Regulatory News:

Caisse des Dépôts, MAIF, CNP Assurances and

MACSF Epargne Retraite take stake in ORPEA in the context of the

€1.16 billion capital increase without preferential subscription

rights reserved for named persons, with a priority right granted to

existing shareholders

Not to be published, distributed or circulated

directly or indirectly in the United States, Canada, Australia or

Japan.

This press release is an advertisement and not

a prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017

ORPEA S.A (Paris:ORP) (the « Company »), announces today

the results of its share capital increase without preferential

subscription rights reserved for named persons, namely to Caisse

des Dépôts et Consignations (CDC), Mutuelle Assurance des

Instituteurs de France (MAIF), CNP Assurances and MACSF Epargne

Retraite (or companies affiliated to them) (the

“Groupement”), with a priority right granted to the Existing

Shareholders (as defined below) for a gross amount, including issue

premium, of EUR 1,160,080,552, by way of issuance of 65,173,064,696

new shares (the “New Shares”) at a subscription price of EUR

0.0178 per New Share (the “Groupement Capital

Increase”).

RESULTS OF THE GROUPEMENT CAPITAL INCREASE

Following the priority period which ended on December 12th,

2023, total demand arising from Existing Shareholders amounted to

5,625,195 New Shares.

Consequently, the 65,173,064,696 New Shares issued as part of

the Groupement Capital Increase have been subscribed as

follows:

- 5,625,195 New Shares have been subscribed by Existing

Shareholders, i.e. approximately EUR 0.1 million;

- 65,167,439,501 New Shares have been subscribed by the members

of the Groupement pursuant to their subscription commitment, i.e. a

total of approximately EUR 1 160 million, with a breakdown as

follows:

- Caisse des Dépôts et Consignations: 29,096,901,032 New Shares

representing a total subscription amount (including issue premium)

of approximately EUR 517.9 million;

- Mutuelle Assurance des Instituteurs de France (MAIF):

19,237,620,517 New Shares representing a total subscription amount

(including issue premium) of approximately EUR 342.4 million;

- CNP Assurances: 7,214,107,694 New Shares representing a total

subscription amount (including issue premium) of approximately EUR

128.4 million; and

- MACSF Epargne Retraite: 9,618,810,258 New Shares representing a

total subscription amount (including issue premium) of

approximately EUR 171,2 million.

As a reminder, the Groupement Capital Increase follows the

Equitization Capital Increase (as defined below) and is carried out

in the context of the accelerated safeguard plan adopted by the

Nanterre Specialised Commercial Court on July 24th, 2023 (the

“Accelerated Safeguard Plan”).

As previously described by the Company in the prospectus related

to the Groupement Capital Increase, and according to the terms of

the Accelerated Safeguard Plan, the priority right granted in the

Groupement Capital Increase benefited only to shareholders whose

shares were evidenced by book-entries (inscription en compte) at

the end of the accounting day of November 15th, 2023 (the

“Existing Shareholders”) based on the number of shares they

held as of this date, adding thereto, if applicable, and provided

that their shares were held in pure registered form (nominatif pur)

from November 15th, 2023 at the latest and are maintained in such

form until the settlement and delivery date of the Groupement

Capital Increase expected to take place on December 19th, 2023, the

shares that they may have subscribed as part of the Equitization

Capital Increase, i.e. a total number of shares on the basis of

which the priority right could be exercised of 69,015,525

shares.

IMPACT OF THE CAPITAL INCREASE ON THE COMPANY’S

SHAREHOLDING

After completion of the Groupement Capital Increase, the Company

share capital stands at EUR 1,298,669,156.96, comprised of

129,866,915,696 shares with a par value of EUR 0.01 each, held as

follows:

- Groupement: 50.18% of which:

- CDC: 22.41%,

- MAIF: 14.81%,

- CNP Assurances : 5.56%, and

- MACSF Epargne Retraite: 7.41%

- Unsecured Creditors: 48.84%

- Free float: 0.98%

It is reminded that pursuant to (i) the Lock-Up agreement,

entered into on 14 February 2023 between the Company, the

Groupement and five institutions holding unsecured debt of the

Company and (ii) the accelerated safeguard plan of the Company

approved by the specialized Commercial court of Nanterre on 24 July

2023, the appointment of the new directors will be submitted to the

next annual general meeting of the Company, to be held on 22

December 2023 (see also the press release of the Company dated 13

November 2023).

It is also reminded that, by letter received on 7 December 2023

(see the threshold crossing notification 223C2024 dated 11 December

2023), completed by a letter received on 8 December 2023, the

concert comprising Concert’O, Nexstone Capital and Mat Immo Beaune

has declared that it has crossed upwards, on 4 December 2023, the

thresholds of 5% and 10% of the capital and voting rights of the

Company and holds 7,670,545,736 ORPEA shares representing the same

number of voting rights, i.e. 11.86% of the capital and voting

rights of the Company, specifying that “this crossing of thresholds

results from the subscription to a share capital increase of the

Company (see in particular the prospectus approved by the AMF under

number 23-465 dated 10 November 2023 and the press release of ORPEA

dated 30 November 2023)”.

On this occasion, Concert’O has declared that it has crossed

upwards the thresholds of 5% of the capital and voting rights of

the Company. Any thresholds crossings (upwards or downwards) by

shareholders of the Company, following the settlement-delivery of

the Groupement Capital Increase, shall, as the case may be, be

subject to applicable notifications pursuant to regulations or the

by-laws and will be communicated to the market pursuant to

applicable regulations.

