Further market share gains

Upgrading guidance

Regulatory News:

Publicis Groupe (Paris:PUB):

- H1 2024 net revenue organic growth of +5.4%; +7.4% on a

like-for-like revenue basis

- Stronger than expected Q2 net revenue organic growth at

+5.6%

- Accelerating versus 4Y Q2 CAGR of 4.7%

- Gaining market share with c. 400 bps1 outperformance versus

peer average

- Solid performance across all regions in Q2:

- Continued momentum in the U.S. at +5.3%

- Robust Europe at +4.2% on top of a high comparable

- Strong APAC at +7.7%, with China accelerating to

+10.5%

- Operating margin rate at record H1 level of 17.3%, including

AI investment

- Headline diluted EPS up +5.3% at €3.38, Free cash flow2 up

at €744m

- Upgrading full year 2024 net revenue organic growth to +5-6%

vs +4-5% previously, despite persistent macro

uncertainties

- Maintaining industry-high 2024 financial KPIs: Operating

margin at 18.0%, Free cash flow2 between €1.8bn-1.9bn

Q2 2024

€3,458m

+6.8%

+5.6%

H1 2024 Results

H1 2024

2024 vs 2023

7,650

+7.7%

6,688

+5.9%

+5.4%

1,160

+6.1%

17.3%

- Headline Groupe net income

857

+5.4%

- Headline diluted EPS (euro)

3.38

+5.3%

744

+2.6%

_________________________________ 1 Based on consensus 2 Before

change in working capital requirements

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

“Publicis achieved a very strong first half of the year, with

net revenue organic growth at +5.4% and +7.4% growth on a

like-for-like revenue basis.

We continued to win market share, with Q2 net revenue organic

growth accelerating to +5.6%, above expectations and 400bps ahead

of our industry.

For the first 6 months of the year, we kept delivering industry

leading financial KPIs.

Despite a backdrop of ongoing macro-economic pressures, not only

did our H1 performance demonstrate that our model is strong. It

also showed that our outperformance versus our peers is

sustainable, with our growth rate close to doubling that of our

competitors since 2019.

As a result, we are confident in our ability to accelerate

further in H2.

We are raising our net revenue organic growth guidance and now

expect to deliver between +5-+6%. We will maintain our

best-in-class financial ratios while continuing to make material

investments in our talent and AI strategy.

As we further extract ourselves from the pack, we have

everything we need to continue to lead and reinvent our industry

thanks to our transformation.

We have a winning go to market, which has put us at the head of

the new business rankings for the past five years. We have taken

the leadership of personalization at scale, demonstrated by our

combined Data and Media offering’s double-digit growth this

quarter, for the third year in a row. And thanks to Publicis

Sapient, we are uniquely positioned to partner with our clients in

their AI-led transformation.

I would like to take this opportunity to thank all of our

clients for their trust. I would also like to thank our people

around the world for their outstanding work. Sustaining these

levels of outperformance in such a difficult environment is an

everyday battle and with the Executive Committee we are truly

grateful for all of their efforts.”

The Publicis Board of Directors met on July 17, 2024 under

the chairmanship of Arthur Sadoun and approved the financial

statements for the first half of 2024.

KEY FIGURES

EUR million, except per-share

data and percentages

H1 2024

H1 2023

2024

vs 2023

Data from the Income statement and Cash

flow statement

Net revenue

6,688

6,318

+5.9%

Pass-through revenue

962

787

+22.2%

Revenue

7,650

7,105

+7.7%

EBITDA

1,401

1,335

+4.9%

% of net revenue

20.9%

21.1%

-20bps

Operating margin

1,160

1,093

+6.1%

% of net revenue

17.3%

17.3%

0bps

Operating income

1,008

843

+19.6%

Net income attributable to the

Groupe

773

623

+24.1%

Earnings per share (EPS)

3.08

2.48

+24.2%

Headline diluted EPS3

3.38

3.21

+5.3%

Free cash flow before change in

working capital requirements

744

725

+2.6%

Data from the Balance

sheet

June 30, 2024

Dec 31, 2023

Total assets

35,918

36,716

Groupe share of Shareholders’

equity

9,916

9,788

Net debt (net cash)

99

(909)

_________________________________ 3 Net income attributable to

the Groupe, after elimination of impairment charges, amortization

of intangibles arising on acquisitions, the main capital gains (or

losses) on disposals, change in the fair value of financial assets,

the revaluation of earn-out costs, divided by the average number of

shares on a diluted basis

NET REVENUE IN Q2 2024

Publicis Groupe’s net revenue in Q2 2024 was 3,458 million

euros, up +6.8% from 3,239 million euros in 2023. Exchange rates

had a small positive impact of 13 million euros. Acquisitions, net

of disposals, accounted for an increase in net revenue of 25

million euros. Organic growth reached +5.6%.

