High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its first quarter results today.

Mike Maguire, Chief Executive Officer

commented:

“We navigated the difficult past twelve months

with a keen focus on safe and effective operations and maintaining

our reputation for superior quality service. High Arctic is

emerging from the global crisis with a strong balance sheet and is

positioned well to ride the improved market conditions in 2021.

With oil and gas prices having sustained a return to pre-pandemic

levels, our customer base is considering opportunities to expand

their business activities. Sequential quarterly increases in

utilization of our services in Canada has been achieved and I

believe we are well placed for high growth in a significantly

stronger Canadian market.

In PNG a Covid-19 spike put a stop to almost all

activities during the quarter, resulting in a short-term drain on

our earnings as we continued to maintain operational readiness. We

expect to benefit from this readiness later in 2021 as government

and industry Covid-19 prevention strategies take hold, travel

restrictions are lessoned and business activities increase. In

addition, the Papua LNG partners recently announced remobilization

to complete project pre-feed which is a key step on the pathway to

a final investment decision. I believe that our commitment to PNG

will, in time, provide significant upside for our

shareholders.”

HIGHLIGHTS

The following highlights the Corporation’s

results for Q1-2021:

- First quarter

revenue of $17.8 million, EBITDA of $1.2 million, compared to $39.6

million and $5.5 million respectively in Q1-2020 and a slight

improvement over Q4-2020 with $16.6 million and $0.7 million

respectively.

- Total Energies SA

recently announced its intention to remobilize teams and resources

needed to proceed with development of the Papua LNG project.

- Balance sheet and

liquidity remains strong with cash of $21.0 million, no long-term

debt and liquidity that includes an undrawn $45.0 million revolving

loan facility.

- Patent pending on a

new low emission electric service rig design.

The Corporation’s strategic priorities

for 2021 include:

- Safety excellence and focus on

quality service delivery through consistent global standards;

- Cost control focused on operating

cash flow, while balancing strategic priorities to fuel

growth;

- The pursuit of opportunities that

secure the Corporation’s future as a lower emissions energy

services provider;

- Growth and divestiture

opportunities that enhance shareholder value, align with our core

service offerings, and are located in well understood markets;

and

- Disciplined working capital

management and capital stewardship to improve returns for

shareholders that potentially include dividends and common share

buybacks.

For more than a year High Arctic has been

internally progressing work on a practical process to convert

existing Concord well servicing rigs to a reliable, efficient and

inexpensive electric drive. We are pleased to announce that patent

is pending on the design and we plan to identify industry partners

to further test the technology at a pilot site in 2021. We see

tremendous opportunity for the deployment of this technology in

Western Canada, particularly in thermal well applications where

existing supply of electrical power of adequate capacity is already

available. Crucially at this stage of development the upgraded

service rig maintains its ability to self-propel down the highway.

The upgrade is estimated to reduce the Co2 emissions of a well

service rig over the well-bore by more than 35% compared to current

diesel-powered rigs.

The unaudited interim consolidated financial

statements (“Financial Statements”) and management discussion &

analysis (“MD&A”) for the quarter ended March 31, 2021 will be

available on SEDAR at www.sedar.com, and on High Arctic’s website

at www.haes.ca. Non-IFRS measures, such as EBITDA, Adjusted EBITDA,

Adjusted net earnings (loss), Oilfield services operating margin,

Operating margin %, Percent of revenue, Funds provided from

operations, Working capital and Net cash are included in this News

Release. See Non-IFRS Measures section, below. All amounts are

denominated in Canadian dollars (“CAD”), unless otherwise

indicated.

Within this News Release, the three months ended

March 31, 2021 may be referred to as the “Quarter”

or “Q1-2021”. The comparative three months ended

March 31, 2020 may be referred to as “Q1-2020”.

References to other quarters may be presented as

“QX-20XX” with X being the quarter/year to which

the commentary relates.

