Paramount Resources Ltd. Announces the Proposed Offering of an Additional $100 Million of Its 7.625% Senior Notes Due 2019 an...

04 Dezember 2013 - 1:43PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Paramount Resources Ltd. (TSX:POU) ("Paramount" or the "Company") intends to

sell an additional $100 million aggregate principal amount of its 7.625% senior

unsecured notes due 2019 (the "Senior Notes") by way of a public offering in

Canada and on a private placement basis in the United States through a syndicate

of underwriters (the "Offering"). The Offering is expected to close before

mid-December 2013.

Net proceeds from the Offering will be used to fund a portion of Paramount's

2014 capital expenditure program, the size and scope of which will be finalized

in the first quarter of 2014 after incorporating results from the Company's

2013/2014 winter drilling and completion program, and for general corporate

purposes. The Company may initially use the net proceeds from the Offering for

the non-permanent repayment of indebtedness under its secured bank credit

facility (the "Credit Facility").

The annual renewal of the Credit Facility has been completed. The aggregate size

of the facility increased from $450 million to $600 million based on the results

of Paramount's Deep Basin development program and its significant current year

reserves additions. The revolving period of the Credit Facility was extended to

November 30, 2014.

The underwriting syndicate for the Offering is co-led by Scotia Capital Inc.,

RBC Dominion Securities Inc. and BMO Nesbitt Burns Inc. and also includes

AltaCorp Capital Inc., HSBC Securities (Canada) Inc., TD Securities Inc., CIBC

World Markets Inc. and Peters & Co. Limited. The public offering in Canada is

being made by way of a prospectus supplement to Paramount's short form base

shelf prospectus dated November 14, 2012, as amended.

The Senior Notes have not been and will not be registered under any federal or

state securities laws of the United States. Accordingly, the Senior Notes may

not be offered or sold within the United States, except in transactions exempt

from the registration requirements of the federal and applicable state

securities laws of the United States. This news release shall not constitute an

offer to sell or the solicitation of an offer to buy the Senior Notes in any

jurisdiction.

Paramount is a Canadian oil and natural gas exploration, development and

production company with operations focused in Western Canada. Paramount's Class

A Common Shares are listed on the Toronto Stock Exchange under the symbol "POU".

Advisory Regarding Forward-Looking Statements

This news release contains forward-looking statements pertaining to the proposed

Offering, the timing of closing of the Offering, the amount and use of proceeds

from the Offering and the size and scope of the Company's 2014 capital

expenditure program. Although Paramount believes that the expectations reflected

in such forward looking statements are reasonable, undue reliance should not be

placed on them as Paramount cannot give any assurance that such expectations

will prove to be correct. The forward-looking statements in this news release

are made as of the date hereof and, except as required by applicable securities

law, Paramount undertakes no obligation to update publicly or revise such

statements, whether as a result of new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Paramount Resources Ltd.

J.H.T. (Jim) Riddell

President and Chief Operating Officer

Paramount Resources Ltd.

B.K. (Bernie) Lee

Chief Financial Officer

(403) 290-3600

(403) 262-7994 (FAX)

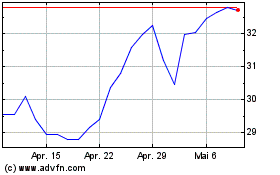

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024