UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

SCHEDULE 14A

_________________________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant

|

|

☒

|

|

Filed by a Party other than the Registrant

|

|

☐

|

Check the appropriate box:

|

☐

|

|

Preliminary proxy statement.

|

|

☐

|

|

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

|

|

☒

|

|

Definitive proxy statement.

|

|

☐

|

|

Definitive Additional Materials.

|

|

☐

|

|

Soliciting Material Pursuant to Rule 240.14a-12.

|

APPLIED ENERGETICS, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

Table of Contents

APPLIED ENERGETICS, INC.

9070 S Rita Road, Suite 1500

Tucson, Arizona 85747

September 18, 2024

Dear Stockholder:

I am pleased to invite you to attend the Annual Meeting of Stockholders of Applied Energetics, Inc. (“Applied Energetics”) to be held on October 29, 2024, at 10:00 a.m., Arizona time (the “Annual Meeting”). The Annual Meeting will be held at Applied Energetics’ headquarters at the UA Tech Park, 9070 S Rita Road, Suite 1500, Tucson, AZ 85747. During our Annual Meeting, we will discuss each item of business described in the Notice of Annual Meeting and Proxy Statement, and, as time permits, we will discuss our business operations. We also plan to set aside time for questions after the meeting.

We hope that you will exercise your right to vote, either by attending the Annual Meeting and voting in person or by voting through other acceptable means, as promptly as possible. Stockholders of record at the close of business on September 6, 2024, are entitled to notice of, and to vote at, the meeting. We will be using the “notice and access” method of providing proxy materials to you via the internet. On or about September 18, 2024, we are mailing to our stockholders a notice of availability of proxy materials containing instructions on how to access our Proxy Statement and our 2023 Annual Report on Form 10-K and vote electronically via the internet. The notice also contains instructions on how to receive a printed copy of your proxy materials. You may vote over the internet or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card (or voting instruction form, if you hold your shares through a broker). Please review the instructions for each of your voting options described in the Proxy Statement, as well as in the Notice you will receive in the mail.

We are delighted to have you as a stockholder of Applied Energetics and thank you for your ongoing support.

|

|

|

Sincerely,

|

| |

|

/s/ Gregory J. Quarles

|

| |

|

President and Chief Executive Officer

|

Table of Contents

APPLIED ENERGETICS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 29, 2024

TO THE STOCKHOLDERS OF APPLIED ENERGETICS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Applied Energetics, Inc. (“Applied Energetics” or the “Company”) will be held on Tuesday, October 29, 2024, at 10:00 a.m. Arizona time (the “Annual Meeting”), at the Company’s headquarters at the UA Tech Park, 9070 S Rita Road, Suite 1500, Tucson, AZ 85747, for the following purposes:

To elect the following members of the Company’s Board of Directors, each to serve for the terms set forth opposite his or her name and until his or her successor is duly elected and qualified:

|

Name

|

|

Term

|

|

John E. Schultz

|

|

One Year

|

|

Gregory J. Quarles

|

|

Two Years

|

|

Michael J. Alber

|

|

Two Years

|

|

Bradford T. Adamczyk

|

|

Three Years

|

|

Mary P. O’Hara

|

|

Three Years

|

To ratify the appointment of RBSM LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

To consider and act upon any other matter that may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement for Annual Meeting of Stockholders. We are beginning mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about September 18, 2024, to stockholders of record at the close of business on September 6, 2024. The Notice contains instructions on how to access our Proxy Statement, our 2023 Annual Report on Form 10-K and the form of proxy on the Internet, as well as instructions on how to request a paper copy of the proxy materials. Only stockholders of the Company of record at the close of business on September 6, 2024, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

All stockholders of the Company are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the Annual Meeting, you are urged to vote over the Internet, or by marking, signing, dating, and returning your proxy card. You may revoke your voted proxy at any time prior to the Annual Meeting or vote in person if you attend the Annual Meeting.

The Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, are available at:www.cstproxy.com/appliedenergetics/2024 or our website, www.appliedenergetics.com.

|

|

|

By Order of the Board of Directors,

|

|

Dated: September 18, 2024

|

|

|

| |

|

/s/ Mary P. O’Hara

|

| |

|

General Counsel, CLO and Secretary

|

IMPORTANT: WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO VOTE YOUR SHARES AS PROMPTLY AS POSSIBLE. IN ADDITION TO VOTING IN PERSON, STOCKHOLDERS OF RECORD MAY VOTE OVER THE INTERNET AS INSTRUCTED IN THE PROXY MATERIALS. YOU MAY ALSO VOTE BY MARKING, SIGNING, DATING AND MAILING THE PROXY CARD PROMPTLY IN THE RETURN ENVELOPE PROVIDED. PLEASE NOTE THAT IF YOUR SHARES ARE HELD BY A BROKER OR OTHER INTERMEDIARY, AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN A LEGAL PROXY FORM FROM THAT RECORD HOLDER.

Table of Contents

i

Table of Contents

APPLIED ENERGETICS, INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

PROXY SUMMARY

General Voting and Meeting Information

The Notice and Access cards detailing the availability of this Proxy Statement and proxy card are being mailed to stockholders on or about September 18, 2024, and all proxy documents will be made available via: www.cstproxy.com/appliedenergetics/2024. It is important that you carefully review the proxy materials and follow the instructions below to cast your vote on all voting matters.

Voting Methods

Even if you plan to attend the Annual Meeting in person, please vote as soon as possible by using one of the following advance voting methods.

Voting via the internet helps save money by reducing postage and proxy tabulation costs.

|

VOTE BY INTERNET* 24 hours a day/7 days a week

|

|

Instructions:

1. Read this Proxy Statement.

2. Go to the applicable website listed on your proxy card or voting instruction form.

3. Have this Proxy Statement, proxy card, or voting instruction form in hand and follow the instructions.

|

|

VOTE BY MAIL

|

|

Instructions:

1. Read this Proxy Statement.

2. Fill out, sign and date each proxy card or voting instruction form you receive and return it in the prepaid envelope.

|

Voting at the Annual Meeting

Stockholders of record as of September 6, 2024 (the “Record Date”) may vote at the Annual Meeting. Beneficial owners holding through a bank, broker or other nominee may vote in person if they have a “legal proxy” from their brokerage firm, bank, or custodian giving you the right to vote the shares. Beneficial owners should contact their bank or brokerage account representative to learn how to obtain a legal proxy. Please also bring a valid photo identification to attend the Annual Meeting. We encourage you to vote your shares in advance of the Annual Meeting by one of the methods described above, even if you plan on attending the Annual Meeting.

Voting Matters and Board Recommendations

Stockholders are being asked to vote on the following matters at the 2024 Annual Meeting:

PROPOSAL 1 — Election of Directors

Recommendation: FOR

Election of director nominees. The Board believes that the nominees’ knowledge, skills, and abilities make them the most effective board members to continue to steer the Company through this period of its development.

PROPOSAL 2 — Approval of RBSM LLP as Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2024

Recommendation: FOR

The Board of Directors has appointed RBSM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. The Board believes that the retention of RBSM LLP is in the best interests of the Company and its stockholders and is seeking ratification and approval of its selection. Such approval is not required under the Company’s Certificate of Incorporation, By-laws or other constituent documents.

1

Table of Contents

QUESTIONS AND ANSWERS

Q: Why am I receiving these materials?

A: Our Board of Directors has made these materials available to you on the internet or, upon your request, delivered printed proxy materials to you, in connection with the solicitation of proxies for use at the Company’s Annual Meeting of Stockholders, which will take place at 10:00 am local time on Tuesday, October 29, 2024, at the Company’s headquarters, UA Tech Park, 9070 S Rita Road, Suite 1500, Tucson, AZ 85747. As a stockholder, you are invited to attend the Annual Meeting, and you are requested to vote on the items of business described in this Proxy Statement.

