PSI Software AG PSI Exceeds Targets for 2019

24 März 2020 - 8:00AM

RNS Non-Regulatory

TIDM0KUR

PSI Software AG

24 March 2020

PSI Software AG / Key word(s): Annual Results/Dividend

Thanks to Strong Final Quarter PSI Exceeds Targets for 2019

24-March-2020

Disclosure of an inside information acc. to Article 17 MAR of the Regulation (EU) No 596/2014,

transmitted by DGAP - a service of EQS Group AG.

The issuer is solely responsible for the content of this announcement.

Thanks to Strong Final Quarter PSI Exceeds Targets for 2019

- Sales in 2019 grows by 13 % to 225.2 million euros

- EBIT increased by 11.4 % to 17.2 million euros

- Group net result 34.7 % above previous year at 14.3 million eurosKPI (TEUR) 01 Jan. - 31 Dec. 2019 01 Jan. - 31 Dec. 2018 Change

Sales 225,180 199,156 +13.1 %

EBIT 17,205 15,450 +11.4 %

Group net result 14,262 10,585 +34.7 %

Result per share (EUR) 0.91 0.68 +33.8 %

Berlin - PSI Group increased its EBIT to 17.2 million euros (31 Dec. 2018: 15.5 million euros)

in financial year 2019. The EBITDA jumped by almost 40 % to 28.0 million euros (31 Dec. 2018:

20.1 million euros), to which the conversion to IFRS 16 also contributed 5.3 million euros.

The Group net result increased by almost 35 % to 14.3 million euros (31 Dec. 2018: 10.6 million

euros) due to fiscal effects, the result per share improved accordingly to 0.91 Euro (31 Dec.

2018: 0.68 Euro). Sales increased by 13.1 % to 225.2 million euros (31 Dec. 2018: 199.2 million

euros). The thematic fields smart grid and transportation transition grew by 15 %, industry

4.0 sectors increased organically by 10 %, despite the steel and diesel crisis in Europe.

New orders increased by 8.8 % to 236 million euros (31 Dec. 2018: 217 million euros), the

order book volume at the end of the year increased by 2.2 % to 142 million euros (31 Dec.

2018: 139 million euros).

Energy Management (energy networks, energy trading, public transportation) increased sales

by 16.1 % to 115.8 million euros (31 Dec. 2018: 99.7 million euros) after the acquisition

of BTC Smart Grid, the EBIT for the segment improved to 7.2 million euros (31 Dec. 2018: 6.8

million euros), despite the 2.1 million in integration costs. The electrical and integrated

grids business increased its new orders and sales significantly and completed the integration

of the acquired activities. The gas networks and pipelines business increased its new orders

and sales, also thanks to large orders from Russia, and results recovered. The PSI subsidiary

in Southeast Asia continued its austerity measures. Public transport grew by 45 %, doubled

its earnings and currently has a top seller for the German and French markets with the new

electric bus charging and depot management system.

Sales in Production Management (raw materials, metals, industry, logistics) grew organically

by 9.9 % to 109.4 million euros (31 Dec. 2018: 99.5 million euros), the EBIT increased by

18 % to 11.8 million euros (31 Dec. 2018: 10.0 million euros). Metals production business

was able to compensate for the weakness in Europe with major orders from the USA and China.

Automotive & industry came through the year of the diesel and particulate matter crisis well

with numerous upgrade projects. Logistics grew by 28 % with strong partner business. All segments

significantly improved their results based on the migration of their products to the PSI Java

Framework and a growing partner structure. In Poland, PSI continued to grow with orders for

logistics, production and energy networks.

The number of employees in the group on 31 Dec. 2019 rose by 197 to 1,984 (31 Dec. 2018: 1,787)

compared with the previous year due to new hires and the acquisition in the Energy segment.

Cash flow from operating activities, at EUR 12.5 million (Dec. 31, 2018: EUR 19.0 million)

was down from the strong prior-year figure, not least due to growth financing. The share of

revenues from maintenance and upgrade subscriber contracts was further increased to 33.5%.

After payment of the purchase price for the BTC Smart Grid, liquid funds at the end of the

year decreased to 38.7 million euros (31 Dec. 2018: 44.6 million euros), so that PSI continues

to have sufficient funds for targeted acquisitions. The Management Board will propose a dividend

of 0.05 euro (previous year: 0.25 euro) to the Annual General Meeting in consultation with

the Supervisory Board. The effects of the current corona crisis cannot be conclusively quantified

at this point in time from the perspective of the Executive Board and the Supervisory Board.

The Federal Government has identified an exceptional emergency situation. In such a situation,

the Management Board and Supervisory Board consider it advisable, as a precaution, to leave

a higher proportion of the profit than in previous years in the company.

PSI again spent 24.0 million euros on research and development in the reporting year, about

one third of which was for the product and platform strategy. Two thirds of the products have

been converted to the PSI Java platform, and intensive work is being done on the remaining

third. The graphical user interface of the platform also runs without adjustment expenses

in the Internet (or in intranets) and on mobile devices. PSI is currently testing an app store

for the platform products, from which partners and regular customers can choose automatic

delivery to various clouds.

PSI will participate in the climate protection programme of the German federal government

(energy transition, heat transition, transport transition) and the Green Deal in the European

Union. PSI software contributes significantly to the integration of renewable energy into

the electricity networks. The gas network will become the sole failure guarantor and be expanded

in the future by green gases and a hydrogen network.

Prior to the corona crisis, PSI had aimed for a continuation of growth and a further increase

in the EBIT by 10% in 2020. The corona virus will lead to delays in the awarding of contracts,

but for many customers PSI is also important in defending against the crisis. PSI had already

equipped all 2,000 employees in advance with notebooks and remote access for home offices.

Due to the high volume of orders on hand, management is therefore currently expecting a slight

weakening of sales and a one-time 20% decrease in the EBIT.

Contact

PSI Software AG

Karsten Pierschke

Head of Investor Relations and

Corporate Communication

Dircksenstraße 42-44

10178 Berlin

Germany

Phone +49 30 2801-2727

Fax +49 30 2801-1000

Email: KPierschke@psi.de

End of ad hoc announcement

Information and Explanation of the Issuer to this News:

On the basis of its own software products, the PSI Group develops and integrates complete

solutions for optimizing the flow of energy and material at suppliers (energy networks, energy

trading, public passenger transport) and industry (raw material extraction, metal production,

automotive, mechanical engineering, logistics). PSI was founded in 1969 and employs 2,000

persons worldwide. www.psi.de

24-March-2020 CET/CEST The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate

News and Press Releases.

Archive at www.dgap.de

Language: English

Company: PSI Software AG

Dircksenstraße 42-44

10178 Berlin

Germany

Phone: +49 (0)30 2801-0

Fax: +49 (0)30 2801-1000

E-mail: ir@psi.de

Internet: www.psi.de

ISIN: DE000A0Z1JH9

WKN: A0Z1JH

Listed: Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf,

Hamburg, Munich, Stuttgart, Tradegate Exchange

EQS News ID: 1004819

End of Announcement DGAP News Service

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRAFIFLRVFISFII

(END) Dow Jones Newswires

March 24, 2020 03:00 ET (07:00 GMT)

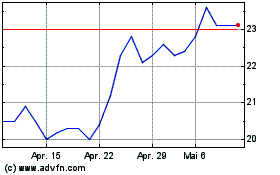

PSI Software (TG:PSAN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

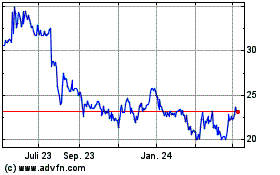

PSI Software (TG:PSAN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024