Societe Generale: Fourth quarter & 2022 full year results

RESULTS AT 31 DECEMBER 2022

Press releaseParis, 8 February

2023

EXCELLENT

PERFORMANCE ACROSS BUSINESS

LINES

Record

revenues

up by

+9.3%(1)

vs. 2021, driven by historical

highs in Financing & Advisory, Global Markets and ALD, sharp

growth in Private Banking and International Retail Banking, and a

solid performance by French Retail Banking

Strong improvement in the cost

to income ratio to

61.0%(1)

(vs. 64.4%(1) in 2021), excluding contribution to the Single

Resolution Fund

Cost of risk at 28 basis

points, with a low level of defaults at 17 basis

points and continued prudent provisioning resulting in provisions

on performing loans of EUR 3.8bn at end-December 2022

Underlying Group net income of

EUR

5.6bn(1)

(EUR 2.0bn on a reported basis including the impact of the disposal

of Rosbank and its Russian subsidiaries),

underlying profitability

of

9.6%(1)

(ROTE)

SOLID QUARTERLY

RESULTS

In Q4 22, underlying gross

operating income came to EUR

2.2bn(1)

+14.9% vs. Q4 21

Underlying Group net

income at

EUR

1.1bn(1)

(EUR 1.2bn on a reported basis), underlying

profitability

at

7.6%(1)

CET 1 ratio of

13.5%(2)

at end-2022,

around

420

basis points above the regulatory requirement

DISTRIBUTION TO

SHAREHOLDERS

Distribution of

EUR

1.8bn,

equivalent to EUR

2.25

per

share(3)

(4),

i.e.:

-

a cash dividend

of EUR

1.70 per

share to be proposed at the General Meeting

- a share buyback

programme, of

approximately EUR 440m, equivalent

to around

EUR 0.55

per share

FINANCIAL

TARGETS

2025: financial targets

confirmed, notably a cost to income ratio below

62%, expected profitability of 10% (ROTE) based on a CET1 ratio

target of 12% post Basel IV

2023: a transition

year, with the

negative impacts related to the end of the TLTRO benefit and to the

specific functioning of the French retail banking

marketUnderlying

cost to income

ratio (1),

excluding contribution to the Single Resolution Fund,

expected

at between

66% and

68%Cost

of risk is

expected

at between 30 and

35 basis points

(1) Underlying data (see methodology note No. 5

for the transition from accounting data to underlying data), (2)

Phased-in ratio (fully-loaded ratio of 13.3%), (3) Based on the

number of shares in circulation at 31/12/2022, (4) Subject to usual

approvals from the General Meeting and the ECB

MAJOR

ACHIEVEMENTS IN

STRATEGIC INITIATIVES

Decisive

milestones

achieved in the

merger of the retail banking networks in France,

resulting in the legal merger - on schedule - of the Societe

Generale and Crédit du Nord networks on 1 January 2023 and the

launch of a new retail bank in France

Accelerated development

of

Boursorama, with

record annual new client growth of 1.4 million, taking the total

number of clients to 4.7 million at end-2022

Plans

on track to

create global leaders in sustainable mobility and

equities with the acquisition of LeasePlan by ALD

and the creation of the Bernstein joint venture

Rapid and successful adaptation

amid a complex and uncertain environment,

particularly as regards the Rosbank disposal, which had limited

capital impact

Upscaled ESG actions and

commitments by the Group, notably by integrating

ESG considerations across all Group activities and a reinforcement

of our decarbonisation ambitions

Ongoing rollout of digital

transformation initiatives and operational efficiency improvement

actions

Fréderic

Oudéa, the Group’s Chief Executive

Officer, commented:

“2022 marked a decisive stage for the Group,

which was able to deliver record underlying performances while

adapting itself swiftly and efficiently to an uncertain and complex

environment. Throughout the year, the Group made major strategic

progress that has unlocked value. We launched the new SG retail

bank resulting from the merger of our networks in France and pushed

further ahead at Boursorama. The planned acquisition of LeasePlan

by ALD in the mobility sector and the planned Bernstein joint

venture deal for our Equities business will create global leaders.

We also defined the Group’s new CSR ambitions with the aim of

supporting our clients in responsible energy transition. Building

on the commercial momentum of the businesses and the strength of

the balance sheet, the Group is confident of being able to reap the

benefit of ongoing projects and business developments, confirms its

financial guidance for 2025, and is embarking with determination on

2023, a year of transition in many respects.”

-

GROUP CONSOLIDATED RESULTS

|

In EURm |

Q4 22 |

Q4 21 |

Change |

2022 |

2021 |

Change |

|

Net banking income |

6,885 |

6,620 |

+4.0% |

+6.2%* |

28,059 |

25,798 |

+8.8% |

+9.7%* |

|

Underlying net banking income(1) |

6,885 |

6,503 |

+5.9% |

+8.1%* |

28,059 |

25,681 |

+9.3% |

+10.2%* |

|

Operating expenses |

(4,610) |

(4,565) |

+1.0% |

+3.3%* |

(18,630) |

(17,590) |

+5.9% |

+7.5%* |

|

Underlying operating expenses(1) |

(4,718) |

(4,617) |

+2.2% |

+4.5%* |

(17,991) |

(17,211) |

+4.5% |

+6.1%* |

|

Gross operating income |

2,275 |

2,055 |

+10.7% |

+12.5%* |

9,429 |

8,208 |

+14.9% |

+14.4%* |

|

Underlying gross operating income(1) |

2,167 |

1,886 |

+14.9% |

+16.9%* |

10,068 |

8,470 |

+18.9% |

+18.4%* |

|

Net cost of risk |

(413) |

(86) |

x 4.8 |

x 6.3* |

(1,647) |

(700) |

x 2.4 |

+93.0%* |

|

Operating income |

1,862 |

1,969 |

-5.4% |

-4.7%* |

7,782 |

7,508 |

+3.6% |

+5.3%* |

|

Underlying operating income(1) |

1,754 |

1,800 |

-2.6% |

-1.7%* |

8,421 |

7,770 |

+8.4% |

+10.1%* |

|

Net profits or losses from other assets |

(4) |

449 |

n/s |

n/s |

(3,290) |

635 |

n/s |

n/s |

|

Income tax |

(484) |

(311) |

+55.5% |

+55.5%* |

(1,560) |

(1,697) |

-8.1% |

-5.8%* |

|

Net income |

1,381 |

1,995 |

-30.8% |

-30.2%* |

2,947 |

6,338 |

-53.5% |

-53.2%* |

|

O.w. non-controlling interests |

221 |

208 |

+6.3% |

+7.6%* |

929 |

697 |

+33.3% |

+32.3%* |

|

Reported Group net income |

1,160 |

1,787 |

-35.1% |

-34.5%* |

2,018 |

5,641 |

-64.2% |

-64.0%* |

|

Underlying Group net

income(1) |

1,126 |

1,226 |

-8.1% |

-7.2%* |

5,616 |

5,264 |

+6.7% |

+7.9%* |

|

ROE |

6.9% |

12.1% |

|

|

2.6% |

9.6% |

+0.0% |

+0.0%* |

|

ROTE |

7.8% |

16.6% |

|

|

2.9% |

11.7% |

+0.0% |

+0.0%* |

|

Underlying

ROTE(1) |

7.6% |

9.2% |

|

|

9.6% |

10.2% |

+0.0% |

+0.0%* |

(1) Underlying data (see methodology note No. 5 for

the transition from accounting data to underlying data)

Societe Generale’s Board of Directors, which met

on 7 February 2023 under the chairmanship of Lorenzo Bini Smaghi,

examined the Societe Generale Group’s results for Q4 and FY

2022.

The various restatements enabling the transition

from underlying data to published data are presented in the

methodology notes (section 9.5).

Net banking

income

Underlying

net banking

income(1)

grew strongly in 2022

at +9.3%

(+10.2%*) vs. 2021,

fuelled by record performances in Financing & Advisory, Global

Markets and ALD, strong growth in Private Banking and International

Retail Banking and a solid performance by the French Retail

Bank.

French Retail Banking revenues grew +4.1% vs.

2021 fuelled notably by robust service fee growth and a very solid

showing by Private Banking.