Q: What is a proxy statement and what is a proxy card?

A: A proxy statement provides you with information you need to make an informed decision regarding whether to designate a proxy to vote your shares at the Annual Meeting. The proxy card is a document you sign indicating who may vote your shares of common stock, and the person you designate to vote your shares is called a proxy. By signing and returning the proxy card provided by the board, you are designating the proxies named therein as your proxy to cast your votes at the Annual Meeting. The proxies intend to cast your votes as you indicate on the proxy card.

The Company’s management and other related persons may solicit proxies. The Company will bear the cost of soliciting proxies and will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable, out-of-pocket expenses for forwarding proxy and solicitation material to the owners of our common stock.

Q: Who is entitled to vote at the 2024 Annual Meeting of Stockholders?

A: Only stockholders of record of Applied Energetics, Inc. at the close of business on Record Date may vote at the 2024 Annual Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the Record Date.

Q: What is the difference between a stockholder of record and a beneficial owner?

A: A “stockholder of record” is one that holds shares, registered directly in his, her or its name with the Company’s transfer agent, Continental Stock Transfer and Trust. As a stockholder of record, you should receive a notice regarding the availability of the Proxy Statement, Annual Report, and proxy card directly from us.

The term “beneficial owner” is used in a broader sense to include those whose shares are held in a brokerage account or by a bank or other nominee. As a beneficial owner, you will receive a notice regarding the availability of the Proxy Statement, Annual Report, and voting instruction form forwarded to you by your broker, bank, or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct the holder of record to vote your shares by following the instructions provided in your proxy materials. If you do not give instructions to the holder of record of your shares, it will nevertheless be entitled to vote your shares with respect to “routine” items but will not be permitted to vote your shares with respect to “non-routine” items. In the case of a non-routine item, your shares will be considered “broker non-votes” on that proposal.

Q: Will there be any other items of business on the agenda?

A: We do not expect any other items of business because the deadline for stockholder proposals and nominations has already passed. Nonetheless, in case there is an unforeseen need, the accompanying proxy gives discretionary authority to the persons named on the proxy with respect to any other matters that might be brought before the meeting. Those persons intend to vote that proxy in accordance with their best judgment.

Q: How will my shares be voted?

A: If you indicate your intention with respect to any or all proposals listed on the proxy card, your shares will be voted in accordance with your wishes as so indicated. If you sign and return the proxy card, but do not specify how your shares are to be voted, the proxies intend to vote your shares FOR the director nominees in Proposal No. 1 and FOR Proposal No. 2.

2

Table of Contents

Q: What constitutes a quorum?

A: A quorum is the minimum number of stockholders necessary to conduct business at the Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the issued and outstanding shares of the Company’s common stock on the Record Date will constitute a quorum. As of the close of business on the Record Date, there were 213,760,472 shares of common stock outstanding. Votes “for” and “against,” “abstentions,” and broker “non-votes” will all be counted as present to determine whether a quorum has been established.

Q: What is the vote required for each proposal to pass?

A: Required votes for each proposal are as follows:

Proposal No. 1 — Election of Directors: The affirmative vote “FOR” of a plurality of the votes cast at the Annual Meeting is required for the election of each director. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors so indicated or the other items to be voted on; although, it will be counted for purposes of determining whether there is a quorum. Voting Shares represented by properly executed proxies for which no instruction is given will be voted “FOR” election of the nominees for director.

Proposal No. 2 — Ratification of Independent Registered Public Accounting Firm: The affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting, in person or by proxy, is required to ratify our selection of RBSM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Abstentions will have the practical effect of a vote not to ratify our selection. Because we believe that Proposal No. 2 is a routine proposal on which a broker or other nominee is generally empowered to vote, broker “non-votes” likely will not result from this proposal. If you are a beneficial owner holding shares through a broker, bank, or other nominee and you do not instruct your broker or bank, your broker or bank may cast a vote on your behalf for this proposal.

3

Table of Contents

PROPOSAL 1

The following individuals, all of whom are currently directors, are nominated to continue to serve on the Board of Directors, for the term set forth opposite his or her name:

|

Name

|

|

Term

|

|

Class

|

|

John E. Schultz

|

|

One Year

|

|

Class I

|

|

Gregory J. Quarles

|

|

Two Years

|

|

Class II

|

|

Michael J. Alber

|

|

Two Years

|

|

Class II

|

|

Bradford T. Adamczyk

|

|

Three Years

|

|

Class III

|

|

Mary P. O’Hara

|

|

Three Years

|

|

Class III

|

Issued and outstanding shares of our common stock are entitled to one vote per share for each director for the term indicated and until a successor has been elected and qualified or the director’s earlier resignation or removal. Cumulative voting is not permitted. Pursuant to our Certificate of Incorporation, as amended, our Board of Directors is divided into three classes with each class of directors serving for a three-year term or until successors of directors serving in that class have been elected and qualified. We recently adopted the Company’s First Amended and Restated By-laws which bring the structure of the board into line with the Certificate of Incorporation. Accordingly, we are now proposing for election the directors listed above in three classes (I, II, and III), each to serve initially for the number of years indicated. Following this Annual Meeting, the board plans to nominate each class whose term is expiring for a three-year term following the date of re-election. Similarly, any director elected to replace a sitting director will be nominated by class and stand for re-election to a three-year term if and when nominated upon expiration of his or her then-current term.

Unless stated to be voted otherwise, each proxy will be voted for the election of the nominees named. The nominees have consented to serve as directors if elected. If a nominee becomes unavailable for election before the Annual Meeting of Stockholders, the Board of Directors may name a substitute nominee and proxies will be voted for such substitute nominee unless an instruction to the contrary is written on the proxy card.

Information about Director Nominees

Messrs. Adamczyk and Schultz joined the Board of Directors in March and November of 2018, respectively; Dr. Quarles joined in May 2019, Ms. O’Hara joined in August 2021, and Mr. Alber joined in April 2024. Mr. Alber was elected to the board, effective April 1, 2024, by the other then sitting directors to fill a vacancy. Following is a brief description of the business experiences, ages as of August 31, 2024, and positions and offices with the Company for each of the director nominees. Additional information regarding management and compensation appears elsewhere in this Proxy Statement.

Bradford T. Adamczyk, Executive Chairman and Director, age 55

Mr. Adamczyk was elected as the Company’s Chairman in May 2019 and its Executive Chairman in November 2021. He served as Principal Executive Officer from August 6, 2018, until becoming Chairman and was elected as a Company director on March 8, 2018. Mr. Adamczyk has over 25 years of experience in investments and financial analysis. He founded MoriahStone Investment Management in 2013. MoriahStone Investment Management specializes in both public equities and small-cap private companies. From 2014 until 2024, he served on the board of advisors of BroVo Spirits, LLC (which, in 2018, became the board of directors), acting as its Chairman from 2018 – 2024. He still serves on its board of directors. Prior to founding MoriahStone, he was a senior securities analyst at Columbus Circle Investors in Stamford, CT, where he focused on traditional and emerging technology investments. Mr. Adamczyk started his financial career at Morgan Stanley after business school. Mr. Adamczyk helped drive the initial recapitalization efforts of Applied Energetics in 2018. He was part of the team that led the 2018 proxy of Applied Energetics, establishing a new company board and management team and recapitalizing the Company to pursue the development of its technology and IP portfolio. He received his MBA from the University of Michigan and his undergraduate degree from Western Michigan University, graduating Magna Cum Laude.

