Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) is pleased to announce the Company’s

unaudited financial results for the three and nine months ended

September 30, 2024 (“

Q3 2024”), located on Nisga’a

Nation Treaty Lands in the prolific Golden Triangle of northwestern

British Columbia. For details of the unaudited condensed interim

consolidated financial statements and Management's Discussion and

Analysis for the three and nine months ended September 30, 2024,

please see the Company’s filings on SEDAR+ (www.sedarplus.ca).

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise

specified.

Q3 2024 AND RECENT

HIGHLIGHTS

- On October 30, 2024, the Company

further announced it was able to reduce the size of the proposed

senior debt financing to US$7.5 million instead of the original

US$11.25 million previously disclosed. It had entered into a

non-binding indicative term sheet with Sprott Private Resource

Streaming and Royalty (B) Corp. (“Sprott”), to provide US$7.5

million of financing by way of an amendment to the terms of one of

its existing stream agreements between the Company and Sprott

(“Amended Debt Financing”). As part of the Amended Debt Financing,

the secured creditors would extend their existing waiver and

forbearance conditions until May 31, 2025.

- On October 22,

2024, the Company announced upsize of the previously announced

equity financing from gross proceeds of at least C$25 million and

up to a maximum of C$35 million, to gross proceeds of up to C$42

million.

- On October 21,

2024, the Company announced a plan to raise approximately C$40

million in funding to advance the development of PNL, restart the

mill and restart BM from the current state of temporary care and

maintenance. The funding will be through both debt and equity

financing and will enable the management to execute the mine

development plans. Subject to the satisfaction of certain

conditions precedent, the Company anticipates the execution of

definitive documentation in respect of the new debt and the closing

of equity financing are expected to occur on or about November 18,

2024.

- On September 19,

2024, the Company and its secured creditors, Sprott Private

Resource Streaming and Royalty (B) Corporation, Nebari Gold Fund 1,

LP, Nebari Natural Resources Credit Fund II, LP and Nebari

Collateral Agent LLC agreed to extend the waiver arrangements until

October 31, 2024. On October 29, 2024, the waivers were further

extended to November 18, 2024.

- On September 6,

2024, the Company had made a prudent decision to suspend operation

due to delays in mine development that had hindered access to

sufficient ore feed.

- In Q3 2024

before the suspension of operations, the Big Missouri deposit

delivered 44,797 wet tonnes of material. Total mine development

achieved 1,428 meters of which 1,074 metres related to Big Missouri

and 354 metres relate to PNL.

- During Q3 2024

before the suspension of operations, the plant processed 71,386 dry

tonnes of mostly development ore in the commissioning of the mill.

In August 2024, the mill processed, near its design capacity, over

2,300 tpd for its 14-day operating schedule continuously.

- During Q3 2024,

the Company poured 3,885 ounces of gold and 10,153 ounces of

silver. It sold 3,452 ounces of gold to the offtaker at a realized

price of US$2,448/oz and delivered 399 ounces of gold and 6,979

ounces of silver pursuant to stream and royalty agreement.

- On July 25, 2024,

the Company closed the previously announced bought deal financing,

including the full exercise of the over-allotment option, for gross

proceeds of approximately $34 million (the “Offering”). The

Offering consisted of 30,242,000 flow-through units (the

“Flow-Through Units”) at a price of C$0.496 per Flow-Through Unit

and 44,188,000 hard dollar units (the “HD Units”) of the Company

(together, the “Offered Securities”) of C$0.43 per HD Unit. Each

Offered Security consisted of one common share of the company and

one common share purchase warrant of the Company. Each warrant

entitled the holder to acquire one share (each, a “Warrant Share”)

at a price of C$0.52 per Warrant Share for a period of 24 months

following closing.