International Retail Banking & Financial

Services’ revenues rose +12.4% (+17.9%*) vs. 2021, driven by a

record performance at ALD and strong growth at International Retail

Banking whose revenues grew +11.5%* vs. 2021. Financial Services’

net banking income was significantly higher by +35.8%* vs. 2021,

while Insurance net banking income increased by +6.5%* vs.

2021.

Global Banking & Investor Solutions’

revenues were up +14.3% (+12.9%*) vs. 2021. Global Markets &

Investor Services’ revenues posted a +18.7% increase in revenues

(14.1%*) vs. 2021, while Financing & Advisory activities

increased by +15.2% (+10.7%*) vs. 2021.

In Q4

22, the Group continued to post robust revenue

growth of +5.9% (+8.1%*) vs. Q4 21.

Operating

expenses

In 2022, operating expenses totalled EUR

18,630 million on a reported basis and EUR 17,991 million on an

underlying basis (restated for transformation costs),

i.e., an increase of +4.5% vs. 2021 (on an underlying basis).

The rise can be mainly attributed to the EUR 864

million contribution to the Single Resolution Fund, and increase of

EUR 278 million, currency effects, notably in US dollars and a rise

in the variable components of employee remuneration associated with

higher revenues. Underlying(1) gross operating income increased by

+18.9% to EUR 10,068 million in 2022, while the underlying(1) cost

to income ratio (excluding the Single Resolution Fund) posted a 3.4

point improvement to 61.0% (vs. 64.4% in 2021).

In Q4 22, operating expenses totalled

EUR 4,610 million on a reported basis and EUR

4,718 million on an underlying basis (restated for the

linearisation of IFRIC 21 and transformation costs), i.e., a

limited increase of +2.2% vs. Q4 21.

Excluding the Single Resolution Fund,

the

underlying(1)

cost to income ratio is expected to range between 66% and

68% in 2023, based

notably on normalised revenues in Global

Markets.

Cost of

risk

The cost of risk remained moderate at 28

basis points in Q4 22, or EUR 413 million. It breaks down

into a provision on non-performing loans which remains limited at

EUR 346 million (23 basis points), and an additional provision on

performing loans of EUR 67 million (5 basis points).

Over the full year, the cost of risk amounted to

28 basis points, landing below the guidance of between 30 and 35

basis points.

Offshore exposure to Russia was reduced to EUR

1.8 billion of EAD (Exposure At Default) at 31 December 2022, i.e.,

a decrease of around -45% since 31 December 2021. Exposure at risk

on this portfolio is estimated at less than EUR 0.6 billion,

compared with less than EUR 1 billion for the previous quarter.

Total associated provisions stood at EUR 427 million at

end-December 2022.

Moreover, at end-December 2022, the Group’s

residual exposure to Rosbank amounted to less than EUR 0.1 billion,

corresponding mainly to guarantees and letters of credit.

The Group’s provisions on performing loans

amounted to EUR 3,769 million at end-December, an increase of EUR

414 million in 2022.

The non-performing loans ratio amounted to

2.8%(2) at 31 December 2022, down 10 basis points vs. 31 December

2021. The gross coverage ratio on doubtful loans for the Group

stood at 48%(3) at 31 December 2022.

The cost of risk in 2023 is expected to

range between 30 and 35 basis points.

(1) Underlying data (see

Methodology note No.5 for the transition from accounting data to

underlying data)(2) NPL ratio calculated according

to EBA methodology published on 16 July

2019(3) Ratio of S3 assets calculated on the gross

carrying amount of the loans before offsetting guarantees and

collateral

Group net

income

|

In EURm |

|

|

|

|

Q4 22 |

Q4 21 |

2022 |

2021 |

|

Reported Group net income |

|

|

1,160 |

1,787 |

2,018 |

5,641 |

|

Underlying Group net income(1) |

|

|

1,126 |

1,226 |

5,616 |

5,264 |

|

As a % |

|

|

|

|

Q4 22 |

Q4 21 |

2022 |

2021 |

|

ROTE |

|

|

|

|

7.8% |

16.6% |

2.9% |

11.7% |

|

Underlying ROTE(1) |

|

|

|

|

7.6% |

9.2% |

9.6% |

10.2% |

Earnings per share amounts to EUR 1.73 in 2022

(EUR 5.97 in 2021). Underlying earnings per share amounts to EUR

6.10 over the same period (EUR 5.52 in 2021).

Shareholder

distribution

The Board of Directors approved its distribution

policy to an equivalent of EUR 2.25 per share(2). A cash dividend

of EUR 1.70 per share will be proposed at the General Meeting of

Shareholders on 23 May 2023. The dividend will be detached on 30

May 2023 and paid out on 1 June 2023.

The Group is also planning to launch a share

buyback programme for a total of around EUR 440 million, i.e.,

equivalent to EUR 0.55 per share. The rollout of the programme is

conditional on receiving the usual clearances from the ECB.

Considering the strong financial performance in

2022 and an exceptional year, this distribution level ensures on

one hand a fair remuneration of shareholders, and on the other

hand, further strengthens the Group CET 1 ratio.

Upscaled ESG actions and

commitments by the Group

The Group defined its new CSR ambition in 2022

and committed to accelerating the decarbonisation of its business

portfolios. It also adopted a global approach to preserve

biodiversity, enhance positive local impact and deploy an ESG

culture to support clients in responsible social and energy

transition.

On this score, Societe Generale strengthened its

ambitions to reduce finance for the most carbon-emissive sectors by

setting new targets for upstream oil and gas. We are committed to

reducing our exposure by -20% out to 2025 vs. 2019 and to scaling

down scope 3 carbon emissions by -30% out to 2030 vs. 2019.

Likewise, Societe Generale is targeting power generation emission

intensity of 125g of Co2/KWh out to 2030. During 2022, the Group

fixed a new sustainable finance contribution target of EUR 300

billion out to 2025. At end-2022, the bank had already exceeded the

EUR 100 billion mark.

The bank has also implemented several sectorial

initiatives such as playing an active role in market coalitions

destined to establish a common financing framework on aluminium,

steel and aviation, and being at the forefront of rapid-growth

economies, such as hydrogen. Societe Generale also increased

the weight of biodiversity concerns when managing new commitments

involving agriculture and logging operations by giving them greater

prominence in its activities, and by taking active part in market

initiatives to create common frameworks.

Last, to integrate ESG considerations within the

Group, Societe Generale launched a vast internal programme to make

ESG culture second nature among its employees, notably by rolling

out an extensive training programme and making ESG transformation

operational as part of the “ESG by Design” strategic project.

(1) Underlying data (see

methodology note No.5 for the transition from accounting data to

underlying data)(2) Subject to usual approvals

from the General Meeting and the ECB

-

THE GROUP’S FINANCIAL STRUCTURE

Group shareholders’ equity

totalled EUR 66.5 billion at 31 December 2022 (vs. EUR 65.1 billion

at 31 December 2021). Net asset value per share was EUR 70.5 and

tangible net asset value per share was EUR 62.3.

The consolidated balance sheet totalled EUR

1,487 billion at 31 December 2022 (EUR 1,464 billion at 31 December

2021). The net amount of customer loan outstandings, including

lease financing, was EUR 496 billion at 31 December 2022 (EUR 488

billion at 31 December 2021) – excluding assets and securities

purchased under resale agreements. At the same time, customer

deposits amounted to EUR 524 billion vs. EUR 502 billion at 31

December 2021 (excluding assets and securities sold under

repurchase agreements).

At 31 December 2022, the parent company had

issued EUR 44 billion of medium/long-term debt, having an average

maturity of 4.9 years and an average spread of 59 bps (over 6-month

midswaps, excluding subordinated debt). The subsidiaries had issued

EUR 2.7 billion. In total, the Group had issued EUR 46.7 billion of

medium/long-term debt.

The LCR (Liquidity Coverage Ratio) was well

above regulatory requirements at 141% at end-December 2022 (145% on

average in Q4), vs. 129% at end-December 2021. At the same time,

the NSFR (Net Stable Funding Ratio) was at a level of 114% at

end-December 2022.

The Group’s risk-weighted

assets (RWA) amounted to EUR 360.5 billion at 31 December

2022 (vs. EUR 363.4 billion at end-December 2021) according to

CRR2/CRD5 rules. Risk-weighted assets in respect of credit risk

represent 83.4% of the total, at EUR 300.7 billion, down 1.4% vs.

