Altius Minerals Corporation Reports Annual Net Loss of $22,565,000

02 Juli 2014 - 2:21PM

Marketwired

Altius Minerals Corporation Reports Annual Net Loss of $22,565,000

Anticipates financial benefit of the recent Prairies Royalties

acquisition in the next financial quarter

ST. JOHN'S, NEWFOUNDLAND--(Marketwired - Jul 2, 2014) - Altius

Minerals Corporation ("Altius" or the "Corporation") (TSX:ALS)

reports attributable revenue(1) of $6,236,000 and net loss

attributable to common shareholders of $22,565,000 or ($0.81) per

share for the year ended April 30, 2014 compared to attributable

revenue(1) of $5,865,000 and a net loss of $13,339,000 for the same

period last year. The current year results were affected by various

investment losses and adjustments to carrying value totaling

$16,358,000, primarily related to the Corporation's carrying value

of its founding shareholding in Alderon Iron Ore Corp., certain

corporate development expenses of $3,616,000 related to the

Prairies Royalties acquisition and higher share based compensation

as a result of Altius' increased share price during the year.

On April 28, 2014, Altius reached an important milestone by

closing the Prairies Royalties acquisition, which comprised royalty

interests in eleven producing mines of electrical coal, potash, and

metallurgical coal, all located within Canada. The acquisition has

increased the Corporation's anticipated per annum royalty revenue

by more than tenfold while substantially diversifying its asset

base by commodity, geography and asset. Altius now has royalty

revenue from six commodities with more than 50% of that revenue

from low risk, inflation adjusted electrical coal royalties and no

single asset that contributes more than 22% of expected revenue.

Altius expects to begin to realize substantial cash flow from the

royalty income it will receive from the royalty portfolio in the

current fiscal year. A summary of the financial results is included

in the following table.

|

Three months ended April 30, |

|

Year ended April 30, |

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

| Royalty revenue |

|

|

|

|

|

|

|

|

|

Voisey's Bay |

664,000 |

|

891,000 |

|

2,773,000 |

|

3,136,000 |

|

|

Coal

(1) |

114,000 |

|

- |

|

114,000 |

|

- |

|

|

Potash (1) |

44,000 |

|

- |

|

44,000 |

|

- |

|

| Interest and investment |

404,000 |

|

679,000 |

|

1,780,000 |

|

2,500,000 |

|

| Other |

9,000 |

|

14,000 |

|

1,525,000 |

|

229,000 |

|

| Attributable revenue |

1,235,000 |

|

1,584,000 |

|

6,236,000 |

|

5,865,000 |

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common shareholders |

(23,898,000 |

) |

(3,970,000 |

) |

(22,565,000 |

) |

(13,882,000 |

) |

| Net loss per share - basic and diluted |

(0.73 |

) |

(0.14 |

) |

(0.81 |

) |

(0.47 |

) |

| Net cash flow from operations |

3,396,000 |

|

(118,000 |

) |

753,000 |

|

3,751,000 |

|

|

|

|

|

|

|

|

|

|

| (1) See non-IFRS measures for reconciliation of

attributable revenue |

|

| (2) Coal and Potash royalties were acquired on April

28, 2014 and include three days of revenue |

|

Additional information on the Corporation's results of

operations is included in the Corporation's Annual Information

Form, MD&A, and Financial Statements, which were filed on SEDAR

today and are also available on the Corporation's website at

www.altiusminerals.com.

Non-IFRS Measures

Attributable royalty is intended to provide additional

information only and do not have any standardized meaning

prescribed under IFRS and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. Other companies may calculate these measures

differently. For a reconciliation of these measures to various IFRS

measures, please see below.

- Attributable revenue is defined by the Corporation as total

revenue from the consolidated financial statements and the

Corporation's proportionate share of gross revenue in the joint

ventures. The Corporation's key decision makers use attributable

royalty revenue and related attributable royalty expenses as a

basis to evaluate the business performance. The attributable

royalty revenue amounts, together with as amortization of royalty

interests, general and administrative costs and mining tax, are not

reported gross in the consolidated statement of earnings (loss)

since the royalty revenues are being generated in a joint venture

and IFRS 11 Joint Arrangements requires net reporting as an equity

pick up. The reconciliation to IFRS reports the elimination of the

attributable revenues and reconciles to the revenues recognized in

the consolidated statements of earnings (loss).

Reconciliations to IFRS measures

Attributable revenue

|

3 months ended April 30, |

|

Year ended April 30, |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

| Royalty revenue |

|

|

|

|

|

|

|

|

|

Voisey's Bay |

664,000 |

|

891,000 |

|

2,773,000 |

|

3,136,000 |

|

|

Coal

(1) |

114,000 |

|

- |

|

114,000 |

|

- |

|

|

Potash (1) |

44,000 |

|

- |

|

44,000 |

|

- |

|

| Interest and investment |

404,000 |

|

679,000 |

|

1,780,000 |

|

2,500,000 |

|

| Other |

9,000 |

|

14,000 |

|

1,525,000 |

|

229,000 |

|

| Attributable revenue |

1,235,000 |

|

1,584,000 |

|

6,236,000 |

|

5,865,000 |

|

| Adjust: joint venture revenue |

(822,000 |

) |

(891,000 |

) |

(2,931,000 |

) |

(3,136,000 |

) |

| IFRS financial statement revenue |

413,000 |

|

693,000 |

|

3,305,000 |

|

2,729,000 |

|

|

|

|

|

|

|

|

|

|

| (1) Coal and Potash royalties were acquired on April

28, 2014 and include three days of revenue |

|

About Altius

Altius is diversified minerals royalty company with royalty

interests in 12 producing mines located in Canada. The royalty

interests include mining operations that produce thermal

(electrical) and metallurgical coal, potash, nickel, copper and

cobalt.

Altius holds other significant pre-development stage royalty

interests that include a 3% gross sales royalty on the development

stage Kami iron ore project of Alderon Iron Ore Corp. ("Alderon"),

a 2% gross sales royalty for the advanced exploration stage Central

Mineral Belt uranium project of Paladin Energy Limited, and several

other resource stage project royalties. Its project generation

pipeline contains a diversified portfolio of exploration stage

projects and royalties, many of which are being advanced through

various partner-funding arrangements.

Altius has also built a portfolio of directly and indirectly

held junior resource investments, including a ~25% shareholding in

Alderon (TSX:ADV), an ~8% shareholding in Virginia Mines Inc.

(VGQ:TSX), and a ~5.9% shareholding in Callinan Royalties

Corporation (TSX-VENTURE:CAA).

Altius has 32,238,821 shares issued and outstanding that are

listed on Canada's Toronto Stock Exchange. It is a member of both

the S&P/TSX Small Cap and S&P/TSX Global Mining

Indices.

Altius Minerals CorporationBen LewisToll Free:

1-877-576-2209Altius Minerals CorporationChad WellsToll Free:

1-877-576-2209709-576-3441info@altiusminerals.comwww.altiusminerals.com

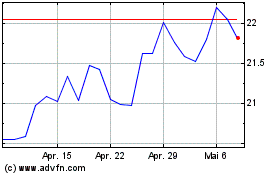

Altius Minerals (TSX:ALS)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

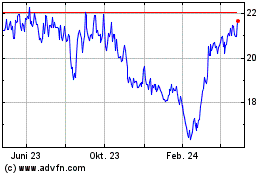

Altius Minerals (TSX:ALS)

Historical Stock Chart

Von Apr 2024 bis Apr 2025