RESULTS OVERVIEW

|

|

|

For the three months ended March 31 |

|

($ millions, except per share amounts) |

|

|

2021 |

|

2020 |

|

|

Revenue |

|

|

17.8 |

|

39.6 |

|

| Net loss |

|

|

(5.2 |

) |

(2.2 |

) |

|

Per share (basic and diluted) (2) |

|

|

(0.11 |

) |

(0.04 |

) |

| Oilfield services operating

margin (1) |

|

|

3.3 |

|

7.3 |

|

| Oilfield services operating

margin as a % of revenue (1) |

|

|

18.5 |

% |

18.4 |

% |

| EBITDA (1) |

|

|

1.2 |

|

5.5 |

|

| Adjusted EBITDA (1) (3) |

|

|

0.8 |

|

2.7 |

|

| Adjusted EBITDA as % of revenue

(1) |

|

|

4.5 |

% |

6.8 |

% |

| Operating loss |

|

|

(6.2 |

) |

(4.7 |

) |

| Cash provided by (used in)

operating activities |

|

|

(1.3 |

) |

8.6 |

|

|

Per share (basic and diluted) (2) |

|

|

(0.03 |

) |

0.17 |

|

| Funds provided by operations

(1) |

|

|

0.4 |

|

2.0 |

|

|

Per share (basic and diluted) (2) |

|

|

0.01 |

|

0.04 |

|

| Dividends |

|

|

- |

|

1.6 |

|

|

Per share (basic and diluted) (2) |

|

|

- |

|

0.03 |

|

|

Capital expenditures |

|

|

0.8 |

|

1.9 |

|

|

|

|

As at |

| ($

millions, except share amounts) |

|

|

March 31, 2021 |

|

December 31, 2020 |

|

|

Working capital (1) |

|

|

34.7 |

|

44.8 |

|

| Cash, end of period |

|

|

21.0 |

|

32.6 |

|

| Total assets |

|

|

197.6 |

|

214.2 |

|

| Long-term debt |

|

|

- |

|

10.0 |

|

| Total long-term financial

liabilities |

|

|

7.7 |

|

7.8 |

|

| Shareholders’ equity |

|

|

171.3 |

|

177.3 |

|

|

Per share (basic and diluted) (2) |

|

|

3.51 |

|

3.58 |

|

| Common

shares outstanding, millions |

|

|

48.8 |

|

48.8 |

|

(1) Readers are cautioned that Oilfield

services operating margin, EBITDA (Earnings before interest, tax,

depreciation and amortization), Adjusted EBITDA, Funds provided by

operations, and working capital do not have standardized meanings

prescribed by IFRS – see “Non IFRS Measures” on page 16 of the

Q1-2021 MD&A for calculations of these

measures.(2) The number of common shares used in

calculating net loss per share, cash provided by (used in)

operating activities per share, funds provided by operations per

share, dividends per share and shareholders’ equity per share is

determined as explained in Note 7(b) of the Financial Statements.

(3) Adjusted EBITDA includes the impact of wage and rent

subsidies recorded.

First Quarter 2021 Summary:

- High Arctic reported revenue of

$17.8 million, incurred a net loss of $5.2 million and realized

Adjusted EBITDA of $0.8 million during Q1-2021. This compares to

Q1-2020, with revenue of $39.6 million, a net loss of $2.2 million

and Adjusted EBITDA of $2.7 million.

- Changes were mainly due to $21.8

million of reduced revenue, primarily attributable to the ongoing

suspension of drilling activity in PNG and associated ancillary

services and the impact of two extreme weather events that impacted

some of the Corporations activity in Western Canada, partially

offset by $2.1 million in reduced general and administrative costs

attributable to the 2020 restructuring and cost reduction

initiatives undertaken by management.

- Oilfield services operating margin

decreased by 54.8% in Q1-2021 compared to Q1-2020 to $3.3 million

from $7.3 million, with reductions of $3.2 million in Drilling

Services and $1.5 million in Ancillary Services, partially offset

by an increase of $0.7 million in Production Services.

