% |

|

Income tax provision |

|

2,593 |

|

2,707 |

|

|

3,634 |

|

-4.2 |

% |

|

-28.6 |

% |

| |

|

|

|

|

|

|

| Net

Income |

|

6,062 |

|

6,711 |

|

|

12,072 |

|

-9.7 |

% |

|

-49.8 |

% |

|

Preferred stock dividends |

|

182 |

|

173 |

|

|

172 |

|

5.2 |

% |

|

5.6 |

% |

| Net

Income available to common stockholders |

$ |

5,880 |

$ |

6,538 |

|

$ |

11,900 |

|

-10.1 |

% |

|

-50.6 |

% |

|

|

|

|

|

|

|

|

| Net

Income per common share-basic and diluted |

|

|

|

|

|

|

|

Basic |

$ |

0.35 |

$ |

0.39 |

|

$ |

0.70 |

|

-10.3 |

% |

|

-50.5 |

% |

|

Diluted |

$ |

0.35 |

$ |

0.39 |

|

$ |

0.69 |

|

-10.2 |

% |

|

-49.4 |

% |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding |

|

|

|

|

|

|

|

Basic |

|

16,876 |

|

16,830 |

|

|

16,916 |

|

0.3 |

% |

|

-0.2 |

% |

|

Diluted |

|

16,884 |

|

16,854 |

|

|

17,289 |

|

0.2 |

% |

|

-2.3 |

% |

| |

|

|

|

|

|

|

| |

Statements of Income - Twelve Months Ended, |

|

| |

December 31, 2023 |

December 31, 2022 |

Dec 31, 2023 vs. Dec 31, 2022 |

|

Interest and dividend income: |

(In

thousands, except per share amounts, Unaudited) |

|

|

Loans, including fees |

$ |

169,559 |

|

$ |

123,577 |

|

37.2 |

% |

|

Mortgage-backed securities |

|

880 |

|

|

564 |

|

56.0 |

% |

|

Other investment securities |

|

4,226 |

|

|

4,167 |

|

1.4 |

% |

|

FHLB stock and other interest-earning assets |

|

13,695 |

|

|

3,133 |

|

337.1 |

% |

|

Total interest and dividend

income |

|

188,360 |

|

|

131,441 |

|

43.3 |

% |

| |

|

|

|

|

Interest expense: |

|

|

|

|

Deposits: |

|

|

|

|

Demand |

|

16,915 |

|

|

5,283 |

|

220.2 |

% |

|

Savings and club |

|

620 |

|

|

449 |

|

38.1 |

% |

|

Certificates of deposit |

|

39,157 |

|

|

6,889 |

|

468.4 |

% |

| |

|

56,692 |

|

|

12,621 |

|

349.2 |

% |

|

Borrowings |

|

27,606 |

|

|

4,875 |

|

466.3 |

% |

|

Total interest

expense |

|

84,298 |

|

|

17,496 |

|

381.8 |

% |

| |

|

|

|

| Net

interest income |

|

104,062 |

|

|

113,945 |

|

-8.7 |

% |

|

Provision (benefit) for credit

losses |

|

6,104 |

|

|

(3,075 |

) |

-298.5 |

% |

| |

|

|

|

| Net

interest income after provision (benefit) for credit

losses |

|

97,958 |

|

|

117,020 |

|

-16.3 |

% |

| |

|

|

|

|

Non-interest income: |

|

|

|

|

Fees and service charges |

|

5,334 |

|

|

4,816 |

|

10.8 |

% |

|

Gain on sales of loans |

|

36 |

|

|

129 |

|

-72.1 |

% |

|

Gain on sales of other real estate owned |

|

77 |

|

|

- |

|

- |

|

|

Realized and unrealized loss on equity investments |

|

(3,361 |

) |

|

(6,269 |

) |

-46.4 |

% |

|

BOLI income |

|

1,751 |

|

|

2,671 |

|

-34.4 |

% |

|

Other |

|

251 |

|

|

248 |

|

1.2 |

