Sangoma Technologies Corporation (TSX: STC; Nasdaq: SANG)

(“Sangoma” or the “Company”), a trusted leader in delivering

cloud-based Communications as a Service solutions for companies of

all sizes, today announced highlights of its unaudited results for

the second quarter of fiscal year 2022 ended December 31, 2021.

Sales for the second quarter of fiscal 2022 were

a record $54.24 million, twice that of the same quarter last year.

Please note that these results are being presented in United States

dollars, and so all historical numbers have been converted from

Canadian dollars where applicable, for comparison purposes.

|

|

|

|

|

|

|

|

|

|

|

|

US $M |

Q2 FY2022 |

Q2 FY2021 |

Change |

Q1 FY2022 |

Change |

|

Sales |

$54.24 |

|

m |

$27.09 |

|

m |

100% |

$52.48 |

|

m |

3% |

| Gross

profit |

$39.40 |

|

m |

$17.93 |

|

m |

120% |

$37.85 |

|

m |

4% |

| Operating

expense |

$40.24 |

|

m |

$15.13 |

|

m |

166% |

$38.71 |

|

m |

4% |

| Adjusted

operating income1 (loss) |

($0.84 |

) |

m |

$2.80 |

|

m |

|

($0.85 |

) |

m |

|

| Net

income (loss) |

($2.48 |

) |

m |

$1.77 |

|

m |

|

($2.30 |

) |

m |

|

| Net

earnings/(loss) per share (fully diluted) |

$(0.078 |

) |

|

$0.110 |

|

|

|

$(0.073 |

) |

|

|

| Adjusted

EBITDA1 |

$10.43 |

|

m |

$5.14 |

|

m |

103% |

$10.09 |

|

m |

3% |

|

|

|

|

|

|

|

|

|

|

|

The Company undertook a seven for one share

consolidation on November 2, 2021, so please note that in this

press release, as well as the accompanying interim financial

statements and MD&A (all of which have been filed on SEDAR),

the share count, option count, exercise prices, and earnings per

share reflect this share consolidation for all periods reported.

“I am pleased with our performance this quarter,

on both the top and the bottom lines,” said Bill Wignall, President

and CEO of Sangoma. “Our services business continues to grow and

compound nicely, we had a slight uptick in our product revenue

again this quarter with prudent management of our supply chain, and

the successful integration of Star2Star all helped contribute to

record revenue and Adjusted EBITDA, both at more than double that

of last year. In addition, we continued to execute on our strategic

initiatives this quarter, first with the successful up-listing to

the TSX from the Venture exchange, followed by our cross-listing to

Nasdaq.”

Gross profit for the second quarter of fiscal

2022 was $39.40 million, delivering gross margin of over 72% of

sales, up from 66% in the same quarter last year.

Operating expenses were $40.24 million for the

second quarter of fiscal 2022, up 4% sequentially over the most

recent first quarter of this fiscal year, and up significantly from

the prior year in sync with our growth and factoring in the

non-cash intangible asset amortization arising from the

acquisition.

Adjusted EBITDA1 was $10.43 million in the

second quarter of fiscal 2022, more than twice that of the same

quarter last year, and at about 19% of revenue, is consistent with

expectations for this point in the fiscal year.

Net loss for the second quarter of fiscal 2022

was $2.48 million, which includes the additional non-cash

intangible asset amortization, together with the one-time $1.05

million expense associated with the listing on the TSX and Nasdaq

exchanges during the quarter.

Sangoma continues to maintain a healthy balance

sheet, finishing the second quarter of fiscal 2022 with a cash

balance of $16.95 million on December 31, 2021 and remains

comfortably within its debt covenants. Adjusted Cash Flow from

Operations1 during the second quarter was $3.90 million, compared

to $4.87 million in the same quarter of fiscal

2021.

Outlook for fiscal year 2022Based upon these

results for the second quarter, and upon the assumptions outlined

below, Sangoma is increasing guidance for its fiscal year 2022.

Prior guidance for this year, as disclosed in the news release

dated November 12, 2021, had been for revenue of between $209 and

$213 million, and Adjusted EBITDA in a range of $41 to $43 million.

The Company now expects revenue of between $215 and $219 million,

and Adjusted EBITDA of $42 to $44 million, for fiscal 2022.

The above outlook and modified guidance constitute

forward-looking information and are based on the Company’s

assessment of many material assumptions, including:

