Avante Corp. (TSX.V: XX) (OTC: ALXXF) (“

Avante” or

the “

Company”) is pleased to announce its

financial results for fiscal 2024, representing the three and

twelve months ended March 31, 2024 all amounts in Canadian dollars

thousands, unless otherwise indicated).

Manny Mounouchos, Founder, CEO and Board Chair

of Avante, commented, “Fiscal 2024 was a remarkable year of growth

for Avante, with a 25% increase in annual revenue, capped off with

a 35% increase in Q4 quarterly revenue compared to the prior year.

Our core business remains robust, with 10% annual growth in

Recurring Monthly Revenue. During the year, we completed the NSSG

acquisition which positions us to significantly boost international

revenue and serve customers on a global scale. We also launched our

Argus App, Homeworxx and Toyboxx services which have garnered

strong market interest. As we look ahead to Fiscal 2025, we are

committed to continuing our approach of organic growth,

complemented by strategic acquisitions to build the Avante Security

business.”

Raj Kapoor, Avante’s Chief Financial Officer,

added, “I am pleased to report that we maintain a robust balance

sheet, enabling us to fund the Company’s organic growth initiatives

through positive cash flows from operations. We continue to

forecast a positive outlook for the upcoming fiscal year.”

ANNUAL FINANCIAL HIGHLIGHTS FOR THE

FISCAL 2024 ENDED MARCH 31, 2024:

- Within

continuing operations, the Company reported revenue of $24,950

during fiscal 2024, representing year-over-year revenue growth of

25%, or $4,990, compared to $19,960 for the prior fiscal year. The

increase was mainly due to the acquisition of NSSG and an increased

demand for the Company’s products and services in its domestic

market.

- Total Gross

profit within continuing operations increased by $2,193 during

fiscal 2024 compared to fiscal 2023. Gross profit margins increased

to 41.3% compared to 40.7%, indicating a consistent level of

profitability.

- The Avante

Security segment delivered recurring monthly revenues (“RMR”) of

$11,390 during fiscal 2024, up from $10,338 during the Company’s

prior fiscal year, a year-over-year growth of 10%. This growth was

driven by the increased demand due to higher crime rates, and

growth in video analytics following a software and personnel

reconfiguration.

- The Company

achieved Adjusted EBITDA from continuing operations of $(824)

during fiscal 2024, compared to $1,046 for the prior fiscal

year.

QUARTERLY FINANCIAL HIGHLIGHTS FOR THE

FOURTH FISCAL QUARTER ENDED MARCH 31,

2024:

- Within

continuing operations, the Company reported revenue of $7,260

during the fourth quarter of fiscal 2024, representing

year-over-year revenue growth of 35%, or $1,894, compared to $5,366

for the prior fiscal year fourth quarter. The increase was mainly

due to the acquisition of NSSG and an increased demand for the

Company’s products and services as crime rates have increased in

its’ domestic market.

- Total gross profit from continuing

operations increased by $1,182 in the fourth quarter of fiscal 2024

compared to the same quarter in fiscal 2023. Gross profit margins

rose to 44% from 38%, largely due to a change in the sales mix and

increased sales in higher margin businesses.

- The Avante

Security segment delivered recurring monthly revenues

(“RMR”) of $3,019 during the fourth quarter of

fiscal 2024, up from $2,691 during the Company’s fourth quarter in

the prior year, a year-over-year growth of 12%. This growth was

driven by the increased demand due to higher crime rates, and

growth in video analytics following a software and personnel

reconfiguration.

ACQUISITION of

NSSG:

On September 19, 2023, Avante announced its

majority stake acquisition of North Star Support Group S.R.L.

(“NSSG”), through its subsidiary

Avante International Inc. The transaction’s effective date is

October 1, 2023. Avante acquired a 55% majority interest in NSSG,

for an aggregate purchase price of EUR1,300,000, paid by way of a

combination of cash in the amount of EUR1,200,000 and the

issuance of 154,301 common shares in the capital of the

Company. In addition, as part of the transaction, Avante

advanced to NSSG a loan in principal amount of up to EUR 1

million for a term of 4 years, bearing interest at a rate equal to

the Bank of Canada Prime Rate plus 1%, and repayable in 8

quarterly equal repayments starting on the date that is 24

months after the date of each drawdown under the loan.

