What The 50-Day Moving Average At $0.22 Says About The Dogecoin Price

26 November 2024 - 10:00PM

NEWSBTC

The Dogecoin price has been gearing up for a major bull rally since

it rose to the $0.4 threshold and began testing this resistance.

Shedding light on Dogecoin’s future bullish trajectory, a crypto

analyst has discussed the importance of the $0.22 50-day Moving

Average (MA) in determining the Dogecoin price movements in this

bull cycle. How The 50-Day MA Impacts The Dogecoin Price Rally The

50-day MA is a technical indicator that highlights a

cryptocurrency’s average price over the last 50 trading days. It is

primarily used to identify price trends, determine resistance and

support levels, and generate buy and sell signals. Related Reading:

Long-Term Bitcoin Holders Remain Greedy Amid Price Break Toward

$100,000, Why This Is Good Kevin, a crypto analyst on X (formerly

Twitter), has underscored the significance of this critical

technical indicator in the recent Dogecoin price movements and its

influence on the meme coin’s future bull rally. The analyst

disclosed that historically, during Dogecoin’s previous bull

markets, its price consistently stayed above the 50-day MA, never

losing this crucial threshold despite testing it multiple times.

Typically, staying above the 50-day MA is seen as a bullish

indicator, while consistently dropping below this average suggests

a downtrend. Presenting a detailed chart of Dogecoin’s price

action in the last bull cycle in late 2020 to date, Kevin disclosed

that the current 50-day MA for the meme coin is at $0.22. However,

this price threshold is rising quickly as Dogecoin closes each

daily candle. Additionally, the rapid increase suggests that if

Dogecoin can remain steady around or above the 50-day MA, its price

should see a significant bullish trend continuation, providing a

strong foundation for even higher prices. Dogecoin

Enters Distribution Phase, $9.5 Target In Sight In a different X

post, Trader Tardigrade, a prominent crypto market expert, declared

that Dogecoin has officially entered the Distribution phase in the

classic Power of Three (PO3) market cycle. The PO3 cycle is a

popular concept in technical analysis used to identify key market

phases — Accumulation, Distribution, and Manipulation. Related

Reading: Over $500 Million Wiped Out From The Market As Bitcoin

Price Fluctuates Heavily With Dogecoin now firmly in the

Distribution phase, large holders may be offloading their assets,

potentially locking in profits following DOGE’s recent price

increase. While the distribution phase could be seen as the end of

a bull rally characterized by sell-offs and slow momentum, Trader

Tardigrade believes that this phase could be calm before a massive

price surge. The analyst shared two price charts comparing

Dogecoin’s movements during the bull cycle between 2016 and 2017

and its future price action in 2024 and 2025. In the 2017 bull

market, Dogecoin entered a distribution phase, which led to a

significant bull rally to new levels above $0.00066. If this

trend holds true for Dogecoin’s current distribution phase, Trader

Tardigrade has predicted that its price could surge as high as $9.5

from its current value of $0.4. Featured image created with Dall.E,

chart from Tradingview.com

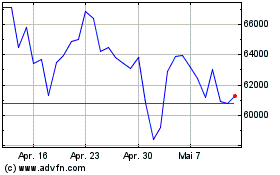

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024