- The CEWS provided $0.9 million in

wage subsidy relief, of which $0.8 million offset Oilfield services

expenses and $0.1 million offset General and administrative

expenses.

- No dividends were paid in Q1-2021,

compared to $1.6 million paid in Q1-2020 ($0.03 per share). High

Arctic suspended its monthly dividend in March 2020.

- Cash decreased by $11.6 million in

Q1-2021 as compared to a cash increase of $19.0 million in

Q1-2020.

- The Corporation repaid the $10

million outstanding amount on its available $45 million revolving

loan facility in March 2021. No amount is drawn under this facility

as of the date of this News Release.

- Utilization for High Arctic’s 49

registered Concord Well Servicing rigs was 48% in the Quarter

versus industry utilization of 39% (source: Canadian Association of

Oilwell Drilling Contractors “CAODC”), and

- High Arctic did not repurchase any

shares under the NCIB in place during the Quarter.

Drilling Services Segment

|

|

Three months ended March 31 |

| ($

millions, unless otherwise noted) |

2021 |

|

2020 |

|

|

Revenue |

0.8 |

|

13.9 |

|

|

Oilfield services expense |

0.8 |

|

10.7 |

|

|

Oilfield services operating margin |

- |

|

3.2 |

|

|

Operating margin (%) |

- |

% |

23.0 |

% |

Production Services Segment

|

|

Three months ended March 31 |

| ($

millions, unless otherwise noted) |

2021 |

|

2020 |

|

|

Revenue |

15.4 |

|

21.8 |

|

|

Oilfield services expense |

13.2 |

|

20.3 |

|

|

Oilfield services operating margin |

2.2 |

|

1.5 |

|

|

Operating margin (%) |

14.3 |

% |

6.9 |

% |

|

|

Three months ended March 31 |

|

Operating Statistics - Canada |

2021 |

|

2020 |

|

| Service rigs: |

|

|

|

Average fleet |

49 |

|

51 |

|

|

Utilization |

48 |

% |

58 |

% |

|

Operating hours |

21,120 |

|

26,899 |

|

|

Revenue per hour ($) |

600 |

|

623 |

|

|

|

|

|

| Snubbing rigs: |

|

|

|

Average fleet |

8 |

|

9 |

|

|

Utilization |

28 |

% |

31 |

% |

|

Operating hours |

2,009 |

|

2,555 |

|

Ancillary Services Segment

|

|

Three months ended March 31 |

|

($ millions, unless otherwise noted) |

2021 |

|

2020 |

|

| Revenue |

2.2 |

|

4.5 |

|

|

Oilfield services expense |

1.1 |

|

1.9 |

|

|

Oilfield services operating margin |

1.1 |

|

2.6 |

|

|

Operating margin (%) |

50.0 |

% |

57.8 |

% |

Liquidity and Capital

Resources

Operating Activities

Cash used in operating activities of $1.3

million for the Quarter (Q1-2020 – cash from operating activities

of $8.6) was due to $0.4 million of funds provided by operations

less $1.7 million due to working capital changes, mainly the

increase in accounts receivable during the Quarter.

Investing Activities

During the Quarter, the Corporation’s cash from

investing activities amounted to $0.1 million (Q1-2020 – $1.9

million). Capital expenditures during the Quarter of $0.8 million

(Q1-2020 - $1.9 million) were partially offset by proceeds on

disposal of $0.6 million (Q1-2020 – $4.9 million). The balance of

the change related to working capital balance changes for capital

items.

Financing Activities

During the Quarter, the Corporation repaid the

$10 million amount outstanding on its $45 million revolving debt

facility from December 31, 2020.

Credit Facility

The Corporation has a $45.0 million revolving

facility which has a maturity date of August 31, 2023, is renewable

with the lender’s consent, and is secured by a general security

agreement over the Corporation’s assets. The Corporation’s loan

facility is subject to two financial covenants which are reported

to the lender on a quarterly basis. As at March 31, 2021, the

Corporation remains in compliance with these two financial

covenants under the credit facility.