Gregory J. Quarles, President and Chief Executive Officer and Director, age 63

Dr. Quarles was elected as the Company’s Chief Executive Officer and as a Company director effective May 4, 2019. In January 2021, the Board of Directors also elected him as President of the Company. Prior to May 2019, he had served on the Company’s Scientific Advisory Board since March 18, 2017. Before joining Applied Energetics,

4

Table of Contents

Dr. Quarles spent six years with Optica (formerly, The Optical Society of America) in Washington D.C., both as a member of the Board and the Executive Committee and more recently as the Chief Scientific Officer. His responsibilities at Optica encompassed a broad range of scientific, technical and engineering infrastructure, and included content development for the Optica meetings portfolio, along with many other related projects, highlighted by his reports to Congress. Moreover, Dr. Quarles had been personally involved through Optica in the establishment of many crucial partnerships involving major R&D laboratories and global agencies worldwide. This involvement included being a long-standing member of the U.S. Department of Commerce, Bureau of Industry and Security, and Sensors and Instrumentation Technical Advisory Committee. In addition to his executive leadership, Dr. Quarles is a well-respected member of the laser development community globally with over 35 years of experience since the award of his Ph.D. from Oklahoma State University. He has served on the board of directors of Nanocerox, Inc., a private company, since 2011, and on the Physics Department Advisory Board of Oklahoma State University, and the LLE Advisory Board of the University of Rochester, since 2017 and 2021, respectively. He is a Fellow in both the SPIE and Optica, a Senior Member of the IEEE and received the Memorial D.S. Rozhdestvensky Medal from the Russian Optical Society (2015). In 2016, he joined the Oklahoma State University CAS Hall of Fame, and in 1996 received the R&D 100 Award for the Ce:LiSAF Laser System.

John E. Schultz Jr., Director, age 71

Mr. Schultz was elected as a Company director on November 11, 2018. Mr. Schultz has had a long affiliation with Wall Street, having founded CSG Spectra, Inc., a risk analytics firm, in 1984. He also founded Oak Tree Asset Management Ltd. in 2000, where he actively trades securities in managed LLC’s. Mr. Schultz’s strong networks have emphasized outside-the-box investment opportunities and early-stage new frontier private equity investment deals. Mr. Schultz has an intimate knowledge of Applied Energetics, including its history and financials and has in the past served as a consultant to the company. Additionally, Mr. Schultz helped drive the initial recapitalization efforts of Applied Energetics in 2018. He was part of the team that led the 2018 proxy of Applied Energetics, establishing a new company board and management team and recapitalizing the Company to pursue the development of its technology and IP portfolio. Mr. Schultz is a graduate of California State University at Long Beach.

Mary P. O’Hara, General Counsel, Chief Legal Officer, Secretary and Director, age 57

Ms. O’Hara was appointed to the Board of Directors on August 20, 2021. Ms. O’Hara was appointed General Counsel and Chief Legal Officer in January 2022 and Secretary in September 2022. She has been in private law practice for over thirty years and has broad experience in all facets of securities, corporate and commercial law. Prior to her joining the Company full time, she was affiliated with the law firm of Masur, Griffitts, Avidor, LLP (now known as Griffitts LLP) and had represented the Company for several years. Previously, she was a partner at Hodgson Russ LLP and an associate at Fulbright & Jaworski LLP (now known as Norton Rose Fulbright) and Mayer Brown & Platt, LLP (now known as Mayer Brown LLP). Ms. O’Hara has a J.D. from New York University School of Law and a B.A. in Economics, magna cum laude, from the University of New Mexico.

Michael Alber, Director, age 67

Mr. Alber has an extensive career spanning over 35 years in corporate finance, capital markets, treasury, risk allocation and mergers and acquisition experience. From April 2021, he was the Chief Financial Officer and Founder of First Light Acquisition Group (NYSE: FLAG), a special purpose acquisition company. He previously served on the SSA (Special Security Agreement) of AceInfo Tech (subsidiary of Dovel Technologies) and advisory board of Sincerus Global Solutions. From June 2016, he was the Chief Financial Officer and Executive Vice President of KeyW (NASDAQ: KEYW), until its sale to Jacobs (NYSE: J) in June 2019. During this period, he led several capital market transactions along with two strategically important M&A transactions, one that resulted in a record setting sale multiple and change in control. Mr. Alber served as a Principal with Growth Strategy Leaders, a business and financial consulting firm (specializing in M&A and due diligence support), from April 2015 to May 2016, and as Chief Financial Officer and SVP at Engility Corporation (NYSE: EGL) a $2.5 billion technology services and solutions provider to both U.S. Government and International customers from May 2012 to March 2015. During this period, he supported the company’s spin-out from L3 Technologies as a stand-alone publicly traded company. Prior to Engility, Mr. Alber held the position of Chief Financial Officer and Treasurer at Alion Science and Technology from 2007 to 2012. He has also held senior executive positions at SAIC (NYSE: SAIC) for 18 years, where he served as a Senior Vice President and Group CFO, and prior to that was Director of Finance at Network Solutions, Inc. He has served on the board of directors of Sincerus Global Solutions, a private company, since October 2022. Mr. Alber received his

5

Table of Contents

Bachelor of Science degree from George Mason University in Business Administration with a concentration in finance and subsequently completed an Advanced Management Program (AMP) at Georgetown University’s McDonough School of Business.

Board of Directors Independence and Committees

The Company is currently listed on the OTCQB Market, the listing standards of which do not require the appointment of committees or that any number of directors meet any standards of independence, except in the case of an “alternative reporting company,” which Applied Energetics is not. However, the Board of Directors is discussing recruiting additional directors and implementing a committee structure in the future, noting that the Company has had one in the past. If the board appoints additional directors and/or constitutes board committees, such developments will be described in the Company’s reports on file with the Securities and Exchange Commission.

Board Meetings and Attendance

The Company’s Board of Directors generally holds at least one formal telephonic meeting per month, and frequently schedules an additional informal conference call for informational purposes only. During the fiscal year ended December 31, 2023, the board held 12 formal meetings, 11 of which were regularly scheduled and one of which was a special meeting. Each nominee for director, who was also then a director, attended all formal board meetings during 2023. All nominees are expected to attend the 2024 Annual Meeting. Each of the directors then in office also attended the 2023 Annual Meeting.

All five directors are nominated for re-election to the Board of Directors for the terms set forth.

Vote Required

In compliance with our corporate By-laws, the election of each director nominee requires the affirmative vote “FOR” of a plurality of the shares present in person or by proxy at the Annual Meeting.

The Board of Directors recommends that Stockholders vote “FOR” election of the nominees for director named above.

6

Table of Contents

PROPOSAL 2

Ratification of the Appointment of RBSM LLP

as the Company’s Independent Registered Public Accounting Firm

for the Fiscal Year Ending December 31, 2024

The Board of Directors has selected RBSM LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. The board is submitting the appointment of our independent registered public accounting firm to the stockholders for ratification at the Annual Meeting.

A representative of RBSM LLP is expected to be available either in person or by teleconference at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and is expected to be available to respond to appropriate questions.

Stockholder ratification of the appointment of RBSM LLP as the Company’s independent registered public accounting firm is not required by the Company’s Certificate of Incorporation, By-laws or otherwise; however, the Board of Directors is submitting the selection of RBSM LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the board will review its future selection of an independent registered public accounting firm considering that vote result. Your ratification of the appointment of RBSM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, does not preclude us from terminating our engagement of RBSM LLP and retaining a new independent registered public accounting firm if we determine that such an action would be in the best interests of the Company and its stockholders.

