TransAlta Renewables Announces $150 Million Bought Deal Offering of Common Shares

13 Juni 2018 - 10:15PM

Not for distribution to U.S. news wire

services or public dissemination in the United States

TransAlta Renewables Inc. (“TransAlta Renewables” or the “Company”)

(TSX:RNW) today announced that it has entered into an agreement

with a syndicate of underwriters co-led by CIBC Capital Markets,

RBC Capital Markets and Scotiabank, as joint bookrunners, for an

offering, on a bought deal basis, of 11,860,000 common shares

(“Common Shares”) in the capital of TransAlta Renewables at a price

of $12.65 (the “Offering Price”) per share which will result

in gross proceeds to TransAlta Renewables of approximately $150

million (the “Offering”).

TransAlta Renewables has also granted the

underwriters an over-allotment option (the “Over-Allotment Option”)

to purchase up to an additional 1,779,000 Common Shares at the

Offering Price which, if exercised in full will result in

additional gross proceeds to TransAlta Renewables of

approximately $22.5 million. The Over-Allotment Option

is exercisable, in whole or in part, by the underwriters at any

time within 30 days following closing of the Offering. TransAlta

Corporation currently holds approximately 161 million Common Shares

and does not intend to purchase any additional Common Shares under

the Offering.

The net proceeds of the Offering will be used to

partially repay drawn amounts under the Company’s credit facility,

which were drawn in order to fund recent acquisitions. The

additional liquidity under the credit facility will be used for

general corporate purposes, including ongoing construction costs

associated with such acquisitions.

The Common Shares will be offered in all

provinces of Canada pursuant to a prospectus supplement to the

Company’s short form base shelf prospectus dated July 12,

2017. Completion of the Offering is subject to, and

conditional upon, the approval of the Toronto Stock Exchange and

all other required regulatory approvals. The Offering is expected

to close on June 22, 2018. This news release does not

constitute an offer to sell or a solicitation of an offer to buy

the Common Shares in any jurisdiction.

About TransAlta Renewables

Inc.

TransAlta Renewables is among the largest of any

publicly traded renewable independent power producers (“IPP”) in

Canada. Our asset platform and economic interests are

diversified in terms of geography, generation and counterparties

and consist of interests in 20 wind facilities, 13 hydroelectric

facilities, seven natural gas generation facilities, one solar

facility and one natural gas pipeline, representing an ownership

interest of 2,407 megawatts of owned generating capacity, located

in the provinces of British Columbia, Alberta, Ontario, Québec, New

Brunswick, the State of Wyoming, the State of Massachusetts, the

State of Minnesota and the State of Western Australia. Our

objectives are to (i) provide stable, consistent returns for

investors through the ownership of, and investment in, highly

contracted renewable and natural gas power generation and other

infrastructure assets that provide stable cash flow primarily

through long-term contracts with strong counterparties; (ii) pursue

and capitalize on strategic growth opportunities in the renewable

and natural gas power generation and other infrastructure sectors;

(iii) maintain diversity in terms of geography, generation and

counterparties; and (iv) pay out 80 to 85 per cent of cash

available for distribution to the shareholders of the Company on an

annual basis.

Forward-Looking Statements

This news release contains "forward-looking

statements" and "forward-looking information" (collectively,

"forward-looking information") within the meaning of applicable

Canadian securities legislation. All information contained in this

news release, other than statements of current and historical fact,

is forward-looking information. Forward-looking information can

often be identified by the use of words such as "plans", "expects",

"budget", "guidance", "scheduled", "estimates", "forecasts",

"strategy", "target", "intends", "objective", "goal",

"understands", "anticipates" and "believes" (and variations of

these or similar words) and statements that certain actions, events

or results "may", "could", "would", "should", "might" "occur" or

"be achieved" or "will be taken" (and variations of these or

similar expressions). All of the forward-looking information

in this news release is qualified by this cautionary note.

Forward-looking information includes, but is not limited to,

statements related to the Offering, the anticipated closing date of

the Offering, receipt of all necessary regulatory approvals

including the approval of the TSX, the Company’s intention to

complete the proposed Offering, the exercise of the Over-Allotment

Option, expectations as to the use of proceeds from the Offering,

the planned use of the increased borrowing capacity under the

credit facility and TransAlta Corporation’s continued ownership of

Common Shares. These forward-looking statements are not

historical facts but reflect TransAlta Renewables current

expectations concerning future plans, actions and results.

These statements are subject to a number of risks and uncertainties

that could cause actual plans, actions and results to differ

materially from current expectations including, but not limited to,

changes in economic and market conditions, and other risks and

uncertainties discussed in TransAlta Renewables’ materials filed

with the Canadian securities regulatory authorities from time to

time and as also set forth in the final prospectus supplement of

TransAlta Renewables. Readers are cautioned not to place undue

reliance on these forward-looking statements, which reflect

TransAlta Renewables’ expectations only as of the date of this news

release. TransAlta Renewables disclaims any intention or obligation

to update or revise these forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

For more information:

| Investor

Inquiries: |

Media

Inquiries: |

| Sally Taylor |

Stacey Hatcher |

| Manager, Investor

Relations |

Manager,

Communications |

| Phone:

1-800-387-3598 |

Phone:

1-855-255-9184 |

| Email:

investor_relations@transalta.com |

Email:

ta_media_relations@transalta.com |

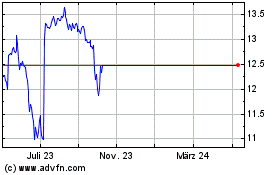

TransAlta Renewables (TSX:RNW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

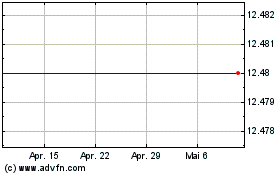

TransAlta Renewables (TSX:RNW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025