Paramount Resources Ltd. (TSX:POU) ("Paramount" or the "Company") is pleased to

announce the reorganization of all of the Company's oil sands and carbonate

bitumen interests into a new wholly-owned subsidiary, Pixar Petroleum Corp.

("Pixar"). The reorganization is being undertaken to create a focused,

self-funding oil sands entity in order to accelerate the development of

Paramount's bitumen interests. Dr. William Roach has been appointed as Pixar's

President and Chief Executive Officer. In addition, the initial independent

resource estimates for the Saleski and other carbonate bitumen properties have

now been completed and the Company is pleased to announce the results.

REORGANIZATION

Upon completion of the reorganization in early-December, all of Paramount's oil

sands and carbonate bitumen leases will be owned by Pixar - including

Paramount's Hoole and Saleski leases.

In total, Pixar will own approximately 275 sections of Crown oil sands leases in

the western Athabasca region of Alberta, the majority of which are 100 percent

owned. These leases are prospective in multiple formations, primarily for

thermal in-situ development, but also have potential for cold production.

To view the map associated with this release, please visit the following link:

http://media3.marketwire.com/docs/748222_figure_1.pdf

PIXAR'S EXECUTIVE LEADERSHIP TEAM

Mr. James Riddell, Paramount's President and Chief Operating Officer, has been

appointed the Executive Chairman of Pixar.

Dr. William Roach has been appointed President and Chief Executive Officer of

Pixar. From 2004 to 2010, Dr. Roach served on the Board of Directors and as

President and Chief Executive Officer of UTS Energy Corporation ("UTS"), which

at that time was a publicly listed energy company focused on the exploration,

development and production of oil sands deposits in the Athabasca Oil Sands Area

of northeastern Alberta. During his tenure, the market capitalization of UTS

increased from $50 million to over $1.75 billion. Prior to UTS, Dr. Roach had a

successful 20-year career directing and managing the design, construction and

delivery of large capital-intensive national and international upstream oil and

gas projects. In the coming year, Dr. Roach will primarily focus on overseeing

the submission of a development application for Pixar's Hoole oil sands property

and building the team necessary to execute that development.

Mr. Martin Sandell has been appointed Senior Vice President, Development of

Pixar. Mr. Sandell was previously Vice President Engineering of UTS and has 25

years of experience leading large diverse oil and gas projects from conception

to operation in Canada, the United Kingdom, the North Sea and the Gulf of

Mexico.

Mr. William Robinson has been appointed Vice President, Geoscience of Pixar.

Prior to joining Pixar, Mr. Robinson oversaw the exploration and delineation of

Paramount's oil sands assets.

PIXAR'S PROPERTIES

Pixar's properties will include approximately 56 sections of land at Hoole,

which are primarily prospective for bitumen in the Grand Rapids formation and

the carbonate properties, which are primarily prospective for bitumen in the

Grosmont formation. The carbonate properties will include approximately 15

sections of land at Saleski and 186 sections of land in other areas (the "Other

Carbonate Leases"), including leases at Orchid, Granor and House. The new

subsidiary will also own approximately 18 additional sections in the Athabasca

Oil Sands Area of northeastern Alberta. Pixar's near-term plans are expected to

focus on the development of its 100 percent owned oil sands leases at Hoole and

the further delineation of its carbonate bitumen leases at Saleski.

Hoole

The majority of the work necessary for the regulatory application for commercial

development at the Hoole oil sands property has been completed, together with

preliminary front-end engineering and design, and reservoir modelling and

simulation (which has been verified by core flood experiments). Preparatory work

for project development is continuing, including field activities focused on

optimizing water source and disposal options.

In July 2011, Paramount received an updated independent evaluation of its

bitumen resources within the Grand Rapids formation at the Hoole oil sands

property. The updated evaluation was conducted by the Company's independent

reserves evaluator, McDaniel & Associates Consultants Ltd. ("McDaniel"). The

table below summarizes McDaniel's estimates of volumes attributable to

Paramount's 100 percent interest in the economic contingent bitumen resources in

the Grand Rapids formation at Hoole as of April 30, 2011, and estimates of

initial and fully developed production from such interests using a conventional

steam assisted gravity drainage ("SAGD") development scenario.