Principal Accountant Fees and Services:

On November 15, 2022, the Company engaged RBSM LLP as its independent registered public accounting firm for the audit of our financial statements for the year ended December 31, 2022. On November 15, 2023, the Company engaged RBSM LLP as its independent registered public accounting firm for the audit of our financial statements for the year ended December 31, 2023. The following is a summary of the fees billed to the Company by RBSM LLP for professional services rendered for the years ended December 31, 2023 and 2022, respectively.

|

|

|

2023

|

|

2022

|

|

Audit fees

|

|

$

|

61,000

|

|

$

|

54,000

|

|

Audit related fees

|

|

|

—

|

|

|

—

|

|

All other fees

|

|

|

—

|

|

|

—

|

|

Tax fees

|

|

|

6,000

|

|

|

6,000

|

| |

|

|

67,000

|

|

|

60,000

|

Fees for audit services include fees associated with the annual audit of the Company and its subsidiaries and the review of our quarterly reports on Form 10-Q. Other fees include review and consent with respect to registration statements which require such review. Tax fees include tax compliance, tax advice, research and development credits and tax planning related to federal and state tax matters.

Vote Required

Ratification of the appointment of RBSM LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 requires the affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and voting FOR the proposal.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of RBSM LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024.

7

Table of Contents

DIRECTORS AND EXECUTIVE OFFICERS

The following is information with respect to our executive officers and directors:

|

Name

|

|

Age

|

|

Principal Position

|

|

Director Term Expiring in

|

|

Bradford T. Adamczyk

|

|

55

|

|

Director and Executive Chairman

|

|

Two Years

|

|

Gregory J. Quarles

|

|

63

|

|

Director, President and Chief Executive Officer

|

|

Two Years

|

|

Michael J. Alber

|

|

67

|

|

Director

|

|

*

|

|

Christopher W. Donaghey

|

|

52

|

|

Chief Operating and Financial Officer

|

|

N/A

|

|

Mary P. O’Hara

|

|

57

|

|

Director, General Counsel, Chief Legal Officer and Secretary

|

|

Two Years

|

|

John E. Schultz Jr.

|

|

71

|

|

Director

|

|

Less Than One Year

|

|

Stephen W. McCahon

|

|

66

|

|

Chief Science Officer and Consultant

|

|

N/A

|

Information Regarding Messrs. Donaghey and McCahon

(Information regarding director nominees appears under Proposal 1 elsewhere in this Proxy Statement.)

Christopher Donaghey

Mr. Donaghey is an experienced financial executive with extensive experience in the defense industry. Mr. Donaghey most recently served as senior vice president and head of corporate development for Science Applications International Corporation (SAIC), a defense and government agency technology integrator, where he was responsible for executing the company’s mergers and acquisitions (M&A) and strategic ventures strategy. He joined SAIC in 2017, as senior vice president of finance for SAIC’s operations. Mr. Donaghey is also a Founder and Executive Board member of the Silicon Valley Defense Group, a non-profit organization whose mission is to create the nexus of pioneering ideas, people, and capital that will unlock new sources of innovation for national security and power the digital evolution of the defense industrial base. Prior to joining SAIC, Donaghey was Vice President of Corporate Strategy and Development for KeyW Corporation, a national security solutions provider for the intelligence, cyber and counterterrorism communities, where he guided the overall corporate strategy, M&A, and capital markets activities. Mr. Donaghey was also a senior research analyst for SunTrust Robinson Humphrey Capital Markets during which time, he was ranked the number one defense analyst and number two analyst overall for stock selection by Forbes/Starmine in 2005 and was named in the Wall Street Journal Best on the Street survey in 2005, 2008, and 2009.

Mr. Donaghey served in the U.S. Navy Reserve where he provided scientific and technical analysis of missile guidance and control systems and advanced electronics for the Short-Range Ballistic Missile group at the Defense Intelligence Agency’s Missile and Space Intelligence Center. Donaghey earned his bachelor’s degree in mechanical engineering from Texas Tech University and served as an officer in the U.S. Navy. Mr. Donaghey served on Applied Energetics’ Board of Advisors from April 30, 2019 until becoming Chief Operating and Financial Officer.

Stephen W. McCahon

Dr. Stephen McCahon has served as the Company’s Chief Science Officer since May 1, 2023. Dr. McCahon has been a scientific researcher, technology developer, and entrepreneur for over 30 years. He has co-authored more than 50 scientific publications and has more than 30 patents issued, patents pending, or invention disclosures in preparation for patent submission. He was an original founder of Applied Energetics, Inc. and then returned to the Company to serve as our Chief Scientist, pursuant to a Consulting Agreement, dated as of May 24, 2019, providing input into the strategic direction of the Company and assistance in building relationships in the defense markets. Dr. McCahon was a Member of the Research Staff in the Optical Physics Department at the Hughes Research Laboratory in Malibu, California from 1986 to 1996 performing basic research in the area of optical physics and non-linear optical materials. In 1996, Dr. McCahon moved to Raytheon (Hughes) Missile Systems Co, in Tucson, AZ during which time he was significantly responsible for the successful creation and development of the Directed Energy Weapons Product Line and served as its Chief Scientist. He left Raytheon in 2002 to co-found Applied Energetics Inc. in Tucson, AZ to develop Directed Energy Weapons for the Defense Department including very high energy and average power ultrashort pulse (USP) laser sources and Laser Guided Energy (LGE®) technologies. In April 2010, he left Applied

8

Table of Contents

Energetics to form Applied Optical Sciences where he developed technologies related to the application of optical physics to a broad range of areas, including photonics and USP laser development. From February 2016 through May 2019, he served as a consultant to the Company. In 2019, Applied Energetics purchased substantially all of the assets of Applied Optical Sciences, integrating it into Applied Energetics, and retained him as Chief Scientist through the above-mentioned Consulting Agreement. He served as Chief Scientist under this Consulting Agreement until the board appointed him Chief Science Officer on May 1, 2023. Dr. McCahon is a graduate of the University of Southern California (BSEE, MSEE) and holds a Ph.D., Photonics, Inter-disciplinary Physics and Electrical Engineering, from the University of Iowa.

Directors Qualifications, Experience and Skills

Our directors bring to our board a wealth of executive leadership experience and technical knowledge derived from their service, respectively, as senior executives, founders of industry and legal or financial professionals. Our board members have demonstrated strong business acumen and an ability to exercise sound judgment, and each of them has a reputation for integrity, honesty and adherence to ethical standards. When considering whether each director/nominee has the experience, qualifications, attributes, and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the other board members focused primarily on the information discussed in each of the directors’ individual biographies set forth above and the specific individual qualifications, experience and skills as described below:

• Mr. Adamczyk’s qualifications as a director include his expertise in corporate finance, capital markets, strategy and building high performing teams to execute the Company’s business strategy. Mr. Adamczyk was part of the team that led the 2018 proxy of Applied Energetics, establishing a new company board and management team and recapitalizing the Company to pursue the development of its technology and IP portfolio. He, along with the others in this group, continues his work to establish a foundation of good corporate governance and transparency, and focus the Company’s efforts in driving growth and stockholder value.

• Dr. Quarles’s qualifications as a director include his experience as director and senior executive in the laser industry with primary focus on the defense and aerospace sector.

• Mr. Schultz’s qualifications as a director include his expertise in the equity investment industry. He has been a friend of Applied Energetics since its public inception in 2004 and has an intimate knowledge of the Company’s background, including its history and financials. Mr. Schultz and his entity Oak Tree Asset Management were part of the team that led the 2018 proxy, establishing a new company board and management team and recapitalizing the Company to pursue the development of its technology and IP portfolio. He, along with the others in this group, continues his work to establish a foundation of good corporate governance and transparency.