FINANCIAL RESULTS

Three months ended September 30, 2024

compared to three months ended September 30, 2023

The Company reported a net loss of $11,232 for

Q3 2024 compared to a net loss of $1,473 for Q3 2023. The increase

in net loss of $9,759 for the current period is primarily

attributable to a combination of factors, including:

- A $11,638 decrease in fair value of

derivatives mainly driven by the adjustment to discount rate

offsetting by higher gold and silver prices, which is a non-cash

item.

These factors were partially offset by a

decrease in general and administrative costs of $602 and revenue,

net of cost of sales of $461.

Nine months ended September 30, 2024

compared to nine months ended September 30, 2023

The Company reported a net loss of $14,490 for

the nine month period ended September 30, 2024 compared to $12,135

for the same period in 2023. The increase in net loss of $2,355 is

primarily attributable to a combination of factors, including:

- A $7,286 decrease in fair value of

derivatives mainly driven by the adjustment to discount rate

offsetting by higher gold and silver prices, which is a non-cash

item.

Partially offsetting by:

- A $1,008 decrease in financing

costs; and

- A $4,432 decrease in the loss of

extinguishment of debt.

LIQUIDITY AND CAPITAL

RESOURCES

During the nine months ended September 30, 2024,

the Company issued 153,086,953 common shares, 84,594,528 warrants,

and granted 300,000 stock options, 89,667 Deferred Share Units

(“DSUs”) and 142,892 Restricted Share Units (“RSU”). Also,

5,263,230 stock options expired or were forfeited, 305,848 RSUs

were forfeited, 13,710,500 warrants expired and 371,369 stock

options, 137,533 DSUs and 1,087,983 RSUs were exercised in nine

months ended September 30, 2024.

As at September 30, 2024, the Company had cash

and cash equivalents of $9,882 and a working capital deficiency of

$62,389. Excluding the non-cash current liabilities, the working

capital deficiency was $42,764. The decrease in cash and cash

equivalents since December 31, 2023 was due to the increase in

expenditures in mine development, plant and equipment of 138,274

which is offset by net proceeds from the sale of Sprott royalty of

$40,554, net proceeds from the COF of $26,766, proceeds from the

bought deal private placement of $67,752 and proceeds from the

exercise of stock options of $193; cash outflows from operating

activities of $1,654; share issue costs of $4,175, financing costs

of $881, payment for lease liabilities of $2,937, and payment of

principal interest on COF of $3,096.

The negative working capital and suspension of

operations would have resulted in a default on Ascot’s credit

facilities. However, the Company obtained waivers from its lenders

providing for limited suspension of covenant compliance

requirements until November 18, 2024. Concurrent with closing of

the financing package and Amended Debt Financing, the lenders would

extend existing waivers and forbearance conditions until May 31,

2025. The Amended Debt Financing remains subject to receipt of

necessary regulatory approvals and exemptions, which may not be

received. The Company has not yet received any funding from the

Amended Debt Financing and the Amended Debt Financing remains

subject to several conditions which may not be satisfied or waived.

These considerations indicate material uncertainties which cast

significant doubt upon the Company’s ability to continue as a going

concern (refer to Note 1 to the Company’s unaudited condensed

interim consolidated financial statements for the three and nine

months ended September 30, 2024).

MANAGEMENT’S OUTLOOK FOR

2024

In 2024, the Company intended to transition from

the construction of the mine and related infrastructure to the

operation of the entire site and to become a gold producer.

After the announcement of temporary suspension

of operations in early September 2024, the key activities and

priorities for the remainder of 2024 include:

- Completing

financing for additional funding in Q4 2024.

- Developing a

comprehensive plan to accelerate mine development at PNL and ensure

a successful restart of production in Q2 2025.

- In order to

operate the processing plant at 2,400 tpd (100 tph) the company

needs to complete the mine development of PNL, ensuring that it, in

conjunction with Big Missouri production, supplies sufficient mill

feed to the processing plant. Management is addressing this by

developing over 6m per day on average at PNL continuously with

anticipation of breakthrough to the Prew ore zone, when rates are

expected to increase with multiple headings.