31 December 2021.

At 31 December 2022, the Group’s Common

Equity Tier 1 ratio stood at 13.5%, or around 420 basis

points above the regulatory requirement. The CET1 ratio at 31

December 2022 includes an effect of +17 basis points for phasing of

the IFRS 9 impact. Excluding this effect, the fully-loaded ratio

amounts to 13.3%. The Tier 1 ratio stood at 16.3% at end-September

2022 (15.9% at end-December 2021) and the total capital ratio

amounted to 19.4% (18.8% at end-December 2021).

The leverage ratio stood at

4.4% at 31 December 2022 (4.9% at end-December 2021, including ~40

basis points for the European Central Bank’s transitional measures

which ended in March 2022).

With a level of 33.7% of RWA and 9.0% of

leverage exposure at end-December 2022, the Group’s TLAC ratio is

above the Financial Stability Board’s requirements for 2022. At 31

December 2022, the Group also exceeded its 2022 MREL requirements

of 25.31% of RWA and 5.91% of leverage exposure.

The Group is rated by four rating agencies: (i)

Fitch Ratings - long-term rating “A-”, stable rating, senior

preferred debt rating “A”, short-term rating “F1” (ii) Moody’s -

long-term rating (senior preferred debt) “A1”, stable outlook,

short-term rating “P-1” (iii) R&I - long-term rating (senior

preferred debt) “A”, stable outlook; and (iv) S&P Global

Ratings - long-term rating (senior preferred debt) “A”, stable

outlook, short- term rating

“A-1”.3. FRENCH

RETAIL BANKING

|

In EURm |

Q4 22 |

Q4 21 |

Change |

2022 |

2021 |

Change |

|

Net banking income |

2,219 |

2,221 |

-0.1% |

8,839 |

8,489 |

+4.1% |

|

Net banking income excl. PEL/CEL |

2,174 |

2,200 |

-1.2% |

8,647 |

8,450 |

+2.3% |

|

Operating expenses |

(1,717) |

(1,688) |

+1.7% |

(6,473) |

(6,248) |

+3.6% |

|

Underlying operating expenses(1) |

(1,773) |

(1,731) |

+2.4% |

(6,473) |

(6,248) |

+3.6% |

|

Gross operating income |

502 |

533 |

-5.8% |

2,366 |

2,241 |

+5.6% |

|

Underlying gross operating income(1) |

446 |

490 |

-9.0% |

2,366 |

2,241 |

+5.6% |

|

Net cost of risk |

(219) |

20 |

n/s |

(483) |

(125) |

x 3.9 |

|

Operating income |

283 |

553 |

-48.8% |

1,883 |

2,116 |

-11.0% |

|

Net profits or losses from other assets |

51 |

21 |

x 2.4 |

57 |

23 |

x 2.5 |

|

Reported Group net income |

250 |

414 |

-39.6% |

1,445 |

1,550 |

-6.8% |

|

Underlying Group net income(1) |

208 |

383 |

-45.6% |

1,445 |

1,550 |

-6.8% |

|

RONE |

7.9% |

14.0% |

|

11.6% |

12.9% |

|

|

Underlying

RONE(1) |

6.6% |

12.9% |

|

11.6% |

12.9% |

|

(1) Including PEL/CEL provision

and adjusted for the linearisation of IFRIC 21NB: excluding Private

Banking activities as per Q1 22 restatement (France and

International). Includes activities transferred after the disposal

of Lyxor

Societe Generale and

Crédit du Nord networks

Average loan outstandings were +1.6% higher than

in Q4 21 at EUR 213 billion. Home loan outstandings rose +1.2% vs.

Q4 21. Outstanding loans to corporate and professional customers

were +2.4% higher than in Q4 21.

Average outstanding balance sheet deposits

including BMTN (negotiable medium-term notes) contracted by -2.6%

vs. Q4 21 to EUR 235 billion.

As a result, the average loan/deposit ratio

stood at 91% in Q4 22 vs. 87% in Q4 21.

Life insurance assets under management totalled

EUR 109 billion at end-December 2022, unchanged year-on-year (with

the unit-linked share accounting for 32%). Gross life insurance

inflow amounted to EUR 1.8 billion in Q4 22.

Personal protection insurance premiums were up

+4% vs. Q4 21 and property/casualty insurance premiums were up +3%

vs. Q4 21.

On 1 January 2023, Societe Generale Group

performed the legal merger of its two French retail banking

networks, Societe Generale and Crédit du Nord. SG is henceforth the

Group’s new retail bank in France. SG bank’s ambition is to create

a top-tier banking partner, serving 10 million clients in the

French market and ranking among the Top 3 for customer

satisfaction.

Boursorama

The bank enjoyed a new client acquisition

record, attracting more than 1.4 million new clients in 2022 (2x

the 2021 level), including nearly 396,000 in Q4 22 alone. The bank

consolidated its position as the leading online bank in France,

with almost 4.7 million clients at end-December 2022, and a target

of more than 5.5 million clients at the end of 2023. In the

meantime, the acquisition cost per client contracted by around -20%

relative to 2021.

Average outstanding loans rose +14.4% vs. Q4 21

to EUR 16 billion. Home loan outstandings were up +14.0% vs. Q4 21,

while consumer loan outstandings climbed +18.0% vs. Q4 21.

Average outstanding savings including deposits

and financial savings were +38.1% higher than in Q4 21 at EUR 49

billion, with deposits rising by a sharp +43.3% vs. Q4 21 on back

of organic growth and the onboarding of ING clients. Brokerage

recorded more than 1.5 million transactions in Q4 22 alone.

Boursorama reinforced its day-to day banking

operations with a +44% growth notably in payments vs. Q4 21.

Private Banking

Private Banking activities, which were

transferred to French Retail Banking at the beginning of 2022,

cover private banking activities in France and internationally.

Assets under management totalled EUR 147 billion at Q4 22. Asset

inflow growth rose +4% in 2022 relative to end-2021. Net banking

income amounted to EUR 296 million in Q4 22 (+7.6% vs. Q4 21) and

EUR 1,278 million over the full year (+15.9% vs. 2021).

Net banking

income

In Q4

22, revenues totalled EUR 2,219 million,

stable vs. Q4 21, including PEL/CEL. Net interest income and other

revenues, including PEL/CEL, was down -1.8% vs. Q4 21, impacted

primarily by the higher interest rate on regulated savings and the

usury rate, which was partly offset by TLTRO benefits. Fees

increased by +1.9% vs. Q4 21, driven by the +5% rise vs. Q4 21 in

service and financial fees in the Societe Generale and Crédit du

Nord networks.

In 2022,

revenuestotalled EUR 8,839 million, up +4.1% vs. 2021, including

PEL/CEL. Net interest income and other revenues, including PEL/CEL,

were up +2.9% vs. 2021. Fees were +5.6% higher than in 2021,

benefiting from strong growth in service and financial fees.

In respect of the outlook, 2023 will be a

transition year with decreased revenues due to the negative impacts

of the end of the TLTRO benefit for around EUR 0.3bn vs. 2022, the

specific functioning of the French market that will continue to

curb loan production due to the usury rate, as was also the case in

2022, and the continued rise in the regulated savings rate that

will have an impact on net banking income of around EUR 50m for

each 25 basis point increase. Furthermore, net interest margin

hedges that will gradually mature as of 2024 will deprive us in

2023 of the benefit of increased savings.

Operating

expenses

Quarterly

operating expenses totalled EUR 1,717 million (+1.7% vs. Q4 21) and

EUR 1,773 million on an underlying basis (+2.4% vs. Q4 21).

Operating expenses, which were adjusted for the Value Sharing

Premium (PPV) provision, contracted by -0.7% vs. Q4 21. The cost to

income ratio stood at 77% for Q4 22.

In 2022, operating expenses

came to EUR 6,473 million (+3.6% vs. 2021). The cost to income

ratio stood at 73%, down 0.4 points vs. 2021.

Cost of

risk

In Q4

22, the commercial cost of risk amounted

to EUR 219 million or 35 basis points. It was higher than in Q4 21

(by 3 basis points).