% |

|

Total non-interest

income |

|

4,088 |

|

|

1,595 |

|

156.3 |

% |

| |

|

|

|

|

Non-interest expense: |

|

|

|

|

Salaries and employee benefits |

|

30,827 |

|

|

28,021 |

|

10.0 |

% |

|

Occupancy and equipment |

|

10,340 |

|

|

10,627 |

|

-2.7 |

% |

|

Data processing and communications |

|

6,968 |

|

|

6,033 |

|

15.5 |

% |

|

Professional fees |

|

2,735 |

|

|

3,766 |

|

-27.4 |

% |

|

Director fees |

|

1,083 |

|

|

1,253 |

|

-13.6 |

% |

|

Regulatory assessments |

|

3,585 |

|

|

1,243 |

|

188.4 |

% |

|

Advertising and promotions |

|

1,348 |

|

|

941 |

|

43.3 |

% |

|

Other real estate owned, net |

|

7 |

|

|

10 |

|

-30.0 |

% |

|

Other |

|

3,698 |

|

|

3,611 |

|

2.4 |

% |

|

Total non-interest

expense |

|

60,591 |

|

|

55,505 |

|

9.2 |

% |

| |

|

|

|

|

Income before income tax provision |

|

41,455 |

|

|

63,110 |

|

-34.3 |

% |

|

Income tax provision |

|

11,972 |

|

|

17,531 |

|

-31.7 |

% |

| |

|

|

|

| Net

Income |

|

29,483 |

|

|

45,579 |

|

-35.3 |

% |

|

Preferred stock dividends |

|

702 |

|

|

796 |

|

-11.9 |

% |

| Net

Income available to common stockholders |

$ |

28,781 |

|

$ |

44,783 |

|

-35.7 |

% |

| |

|

|

|

| Net

Income per common share-basic and diluted |

|

|

|

|

Basic |

$ |

1.71 |

|

$ |

2.64 |

|

-35.4 |

% |

|

Diluted |

$ |

1.70 |

|

$ |

2.58 |

|

-34.1 |

% |

| |

|

|

|

|

Weighted average number of common shares

outstanding |

|

|

|

|

Basic |

|

16,870 |

|

|

16,969 |

|

-0.6 |

% |

|

Diluted |

|

16,932 |

|

|

17,349 |

|

-2.4 |

% |

| |

|

|

|

|

Statements of Financial Condition |

December 31, 2023 |

September 30, 2023 |

December 31, 2022 |

December 31, 2023 vs. September 30, 2023 |

December 31, 2023 vs. December 31, 2022 |

|

ASSETS |

(In

Thousands, Unaudited) |

|

|

|

Cash and amounts due from depository institutions |

$ |

16,597 |

|

$ |

16,772 |

|

$ |

11,520 |

|

-1.0 |

% |

44.1 |

% |

|

Interest-earning deposits |

|

262,926 |

|

|

235,144 |

|

|

217,839 |

|

11.8 |

% |

20.7 |

% |

|

Total cash and cash equivalents |

|

279,523 |

|

|

251,916 |

|

|

229,359 |

|

11.0 |

% |

21.9 |

% |

| |

|

|

|

|

|

|

Interest-earning time deposits |

|

735 |

|

|

735 |

|

|

735 |

|

- |

|

- |

|

| Debt

securities available for sale |

|

87,769 |

|

|

86,172 |

|

|

91,715 |

|

1.9 |

% |

-4.3 |

% |

| Equity

investments |

|

9,093 |

|

|

8,272 |

|

|

17,686 |

|

9.9 |

% |

-48.6 |

% |

| Loans held

for sale |

|

1,287 |

|

|

472 |

|

|

658 |

|

172.7 |

% |

95.6 |

% |

| Loans

receivable, net of allowance for credit losses |

|

|

|

|

|

|

of $33,608, $31,914 and $32,373,

respectively |

|

3,279,708 |

|

|

3,285,727 |

|

|

3,045,331 |