The covenant calculations at March 31, 2021 are:

|

|

|

|

Covenant |

Required |

As at March 31, 2021 |

|

Funded debt to covenant EBITDA (1)(2) |

3.0 : 1 Maximum |

0.0 : 1 |

|

Covenant EBITDA to Interest expense (2) |

3.0 : 1 Minimum |

32.64 : 1 |

(1) Funded debt to covenant

EBITDA is defined as the ratio of consolidated Funded Debt to the

aggregate covenant EBITDA for the trailing four quarters. Funded

debt is the amount of debt provided and outstanding at the date of

the covenant calculation. (2) EBITDA for the

purposes of calculating the covenants, “covenant EBITDA,” is

defined as net income plus interest expense, current tax expense,

depreciation, amortization, future income tax expense (recovery),

share based compensation expense less gains from foreign exchange

and sale or purchase of assets.

Outlook

The rally in oil and gas prices in markets

around the world continued throughout the first quarter of 2021

despite some challenges and the price rally continues to the date

of this News Release. Benchmark indices including Brent Crude, WTI

Crude, Western Canadian Select, LNG JKM, Henry Hub and Alberta

Natural Gas all reached peaks not seen since the pre-pandemic

period in Q1-2020 and have been recently trading in elevated stable

bands. Utilization of High Arctic’s services in Canada has

continued to rise through the Quarter as our customers sought to

raise their production. To date, producers have been conservative

with their capital, with many prioritizing balance sheet

improvement over capital investment, but the prospect of sustained

commodity prices has High Arctic expecting further increases in

demand for our services throughout 2021.

During Q1-2021, Covid-19 continued to impact the

global economy, with governments around the world attempting to

balance measures to contain the virus, including new and emerging

variants, against the need to open up economies. In the US,

infection rates have slowed markedly as vaccinated populations

grow. There are strong indications of economic recovery in the US

that have buoyed both consumers and capital markets. In Canada as

vaccination rates climb relaxation of social and economic

restrictions are expected to take place with a corresponding

improvement in business and travel confidence. In turn, this should

drive increases in domestic energy demand during the second half of

2021 and beyond, matching the momentum in the US, the largest buyer

of exported Western Canadian crude oil products. High Arctic has

already seen a busier Q2-2021 in Canada following an early spring

breakup and we are seeing improved interest in our services. High

Arctic aims to differentiate itself by focusing on high quality

customer service using well maintained equipment that is operated

by highly competent personnel.

High Arctic was eligible for various government

subsidies during Q1-2021, which are described in our MD&A. The

Corporation will continue to apply for programs where eligibility

criteria are met, including the Canada Emergency Wage Subsidy

(“CEWS”), however, the amount of subsidies is expected to be less

than comparable 2020 levels.

In Papua New Guinea, a recent spike in Covid-19

cases has seen travel bans imposed by its near neighbour Countries,

particularly Australia. The Australian travel ban has the result of

shutting down the primary source of skilled expatriate PNG workers.

The result for High Arctic has been a continuation of the cessation

of all drilling and exploration activity and the deferral of our

customers nonessential plant maintenance and project activity.

Reliable travel routes to PNG are essential for projects to

recommence. High Arctic has taken steps to ensure that our

capability as the PNG specialist energy service contractor will be

preserved. We maintain regular dialogue with our customers,

employees, and industry and government representatives. We expect a

modest return to work later in 2021 as Covid-19 prevention

strategies take hold and are optimistic of more meaningful activity

increases in the medium to longer term. Last week, TotalEnergies

and the PNG government announced the remobilization of Papua LNG

Project teams and other required resources to complete project

pre-feed on the pathway to a final investment decision in 2023.

This announcement follows others from the PNG Government in recent

months that indicate a change in tone towards both foreign

investment and resource projects, and the importance of LNG

expansion to the people of PNG.

