Exor Press Release - H1 2023 Results

Amsterdam, 13 September 2023

EXOR DELIVERS 23% GROWTH IN NAV PER SHARE

IN H1, OUTPERFORMING MSCI BY 11 p.p.

€1 BILLION BUYBACK PROGRAM

ANNOUNCED WITH TENDER OFFER AT UP TO 10%

PREMIUM

-

Exor reports NAV of €34.2 billion at

30 June 2023. NAV per share increased 22.8% over the

first half of 2023, while outperforming the MSCI World Index by

11.3 p.p., mainly driven by the market performance of

Listed Companies.

-

Net debt was €0.1 billion at 30 June 2023,

from a net cash position of €0.8 billion at

31 December 2022, mainly driven by cash deployment into

Companies, Investments and share buyback, partially offset by

dividends received.

-

The Board of Directors approved today a €1

billion buyback program. Up to €750 million of this will be

executed in the form of a Tender Offer to be launched on

14 September 2023, at a premium of up to

10%.

| € million |

30/6/2023 |

31/12/2022 |

|

Net Asset Value |

34,189 |

28,233 |

| Net Asset Value

per share - € |

150.21 |

122.34 |

| Net Financial

Position of Exor Holdings System |

(133) |

795 |

| Loan-to-Value

ratio (%) |

0.4% |

n.a. |

|

|

|

|

| |

Six months ended 30 June |

|

€ million |

2023 |

2022 |

|

Net profit attributable to the owners of the parent |

2,157 |

265 |

| Dividends

received |

815 |

794 |

|

Dividends paid |

(99) |

(100) |

KEY EVENTS IN H1 2023 AND SUBSEQUENT EVENTS

During the first half of 2023 Exor bought a

stake of 2.96% in Philips for a total amount of

€511 million.

On 14 August 2023 Philips and Exor

announced that they had entered into a relationship agreement, and

as a result of which Exor has increased its stake in Philips to

15%. Exor fully supports Philips’ leadership, their strategy and

their view of the company’s value creation potential.

The relationship agreement includes Exor’s

commitment to be a long-term minority investor and the right to

propose one member to the Supervisory Board, as well as several

customary conditions. While Exor does not plan to buy further

Philips shares in the short term, over time Exor can, at its

discretion, increase its participation to a maximum limit of 20% of

Philips’ outstanding ordinary share capital.

During the first half of 2023 Exor invested a

total amount of €400 million in the Opportunity and Innovation

strategies managed by Lingotto.

-

Announcement of new share buyback program of €1

billion

During the first half of 2023 Exor bought back

€246 million worth of ordinary shares, completing the

€500 million share buyback program announced in March

2022.

Exor’s Board has today approved a new share

buyback program of €1 billion to be completed in the next

12 months. The Board believes that the current value of Exor

provides an attractive opportunity to invest in its own Companies

through buying back shares.

As part of this program, Exor will launch a

reverse Dutch auction Tender Offer on 14 September 2023

for an aggregate consideration up to €750 million to

Qualifying Shareholders1. In the Tender Offer, Qualifying

Shareholders will be able to select the price at which they wish to

tender their Ordinary Shares in a price range from a 3% discount to

a 10% premium over the VWAP during the Determination period, with a

price cap of the lower of €89.71 (being 110% of the closing price

on the last trading day prior to announcement of the Tender Offer)

and 110% of the highest closing price recorded for the Ordinary

Shares on Euronext Amsterdam during the Determination Period.

The Tender Offer allows to acquire shares in a

short time frame and undertake an effective and efficient share

buyback.

Exor’s controlling shareholder Giovanni Agnelli

B.V. has provided an irrevocable undertaking to participate to the

Tender Offer for an aggregate amount of €250 million, with the

objective to reduce its net debt position.

Exor is planning to buy back the remaining

amount after the Tender Offer through on-market purchases of

Ordinary Shares on Euronext Amsterdam, including any part of the

€750 million not taken up in the Tender Offer. Exor plans to

start the cancellation process of the purchased shares after the

settlement of the Tender Offer.

More details on the Tender Offer transaction,

including definitions of capitalised terms used in this section,

can be found in the launch press release and offer memorandum

available on Exor’s website at:

https://www.exor.com/pages/investors-media/shareholders-corner/share-buyback.

