JCDecaux : Q3 2024 - Business Review

Q3 2024 – Business review

Paris, November

7th, 2024 – JCDecaux

SE (Euronext Paris: DEC), the number one outdoor

advertising company worldwide, published today this report for the

third quarter of 2024 ending September 30th 2024.

THIRD QUARTER 2024: BUSINESS HIGHLIGHTS

Key contracts wins

In July, JCDecaux SE announced that JCDecaux

Macau, a joint-venture between JCDecaux (80% equity) and HN Group

(20% equity), has renewed its exclusive advertising contract with

Macau International Airport for a 10-year period, following a

competitive tender process. Running from July 1, 2024, this new

contract strengthens JCDecaux’s presence in Macau and follows the

award of the 15-year street furniture contract.

In September, JCDecaux SE announced that

following a competitive tender, it has been awarded the iconic

London bus shelter advertising contract by Transport for London

(TfL) for an 8-year period, with the option of a 2-year extension.

The contract will commence on 1st April 2025. This is the

second-largest bus shelter advertising contract in the world and

covers advertising on all TfL’s more than 4,700 advertising bus

shelters across all 33 London boroughs including the City of

London, Royal Borough of Kensington and Chelsea, and City of

Westminster. JCDecaux has held the previous contract since 2016.

The contract currently includes 612 x 86” digital screens and 9,400

non-digital poster sites on bus shelters.

In September, JCDecaux SE announced that

following a competitive tender, its Swedish company JCDecaux Sweden

AB has been awarded both the Stockholm bus shelter and the largest

central subway stations advertising contracts by the Greater

Stockholm Public Transport Authority (SL) for 7 years with the

possibility to extend for up to 6 months. The contracts will start

on January 1st, 2026. The bus shelter advertising contract covers

both digital and analogue advertising on over 1,500 bus shelters

throughout Stockholm County with a majority in Stockholm City. The

subway contract covers advertising at the 14 largest and busiest

subway stations and commuter train stations in Stockholm inner

city. The new contract will include spectacular large format

digital cross track screens.

Other events

In July, JCDecaux SE announced that its carbon

reduction trajectory has been approved by the Science Based Targets

initiative (SBTi). Known as the “Corporate Net Zero norm”, this

climate action organisation supports companies worldwide in their

reduction of greenhouse gas (GHG) emissions and their

decarbonisation via a methodology consistent with the IPCC’s

recommendations. This validation, the most ambitious designation

available through the SBTi process, reaffirms JCDecaux’s commitment

to actively participate in the fight against climate change by

adopting eco-responsible practices and promoting sustainable

innovation in its business practices.

THIRD QUARTER 2024 AND OUTLOOK

Commenting on the 2024 third quarter revenue,

Jean-Charles Decaux, Chairman of the Executive Board and

Co-CEO of JCDecaux, said:

“Our Q3 2024 Group revenue grew by +10.9%,

+11.1% on an organic basis, above our expectations, to reach €948.2

million with a solid business momentum across all segments and

geographies, mainly driven by continued strong digital revenue

growth, while France benefited from the positive impact of the

Paris Olympic and Paralympic Games.

Digital Out Of Home (DOOH) revenue grew by

+17.8%, +18.5% on an organic basis, to reach a new record high of

38.5% of Group revenue including an ongoing strong programmatic

revenue growth.

All business segments recorded strong

organic revenue growth: Street Furniture grew by +8.8% with

continued solid momentum, Transport grew by +15.5% reflecting the

strong growth in both airports and public transport systems and

Billboard grew by +7.9% driven by solid momentum across

markets.

France and UK delivered strong double-digit

organic revenue growth with all other geographies growing high

single-digit. Our business in China, while still well below

pre-covid levels, grew double-digit with an increased digital

penetration.

As far as Q4 is concerned and bearing in

mind our record Q4 last year, we expect a low single-digit organic

revenue growth rate, including continued solid development of

digital revenue and reflecting some macro uncertainties such as

ongoing debates about government budgets in France and UK, while

China is expected to be around flat due to low consumer

demand.