|

-0.18 |

% |

7.70 |

% |

| Federal Home

Loan Bank of New York stock, at cost |

|

24,917 |

|

|

31,629 |

|

|

20,113 |

|

-21.2 |

% |

23.9 |

% |

| Premises and

equipment, net |

|

13,057 |

|

|

13,363 |

|

|

10,508 |

|

-2.3 |

% |

24.3 |

% |

| Accrued

interest receivable |

|

16,072 |

|

|

16,175 |

|

|

13,455 |

|

-0.6 |

% |

19.5 |

% |

| Other real

estate owned |

|

- |

|

|

75 |

|

|

75 |

|

-100 |

% |

-100 |

% |

| Deferred

income taxes |

|

18,213 |

|

|

16,749 |

|

|

16,462 |

|

8.7 |

% |

10.6 |

% |

| Goodwill and

other intangibles |

|

5,253 |

|

|

5,288 |

|

|

5,382 |

|

-0.7 |

% |

-2.4 |

% |

| Operating

lease right-of-use asset |

|

12,935 |

|

|

12,953 |

|

|

13,520 |

|

-0.1 |

% |

-4.3 |

% |

| Bank-owned

life insurance ("BOLI") |

|

73,406 |

|

|

72,810 |

|

|

71,656 |

|

0.8 |

% |

2.4 |

% |

| Other

assets |

|

10,429 |

|

|

9,784 |

|

|

9,538 |

|

6.6 |

% |

9.3 |

% |

|

Total Assets |

$ |

3,832,397 |

|

$ |

3,812,120 |

|

$ |

3,546,193 |

|

0.5 |

% |

8.1 |

% |

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Non-interest

bearing deposits |

$ |

536,264 |

|

$ |

523,912 |

|

$ |

613,910 |

|

2.4 |

% |

-12.6 |

% |

| Interest

bearing deposits |

|

2,442,816 |

|

|

2,295,644 |

|

|

2,197,697 |

|

6.4 |

% |

11.2 |

% |

|

Total deposits |

|

2,979,080 |

|

|

2,819,556 |

|

|

2,811,607 |

|

5.7 |

% |

6.0 |

% |

| FHLB

advances |

|

472,811 |

|

|

622,674 |

|

|

382,261 |

|

-24.1 |

% |

23.7 |

% |

| Subordinated

debentures |

|

37,624 |

|

|

37,624 |

|

|

37,508 |

|

0.0 |

% |

0.3 |

% |

| Operating

lease liability |

|

13,315 |

|

|

13,318 |

|

|

13,859 |

|

-0.0 |

% |

-3.9 |

% |

| Other

liabilities |

|

15,512 |

|

|

15,312 |

|

|

9,704 |

|

1.3 |

% |

59.9 |

% |

|

Total Liabilities |

|

3,518,342 |

|

|

3,508,484 |

|

|

3,254,939 |

|

0.3 |

% |

8.1 |

% |

| |

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Preferred

stock: $0.01 par value, 10,000 shares authorized |

|

- |

|

|

- |

|

|

- |

|

- |

|

- |

|

| Additional

paid-in capital preferred stock |

|

25,043 |

|

|

20,783 |

|

|

21,003 |

|

20.5 |

% |

19.2 |

% |

| Common

stock: no par value, 40,000 shares authorized |

|

- |

|

|

- |

|

|

- |

|

0.0 |

% |

0.0 |

% |

| Additional

paid-in capital common stock |

|

198,923 |

|

|

198,097 |

|

|

196,164 |

|

0.4 |

% |

1.4 |

% |

| Retained

earnings |

|

135,927 |

|

|

132,729 |

|

|

115,109 |

|

2.4 |

% |

18.1 |

% |

| Accumulated

other comprehensive loss |

|

(7,491 |

) |

|

(9,626 |

) |

|

(6,491 |

) |

-22.2 |

% |

15.4 |

% |

| Treasury

stock, at cost |

|

(38,347 |

) |

|

(38,347 |

) |

|

(34,531 |

) |

0.0 |

% |

11.1 |

% |

|

Total Stockholders'