- Preserving the

site for winter season and ensuring the infrastructure is protected

and maintained for restart of operations in Q2 2025.

- Finalizing the

commission of the Moving Bed Bio-Reactor (“MBBR”) portion of the

water treatment plant.

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President &

CEO

For further information

contact:

Kristina HoweVP

Communicationsinfo@ascotgold.com778-725-1060

About Ascot Resources Ltd.

Ascot is a Canadian mining company focused on

commissioning its 100%-owned Premier Gold Mine, which poured first

gold in April 2024 and is located on Nisga’a Nation Treaty Lands,

in the prolific Golden Triangle of northwestern British Columbia.

Concurrent with commissioning Premier towards commercial

production, the Company continues to explore its properties for

additional high-grade gold mineralization. Ascot’s corporate office

is in Vancouver, and its shares trade on the TSX under the ticker

AOT and on the OTCQX under the ticker AOTVF. Ascot is committed to

the safe and responsible operation of the Premier Gold Mine in

collaboration with Nisga’a Nation and the local communities of

Stewart, BC and Hyder, Alaska.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws (“forward-looking statements”). Forward-looking statements are

often, but not always, identified by the use of words such as

“seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”,

“targeted”, “outlook”, “on track” and “intend” and statements that

an event or result “may”, "will”, “should”, “could”, “would” or

“might” occur or be achieved and other similar expressions. All

statements, other than statements of historical fact, included

herein are forward-looking statements, including statements in

respect of advancement and development of the PGP and the timing

related thereto, the completion of the PGP mine, the production of

gold, the use of proceeds from our financings, our ability to

secure additional financing, our financing needs, the resolution of

commissioning challenges, the anticipated grade of mineral

production, the operation of the mill and management’s outlook for

the remainder of 2024 and beyond. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements, including risks

associated with uncertainties relating to the grade of mineral

deposits; the inability to resolve commissioning challenges; lack

of liquidity; being in default under our credit facilities; the

need to obtain additional financing to develop properties and

uncertainty as to the availability and terms of future financing;

the possibility of delay in exploration or development programs and

uncertainty of meeting anticipated program milestones; risks

related to exploration and potential development of Ascot's

projects; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; uncertainties relating to interpretation of drill results

and the geology and continuity of mineral deposits; the need for

cooperation of government agencies and indigenous groups in the

exploration and development of Ascot’s properties and the issuance

of required permits; uncertainty as to timely availability of

permits and other governmental approvals; and other risk factors as

detailed from time to time in Ascot's filings with Canadian

securities regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024 in the section entitled “Risk

Factors”. Forward-looking statements are based on assumptions made

with regard to: the grade of mineral production; the capacity and

operation of the mill; production results and aggregate gold sales;

the estimated costs associated with construction of the Project;

the ability to maintain throughput and production levels at the PGP

mill; the tax rate applicable to the Company; future commodity

prices; the grade of mineral resources and mineral reserves; the

ability of the Company to convert inferred mineral resources to

other categories; the ability of the Company to reduce mining

dilution; the ability to reduce capital costs; and exploration

plans. Forward-looking statements are based on estimates and

opinions of management at the date the statements are made.

Although Ascot believes that the expectations reflected in such

forward-looking statements and/or information are reasonable, undue

reliance should not be placed on forward-looking statements since

Ascot can give no assurance that such expectations will prove to be

correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

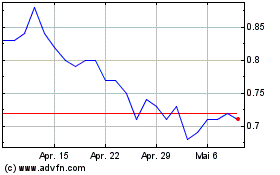

Ascot Resources (TSX:AOT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

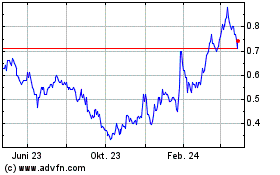

Ascot Resources (TSX:AOT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024