• Ms. O’Hara’s qualifications as a director include her many years of experience in securities, corporate and commercial law and the business and financial knowledge she has acquired over those years as well. She has also acquired specific knowledge and experience in the various other areas of law and business that affect the Company on a daily basis.

• Mr. Alber’s qualifications as a director include 30+ years of experience serving in executive leadership positions within both public and private companies, possessing a strong balance of strategic thinking, business acumen and operational skills. He has served as a finance executive, with particular experience with publicly listed government contractors where he has navigated challenging situations and handled many of the issues that typically face growing companies in this space. He also has experience with stock exchange listings and knows the relevant processes, criteria, and requirements as well as extensive experience with capital restructuring transactions, including initial public offering (IPO), multiple debt/equity offerings, new credit facilities, and equity buy-back programs. He has led multiple strategic acquisitions, divestitures and reorganizations to drive growth, diversification, and shareholder value.

9

Table of Contents

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires certain officers and directors of Applied Energetics, and any persons who own more than ten percent of the common stock outstanding to file forms reporting their initial beneficial ownership of shares and subsequent changes in that ownership with the SEC. Officers and directors of Applied Energetics, and greater than ten percent beneficial owners are also required to furnish us with copies of all such Section 16(a) forms they file. Based on a review of these filings, the initial Form 3 for the Company’s Chief Financial Officer and a Form 4 reporting a change in ownership for Mr. Schultz were filed after their respective deadlines. The Company does not believe any other officers or directors failed to timely file any required forms under Section 16(a) during the year ended December 31, 2023.

Code of Ethics

Applied Energetics has adopted a Code of Business Conduct and Ethics that applies to all of Applied Energetics’ employees and directors, including its Chief Executive Officer and Chief Financial Officer (and principal accounting officer). Applied Energetics’ Code of Business Conduct and Ethics covers all areas of professional conduct including, but not limited to, conflicts of interest, disclosure obligations, insider trading, confidential information, as well as compliance with all laws, rules and regulations applicable to Applied Energetics’ business.

Our Code of Ethics and Business Conduct is available upon request made to us in writing at the following address, and will be provided without charge:

Applied Energetics, Inc.

Attention: Chief Legal Officer

9070 S. Rita Road, Suite 1500

Tucson, AZ 85747

Committees of the Board of Directors and Director Independence

The members of the Board of Directors continue to evaluate the need and utility of establishing one or more committees of the Board of Directors and to review relevant legal or regulatory requirements with respect thereto. At present all functions that would be fulfilled by committees are being fulfilled by the entire board, and the board believes that currently no committees are necessary or legally required. Although, as a “smaller reporting company” on the OTCQB Market, the Company is not currently required to have Independent Directors, the Board of Directors believes that Messrs, Adamczyk, Schultz, and Alber qualify as Independent Directors, as defined in the OTCQB Standards.

Executive Employment Agreements

See “Executive Compensation — Employment Agreement for Named Executive Officers” elsewhere in this Proxy Statement.

Communication Directed to the Board

Any stockholder interested in addressing a communication to the Board of Directors may do so directly by mail to the following address:

Applied Energetics, Inc.

Attention: Board of Directors

9070 S. Rita Road, Suite 1500

Tucson, AZ 85747

10

Table of Contents

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table discloses the compensation for the persons who served as our Executive Chairman, President and Chief Executive Officer, Chief Operating and Financial Officer, General Counsel, Chief Legal Officer and Secretary, and Chief Science Officer for the years ended December 31, 2023 and 2022. Dr. Quarles has been our Chief Executive Officer since May 6, 2019 and was elected President as of January 2021. Ms. O’Hara was appointed General Counsel and Chief Legal Officer in January 2022 and Secretary in September 2022. Mr. Donaghey was appointed Chief Operating and Financial Officer in July 2022. Mr. Adamczyk received compensation as a director as set forth under Director Compensation below.

|

Name and Principal Position

|

|

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

Stock

Awards

($)(1)

|

|

Option

Awards

($)(1)

|

|

All Other

Compensation

($)

|

|

Total

|

|

Bradford T. Adamczyk,

|

|

2023

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

Executive Chairman

|

|

2022

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gregory J Quarles,

|

|

2023

|

|

$

|

400,000

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

400,000

|

|

President and Chief Executive Officer

|

|

2022

|

|

$

|

353,632

|

|

$

|

95,000

|

|

$

|

3,850,454

|

(2)

|

|

$

|

—

|

|

$

|

—

|

|

$

|

4,299,086

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Christopher Donaghey,

|

|

2023

|

|

$

|

350,000

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

350,000

|

|

Chief Operating and Financial Officer

|

|

2022

|

|

$

|

145,833

|

|

$

|

—

|

|

$

|

920,000

|

(2)

|

|

$

|

1,977,796

|

|

$

|

—

|

|

$

|

3,043,629

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mary P. O’Hara,

|

|

2023

|

|

$

|

250,000

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

250,000

|

|

General Counsel, CLO and Secretary

|

|

2022

|

|

$

|

250,000

|

|

$

|

—

|

|

|

|

|

|

$

|

1,301,130

|

|

$

|

—

|

|

$

|

1,551,130

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen McCahon,

|

|

2023

|

|

$

|

300,000(3)

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

300,000

|

|

Chief Scientist

|

|

2022

|

|

$

|

250,000(3)

|

|

$

|

—

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

250,000

|

11

Table of Contents

Director Compensation

The following table discloses our director compensation for the years ended December 31, 2023 and 2022:

|

Name

|

|

Year

|

|

Fees

Earned or

Paid in

Cash

($)

|

|

Stock

Awards

($)

|

|

Option

Awards

($)(1)

|

|

All Other

Compensation

($)

|

|

Total

|

|

Bradford T. Adamczyk,

|

|

2023

|

|

$

|

215,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

215,000

|

|

Executive Chairman

|

|

2022

|

|

$

|

215,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

215,000

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Alber(1)

|

|

2023

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

| |

|

2022

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John E. Schultz, Jr.

|

|

2023

|

|

$

|

90,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

90,000

|

| |

|

2022

|

|

$

|

90,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

90,000

|

Board Considerations in Determining Salaries

Our executive compensation program is designed to attract, retain, and incentivize talented executives with a dedication to achieving our scientific and strategic objectives. Our 2023 compensation program consisted primarily of base salary as we awarded certain officers time vesting equity during the prior year. Compensation of our named executive officers is primarily determined by compensation levels in the market for their services, among large- and small-cap defense and technology companies. The Board considers recommendations from various outside consultants and other informed sources in making compensation decisions. Aligning executive compensation with stockholder interests is a key consideration for our compensation program. As we continue to grow, we anticipate developing and evolving our compensation program around specific objectives and key responsibilities with metrics and compensation targets.

Employment Agreements for Named Executive Officers

As of April 18, 2019, we entered into an Executive Employment Agreement with Dr. Gregory J. Quarles setting forth the terms of his service as Chief Executive Officer. The agreement is for a term of three years and is renewable thereafter for sequential one-year periods. The agreement may be terminated by the company for “cause” or by Quarles for “Good Reason” both of which terms are defined in the agreement. The agreement may also be terminated, without cause or Good Reason, by either party upon sixty days’ written notice to the other.

