APA Corporation Provides Fourth-Quarter 2024 Supplemental Information and Schedules Results Conference Call for February 27 at 10 a.m. Central Time

22 Januar 2025 - 10:15PM

APA Corporation (Nasdaq: APA) today provided supplemental

information regarding certain fourth-quarter 2024 financial and

operational results. This information is intended only to provide

additional information regarding current estimates management

believes will affect results for the fourth-quarter 2024. It is

provided to assist investors, analysts and others in formulating

their own estimates, and is not intended to be a comprehensive

presentation of all factors that will affect fourth-quarter 2024

results. Actual results and the impact of factors identified here

may vary depending on the impact of other factors not identified

here and are subject to finalization of the financial reporting

process for fourth-quarter 2024.

|

Estimated Average Realized Prices – 4Q24 |

|

|

Oil (bbl) |

NGL (bbl) |

Natural Gas (Mcf) |

|

United States |

$70.25 |

$24.50 |

$1.00 |

|

International |

$74.75 |

$50.50 |

$4.00 |

|

Egypt tax barrels: |

35 MBoe/d |

|

Realized gain on commodity derivatives (before tax): |

$1 million |

|

Dry hole costs (before tax): |

$30 million |

|

Net gain on oil and gas purchases and sales (before tax): |

$140 million |

|

General and administrative expense: |

$100 million |

| |

|

Production update

APA curtailed approximately 23.5 MBoe/d in the fourth quarter in

response to weak or negative Waha hub prices. Fourth-quarter 2024

guidance issued in November contemplated curtailments of 22

MBoe/d.

Asset sale update

In September, APA announced an agreement to divest non-core

assets in the Permian Basin. This divestiture closed on Dec. 31,

2024. After a deposit of $95 million received in September and a

purchase price adjustment for the effective date of July 1, 2024,

net proceeds were approximately $774 million.

Weighted-average shares outstanding

The estimated weighted-average basic common shares for the

fourth quarter is 369 million, compared with a weighted average of

370 million shares in the third-quarter 2024. APA repurchased 4.6

million shares at an average price of $21.90 per share during the

fourth quarter.

Fourth-quarter 2024 earnings call

APA will host a conference call to discuss its fourth-quarter

2024 results at 10 a.m. Central time, Thursday, February 27. The

conference call will be webcast from APA’s website at

www.apacorp.com and investor.apacorp.com. Following the conference

call, a replay will be available for one year on the “Investors”

page of the company’s website.

About APA

APA Corporation owns consolidated subsidiaries that explore for

and produce oil and natural gas in the United States, Egypt and the

United Kingdom and that explore for oil and natural gas offshore

Suriname and elsewhere. APA posts announcements, operational

updates, investor information and press releases on its website,

www.apacorp.com.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “continues,” “could,”

“estimates,” “expects,” “goals,” “guidance,” “may,” “might,”

“outlook,” “possibly,” “potential,” “projects,” “prospects,”

“should,” “will,” “would,” and similar references to future

periods, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about future plans, expectations, and

objectives for operations, including statements about our capital

plans, drilling plans, production expectations, asset sales, and

monetizations. While forward-looking statements are based on

assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. See “Risk Factors” in APA’s Form 10-K for

the year ended December 31, 2023, and in our quarterly reports on

Form 10-Q, filed with the Securities and Exchange Commission for a

discussion of risk factors that affect our business. Any

forward-looking statement made in this news release speaks only as

of the date on which it is made. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. APA and its

subsidiaries undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development or otherwise, except as may be required by

law.

Contacts

| Investor: |

(281)

302-2286 |

Ben

Rodgers |

| Media: |

(713) 296-7276 |

Alexandra Franceschi |

| Website: |

www.apacorp.com |

|

| |

|

|

APA-F

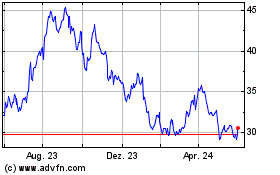

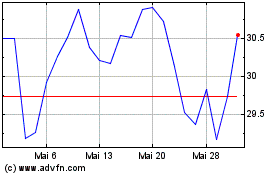

APA (NASDAQ:APA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

APA (NASDAQ:APA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025