Equity |

|

314,055 |

|

|

303,636 |

|

|

291,254 |

|

3.4 |

% |

7.8 |

% |

| |

|

|

|

|

|

|

Total Liabilities and

Stockholders' Equity |

$ |

3,832,397 |

|

$ |

3,812,120 |

|

$ |

3,546,193 |

|

0.5 |

% |

8.1 |

% |

| |

|

|

|

|

|

|

Outstanding common shares |

|

16,848 |

|

|

16,848 |

|

|

16,931 |

|

|

|

| |

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

|

(Dollars in

thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

Loans Receivable (4)(5) |

$ |

3,311,946 |

$ |

43,893 |

5.30 |

% |

|

$ |

2,939,281 |

$ |

36,173 |

4.92 |

% |

|

Investment Securities |

|

93,638 |

|

1284 |

5.48 |

% |

|

|

110,142 |

|

1,362 |

4.95 |

% |

| FHLB

stock and other interest-earning assets |

|

323,064 |

|

4,527 |

5.61 |

% |

|

|

157,807 |

|

1,321 |

3.35 |

% |

|

Total Interest-earning assets |

|

3,728,648 |

|

49,704 |

5.33 |

% |

|

|

3,207,230 |

|

38,856 |

4.85 |

% |

|

Non-interest-earning assets |

|

124,809 |

|

|

|

|

110,701 |

|

|

|

Total assets |

$ |

3,853,457 |

|

|

|

$ |

3,317,931 |

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

Interest-bearing demand accounts |

$ |

578,890 |

$ |

2,184 |

1.51 |

% |

|

$ |

729,160 |

$ |

1,295 |

0.71 |

% |

| Money

market accounts |

|

359,366 |

|

2,832 |

3.15 |

% |

|

|

345,343 |

|

1,114 |

1.29 |

% |

| Savings

accounts |

|

288,108 |

|

177 |

0.25 |

% |

|

|

334,394 |

|

118 |

0.14 |

% |

|

Certificates of Deposit |

|

1,140,656 |

|

13,307 |

4.67 |

% |

|

|

734,216 |

|

3,974 |

2.17 |

% |

|

Total interest-bearing deposits |

|

2,367,020 |

|

18,500 |

3.13 |

% |

|

|

2,143,112 |

|

6,501 |

1.21 |

% |

| Borrowed

funds |

|

622,860 |

|

7,282 |

4.68 |

% |

|

|

239,252 |

|

2,174 |

3.63 |

% |

|

Total interest-bearing liabilities |

|

2,989,880 |

|

25,782 |

3.45 |

% |

|

|

2,382,364 |

|

8,675 |

1.46 |

% |

|

Non-interest-bearing liabilities |

|

557,156 |

|

|

|

|

651,408 |

|

|

|

Total liabilities |

|

3,547,036 |

|

|

|

|

3,033,772 |

|

|

|

Stockholders' equity |

|

306,420 |

|

|

|

|

284,159 |

|

|

|

Total liabilities and stockholders' equity |

$ |

3,853,457 |

|

|

|

$ |

3,317,931 |

|

|

| Net

interest income |

|

$ |

23,922 |

|

|

|

$ |

30,181 |

|

| Net

interest rate spread(1) |

|

|

1.88 |

% |

|

|

|

3.39 |

% |

| Net

interest margin(2) |

|

|

2.57 |

% |

|

|

|

3.76 |

% |

|

|

|

|

|

|

|

|

|

| (1) Net interest rate

spread represents the difference between the average yield on

average interest-earning assets and the average cost of average

interest-bearing liabilities. |

| (2) Net interest

margin represents net interest income divided by average total

interest-earning assets. |

| (3) Annualized. |

| (4) Excludes allowance