NON - IFRS MEASURES

This News Release contains references to certain

financial measures that do not have a standardized meaning

prescribed by International Financial Reporting Standards (“IFRS”)

and may not be comparable to the same or similar measures used by

other companies. High Arctic uses these financial measures to

assess performance and believes these measures provide useful

supplemental information to shareholders and investors. These

financial measures are computed on a consistent basis for each

reporting period and include EBITDA, Adjusted EBITDA, Adjusted net

earnings (loss), Oilfield services operating margin, Percent of

revenue, Funds provided from operations, Working capital, and Net

cash, none of which have standardized meanings prescribed under

IFRS.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at www.sedar.com

and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTS

This News Release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the Corporation’s actual

results, performance or achievements to vary from those described

in this News Release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this News Release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this News Release include, among

others, statements pertaining to the following: general economic

and business conditions which will, among other things, impact

demand for and market prices for the Corporation’s services;

expectations regarding the Corporation’s ability to raise capital

and manage its debt obligations; commodity prices and the impact

that they have on industry activity; increases in demand for our

services; improved interest in our services; a modest return to

work later in 2021 as Covid-19 prevention strategies taking hold;

relaxation of social and economic restrictions; travel restrictions

lessoning and business activities increasing; improvement in

business and travel confidence; more meaningful activity increases

in the medium to longer term; continued safety performance

excellence; oversight of working capital to maintain a strong

balance sheet; plans to identify industry partners to further test

the technology at a pilot site in 2021; estimated capital

expenditure programs for fiscal 2021 and subsequent periods;

projections of market prices and costs; factors upon which the

Corporation will decide whether or not to undertake a specific

course of operational action or expansion; the Corporation’s

ongoing relationship with major customers; treatment under

governmental regulatory regimes and political uncertainty and civil

unrest; a final Papua LNG investment decision in 2023; the

Corporation’s ability to maintain a USD bank account and conduct

its business in USD in PNG; and the Corporation’s ability to

repatriate excess funds from PNG as approval is received from the

Bank of PNG and the PNG Internal Revenue Commission.

With respect to forward-looking statements

contained in this News Release, the Corporation has made

assumptions regarding, among other things, its ability to: obtain

equity and debt financing on satisfactory terms; market

successfully to current and new customers; the general continuance

of current or, where applicable, assumed industry conditions;

activity and pricing; assumptions regarding commodity prices, in

particular oil and gas; the Corporation’s primary objectives, and

the methods of achieving those objectives; obtain equipment from

suppliers; construct property and equipment according to

anticipated schedules and budgets; remain competitive in all of its

operations; and attract and retain skilled employees.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this News Release, along with the risk factors set out

in the most recent Annual Information Form filed on SEDAR at

www.sedar.com.

The forward-looking statements contained in this

News Release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this News Release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

ServicesHigh Arctic’s principal focus is to provide

drilling and specialized well completion services, equipment

rentals and other services to the oil and gas industry. High Arctic

is a market leader providing drilling and specialized well

completion services and supplies rig matting, camps and drilling

support equipment on a rental basis in Papua New Guinea. The

Western Canadian operation provides well servicing, well

abandonment, snubbing and nitrogen services and equipment on a

rental basis to a large number of oil and natural gas exploration

and production companies.

For further information contact:

Michael J. MaguireChief Executive Officer+1 (587) 318 3826+1

(800) 688 7143

High Arctic Energy Services Inc.Suite 500, 700 – 2nd Street

S.W.Calgary, Alberta, Canada T2P 2W1Website: www.haes.caEmail:

info@haes.ca

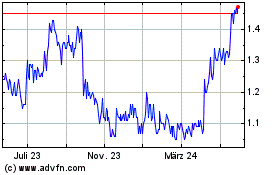

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

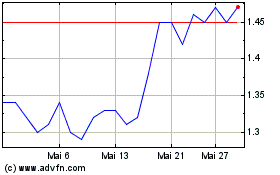

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025