NPV(6) of

Economic Fully Future

Contingent Initial Developed Net Revenue

Category / Level of Resources Production Production (Discounted

Certainty(1) DEBIP(2) (3)(4) (5) (5) at 10%)

(MBbl) (MBbl) (Bbl/d) (Bbl/d) ($MM)

----------------------------------------------------------------------------

High Estimate 1,821,614 952,544 27,000 105,000 4,336

Best Estimate 1,631,742 762,661 26,000 80,000 2,834

Low Estimate 1,320,406 552,094 25,000 60,000 1,602

----------------------------------------------------------------------------

DEBIP means Discovered Exploitable Bitumen In Place.

MBbl means thousands of barrels.

Bbl/d means barrels per day.

$MM means millions of Canadian dollars.

See the Advisories section at the end of this document for note references.

Saleski

In April 2011, Paramount completed a ten-well delineation drilling program at

the Saleski property. Plans are currently being developed for the 2011/2012

winter capital program, including further delineation drilling and seismic

surveys.

Paramount has now received an independent evaluation of its bitumen resources

within the Grosmont formation at Saleski and the Other Carbonate Leases. The

table below summarizes the estimated volumes attributable to Paramount's 100

percent interest in the carbonate bitumen resources associated with the Saleski

property, evaluated by McDaniel as of October 31, 2011. McDaniel's evaluation

was limited to the Grosmont formation and is based on the resource being

exploited using SAGD. The technology required to economically produce bitumen

from carbonate formations is currently in the development stage and pilot

projects by others in the industry are ongoing. Currently, there is insufficient

economic data available for McDaniel to apply economic cutoffs or estimate

future net revenue.

Contingent

Resources

(Technology

Category / Level of Under Prospective

Certainty(1) DEBIP(2) UDEBIP(7) Development)(8) Resources(9)

(MBbl) (MBbl) (MBbl) (MBbl)

----------------------------------------------------------------------------

High Estimate 1,184,641 133,904 566,795 62,754

Best Estimate 1,184,641 109,332 380,493 34,006

Low Estimate 1,184,641 89,269 - -

----------------------------------------------------------------------------

DEBIP means Discovered Exploitable Bitumen In Place.

UDEBIP means Undiscovered Exploitable Bitumen In Place.

MBbl means thousands of barrels.

See the Advisories section at the end of this document for note references.

Other Carbonate Leases

The table below summarizes the estimated volumes attributable to Paramount's 100

percent interest in the carbonate bitumen resources associated with the Other

Carbonate Leases as evaluated by McDaniel as of October 31, 2011. McDaniel's

evaluation was limited to the Grosmont formation and is based on these resources

being exploited using SAGD. The technology required to economically produce

bitumen from carbonate formations is currently in the development stage and

pilot projects by others in the industry are ongoing. Currently there is

insufficient economic data available for McDaniel to apply economic cutoffs or

estimate future net revenue.

Contingent

Resources

Category / Level of (Technology

Certainty(1) Under Prospective

DEBIP(2) UDEBIP(7) Development)(8) Resources(9)

(MBbl) (MBbl) (MBbl) (MBbl)

----------------------------------------------------------------------------

High Estimate 430,586 5,411,625 183,950 2,211,652

Best Estimate 430,586 4,418,573 111,118 1,073,439

Low Estimate 430,586 3,607,750 - -

----------------------------------------------------------------------------

DEBIP means Discovered Exploitable Bitumen In Place.

UDEBIP means Undiscovered Exploitable Bitumen In Place.

MBbl means thousands of barrels.

See the Advisories section at the end of this document for note references.

Paramount is excited to add an experienced leadership team that will be able to

apply its skills and expertise to develop the significant oil sands land base

the Company has accumulated, including a near-term development project and a

range of future projects. The creation of Pixar will allow for the accelerated

development of these high impact, capital intensive properties, on a

self-funding basis, which will further unlock the value of these assets for the

benefit of Paramount's shareholders.

ADVISORIES

Notes

1. High Estimate is considered to be an optimistic estimate of the quantity

of resources that will actually be recovered. It is unlikely that the

actual remaining quantities of resources recovered will meet or exceed

the high estimate. Those resources at the high end of the estimate range

have a lower degree of certainty (a 10 percent confidence level) that

the actual quantities recovered will equal or exceed the estimate. Best

Estimate is considered to be the best estimate of the quantity of

resources that will actually be recovered. It is equally likely that the

actual remaining quantities recovered will be greater or less than the

best estimate. Those resources that fall within the best estimate have a

50 percent confidence level that the actual quantities recovered will

equal or exceed the estimate. Low Estimate is considered to be a

conservative estimate of the quantity of resources that will actually be

recovered. It is likely that the actual remaining quantities recovered

will exceed the low estimate. Those resources at the low end of the

estimate range have the highest degree of certainty (a 90 percent

confidence level) that the actual quantities recovered will equal or

exceed the estimate.