NSSG is a highly reputed risk management and

security company operating globally. Founded in 2017, NSSG is

headquartered in Bucharest, Romania, with offices in New York,

Cairo, and Kyiv, with representations in Saudi Arabia, Italy,

Israel, and the United Kingdom. NSSG offers a wide range of

integrated corporate security solutions, with a strong focus

on technological advancements and integration with existing

corporate security platforms. NSSG has a worldwide clientele

and has established itself as a trusted partner to Fortune 500

companies in the risk management industry. NSSG generated

revenue of $5.9 million for the twelve-month period ended December

31, 2022 with net profit of $1.3 million.

ANNUAL BUSINESS HIGHLIGHTS

- On September 28,

2023, the Company announced the launch of Avante Argus app, a

mobile connectivity app for corporate clients. Avante Argus app

provides peace of mind for Avante’s Executive Clients with instant

connectivity to the Avante Crisis Centre with real-time location

tracking, enabling immediate emergency and medical response

capabilities. Argus is designed to provide unparalleled security

and support for Avante clients locally and for Avante Black clients

internationally.

- On November 2,

2023, the Company announced it accepted an invitation to join the

Global Shield Network, a law enforcement and intelligence network

immersed in public/private sector partnerships designed to prevent

crime and terrorism and improve public safety. After the safe and

successful evacuation of its clients from the conflict zone in

Israel, Avante was recognized for its world-class security and

crisis management services with an invitation to join the Global

Shield Network. This strategic alliance provides Avante with

real-time access to police and international intelligence agencies

worldwide.

- On February 8,

2024, the Company announced the launch of Avante Homeworxx and

Avante ToyBoxx. Homeworxx is Avante’s new home management service

providing trusted, vetted and security background checked trades

for luxury homes. Avante Toyboxx is an exclusive, top-tier auto

storage service tailored for automotive enthusiasts, collectors,

and owners of high-value vehicles.

OUTLOOK

Management maintains a positive outlook for

Fiscal 2025. The Company’s long-term financials serve as a guide to

developing and executing long-term corporate strategy. The

Company’s long-term financial objectives are:

- Invest in

tuck-in acquisitions to build its Avante Security business;

- Build recurring

revenues;

- Achieve

consolidated Adjusted EBITDA margins consistent with its

industry;

- Achieve growth

in adjusted net income per share;

- Reinvest

cashflow in future business growth.

SUMMARY FINANCIAL RESULTS FOR

FISCAL-2024 ENDED MARCH 31, 2024:

Readers should refer to the Company’s financial

statements and MD&A in respect of its year ended March 31,

2024, for additional risk factors, accounting policies, detailed

financial disclosures, reconciliation of non-IFRS financial

measures to the most directly comparable IFRS financial measures,

related party transactions, contingencies, and reporting of

subsequent events since the year ended March 31, 2024. Such

financial statements and MD&A are incorporated by reference

into this news release and are filed electronically through the

System for Electronic Document Analysis and Retrieval (“SEDAR+”),

which can be accessed at www.sedarplus.ca.

