ORPEA: Availability of the Third Amendment to the 2022 Universal Registration Document and Estimates to Date for the 2023 Financial Year

18 Januar 2024 - 8:00AM

Business Wire

EBITDAR 2023 Estimated at Around €690 Million1,

-2.8% Below the Forecast of €710 Million Published on 6 November

2023

Regulatory News:

ORPEA (Paris:ORP) (the "Company") reminds that a Third

Amendment (the "Amendment" or the "Third Amendment")

(link) to the 2022 Universal Registration Document (the

"Universal Registration Document" or "URD") was filed

on 17 January 2024 under reference number D.23-0461-A03 with the

Autorité des marchés financiers. The Third Amendment is part of the

prospectus approved on 17 January 2024 by the Autorité des marchés

financiers under reference number 24-006 for the purposes of the

rights issue in the amount of 390 million euros announced today by

the Company.

The Company points out that the Third Amendment includes, in

Chapter 4, the Company's estimated financial data for the year

ended 31 December 2023. This information was reviewed by the

Company's Board of Directors on 16 January 2024, and has not been

audited by the Company's statutory auditors. The final consolidated

financial statements may therefore differ from these estimated

financial data.

Based in particular on an average Group occupancy rate estimated

at 83.1% (compared with a forecast of 83.5% set out in the First

Amendment to the Universal Registration Document dated 10 November

2023 (the "First Amendment")), on personnel costs, excluding

headquarters costs, estimated at 62.2% of sales (compared with a

forecast of 61.2% set out in the First Amendment, the Group having

experienced a lower occupancy rate than initially forecasted and

salary increases in certain countries towards the end of the 2023

financial year), and on headquarters costs estimated at 6.8% of

sales (compared with a forecast of 7.1% set out in the First

Amendment), the Company estimates that:

- revenue in 2023 is expected to come in at around 5.2 billion

euros, in line with the forecast set out in the First Amendment

;

- EBITDAR 2023 is expected to be around 690 million euros, -2.8%

below the 710 million euros forecast set out in the First

Amendment;

- Pre-IFRS 16 2023 EBITDA is expected to be around 210 million

euros, compared with the forecast set out in the First Amendment of

around 230 million euros.

- the Group's cash position at 31 December 2023 is estimated at

around 639 million euros, very close to the level set out in the

First Amendment (637 million euros), despite the fact that the

payment of salaries in France was executed earlier, i.e end of

December vs beginning of January, with an impact of 60 million

euros.

The Company also anticipates that, as of the date of this Third

Amendment, the following items are likely to have a material impact

on the consolidated income statement for the year ended 31 December

2023:

- an accounting entry in respect of the financial restructuring

operations carried out in 2023, and more specifically the

conversion into equity of ORPEA S.A.'s Unsecured Debt: in

accordance with the provisions of IFRS 9 (IFRIC 19 interpretation),

the Group will recognize a positive impact (non-cash) on Group net

income of around 2.7 billion euros, corresponding mainly to the

difference between :

- on the one hand, the book value of ORPEA S.A.'s Unsecured Debt

repaid and/or equitized (i.e. nearly 3.9 billion euros) on the

settlement-delivery date of the Equitisation Capital Increase on 4

December 2023; and

- on the other hand, the value received as consideration in cash

(72 million euros) and in the form of new shares issued as part of

the Equitisation Capital Increase (this consideration representing

a fair value of around 964 million euros based on a closing share

price of 0.0152 euro on 4 December 2023, the settlement-delivery

date of the Equitisation Capital Increase),

net of miscellaneous expenses related to the financial

restructuring incurred during 2023 and/or provisioned at 31

December 2023 (approximately 120 million euros);

- a negative impact on net income (non-cash) due to additional

impairments on assets (non-cash) carried on the balance sheet at 31

December 2023, amounting to around 0.4 billion euros, mainly as a

result of revised real estate yields (up 0.5% on average), weighted

average costs of capital in certain countries, and business plans

at facility level as part of the impairment tests carried out under

IAS 36.

With regard to the 2024-2025-2026 financial years, the Company

confirms all the outlooks presented in paragraph 5.5.2 of the First

Amendment, and in particular the objectives, by 2026, of an EBITDAR

margin of 19%, net debt (excluding IFRS adjustments and IFRS 16)

reduced to close to 3.6 billion euros, and the ratio of net debt to

pre-IFRS 16 EBITDA (financial leverage) at 5.5x.

All these items are based on data, assumptions and estimates

considered reasonable by the Group as of today.

The consolidated financial statements prepared in accordance

with IFRS rules for the year ended 31 December 2023, which will be

the subject of a statutory audit report by the Company's Statutory

Auditors, are expected to be released during May 2024 at the

latest.

The table below summarizes the estimated financial data for the

year ended December 31, 2023 presented above, compared with the

forecasts for the year ended December 31, 2023 presented in

paragraph 5.5.1 of the First Amendment:

2023 (estimated

financial data as set

out in the Third

Amendment)

2023 (forecast for the

year ending 31

December 2023 as

set out in the First

Amendment)

Gap estimated data

vs forecast

Revenue

c. €5.2 billion

c. €5.2 billion

unchanged

EBITDAR

c. €690 million

c. €710 million

-2.8%

EBITDA pre-IFRS 16

c. €210 million

c. €230 million

-8.7%

Cash position

€639 million

€637 million

+0.3%

General information

The 2022 Universal Registration Document and its amendments are

available on the website of the Autorité des marchés financiers

(www.amf-france.org) and on the Company's website at

www.orpea-group.com/en, under Publications / Universal registration

document. They can also be sent by e-mail upon request to the

following address: financegroupe@orpea.net and are available free

of charge on written request from ORPEA, Service Relations

Investisseurs, 12 rue Jean Jaurès - 92800 Puteaux.

DISCLAIMER

This document contains forward-looking statements that involve

risks and uncertainties, including those included or incorporated

by reference, concerning the Group's future growth and

profitability, which could cause actual results to differ

materially from those indicated in the forward-looking statements.

These risks and uncertainties relate to factors that the Company

cannot control or estimate precisely, such as future market

conditions. The forward-looking statements contained in this

document constitute expectations of future events and should be

regarded as such. Actual events or results may differ from those

described in this document due to a number of risks or

uncertainties described in Chapter 2 of the 2022 Universal

Registration Document dated 7 June 2023, as amended in Chapter 2 of

the first, second and third amendments to the Company's 2022

Universal Registration Document dated 10 November 2023, 5 December

2023 and 17 January 2024, available on the Company's website and

that of the Autorité des marchés financiers

(www.amf-france.org).

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 20 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), medical and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https://www.orpea-group.com/en

Since December 2023, the ORPEA Group has been 50.2% owned by

Caisse des Dépôts, CNP Assurances, MAIF and MACSF Epargne

Retraite.

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120 and CAC Mid 60 indices.

______________________________ 1 Unaudited figures

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240117849605/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll-free number for shareholders : 0 805 480 480

Investor Relations NewCap Dusan Oresansky 01 44 71

94 94 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Press Relations Director 07 70 29 53 74

i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 - 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

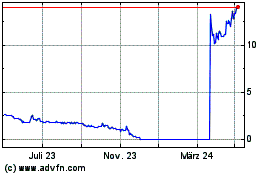

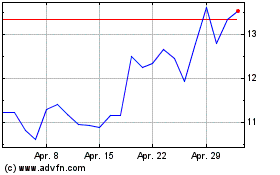

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Orpea (EU:ORP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024