-

Increase in Exor’s investment in Via

Transportation

In February 2023 Exor increased its investment

in Via Transportation by $50 million through its participation

in the $110 million financing round with participation from

new and existing investors to expand the company’s TransitTech

portfolio. After the completion of the financing round, Exor held

18% of the share capital of Via Transportation, being the single

largest shareholder of the Company.

In March 2023 Exor completed the cancellation of

7,007,464 ordinary shares held in treasury, acquired as part of

share buyback programs, bringing the total number of ordinary

shares in the share capital of Exor to 233,992,536.

Exor currently holds 9,164,463 ordinary shares

in treasury (3.92% of total ordinary shares).

On 31 May 2023, Exor’s Annual General

Meeting of shareholders approved an ordinary dividend distribution

of €0.44 per outstanding share, for a total amount of approximately

€99 million. The dividend was paid to the shareholders of

record as of 5 June 2023.

-

New partnership between Impala and Exor

in TagEnergy

On 19 July 2023, Impala (the

investment firm controlled by Jacques Veyrat and his family) and

Exor announced a new partnership to further develop TagEnergy, a

fast-growing company operating in the renewables and energy storage

sectors.

To accelerate TagEnergy’s future growth and

support its experienced team and strong entrepreneurial culture,

Impala and Exor have joined forces in a new joint holding company,

TagHolding, which will become TagEnergy’s largest single

shareholder.

NET ASSET VALUE (NAV)

|

€ million |

Asset Type |

30/6/2023 |

31/12/2022 |

Change vs.31 December

2022 |

|

|

|

|

|

Amount |

% |

|

Companies |

|

30,125 |

24,278 |

5,847 |

24.1 % |

|

Ferrari |

L |

13,308 |

8,896 |

4,412 |

49.6 % |

|

Stellantis |

L |

7,231 |

5,961 |

1,270 |

21.3 % |

|

CNH Industrial |

L |

4,845 |

5,491 |

(646) |

(11.8%) |

|

Iveco |

L |

606 |

408 |

198 |

48.5 % |

|

Juventus |

L |

553 |

510 |

43 |

8.4 % |

|

Philips(a) |

L |

544 |

— |

544 |

n.a. |

|

Other companies(b) |

P |

3,038 |

3,012 |

26 |

0.9% |

|

Investments |

|

2,269 |

1,766 |

503 |

28.5% |

|

Lingotto(c) |

L/P |

1,637 |

1,185 |

452 |

38.1% |

|

Ventures(d) |

P |

632 |

581 |

51 |

8.8% |

|

Others |

|

6,032 |

6,443 |

(411) |

(6.4%) |

|

Reinsurance vehicles |

P |

692 |

622 |

70 |

11.3 % |

|

Other assets(e) |

P |

442 |

378 |

64 |

16.9% |

|

Liquidity(f) |

|

4,808 |

5,349 |

(541) |

(10.1%) |

|

Treasury stock(g) |

|

90 |

94 |

(4) |

(4.3) % |

|

Gross Asset Value |

|

38,426 |

32,487 |

5,939 |

18.3 % |

|

Gross Debt |

|

(4,228) |

(4,234) |

6 |

(0.1) % |

|

Bonds and bank debt |

|

(3,617) |

(3,625) |

8 |

(0.2) % |

|

Financial liabilities(h) |

|

(611) |

(609) |

(2) |

0.3% |

|

Other liabilities |

|

(9) |

(20) |

11 |

(55.0%) |

|

Net Asset Value (NAV) |

|

34,189 |

28,233 |

5,956 |

21.1 % |

|

|

|

|

|

|

|

|

NAV per Share in

Euro(i) |

|

150.21 |

122.34 |

27.87 |

22.8 % |

L= Listed Company; P= Private Company.

(a) At 30 June 2023 Exor held a

2.96% stake in Philips. On 14 August 2023 Exor announced that it

had entered into a relationship agreement with Philips, and as a

result of which Exor bought shares to reach a 15% shareholding in

the company. Following the announcement, Exor classifies Philips as

a company. (b) Other companies at

30 June 2023 include Institut Mérieux

(€838 million), Christian Louboutin (€700 million), Via

Transportation (€523 million), The Economist

(€382 million), Welltec (€242 million), GEDI

(€134 million), Lifenet (€71 million), Shang Xia (€67

million), Casavo (€40 million) and NUO (€41 million).

Other companies at 31 December 2022 included Institut

Mérieux (€848 million) Christian Louboutin

(€700 million), Via Transportation (€477 million), The

Economist (€370 million), Welltec (€217 million), GEDI (€167

million), Lifenet (€71 million), Shang Xia (€67 million),

Casavo (€56 million) and NUO (€39 million).

