CREDIT AGRICOLE SA : Crédit Agricole Immobilier announces the closing of the acquisition of Nexity Property Management and becomes the leader of Property Management in France

06 November 2024 - 6:45AM

UK Regulatory

CREDIT AGRICOLE SA : Crédit Agricole Immobilier announces the

closing of the acquisition of Nexity Property Management and

becomes the leader of Property Management in France

Press release

Montrouge, 6 November 2024

Crédit Agricole Immobilier announces the

closing of the acquisition

of Nexity Property Management

and becomes the leader of Property Management in

France

Crédit Agricole Immobilier is pleased to

announce that it has completed the acquisition of Nexity Property

Management, a Nexity subsidiary specialised in commercial and

residential asset management. With this transaction, announced on

25 July 2024, Crédit Agricole Immobilier becomes the leader in

institutional property management, in France 1.

The acquisition of Nexity Property Management

brings additional expertise to Crédit Agricole Immobilier, ranging

from advisory services to accounting and technical rental

management, supervision of works, shopping malls management

etc.

In addition, Nexity Property Management’s

powerful network of over 30 branches and offices across France,

comes as an addition to strengthens Crédit Agricole Immobilier’s

own presence. It supports Crédit Agricole Immobilier in addressing

the needs of its institutional customers, including the customers

of the Regional Banks and subsidiaries of the

Crédit Agricole Group. This increased local footprint,

will allow CAI to bring their expertise to clients’ investment

projects, in line with the Universal Customer-focused Banking Model

approach.

This new transaction, taking place 18 months

after the acquisition of Sudeco, a long-standing Property

Management player and commercial property specialist, has

established Crédit Agricole Immobilier as the market leader with

the most comprehensive range of services for institutional

customers across all asset categories, from residential to

commercial.

Overall, Crédit Agricole Immobilier now manages more than

11,000 assets.

For Nexity, this transaction is fully aligned

with the group’s roadmap, specifically with the refocusing strategy

launched in 2023.

This transaction has no significant impact on

Crédit Agricole S.A.’s CET1 ratio and should generate a

return on investment that is in line with Crédit Agricole’s

policy.

“We are so delighted and proud to welcome

the Nexity Property Management teams to Crédit Agricole Immobilier.

This acquisition represents a decisive step forward in our strategy

of becoming the leader of property management in France. We are

deepening our expertise in all areas of property management and

strengthening our presence across France. By joining forces, we are

ready to take on new challenges. This is the perfect expression of

our 2025 strategic plan, as well as the mid-term plan of

Crédit Agricole Group: it will allow us to support our

clients more extensively on strategic social and environmental

issues, such as reducing the carbon footprint of their property

assets.”

Valérie Wanquet, Chief Executive Officer

of Crédit Agricole Immobilier

“I am delighted that we have completed this

transaction with the Crédit Agricole Group, a long-term

strategic partner of the Nexity group, which is fully in line with

our efforts to refocus our activities, which we began at the end of

2023. I would like to thank all Nexity Property Management teams

and I wish them every success with their new shareholder. We are

certain that Crédit Agricole Immobilier will be able to maintain

the quality of its services and enhance its market share.”

Jean-Claude Bassien, Deputy Chief

Executive Officer of Nexity

ABOUT CRÉDIT AGRICOLE

IMMOBILIER

A subsidiary of the Crédit Agricole Group, Crédit

Agricole Immobilier supports its individual, corporate and public

authority customers with real estate projects throughout France

while upholding three fundamental principles: sustainability and

performance of buildings, respect for the environment and

decarbonisation, and social cohesion and inclusion.

As a partner in the most ambitious property development projects,

we work with our customers to create value throughout their

projects: transaction, letting, rental management, co-ownership

associations, property strategy, residential and commercial

development, refurbishment, renovation, development of spaces,

property management and operation.

To find out more, visit:

www.ca-immobilier.fr/nous-connaitre

CRÉDIT AGRICOLE IMMOBILIER PRESS

CONTACT

Vanessa Feugères – +33 (0)7 86 84 19 15 –

vanessa.feugeres@ca-immobilier.fr

NEXITY, LIFE TOGETHER

With revenues of €4.3 billion in 2023, Nexity, the leading

global real estate operator, is present all over France and

operates in all areas of development and services. Our strategy as

leading global real estate operator allows us to meet all our

clients’ needs, whether they are individuals, corporates,

institutions or authorities. Our raison d’être ‘life together’

reflects our commitment to create sustainable spaces,

neighbourhoods and towns for them, that help them to build and

rebuild connections. For the sixth consecutive year, Nexity was

ranked the top contracting authority by Association pour le

développement du Bâtiment Bas Carbone (BBCA – a French low-carbon

building association), is a member of the Bloomberg Gender Equality

Index, Best Workplaces 2021 and was certified a Great Place to

Work® in September 2022.

Nexity is listed on Service de Règlement Différé (SRD – Deferred

Settlement Service), in Compartment A of Euronext and on the SBF

120.

NEXITY PRESS CONTACTS

Cyril Rizk – Media Relations Manager / +33(0)6 73 49 72 61 –

presse@nexity.fr

Emma Durel – Media Relations Officer / +33 (0)6 99 14 09 28 –

presse@nexity.fr

Anne-Sophie Lanaute – Head of Investor Relations and Financial

Communications / +33 (0)6 58 17 24 22 -

investorrelations@nexity.fr

1 In terms of revenues, source: Xerfi.

- 2024 11 06 PR Closing CA Immobilier - Nexity PM (GB)

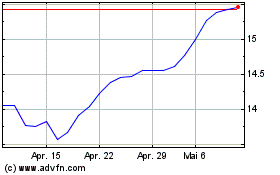

Credit Agricole (EU:ACA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

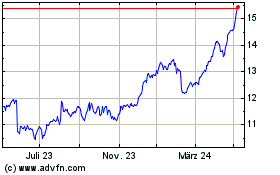

Credit Agricole (EU:ACA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024