for credit losses. |

| (5) Includes

non-accrual loans. |

| |

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

|

(Dollars in

thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

Loans Receivable (4)(5) |

$ |

3,281,334 |

$ |

169,559 |

|

5.17 |

% |

|

$ |

2,626,710 |

$ |

123,577 |

|

4.70 |

% |

|

Investment Securities |

|

100,000 |

|

5,106 |

|

5.11 |

% |

|

|

109,604 |

|

4,731 |

|

4.32 |

% |

| FHLB

stock and other interest-earning assets |

|

270,659 |

|

13,695 |

|

5.06 |

% |

|

|

274,649 |

|

3,133 |

|

1.14 |

% |

|

Total Interest-earning assets |

|

3,651,993 |

|

188,360 |

|

5.16 |

% |

|

|

3,010,963 |

|

131,441 |

|

4.37 |

% |

|

Non-interest-earning assets |

|

123,652 |

|

|

|

|

106,712 |

|

|

|

Total assets |

$ |

3,775,645 |

|

|

|

$ |

3,117,675 |

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

Interest-bearing demand accounts |

$ |

658,023 |

$ |

8,426 |

|

1.28 |

% |

|

$ |

751,708 |

$ |

2,970 |

|

0.40 |

% |

| Money

market accounts |

|

334,353 |

|

8,489 |

|

2.54 |

% |

|

|

350,207 |

|

2,313 |

|

0.66 |

% |

| Savings

accounts |

|

305,778 |

|

620 |

|

0.20 |

% |

|

|

340,232 |

|

449 |

|

0.13 |

% |

|

Certificates of Deposit |

|

980,617 |

|

39,157 |

|

3.99 |

% |

|

|

614,346 |

|

6,889 |

|

1.12 |

% |

|

Total interest-bearing deposits |

|

2,278,771 |

|

56,692 |

|

2.49 |

% |

|

|

2,056,494 |

|

12,621 |

|

0.61 |

% |

| Borrowed

funds |

|

594,564 |

|

27,606 |

|

4.64 |

% |

|

|

149,354 |

|

4,875 |

|

3.26 |

% |

|

Total interest-bearing liabilities |

|

2,873,335 |

|

84,298 |

|

2.93 |

% |

|

|

2,205,848 |

|

17,496 |

|

0.79 |

% |

|

Non-interest-bearing liabilities |

|

602,691 |

|

|

|

|

636,216 |

|

|

|

Total liabilities |

|

3,476,026 |

|

|

|

|

2,842,064 |

|

|

|

Stockholders' equity |

|

299,618 |

|

|

|

|

275,611 |

|

|

|

Total liabilities and stockholders' equity |

$ |

3,775,644 |

|

|

|

$ |

3,117,675 |

|

|

| Net

interest income |

|

$ |

104,062 |

|

|

|

|

$ |

113,945 |

|

|

| Net

interest rate spread(1) |

|

|

2.22 |

% |

|

|

|

3.57 |

% |

| Net

interest margin(2) |

|

|

2.85 |

% |

|

|

|

3.78 |

% |

|

|

|

|

|

|

|

|

|

| (1) Net interest rate

spread represents the difference between the average yield on

average interest-earning assets and the average cost of average

interest-bearing liabilities. |

| (2) Net interest

margin represents net interest income divided by average total

interest-earning assets. |

| (3) Annualized. |

| (4) Excludes allowance

for credit losses. |

| (5) Includes

non-accrual loans. |

| |

|

|

|

|

|

|

|

| |

Financial Condition

data by quarter |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

|

|

|

|

|

| |

(In thousands,