Breakdown of Q2 2024 net revenue by

region

EUR

Net revenue

Reported

Organic

million

Q2 2024

Q2 2023

growth

growth

North America

2,104

1,955

+7.6%

+5.2%

Europe

856

809

+5.8%

+4.2%

Asia Pacific

306

300

+2.0%

+7.7%

Middle East & Africa

100

91

+9.9%

+9.1%

Latin America

92

84

+9.5%

+18.9%

Total

3,458

3,239

+6.8%

+5.6%

North America net revenue was up +7.6% on a reported

basis, including a positive impact of the U.S. dollar to euro

exchange rate. Organic growth in the region was +5.2%. In the

U.S., organic growth came at +5.3%, with Media and Epsilon

continuing to be accretive this quarter, confirming the strength of

our integrated offer in this geography where our model is the most

advanced. Media grew double-digits, on top of double-digit growth

over the last two years, while Epsilon posted mid-single digit

growth mainly led by Digital Media and Data activities. Publicis

Sapient posted a slight decline on top of a solid +5% in Q2 2023,

in a context of continued “wait and see” attitude from clients.

Creative activities were broadly stable.

Net revenue in Europe was up by +5.8% on a reported basis

and +4.2% organically. Organic growth in the U.K. was

broadly stable, with double-digit growth in Media and Creative.

Organic growth in France was +4.2% led by mid-single-digit

growth in Media while Publicis Sapient faced a challenging

comparable base. Germany posted +3.4% organic growth driven

by Media and Publicis Sapient. Central & Eastern Europe

was very strong at +17.4% organically, with double-digit growth in

most countries, led by both Media and Creative.

Net revenue in Asia Pacific recorded +2.0% growth on a

reported basis and +7.7% on an organic basis. China

accelerated to +10.5% organic growth after +6.7% in Q1 2024,

benefitting from new business wins in Media. South-East Asia

posted high-single-digit growth, fueled by Thailand, India and

Malaysia. Australia was up by a low-single-digit, improving

sequentially from Q1 2024.

In Middle East & Africa, net revenue was up +9.9% on

a reported basis, and +9.1% organically, largely driven by

double-digit-growth in Media and Publicis Sapient.

Net revenue in Latin America was up +9.5% on a reported

basis, and +18.9% organically, led by both Media and Creative,

notably in Brazil, Mexico and Colombia.

NET REVENUE IN H1 2024

Publicis Groupe’s net revenue for the first half of 2024 was

6,688 million euros, up by 5.9% compared to 6,318 million euros in

the first half of 2023. Exchange rate variations over the period

had a small negative impact of 16 million euros. Acquisitions (net

of disposals) had a positive impact of 43 million euros on net

revenue. Organic growth was +5.4% in the first half of 2024.

Breakdown of H1 2024 net revenue by

sector Automotive

15%

Healthcare

15%

Financial

13%

Food and beverage

13%

TMT

13%

Non Food consumer products

11%

Retail

9%

Public sectors & Others

4%

Leisure & travel

4%

Energy & Manufacturing

3%

On the basis of 3,266 main clients representing

92% of Groupe net revenue

Breakdown of H1 2024 net revenue by

region

EUR

Net revenue

Reported

Organic

million

H1 2024

H1 2023

growth

growth

North America

4,112

3,893

+5.6%

+5.0%

Europe

1,649

1,552

+6.3%

+5.1%

Asia Pacific

572

550

+4.0%

+7.0%

Middle East & Africa

190

179

+6.1%

+6.6%

Latin America

165

144

+14.6%

+14.0%

Total

6,688

6,318

+5.9%

+5.4%

Net revenue in North America was up by +5.0% on an

organic basis in the first half of 2024 (+5.6% on a reported

basis). The U.S. performed strongly with +5.2% organic

growth.

Europe posted +5.1% organic growth in the first half

(+6.3% on a reported basis). The U.K. was broadly stable,

France at +6.6%, Germany at +4.1% and Central

& Eastern Europe at +19.2% on an organic basis.

Asia Pacific net revenue was up by +7.0% on an organic

basis (+4.0% on a reported basis). China reported an organic

growth of +8.9%, and Australia was up by +1.3% on an organic

basis.

Net revenue in the Middle East & Africa region was up

by +6.6% on an organic basis (+6.1% on a reported basis) and up by

+14.0% in Latin America (+14.6% on a reported basis).