(c) At 30 June 2023 it includes public

funds (€1,112 million) and private funds (€525 million).

At 31 December 2022 it included public funds

(€1,069 million) and private funds

(€116 million).(d) At 30 June 2023

Ventures include Exor Ventures (€542 million) and direct

investments (€90 million). At 31 December 2022

Ventures included Exor Ventures (€504 million) and direct

investments (€77 million). The stake owned in Casavo via Exor

Ventures has been reclassified into Casavo and included in Other

companies.(e) Other assets include minor private

investments and receivables among others. Items previously

classified under Financial investments are included in Other

assets.(f) At 30 June 2023 liquidity

includes cash and cash equivalents (€3,976 million), listed

securities (€713 million) and financial assets

(€119 million) included in the net financial position. At

31 December 2022 liquidity included cash and cash

equivalents (€4,985 million), listed securities

(€320 million) and financial assets (€44 million)

included in the net financial position. Listed securities at

30 June 2023 include Clarivate (€285 million),

Forvia (€215 million) and Investlinx ETFs (€161 million)

among others. Listed securities at 31 December 2022

included Forvia (€141 million) and Clarivate

(€130 million) among others. Financial assets are

investment-grade and high-yield bonds purchased by

Exor.(g) Treasury stock includes shares held in

treasury at the service of 2016 stock option plan, valued at the

option strike price if less than market

price.(h) At 30 June 2023 financial

liabilities corresponds mainly to the outstanding commitment in

Institut Mérieux. (i) Based on 227,608,878 shares

at 30 June 2023 and 230,783,267 shares at

31 December 2022.

SUMMARY OF CONSOLIDATED FINANCIAL RESULTS

(SHORTENED)

Result: Exor closed the first

half of 2023 with a consolidated profit of €2,157 million; in

the same period of 2022 Exor recorded a consolidated profit of

€265 million. The net increase of €1,892 million is

mainly attributable to the improvement of the share of the result

of subsidiaries and associates (€1,628 million). The result of

the first half of 2022 was also affected by unrealized losses of

the fixed income portfolio of PartnerRe (€1,060 million).

Equity: At

30 June 2023 the consolidated equity attributable to

owners of the parent amounts to €22,197 million, with a net

increase of €1,570 million, compared to €20,627 million

at 31 December 2022.

Net Financial Position: The

consolidated net financial position of the Holdings System at

30 June 2023 is negative €133 million and reflects a

negative change of €928 million compared to the positive

financial position of €795 million at

31 December 2022, mainly due to investments

(€1,349 million), share buyback (€246 million) and

dividend distribution (€99 million), partially offset by

dividends received from investments (€815 million).

EXOR GROUP – Consolidated

Income Statement (Shortened)

|

|

Six months ended 30 June |

Change |

|

€ million |

2023 |

2022 |

|

Profit (loss) from investments in subsidiaries and associates: |

|

|

|

|

Share of the profit (loss) |

1,981 |

353 |

1,628 |

|

Gain on disposal |

— |

— |

— |

|

Dividends received |

815 |

794 |

21 |

|

Dividends eliminated(a) |

(815) |

(794) |

(21) |

|

Profit (loss) from investments in subsidiaries and associates |

1,981 |

353 |

1,628 |

| Profit (loss)

from investments at FVTOCI |

11 |

— |

11 |

| Profit (loss)

from investments at FVTPL |

145 |

(15) |

160 |

| Net financial

income (expenses): |

|

|

|

|

Profit (loss) from cash, cash equivalents and financial assets |

88 |

3 |

85 |

|

Cost of debt |

(45) |

(53) |

8 |

|

Exchange gains (losses), net |

3 |

(10) |

13 |

|

Net financial income (expenses) |

46 |

(60) |

106 |

| Net recurring

general expenses |

(21) |

(9) |

(12) |

| Net non -

recurring other income (expenses) |

(3) |

(3) |

0 |

|

Income taxes and other taxes and duties |

(2) |

(1) |

(1) |

|

Profit (loss) attributable to owners of the

parent |

2,157 |

265 |

1,892 |

(a) Dividends from investments in

subsidiaries and associates which are included in the share of the

profit (loss) from investments in subsidiaries and associates are

eliminated in the consolidation process.

