Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

report assay results from resource extension drill holes at the

North Hill and Silica Ridge Prospects within its 100% owned Sandman

Project (“Sandman” or the “Project”) located in Humboldt County,

Nevada, USA. Holes SA-0024 and SA-0027 drilled at the edges of the

Silica Ridge and North Hill deposits have intersected gold

mineralization that is currently open in several directions. These

drill results indicate potential to expand the deposits and

follow-up holes are planned for later in 2021. The Company recently

commenced a Phase 2 5000m Reverse Circulation (RC) drill program of

which 2126 m (6975 ft) for 12 holes has been completed.

HIGHLIGHTS & UPDATE:

- Two mineralization styles

and targets exist at Sandman

- Narrow high grade gold

mineralization (circa 10g/t over <5m widths)

- Broad low grade gold

mineralization (circa 0.4g/t – 1g/t over >15m

widths)

- Drill hole SA-0024 at

Silica Ridge intersected:

- 19.8 m (65 ft) @ 0.67 g/t

Au from 111.3 m (365 ft), including:

- 9.1 m @ 1.13 g/t Au from

114.3 m (375 ft)

- Silica Ridge mineralization

intersected in SA-0024 is open to the west, projecting up-dip into

an under-explored sand-covered area

- Drill hole SA-0027 at North

Hill intersected three mineralized intervals:

- 19.8 m (65 ft) @ 0.6 g/t Au

from 4.6 m (15 ft), including:

- 6.1 m (20 ft) @ 1.18 g/t Au

from 9.1 m (30 ft)

- 15.2 m (50 ft) @ 0.39 g/t

Au from 30.5 m (100 ft)

- 21.3 m (70 ft) @ 0.44 g/t

Au from 51.8 m (170 ft)

- North Hill mineralization

intersected in SA-0027 is open to the east at shallow

depths

- These results open

previously untested areas in which the Mineral Resource Estimate

may be expanded by drilling

- More laboratory assay

results expected imminently

Gold Bull CEO, Cherie Leeden commented:

The gold intersection in

SA-0024 appears to represent a mineralized block of the same rocks

that host gold at Silica Ridge that has been downthrown to the west

by faulting and consequently has not been tested by previous

drilling. The rocks in this area are tilted to the east so we

expect to intersect the same receptive rocks – hopefully also

mineralized - closer to surface west of the location of this hole.

This result opens a new prospective area for exploration close to

the Silica Ridge deposit and informs our planned drill program to

the north in the Midway, an underexplored area between North Hill

& Silica ridge. The SA-0027 intersection at North Hill confirms

that the flat-lying gold mineralization remains open to the east

and is close to surface, well within range of a possible open pit.

The area east of North Hill has received little historic drilling

and we have two holes planned to test for extensions to the deposit

later this year when the RC rig returns.

Background

The recently complete Phase 2 drill program at

Sandman comprised both exploration and resource extension holes.

Results from SA-0024 at Silica Ridge and SA-0027 at North Hill

indicate that both deposits remain open.

The gold mineralization at Silica Ridge is

mostly influenced by a large north-north-west striking fault

dipping to the west associated with antithetic steep easterly

dipping faults in the hanging wall of the Silica Ridge fault.

Lithology also plays an important role in localizing gold

mineralization. The primary host units at Silica Ridge are fluvial

siltstone, sandstone, conglomerate, and epiclastic tuff of the

Comforter Basin. High gold values are usually located in fault

breccias, especially where coincident with conglomerate beds.

Hole SA-0024, drilled on the western margin of

the Silica Ridge Mineral Resource Estimate, intersected the

favorable conglomerate unit, with evidence of faulting (rapid

transition to fractured, oxidized rock), from 109.7 m to 131.1 m

(360 to 430 feet), returning 19.8 m (65 ft) @ 0.67 g/t Au from

111.3 m (365 ft), including 9.1 m @ 1.13 g/t Au from 114.3 m (375

ft) – refer to cross section (Figure 1) and drill status plan

(Figure 2). The closest intersection of the conglomerate in

historic drilling was from 39.6 m to 45.9 m (130 to 180 feet)

down-hole in SR06-0122, indicating a vertical displacement of

around 75 m.