2. Discovered Exploitable Bitumen In Place is the estimated volume of

bitumen, as of a given date, which is contained in a subsurface

stratigraphic interval of a known accumulation that meets or exceeds

certain reservoir characteristics, such as minimum continuous net pay,

porosity and mass bitumen content. For the Hoole oil sands property, the

presence of these characteristics is considered necessary for the

commercial application of known recovery technologies. For the Saleski

property and the Other Carbonate Leases, these volumes have been

constrained to areas that have a minimum thickness of 10 meters of

substantially clean, continuous predominantly bitumen-saturated

carbonate with log porosity meeting a minimum of 10 percent and bitumen

saturation greater than 50 percent, respectively and with both competent

top and lateral reservoir containment. These carbonate bitumen resources

are constrained to one mile in area around known data points that

penetrate the zone and possess definitive geophysical log data.

Discovered Exploitable Bitumen in Place for the Saleski property and the

Other Carbonate Leases may be assigned outside of the one mile area if

reservoir continuity between offsetting delineation is expected. The

technology required to economically produce bitumen from carbonate

formations is currently in the development stage and has not been proven

on a commercial scale. There is no certainty that it will be

commercially viable to produce any portion of the resources from the

Hoole oil sands property, the Saleski property or the Other Carbonate

Leases.

3. Contingent Resources are those quantities of bitumen estimated, as of a

given date, to be potentially recoverable from known accumulations using

established technology or technology under development, but are

classified as a resource rather than a reserve due to one or more

contingencies, such as the absence of regulatory approvals, detailed

design estimates or near term development plans. There is no certainty

that it will be commercially viable to produce any portion of the

contingent resources. For the Hoole oil sands property, contingencies

which must be overcome to enable the reclassification of bitumen

contingent resources as reserves include the finalization of plans for

the initial development, a regulatory application submission with no

major issues raised, access to capital markets and other sources of

funding and management's intent to proceed evidenced by a development

plan with major capital expenditures. Economic Contingent Resources are

those contingent resources that are economically recoverable based on

specific forecasts of commodity prices and costs (based on McDaniel's

forecast prices and costs as of April 1, 2011).

4. Represents the Company's share of recoverable volumes before deduction

of royalties. In the assessment of contingent resources, McDaniel used a

minimum net pay cut-off of 10 meters in the best estimate case.

5. Initial production means the average daily production rate during the

first year of production. Estimates of production rates assume that

production will commence in 2015 and fully developed production will be

reached in 2016 for the low estimate, 2017 for the best estimate and

2018 for the high estimate.

6. NPV means net present value and represents the Company's share of future

net revenue, before the deduction of income tax from the Economic

Contingent Resources in the Grand Rapids formation within the Hoole oil

sands property. The calculation considers such items as revenues,

royalties, operating costs, abandonment costs and capital expenditures.

Royalties have been calculated based on Alberta's Royalty Framework

applicable to oil sands projects in Alberta. The calculation does not

consider financing costs and general and administrative costs. NPVs were

calculated assuming natural gas is used as a fuel for steam generation.

Revenues and expenditures were calculated based on McDaniel's forecast

prices and costs as of April 1, 2011. The estimated net present values

disclosed in this press release do not represent fair market value.

7. Undiscovered Exploitable Bitumen In Place is the volume of petroleum

estimated, as of a given date, to be contained in accumulations yet to

be discovered. These resources are mapped using known data points

penetrating the zone and possess definitive geophysical log data along

with seismic data and regional mapping. There is no certainty that any

portion of the resources will be discovered. If discovered, there is no

certainty that it will be commercially viable to produce any portion of

the resources.

8. Contingent Resources/Technology Under Development are those quantities

of bitumen estimated, as of a given date, to be potentially recoverable

from known accumulations using established technology or technology

under development, but are classified as a resource rather than a

reserve due to one or more contingencies, such as the absence of

regulatory approvals, detailed design estimates or near term development

plans. There is no certainty that it will be commercially viable to

produce any portion of the contingent resources. For the Saleski

property and the Other Carbonate Leases, because of the lack of

demonstrated commercial SAGD production within carbonate reservoirs, the

recoverable resources assigned are contingent upon successful

application of SAGD to the subject reservoir or a reasonable analog. The

successful implementation of SAGD technology in carbonate reservoirs is

a significant contingency associated with these assignments that

separate them from typical McMurray clastic SAGD contingent and

prospective resources, where the technology has been proven effective.