ANALYSIS OF H1 2024 KEY FIGURES

Income statement

EBITDA amounted to 1,401 million euros in H1 2024,

compared to 1,335 million euros in H1 2023, up by +4.9%. This

represents 20.9% of net revenue.

Personnel costs totaled 4,498 million euros in H1 2024

from 4,200 million euros in H1 2023, an increase of +7.1%. As a

percentage of net revenue, personnel expenses were 67.3% in H1

2024, versus 66.5% in H1 2023. Fixed personnel costs were 4,006

million euros and represented 59.9% of net revenue versus 59.0% in

H1 2023, the increase being largely attributable to the AI

investment. The cost of freelancers remained stable compared to H1

2023 in percentage of net revenue, representing 174 million euros

in H1 2024. Restructuring costs were 41 million euros, slightly

down versus 45 million euros in H1 2023.

Non personel costs amounted to 1,030 million euros in H1

2024, compared to 1,025 million euros in H1 2023. This represented

15.4% of net revenue in H1 2024 versus 16.2% of net revenue in H1

2023, improving by 80 basis points. They comprised:

- Other operating expenses (excluding pass-through costs,

depreciation & amortization) amounted to 789 million euros,

compared to 783 million euros in H1 2023. They represent 11.8% of

net revenue, compared to 12.4% in H1 2023, reflecting solid cost

control.

- Depreciation and amortization charge was 241 million euros in

H1 2024, stable compared to 242 million euros in H1 2023.

As a result, the operating margin amounted to 1,160

million euros, up by +6.1% compared to H1 2023. This represents an

operating margin rate of 17.3% in H1 2024, in line with H1 2023,

while including circa 45 million euros relating to the Groupe’s AI

investment.

Operating margin rates by geographies were 18.7% in North

America, 16.1% in Europe, 19.6% in Asia-Pacific, 3.7% in Middle

East & Africa and 3.6% in Latin America.

Amortization of intangibles arising from acquisitions

totaled 123 million euros in H1 2024, down 19 million euros versus

H1 2023, related to the end of the amortization associated with

technologies.

Impairment losses amounted to 45 million euros, down from

112 millions euros in H1 2023, as 2023 included the impact of our

real estate footprint optimization.

In addition, non-current expense was an income of 16

million euros, mainly corresponding to the contribution of the

CitrusAd and Epsilon technologies to the Group's 49%-owned

associate Unlimitail. In H1 2023, non-current income amounted to 4

million euros.

Operating income totaled 1,008 million euros in H1 2024,

versus 843 million euros in H1 2023.

The financial result, comprising the cost of net

financial debt and other financial charges and income, was at 0

million euro in H1 2024, compared to a charge of 14 million euros

in H1 2023.

- The cost of net financial debt was an income of 39 million

euros in H1 2024, compared to an income of 42 million euros in H1

2023. In H1 2024, it included 61 million euros of financial

expenses (59 million euros in H1 2023) and financial income of 100

million euros, broadly stable versus last year.

- Other financial income and expenses were a charge of 39 million

euros in H1 2024, notably composed by 42 million euros interest on

lease liabilities and 7 million euros income from the fair value

remeasurement of mutual funds. In H1 2023, other financial income

and expenses were a charge of 56 million euros, notably composed by

39 million euros interest on lease liabilities and 8 million euros

cost from the fair value remeasurement of Mutual Funds.

The revaluation for earn-outs payments was an income of

28 million euros in H1 2024, compared to 1 million euros income in

H1 2023.

The income tax charge was 256 million euros in H1

2024, corresponding to a forecasted effective tax rate of 24.9% for

2024, compared to 205 million euros in H1 2023 corresponding to a

forecasted effective tax rate of 24.8% for 2023.

The share of profit of associates is a 3 million euros

loss in H1 2024, compared to a 3 million euros profit in H1

2023.

Minority interests were a gain of 4 million euros in H1

2024 compared to a gain of 5 million euros in Groupe results in H1

2023.

Overall, net income attributable to the Groupe was 773

million euros in H1 2024, compared to 623 million euros in H1

2023.

Finally the earning per share was 3.08 euros in H1 2024,

compared to 2.48 euros in H1 2023, up by +24.2%.

Free cash flow

EUR million

H1 2024

H1 2023

EBITDA

1,401

1,335

Repayment of lease liabilities and related

interests

(224)

(207)

Investments in fixed assets (net)

(118)

(75)

Financial interest paid (net)

13

17

Tax paid

(376)

(386)

Other

48

41

Free cash flow before changes

in WCR

744

725

The Groupe’s free cash flow, before change in working

capital requirements, is up by 19 million euros compared to H1

2023, to 744 million euros.

Repayment of lease liabilities and related interests

amounted to 224 million euros in H1 2024, compared to 207 million

euros in H1 2023.