In 2022, the

commercial cost of risk amounted to EUR 483 million or 20 basis

points, higher than in 2021 (by 5 basis points).

Contribution to Group net

Income

In Q4

22, the contribution to Group net income

was EUR 250 million in Q4 22, down -39.6% vs. Q4 21. RONE(1) stood

at 6.6% in Q4 22 (8.4% excluding Boursorama).

In

2022, the contribution to Group

net income was EUR 1,445 million, contracting to -6.8% vs. 2021.

Underlying normative RONE came to 11.6% in 2022 (13.4% excluding

Boursorama).

(1) Underlying data (see

methodology note No. 5 for the transition of accounting

data)4. INTERNATIONAL

RETAIL BANKING &

FINANCIAL SERVICES

|

In EURm |

Q4 22 |

Q4 21 |

Change |

2022 |

2021 |

Change |

|

Net banking income |

2,369 |

2,159 |

+9.7% |

+17.4%* |

9,122 |

8,117 |

+12.4% |

+17.9%* |

|

Operating expenses |

(1,100) |

(1,088) |

+1.1% |

+10.9%* |

(4,334) |

(4,203) |

+3.1% |

+10.0%* |

|

Underlying operating expenses(1) |

(1,131) |

(1,112) |

+1.7% |

+11.3%* |

(4,334) |

(4,203) |

+3.1% |

+10.0%* |

|

Gross operating income |

1,269 |

1,071 |

+18.5% |

+23.4%* |

4,788 |

3,914 |

+22.3% |

+26.0%* |

|

Underlying gross operating income(1) |

1,238 |

1,047 |

+18.3% |

+23.3%* |

4,788 |

3,914 |

+22.3% |

+26.0%* |

|

Net cost of risk |

(133) |

(96) |

+38.5% |

+68.3%* |

(705) |

(504) |

+39.9% |

+7.6%* |

|

Operating income |

1,136 |

975 |

+16.5% |

+19.7%* |

4,083 |

3,410 |

+19.7% |

+29.9%* |

|

Net profits or losses from other assets |

(1) |

8 |

n/s |

n/s |

11 |

18 |

-38.9% |

-36.8%* |

|

Reported Group net income |

658 |

584 |

+12.7% |

+16.1%* |

2,376 |

2,082 |

+14.1% |

+25.6%* |

|

Underlying Group net income(1) |

640 |

570 |

+12.3% |

+15.7%* |

2,376 |

2,082 |

+14.1% |

+25.6%* |

|

RONE |

25.0% |

22.2% |

|

|

22.4% |

20.3% |

|

|

|

Underlying

RONE(1) |

24.3% |

21.7% |

|

|

22.4% |

20.3% |

|

|

(1) Underlying data (see methodology note No. 5

for the transition from accounting data to underlying data)

International Retail Banking’s

outstanding loans posted healthy momentum of EUR 88.2 billion, up

+5.6%* for 2022. Outstanding deposits totalled EUR 78.5 billion, a

slightly +1.4%* than 2021.

For the Europe scope, outstanding loans were up

+4.9%* vs. 2021 at EUR 63.8 billion, driven by positive momentum on

the corporate segment in the Czech Republic (+11.0%* vs. 2021).

Outstanding deposits are stable* at EUR 51.6 billion. Robust

momentum in Romania (+8.3%* vs. 2021) offset the slowdown in the

Czech Republic notably due to a shift in some deposits towards

financial savings.

In Africa, Mediterranean Basin and French

Overseas Territories, outstanding loans confirmed their solid

commercial performances in Q4 22. Over the year, outstanding

deposits continued to enjoy positive momentum, up by +7.5%* and

+5.6%* respectively vs. 2021.

In the Insurance business, life

insurance outstandings showed resilience in 2022, totalling EUR

131.6 billion despite unfavourable market conditions. The

share of unit-linked products in outstandings remained high at 36%.

Gross life insurance savings inflow amounted to EUR 12,754 million

in 2022 (42% of unit-linked products in 2022).

Protection insurance saw an increase of +5.8%* vs. 2021, with good

momentum for personal protection premiums that rose +8.0%* and a

more minor +4.1%* increase for P&C insurance.

Financial Services also enjoyed

very solid momentum. Operational Vehicle Leasing and Fleet

Management posted growth of +3.1% vs. end-December 2021 and the

number of contracts totalled 1.8 million (excluding contracts

involving Russia, Belarus and remediation actions agreed with

anti-trust authorities, Portugal, Ireland and Norway, excepting NF

Fleet Norway). Equipment Finance outstanding loans were slightly

higher (+2.2%) than at end-September 2021, at EUR 15 billion

(excluding factoring).

Net banking

income

Net banking income amounted to EUR 9,122 million

over the full year, up +17.9%* vs. 2021. Net banking income came to

EUR 2,369 million in Q4 22, up +17.4%* vs. Q4 21.

International Retail Banking’s

net banking income stood at 5,153 million, up +11.5%* vs. 2021.

International Retail Banking’s net banking income totalled EUR

1,280 million in Q4 22, up +8.3%*.

Revenues in Europe climbed +13.5%* vs. 2021, due

primarily to substantial growth in net interest income (+15.7%*),

driven notably by the Czech Republic (+33.6%*) and Romania

(+17.5%*). These regions benefit from increased volumes and high

interest rates.

The Africa, Mediterranean Basin and French

Overseas Territories scope posted revenues up +8.7%* vs. 2021 on

back of net interest income (+5.0%*) and fees (+11.2%*).

The Insurance business posted

net banking income up +6.5%*, at EUR 1,012 million vs. 2021 driven

by stronger life insurance savings and protection activities. Over

the quarter, net banking income for the Insurance activity grew by

+10.6%* vs. Q4 21 to EUR 263 million.

Financial Services’ net banking

income was substantially higher (+37.9%*) than in Q4 21, at EUR 826

million. ALD benefited again last quarter from robust commercial

momentum, strong used-car sale results and the reduction of the

vehicle depreciation costs in line with the current increase in

vehicle values. Over the year, ALD’s net banking income was up

+43%* vs. 2021 driven by positive commercial dynamics and still

strong used car sales results (EUR 2,846 per unit in 2022).

In 2022, Financial Services’ net banking income

totalled EUR 2,957 million in 2022, up +35.8%* vs. 2021.

Operating

expenses

Operating expenses increased by +10.0%* vs. 2021

to EUR 4,334 million, generating a positive jaws effect that

produced a cost to income ratio that stood at 47.5% in 2022, which

was lower than in 2021 (51.8%). In Q4 22, operating expenses rose

(after linearisation of the IFRIC 21 charge) by +11.3%*(1) vs. Q4

21 to EUR 1,131 million(1) .

In International Retail

Banking, rising costs were kept contained over the year at

+5.9%* vs. 2021 despite spiking inflation.

In the Insurance business,

operating expenses were up +7.2%* vs. 2021, with a cost to income

ratio of 38.6%.

In Financial Services,

operating expenses increased by +22.1%* vs. 2021. The increase can

be attributed to the recognition of charges related to the

preparation of the LeasePlan acquisition.

Cost of

risk

In

2022, the cost of risk amounted

to 52 basis points (EUR 705 million). It was 38 basis points in

2021.

In Q4 22, the cost of risk was

higher at 40 basis points (EUR 133 million), vs. 28 basis points in

Q4 21.

Contribution to Group net

Income

The contribution to Group net income was EUR

2,376 million in 2021 (+25.6%* vs. 2021) and totalled EUR 640

million(1) in Q4 22, up 15.7%*(1) vs. Q4 21.

RONE stood at 22.4% in 2022 and 24.3%(1) in Q4

22. Underlying RONE(1) was 15.1% in International Retail Banking

and 30.6% in Financial Services and Insurance in 2022.

