Bitcoin Holds Steady As Bullish Breakout Awaits These Conditions – Details

06 Oktober 2024 - 7:30AM

NEWSBTC

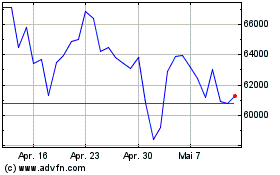

According to data from CoinMarketCap, Bitcoin currently hovers near

the $62,000 price mark with no significant movement in the past

day. Notably, the premier cryptocurrency has slipped into a minor

consolidation state since the little gains recorded on Friday.

However, for long-term traders, Bitcoin has remained in a

range-bound movement stretching to March. And while many investors

are highly expectant of a bullish breakout in Q4 2024, certain

market conditions must be met. Related Reading: Bitcoin Futures

Liquidation Forms Local Price Bottom — A Return To $65,000

Inevitable? Bitcoin MVRV, CQ Bull & Bear Indicators Show Market

Uneasiness In a Quicktake post on CryptoQuant, an analyst with

username burakkesmeci shares that the Bitcoin market is currently

set for key price movements. Based on the MVRV Ratio and CQ Bull

& Bear metric, burakkesmeci notes that Bitcoin investors are

presently showing a significant level of market anticipation.

For context, the MVRV Ratio compares the current price of Bitcoin

to its realized value i.e. the price at which the asset last moved

on-chain. It is generally used to indicate if Bitcoin is

undervalued or overvalued relative to its realized value.

When the MVRV ratio crosses above its 365-day Simple Moving Average

(SMA 365), it indicates a bullish trend as investors are seeing a

year-to-date gain on their assets. However, burakkesmeci notes that

Bitcoin’s MVRV currently at 1.90 has been hovering just below its

SMA 365 (2.03) since July showing the BTC market remains in a

steady position waiting for a breakout. The analyst has also

observed a similar pattern in the CQ Bull & Bear indicator

which measures recent price action relative to longer-term price

movements. According to burrakesmeci, the CQ Bull & Bear metric

has been oscillating slightly below its SMA 365 (0.46) since August

enforcing the notion that the Bitcoin market is in a holding

pattern. Related Reading: Bitcoin Investors Show Fear –

Could A Price Bottom Be Imminent? Factors That Will Spark A Bitcoin

Rally For Bitcoin to experience a bullish breakout from its current

holding position, burakkesmeci highlights certain events that must

occur. First, he notes that the Federal Reserve must fully engage

in a rate-cut cycle, gradually lowering interest rates over time.

Interestingly, following a 50 basis points cut in September, market

experts are tipping the Fed to implement another 25% cut at their

next FOMC meeting in November. Another bullish factor

highlighted by burakkesmeci is an impending quantitative easing

which will see the US government inject liquidity into the economy.

It is expected that higher liquidity will allow individuals to

explore risky investments such as Bitcoin. At the time of

writing, Bitcoin trades at $62,009 with a 0.02% loss in the past 24

hours. Meanwhile, the asset’s daily trading volume is down by

53.80% and valued at $12.97 billion. Featured image from

StomGain, chart from Tradingview

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Sep 2024 bis Okt 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Okt 2023 bis Okt 2024