Slate Grocery REIT Establishes U.S.$150 Million At-The-Market Equity Program

31 März 2022 - 1:58AM

Slate Grocery REIT (TSX: SGR.U) (TSX: SGR.UN) (the “REIT”), an

owner and operator of U.S. grocery-anchored real estate, announced

today that it has established an at-the-market equity program (the

"ATM Program") that allows the REIT to issue, at its discretion, up

to U.S.$150,000,000 of class U trust units of the REIT (the

“Units”) to the public from time to time through BMO Capital

Markets (the “Agent”). Distributions of Units pursuant to the ATM

Program, if any, will be made in accordance with the terms of an

equity distribution agreement dated March 30, 2022 (the “Equity

Distribution Agreement”) entered into among the REIT and the Agent.

Units issued under the ATM Program will be issued from treasury and

distributed directly on the Toronto Stock Exchange, or such other

recognized marketplaces to the extent permitted, at prevailing

market prices at the time of sale, all in accordance with the terms

of the Equity Distribution Agreement.

The ATM Program will be effective until April 28, 2024, unless

earlier terminated in accordance with the terms of the Equity

Distribution Agreement. The REIT intends to use the net proceeds

from Units sold under the ATM Program, if any, to fund ongoing

development and acquisition activities and for general working

capital purposes.

Since the Units distributed pursuant to the ATM Program will be

distributed to the public at prevailing market prices at the time

of sale, prices may vary among purchasers and during the period of

distribution. In connection with the ATM Program, the REIT has

filed a prospectus supplement dated March 30, 2022 (the “Prospectus

Supplement”) to its base shelf prospectus dated March 28, 2022 (the

“Shelf Prospectus”). Further details of the ATM Program are set out

in the Prospectus Supplement. The Prospectus Supplement, Shelf

Prospectus and Equity Distribution Agreement are available on SEDAR

at www.sedar.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of,

the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful. The Units have not been,

nor will they be, registered under the United States Securities Act

of 1933, as amended, (the "1933 Act") and may not be offered, sold

or delivered, directly or indirectly, in the United States, or to,

or for the account or benefit of, "U.S. persons" (as defined in

Regulation S under the 1933 Act), except pursuant to an exemption

from the registration requirements of the 1933 Act.

About Slate Grocery REIT (TSX: SGR.U /

SGR.UN)Slate Grocery REIT is an owner and operator of U.S.

grocery-anchored real estate. The REIT owns and operates

approximately U.S. $1.9 billion of critical real estate

infrastructure across major U.S. metro markets that communities

rely upon for their daily needs. The REIT’s resilient

grocery-anchored portfolio and strong credit tenants provide

unitholders with durable cash flows and the potential for capital

appreciation over the longer term. Visit slategroceryreit.com to

learn more about the REIT.

About Slate Asset ManagementSlate Asset

Management is a global alternative investment platform targeting

real assets. We focus on fundamentals with the objective of

creating long-term value for our investors and partners. Slate’s

platform has a range of real estate and infrastructure investment

strategies, including opportunistic, value add, core plus, and debt

investments. We are supported by exceptional people and flexible

capital, which enable us to originate and execute on a wide range

of compelling investment opportunities. Visit slateam.com to learn

more.

Forward-Looking StatementsCertain information

herein constitutes “forward-looking information” as defined under

Canadian securities laws which reflect management’s expectations

regarding objectives, plans, goals, strategies, future growth,

results of operations, performance, business prospects and

opportunities of the REIT. The words “plans”, “expects”, “does not

expect”, “scheduled”, “estimates”, “intends”, “anticipates”, “does

not anticipate”, “projects”, “believes”, or variations of such

words and phrases or statements to the effect that certain actions,

events or results “may”, “will”, “could”, “would”, “might”,

“occur”, “be achieved”, or “continue” and similar expressions

identify forward-looking statements. Such forward-looking

statements are qualified in their entirety by the inherent risks

and uncertainties surrounding future expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators.

SGR-Fin

For Further InformationInvestor Relations+1 416

644 4264ir@slateam.com

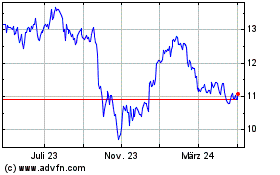

Slate Grocery REIT (TSX:SGR.UN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

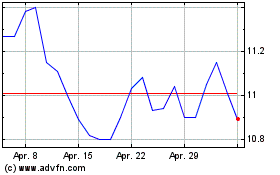

Slate Grocery REIT (TSX:SGR.UN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025