Net investments in fixed assets were 118 million euros in

H1 2024, up 43 million compared to 75 million euros in H1 2023,

reflecting higher investment in platforms and cloud infrastructure,

the cost related to ERP deployment across the entire organization,

as well as costs associated with new leases.

Financial interest were an income of 13 million euros in

H1 2024, compared to an income of 17 million euros in H1 2023.

Tax paid amounted to 376 million euros, down 10 million

euros compared to H1 2023. In January 2023, the Group made an

additional payment of 110 million euros related to fiscal year

2022, reflecting the implementation of the Tax Cuts and Jobs Act

(TCJA) in the United States. However, this impact was largely

offset by an increase in taxes paid in H1 2024, due to various

items including true-ups on 2023 tax and withholding tax.

Net debt

Net financial debt amounted to 99 million euros as of June 30,

2024 compared to a net cash position of 909 million euros of

December 31, 2023 reflecting the seasonality of the activity. The

Groupe's last twelve months average net debt as of June 30, 2024

amounted to 375 million euros compared to 498 million euros as of

June 30, 2023.

ACQUISITIONS

On January 18, 2024, Publicis Groupe Singapore announced

the acquisition of AKA Asia, one of Singapore's leading

integrated communications agencies. Founded in 2009, AKA is a

highly respected player in the South-East Asian market, known for

delivering award-winning and innovative communication campaigns.

The acquisition will expand and diversify Publicis Groupe's

capabilities in the region, while bolstering the Groupe's strategic

communications, PR and influence offering. AKA will join the

Groupe's regional Influence practice.

On March 12, 2024, Publicis Sapient announced the

acquisition of Spinnaker SCA, a leading supply chain

services firm that provides end-to-end supply chain strategy,

planning and execution consulting services. Founded in 2002 and

based in Boulder in the U.S., Spinnaker SCA will become part of

Publicis Sapient and bring core capabilities and skill sets

including advanced AI and ML analytics, supply chain digital twins,

warehouse and transportation management and expanded digital

services. Spinnaker SCA will further enable Publicis Sapient to

offer solutions for clients to optimize their agile supply chains

as part of their digital business transformation.

On June 5, 2024, Publicis Groupe in France announced the

acquisition of Downtown Paris, a creation and production

house specialized in leading brands in the beauty and luxury

business. Founded in 2016, the agency will strengthen the

production vertical of Publicis France and will work with the

Groupe's various luxury entities.

CSR

In May 2024, the Groupe announced the arrival of Nannette

LaFond-Dufour as Chief Impact Officer. In this newly created global

role, Nannette will be responsible for driving immediate impact

across the Groupe’s long-term ESG commitments. These include

Publicis’ ambitious SBTI-approved climate goals, its concrete

diversity, equity and inclusion action plans, as well as its

flagship initiatives like the Working with Cancer pledge and the

Women’s Forum for the Economy & Society.

GOVERNANCE

The Combined General Shareholder’s meeting of Publicis Groupe

SA, held on May 29, 2024, approved the change in the Company's

governance structure to adopt a Board of Directors, replacing the

previous Management Board and Supervisory Board.

The Board of Directors, which met following the General Meeting,

agreed to combine the roles of Chairman and Chief Executive

Officer, appointing Mr. Arthur Sadoun as Chairman and CEO.

Mrs. Élisabeth Badinter was appointed Vice-Chair of the Board of

Directors.

Mr. Maurice Lévy has taken on the role of Chairman Emeritus of

Publicis Groupe and is invited to attend Board meetings.

Mr. André Kudelski was appointed to the position of Lead

Director (Administrateur Référent). In this role, his primary

missions are to facilitate the smooth operation of the Company’s

governing bodies alongside the Chairman of the Board; preside over

executive sessions; guard against potential conflicts of interest;

and supervise the evaluation process of the Board of Directors.

All the proposed amendments to the Articles of Incorporation

were approved, as was the extension of the Company’s term.

POST-REPORTING PERIOD EVENTS

On July 12, 2024, the Groupe put a new Revolving Credit Facility

in place for an amount of 2,000 million euros with a maturity of

July 2029 (and a two-year extension option). This facility cancels

and replaces the confirmed credit facility of 1,579 million euros,

maturing in 2026.

OUTLOOK

After a better than expected first half of 2024, which

demonstrated the strength of the Groupe’s model and the

sustainability of its industry outperformance, the Groupe is

confident in its potential to accelerate further on organic growth

in the second half of the year, and upgrades its organic growth

guidance for the full year 2024 despite ongoing macroeconomic

uncertainties.

