Current Report Filing (8-k)

06 Januar 2022 - 10:52PM

Edgar (US Regulatory)

0000200406false00002004062022-01-062022-01-060000200406us-gaap:CommonStockMember2022-01-062022-01-060000200406jnj:A0.250NotesDue2022Member2022-01-062022-01-060000200406jnj:A0.650NotesDue2024Member2022-01-062022-01-060000200406jnj:A5.50NotesDue2024Member2022-01-062022-01-060000200406jnj:A1.150NotesDue2028Member2022-01-062022-01-060000200406jnj:A1.650NotesDue2035Member2022-01-062022-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 6, 2022

Johnson & Johnson

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

New Jersey

|

1-3215

|

22-1024240

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

One Johnson & Johnson Plaza, New Brunswick, New Jersey 08933

(Address of Principal Executive Offices)

(Zip Code)

Registrant's telephone number, including area code:

732-524-0400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Recommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $1.00

|

JNJ

|

New York Stock Exchange

|

|

0.250% Notes Due January 2022

|

JNJ22

|

New York Stock Exchange

|

|

0.650% Notes Due May 2024

|

JNJ24C

|

New York Stock Exchange

|

|

5.50% Notes Due November 2024

|

JNJ24BP

|

New York Stock Exchange

|

|

1.150% Notes Due November 2028

|

JNJ28

|

New York Stock Exchange

|

|

1.650% Notes Due May 2035

|

JNJ35

|

New York Stock Exchange

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously announced by Johnson & Johnson (the “Company”) on August 19, 2021, effective as of January 3, 2022, Joaquin Duato, previously Vice Chairman of the Company’s Executive Committee, assumed the role of Chief Executive Officer (“CEO”) of the Company and has been appointed as a member of the Company’s Board of Directors (the “Board”). Alex Gorsky, previously Chairman and CEO of the Company, transitioned to Executive Chairman of the Company, also effective January 3, 2022.

On January 4, 2022, the Board approved compensation changes for Mr. Duato and Mr. Gorsky in conjunction with their respective role changes. Upon his assumption of the CEO role, Mr. Duato’s annual compensation opportunities increased as follows: his annual base salary is $1,500,000, his annual incentive target is 175% of base salary ($2,625,000), and his long-term incentive target is 820% of base salary ($12,300,000). Actual annual incentive and long-term incentive awards will be based on achievement of the applicable business and individual performance objectives and subject to approval by the independent members of the Board. As an employee of the Company, Mr. Duato will receive no additional compensation for his service as a member of the Board.

In connection with his transition to Executive Chairman of the Company, Mr. Gorsky’s annual compensation opportunities were adjusted as follows: his annual base salary was decreased to $1,400,000, and his annual incentive target for 2022 was decreased to 150% of base salary ($2,100,000). Actual payout of annual incentive compensation will be based on achievement of the applicable business and individual performance objectives and subject to approval by the independent members of the Board. In conjunction with the Company’s long-standing practice, Mr. Gorsky will receive a long-term incentive award in February 2022 based on his performance as Chairman and CEO in 2021. He will not be eligible to receive future long-term incentive awards for his service in his capacity as Executive Chairman.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Johnson & Johnson

|

|

|

|

|

|

(Registrant)

|

|

|

Date:

|

January 6, 2022

|

By:

|

/s/ Matthew Orlando

|

|

|

|

|

|

Matthew Orlando

Corporate Secretary

|

|

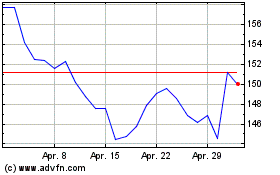

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

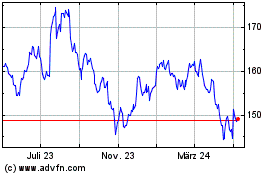

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024