(1) Underlying data (see methodology note No. 5

for the transition from accounting data to underlying data)

-

GLOBAL BANKING & INVESTOR SOLUTIONS

|

In EURm |

Q4 22 |

Q4 21 |

Variation |

2022 |

2021 |

Variation |

|

Net banking income |

2,452 |

2,147 |

+14.2% |

+14.7%* |

10,082 |

8,818 |

+14.3% |

+12.9%* |

|

Operating expenses |

(1,469) |

(1,402) |

+4.8% |

+5.4%* |

(6,634) |

(6,250) |

+6.1% |

+6.2%* |

|

Underlying operating expenses(1) |

(1,654) |

(1,523) |

+8.6% |

+9.2%* |

(6,634) |

(6,250) |

+6.1% |

+6.2%* |

|

Gross operating income |

983 |

745 |

+31.9% |

+32.2%* |

3,448 |

2,568 |

+34.3% |

+28.8%* |

|

Underlying gross operating income(1) |

798 |

624 |

+27.8% |

+28.2%* |

3,448 |

2,568 |

+34.3% |

+28.8%* |

|

Net cost of risk |

(78) |

(3) |

x 26.0 |

x 102.8* |

(421) |

(65) |

x 6.5 |

x 6.1* |

|

Operating income |

905 |

742 |

+22.0% |

+21.9%* |

3,027 |

2,503 |

+20.9% |

+16.0%* |

|

Reported Group net income |

754 |

621 |

+21.4% |

+21.4%* |

2,427 |

2,018 |

+20.3% |

+15.6%* |

|

Underlying Group net income(1) |

611 |

528 |

+15.8% |

+15.7%* |

2,427 |

2,018 |

+20.3% |

+15.6%* |

|

RONE |

19.1% |

16.8% |

+0.0% |

+0.0%* |

16.3% |

14.4% |

+0.0% |

+0.0%* |

|

Underlying

RONE(1) |

15.5% |

14.3% |

+0.0% |

+0.0%* |

16.3% |

14.4% |

+0.0% |

+0.0%* |

(1) Underlying data (see

methodology note No. 5 for the transition from accounting data to

underlying data)NB: excluding Private Banking activities as per Q1

22 restatement (France and International). Excludes other

activities transferred after the disposal of Lyxor

Net banking

income

Global Banking & Investor

Solutions delivered record revenue in 2022(2), posting

revenue up by +14.3% vs. 2021 of EUR 10,082 million, driven by

robust momentum across all business lines. This very sound

financial performance is predominantly due to the highly successful

execution of the strategic plan unveiled in May 2021, the aim of

which is to create value continuously over the long term.In

Q4 22, revenues jumped by +14.2% vs. Q4 21, to EUR 2,452

million.

In Global Markets & Investor

Services, net banking income totalled EUR 6,708 million,

up +18.7% vs. 2021. In Q4 22, it amounted to EUR 1,496 million,

+19.1% vs. Q4 21.

Global Markets notched up a record

performance(2) of EUR 5,859 million, up +17.1% vs. 2021, benefiting

from robust commercial activity in a durably volatile environment,

particularly with regard to interest rates. In Q4 22, revenues

stood at EUR 1,222 million, +11.2% vs. Q4 21.

The Equity activity recorded its best-ever

year(2) in 2022, registering revenues of EUR 3,294 million , up

+4.7% vs. 2021. Over the quarter, revenues contracted by -11.5% vs.

Q4 21 revenues, which were comparatively very high.

Amid highly volatile interest rates, Fixed

Income and Currencies (FIC) posted a record year(2), generating EUR

2,565 million in revenues, up +38.2% vs. 2021. In Q4 22, revenues

rose to EUR 577 million, (+55.9% vs. Q4 21).

Securities Services’ revenues grew +31.2% in

2022 to EUR 849 million, including EUR 168 million from a 2022

revaluation of our stake in Euroclear. In Q4 22,

revenues climbed +74.5% vs. Q4 21 to EUR 274 million, including EUR

91 million from a revaluation of our stake in Euroclear. Assets

under Custody and Assets under Administration amounted to EUR 4,257

billion and EUR 580 billion, respectively.

Financing & Advisory

activities also posted an excellent performance, with

record annual revenues of EUR 3,374 million, up +15.2% vs. 2021. In

Q4 22, they amounted to EUR 956 million, significantly higher

(+16.6%) than in Q4 21.

(2) Using a comparable economic model in the

post-GFC (Global Financial Crisis) regulatory regime

The Global Banking & Advisory business grew

+9.3% in 2022 and continued to capitalise on solid market momentum

in Asset Finance and activities related to Natural Resources. The

Asset-Backed Products platform also turned in a solid performance

in 2022. By contrast, investment banking activities were negatively

impacted by market conditions and falling volumes. In Q4 22,

revenues grew +6.3%.

Global Transaction and Payment Services posted a

record performance, with revenue growth of 44.7% in 2022 on the

back of very strong performances across all activities that took

advantage of rising interest rates and excellent commercial

performances. Over the quarter, revenues surged by +67.9% vs. Q4

21.

Operating

expenses

In

2022, operating expenses

came to EUR 6,634 million (+6.1% vs. 2021). The increase can be

primarily explained by a negative currency effect owing to the

stronger US dollar and a rise in IFRIC 21 charges. Excluding the

contribution to the Single Resolution Fund, operating expenses rose

+2.8% vs. 2021.

Consistent with a positive jaws effect, the

underlying cost to income ratio excluding the contribution to the

Single Resolution Fund improved strongly to 59.6% vs. 66.3% in

2021.

In Q4 22, operating costs grew

+4.8% to EUR 1,469 million.

Cost of

risk

In

2022, the cost of risk amounted

to 23 basis points (EUR 421 million).

In Q4

22, the cost of risk came to 16 basis

points (EUR 78 million).

Contribution to Group net

Income

The contribution to Group net income grew

sharply by +20.3% to EUR 2,427 million in 2022. In Q4 22, the

contribution to Group net income was EUR 754 million on a reported

basis and EUR 611 million on an underlying basis(1) (+15.8% vs. Q4

21).

Global Banking & Investor Solutions posted

strong RONE of 16.3% in 2022 (19.5% restated for the impact of the

contribution to the Single Resolution Fund).The underlying RONE was

15.5% in Q4 22, and 18.5% excluding the contribution to the Single

Resolution Fund.

(1) Underlying data (see

methodology note No. 5 for the transition from accounting data to

underlying data)

-

CORPORATE CENTRE

|

In EURm |

Q4 22 |

Q4 21 |

2022 |

2021 |

|

Net banking income |

(155) |

93 |

16 |

374 |

|

Underlying net banking income(1) |

(155) |

(24) |

16 |

257 |

|

Operating expenses |

(324) |

(387) |

(1,189) |

(889) |

|

Underlying operating expenses(1) |

(160) |

(251) |

(550) |

(510) |

|

Gross operating income |

(479) |

(294) |

(1,173) |

(515) |

|

Underlying gross operating

income(1) |

(315) |

(275) |

(534) |

(253) |

|

Net cost of risk |

17 |

(7) |

(38) |

(6) |

|

Net profits or losses from other assets |

(60) |

429 |

(3,364) |

603 |

|

Income tax |

31 |

193 |

516 |

187 |

|

Reported Group net income |

(502) |

168 |

(4,230) |

(9) |

|

Underlying Group net

income(1) |

(333) |

(255) |

(633) |

(386) |

(1) Underlying data (see

methodology note No. 5 for the transition from accounting data to

underlying data)

The Corporate Centre includes:

- the property management of the

Group’s head office,

- the Group’s equity portfolio,

- the Treasury function for the

Group,

- certain costs related to

cross-functional projects as well as certain costs incurred by the

Group not re-invoiced to the businesses.

The Corporate Centre’s net banking

income totalled EUR +16

million in 2022 vs. EUR +374 million in 2021, and

EUR -155 million in Q4 22 vs. EUR +93 million in Q4 21. It includes

the negative revaluation of financial instruments to hedge the

equity portfolios of Group subsidiaries, in contrast to 2021, when

the Corporate Centre’s net banking income included the positive

revaluation of an asset valued at EUR 117 million.

Operating expenses

totalled EUR 1,189 million in

2022 vs. EUR 889 million in 2021. They include the Group’s

transformation costs for a total amount of EUR 639 million relating

to the activities of French Retail Banking (EUR 370 million),

Global Banking & Investor Solutions (EUR 117 million) and the

Corporate Centre (EUR 152 million). Underlying costs came to EUR

-550 million in 2022 compared to EUR -510 million

in 2021.

Gross operating income totalled EUR

-1,173 million in 2022

vs. EUR -515 million in 2021. Underlying gross operating income

came in at EUR -534 million in 2022, vs. EUR -253 million in

2021.

