Avalanche Remains Under Pressure Despite Circle’s CCTP Effort

27 April 2023 - 8:00PM

NEWSBTC

The native currency of Avalanche, AVAX, remains under pressure

despite Circle’s effort to launch a facility that will enable

the direct transfer of USDC between Ethereum and Avalanche

blockchains. Avalanche (AVAX) Is Down 18% From April 2023

Peaks Avalanche is a smart contracting platform with sub-second

transaction finality and a rival of Ethereum. However, considering

the first-mover advantage of Ethereum and the activity level on the

pioneer smart contracting platform, Avalanche lags even though it

offers high scalability translating to relatively low trading fees.

Despite the launch of the Cross-Chain Transfer Protocol (CCTP) by

Circle, the team behind USDC, a stablecoin; AVAX remains under

trading range and has been unable to move higher, reversing recent

losses. Related Reading: Avalanche Struggles Under $18 – More

Losses Seem Likely When writing on April 27, AVAX is down 18% from

April 2023 highs of around $20 and down roughly 10% in the last

trading week, according to CoinMarketCap data. Although the market

uptrend of April 26 temporarily forced AVAX higher, buyers on April

27 didn’t follow through. AVAX remains below the local resistance

at $18 but above last week’s support at around $16. However,

from a broader perspective, AVAX is up 25% from March 2023 lows and

has gained 65% from December 2022 lows. The impressive performance

was a huge boost for AVAX, a coin that plunged 88% from November

2021 peaks when it was changing hands at around $145. Based

on the current AVAX formation, it is yet to be seen whether

fundamental events will trigger demand and push the coin above $20,

reversing this week’s losses. Circle Launches Cross-Chain

Transfer Protocol For USDC Transfer The decision by Circle to

develop and launch a mainnet protocol for bidirectional

cross-chain transfers between Ethereum and Avalanche will be

convenient for users. It could also boost decentralized finance

(DeFi) activities in Avalanche since users don’t have to use a

third party, effectively eradicating the need for bridges and

helping consolidate the web3 ecosystem. This would also have a

significant effect on general liquidity on the Avalanche

blockchain. Avalanche is suited for the development of

decentralized finance (DeFi) dapps and as of April 27, the

blockchain managed over $798 million as measured by the total

value locked (TVL), according to DeFiLlama. Aave, a lending

protocol available in, among other chains, Ethereum, is the largest

DeFi dapp by TVL, managing $262 million. Besides liquidity,

considering the mega hacks of 2022, for example, the Ronin and BNB

Chain Bridge hacks, the Cross-Chain Transfer Protocol (CCTP) also

boosts security for users and DeFi protocols. Related Reading: Will

AVAX Price Get A Lift From Avalanche NFTs? Let’s Examine The

Metrics Circle said several firms, including MetaMask, Celer, and

Wormhole, have pledged to use the CCTP. Feature Image From Canva,

Chart From TradingView

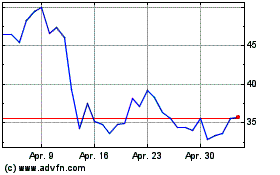

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024