SETTLEMENT AND DELIVERY

Settlement, delivery and start of trading of the New Shares on

the regulated market of Euronext in Paris (“Euronext Paris”)

are expected to take place on December 19th, 2023. The New Shares

will immediately entitle their holders to all distributions, will

be immediately fungible with existing ordinary shares of the

Company and will be traded on the same trading line under the same

ISIN code FR0000184798.

REMINDER ON THE ACCELERATED SAFEGUARD PLAN

It is reminded that the Accelerated Safeguard Plan provides for

the implementation of three capital increases, namely (i) a capital

increase with shareholders' preferential subscription rights

backstopped by the unsecured creditors (the “Equitization

Capital Increase”), having been the subject of a prospectus

approved by the AMF on November 10th, 2023 under number 23-465, and

whose delivery-settlement occurred on December 4th, 2023, (ii) the

Groupement Capital Increase, as detailed in the press release dated

December 5th, 2023 and this press release, and (iii) a capital

increase with shareholders' preferential subscription right in an

amount (including the issue premium) of EUR 390,019,672.62, by

issuing 29,324,787,415 new shares at an issue price of EUR 0.0133

per new share, to which the members of the Groupement have

committed to subscribe in the amount of approximately EUR 196

million, the balance, i.e. EUR 194 million, being backstopped by

five institutions holding a significant portion of the Company's

unsecured debt (the “Rights Issue” and together with the

Equitization Capital Increase and the Groupement Capital Increase,

the “Capital Increases”, all three Capital Increases forming

an indivisible whole).

AVAILABILITY OF THE PROSPECTUS

The prospectus (the « Prospectus ») approved by the AMF

under number 23-503 on December 5th, 2023 and comprised of (i)

ORPEA S.A. 2022 universal registration document filed with the AMF

on June 7th, 2023 under number D. 23-0461 (the “Universal

Registration Document” or “URD”), (ii) the first

amendment to the URD filed with the AMF on November 10th, 2023

under number D.23-0461-A01 (the “First Amendment to the

URD”), (iii) the second amendment to the URD filed with the AMF

on December 5th, 2023 under number D.23-0461-A02 (the "Second

Amendment to the URD”), (iv) the securities note dated December

5th, 2023 (the “Securities Note”) and (v) the summary of the

Prospectus (included in the Securities Note) is available on the

websites of the AMF (www.amf-france.org) and the Company

(www.orpea-group.com). Copies of the Prospectus are available free

of charge at the Company’s registered office (12, rue Jean Jaurès,

92813 Puteaux).

RISK FACTORS

Investors’ attention is drawn to the risk factors relating to

the Company included in chapter 2 « Internal Control and Risk

Factors » of the URD as updated in chapter 2 of the First Amendment

to the URD and in chapter 2 of the Second Amendment to the URD and

the risk factors relating to the transaction and the New Shares

mentioned in chapter 2 “Risk Factors” of the Securities Note, in

particular risk factor 2.1 related to the massive dilution implied

by the Capital Increases and the need for Existing Shareholders to

invest or to have invested significant amounts if they want to

maintain their stakes unchanged.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 20 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https ://www.orpea-group.com/en

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120 and CAC Mid 60 indices

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

ordinary shares in any State or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the member states of the European Economic Area

(others than France) and the United Kingdom (each a “Relevant

State”), no action has been undertaken or will be undertaken to

make an offer to the public of the securities referred to herein

requiring a publication of a prospectus in any Relevant State. As a

result, the securities may and will be offered in any Relevant

State only (i) to qualified investors within the meaning of the

Prospectus Regulation, for any investor in a Member State of the

European Economic Area, or Regulation (EU) 2017/1129 as part of

national law under the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”), for any investor in the United

Kingdom, (ii) to fewer than 150 individuals or legal entities

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions set forth in Article 1 (4)

of the Prospectus Regulation or under any other circumstances which

do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation, of the UK

Prospectus Regulation and/or to applicable regulations of that

Relevant State.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of Article 21 of the Financial

Services and Markets Act 2000) in connection with the issue or sale

of any securities may otherwise lawfully be communicated or caused

to be communicated (all such persons together being referred to as

“Relevant Persons”). Any investment or investment activity

to which this document relates is available only to Relevant

Persons and will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person should not act or rely on this

document or any of its contents.

This press release may not be published, distributed or

transmitted in the United States (including its territories and

dependencies). This press release does not constitute or form part

of any offer of securities for sale or any solicitation to purchase

or to subscribe for securities or any solicitation of sale of

securities in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”) or the law of

any State or other jurisdiction of the United States, and may not

be offered or sold in the United States absent registration under

the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Company does not intend to register all or any

portion of the securities in the United States under the Securities

Act or to conduct a public offering of the securities in the United

States.

This announcement may not be published, forwarded or

distributed, directly or indirectly, in the United States, Canada,

Australia or Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231214980615/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll-free number for shareholders : 0 805 480 480

Investor Relations NewCap Dusan Oresansky Tel. :

07 70 29 53 74 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Investor Relations Director Tel. : 01 44 71 94 94

i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 – 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

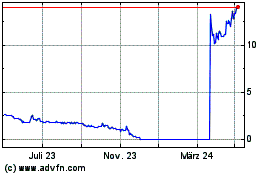

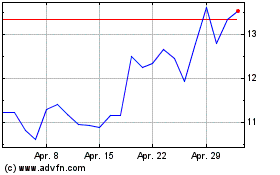

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Orpea (EU:ORP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024