We are confident that Out of Home (OOH) will

continue to grow its market share in a fragmented media landscape

with Digital Out of Home (DOOH) being the fastest growing media

segment. JCDecaux as the industry leader and the most digitised

global OOH Media company is well positioned to benefit from this

digital transformation.”

Following the adoption of IFRS 11 from January

1st, 2014, the operating data presented below is

adjusted to include our prorata share in companies under

joint control.

Please refer to the paragraph “Adjusted data” of this report for

the definition of adjusted data and reconciliation with IFRS.

The values shown in the tables are generally expressed in millions

of euros. The sum of the rounded amounts or variations calculations

may differ, albeit to an insignificant extent, from the reported

values.

Adjusted revenue for the third quarter 2024

increased by +10.9% to €948.2 million compared to

€855.0 million in the third quarter of 2023.

Excluding the negative impact from foreign exchange variations and

the positive impact of changes in perimeter, adjusted revenue

increased by +11.1%.

Adjusted advertising revenue, excluding revenue related to sale,

rental and maintenance of street furniture and advertising

displays, increased by +10.4% on an organic basis in the third

quarter of 2024.

By activity:

|

Q3 adjusted revenue |

2024 (€m) |

2023 (€m) |

Reported growth |

Organic growth(a) |

|

Street Furniture |

468.5 |

432.0 |

+8.4% |

+8.8% |

|

Transport |

346.9 |

302.1 |

+14.8% |

+15.5% |

|

Billboard |

132.7 |

120.8 |

+9.8% |

+7.9% |

|

Total |

948.2 |

855.0 |

+10.9% |

+11.1% |

(a) Excluding acquisitions/divestitures and the impact of

foreign exchange

|

9-month adjusted revenue |

2024 (€m) |

2023 (€m) |

Reported growth |

Organic growth(a) |

|

Street Furniture |

1,386.4 |

1,254.7 |

+10.5% |

+10.0% |

|

Transport |

980.8 |

838.8 |

+16.9% |

+17.6% |

|

Billboard |

388.6 |

346.5 |

+12.2% |

+9.5% |

|

Total |

2,755.8 |

2,440.0 |

+12.9% |

+12.6% |

(a) Excluding acquisitions/divestitures and the impact of

foreign exchange

Please note that the geographic comments below

refer to organic revenue growth.

STREET FURNITURE

Third quarter adjusted revenue increased by

+8.4% to €468.5 million (+8.8% on an organic basis). France

driven by the Paris Olympic and Paralympic Games, UK and Rest of

the World grew double-digit. North America and Asia-Pacific

recorded high single-digit growth.

Third quarter adjusted advertising revenue,

excluding revenue related to sale, rental and maintenance of street

furniture was up +7.3% on an organic basis.

TRANSPORT

Third quarter adjusted revenue increased by

+14.8% to €346.9 million (+15.5% on an organic basis). France,

UK, Rest of Europe and Asia-Pacific grew double-digit.

BILLBOARD

Third quarter adjusted revenue increased by

+9.8% to €132.7 million (+7.9% on an organic basis). France

and Rest of Europe grew double-digit. North America and Rest of the

World recorded high-single digit growth.

ADJUSTED DATA

Under IFRS 11, applicable from January

1st, 2014, companies under joint control are accounted

for using the equity method.

However, in order to reflect the business reality of the Group,

operating data of the companies under joint control will continue

to be proportionately integrated in the operating management

reports used by directors to monitor the activity, allocate

resources and measure performance.

Consequently, pursuant to IFRS 8, Segment Reporting presented in

the financial statements complies with the Group’s internal

information, and the Group’s external financial communication

therefore relies on this operating financial information. Financial

information and comments are therefore based on “adjusted” data,

consistent with historical data prior to 2014, which is reconciled

with IFRS financial statements.