Net profits or losses from other

assets totalled EUR

-3,364 million in 2022

vs. EUR 603 million in 2021. It includes the EUR -3.3 billion

accounting loss from the disposal of Rosbank and insurance

activities in Russia recognised in H1 22. In Q4 22, net profits or

losses from other assets stood at EUR -60 million, vs. EUR 429

million in Q4 21, with an unfavourable base effect owing to the

disposal of Lyxor’s asset management activities for EUR 439

million recognised in Q4 21.

The Corporate Centre’s contribution to

Group net income totalled EUR

-4,230 million

in 2022 vs. EUR -9 million in 2021. The Corporate

Centre’s contribution to Group underlying net income was

EUR -633 million in 2022, vs. EUR -386 million in 2021.

7. 2023

FINANCIAL CALENDAR

|

2023 Financial communication calendar |

|

12 May 2023

First quarter 2023 results23 May 2023 2023 General Meeting 3 August

2023 Second quarter and first half 2023 results |

|

3 November 2023 Third quarter and nine months 2023 results |

|

|

|

The Alternative Performance Measures, notably the notions

of net banking income for the pillars, operating expenses, IFRIC 21

adjustment, cost of risk in basis points, ROE, ROTE, RONE, net

assets, tangible net assets, and the amounts serving as a basis for

the different restatements carried out (in particular the

transition from published data to underlying data) are presented in

the methodology notes, as are the principles for the presentation

of prudential ratios. This document contains

forward-looking statements relating to the targets and strategies

of the Societe Generale Group.These forward-looking statements are

based on a series of assumptions, both general and specific, in

particular the application of accounting principles and methods in

accordance with IFRS (International Financial Reporting Standards)

as adopted in the European Union, as well as the application of

existing prudential regulations.These forward-looking statements

have also been developed from scenarios based on a number of

economic assumptions in the context of a given competitive and

regulatory environment. The Group may be unable to:- anticipate all

the risks, uncertainties or other factors likely to affect its

business and to appraise their potential consequences;- evaluate

the extent to which the occurrence of a risk or a combination of

risks could cause actual results to differ materially from those

provided in this document and the related

presentation. Therefore, although Societe Generale believes

that these statements are based on reasonable assumptions, these

forward-looking statements are subject to numerous risks and

uncertainties, including matters not yet known to it or its

management or not currently considered material, and there can be

no assurance that anticipated events will occur or that the

objectives set out will actually be achieved. Important factors

that could cause actual results to differ materially from the

results anticipated in the forward-looking statements include,

among others, overall trends in general economic activity and in

Societe Generale’s markets in particular, regulatory and prudential

changes, and the success of Societe Generale’s strategic, operating

and financial initiatives. More detailed information on the

potential risks that could affect Societe Generale’s financial

results can be found in the section “Risk Factors” in our Universal

Registration Document filed with the French Autorité des Marchés

Financiers (which is available on

https://investors.societegenerale.com/en). Investors are advised to

take into account factors of uncertainty and risk likely to impact

the operations of the Group when considering the information

contained in such forward-looking statements. Other than as

required by applicable law, Societe Generale does not undertake any

obligation to update or revise any forward-looking information or

statements. Unless otherwise specified, the sources for the

business rankings and market positions are internal. |

8. APPENDIX 1: FINANCIAL

DATA

GROUP NET INCOME BY CORE

BUSINESS

|

In EURm |

Q4 22 |

Q4 21 |

Variation |

2022 |

2021 |

Variation |

|

French Retail Banking |

250 |

414 |

-39.6% |

1,445 |

1,550 |

-6.8% |

|

International Retail Banking and Financial Services |

658 |

584 |

+12.7% |

2,376 |

2,082 |

+14.1% |

|

Global Banking and Investor Solutions |

754 |

621 |

+21.4% |

2,427 |

2,018 |

+20.3% |

|

Core Businesses |

1,662 |

1,619 |

+2.7% |

6,248 |

5,650 |

+10.6% |

|

Corporate Centre |

(502) |

168 |

n/s |

(4,230) |

(9) |

n/s |

|

Group |

1,160 |

1,787 |

-35.1% |

2,018 |

5,641 |

-64.2% |

NB: Amounts restated in Q1 22 to take into

account the transfer of Private Banking activities (French and

international) to the French Retail Banking. Includes other

activities transferred after the disposal of Lyxor

CONSOLIDATED BALANCE

SHEET

|

In EUR m |

31.12.2022 |

31.12.2021 |

|

Cash, due from central banks |

207,013 |

179,969 |

|

Financial assets at fair value through profit or loss |

329,437 |

342,714 |

|

Hedging derivatives |

32,850 |

13,239 |

|

Financial assets at fair value through other comprehensive

income |

37,463 |

43,450 |

|

Securities at amortised cost |

21,430 |

19,371 |

|

Due from banks at amortised cost |

66,903 |

55,972 |

|

Customer loans at amortised cost |

506,529 |

497,164 |

|

Revaluation differences on portfolios hedged against interest rate

risk |

(2,262) |

131 |

|

Investments of insurance companies |

158,415 |

178,898 |

|

Tax assets |

4,696 |

4,812 |

|

Other assets |

85,072 |

92,898 |

|

Non-current assets held for sale |

1,081 |

27 |

|

Deferred profit-sharing |

1,175 |

- |

|

Investments accounted for using the equity method |

146 |

95 |

|

Tangible and intangible fixed assets |

33,089 |

31,968 |

|

Goodwill |

3,781 |

3,741 |

|

Total |

1,486,818 |

1,464,449 |

|

In EUR m |

31.12.2022 |

31.12.2021 |

|

Due to central banks |

8,361 |

5,152 |

|

Financial liabilities at fair value through profit or loss |

300,618 |

307,563 |

|

Hedging derivatives |

46,164 |

10,425 |

|

Debt securities issued |

133,176 |

135,324 |

|

Due to banks |

132,988 |

139,177 |

|

Customer deposits |

530,764 |

509,133 |

|

Revaluation differences on portfolios hedged against interest rate

risk |

(9,659) |

2,832 |

|

Tax liabilities |

1,638 |

1,577 |

|

Other liabilities |

107,553 |

106,305 |

|

Non-current liabilities held for sale |

220 |

1 |

|

Insurance contracts related liabilities |

141,688 |

155,288 |

|

Provisions |

4,579 |

4,850 |

|

Subordinated debts |

15,946 |

15,959 |

|

Total liabilities |

1,414,036 |

1,393,586 |

|

Shareholder's equity |

- |

- |

|

Shareholders' equity, Group share |

- |

- |

|

Issued common stocks and capital reserves |

21,248 |

21,913 |

|

Other equity instruments |

9,136 |

7,534 |

|

Retained earnings |

34,267 |

30,631 |

|

Net income |

2,018 |

5,641 |

|

Sub-total |

66,669 |

65,719 |

|

Unrealised or deferred capital gains and losses |

(218) |

(652) |

|

Sub-total equity, Group share |

66,451 |

65,067 |

|

Non-controlling interests |

6,331 |

5,796 |

|

Total equity |

72,782 |

70,863 |

|

Total |

1,486,818 |

1,464,449 |

9. APPENDIX

2:

METHODOLOGY

1 –The financial information

presented for the fourth quarter

and full year 2022 was examined by the Board of

Directors on 7 February

2023 and has been prepared in

accordance with IFRS as adopted in the European Union and

applicable at that date. This information has not been audited.

2 - Net banking income

The pillars’ net banking income is defined on

page 41 of Societe Generale’s 2022 Universal Registration Document.

The terms “Revenues” or “Net Banking Income” are used

interchangeably. They provide a normalised measure of each pillar’s

net banking income taking into account the normative capital

mobilised for its activity.

3 - Operating expenses

Operating expenses correspond to the “Operating

Expenses” as presented in note 8.1 to the Group’s consolidated

financial statements as at 31 December 2021 (pages 482 et seq. of

Societe Generale’s 2022 Universal Registration Document). The term

“costs” is also used to refer to Operating Expenses. The

Cost/Income Ratio is defined on page 41 of Societe Generale’s 2022

Universal Registration Document.