Share of the profit (loss)

The share of the results from investments in

subsidiaries and associates in the six months ended

30 June 2023 is a profit of €1,981 million, an

increase of €1,628 million compared to the profit of the six

months ended 30 June 2022 of €353 million. The increase

is mainly attributable to the fact that the result of the first

half of 2022 included unrealized losses of the fixed income

portfolio of PartnerRe. It also reflects the positive performances

of Exor’s subsidiaries and the associates, in particular Stellantis

and CNH Industrial.

|

|

Result(a) |

Exor’s share(b) |

Change |

| |

Six months ended 30 June |

Six months ended 30 June |

|

€ million |

2023 |

2022 |

2023 |

2022 |

|

|

Stellantis |

10,923 |

7,960 |

1,571 |

1,133 |

438 |

| CNH

Industrial |

1,059 |

697 |

291 |

189 |

102 |

| Ferrari |

629 |

487 |

154 |

118 |

36 |

| Iveco Group |

157 |

13 |

43 |

4 |

39 |

| Welltec |

59 |

24 |

28 |

11 |

17 |

| Christian

Louboutin |

34 |

69 |

8 |

17 |

(9) |

| The Economist

Group(c) |

18 |

20 |

8 |

9 |

(1) |

| Institut

Mérieux(d) |

66 |

— |

2 |

— |

2 |

| Exor

Ventures |

(23) |

27 |

(16) |

31 |

(47) |

| Juventus Football

Club(e) |

(81) |

(132) |

(51) |

(84) |

33 |

| Other(f) |

— |

— |

(57) |

(15) |

(42) |

|

PartnerRe(g) |

— |

(1,060) |

— |

(1,060) |

1,060 |

|

Share of the profit (loss) of investments in subsidiaries

and associates |

1,981 |

353 |

1,628 |

(a) Results attributable to owners of

the parents, prepared by each subsidiary and associate for Exor

consolidation purposes, which may differ from those published by

each reporting entity in its own financial report. Results reported

in foreign currencies have been converted into Euro at the average

exchange rate of the period.(b) Including consolidation

adjustments, where applicable.(c) The result refers to

the period 1 October – 31 March.(d) The acquisition

date was 1 July 2022.(e) The result refers to

the accounting data prepared for consolidation in Exor for the

period 1 January – 30 June. The result may differ from those

that will be published by Juventus when approving the financial

statement for the 2022/2023 financial year.(f) Mainly

includes the share of the results of GEDI, Shang Xia, Casavo and

Lingotto Investment Management.(g) The disposal was

completed on 12 July 2022.

EXOR GROUP – Consolidated Statement of

Financial Position (Shortened)

|

|

|

Change |

|

€ million |

At 30 June 2023 |

At 31 December 2022 |

|

Investments in subsidiaries and associates |

17,173 |

16,244 |

929 |

| Investments at

FVTOCI |

1,803 |

971 |

832 |

| Investments at

FVTPL |

2,537 |

1,854 |

683 |

|

Other asset (liabilities), net |

817 |

763 |

54 |

|

Invested capital |

22,330 |

19,832 |

2,498 |

|

Issued capital and reserves attributable to owners of the

parent |

22,197 |

20,627 |

1,570 |

| Cash, cash

equivalents and financial assets |

(4,095) |

(5,029) |

934 |

|

Gross debt |

4,228 |

4,234 |

(6) |

|

Equity and net financial position |

22,330 |

19,832 |

2,498 |

Net Financial Position

|

|

|

Change |

|

€ million |

At 30 June 2023 |

At 31 December 2022 |

|

Bank accounts and time deposits |

1,702 |

1,860 |

(158) |

| Liquidity

funds |

842 |

1,114 |

(272) |

| Short duration

and other bond funds |

1,432 |

2,011 |

(579) |

| Financial

assets |

114 |

38 |

76 |

|

Financial receivables |

5 |

6 |

(1) |

|

Cash, cash equivalents and financial

assets(a) |

4,095 |

5,029 |

(934) |

|

Exor bonds |

(3,466) |

(3,475) |

9 |

| Bank debt |

(151) |

(150) |

(1) |

|

Other financial liabilities |

(611) |

(609) |

(2) |

|

Gross debt |

(4,228) |

(4,234) |

6 |

|

Net financial position of the Holdings System |

(133) |

795 |

(928) |

(a) Cash, cash equivalents and

financial assets available amount to €4,545 million

(€5,479 million at 31 December 2022) considering

also the undrawn committed credit lines for €450 million (in

line with 31 December 2022).(b)