In Q3 2024, the impact of IFRS 11 on adjusted revenue was

-€76.1 million (-€66.0 million in Q3 2023), leaving

IFRS revenue at €872.0 million (€789.0 million in

Q3 2023). For the first nine months of 2024, the impact of

IFRS 11 on adjusted revenue was -€217.1 million

(-€184.1 million for the first nine months of 2023), leaving

IFRS revenue at €2,538.7 million (€2,255.9 million for

the first nine months of 2023).

ORGANIC GROWTH DEFINITION

The Group’s organic growth corresponds to the

adjusted revenue growth excluding foreign exchange impact and

perimeter effect. The reference fiscal year remains unchanged

regarding the reported figures, and the organic growth is

calculated by converting the revenue of the current fiscal year at

the average exchange rates of the previous year and taking into

account the perimeter variations prorata temporis, but

including revenue variations from the gains of new contracts and

the losses of contracts previously held in our portfolio.

|

€m |

|

Q1 |

Q2 |

H1 |

Q3 |

9M |

|

|

|

|

|

|

|

|

|

2023 adjusted revenue |

(a) |

721.3 |

863.7 |

1,585.0 |

855.0 |

2,440.0 |

|

|

|

|

|

|

|

|

|

2024 IFRS revenue |

(b) |

740.4 |

926.3 |

1,666.7 |

872.0 |

2,538.7 |

|

IFRS 11 impacts |

(c) |

61.2 |

79.8 |

141.0 |

76.1 |

217.1 |

|

2024 adjusted revenue |

(d) = (b) + (c) |

801.6 |

1,006.1 |

1,807.6 |

948.2 |

2,755.8 |

|

Currency impacts |

(e) |

7.1 |

0.2 |

7.3 |

5.4 |

12.8 |

|

2024 adjusted revenue at 2023 exchange rates |

(f) = (d) + (e) |

808.7 |

1,006.3 |

1,814.9 |

953.7 |

2,768.6 |

|

Change in scope |

(g) |

-8.4 |

-9.8 |

-18.2 |

-4.1 |

-22.3 |

|

2024 adjusted organic revenue |

(h) = (f) + (g) |

800.3 |

996.5 |

1,796.8 |

949.5 |

2,746.3 |

|

|

|

|

|

|

|

|

|

Organic growth |

(i) = (h)/(a)-1 |

+11.0% |

+15.4% |

+13.4% |

+11.1% |

+12.6% |

€m |

Impact of currency as of September

30th,

2024 |

|

|

|

|

CNY |

4.6 |

|

BRL |

4.0 |

|

AUD |

2.3 |

|

GBP |

-7.0 |

|

Other |

8.9 |

|

|

|

|

Total |

12.8 |

|

Average exchange rate |

9M 2024 |

9M 2023 |

|

|

|

|

|

CNY |

0.1278 |

0.1312 |

|

BRL |

0.1757 |

0.1843 |

|

AUD |

0.6091 |

0.6170 |

|

GBP |

1.1744 |

1.1484 |

Forward looking statements

This report may contain some forward-looking

statements. These statements are not undertakings as to the future

performance of the Company. Although the Company considers that

such statements are based on reasonable expectations and

assumptions on the date of publication of this report, they are by

their nature subject to risks and uncertainties which could cause

actual performance to differ from those indicated or implied in

such statements.

These risks and uncertainties include without limitation the risk

factors that are described in the universal registration document

registered in France with the French Autorité des Marchés

Financiers.

Investors and holders of shares of the Company may obtain copy of

such universal registration document by contacting the Autorité des

Marchés Financiers on its website www.amf-france.org or directly on

the Company website www.jcdecaux.com.

The Company does not have the obligation and undertakes no

obligation to update or revise any of the forward-looking

statements.

FINANCIAL SITUATION

The evolution of revenue is the major factor

which to impact the operating margin, free cash flow or net debt

during Q3 2024.

- 07-11-24 # T3 2024_Business Review_UK

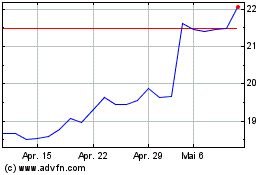

JCDecaux (EU:DEC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

JCDecaux (EU:DEC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024