In addition to the technical contingency, additional contingencies

applicable to the carbonate resources include being in the early

evaluation stage, the economic viability of development and the absence

of regulatory approvals. The economic status of these resources are

undetermined.

9. Prospective Resources are those quantities of bitumen estimated, as of a

given date, to be potentially recoverable from undiscovered

accumulations by application of future development projects. Prospective

resources have both an associated chance of discovery and a chance of

development. Prospective Resources have not been, and may never be,

discovered.

Forward-looking Information

Certain statements in this document constitute forward-looking information under

applicable securities legislation. Forward-looking information typically

contains statements with words such as "anticipate", "believe", "estimate",

"expect", "plan", "intend", "propose", or similar words suggesting future

outcomes or an outlook. Forward looking information in this document includes,

but is not limited to:

-- the planned reorganization and the scope and timing thereof;

-- estimated resources and the discounted net present value of future net

revenues from such resources (including the forecast prices and costs

and the timing of expected production volumes and future development

capital);

-- expected production volumes from Hoole and the timing thereof;

-- exploration and development plans for oil sands leases and the timing

thereof;

-- the ability of Pixar to be self-funding;

-- the scope and timing of regulatory applications; and

-- business strategies and objectives;

Such forward-looking information is based on a number of assumptions which may

prove to be incorrect. The following assumptions have been made, in addition to

any other assumptions identified in this document:

-- future crude oil, bitumen, natural gas and NGLs prices and general

economic and business conditions;

-- the ability to obtain required capital to finance exploration,

development and operations;

-- the ability to obtain equipment, services, supplies and personnel in a

timely manner to carry out activities;

-- the ability to market oil successfully to current and new customers;

-- estimates of input and labour costs for an oil sands project;

-- the ability to secure adequate product processing transportation and

storage;

-- the ability to obtain drilling success consistent with expectations;

-- the timely receipt of required regulatory approvals;

-- estimated timelines being met in respect of the development of the oil

sands properties;

-- access to capital markets and other sources of funding; and

-- currency exchange and interest rates.

Although Paramount believes that the expectations reflected in such forward

looking information is reasonable, undue reliance should not be placed on it as

Paramount can give no assurance that such expectations will prove to be correct.

Forward-looking information is based on current expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Paramount and

described in the forward looking information. These risks and uncertainties

include, but are not limited to:

-- fluctuations in crude oil, bitumen, natural gas and NGLs prices, foreign

currency exchange rates and interest rates;

-- the uncertainty of estimates and projections relating to future revenue,

future production, costs and expenses and the timing thereof;

-- the ability to secure adequate product processing, transportation and

storage;

-- the uncertainty of exploration, development and drilling;

-- operational risks in exploring for, developing and producing crude oil

and natural gas, and the timing thereof;

-- the ability to obtain equipment, services, supplies and personnel in a

timely manner;

-- potential disruption or unexpected technical difficulties in designing,

developing or operating new or existing facilities;

-- risks and uncertainties involving the geology of oil and gas deposits;

-- the uncertainty of resource estimates;

-- the ability to generate sufficient cash flow from operations and other

sources of financing at an acceptable cost to meet current and future

obligations, including costs of anticipated projects;

-- changes to the status or interpretation of laws, regulations or

policies;

-- changes in environmental laws including emission reduction obligations;

-- the receipt and timing of governmental or regulatory approvals;

-- changes in general business and economic conditions;

-- uncertainty regarding aboriginal land claims and co-existing with local

populations;

-- the effects of weather;

-- the ability to fund exploration, development and operational activities

and meet current and future obligations;

-- the timing and cost of future abandonment and reclamation activities;

-- cleanup costs or business interruptions due environmental damage and

contamination;

-- the ability to enter into or continue leases;

-- existing and potential lawsuits and regulatory actions; and

-- other risks and uncertainties described elsewhere in this document and

in Paramount's other filings with Canadian securities authorities,

including its Annual Information Form.

The foregoing list of risks is not exhaustive. Additional information concerning

these and other factors which could impact Paramount are included in Paramount's

most recent Annual Information Form. The forward-looking information contained

in this document is made as of the date hereof and, except as required by

applicable securities law, Paramount undertakes no obligation to update publicly

or revise any forward-looking statements or information, whether as a result of

new information, future events or otherwise.

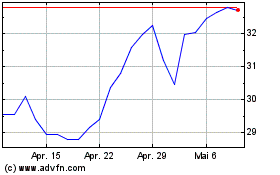

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024