The agreement calls for (i) a cash salary of $250,000 per annum, payable monthly, and eligibility for a discretionary bonus within 60 days of the end of each year, and (ii) options to purchase up to 5,000,000 shares of our common stock at an exercise price of $0.35 per share. These options were issued pursuant to a grant agreement, dated as of April 18, 2019 and vest immediately with respect to 500,000 shares and in semi-annual installments with respect to the remaining 4,500,000 shares. The agreement also provides for Quarles to retain 2,000,000 options previously granted to him under a Consultant Stock Option Agreement in 2017, for his services on the Scientific Advisory Board, which are subject to vesting based on achievement of performance milestones. Dr. Quarles forfeited options to purchase an additional 1,500,000 shares under another prior option agreement. Under the agreement, Dr. Quarles also is to receive health and life insurance as well as other standard benefits. The agreement also requires the company to reimburse certain out-of-pocket expenses and to compensate Quarles in the event that it requires him to resign from certain boards on which he serves.

12

Table of Contents

In the event of a termination of the agreement by Quarles with Good Reason, or by us without cause, we must pay him any unpaid base compensation due as of the termination date as well as any pro rata unpaid bonus and any unpaid expenses. Any unvested options will vest upon such termination. In such event, we must continue to pay Dr. Quarles his monthly base compensation and any health and life insurance benefits until he has secured full-time employment, but not to exceed a period of three months from the termination date.

In the event that we terminate the agreement for cause or he terminates without Good Reason, he will receive base compensation and expense reimbursement through the date of termination but will forfeit any unvested equity compensation.

This agreement was amended December 15, 2020, increasing Dr. Quarles’ salary to $300,000 per year effective January 1, 2021, on November 30, 2021, increasing his salary to $350,000 per year effective January 1, 2022, and again, on November 29, 2022, increasing his salary to $400,000 per year effective November 1, 2022.

As of May 1, 2023, we entered into an Executive Employment Agreement with Dr. Stephen W. McCahon setting forth the terms of his service as Chief Science Officer. The agreement is for an initial term through December 31, 2025, and is renewable thereafter for sequential one-year periods unless terminated by either party. The agreement may be terminated by the company for “cause” or by McCahon for “Good Reason” both of which terms are defined in the agreement.

The agreement calls for a cash salary of $300,000 annualized for 2023, $325,000 for 2024 and $350,000 for 2025, plus standard benefits. Dr. McCahon’s salary is payable monthly. The agreement also requires the company to reimburse certain out-of-pocket expenses. In the event that we terminate the agreement for cause or he terminates without Good Reason, he will receive base compensation and expense reimbursement through the date of termination but will forfeit any unvested equity compensation.

Prior to entering into his Executive Employment Agreement described above, Dr. McCahon served as our Chief Scientist, pursuant to a Consulting Agreement, dated as of May 24, 2019 (the “SWM Consulting Agreement”), by and between the company and SWM Consulting LLC, of which he is the principal. The SMW Consulting Agreement provided for a combination of cash and equity compensation. The SWM Consulting Agreement provided for cash compensation of $180,000 for the first year and $250,000 during each of the second and third years of the term. Under the SWM Consulting Agreement, the company also repurchased 5,000,000 shares if its common stock, issued to Dr. McCahon in 2016 under a prior Consulting Agreement, at a price of $0.06 per share based on the company share price at the time of the SWM Consulting Agreement. 5,000,000 of an additional 15,000,000 shares held by Dr. McCahon are subject to a lock-up and released pro rata each month during the term of the agreement which may be accelerated in the event of termination other than for cause or a change in control. Effective May 23, 2022, the company and Dr. McCahon agreed to an extension of the SWM Consulting Agreement upon the same general terms and conditions. On January 17, 2023, the company amended the SWM Consulting Agreement. The amendment was effective as of January 1, 2023, provided for an extended term of three years, commencing on that date, and increased compensation under the agreement to $300,000, $325,000 and $350,000 per year for the first, second and third years of the extended term, respectively. The Consulting Agreement terminated upon execution of Dr. McCahon’s Executive Employment Agreement described above. Thus Dr. McCahon’s current compensation under his Executive Employment Agreement is commensurate with what he was to receive under the SMW Consulting Agreement.

Effective May 24, 2019, and in connection with the entry into the SWM Consulting Agreement, the company entered into an Asset Purchase Agreement with Applied Optical Sciences, Inc. (“AOS”), an Arizona corporation of which Stephen W. McCahon is the majority stockholder. The Asset Purchase Agreement provided for purchase of specified assets from AOS, including principally intellectual property, contracts and equipment in exchange for consideration consisting of (i) cash in the amount of $2,500,000.00, payable in the form of a Promissory Note, secured by the assets, and (ii) warrants to purchase up to 2,500,000 shares of Applied Energetics’ common stock at an exercise price of $0.06 per share. The Promissory Note was initially payable in six-month installments, with the first payment being due on the first anniversary of the note but was amended in February 2021 to extend the maturity date by six months and restructure the payment to time up to the adjusted maturity date. The amendment also called for waiver of any late payment penalties for the first two payments. The company made the first three payments of $500,000 each on February 10, 2021, May 24, 2021, and November 19, 2021, respectively. Effective May 23, 2022, the parties

13

Table of Contents

further amended the Promissory Note to extend the maturity date by an additional six months and to further restructure the remaining payments due thereunder to be monthly at $100,000 each with the final such payment being due on April 24, 2023. Accordingly, the Company paid the Promissory Note in full in April 2023.

Dr. McCahon is a significant stockholder of the Company. See “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

Effective January 1, 2022, the Company and Mary P. O’Hara entered into an Executive Employment Agreement, pursuant to which she is currently serving as General Counsel and Chief Legal Officer for an initial term of three years, with automatic renewal for additional one-year periods thereafter unless either party terminates the agreement. The agreement calls for salary of $250,000 per year, plus standard benefits and eligibility for a bonus at the discretion of the board. The Company has also granted Ms. O’Hara incentive stock options to purchase up to 640,000 shares of its common stock under its 2018 Incentive Stock Plan, which vest over four years, at an exercise price of $2.40 per share.

Effective August 1, 2022, the Company and Christopher Donaghey entered into an Executive Employment Agreement, pursuant to which he is to serve as Chief Financial and Chief Operating Officer for an initial term of four years, with automatic renewal for additional one-year periods thereafter unless either party terminates the agreement. The agreement calls for salary of $350,000 per year, plus standard benefits and eligibility for a bonus at the discretion of the board. The Company has also granted Mr. Donaghey additional options to purchase up to 1,000,000 shares of its common stock under its 2018 Incentive Stock Plan, which vest over four years and have an exercise price of $2.36 per share, and Restricted Stock Units representing up to 400,000 shares of the Company’s common stock which also vest over four years. The Restricted Stock Units are issued pursuant to a Restricted Stock Unit Agreement, dated as of July 13, 2022. Mr. Donaghey forfeited unvested options to purchase up to 950,000 shares of common stock which he had previously received for service on the Company’s Board of Advisors.

Grants of Plan-Based Awards

The Company did not grant any plan- or nonplan-based awards to our named executive officers during the fiscal year ended December 31, 2023.