The Groupe now aims for +5% to +6% organic growth for the

full year, compared to +4% to +5% previously.

The bottom-end of the guidance at +5% is the new floor in

the current macroeconomic environment, factoring in continued

delays in clients’ digital business transformation projects and

reduced spend in classic advertising.

The top-end of the guidance at +6% is the new stretch,

assuming an improved macroeconomic context, which would lead to

resumed spend on digital business transformation projects, fewer

reductions in classic advertising and some positive impact from

increased client budgets in the fourth quarter.

The Groupe also confirms its 2024 guidance on financial

ratios, which will be maintained at the industry-leading levels

of 18% operating margin rate and between 1.8 and 1.9 billion euros

free cash flow before change in working capital, including the

Groupe’s opex investment of 100 million euros for its AI plan.

Disclaimer

Certain information contained in this document, other than

historical information, may constitute forward-looking statements

or unaudited financial forecasts. These forward-looking statements

and forecasts are subject to risks and uncertainties that could

cause actual results to differ materially from those projected.

These forward-looking statements and forecasts are presented at the

date of this document and, other than as required by applicable

law, Publicis Groupe does not assume any obligation to update them

to reflect new information or events or for any other reason.

Publicis Groupe urges you to carefully consider the risk factors

that may affect its business, as set out in the Universal

Registration Document filed with the French Autorité des Marchés

Financiers (AMF) and which is available on the website of Publicis

Groupe (www.publicisgroupe.com), including an unfavorable economic

climate, a highly competitive industry, risks associated with the

confidentiality of personal data, the Groupe’s business dependence

on its management and employees, risks associated with mergers and

acquisitions, risks of IT system failures and cybercrime, the

possibility that our clients could seek to terminate their

contracts with us on short notice, risks associated with the

reorganization of the Groupe, risks of litigation, governmental,

legal and arbitration proceedings, risks associated with the

Groupe’s financial rating and exposure to liquidity risks.

About Publicis Groupe - The Power of One

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a

global leader in communication. The Groupe is positioned at every

step of the value chain, from consulting to execution, combining

marketing transformation and digital business transformation.

Publicis Groupe is a privileged partner in its clients’

transformation to enhance personalization at scale. The Groupe

relies on ten expertise concentrated within four main activities:

Communication, Media, Data and Technology. Through a unified and

fluid organization, its clients have a facilitated access to all

its expertise in every market. Present in over 100 countries,

Publicis Groupe employs around 103,000 professionals.

www.publicisgroupe.com | Twitter: @PublicisGroupe | Facebook |

LinkedIn | YouTube | Viva la Difference!

Appendices

Net revenue: organic growth

calculation

(million euro)

Q1

Q2

H1

Impact of currency at end June

2024 (million euro)

2023 net revenue

3,079

3,239

6,318

GBP (2)

15

Currency impact (2)

(29)

13

(16)

USD (2)

(1)

2023 net revenue at 2024 exchange rates

(a)

3,050

3,252

6,302

Others

(30)

2024 net revenue before acquisition impact

(b)

3,212

3,433

6,645

Total

(16)

Net revenue from acquisitions (1)

18

25

43

2024 net revenue

3,230

3,458

6,688

Organic growth (b/a)

+5.3%

+5.6%

+5.4%

(1)

Acquisitions (Spinnaker SCA, Practia, Corra, AKA Asia, ARBH,

Downtown Paris), net of disposals.

(2)

EUR = USD 1.081 on average in H1 2024 vs. USD 1.081 on average in

H1 2023 EUR = GBP 0.855 on average in H1 2024 vs. GBP 0.877 on

average in H1 2023

Definitions

Net revenue or Revenue less pass-through costs:

Pass-through costs mainly concern production and media activities,

as well as various expenses incumbent on clients. These items that

can be re-billed to clients do not come within the scope of

assessment of operations, net revenue is a more relevant indicator

to measure the operational performance of the Groupe’s

activities.

Organic growth: Change in net revenue excluding the

impact of acquisitions, disposals and currencies.

Like-for-like growth: Growth at current year exchange

rates and current perimeter, including organic growth coming from

acquisitions since the acquisition date.

4Y CAGR organic growth: Calculated as: ( [1 + organic

growth (n-4)]*[1 + organic growth (n-3)]*[1 + organic growth

(n-2)]*[1 + organic growth (n-1)] )^(1/4) - 1.

EBITDA (Earnings Before Interest, Taxes, Depreciation and

Amortization): Operating margin before depreciation &

amortization.

Operating margin: Revenue after personnel costs, other

operating expenses (excl. non-current income and expense) and

depreciation (excl. amortization of intangibles arising on

acquisitions).