| |

|

|

|

$ thousands unless otherwise noted |

Mar. 31, 2024 |

Mar. 31, 2023 |

| INCOME STATEMENT

INFORMATION: |

|

|

| RMR in the period, continuing

operations (1) (3) |

$ |

11,389 |

|

$ |

10,337 |

|

| Revenues, continuing operations

(1) |

$ |

24,950 |

|

$ |

19,960 |

|

| Gross profit, continuing

operations (1) (3) |

$ |

10,315 |

|

$ |

8,122 |

|

| Gross profit margin, continuing

operations (1) (3) |

|

41.3 |

% |

|

40.7 |

% |

| Adjusted EBITDA, continuing

operations (1) (3) |

$ |

(824 |

) |

$ |

1,046 |

|

| Net loss, continuing operations

(1) (2) |

$ |

(3,049 |

) |

$ |

(3,856 |

) |

| Net Income (loss) (2) |

$ |

(3,049 |

) |

$ |

32 |

|

| Average Common Shares during the

year |

|

26,570,828 |

|

|

26,489,438 |

|

| |

|

|

| BALANCE SHEET

INFORMATION: |

Mar. 31, 2024 |

Mar. 31, 2023 |

| Cash balances & GIC

investments (1) |

$ |

6,031 |

|

$ |

10,114 |

|

| Total funded debt as reported,

IFRS |

$ |

0 |

|

$ |

500 |

|

| Total funded debt & lease

obligations, IFRS (1) |

$ |

1,380 |

|

$ |

2,134 |

|

| Common Shares at period end |

|

26,643,739 |

|

|

26,489,438 |

|

|

|

Year ended |

|

RECONCILIATION OF ADJUSTED EBITDA |

Mar 31, 2024 |

Mar 31, 2023 |

|

|

Total comprehensive income (loss) from continuing operations |

$ |

(3,049 |

) |

$ |

(3,856 |

) |

|

|

Deferred income tax expense (recovery) |

|

(87 |

) |

|

593 |

|

|

|

Interest expense |

|

(50 |

) |

|

(95 |

) |

|

|

Depreciation and amortization |

|

1,420 |

|

|

1,099 |

|

|

|

Amortization on capitalized commission |

|

6 |

|

|

9 |

|

|

|

Share based payments |

|

55 |

|

|

697 |

|

|

|

Reorganization and acquisition expenseDeferred financing feesLoss

in fair value of put option |

231-649 |

|

2,56039 |

|

|

| Adjusted

EBITDA from continuing operations |

$ |

(824 |

) |

$ |

1,046 |

|

|

The Company’s (“RMR”) from

continuing operations during the last eight quarters are summarized

below. Gross profit margins over the last eight quarters ranged

between 37.7% and 43.7%, and were 39.6% on a trailing twelve-month

basis to December 31, 2023:

|

Avante Security |

F23(1) |

F24 |

|

|

$thousands |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

|

RMR in the period |

$ |

2,463 |

|

$ |

2,584 |

|

$ |

2,600 |

|

$ |

2,691 |

|

$ |

2,648 |

|

$ |

2,834 |

|

$ |

2,889 |

|

$ |

3,018 |

|

|

Other revenue |

|

2,105 |

|

|

2,350 |

|

|

2,492 |

|

|

2,675 |

|

|

2,762 |

|

|

2,505 |

|

|

4,052 |

|

|

4,241 |

|

|

Total revenue |

$ |

4,568 |

|

$ |

4,934 |

|

$ |

5,092 |

|

$ |

5,366 |

|

$ |

5,410 |

|

$ |

5,339 |

|

$ |

6,941 |

|

$ |

7,259 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Gross Profit |

$ |

1,995 |

|

$ |

1,921 |

|

$ |

2,177 |

|

$ |

2,029 |

|

$ |

2,039 |

|

$ |

2,118 |

|

$ |

2,948 |

|

$ |

3,211 |

|

|

Gross Profit % |

|

43.7 |

% |

|

38.9 |

% |

|

42.8 |

% |

|

37.8 |

% |

|

37.7 |

% |

|

39.7 |

% |

|

42.5 |

% |

|

44.2 |

% |

(1) The

Company’s fiscal year end is on March 31 of each year. “F23” means

the fiscal year ended March 31, 2023; and “F24” means the fiscal

year ended March 31, 2024.

ABOUT AVANTE

CORP.:

Avante Corp Inc. is a Toronto based leading

provider of security operatives and technology enabled security

solutions to residential and commercial clients. Avante’s mission

is to deliver an elevated level of security globally, with

white-glove mentality to high- net-worth families and corporations

alike, through advanced solutions and methods of detecting

conditions that require immediate response. The Company has

developed a diversified security platform that leverages advanced

technology solutions to provide a superior level of security

services. With an experienced team and proven track record of solid

growth, Avante is taking steps to establish a broad portfolio of

security businesses and solutions for its customers through organic

growth complemented by strategic acquisitions. Avante acquires,

manages and builds industry leading businesses which provide

specialized, mission-critical solutions that address the security

risks of its clients. Avante is listed on the TSX Venture Exchange

under the ticker “XX”. For more information,

please visit www.avantecorp.ca and consider joining our investor

email list.