except book values) |

| Total

assets |

$ |

3,832,397 |

|

$ |

3,812,120 |

|

$ |

3,872,853 |

|

$ |

3,763,056 |

|

$ |

3,546,193 |

|

| Cash and

cash equivalents |

|

279,523 |

|

|

251,916 |

|

|

273,212 |

|

|

261,075 |

|

|

229,359 |

|

|

Securities |

|

96,862 |

|

|

94,444 |

|

|

100,473 |

|

|

101,446 |

|

|

109,401 |

|

| Loans

receivable, net |

|

3,279,708 |

|

|

3,285,727 |

|

|

3,319,721 |

|

|

3,231,864 |

|

|

3,045,331 |

|

|

Deposits |

|

2,979,080 |

|

|

2,819,556 |

|

|

2,885,721 |

|

|

2,867,209 |

|

|

2,811,607 |

|

|

Borrowings |

|

510,435 |

|

|

660,298 |

|

|

660,160 |

|

|

569,965 |

|

|

419,769 |

|

|

Stockholders’ equity |

|

314,055 |

|

|

303,636 |

|

|

299,623 |

|

|

297,618 |

|

|

291,254 |

|

| Book value

per common share1 |

$ |

17.15 |

|

$ |

16.79 |

|

$ |

16.60 |

|

$ |

16.38 |

|

$ |

15.96 |

|

| Tangible

book value per common share2 |

$ |

16.84 |

|

$ |

16.48 |

|

$ |

16.28 |

|

$ |

16.07 |

|

$ |

15.65 |

|

| |

|

|

|

|

|

| |

Operating data by quarter |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In thousands, except for per share amounts) |

| Net interest

income |

$ |

23,922 |

|

$ |

25,680 |

|

$ |

26,989 |

|

$ |

27,471 |

|

$ |

30,181 |

|

| Provision

(benefit) for credit losses |

|

1,927 |

|

|

2,205 |

|

|

1,350 |

|

|

622 |

|

|

(500 |

) |

| Non-interest

income (loss) |

|

3,228 |

|

|

1,406 |

|

|

1,118 |

|

|

(1,664 |

) |

|

1,062 |

|

| Non-interest

expense |

|

16,568 |

|

|

15,463 |

|

|

14,706 |

|

|

13,854 |

|

|

16,037 |

|

| Income tax

expense |

|

2,593 |

|

|

2,707 |

|

|

3,447 |

|

|

3,225 |

|

|

3,634 |

|

| Net

income |

$ |

6,062 |

|

$ |

6,711 |

|

$ |

8,604 |

|

$ |

8,106 |

|

$ |

12,072 |

|

| Net income

per diluted share |

$ |

0.35 |

|

$ |

0.39 |

|

$ |

0.50 |

|

$ |

0.46 |

|

$ |

0.69 |

|

| Common

Dividends declared per share |

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

| |

|

|

|

|

|

| |

Financial Ratios(3) |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| Return on

average assets |

|

0.63 |

% |

|

0.70 |

% |

|

0.90 |

% |

|

0.90 |

% |

|

1.46 |

% |

| Return on

average stockholders' equity |

|

7.91 |

% |

|

8.92 |

% |

|

11.57 |

% |

|

11.05 |

% |

|

16.99 |

% |

| Net interest

margin |

|

2.57 |

% |

|

2.78 |

% |

|

2.92 |

% |

|

3.15 |

% |

|

3.76 |

% |

|

Stockholders' equity to total assets |

|

8.19 |

% |

|

7.97 |

% |

|

7.74 |

% |

|

7.91 |

% |

|

8.21 |

% |

| Efficiency

Ratio4 |

|

61.02 |

% |

|

57.09 |

% |

|

52.32 |

% |

|

53.68 |

% |

|

51.33 |

% |

| |

|

|

|

|

|

| |

Asset Quality Ratios |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In thousands, except for ratio %) |