Figure 1 Silica Ridge SA-0024 cross

section:https://www.globenewswire.com/NewsRoom/AttachmentNg/5874ef85-2888-4752-9883-f659d438976e

Figure 2 Silica Ridge SA-0024 drill status plan, with

line of section

A-A':https://www.globenewswire.com/NewsRoom/AttachmentNg/03751303-b445-4ffa-9044-33a6be5d2029

If this downthrown block of prospective host

rocks has continuity to the north and south, this would represent a

significant untested area for future resource extension drilling.

The overall dip direction in the Silica Ridge – North Hill area is

toward the east, so the downthrown conglomerate host rocks are

expected to project up-dip to the west of Silica Ridge into an area

with little historic drilling that is covered by sand dunes.

Gold mineralization at North Hill occurs in

shallow dipping, bedding parallel domains. The higher

concentrations and more extensively defined mineralized zones are

associated with either the upper or lower contact position of a

basalt unit. Hole SA-0027 was drilled at the eastern edge of the

current Mineral Resource Estimate in an area where historic

drilling was too shallow to intersect the prospective basalt

contacts. The purpose of the hole was to define a new eastern limit

to the extent of low-grade gold mineralization.

Hole SA-0027 returned three mineralized

intervals (Figure 3 and Figure 4): 19.8 m (65 ft) @ 0.6 g/t Au from

4.6 m (15 ft), (including: 6.1 m (20 ft) @ 1.18 g/t Au from 9.1 m

(30 ft)), 15.2 m (50 ft) @ 0.39 g/t Au from 30.5 m (100 ft), and

21.3 m (70 ft) @ 0.44 g/t Au from 51.8 m (170 ft). The dip of the

mineralized contacts appears to flatten in this area. The bottom of

the deepest interval of gold mineralization in SA-0027 is 65 m (213

ft) vertical depth below surface, which is within range of a

possible open pit design. The mineralization remains open to the

east, with few historic holes having been drilled east of North

Hill. This area will be a focus of drilling during the Phase 3

program planned for the fourth quarter of 2021.

Figure 3 North Hill SA-0027 drill

section. Mineral Resource Estimate (MRE) will require modification

for consistency with the new

intersection:https://www.globenewswire.com/NewsRoom/AttachmentNg/bb0704bf-7a01-4bf5-b4d7-0b7f8855cb72

Figure 4 North Hill SA-0027 drill status plan with

line of section

A-A':https://www.globenewswire.com/NewsRoom/AttachmentNg/a3d24526-cce9-4889-98ed-dab8cf970ca1

|

Hole ID |

From(m) |

To(m) |

Width(m) |

From(ft) |

To(ft) |

Width(ft) |

Gold ppm (Au g/t) |

|

SA-0024 |

111.3 |

131.1 |

19.8 |

365 |

430 |

65 |

0.67 (using 0.2 g/t Au cut-off, inc. 4.6 m internal dilution) |

|

including |

114.3 |

123.4 |

9.1 |

375 |

405 |

30 |

1.13 (using 0.5 g/t Au cut-off) |

|

SA-0027 |

4.6 |

24.4 |

19.8 |

15 |

80 |

65 |

0.60 (using 0.2 g/t Au cut-off, inc. 1.5 m internal dilution) |

|

including |

9.1 |

15.2 |

6.1 |

30 |

50 |

20 |

1.18 (using 0.9 g/t Au cut-off) |

|

SA-0027 |

30.5 |

45.7 |

15.2 |

100 |

150 |

50 |

0.39 (using 0.2 g/t Au cut-off) |

|

SA-0027 |

51.8 |

73.2 |

21.3 |

170 |

240 |

70 |

0.44 (using 0.2 g/t Au cut-off) |

Table 1 Significant intersections in holes SA-0024 and

SA-0027

|

Hole ID |

Total depth (m) |

Easting |

Northing |

Elevation |

Coordinate system |

Azimuth collar |

Dip collar |

|

SA-0024 |

182.9 |

415,932 |

4,546,027 |

1,391.9 |

NAD83 UTM Zone 11N |

20.5 |

-65.7 |

|

SA-0027 |

126.5 |

415,209 |

4,548,415 |

1,398.3 |

NAD83 UTM Zone 11N |

270.9 |

-60.1 |

Table 2 Drill hole collar surveys (positions

surveyed using Garmin hand-held GPS)

Figure 5 Project location

plan:https://www.globenewswire.com/NewsRoom/AttachmentNg/e95c42cb-21dd-4c4c-8a3d-2e60833734d0

