Ascot Announces Upsize of Previously Announced Equity Financing

22 Oktober 2024 - 1:31PM

Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF)

(“

Ascot” or the “

Company”) is

pleased to announce that the Company and a syndicate of agents (the

“

Agents”) co-led by Desjardins Capital Markets

(“

Desjardins”) and BMO Capital Markets

(“

BMO”, and together with Desjardins, the

“

Bookrunners”) have agreed to increase the size of

its previously announced best-efforts private placement offering of

common shares (the “

Common Shares”) from gross

proceeds of at least C$25,000,000 and up to a maximum of

C$35,000,000, to gross proceeds of up to C$42,000,000 (the

“

Equity Financing”).

Proceeds from the Equity Financing and Debt

Financing (as defined in the press release titled “Ascot Provides

an Update on Funding for Future Mine Development & Restart of

Operations” dated October 21, 2024) are expected to be used to

advance the mine development of the PNL mine by completing

approximately 2,400 metres of mine development and advance this

development to enable the Company to access and mine the Prew zone

phase 1 including the required second egress to the mine. In

addition, funds will be used to restart the mill and re-start the

BM mine from its current state of temporary care and maintenance.

The goal of the Company is to restart mill operations in Q2 2025

and restart the BM mine so that the mill can be sustainably fed

with ore from both mines.

Closing of the Equity Financing is expected to

occur on or about November 18, 2024 and is conditional on: (i) the

execution of all necessary definitive documentation in respect of

the Debt Financing, (ii) the deposit of the proceeds of the Debt

Financing into an escrow account and (iii) receipt of the necessary

TSX approvals and exemptions. The Equity Financing is also

conditional upon the Company not being required to obtain any

shareholder approvals in respect of the Equity Financing (whether

by way of exemption by the TSX or otherwise).

On behalf of the Board of Directors of

Ascot Resources Ltd.

“Derek C. White”

President & CEO, Director

For further information

contact:

Kristina Howe

VP, Communications khowe@ascotgold.com

778-725-1060 ext. 1019

About Ascot

Ascot is a Canadian mining company headquartered

in Vancouver, British Columbia and its shares trade on the TSX

under the ticker AOT and on the OTCQX under the ticker AOTVF. Ascot

is the 100% owner of the Premier Gold Mine

(“Premier”), which poured first gold in April 2024

and is located on Nisga’a Nation Treaty Lands, in the prolific

Golden Triangle of northwestern British Columbia.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements").

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "believe", "plan",

"estimate", "expect", "targeted", "outlook", "on track" and

"intend" and statements that an event or result "may", "will",

"should", "could", “would” or "might" occur or be achieved and

other similar expressions. All statements, other than statements of

historical fact, included herein are forward-looking statements,

including statements in respect of the terms and conditions of the

Debt Financing or the Equity Financing, the completion of the Debt

Financing or the Equity Financing, the anticipated use of proceeds

from the funding package and the ability of the Company to

accomplish its business objectives and the intentions described

herein; and future plans, development and operations of the

Company. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements, including risks related to whether the

Equity Financing and/or Debt Financing will be completed on the

terms described or at all; business and economic conditions in the

mining industry generally; fluctuations in commodity prices and

currency exchange rates; uncertainty of estimates and projections

relating to development, production, costs and expenses, and

health, safety and environmental risks; uncertainties relating to

interpretation of drill results and the geology, continuity and

grade of mineral deposits; the need for cooperation of government

agencies and indigenous groups in the exploration and development

of Ascot’s properties and the issuance of required permits; the

need to obtain additional financing to finance operations and

uncertainty as to the availability and terms of future financing;

the possibility of delay in future plans and uncertainty of meeting

anticipated program milestones; uncertainty as to timely

availability of permits and other governmental approvals; the need

for TSX approval, including pursuant to financial hardship

exemptions, and other regulatory approvals and other risk factors

as detailed from time to time in Ascot's filings with Canadian

securities regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024 in the section entitled "Risk

Factors". Forward-looking statements are based on assumptions made

with regard to: the estimated costs associated with the care and

maintenance plans; the ability to maintain throughput and

production levels at BM and PNL; the tax rate applicable to the

Company; future commodity prices; the grade of mineral resources

and mineral reserves; the ability of the Company to convert

inferred mineral resources to other categories; the ability of the

Company to reduce mining dilution; the ability to reduce capital

costs; the ability of the Company to raise additional financing;

compliance with the covenants in Ascot’s credit agreements; and

exploration plans. Forward-looking statements are based on

estimates and opinions of management at the date the statements are

made. Although Ascot believes that the expectations reflected in

such forward-looking statements and/or information are reasonable,

undue reliance should not be placed on forward-looking statements

since Ascot can give no assurance that such expectations will prove

to be correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

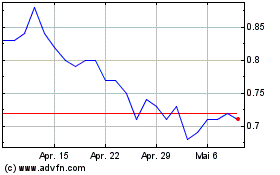

Ascot Resources (TSX:AOT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

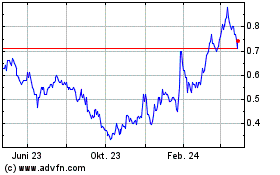

Ascot Resources (TSX:AOT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024