| Non-Accrual

Loans |

$ |

18,783 |

|

$ |

7,931 |

|

$ |

5,696 |

|

$ |

5,058 |

|

$ |

5,109 |

|

| Non-Accrual

Loans as a % of Total Loans |

|

0.57 |

% |

|

0.24 |

% |

|

0.17 |

% |

|

0.16 |

% |

|

0.17 |

% |

| ACL as % of

Non-Accrual Loans |

|

178.9 |

% |

|

402.4 |

% |

|

530.3 |

% |

|

571.0 |

% |

|

633.6 |

% |

| Individually

Analyzed Loans |

|

54,019 |

|

|

35,868 |

|

|

28,250 |

|

|

17,585 |

|

|

28,272 |

|

| Classified

Loans |

|

85,727 |

|

|

42,807 |

|

|

28,250 |

|

|

17,585 |

|

|

17,816 |

|

| |

|

|

|

|

|

| (1) Calculated by

dividing stockholders' equity, less preferred equity, to shares

outstanding. |

|

|

| (2) Calculated by

dividing tangible stockholders’ common equity, a non-GAAP measure,

by shares outstanding. Tangible stockholders’ |

| common equity is

stockholders’ equity less goodwill and preferred stock. See

“Reconciliation of GAAP to Non-GAAP Financial Measures by

quarter.” |

|

(3) Ratios are presented on an annualized basis, where

appropriate. |

|

|

|

| (4) The Efficiency

Ratio, a non-GAAP measure, was calculated by dividing non-interest

expense by the total of net interest income |

| and non-interest

income. See “Reconciliation of GAAP to Non-GAAP Financial Measures

by quarter.” |

|

| |

|

|

|

|

|

| |

Recorded Investment in Loans Receivable by quarter |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In thousands) |

|

Residential one-to-four family |

$ |

248,295 |

|

$ |

251,845 |

|

$ |

250,345 |

|

$ |

246,683 |

|

$ |

250,123 |

|

| Commercial

and multi-family |

|

2,434,115 |

|

|

2,444,887 |

|

|

2,490,883 |

|

|

2,466,932 |

|

|

2,345,229 |

|

|

Construction |

|

192,816 |

|

|

185,202 |

|

|

179,156 |

|

|

162,553 |

|

|

144,931 |

|

| Commercial

business |

|

372,202 |

|

|

370,512 |

|

|

368,948 |

|

|

327,598 |

|

|

282,007 |

|

| Home

equity |

|

66,331 |

|

|

66,046 |

|

|

61,595 |

|

|

58,822 |

|

|

56,888 |

|

|

Consumer |

|

3,643 |

|

|

3,647 |

|

|

3,994 |

|

|

3,383 |

|

|

3,240 |

|

| |

$ |

3,317,402 |

|

$ |

3,322,139 |

|

$ |

3,354,921 |

|

$ |

3,265,971 |

|

$ |

3,082,418 |

|

| Less: |

|

|

|

|

|

|

Deferred loan fees, net |

|

(4,086 |

) |

|

(4,498 |

) |

|

(4,995 |

) |

|

(5,225 |

) |

|

(4,714 |

) |

|

Allowance for credit losses |

|

(33,608 |

) |

|

(31,914 |

) |

|

(30,205 |

) |

|

(28,882 |

) |

|

(32,373 |

) |

| |

|

|

|

|

|

|

Total loans, net |

$ |

3,279,708 |

|

$ |

3,285,727 |

|

$ |

3,319,721 |

|

$ |

3,231,864 |

|

$ |

3,045,331 |

|

| |

|

|

|

|

|

| |

Non-Accruing Loans in Portfolio by quarter |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In thousands) |

| Residential

one-to-four family |

$ |

270 |

|

$ |

178 |

|

$ |

178 |

|

$ |

237 |

|

$ |

243 |

|

| Commercial

and multi-family |

|

8,684 |

|

|

3,267 |

|

|

- |

|

|

340 |

|

|

346 |

|

|

Construction |

|

4,292 |

|

|

2,886 |

|

|

4,145 |

|

|

3,217 |

|

|

3,180 |

|

| Commercial

business |

|

5,491 |

|

|

1,600 |

|

|

1,373 |

|

|

1,264 |

|

|

1,340 |

|

| Home

equity |

|

46 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

Total: |

$ |

18,783 |

|

$ |

7,931 |

|

$ |

5,696 |

|

$ |

5,058 |

|

$ |

5,109 |

|

| |

|

|

|

|

|

| |

Distribution of Deposits by quarter |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In