Outstanding Equity Awards at Fiscal Year-End

The following table discloses unexercised options held by the named executives at December 31, 2023:

|

|

|

Option Awards

|

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#)

|

|

Number of

Securities

Underlying

Unexercised

Options

Unexercisable

|

|

Option

Exercise Price

|

|

Option

Expiration Date

|

|

Bradford T. Adamczyk

|

|

4,960,000

|

|

—

|

|

$

|

0.07

|

|

11/12/2028

|

|

Gregory J. Quarles(1)

|

|

4,970,000

|

|

—

|

|

$

|

0.35

|

|

4/18/2029

|

|

Christopher Donaghey(2)

|

|

150,000

|

|

—

|

|

$

|

0.35

|

|

4/29/2029

|

| |

|

200,000

|

|

—

|

|

$

|

0.61

|

|

5/12/2031

|

| |

|

250,000

|

|

750,000

|

|

$

|

2.36

|

|

7/13/2032

|

|

Mary P. O’Hara

|

|

280,000

|

|

80,000

|

|

$

|

1.27

|

|

8/20/2031

|

| |

|

320,000

|

|

320,000

|

|

$

|

2.40

|

|

1/1/2032

|

|

Stephen W. McCahon

|

|

—

|

|

—

|

|

|

—

|

|

—

|

14

Table of Contents

In addition to the foregoing, as of December 31, 2023, John Schultz, a director, held options to purchase up to 2,500,000 shares of common stock at an exercise price of $0.07 per share. Mike Alber, who was elected to the board effective April 1, 2024, was awarded options to purchase up to 250,000 shares of common stock at an exercise price of $1.99 per share. Details regarding these options are set forth in Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters below.

Payments upon Termination or Change-In-Control

There are no termination or change in control agreements in place that would require payments

Pay versus Performance

The following tables provide information regarding the relationship between compensation actually paid to the Company’s executive officers and its financial performance, over the periods indicated, and is required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K. Fair value amounts below are computed in a manner consistent with the fair value methodology under Black Scholes-Merton option valuation model used to account for share-based payments in our financial statements under generally accepted accounting principles. Assumptions included in these calculations are set forth in Note 1 in the Notes to Consolidated Financial Statements appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. Total stockholder return has been calculated in a manner consistent with Item 402(v) of Regulation S-K.

The disclosure included in this section is prescribed by SEC rules and does not necessarily reflect the Company’s views on the link between company performance and our named executive officers’ (“NEO”) pay. The board did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

“Compensation Actually Paid,” which is presented in the table below, is defined by the SEC and does not refer to cash amounts actually paid, earned or received by our named executive officers. A significant portion of the “Compensation Actually Paid” amounts shown relate to changes in values of awards issued in prior years. Volatility in the stock price is a major factor in calculating these values, and the market for our common stock has experienced periods of significant volatility. Such volatility generally serves to increase the valuation of options but may not yield any benefit to the individual officers holding such options. Any unvested awards remain subject to significant risk from forfeiture conditions and possible future declines in value based on changes in our share price. The ultimate values actually realized by our named executive officers from unvested equity awards, if any, cannot be determined until the awards fully vest and are exercised or settled, as the case may be.

|

Year(1)

|

|

Summary

Compensation

Table Total

for PEO

($)(2)(3)

|

|

Compensation

Actually Paid to

PEO

($)(4)

|

|

Average

Summary

Compensation

Table Total

for Non-

PEO Named

Executive

Officers

($)(2)(5)

|

|

Average

Compensation

Actually

Paid to Non-

PEO Named

Executive

Officers

($)(6)

|

|

Value of

Initial

Fixed $100

Investment

Based

on Total

Shareholder

Return

($)(7)

|

|

Net Loss

($)

|

|

2023

|

|

$

|

400,000

|

|

898,409

|

|

300,000

|

|

606,000

|

|

$

|

649

|

|

7,350,435

|

|

2022

|

|

$

|

4,299,086

|

|

2,299,555

|

|

1,614,920

|

|

924,660

|

|

$

|

576

|

|

5,771,642

|

|

2021

|

|

$

|

421,857

|

|

9,871,867

|

|

212,327

|

|

6,676,322

|

|

$

|

705

|

|

5,425,453

|

15

Table of Contents

|

Adjustments to Determine Compensation “Actually Paid” for PEO

|

|

Deduction

for Amounts

Reported

under the

“Stock

Awards”

and “Option

Awards”

Column in the

SCT

|

|

Increase

for Fair

Value of

Awards

Granted

during the

year that

Remain

Unvested as

of Year End

|

|

Increase/

deduction

for Fair

Value of

Awards

Granted

during the

year that

Vested

during year

|

|

Increase/

deduction

for Change

in Fair Value

from prior

Year-end to

current Year-

end of Awards

Granted

Prior to year

that were

Outstanding

and Unvested

as of Year-end

|

|

Increase/

deduction

for Change

in Fair Value

from Prior

Year-end to

Vesting Date

of Awards

Granted

Prior to year

that Vested

during year

|

|

Deduction

of Fair Value

of Awards

Granted

Prior

to year

that were

Forfeited or

Modified

during year

|

|

Dollar Value of

Dividends or

other Earnings

Paid on Stock

Awards prior

to Vesting Date

not otherwise

included

in Total

Compensation

|

|

Total

Adjustments

|

|

2023

|

|

$

|

—

|

|

|

—

|

|

—

|

|

498,409

|

|

|

$

|

—

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

498,409

|

|

|

2022

|

|

$

|

(3,850,454

|

)

|

|

3,830,908

|

|

—

|

|

(1,799,998

|

)

|

|

$

|

(179,988

|

)

|

|

$

|

—

|

|

$

|

—

|

|

$

|

(1,999,531

|

)

|

|

2021

|

|

$

|

—

|

|

|

—

|

|

—

|

|

1,125,010

|

|

|

$

|

8,325,000

|

|

|

$

|

—

|

|

$

|

—

|

|

$

|

9,450,010

|

|

|

Adjustments to Determine Average Compensation “Actually Paid” for Non-PEO NEOs

|

|

Deduction

for Amounts

Reported

under the

“Stock

Awards”

and Option

Awards”

Column in the

SCT

|

|

Increase for

Fair Value

of Awards

Granted

during the

year that

Remain

Unvested as

of Year End

|

|

Increase for

Fair Value

of Awards

Granted

during the

year that

Vested

during year

|

|

Increase/

deduction

for Change

in Fair Value

from prior

Year-end

to current

Year-end

of Awards

Granted

Prior to year

that were

Outstanding

and Unvested

as of Year-end

|

|

Increase/

deduction

for Change

in Fair Value

from Prior

Year-end to

Vesting Date

of Awards

Granted

Prior to year

that Vested

during year

|

|

Deduction

of Fair

Value of

Awards

Granted

Prior

to year

that were

Forfeited or

Modified

during year

|

|

Dollar Value of

Dividends or

other Earnings

Paid on Stock

Awards prior

to Vesting Date

not otherwise

included

in Total

Compensation

|

|

Total

Adjustments

|

|

2023

|

|

$

|

—

|

|

|

|

—

|

|

$

|

—

|

|

$

|

(349,825

|

)

|

|

$

|

655,825

|

|

$

|

—

|

|

|

—

|

|

$

|

306,000

|

|

|

2022

|

|

$

|

(2,099,463

|

)

|

|

$

|

2,198,467

|

|

$

|

143,733

|

|

$

|

(399,666

|

)

|

|

$

|

201,670

|

|

$

|

(735,000

|

)

|

|

—

|

|

$

|

(690,260

|

)

|

|

2021

|

|

$

|

(101,910

|

)

|

|

$

|

759,000

|

|

$

|

320,997

|

|

$

|

(82,499.07

|

)