Operating margin rate: Operating margin as a percentage

of net revenue.

Headline Group Net Income: Net income attributable to the

Groupe, after elimination of impairment charges / real estate

transformation expenses, amortization of intangibles arising on

acquisitions, the main capital gains (or losses) on disposals,

change in the fair value of financial assets and the revaluation of

earn-out costs.

EPS (Earnings per share): Group net income divided by

average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net

income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share,

diluted): Headline group net income, divided by average number

of shares, diluted.

Capex: Net acquisitions of tangible and intangible

assets, excluding financial investments and other financial

assets.

Free cash flow before changes in working capital

requirements: Net cash flow from operating activities less

interests paid & received, repayment of lease liabilities &

related interests and before changes in WCR linked to operating

activities.

Free cash flow: Net cash flow from operating activities

less interests paid & received, repayment of lease liabilities

& related interests.

Net debt (or financial net debt): Sum of long and short

financial debt and associated derivatives, net of treasury and cash

equivalents, excluding lease liability since 1st January 2018.

Average net debt: Last twelve month average of monthly

net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted

EPS.

Consolidated income statement

(in millions of euros)

June 30, 2024

(6 months)

June 30, 2023

(6 months)

December 31, 2023

(12 months)

Net revenue (*)

6,688

6,318

13,099

Pass-through revenue

962

787

1,703

Revenue

7,650

7,105

14,802

Personnel costs

Other operating costs

(4,498)

(1,751)

(4,200)

(1,570)

(8,514)

(3,443)

Operating margin before depreciation

& amortization

1,401

1,335

2,845

Depreciation and amortization

(excluding intangibles from

acquisitions)

(241)

(242)

(482)

Operating margin

1,160

1,093

2,363

Amortization of intangibles from

acquisitions

(123)

(142)

(268)

Impairment loss

(45)

(112)

(153)

Other non-current income and expenses

16

4

(202)

1 434

Operating income

1,008

843

1,740

Financial expense

Financial income

Cost of net financial debt

Other financial income and expenses

Revaluation of earn-out payments

(61)

100

39

(39)

28

(59)

101

42

(56)

1

(120)

198

78

(99)

12

Pre-tax income of consolidated

companies

1,036

830

1,731

Income taxes

(256)

(205)

(415)

Net income of consolidated

companies

780

625

1,316

Share of profit of associates

(3)

3

6

Net income

777

628

1,322

Of which:

- Net income attributable to

non-controlling interests

4

5

10

Net income attributable to equity

holders of the parent company

773

623

1,312

Per share data (in euros) - Net

income attributable

to equity holders of the parent

company

Number of shares

250,711,640

250,829,338

250,706,485

Earnings per share

3.08

2.48

5.23

Number of diluted shares

253,302,880

253,618,058

253,999,363

Diluted earnings per share

3.05

2.46

5.17

(*) Net revenue: Revenue less pass-through costs. Those costs

are mainly production & media costs and out-of-pocket expenses.

As these items that can be passed on to clients are not included in

the scope of analysis of transactions, the net revenue indicator is

the most appropriate for measuring the Groupe’s operational

performance.

Consolidated statement of comprehensive income

(in millions of euros)

June 30, 2024

(6 months)

June 30, 2023

(6 months)

December 31, 2023

(12 months)

Net income for the period

(a)

777

628

1,322

Comprehensive income that will not be

reclassified to income statement

- Actuarial gains (and losses) on defined

benefit plans

18

(6)

12

- Deferred taxes on comprehensive income

that will not be reclassified to income statement

(4)

2

(3)

Comprehensive income that may be

reclassified to income statement

- Remeasurement of hedging instruments

19

13

34

- Consolidation translation

adjustments

239

(217)

(390)

Total other comprehensive income

(b)

272

(208)

(347)

Total comprehensive income for the

period (a) + (b)

1,049

420

975

Of which:

- Comprehensive income for the period

attributable to non-controlling interests

4

(2)

4

- Comprehensive income for the period

attributable to equity holders of the parent company

1,045

422

971

Consolidated balance sheet

(in millions of euros)

June 30, 2024

December 31, 2023

Assets

Goodwill, net

12,812

12,422

Intangible assets, net

901

958

Right-of-use assets related to leases

1,640

1,614

Property, plant and equipment, net

591

596

Deferred tax assets

173

212

Investments in associates

80

46

Other financial assets

316

316

Non-current assets

16,513

16,164

Inventories and work-in-progress

482

341

Trade receivables

12,883

13,400

Contract assets

1,860

1,297

Other receivables and current assets

1,098

1,264

Cash and cash equivalents

3,082

4,250

Current assets

19,405

20,552

Total assets

35,918

36,716

Equity and

liabilities

Share capital

102

102

Additional paid-in capital and retained

earnings, Groupe share

9,814

9,686

Equity attributable to holders of the

parent company – Groupe share

9,916

9,788

Non-controlling interests (minority

interests)