4 - IFRIC 21 adjustment

The IFRIC 21 adjustment corrects the result of

the charges recognised in the accounts in their entirety when they

are due (generating event) so as to recognise only the portion

relating to the current quarter, i.e. a quarter of the total. It

consists in smoothing the charge recognised accordingly over the

financial year in order to provide a more economic idea of the

costs actually attributable to the activity over the period

analysed.

The contributions to Single Resolution

Fund (« SRF ») are part of IFRIC21 adjusted

charges, they include contributions to national resolution funds

within the EU.

5 – Exceptional items – Transition from

accounting data to underlying data

It may be necessary for the Group to present

underlying indicators in order to facilitate the understanding of

its actual performance. The transition from published data to

underlying data is obtained by restating published data for

exceptional items and the IFRIC 21 adjustment.

Moreover, the Group restates the revenues and

earnings of the French Retail Banking pillar for PEL/CEL provision

allocations or write-backs. This adjustment makes it easier to

identify the revenues and earnings relating to the pillar’s

activity, by excluding the volatile component related to

commitments specific to regulated savings.

The reconciliation enabling the transition from

published accounting data to underlying data is set out in the

table below:

|

in EUR m |

Q4-22 |

Q4-21 |

|

2022 |

2021 |

|

Exceptional Net banking income (+) |

0 |

(117) |

|

0 |

(117) |

|

Revaluation gain |

0 |

(117) |

|

0 |

(117) |

|

Exceptional operating expenses (-) |

(108) |

(52) |

|

639 |

379 |

|

IFRIC linearisation |

(285) |

(199) |

|

0 |

0 |

|

Transformation costs(1) |

177 |

147 |

|

639 |

379 |

|

Of which related to French Retail Banking |

69 |

91 |

|

370 |

201 |

|

Of which related to Global Banking & Investor Solutions |

54 |

30 |

|

117 |

92 |

|

Of which related to Corporate Centre |

54 |

26 |

|

152 |

86 |

|

Exceptional Net profit or losses from other assets

(+/-) |

54 |

(439) |

|

3,357 |

(624) |

|

Goodwill impairment

(-)(1) |

0 |

114 |

|

0 |

114 |

|

Total exceptional items (pre-tax) |

(54) |

(494) |

|

3,996 |

(248) |

|

DTA recognition

(+)(1) |

0 |

(130) |

|

0 |

(130) |

|

Total exceptional items (post-tax) |

(34) |

(561) |

|

3,598 |

(377) |

|

|

|

|

|

|

|

|

Reported Net income - Group Share |

1,160 |

1,787 |

|

2,018 |

5,641 |

|

Total exceptional items - Group share

(post-tax) |

(34) |

(561) |

|

3,598 |

(377) |

|

Underlying Net income - Group Share |

1,126 |

1,226 |

|

5,616 |

5,264 |

(1) Allocated to Corporate Centre

NB: Amounts restated in Q1 22 to take into account the

transfer of Private Banking activities (French and international)

to the French Retail Banking. Includes other activities transferred

after the disposal of Lyxor

(2) 6 -

Cost of risk in basis points, coverage ratio for

doubtful outstandings

The cost of risk is defined on pages 43 and 663

of Societe Generale’s 2022 Universal Registration Document. This

indicator makes it possible to assess the level of risk of each of

the pillars as a percentage of balance sheet loan commitments,

including operating leases.

|

In EURm |

|

Q4 22 |

Q4 21 |

2022 |

2021 |

|

French Retail Banking |

Net Cost Of Risk |

219 |

(20) |

483 |

125 |

|

Gross loan Outstandings |

250,175 |

237,305 |

246,249 |

235,220 |

|

Cost of Risk in bp |

35 |

(3) |

20 |

5 |

|

International Retail Banking and Financial

Services |

Net Cost Of Risk |

133 |

96 |

705 |

504 |

|

Gross loan Outstandings |

133,756 |

137,018 |

135,743 |

133,321 |

|

Cost of Risk in bp |

40 |

28 |

52 |

38 |

|

Global Banking and Investor Solutions |

Net Cost Of Risk |

78 |

3 |

421 |

65 |

|

Gross loan Outstandings |

190,079 |

160,333 |

182,110 |

148,426 |

|

Cost of Risk in bp |

16 |

1 |

23 |

4 |

|

Corporate Centre |

Net Cost Of Risk |

(17) |

7 |

38 |

6 |

|

Gross loan Outstandings |

16,363 |

14,574 |

15,411 |

13,835 |

|

Cost of Risk in bp |

(41) |

16 |

25 |

4 |

|

Societe Generale Group |

Net Cost Of Risk |

413 |

86 |

1,647 |

700 |

|

Gross loan Outstandings |

590,373 |

549,229 |

579,513 |

530,801 |

|

Cost of Risk in bp |

28 |

6 |

28 |

13 |

The gross coverage ratio for

doubtful outstandings is calculated as

the ratio of provisions recognised in respect of the credit risk to

gross outstandings identified as in default within the meaning of

the regulations, without taking account of any guarantees provided.

This coverage ratio measures the maximum residual risk associated

with outstandings in default (“doubtful”).

7 - ROE, ROTE, RONE

The notions of ROE (Return on Equity) and ROTE

(Return on Tangible Equity), as well as their calculation

methodology, are specified on page 43 and 44 of Societe Generale’s

2022 Universal Registration Document. This measure makes it

possible to assess Societe Generale’s return on equity and return

on tangible equity.RONE (Return on Normative Equity) determines the

return on average normative equity allocated to the Group’s

businesses, according to the principles presented on page 44 of

Societe Generale’s 2022 Universal Registration Document.Group net

income used for the ratio numerator is book Group net income

adjusted for “interest net of tax payable on deeply subordinated

notes and undated subordinated notes, interest paid to holders of

deeply subordinated notes and undated subordinated notes, issue

premium amortisations” and “unrealised gains/losses booked under

shareholders’ equity, excluding conversion reserves” (see

methodology note No. 9). For ROTE, income is also restated for

goodwill impairment.Details of the corrections made to book equity

in order to calculate ROE and ROTE for the period are given in the

table below:ROTE calculation: calculation

methodology

|

End of period (in EURm) |

Q4-22 |

Q4-21 |

2022 |

2021 |

|

Shareholders' equity Group share |

66,451 |

65,067 |

66,451 |

65,067 |

|

Deeply subordinated notes |

(10,017) |

(8,003) |

(10,017) |

(8,003) |

|

Undated subordinated notes |

- |

- |

- |

- |

|

Interest of deeeply & undated subodinated notes, issue premium

amortisations(1) |

(24) |

20 |

(24) |

20 |

|

OCI excluding conversion reserves |

1,279 |

(489) |

1,279 |

(489) |

|

Distribution provision(2) |

(1,803) |

(2,286) |

(1,803) |

(2,286) |

|

Distribution N-1 to be paid |

0 |

- |

0 |

- |

|

ROE equity end-of-period |

55,886 |

54,310 |

55,886 |

54,310 |

|

Average ROE equity* |

55,889 |

53,878 |

55,164 |

52,634 |

|

Average Goodwill |

(3,660) |

(3,776) |

(3,650) |

(3,890) |

|

Average Intangible Assets |

(2,835) |

(2,687) |

(2,760) |

(2,584) |

|

Average ROTE equity* |

49,394 |

47,415 |

48,754 |

46,160 |

|

|

|

|

|

|

|

Group net Income |

1,160 |

1,787 |

2,018 |

5,641 |

|

Interest on deeply subordinated notes and undated subordinated

notes |

(192) |

(151) |

(596) |

(590) |

|

Cancellation of goodwill impairment |

- |

337 |

3 |

337 |

|

Ajusted Group net Income |

968 |

1,973 |

1,425 |

5,388 |

|

Average ROTE equity* |

49,394 |

47,415 |

48,754 |

46,160 |

|

ROTE |

7.8% |

16.6% |

2.9% |

11.7% |

|

|

|

|

|

|

|

Underlying Group net income |

1,126 |

1,226 |

5,616 |

5,264 |

|

Interest on deeply subordinated notes and undated subordinated

notes |

(192) |

(151) |

(596) |

(590) |

|

Cancellation of goodwill impairment |

- |

- |

3 |

- |

|

Ajusted Underlying Group

net Income |

934 |

1,075 |

5,023 |

4,674 |

|

Average ROTE equity (underlying) (h)* |

49,360 |

46,854 |

52,352 |

45,783 |

|

Underlying ROTE |

7.6% |

9.2% |

9.6% |

10.2% |

(1) Interest net of tax, payable or paid to

holders of deeply subordinated notes & undated subordinated

notes, issue premium amortisations(2) Based on the 2022 proposed

distribution subject to usual approvals from the General meeting

and the ECB(*) Amounts restated compared with the financial

statements published in 2020 (See Note1.7 of the financial

statements)