Net change of Net Financial

Position

|

|

Six months ended 30 June |

|

€ million |

2023 |

2022 |

|

Net financial position of the Holdings

System - Initial amount |

795 |

(3,924) |

|

Dividends received from investments(a) |

815 |

794 |

| Investments [see

table below] |

(1,349) |

(355) |

| Disposals |

— |

11 |

| Dividends paid by

Exor |

(99) |

(100) |

| Buyback Exor

treasury stock |

(246) |

(100) |

|

Other changes [see table below] |

(49) |

(890) |

|

Net change during the year |

(928) |

(640) |

|

Net financial position of the Holdings System - Final

amount |

(133) |

(4,564) |

(a) In the six months ended

30 June 2023 dividends received from Stellantis

(€602 million), CNH Industrial (€132 million) and Ferrari

(€81 million). In the six months ended 30 June 2022

dividends received from Stellantis (€467 million), PartnerRe

(€163 million), CNH Industrial (€103 million), Ferrari

(€61 million).

|

|

Six months ended 30 June |

|

€ million |

2023 |

2022 |

|

Investments |

(1,349) |

(355) |

|

Subsidiaries, associates and funds |

(615) |

(109) |

|

Lingotto |

(400) |

— |

|

Other funds |

(150) |

— |

|

Exor Ventures |

(62) |

— |

|

Exor Seeds |

(3) |

(42) |

|

Lifenet |

— |

(67) |

| Investment

measured at FVTOCI - listed |

(671) |

(36) |

|

Philips |

(511) |

— |

|

Clarivate |

(160) |

— |

|

Forvia |

— |

(36) |

| Investment

measured at FVTOCI - unlisted |

(63) |

(210) |

|

Via Transportation |

(46) |

— |

|

Other |

(17) |

(210) |

|

Other changes |

(49) |

(890) |

|

Net recurring general expenses |

(14) |

(9) |

|

Net non-recurring other income (expenses) |

(1) |

(3) |

|

Net financial (expenses) income generated by the financial

position(a) |

46 |

(60) |

|

Tax claim |

— |

(746) |

|

Other net changes(b) |

(80) |

(72) |

(a) In the six months ended

30 June 2023 related to: cost of debt

(-€45 million), derivative and other, net exchange losses

(+€3 million) and profit from cash, cash equivalents and

financial assets (+€88 million). In the six months ended 30

June 2022 related to: cost of debt (-€53 million), net

exchange losses (-€9 million) and profit from cash, cash

equivalents and financial assets

(+€2 million).(b) In the six months ended 30

June 2023 other net changes includes among other, further

additions to the loan granted to the subsidiaries GEDI for

€35 million and Shang Xia for €9 million.

UPCOMING EVENTS

On 14 September 2023 at 2:00pm CEST /

1:00pm BST / 8:00am EDT, Exor's CFO Guido de Boer will host a live

webcast and conference call to illustrate Exor Half-Year 2023

Results. The webcast and recorded replay will be accessible under

the Investors’ section of Exor’s website (www.exor.com).

Exor’s investor day will be held on 30 November

2023.

ABOUT EXOR

Exor N.V. (AEX: EXO), is a diversified holding

company that is based in the Netherlands and listed on the AEX. For

over a century, Exor has built great companies and made successful

investments worldwide, applying a culture that combines

entrepreneurial spirit and financial discipline. With a Net Asset

Value of around EUR 34 billion, its portfolio is principally made

up of companies in which Exor is the largest shareholder including

Ferrari, Stellantis CNH Industrial and Philips.

For more information, please contact Investor

Relations at ir@exor.com or Media at media@exor.com.

1 The Tender Offer is made to those shareholders

to whom the Tender Offer can legally be made in accordance with the

terms and conditions set out in the Offer Memorandum (“Qualifying

Shareholders”). This includes shareholders based in The

Netherlands, US and in other jurisdictions where applicable legal

or regulatory requirements permit. Retail shareholders in the

European Economic Area outside The Netherlands cannot take part in

the Tender Offer.

- Exor Press Release - H1 2023 Results

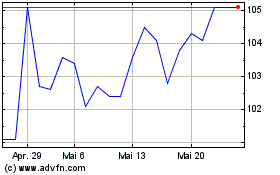

Exor NV (EU:EXO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Exor NV (EU:EXO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024