(41)

(40)

Total equity

9,875

9,748

Long-term borrowings

1,650

2,462

Long-term lease liabilities

1,990

1,992

Deferred tax liabilities

63

98

Pension commitments and other short-term

benefits

260

265

Long-term provisions

365

319

Non-current liabilities

4,328

5,136

Trade payables

15,953

17,077

Contract liabilities

481

513

Short-term borrowings

1,382

726

Short-term lease liabilities

372

360

Income taxes payable

302

378

Pension commitments and other short-term

benefits

24

21

Short-term provisions

207

255

Other creditors and current

liabilities

2,994

2,502

Current liabilities

21,715

21,832

Total equity and liabilities

35,918

36,716

Consolidated statement of cash flows

(in millions of euros)

June 30, 2024

(6 months)

June 30, 2023

(6 months)

December 31, 2023

(12 months)

Cash flow from

operating activities

Net income

777

628

1,322

Neutralization of non-cash income and

expenses:

Income taxes

256

205

415

Cost of net financial debt

(39)

(42)

(78)

Capital losses (gains) on disposal of

assets (before tax)

(16)

(2)

(1)

Depreciation, amortization and impairment

losses

409

496

903

Share-based compensation

46

41

85

Other non-cash income and expenses

12

51

79

Share of profit of associates

3

(3)

(6)

Dividends received from associates

1

2

7

Taxes paid

(376)

(386)

(669)

Change in working capital requirements

(1,629)

(1,053)

(9)

Net cash flows generated by (used in)

operating activities (I)

(556)

(63)

2,048

Cash flow from

investing activities

Purchases of property, plant and equipment

and intangible assets

(120)

(75)

(180)

Disposals of property, plant and equipment

and intangible assets

2

-

2

Purchases of investments and other

financial assets, net

12

(10)

13

Acquisitions of subsidiaries

(229)

(158)

(194)

Disposals of subsidiaries

-

-

11

Net cash flows generated by (used in)

investing activities (II)

(335)

(243)

(348)

Cash flow from

financing activities

Dividends paid to holders of the parent

company

-

-

(726)

Dividends paid to non-controlling

interests

(9)

(7)

(9)

Proceeds from new borrowings

-

4

5

Repayment of borrowings

(5)

-

(502)

Repayment of lease liabilities

(182)

(168)

(344)

Interest paid on lease liabilities

(42)

(39)

(79)

Interest paid

(85)

(86)

(99)

Interest received

98

103

192

Buy-outs of non-controlling interests

(7)

(2)

(4)

Net (buybacks)/sales of treasury shares

and warrants

(119)

(193)

(189)

Net cash flows generated by (used in)

financing activities (III)

(351)

(388)

(1,755)

Impact of exchange rate fluctuations

(IV)

74

(239)

(311)

Change in consolidated cash and cash

equivalents (I + II + III + IV)

(1,168)

(933)

(366)

Cash and cash equivalents on January 1

4,250

4,616

4,616

Bank overdrafts on January 1

(1)

(1)

(1)

Net cash and cash equivalents at

beginning of year (V)

4,249

4,615

4,615

Cash and cash equivalents at closing

date

3,082

3,682

4,250

Bank overdrafts at closing date

(1)

-

(1)

Net cash and cash equivalents at

closing date (VI)

3,081

3,682

4,249

Change in consolidated cash and cash

equivalents (VI - V)

(1,168)

(933)

(366)

Consolidated statement of changes in equity

Number of outstanding

shares

(in millions of euros)

Share capital

Additional paid-in

capital

Reserves and earnings brought

forward

Translation

reserve

Fair value reserve

Equity attributable to equity

holders of the parent company

Non-controlling

interests

Total equity

250,574,493

January 1, 2024

102

3,336

6,633

(299)

16

9,788

(40)

9,748

Net income

773

773

4

777

Other comprehensive income, net

of tax

14

239

19

272

-

272

Total income and expenses for

the period

787

239

19

1,045

4

1,049

-

Dividends

(53)

(800)

(853)

(9)

(862)

-

Share-based compensation, net of

tax

60

60

60

Effect of acquisitions and

commitments to buy-out non-controlling interests

(5)

(5)

4

(1)

-

Equity warrant exercise

-

-

-

416,958

(Buybacks)/Sales of treasury

shares

(119)

(119)

(119)

250,991,451

June 30, 2024

102

3,283

6,556

(60)