RONE calculation: Average capital

allocated to Core Businesses (in EURm)

|

In EURm |

Q4 22 |

Q4 21 |

Change |

2022 |

2021 |

Change |

|

French Retail Banking |

12,673 |

11,847 |

+7.0% |

12,417 |

12,009 |

+3.4% |

|

International Retail Banking and Financial Services |

10,531 |

10,523 |

+0.1% |

10,619 |

10,246 |

+3.6% |

|

Global Banking and Investor Solutions |

15,806 |

14,745 |

+7.2% |

14,916 |

14,055 |

+6.1% |

|

Core Businesses |

39,009 |

37,115 |

+5.1% |

37,951 |

36,310 |

+4.5% |

|

Corporate Center |

16,880 |

16,763 |

+0.7% |

17,213 |

16,323 |

+5.4% |

|

Group |

55,889 |

53,878 |

+3.7% |

55,164 |

52,634 |

+4.8% |

NB: Amounts restated in Q1 22 to take into

account the transfer of Private Banking activities (French and

international) to the French Retail Banking. Includes activities

transferred after the disposal of Lyxor

8 - Net assets and

tangible net assets

Net assets and tangible net assets are defined

in the methodology, page 46 of the Group’s 2022 Universal

Registration Document. The items used to calculate them are

presented below:

|

End of period (in EURm) |

2022 |

2021 |

2020 |

|

Shareholders' equity Group

share* |

66,451 |

65,067 |

61,710 |

|

Deeply subordinated notes |

(10,017) |

(8,003) |

(8,830) |

|

Undated subordinated notes |

0 |

0 |

(264) |

|

Interest of deeeply & undated subodinated notes, issue premium

amortisations(1) |

(24) |

20 |

19 |

|

Bookvalue of own shares in trading portfolio |

67 |

37 |

301 |

|

Net Asset Value* |

56,477 |

57,121 |

52,936 |

|

Goodwill |

(3,652) |

(3,624) |

(3,928) |

|

Intangible Assets |

(2,882) |

(2,733) |

(2,484) |

|

Net Tangible Asset Value* |

49,943 |

50,764 |

46,524 |

|

|

|

|

|

|

Number of shares used to calculate

NAPS** |

801,147 |

831,162 |

848,859 |

|

Net Asset Value per Share |

70.5 |

68.7 |

62.4 |

|

Net Tangible Asset Value per Share |

62.3 |

61.1 |

54.8 |

(1) Interest net of tax, payable or paid to

holders of deeply subordinated notes & undated subordinated

notes, issue premium amortisations(*) Amounts restated compared

with the financial statements published in 2020 (See Note1.7 of the

financial statements)(* *) The number of shares considered is the

number of ordinary shares outstanding as at end of period,

excluding treasury shares and buybacks, but including the trading

shares held by the Group.In accordance with IAS 33, historical data

per share prior to the date of detachment of a preferential

subscription right are restated by the adjustment coefficient for

the transaction.

9 - Calculation of

Earnings Per Share (EPS)

The EPS published by Societe Generale is

calculated according to the rules defined by the IAS 33 standard

(see page 45 of Societe Generale’s 2022 Universal Registration

Document). The corrections made to Group net income in order to

calculate EPS correspond to the restatements carried out for the

calculation of ROE and ROTE. As specified on page 45 of Societe

Generale’s 2022 Universal Registration Document, the Group also

publishes EPS adjusted for the impact of non-economic and

exceptional items presented in methodology note No. 5 (underlying

EPS).The calculation of Earnings Per Share is described in the

following table:

|

Average number of shares (thousands) |

2022 |

2021 |

2020 |

|

Existing shares |

845,478 |

853,371 |

853,371 |

|

Deductions |

|

|

0 |

|

Shares allocated to cover stock option plans and free shares

awarded to staff |

6,252 |

3,861 |

2,987 |

|

Other own shares and treasury shares |

16,788 |

3,249 |

0 |

|

Number of shares used to calculate EPS* |

822,437 |

846,261 |

850,385 |

|

Group net Income |

2,018 |

5,641 |

(258) |

|

Interest on deeply subordinated notes and undated subordinated

notes |

(596) |

(590) |

(611) |

|

Adjusted Group net income (in EURm) |

1,422 |

5,051 |

(869) |

|

EPS (in EUR) |

1.73 |

5.97 |

(1.02) |

|

Underlying EPS** (in EUR) |

6.10 |

5.52 |

0.97 |

(*) Calculated on the basis of underlying Group

net income (excluding linearisation of IFRIC 21). (**) The number

of shares considered is the average number of ordinary shares

outstanding during the period, excluding treasury shares and

buybacks, but including the trading shares held by the Group.

10 - The

Societe Generale Group’s Common Equity

Tier 1 capital is calculated in accordance with applicable

CRR2/CRD5 rules. The fully loaded solvency ratios are presented pro

forma for current earnings, net of dividends, for the current

financial year, unless specified otherwise. When there is reference

to phased-in ratios, these do not include the earnings for the

current financial year, unless specified otherwise. The leverage

ratio is also calculated according to applicable CRR2/CRD5 rules

including the phased-in following the same rationale as solvency

ratios.

NB (1) The sum of values contained in the tables

and analyses may differ slightly from the total reported due to

rounding rules.

(2) All the information on the results for the

period (notably: press release, downloadable data, presentation

slides and supplement) is available on Societe Generale’s website

www.societegenerale.com in the “Investor” section.

Societe

GeneraleSociete Generale is one of the leading

European financial services groups. Based on a diversified and

integrated banking model, the Group combines financial strength and

proven expertise in innovation with a strategy of sustainable

growth. Committed to the positive transformations of the world’s

societies and economies, Societe Generale and its teams seek to

build, day after day, together with its clients, a better and

sustainable future through responsible and innovative financial

solutions.Active in the real economy for over 150 years, with a

solid position in Europe and connected to the rest of the world,

Societe Generale has over 117,000 members of staff in 66 countries

and supports on a daily basis 25 million individual clients,

businesses and institutional investors around the world by offering

a wide range of advisory services and tailored financial solutions.

The Group is built on three complementary core businesses:

- French Retail

Banking with the SG bank, resulting from the merger of the

two Societe Generale and Crédit du Nord networks, and Boursorama.

Each offers a full range of financial services with omnichannel

products at the cutting edge of digital innovation;

-

International Retail Banking, Insurance and Financial

Services, with networks in Africa, Central and Eastern

Europe and specialised businesses that are leaders in their

markets;

- Global Banking and Investor

Solutions, which offers recognised expertise, key

international locations and integrated solutions.

Societe Generale is included in the principal

socially responsible investment indices: DJSI (Europe), FTSE4Good

(Global and Europe), Bloomberg Gender-Equality Index, Refinitiv

Diversity and Inclusion Index, Euronext Vigeo (Europe and

Eurozone), STOXX Global ESG Leaders indexes, and the MSCI Low

Carbon Leaders Index (World and Europe). In case of doubt regarding

the authenticity of this press release, please go to the end of

Societe Generale’s newsroom page where official Press Releases sent

by Societe Generale can be certified using blockchain technology. A

link will allow you to check the document’s legitimacy directly on

the web page. For more information, you can follow us on Twitter

@societegenerale or visit our website societegenerale.com.

- Societe-Generale_PR_Q4-and-FY-2022

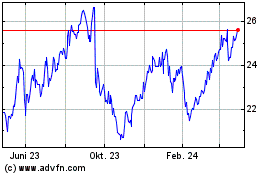

Societe Generale (BIT:1GLE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

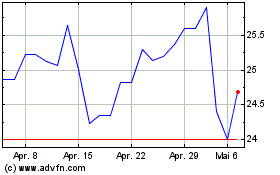

Societe Generale (BIT:1GLE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024