thousands) |

| Demand: |

|

|

|

|

|

|

Non-Interest Bearing |

$ |

536,264 |

|

$ |

523,912 |

|

$ |

620,509 |

|

$ |

604,935 |

|

$ |

613,910 |

|

|

Interest Bearing |

|

564,912 |

|

|

574,577 |

|

|

714,420 |

|

|

686,576 |

|

|

757,614 |

|

|

Money Market |

|

370,934 |

|

|

348,732 |

|

|

328,543 |

|

|

361,558 |

|

|

305,556 |

|

|

Sub-total: |

$ |

1,472,110 |

|

$ |

1,447,221 |

|

$ |

1,663,472 |

|

$ |

1,653,069 |

|

$ |

1,677,080 |

|

|

Savings and Club |

|

284,273 |

|

|

293,962 |

|

|

307,435 |

|

|

319,131 |

|

|

329,753 |

|

|

Certificates of Deposit |

|

1,222,697 |

|

|

1,078,373 |

|

|

914,814 |

|

|

895,009 |

|

|

804,774 |

|

|

Total Deposits: |

$ |

2,979,080 |

|

$ |

2,819,556 |

|

$ |

2,885,721 |

|

$ |

2,867,209 |

|

$ |

2,811,607 |

|

| |

|

|

|

|

|

| |

Reconciliation of GAAP to Non-GAAP Financial Measures by

quarter |

| |

|

|

|

|

|

| |

Tangible Book Value per Share |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In thousands,

except per share amounts) |

|

Total Stockholders' Equity |

$ |

314,055 |

|

$ |

303,636 |

|

$ |

299,623 |

|

$ |

297,618 |

|

$ |

291,254 |

|

| Less:

goodwill |

|

5,253 |

|

|

5,253 |

|

|

5,253 |

|

|

5,253 |

|

|

5,253 |

|

| Less:

preferred stock |

|

25,043 |

|

|

20,783 |

|

|

21,003 |

|

|

21,003 |

|

|

21,003 |

|

| Total

tangible common stockholders' equity |

|

283,759 |

|

|

277,601 |

|

|

273,368 |

|

|

271,363 |

|

|

264,999 |

|

| Shares

common shares outstanding |

|

16,848 |

|

|

16,848 |

|

|

16,788 |

|

|

16,884 |

|

|

16,931 |

|

| Book value

per common share |

$ |

17.15 |

|

$ |

16.79 |

|

$ |

16.60 |

|

$ |

16.38 |

|

$ |

15.96 |

|

| Tangible

book value per common share |

$ |

16.84 |

|

$ |

16.48 |

|

$ |

16.28 |

|

$ |

16.07 |

|

$ |

15.65 |

|

| |

|

|

|

|

|

| |

Efficiency Ratios |

| |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

| |

(In thousands,

except for ratio %) |

| Net interest

income |

$ |

23,922 |

|

$ |

25,680 |

|

$ |

26,989 |

|

$ |

27,471 |

|

$ |

30,181 |

|

| Non-interest

income (loss) |

|

3,228 |

|

|

1,406 |

|

|

1,118 |

|

|

(1,664 |

) |

|

1,062 |

|

| Total

income |

|

27,150 |

|

|

27,086 |

|

|

28,107 |

|

|

25,807 |

|

|

31,243 |

|

| Non-interest

expense |

|

16,568 |

|

|

15,463 |

|

|

14,706 |

|

|

13,854 |

|

|

16,037 |

|

| Efficiency

Ratio |

|

61.02 |

% |

|

57.09 |

% |

|

52.32 |

% |

|

53.68 |

% |

|

51.33 |

% |

| |

|

|

|

|

|

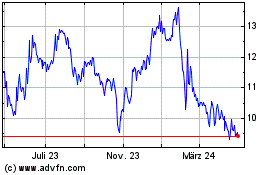

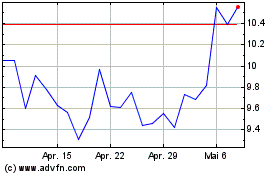

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024