About Sandman

In December 2020, Gold Bull purchased the

Sandman Project from Newmont. Gold mineralization was first

discovered at Sandman in 1987 by Kennecott and the project has been

intermittently explored since then. There are four known pit

constrained gold resources located within the Sandman Project,

consisting of 21.8Mt @ 0.7g/t gold for 494,000 ounces of gold;

comprising of an Indicated Resource of 18,550kt @ 0.73g/t gold for

433kozs of gold plus an Inferred Resource of 3,246kt @ 0.58g/t gold

for 61kozs of gold. Several of the resources remain open in

multiple directions and the bulk of the historical drilling has

been conducted to a depth of less than 100m. Sandman is

conveniently located circa 25-30 km northwest of the mining town of

Winnemucca, Nevada.

Qualified Person

Cherie Leeden, B.Sc Applied Geology (Honours),

MAIG, a “Qualified Person” as defined by National Instrument

43-101, has read and approved all technical and scientific

information contained in this news release. Ms. Leeden is the

Company’s Chief Executive Officer. Cherie Leeden relied on resource

information contained within the Technical Report on the Sandman

Gold Project, prepared by Steven Olsen, a Qualified Person under NI

43-101, who is a Qualified Persons as defined by the National

Instrument NI 43-101. Mr Olsen is an independent consultant and has

no affiliations with Gold Bull except that of an independent

consultant/client relationship. Mr Olsen is a member of the

Australian Institute of Geoscientists (AIG) and is the Qualified

Person under NI 43-101, Standards of Disclosure for Mineral

Projects.

Quality Assurance – Quality Control

Drilling was completed using Reverse Circulation

(RC) drilling utilizing double wall drill pipe, interchange hammer

and 4¾ inch hammer bits to drill and sample the rock formation.

Samples were taken over 5 foot intervals (1.52m) and were collected

after separation of the sample using a rotary splitter situated at

the base of the cyclone. A small portion of the rock chips for each

5 foot interval was placed into chip trays for record keeping and

geological logging. The samples bagged at the rig were taken to

American Assay Laboratories in Sparks NV by a Company employee. The

Company inserts quality control (QC) samples at regular intervals

in the sample stream, including blanks and reference materials with

all sample shipments to monitor laboratory performance. The QAQC

program is overseen by the Company’s Qualified Person, Cherie

Leeden, Chief Executive Officer.

Samples are submitted to American Assay

Laboratories’ analytical facility in Sparks, Nevada for preparation

and analysis. The AAL facility is ISO-17025 accredited by IAS. The

entire sample is dried, weighed and crushed, with 85% passing -10

mesh, then riffle split to 1 kg aliquots, which are fine pulverized

with 90% passing -150mesh. Analysis for gold is by 50 g fire assay

lead collection with Inductively Coupled Plasma Optical Emission

Spectroscopy (ICP-OES) finish with a lower limit of 0.003 ppm.

Samples with gold assays above 10 ppm are re-analyzed using a 50 g

fire assay fusion with gravimetric finish, which has a lower

detection limit of 0.1029 ppm. Ten foot composite samples were also

analyzed using a 35 multi-element (plus Se and Hg) geochemical

package by 5-acid digestion, followed by Inductively Coupled Plasma

Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled

Plasma Mass Spectroscopy (ICP-MS).

About Gold Bull Resources Corp.

Gold Bull’s mission is to grow into a US focused

mid-tier gold development Company via rapidly discovering and

acquiring additional ounces. The Company’s exploration hub is based

in Nevada, USA, a top-tier mineral district that contains

significant historical production, existing mining infrastructure

and an established mining culture. Gold Bull is led by a Board and

Management team with a track record of exploration and acquisition

success.

Gold Bull’s core asset is the Sandman Project,

located in Nevada which has a 494,000 oz gold

resource as per 2021 43-101 Resource Estimate. Sandman is located

23 km south of the Sleeper Mine and boasts excellent large-scale

exploration potential. Drilling at Sandman is currently

underway.

Gold Bull is driven by its core values and

purpose which includes a commitment to safety, communication &

transparency, environmental responsibility, community, and

integrity.

Cherie LeedenPresident and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca or

email admin@goldbull.ca.

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop its projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the ability of the Company to obtain the necessary

permits and consents required to explore, drill and develop the

projects and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

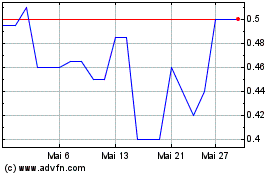

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024