Injective Posts 46% Rally In Last 7 Days – Will INJ Keep Rising Next Week?

15 April 2023 - 5:00PM

NEWSBTC

Injective protocol (INJ) has been on a tear lately, surging past $8

on April 15 and recording a growth rate of over 400% so far this

year. It’s no wonder that social sentiment around this exciting

cryptocurrency has reached near-euphoric levels, with holders and

investors alike giddy at the prospect of continued gains. But

with a large cluster of INJ holders now approaching the break-even

point, some are beginning to wonder whether a price correction

might be imminent. The question on everyone’s lips is — will INJ’s

rally keep going strong or is a correction on the horizon?

Related Reading: Arbitrum (ARB) Leads Top 50 Cryptos With

Double-Digit Gain In Weekly Rankings Injective Token (INJ)

Experiences Significant Price Growth INJ has seen a surge in price

over the past 24 hours, with Coingecko reporting a price of $8.16

per token. This represents a 15% increase in value during that time

period. Over the course of the last seven days, INJ has experienced

even more significant growth, with a 47% rally in price. Investors

and traders will no doubt be keeping a close eye on this

cryptocurrency in the coming days to see if the upward momentum can

continue. Source: Coingecko INJ Continues To Soar, But Could Face

Correction As of today, INJ has once again hit a year-to-date high,

demonstrating its impressive performance in 2023. However, the

latest data from Santiment’s Market Value to Realized Value (MVRV)

analysis suggests that a price correction could be on the horizon

for INJ. MVRV analysis determines potential buy/sell zones by

comparing an asset’s average acquisition price to its current

market value. According to charts, INJ’s MVRV could soon reach a

critical sell zone, indicating that a price correction is possible.

Although most INJ holders who bought in the past month are

currently enjoying profits of around 34%, historical MVRV data

suggests that holders typically book profits around the 42% zone.

This means that once INJ’s price approaches the $6.9 zone, a

retracement could be in the cards. Injective Updates For 2023

Injective has recently announced its partnership with Eclipse to

introduce the first interchain Solana Sealevel Virtual Machine

(SVM) called the Cascade. This innovative technology will enable

developers to leverage the Injective blockchain to deploy Solana

dApps seamlessly. Injective (INJ) total market cap currently

at $622 million on the weekend chart at TradingView.com The Cascade

would be the first iteration of leveraging interchain security for

rollups, offering enhanced scalability and efficiency for

developers. This technology has the potential to improve the

performance of dApps and create new opportunities for developers to

create value in the blockchain space. On April 10, developers

released an upgrade for the Injective mainnet. The latest update

would add improved smart contract capabilities to the mainnet,

aggregated user accounts, automation, and other advanced features.

These updates will provide users with an improved experience on the

platform and set the stage for further innovation in the blockchain

industry. -Featured image from Shrimpy Blog

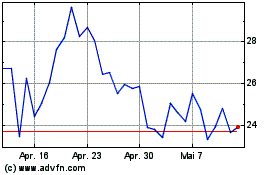

Injective Token (COIN:INJUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Injective Token (COIN:INJUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024