AIM Schedule 1 - Shellproof plc (3065O)

10 Oktober 2012 - 8:30AM

UK Regulatory

TIDMSHLP

RNS Number : 3065O

AIM

10 October 2012

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

---------------------------------------------------------------------

COMPANY NAME:

---------------------------------------------------------------------

Shellproof PLC

---------------------------------------------------------------------

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

---------------------------------------------------------------------

7 Cowley Street, London SW1P 3NB

---------------------------------------------------------------------

COUNTRY OF INCORPORATION:

---------------------------------------------------------------------

England and Wales

---------------------------------------------------------------------

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

---------------------------------------------------------------------

www.shellproofplc.com (available upon admission)

---------------------------------------------------------------------

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

---------------------------------------------------------------------

Admission is being sought as a result of a reverse take-over

under Rule 14 of Shellproof Limited.

The business strategy is to create a prestigious English sparkling

wine production, sales and distribution business. Through the

acquisition and establishment of approximately 150 acres of

vineyards and the construction of a winery, Shellproof PLC

aims to produce leading examples of English sparkling wine.

It is intended that the vineyards and winery will be located

in West Sussex within, or in close proximity to the South Downs

National Park. The business plan is based on approximately

150 acres of vineyards. In full production these vineyards

are expected to produce grapes sufficient for approximately

400,000 bottles of sparkling wine which would make the Enlarged

Group one of the leading producers of English sparkling wine.

There are three principal components involved in developing

the business to be operated by Shellproof PLC:

i. The Vineyards

These will contain or be planted with grape varieties suitable

for English sparkling wine such as Pinot Noir, Pinot Meunier

and Chardonnay. The 150 acre target is expected to come from:

-- The Freehold Property - 13 acres, of which 10 acres are

planted with mature vines, to be acquired in accordance with

the terms of the Acquisition Agreement as a freehold purchase.

-- The FBT Site - 27 acres.

-- Other sites locally, up to a further 110 acres, which are

expected to be on similar long term farm business tenancies

similar to the Farm Business Tenancy will be identified and

planted over the course of the next few years. During the early

years, in order to meet its production plans, the Shellproof

PLC will continue to buy in grapes and process these in other

local wineries on a contract basis. Shellproof PLC currently

has stocks of approximately 25,000 bottles.

Shellproof PLC may also consider the acquisition of freehold

land and mature vineyards if suitable opportunities arise.

ii. The Winery

Shellproof PLC intends to build a winery on one of its target

sites, subject to obtaining the relevant planning consents.

It is likely that the winery would be acquired via a leasehold

arrangement with commencement contingent on planning. The winery

would be expected to be commissioned towards the end of 2014.

The winery and related storage facility would carry out grape

crushing, juice extraction, fermentation, secondary fermentation

and other processes involved in the production of sparkling

wine. The buildings would also accommodate bottling and storage

facilities as well as a small visitor centre.

iii. Sales & Marketing

At a mature production level of approximately 400,000 bottles,

the business is expected to be positioned as one of the leading

producers of English sparkling wine. Sales and marketing will

include:

-- Branding and related support: A brand name or names will

be chosen to reflect the perceived brand values of the product.

The Directors believe that branding will be assisted by the

perceived quality of the region's "terroir". This region on

which Shellproof Wines is based already has established vineyards

for some of the leading English sparkling wine producers. The

region benefits from an attractive setting with particular

soil and climatic conditions which have already produced a

number of award winning sparkling wines.

-- Distribution: Distribution will include direct sales via

a visitor centre, other local direct sales, online and mail-order

purchases, export sales and selected national distribution.

---------------------------------------------------------------------

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

---------------------------------------------------------------------

8,000,002 ordinary shares of 50 pence each.

No shares are held in treasury.

The shares are freely transferable and have no restrictions

placed on them.

---------------------------------------------------------------------

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE) AND ANTICIPATED

MARKET CAPITALISATION ON ADMISSION:

---------------------------------------------------------------------

None - anticipated market capitalisation, approximately GBP4

million

---------------------------------------------------------------------

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

---------------------------------------------------------------------

77.3%

---------------------------------------------------------------------

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM COMPANY HAS APPLIED OR AGREED TO HAVE ANY OF ITS SECURITIES

(INCLUDING ITS AIM SECURITIES) ADMITTED OR TRADED:

---------------------------------------------------------------------

None

---------------------------------------------------------------------

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

---------------------------------------------------------------------

Ian George Robinson, Non-Executive Chairman;

Andrew Stephen Wilson, Non-Executive Director;

Benjamin James Walgate, Chief Executive Officer

---------------------------------------------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

---------------------------------------------------------------------

Lord Ashcroft KCMG - 6,093,616 ordinary shares (76.2% of issued

share capital) before and after admission

---------------------------------------------------------------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

---------------------------------------------------------------------

None

---------------------------------------------------------------------

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

---------------------------------------------------------------------

(i) 31 March

(ii) 31 March 2012

(iii) 31 December 2012, 30 September 2013, 31 December 2013

---------------------------------------------------------------------

EXPECTED ADMISSION DATE:

---------------------------------------------------------------------

24 October 2012

---------------------------------------------------------------------

NAME AND ADDRESS OF NOMINATED ADVISER:

---------------------------------------------------------------------

Cenkos Securities plc, 6.7.8 Tokenhouse Yard, London EC2R 7AS

---------------------------------------------------------------------

NAME AND ADDRESS OF BROKER:

---------------------------------------------------------------------

Cenkos Securities plc, 6.7.8 Tokenhouse Yard, London EC2R 7AS

---------------------------------------------------------------------

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

---------------------------------------------------------------------

Cenkos Securities plc

6.7.8 Tokenhouse Yard

London EC2R 7AS

The Admission Document will contain full details about Shellproof

PLC and the admission of its securities.

---------------------------------------------------------------------

DATE OF NOTIFICATION:

---------------------------------------------------------------------

10 October 2012

---------------------------------------------------------------------

NEW/ UPDATE:

---------------------------------------------------------------------

New

---------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

PAAMLBJTMBJMBLT

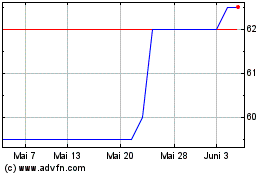

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

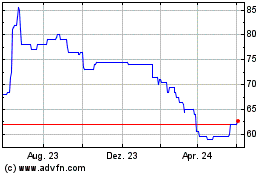

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024