Emmanuel MounouchosFounder, CEO & Board

Chair, Avante Corp.416-923-6984manny@avantesecurity.com

This news release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities described herein in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. This news release does

not constitute an offer of securities for sale in the United

States. The securities described herein have not been, nor will

they be, registered under the United States Securities Act of 1933,

as amended, and such securities may not be offered or sold within

the United States absent registration under U.S. federal and state

securities laws or an applicable exemption from such U.S.

registration requirements.

Non-IFRS Financial Measures

This press release includes certain measures

which have not been prepared in accordance with International

Financial Reporting Standards (“IFRS”) such as EBITDA, Adjusted

EBITDA and Recurring Monthly Revenue (“RMR”). These non-IFRS

measures are not recognized under IFRS and and do not have a

standardized meaning prescribed by IFRS. Accordingly, users are

cautioned that these measures should not be construed as

alternatives to net income determined in accordance with IFRS. The

non-IFRS measures presented are unlikely to be comparable to

similar measures presented by other issuers.

References to EBITDA are to net

income before interest, taxes, depreciation and amortization.

References to Adjusted EBITDA are to net income

before interest, taxes, depreciation, amortization of intangibles

& capitalized commissions, share-based payments, acquisition,

integration and / or reorganization costs, deferred financing

costs, loss (gain) in fair value of derivative liability and

expensing of fair value adjustments per IFRS.

Recurring Monthly Revenues, or

RMR, represent revenue during the fiscal period

that benefited from contractual periodic billing to customers,

typically monthly, quarterly or annually.

Management believes that Adjusted EBITDA and

Recurring Monthly Revenues are appropriate additional measures for

evaluating Avante’s performance. Readers are cautioned that neither

EBITDA, Adjusted EBITDA nor Recurring Monthly Revenues should be

construed as an alternative to net income or revenues (as such

financial measures are determined under IFRS), as an indicator of

financial performance or to cash flow from operating activities (as

determined under IFRS) or as a measure of liquidity and cash flow.

Avante’s method of calculating EBITDA, Adjusted EBITDA and

Recurring Monthly Revenues may differ from methods used by other

issuers and, accordingly, Avante’s reported Non-IFRS measures may

not be comparable to similar measures used by other issuers.

Forward-Looking Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of the Company and the environment in

which it operates. Forward-looking statements are identified by

words such as “believe”, “anticipate”, “project”, “expect”,

“intend”, “plan”, “will”, “may” “estimate”, “pro-forma” and other

similar expressions. These statements are based on the Company’s

expectations, estimates, forecasts and projections. The

forward-looking statements in this news release are based on

certain assumptions. They are not guarantees of future performance

and involve risks and uncertainties that are difficult to control

or predict. A number of factors could cause actual results to

differ materially from the results discussed in the forward-looking

statements, including, but not limited to, the Company’s ability to

achieve the benefits expected as a result of the sale of Logixx

Security Inc., anticipated growth from acquisitions, new service

offerings and from development and deployment of new technologies

and the list of risk factors identified in the Company’s Management

Discussion & Analysis (MD&A), Annual Information Form (AIF)

and other continuous disclosure documents available at

www.sedar.com. There can be no assurance that forward-looking

statements will prove to be accurate as actual outcomes and results

may differ materially from those expressed in these forward-looking

statements. Readers, therefore, should not place undue reliance on

any such forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, the Company assumes no

obligation to publicly update any such statement, whether as a

result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

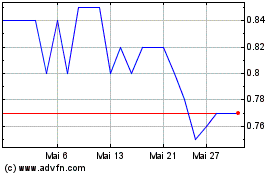

Avante (TSXV:XX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Avante (TSXV:XX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024