Canadian finance teams are under pressure to deliver accurate real-time insights, finds new Sage report

15 Februar 2023 - 3:00PM

Sage (FTSE: SGE) – the leader in accounting, financial, HR and

payroll technology for SMBs – today released the Managing

Modern Finance in a Time of Unprecedented Change report which

examines challenges finance leaders are currently facing and how

they are adapting to drive growth and efficiencies. The report

found that almost two-thirds of financial leaders in Canada (60%)

said the time they spend on accounting, compliance, and the

financial close inhibits their work on strategic projects.

Commissioned by Sage and

published in partnership with Foundry MarketPulse, the report

surveyed 200 Canadian financial and accounting leaders at small and

midsize businesses, which paints a picture of busy finance teams

frustrated by time-consuming manual processes. The report found

many leaders struggle to have a holistic view across the

organization and are stymied by the patch work of siloed systems

and databases. On average, one in five (20%) of the tasks

associated with the financial close take place outside of

financial/accounting applications.

“The current economic

volatility has introduced complications businesses and their

financial teams are struggling to keep up with,” said Daniel Oh,

VP, Medium Segment Leader, in Canada for Sage. “The new challenges

underscore the need for responsiveness and automation in a digital

age. Canadian business leaders know they must pick up the pace.

Taking the right steps to modernize accounting management systems

will help finance teams overcome legacy challenges and gain

insights that will help them to stay agile and drive growth.”

Prioritizing

Efficiency and InsightsFinancial teams are under increased

pressure to become more agile and responsive to market trends. More

than two-thirds of respondents (69%) say company leadership is

requesting financial information in real-time to better understand

company performance. As such, respondents are prioritizing

initiatives designed to increase efficiencies and reporting

capabilities. The top five priorities for finance and accounting

leadership, include:

- Improving efficiency / reducing costs

– 67%

- Improving the accuracy of data for

real-time decision making – 60%

- Strengthening security controls –

54%

- Improving financial reporting

capabilities – 54%

- Improving data availability – 49%

Conversely, while

financial leaders are eager to work on strategic projects including

providing real-time financial reporting, they are frustrated by

time-consuming manual processes. The survey found that 40% of

financial leaders acknowledged lost productivity caused by

time-consuming manual processes. Other frustrations of the

financial close process include:

- Keeping up with technology

updates – 37%

- A lack of adequate staff

resources – 33%

- The need to provide employees with

anytime/anywhere access to data – 32%

- Inability to forecast accurately –

29%

Building an Agile

Future To help drive efficiencies and greater real-time

visibility across a company’s operations, the report identified

several technologies that can significantly reduce time spent on

manual processes.

Adopting a single cloud

platform Integrating financial data on a single cloud platform

gives everyone a common, updated, and accurate set of numbers to

work with. Standardized formatting resolves data integrity issues

when calculations are performed with different measurements or

updated at different times.

Automate tedious manual

processesAutomation can help reduce manual processes enabling

finance teams to prioritize their time on strategic projects to

drive growth. Additionally, automating reporting processes can

reduce the risk of errors that could affect the accuracy of

analysis.

A unified financial

management platformA unified financial management platform enables

organizations to obtain, organize and share real-time insights

holistically across operations; as well as enable increased

collaboration across departments. Consolidating financial

information on a platform can help to reduce the time spent on

management chores while also reducing risk.

“In today’s

hyper-competitive and volatile economy, businesses can no longer

rely on inefficient manual processes, scattered data, and reports

that are stale by the time they’re published,” add Oh. “Speed,

agility and accurate insights delivered in real-time help

businesses grow and are becoming the gold standard for success. By

integrating applications and data on a cloud-native platform,

finance leaders can automate tedious processes and gain real-time

insights into operations, which will help future-proof them during

times of unprecedented change.”

Note to editor: Working with Foundry

MarketPulse, Sage has 200 Canadian financial and accounting leaders

at small and midsize businesses between December 16, 2022 – January

5, 2023. To download the full research report, visit

https://www.sage.com/en-ca/sage-business-cloud/intacct/

About SageSage exists to knock down barriers so

everyone can thrive, starting with the millions of Small and

Mid-Sized Businesses served by us, our partners and accountants.

Customers trust our finance, HR and payroll software to make work

and money flow. By digitising business processes and relationships

with customers, suppliers, employees, banks and governments, our

digital network connects SMBs, removing friction and delivering

insights. Knocking down barriers also means we use our time,

technology and experience to tackle digital inequality, economic

inequality and the climate crisis.Media

Contact

Brittany FarquharPR Manager,

CanadaBrittany.farquhar@sage.com

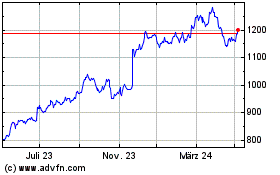

Sage (LSE:SGE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Sage (LSE:SGE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024