- The continuing revenue trends the

Company has experienced in the fiscal year to date

- The continuing recovery of the

global economy, decreased government restrictions and increased

customer demand as a result of COVID-19

- The successful integration of the

Star2Star business and such business continuing to operate and

generate results in a manner consistent with its business preceding

its acquisition by the Company

- There being continuing growth in

the global UCaaS and cloud communications markets more

generally

- There being continuing demand and

subscriber growth for the Company’s cloud offerings

- Changes in global exchange rates do

not disrupt demand for the Company’s Products and Services

- The ability of the Company’s

customers to continue their business operations without any

material impact on their requirements for the Company’s Products

and Services

- The Company’s forecasted revenue

from its internal sales teams and via channel partners will meet

expectations, which is based on certain management assumptions,

including continuing demand for the Company’s products and

services, no material delays in receipt of products from its

contract manufacturers, no material increase to the Company’s

manufacturing, labour or shipping costs

- There being no material further

increase to the Company’s cost of goods sold

- The Company’s manufacturers and

supply chain delivering ongoing quantities of finished products on

schedule

- That the Company can continue to

secure electronic components and parts to support a largely

uninterrupted supply chain

- That the Company is able to attract

and keep the employees needed to maintain the current momentum

- The continued ability for the

Company’s operations employees to work at the Company’s internal

and outsourced facilities

- Other employees being able to work

from home as required without any material impact on

productivity

Full second quarter results and conference

callSangoma will host a conference call on Friday,

February 11, 2022 at 8:00 am EST to discuss these results. The

dial-in number for the call is 1-800-319-4610 (International

1-604-638-5340). Investors are requested to dial in 5 to 10 minutes

before the scheduled start time and ask to join the Sangoma

call.

1 Adjusted Operating Income, Adjusted EBITDA and

Adjusted Cash Flow from Operations are metrics used by the Company

to monitor its performance and definitions of these terms, as well

as other important information on these results, may be found in

the accompanying MD&A posted today at www.sedar.com.

About Sangoma Technologies CorporationSangoma

Technologies is a trusted leader in delivering value-based

Communications as a Service (CaaS) solutions for businesses of all

sizes. Sangoma’s cloud-based Services include Unified Communication

(UCaaS) business communications, Contact Center as a Service

(CCaaS), Video Meetings as a Service (MaaS), Collaboration as a

Service (Collab aaS), Communications Platform as a Service (CPaaS),

Trunking as a Service (TaaS), Fax as a Service (FaaS), Device as a

Service (DaaS), and Access Control as a Service (ACaaS). In

addition, Sangoma offers a full line of communications Products,

including premise-based UC systems, a full line of desk phones and

headsets, and a complete connectivity suite

(gateways/SBCs/telephony cards). Sangoma’s products and services

are used in leading UC, PBX, IVR, contact center, carrier networks,

office productivity, and data communication applications worldwide.

Sangoma is also the primary developer and sponsor of Asterisk and

FreePBX, the world’s two most widely used open source communication

software projects.

Sangoma Technologies Corporation is publicly

traded on the Toronto Stock Exchange (TSX: STC) and Nasdaq (Nasdaq:

SANG). Additional information on Sangoma can be found at:

www.sangoma.com.

Cautionary Statement Regarding Forward

Looking StatementsThis press release contains

forward-looking statements, including statements regarding the

expected fiscal 2022 financial results and the future success of

our business, development strategies and future opportunities.

Forward-looking statements include, but are not

limited to, statements relating to management’s guidance on revenue

and Adjusted EBITDA, statements concerning estimates of expected

expenditures, statements relating to expected future production and

cash flows, and other statements which are not historical facts.

When used in this document, the words such as "could", "plan",

"estimate", "expect", "intend", "may", "potential", "should" and

similar expressions indicate forward-looking statements.

Although Sangoma believes that its expectations

reflected in these forward-looking statements are reasonable, such

statements involve risks and uncertainties and no assurance can be

given that actual results will be consistent with these

forward-looking statements. Forward-looking statements are based on

the opinions and estimates of management at the date that the

statements are made, and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in

forward-looking statements. Such risks and uncertainties include,

but are not limited to, the outcome of our ongoing investigation

into the cyber attack, costs related to our investigation and any

resulting liabilities, our ability to recover any proceeds under

our insurance policies, and costs related to and the effectiveness

of our mitigation and remediation efforts. Sangoma undertakes no

obligation to update forward-looking statements if circumstances or

management's estimates or opinions should change except as required

by law.

Readers are cautioned not to place undue

reliance on forward-looking statements, as there can be no

assurance that the plans, intentions or expectations upon which

they are based will occur. By their nature, forward-looking

statements involve numerous assumptions, known and unknown risks

and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections and

other events contemplated by the forward-looking statements will

not occur. Although Sangoma believes that the expectations

represented by such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be

correct as these expectations are inherently subject to business,

economic and competitive uncertainties and contingencies. Some of

the risks and other factors which could cause results to differ

materially from those expressed in the forward-looking statements

contained in its management's discussion and analysis, annual

information form and management information circular (each

available on www.sedar.com) include, but are not limited to, risks

and uncertainties associated with the continuing integration of

Star2Star, the impact of the continuing COVID-19 pandemic, changes

in exchange rate between the United States dollar and other

currencies, changes in technology, changes in the business climate,

changes in the regulatory environment, the decline in the

importance of the PSTN, new competitive pressures, the impact of

global supply chain delays, the retention of key staff, the

increase in cost of our components and materials and the impact of

changes to interest rates. The forward-looking statements contained

in this press release are expressly qualified by this cautionary

statement.

Neither the TSX nor its Regulation Services

Provider (as that term is defined in policies of the TSX Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Sangoma Technologies Corporation

Larry Stock

Chief Corporate Officer

(256) 428-6285

lstock@sangoma.com

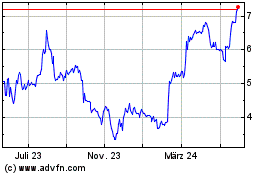

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

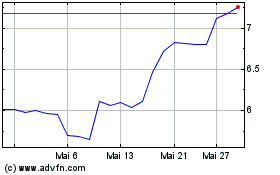

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024