|

|

$

|

5,568,408

|

|

|

—

|

|

|

—

|

|

$

|

6,463,996

|

|

16

Table of Contents

Pay Versus Performance Relationship Disclosures

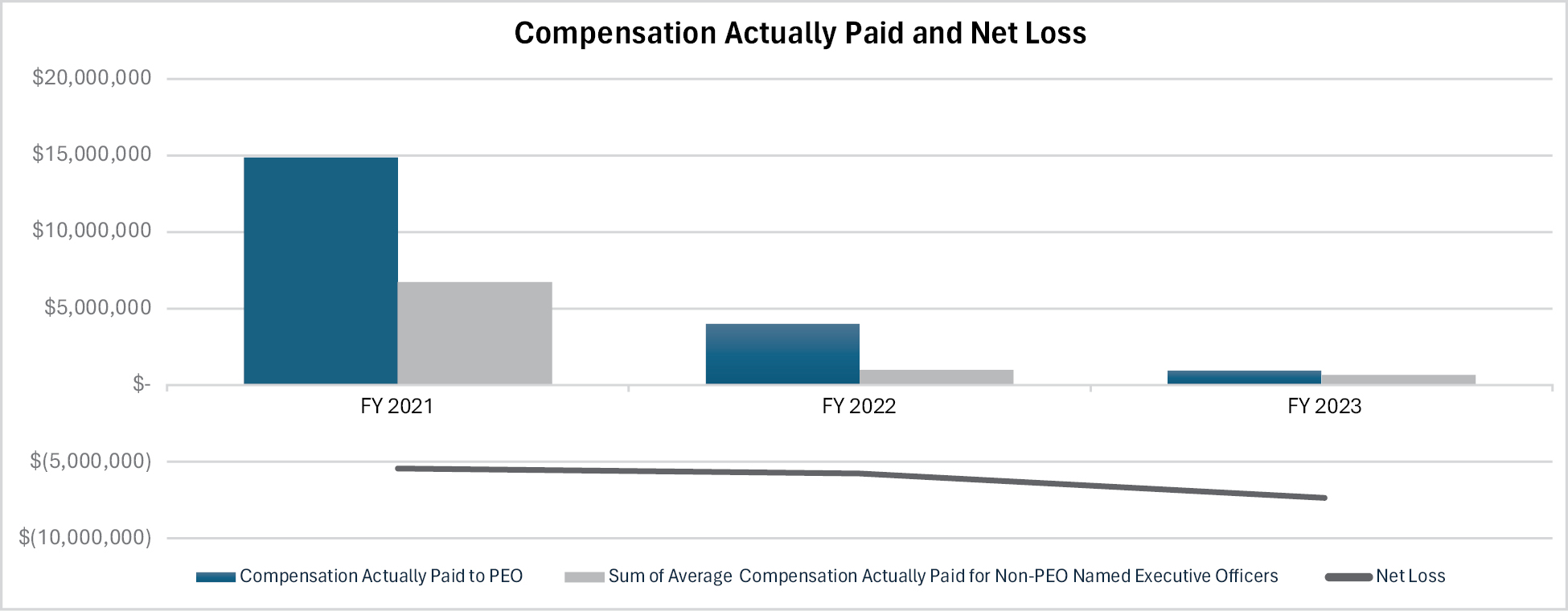

Compensation Actually Paid and Net Loss

The graph below compares the compensation actually paid to our PEO and the average of the compensation actually paid to our remaining NEOs, with our net loss for the fiscal years ended December 31, 2023, 2022 and 2021.

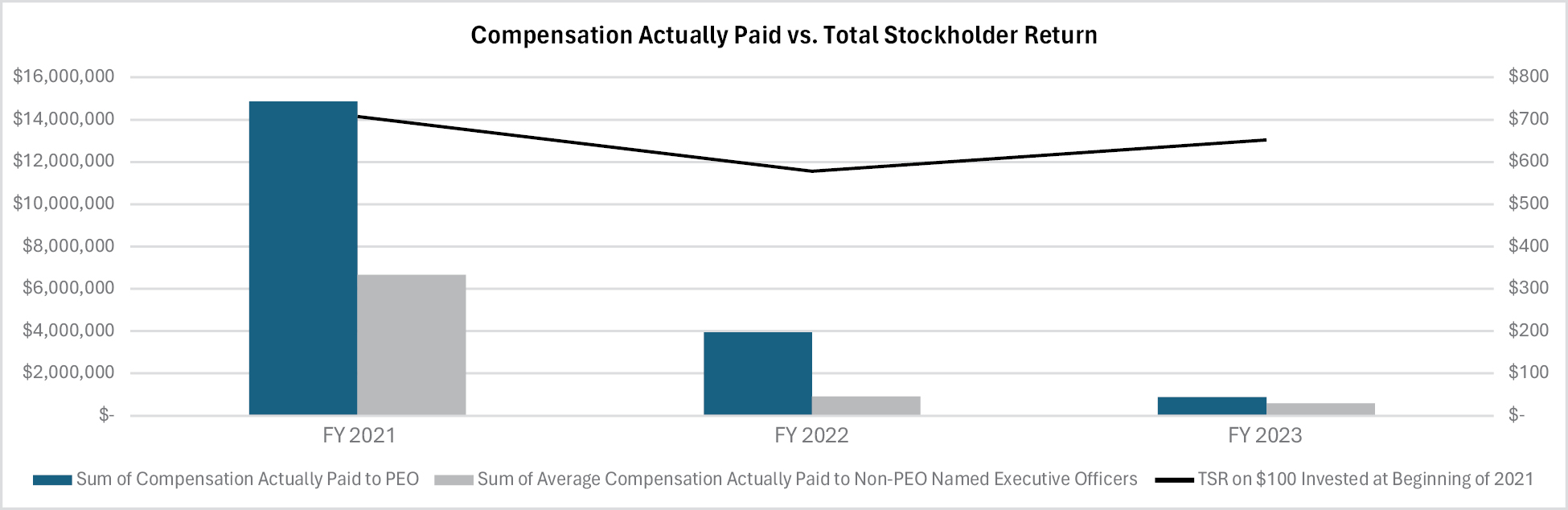

Compensation Actually Paid and Cumulative Total Shareholder Return

The graph below compares the compensation actually paid to our PEO and the average of the compensation actually paid to our remaining NEOs, with our cumulative total stockholder return for the fiscal years ended December 31, 2023, 2022 and 2021. Total stockholder return amounts reported in the graph assume an initial fixed investment of $100 on January 1, 2021.

Payments upon Termination or Change-In-Control

There are no termination or change in control agreements in place that would require payments

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION:

During the fiscal year ended December 31, 2023, none of our executive officers served on the Board of Directors or the Compensation Committee of any other company whose executive officers also serve on our Board of Directors or our Compensation Committee.

17

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information regarding the beneficial ownership of our Common Stock, based on information provided by the persons named below in publicly available filings, as of September 6, 2024:

• each of our directors and executive officers;

• all directors and executive officers of ours as a group; and

• each person who is known by us to beneficially own more than five percent of the outstanding shares of our Common Stock

Unless otherwise indicated, the address of each beneficial owner is in care of Applied Energetics, 9070 South Rita Road, Suite 1500, Tucson, Arizona 85747. Unless otherwise indicated, the Company believes that all persons named in the following table have sole voting and investment power with respect to all shares of common stock that they beneficially own.

For purposes of this table, a person is deemed to be the beneficial owner of the securities if that person has the right to acquire such securities within 60 days of September 6, 2024, upon the exercise of options or warrants. In determining the percentage ownership of the persons in the table below, we assumed in each case that the person exercised all options which are currently held by that person and which are exercisable within such 60-day period, but that options and warrants held by all other persons were not exercised, and based the percentage ownership on 213,760,472 shares outstanding on September 6, 2024.

|

Name of Beneficial Owner

|

|

Number of

Shares

Beneficially

Owned(1)

|

|

Percentage of

Shares

Beneficially

Owned(1)

|

|

Bradford T. Adamczyk

|

|