35

9,916

(41)

9,875

Number of outstanding

shares

(in millions of euros)

Share capital

Additional paid-in

capital

Reserves and earnings brought

forward

Translation

reserve

Fair value reserve

Equity attributable to equity

holders of the parent company

Non-controlling

interests

Total equity

251,992,065

January 1, 2023

102

4,037

5,324

85

87

9,635

(35)

9,600

Net income

623

623

5

628

Other comprehensive income, net

of tax

(210)

9

(201)

(7)

(208)

Total income and expenses for

the period

0

0

623

(210)

9

422

(2)

420

-

Dividends

(701)

(25)

(726)

(7)

(733)

-

Share-based compensation, net of

tax

50

50

50

Effect of acquisitions and

commitments to buy-out non-controlling interests

1

1

0

1

-

Equity warrant exercise

0

0

0

(1,490,149)

(Buybacks)/Sales of treasury

shares

(194)

(194)

(194)

250,501,916

June 30, 2023

102

3,336

5,779

(125)

96

9,188

(44)

9,144

Earnings per share (basic and diluted)

(in millions of euros, except for share

data)

June 30, 2024

June 30, 2023

Net income used for the calculation of

earnings per share

Net income share attributable to equity

holders of the parent company

A

773

623

Impact of dilutive instruments:

- Savings in financial expenses related to

the conversion of debt instruments, net of tax

-

-

Net income – Groupe share – diluted

B

773

623

Number of shares used to calculate

earnings per share

Number of shares at January 1

254,311,860

254,311,860

Shares created over the period

-

-

Treasury shares to be deducted (average

for the period)

(3,600,220)

(3,482,522)

Average number of shares used for the

calculation

C

250,711,640

250,829,338

Impact of dilutive instruments:

- Free shares and dilutive stock

options

2,591,240

2,788,720

- Equity warrants (BSA)

-

-

Number of diluted shares

D

253,302,880

253,618,058

(in euros)

Earnings per share

A/C

3.08

2.48

Diluted earnings per share

B/D

3.05

2.46

Headline earnings per share (basic and diluted)

(in millions of euros, except for share

data)

June 30, 2024

June 30, 2023

Net income used to calculate headline

earnings per share(1)

Net income – Groupe share

773

623

Items excluded:

- Amortization of intangibles from

acquisitions, net of tax

92

105

- Impairment loss, net of tax

34

83

- Revaluation of earn-out payments

(28)

(1)

- Main capital gains and losses on

disposal of assets and fair value adjustment of financial assets,

net of tax(2)

(14)

3

Headline Groupe net income

E

857

813

Impact of dilutive instruments:

- Savings in financial expenses related to

the conversion of debt instruments, net of tax

-

-

Headline Groupe net income, diluted

F

857

813

Number of shares used to calculate

earnings per share

Number of shares at January 1

254,311,860

254,311,860

Shares created over the period

-

-

Treasury shares to be deducted (average

for the period)

(3,600,220)

(3,482,522)

Average number of shares used for the

calculation

C

250,711,640

250,829,338

Impact of dilutive instruments:

- Free shares and dilutive stock

options

2,591,240

2,788,720

- Equity warrants (BSA)

-

-

Number of diluted shares

D

253,302,880

253,618,058

(in euros)

Headline earnings per share(1)

E/C

3.42

3.24

Headline earnings per share –

diluted(1)

F/D

3.38

3.21

(1)

EPS after elimination of impairment losses, amortization of

intangibles from acquisitions, the main capital gains and losses on

disposal and fair value adjustment of financial assets and

revaluation of earn-out payments.

(2)

As of June 30, 2024, the main capital gains and losses on disposal

amount to euro 8 million and the fair value adjustment of financial

assets amounts to euro 6 million. At June 30, 2023, the main

capital gains and losses on disposal amount to euro 4 million and

the fair value adjustment of financial assets amounts to euro (7)

million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717724274/en/

Amy Hadfield Corporate Communications + 33 1 44 43 70 75

amy.hadfield@publicisgroupe.com Jean-Michel Bonamy Investor

Relations + 33 1 44 43 74 88 jean-michel.bonamy@publicisgroupe.com

Lorène Fleury Investor Relations + 33 1 44 43 57 24

lorene.fleury@publicisgroupe.com Maxine Miller Investor Relations +

33 1 44 43 74 21 maxine.miller@publicisgroupe.com

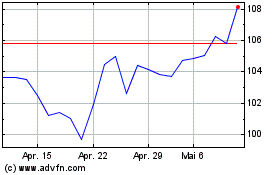

Publicis Groupe (EU:PUB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Publicis Groupe (EU:PUB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024